Business

Cotton closes higher amid US-China trade talks

The US government implied last week that negotiations on a complete deal could be wrapped up this month.

The market was focused on Washington as the US-China trade talks continued. The tariff increase was postponed indefinitely, and the US administration said a full agreement could be made by the end of the month. China is apparently willing to buy a lot of US agricultural goods, and it could buy between $45 and $50 billion each year.

The intellectual property rights and forced technology transfers as well as Chinese structural reforms remain key sticking points and will need much more time to be negotiated. The US is also moving to resolve trade disputes with the EU, Japan, and others and the administration still needs to find a way to get the new North American trade agreement ratified by Congress.

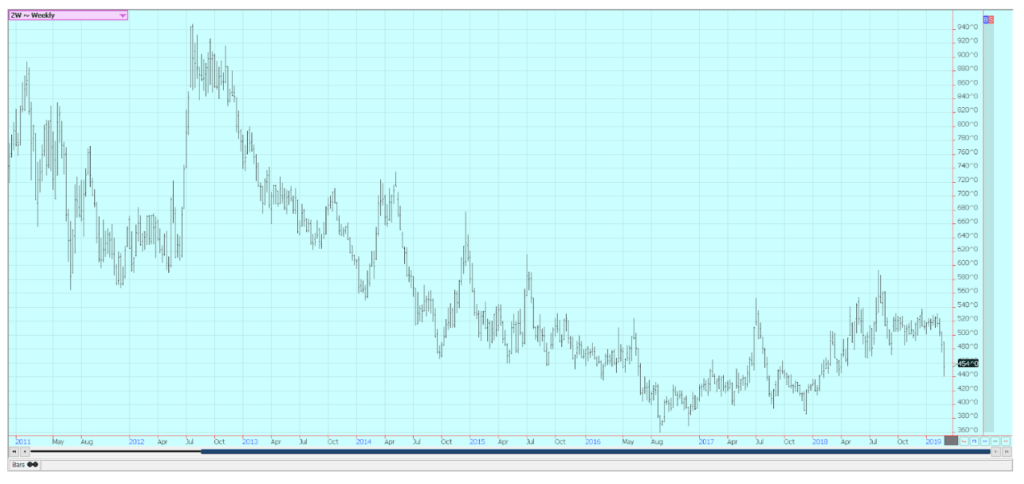

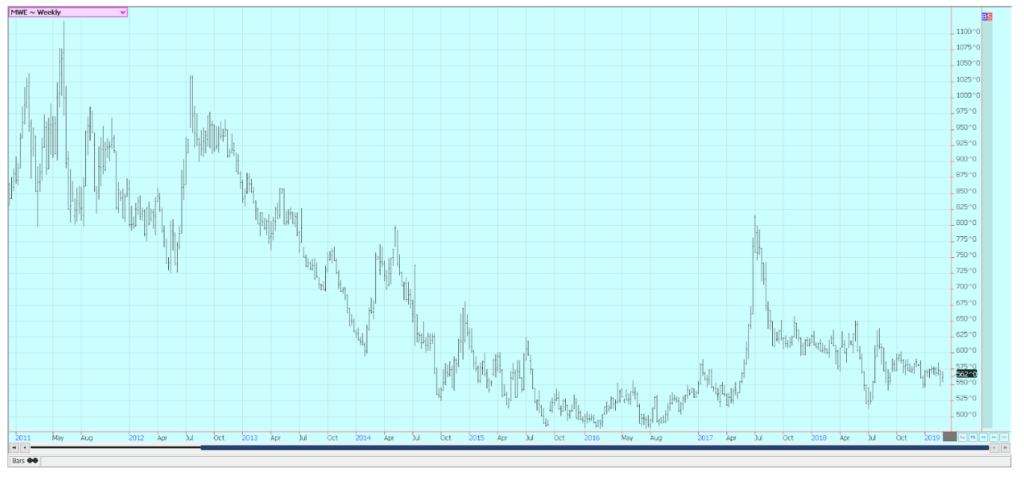

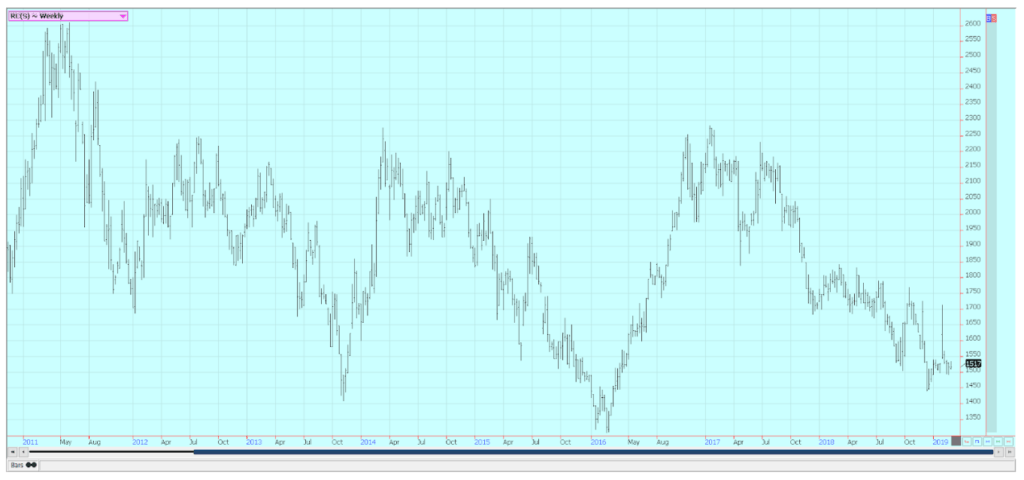

Wheat

Winter wheat markets were sharply lower for the week. Word of cheaper offers from Europe and Russia put US wheat values down. However, the demand for US wheat has improved in the world markets, and wheat export sales have generally been improving over the last couple of months. Good sales were reported by USDA last week.

