Featured

Canadian big 5 banks: Good dividend and growth plays

“The Big 5” are Canada’s five oldest financial institutions. Here are reasons why investors should look into them.

One of Canada’s oldest institutions is its five banks, also known as “The Big 5.” Some of them have been around even before Canada was a country. These five largest banks in Canada are:

-

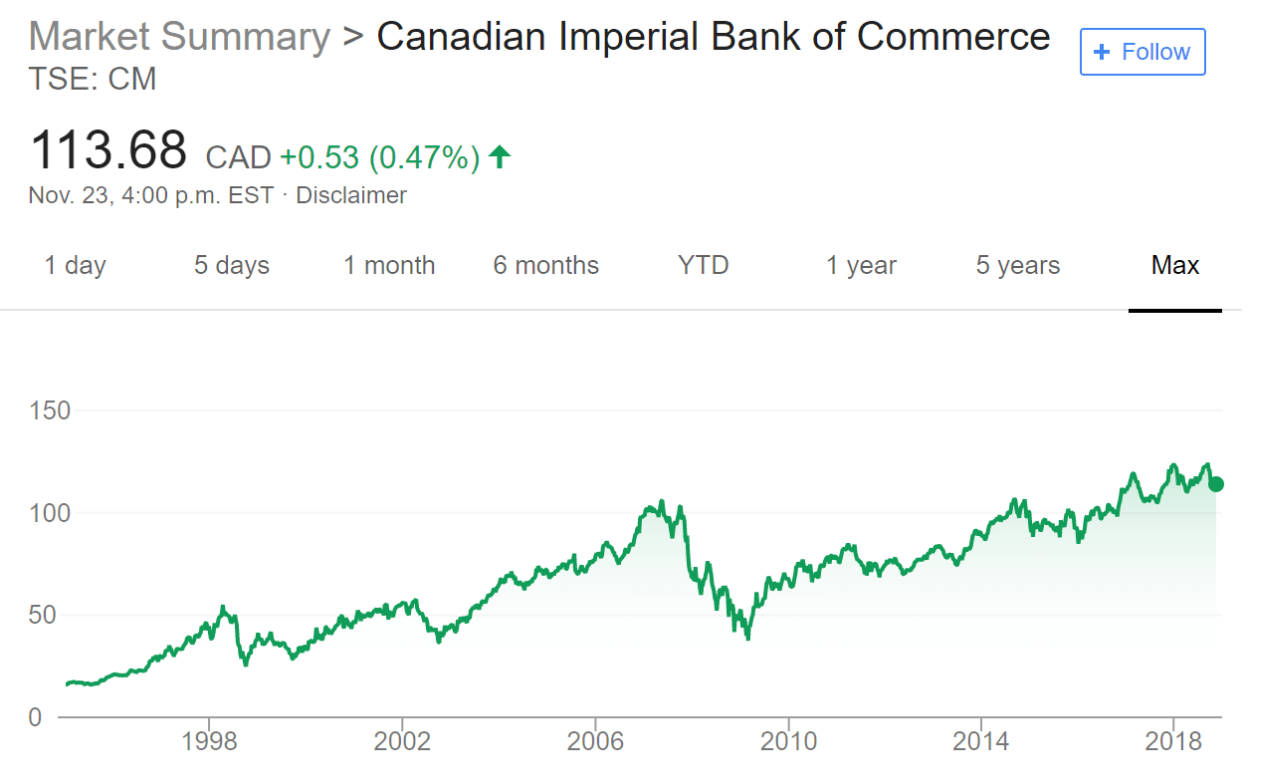

Canadian Imperial Bank of Canada (TSX: CM, NYSE: CM)

-

Royal Bank of Canada (TSX: RY, NYSE: RY)

-

Bank of Montreal (TSX: BMO, NYSE: BMO)

-

Bank of Nova Scotia (TSX: BNS, NYSE: BNS)

-

Toronto Dominion Bank (TSX: TD, NYSE: TD)

The banking industry contributes 3.3 percent to Canada’s GDP, employing a total of 275,825 Canadians and almost 120,000 people in foreign countries. Besides being business juggernauts in the banking world, these banks also make good investments for any investment portfolio. Here are three reasons why any of “The Big 5” makes a good investment:

1. Adaptability and diversification

These banks have been around for more than 100 years and the longevity is a testament to how well these banks are able to adapt to the banking landscape. Originally, “The Big 5” started out as a traditional retail banking bank.

