Markets

The Cocoa Market Is Now Testing the Top End of the Range

Both markets closed higher on Friday and for the week and held to a trading range. It looks like the long liquidation seen in the cocoa market much of the week to drive prices lower. Traders are worried about another short production year and these feelings have been enhanced by El Nino that could threaten West Africa crops with hot and dry weather later this year.

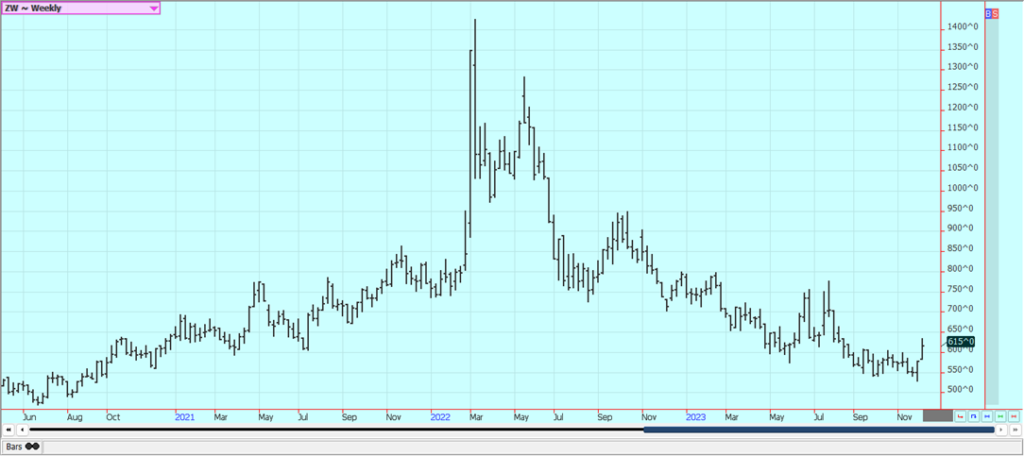

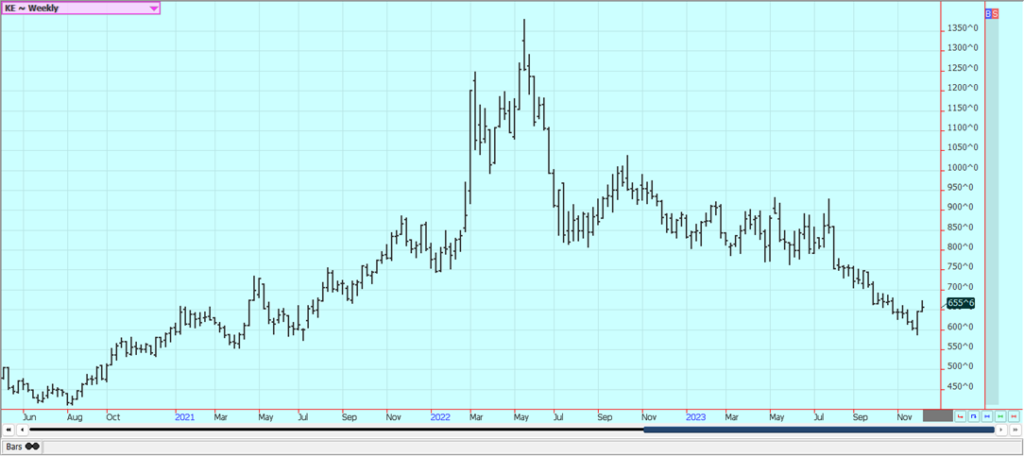

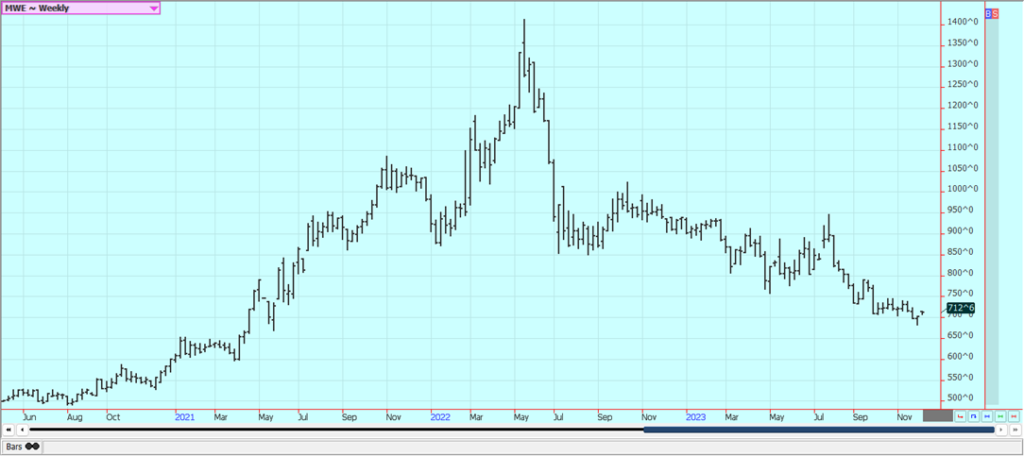

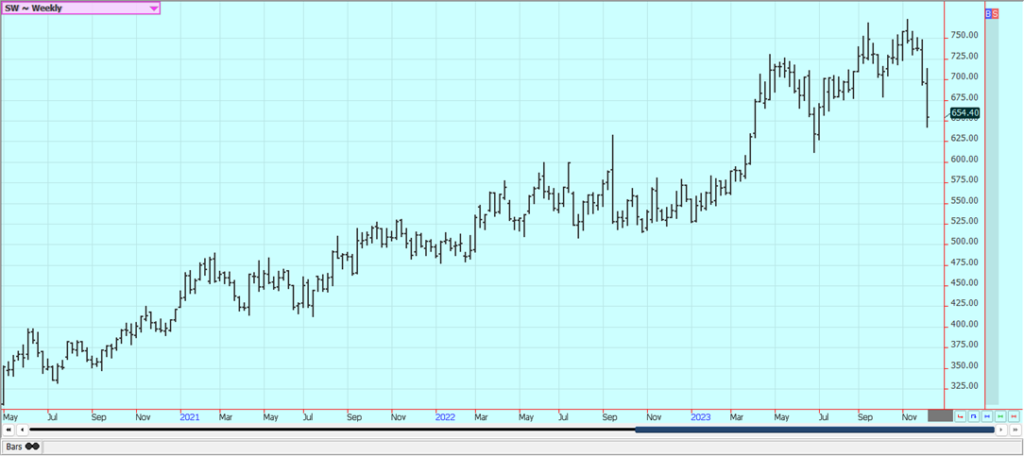

Wheat: Wheat markets were higher last week and trends are still up on the weekly charts on news of significant purchases of US Wheat by China. He WASDE reports showed the Chinese demand through higher export demand and lower ending stocks. Costs for transport of Ukraine Wheat are high and this has hurt any sales.

Russia is still exporting and offering Wheat into the world market and is reporting that the crop is larger than originally thought. Ukraine and the EU countries are offering as well and are getting new business. Demand has been poor for US Wheat as Russia production looks strong, but exports are starting to increase.

Argentine conditions are reported to be good after a very dry start but showers and rains in recent weeks. It has been too wet in southern Brazil and much of the Wheat grown there is expected to be feed grade instead of milling grade.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

