Sponsored

Cannabis retailer Choom secures leadership position with Ontario expansion

Canada’s up and coming cannabis retailer Choom Holdings, Inc. (CSE: CHOO | OTCQB: CHOOF) is securing pole position in the race to dominate Canadian retail

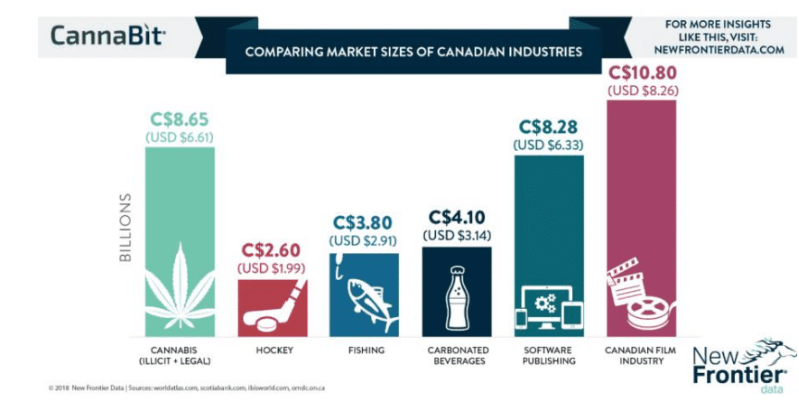

As the dust of legalization settles over Canada, cannabis companies are jockeying for position. Investors are still in the process of understanding how the market will develop and new niches are being carved out in an already dynamic market. The messy implementation of legalization across Canada provides some insight into why some companies, like Choom Holdings Inc. (CSE: CHOO | OTCQB: CHOOF), are betting big on retail.

Legalization implementation problems highlight retail opportunities

The road to legalization in Canada has been a rocky one. Inconsistent licensing laws between different municipalities have created a difficult situation for retailers, which some municipalities even banning brick and mortar shops entirely.

The problem is compounded by the glacial pace at which Health Canada have been awarding new licenses to producers. In early December there were still 500 production licenses awaiting approval. To make matters worse cannabis producers are not allowed to operate retail shops to sell their own product so are reliant upon third parties to get their product to consumers. For example in Ontario growers can’t own more than 9% of a retailer group or operate more than 1 retail store.

These problems have compounded to cause significant supply shortages. Some predictions believe that the Canadian market could experience Cannabis shortages into 2019. The outcome of all this is that suppliers can’t get their product to consumers who may well be forced to return to the grey and black markets.

Retailers who can overcome this challenge will forge national brands

While the situation is dire for cannabis producer profits, it has created the perfect opportunity for the retailers to position themselves to take a huge piece of the Canadian market as supply begins to stabilize. The importance of retail is evidenced by Aurora Cannabis Inc.’s (NYSE: ACB) $20 million investment in Choom. Growers like Aurora cannot own more than 9% of a retailer group and can’t operate more than 1 retail store in some Provinces.

As suppliers are unable to sell their own product directly to consumers they need to ensure a robust retail ecosystem. Becoming established now is paramount for retailers who want to lead the next phase of the Canadian and North American cannabis market. Latecomers will be forced to pay a premium to buy their way into a market controlled by established players.

Choom has utilized their investment from Aurora to make 90 offers for lucrative retail opportunities in in Ontario, with 20 leases already secured. Ontario represents one of the most lucrative cannabis retail opportunities in Canada. Choom is rapidly approaching the legal limit of 75 licenses in Ontario and are well on track to have their retail outlets ready to launch on the April 2019 deadline when Ontario retail channels are expected to open.

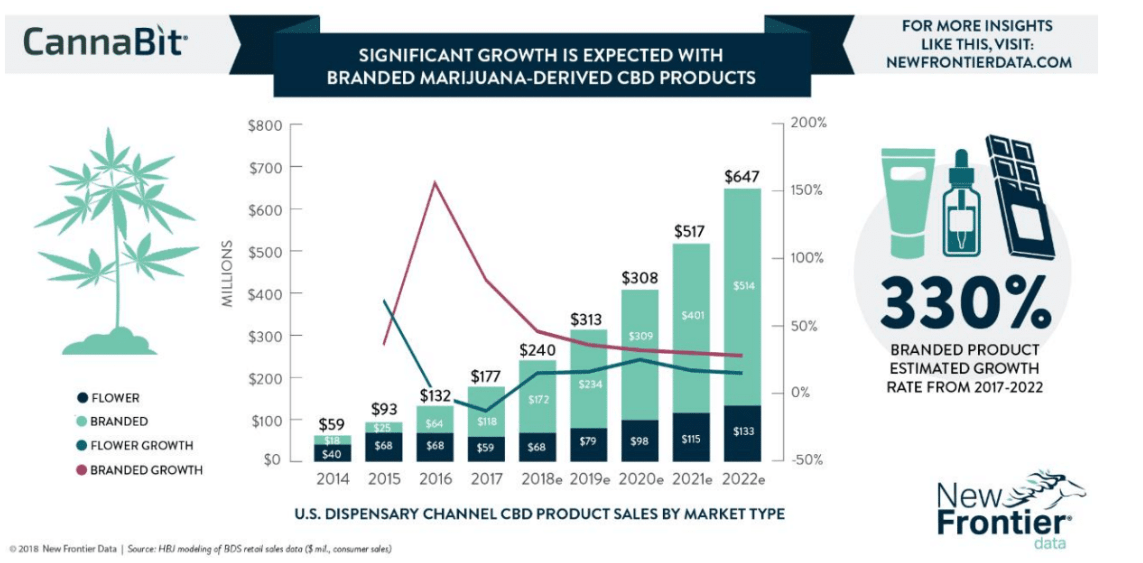

Moving early is important. Choom has now put itself in a position to build a national brand in Canada. The companies that are able to build a recognizable brand first will be able to convert that into early market dominance. Branded product growth in the US CBD market is estimated to be 330% by 2022. By combining a strong retail presence with top quality products from suppliers like Aurora, Choom has put itself in a perfect position to become one of the Canadian market’s key players.

—

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Crypto6 days ago

Crypto6 days agoCaution Prevails as Bitcoin Nears All-Time High

-

Africa2 weeks ago

Africa2 weeks agoMorocco’s Wheat Dependency Persists Despite Improved Harvest

-

Africa2 days ago

Africa2 days agoBridging Africa’s Climate Finance Gap: A Roadmap for Green Transformation

-

Biotech1 week ago

Biotech1 week agoEcnoglutide Shows Promise as Next-Generation Obesity Treatment

You must be logged in to post a comment Login