When revenues hit a point where it couldn’t grow anymore, these banks began acquiring other banking trusts and unions. Whenever these banks want to enter a new market or expand their businesses, they use their vast resources and either buy an existing business or form partnerships with others. Their foray into credit cards, wealth management, mutual funds, and recently into insurance are good examples of this.

“The Big 5” today now offer services that pretty much touch every aspect of Canadian finance.

2. Increasing dividends every year

In 2017, the banking industry collectively paid out a total of $18.3 billion in dividends. A large portion of this comes from “The Big 5.” Since the beginning of 2016, the Big 5 banks have increased their dividends by at least 15 percent:

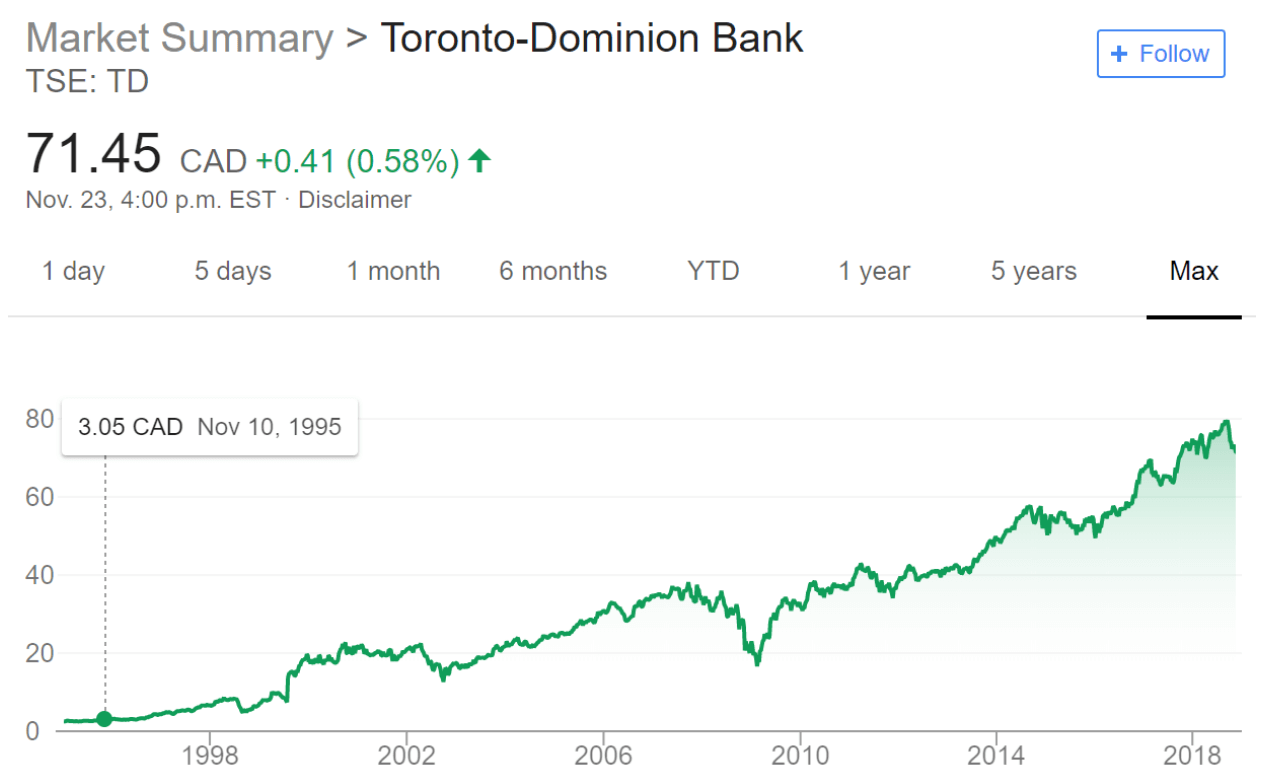

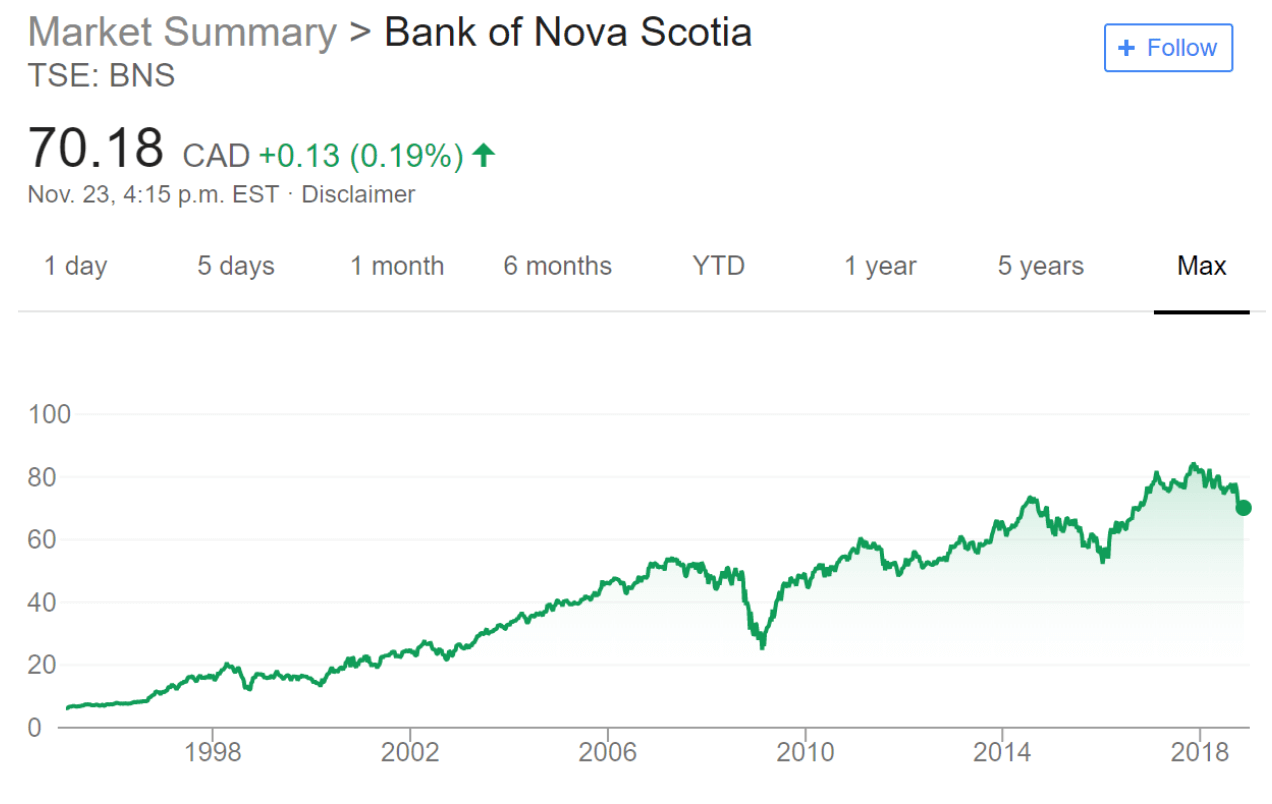

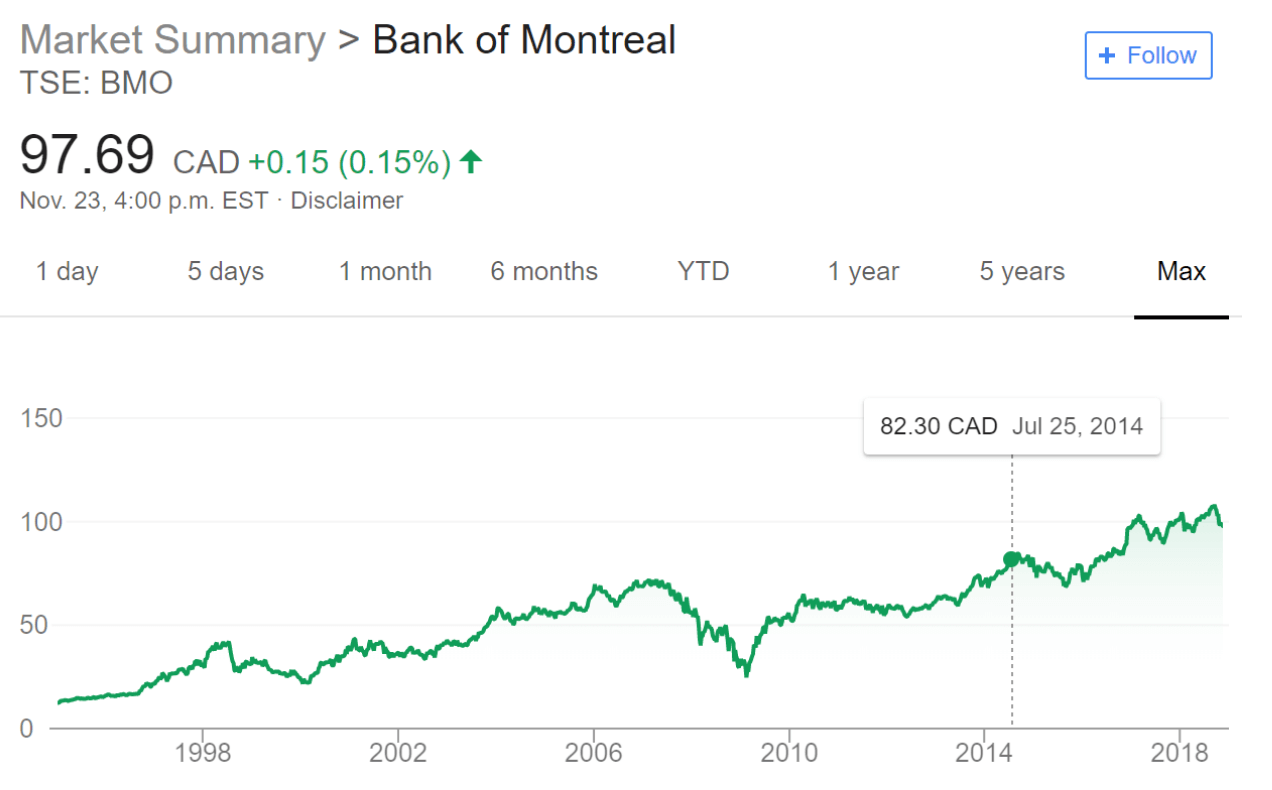