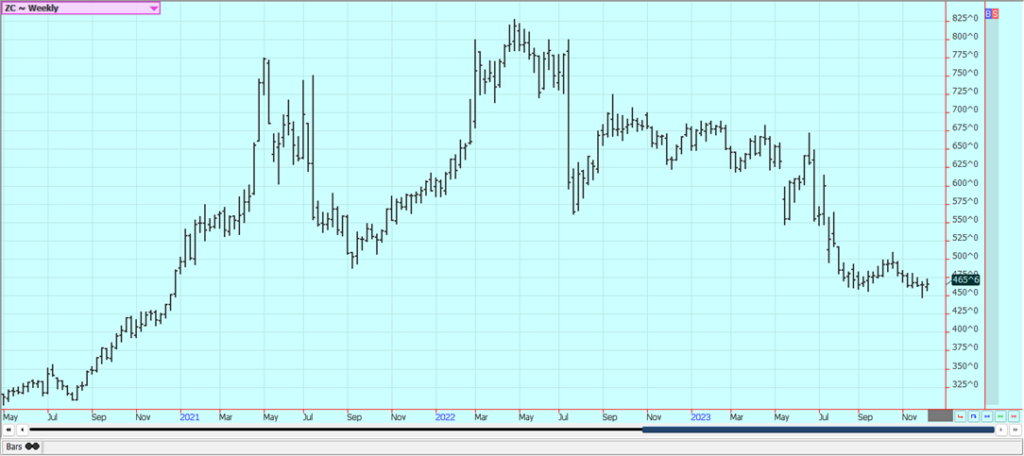

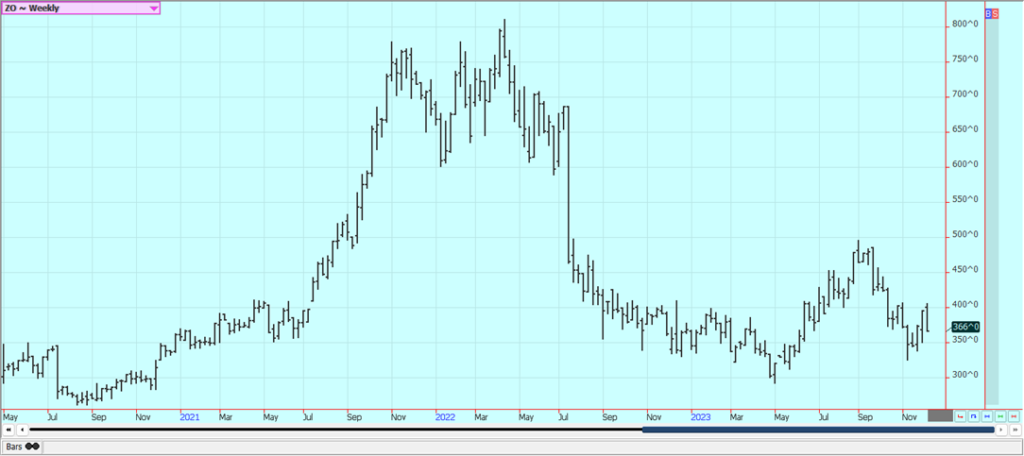

Corn: Corn closed a little higher as export demand was better than expected by traders. Oats were lower. USDA recognized the better export demand by raising the demand by 25 million bushels and cutting ending stocks by the same amount to 2.131 billion bushels. It is still a big ending stocks estimate but the estimate is a little lower than before. Ideas of weak demand are keeping prices low over all, but the weekly export sales reports have shown good demand for the last several weeks.

The market feels that there is more than enough Corn for any demand and are not buying futures despite the improve demand. It is still hot and dry in central and northern Brazil and in Argentina although some beneficial rains have been reported in Argentina and in central and northern Brazil. Southern Brazil is still much too wet. There was some beneficial rains reported in central and northern areas last weekend and more showers and rains are possible this week.

Weekly Corn Futures

Weekly Oats Futures

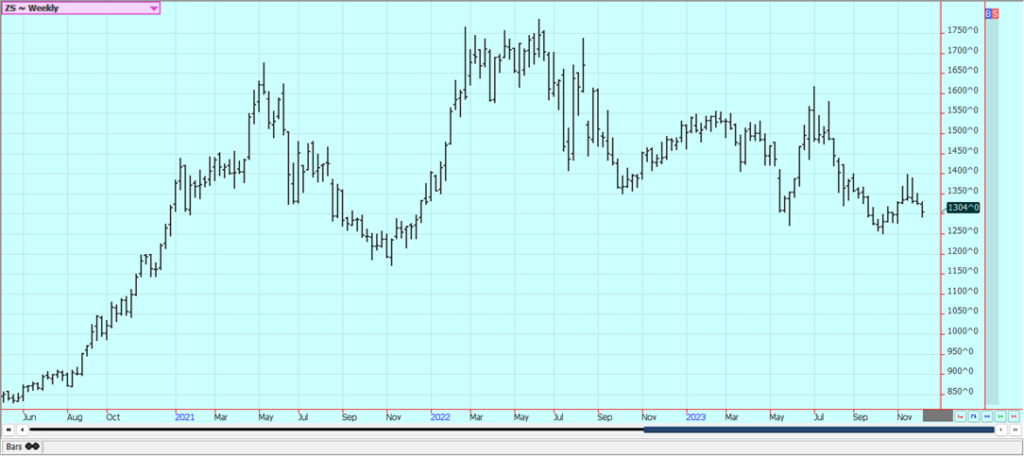

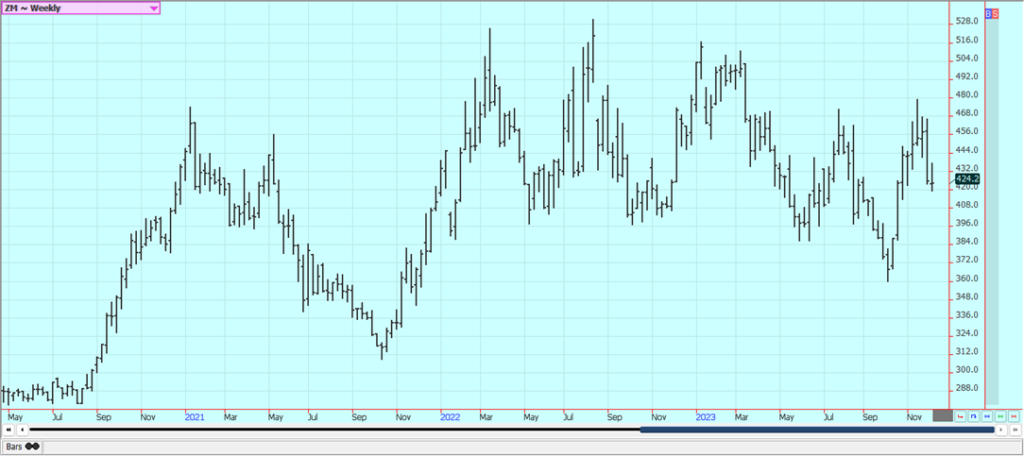

Soybeans and Soybean Meal: Soybeans closed lower on unchanged data for the US WASDE estimates. World estimates showed decreased production for the current year in Brazil to 161 million tons. Reports of improved rains for central and northern Brazil this week are still heard although still too much rain was reported for southern Brazil.

There are some forecasts for scattered showers and rains this week in central and northern Brazil and still very wet conditions in the south. Soybeans appears to be starting a new leg down on the charts. The weekly export sales report for Soybeans was not strong after the record sales report the previous week but sales to China continue.

The trade remains concerned about the weather forecasts for South America. Brazil remains mostly hot and dry in northern areas and too wet in southern areas. Argentina crops are reported o be in good condition with enough moisture. These weather trends are expected to continue after next week.

Weekly Chicago Soybeans Futures

Weekly Chicago Soybean Meal Futures

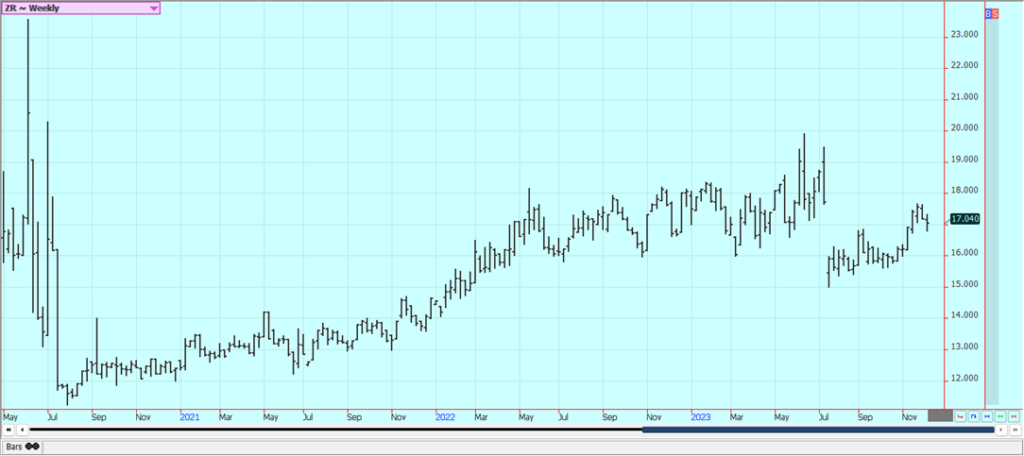

Rice: Rice closed a little lower last week despite some buying late in the week tied to good export demand and demand ideas in general. USDA increased imports into the US for Rice and also ending stocks estimates by 1.0 million cwt. on Friday. World data also showed negative trade ideas. Farmers appear quiet in the market and basis levels are reported to be steady. Short term trends remain down in this market.

The weekly charts show that a big gap was closed with the price action last week since the gap was filled. Demand reports have been solid to strong for the last couple of weeks and have featured traditional buyers in Latin America and Asia ad some nontraditional buyers as well. The weekly export sales report showed very strong demand from Latin America. The daily and weekly chart trends are down.