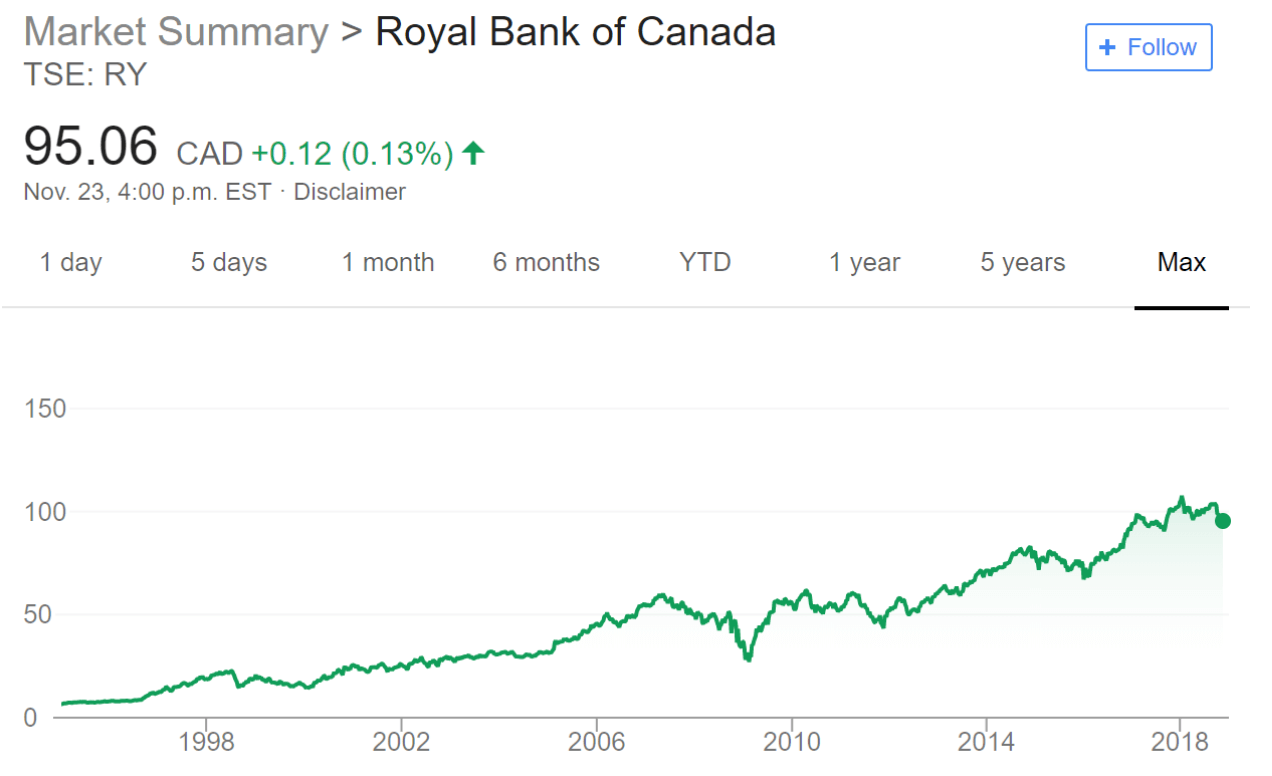

(Source: Google Finance and Respective Bank Info) © Sherif Samy

(Source: Google Finance and Respective Bank Info) © Sherif Samy

(Source: Google Finance and Respective Bank Info) [caption id="attachment_130003" align="alignright" width="1272"] (Source: Google Finance and Respective Bank Info) © Sherif Samy

(Source: Google Finance and Respective Bank Info) © Sherif Samy

(Source: Google Finance and Respective Bank Info) © Sherif Samy

“The Big 5” have a history of increasing their dividends annually. Although dividends are never guaranteed, it is rare for these banks to cancel their quarterly dividend payout. The current dividend yield is also attractive.

3. Recession proof

The economy averages about one recession per decade at least and throughout it all, the stock prices of “The Big 5” have been consistently trending up.