Weekly Chicago Rice Futures

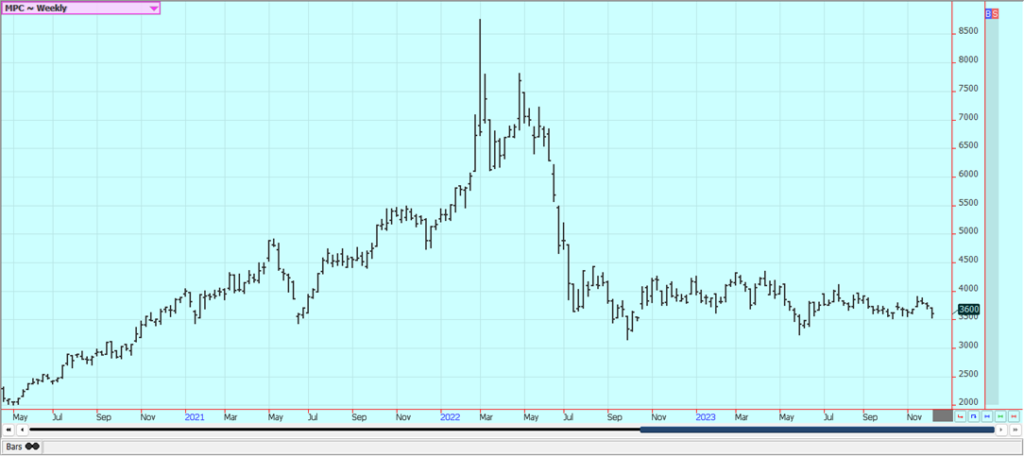

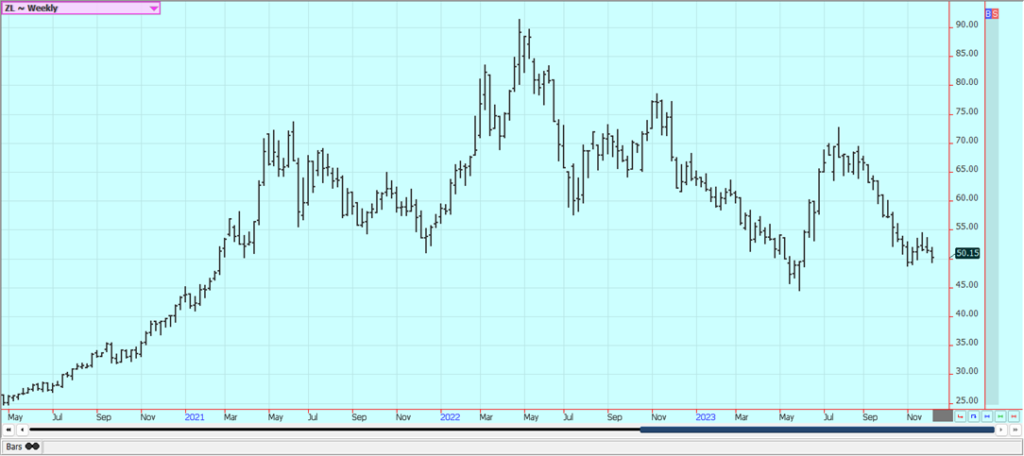

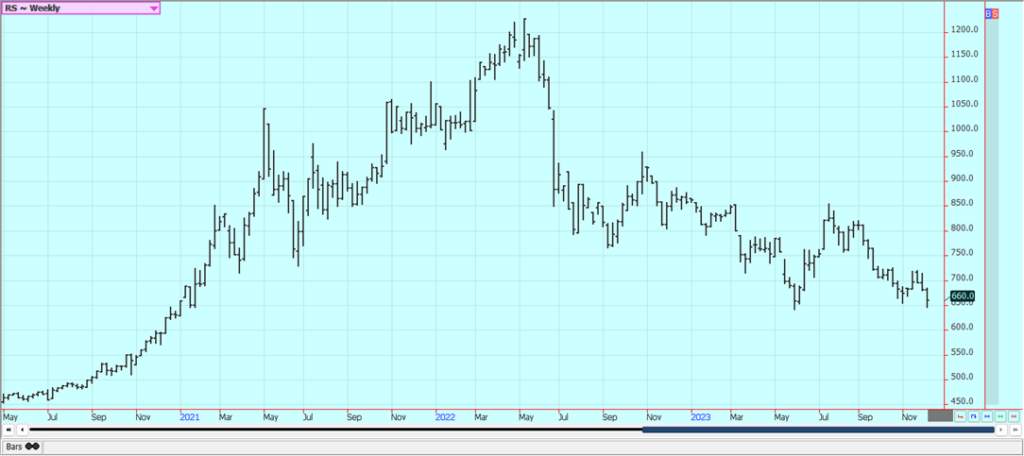

Palm Oil and Vegetable Oils: World vegetable oils prices were down last week with some of the selling related to weakness in Crude Oil futures. Palm Oil was lower along with weakness in Soybean Oil and on ideas of weaker demand for Palm Oil as the private sources reported improved demand for the month so far.

Production was high in the MPOB reports but is expected to drop seasonally in future reports. Trends are sideways on the daily charts and are sideways on the weekly charts. Canola closed lower with Chicago Soybeans and on the weather in Brazil. Current forecasts call for very wet weather in southern Brazil and wetter weather in central and northern areas this week. The Canola crop is harvested and it is in bins, so it will take some price movement to get new farm sales. Trends are down on the daily charts in this market.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures:

Cotton: Cotton closed higher last week, but lower on Friday as selling was seen in most agricultural markets in response to the WASDE reports. The domestic estimates showed a decrease in production and a smaller decrease in demand for ending stocks of 4.10 million bales. World data showed a slight increase in ending stocks to 82.4 million bales. The export sales report was positive for prices once again this week and featured sales to China.

The US Dollar was higher on Friday and US economic data has been positive, but the Chinese economic data has not been real positive and demand has been down. There are still many concerns about demand from China and the rest of Asia due to the slow economic return of China in the world market. There are production concerns about Australian and Indian Cotton as both countries are likely to suffer the effects of El Nino starting this Fall.

Weekly US Cotton Futures

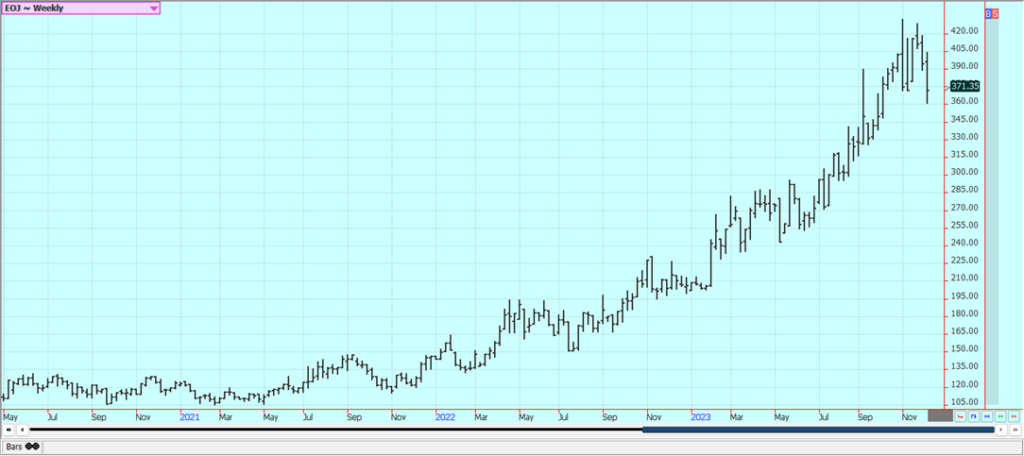

Frozen Concentrated Orange Juice and Citrus: FCOJ closed lower last week, and the short term trends are now mixed in this market as USDA showed unchanged 2023-24 production estimates for Florida at 20.5 million boxes and the US at 68.5 million boxes. There are no weather concerns to speak of for Florida right now with the hurricane season all but over and no major storms hitting the state recently.

The weather has improved in Brazil with some moderation in temperatures and increased rainfall in the forecast for this week. Brazil got more than expected rains over the weekend. Reports of short supplies in Florida and Brazil are around. Historically low estimates of production in Florida due in part to the hurricanes and in part to the greening disease that have hurt production, but conditions are significantly better now with scattered showers and moderate temperatures.

Weekly FCOJ Futures

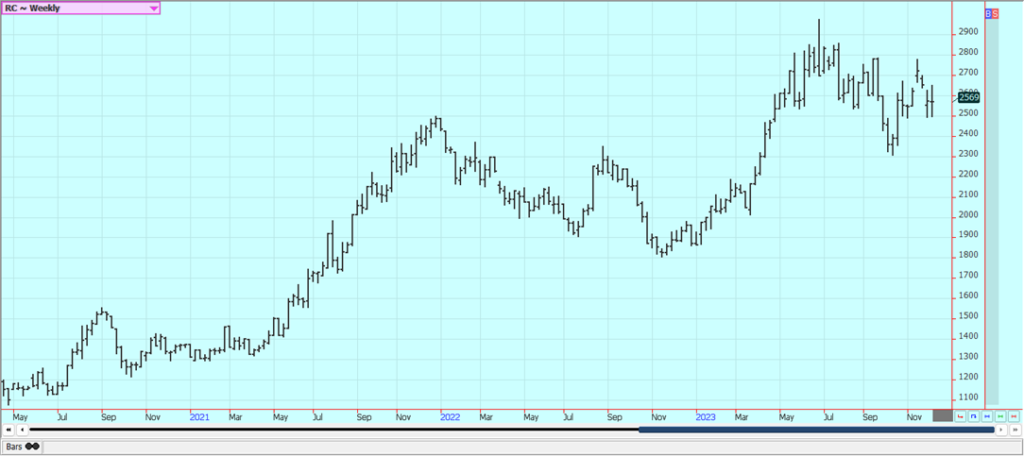

Coffee: Both markets closed higher Friday in recovery trading and New York was higher for the week on the continuation charts. London closed little changed. Traders heard about good rains for some growing areas last week and the forecasts called for more this week but changed on Friday to much drier conditions. Increased producer selling was reported last week.