Besides the short drop in late 2008 because of the Subprime Crisis, these banks have been on an upward trend. Just to add, the subprime crisis hardly made a dent on “The Big 5” profits because these banks steered clear of the subprime products. This also explains how the Canadian mortgage industry during the late 2000s was largely unscathed compared to the U.S. mortgage industry. “The Big 5” are largely risk-averse and this has helped them manage economic downturns.

Also, in the past couple decades, these five banks have been steadily growing their international operations. This has provided diversification in their operations. No longer are these banks solely reliant on the Canadian economy, so investing in these businesses will also provide exposure to international markets.

As an investor, people cannot go wrong with investing in any one of these banks. Even if the stock price drops in the short term, the overall trend is for these companies to go up. For dividend investors, if the price drops, it is a good opportunity to buy more. Do not expect to become rich overnight when investing in bank stocks, however, these stocks will surely help you sleep at night.

(Featured image by Diego Torres Silvestre via Flickr. CC BY 2.0.)

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Business2 weeks ago

Business2 weeks agoFed Holds Interest Rates Steady Amid Solid Economic Indicators

-

Crypto14 hours ago

Crypto14 hours agoBitcoin Surges Toward $110K Amid Trade News and Solana ETF Boost

-

Fintech1 week ago

Fintech1 week agoMuzinich and Nao Partner to Open Private Credit Fund to Retail Investors

-

Crypto4 days ago

Crypto4 days agoBitcoin Traders on DEXs Brace for Downturn Despite Price Rally

You must be logged in to post a comment Login