Brazil weather remains uneven for the best crop production and there are reports of increasing Coffee availability from Vietnam although not enough to meet all of the demand yet. The lack of offers from Asia, mostly from Vietnam but also Indonesia have been a main feature of the market, but the offers are starting to improve. Offers from Brazil and other countries in Latin America has been increasing.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

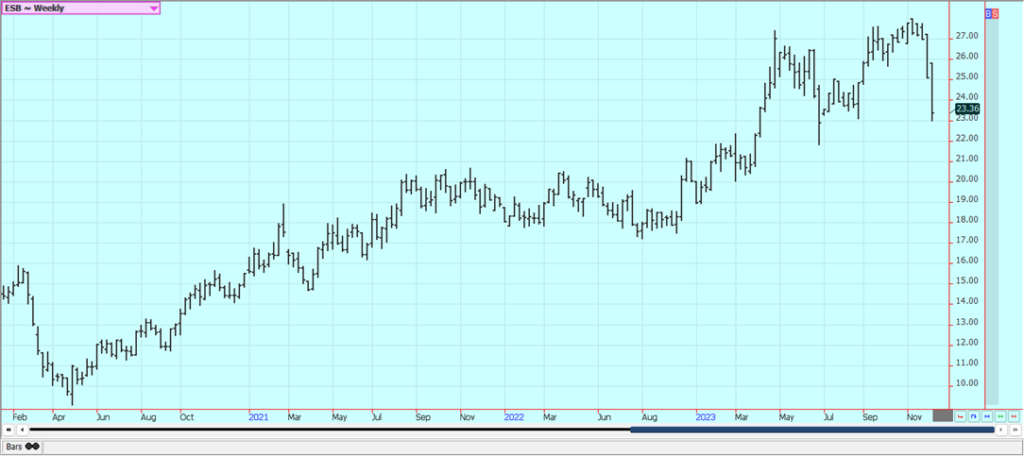

Sugar: New York and London finished the week on a steady note, but closed lower last week on fund long liquidation tied to the Brazil weather and on reports of greatly increased availability of Ukrainian Sugar in the EU. Better than expected rains fell in Brazil over the weekend and Brazil weather forecasts now call for a return to wet in the south and continued showers and rains in central and northern areas this week.

The market continues to see stressful conditions in Asian production areas. The Brazil rains is underway now and have been heavy in the south. There are worries about the Thai and Indian production potential due to El Nino. Offers from Brazil are still active but other origins are still not offering

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

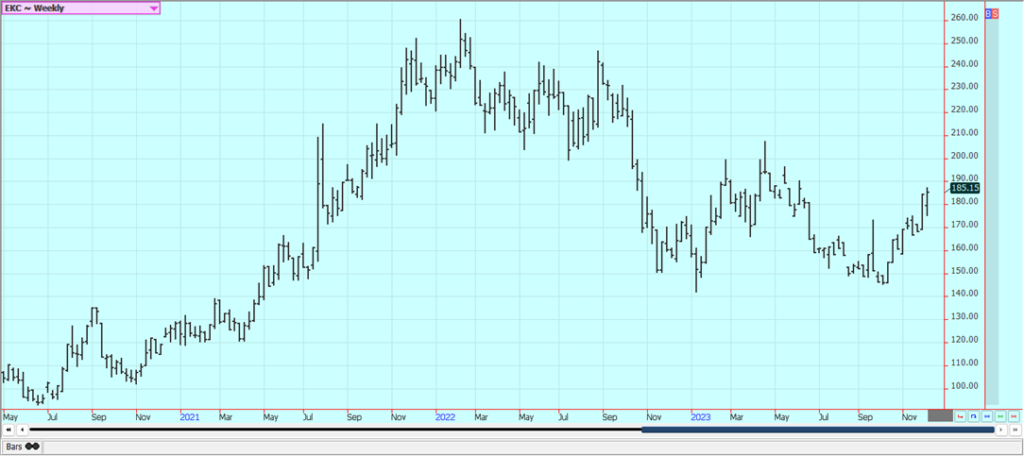

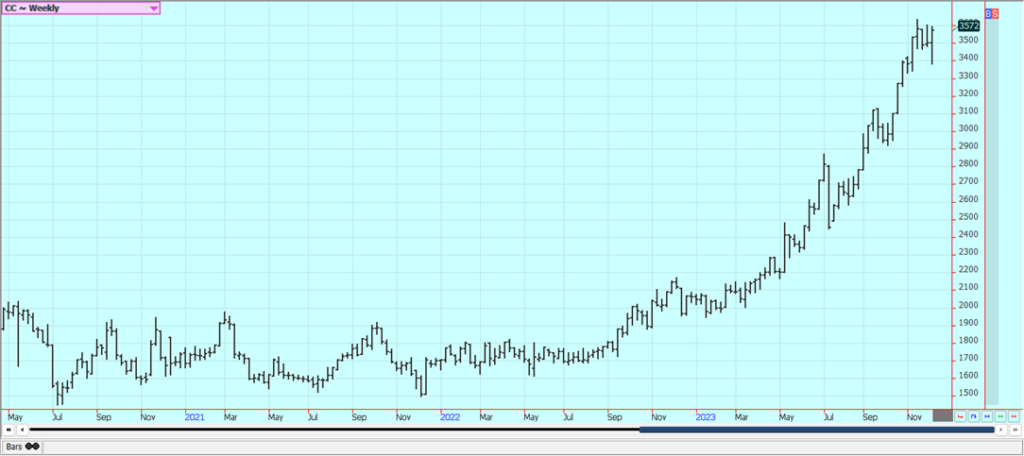

Cocoa: Both markets closed higher on Friday and for the week and held to a trading range. The market is now testing the top end of the range. It looks like the long liquidation seen in this market much of the week to drive prices lower. Traders are worried about another short production year and these feelings have been enhanced by El Nino that could threaten West Africa crops with hot and dry weather later this year.

The main crop harvest comes into focus and as farmers in West Africa report that many areas have too much rain that has caused harvest delays and could lead to disease. Scattered to isolated showers are reported in the region now and the harvest is coming. Ideas of tight supplies remain based on more reports of reduced arrivals in Ivory Coast and Ghana continue,

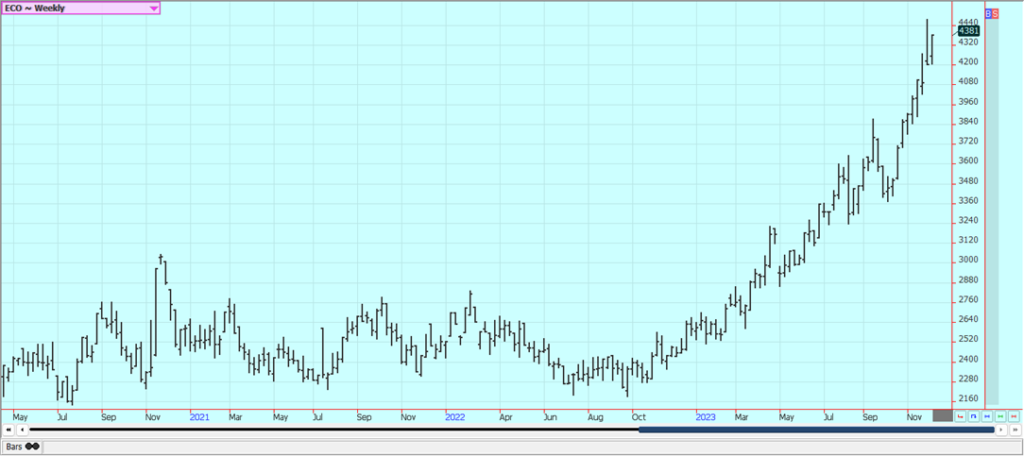

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by Etty Fidele via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Impact Investing1 week ago

Impact Investing1 week agoCDP Approves €1.5 Billion Package to Boost Industry, Renewables, and International Development

-

Crypto2 weeks ago

Crypto2 weeks agoUniswap and BlackRock Partner to Launch BUIDL in DeFi

-

Impact Investing2 days ago

Impact Investing2 days agoThe Sustainability Revolution: Driving a Net-Zero, Nature-Positive Economy

-

Biotech1 week ago

Biotech1 week agoNew Molecular Clues Explain Aggressive Neuroblastoma and Point to Targeted Treatments