The temperatures in the US remain cold, and winter wheat is still dormant. Record and near-record cold for the date were reported in parts of the Midwest and Great Plains, and more cold weather is on tap for this week. There is a chance for winterkill, but many areas do have some snow cover. The fall season in both winter wheat regions featured a lot of rain that hurt harvest and planting all season long. Wet weather has continued for much of the winter, and it is likely that the crop will have good soil moisture to work with as it comes out of dormancy in the next month.

The state departments of agriculture released their monthly crop condition updates, and the winter wheat crop condition is not good and significantly worse than previous reports due to the fall planting problems and the extreme weather seen in winter wheat growing areas over the winter. Traders don’t think that a big part of the crop is at risk.

Minneapolis spring wheat markets held better amid very cold weather in the northern US Great Plains and the Canadian Prairies as well as on the better than expected export demand. Weekly chart trends are down for SRW with a target near 420. Weekly trends for HRW are down and also target about 420. Minneapolis remains the stronger market and has not completely turned trends down. It could move to about 525 if it does go lower, and possibly 485 over time.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

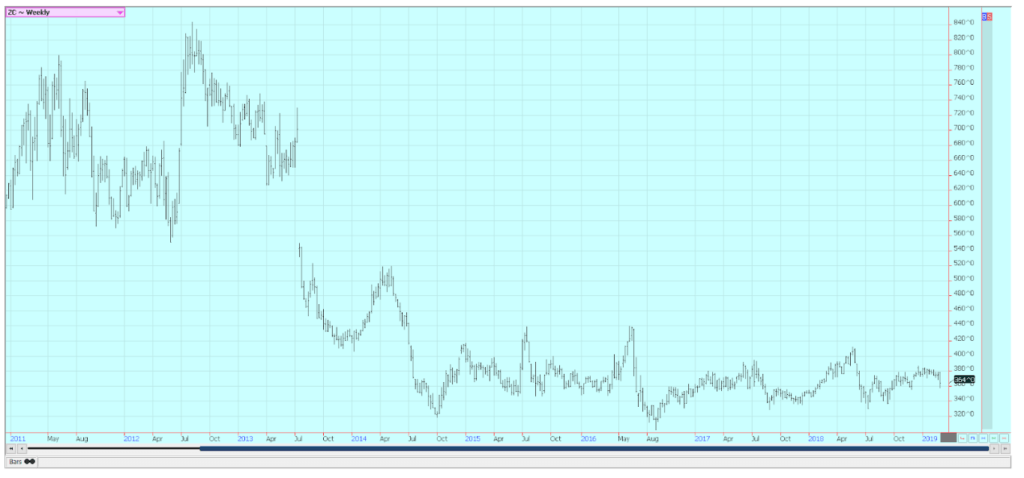

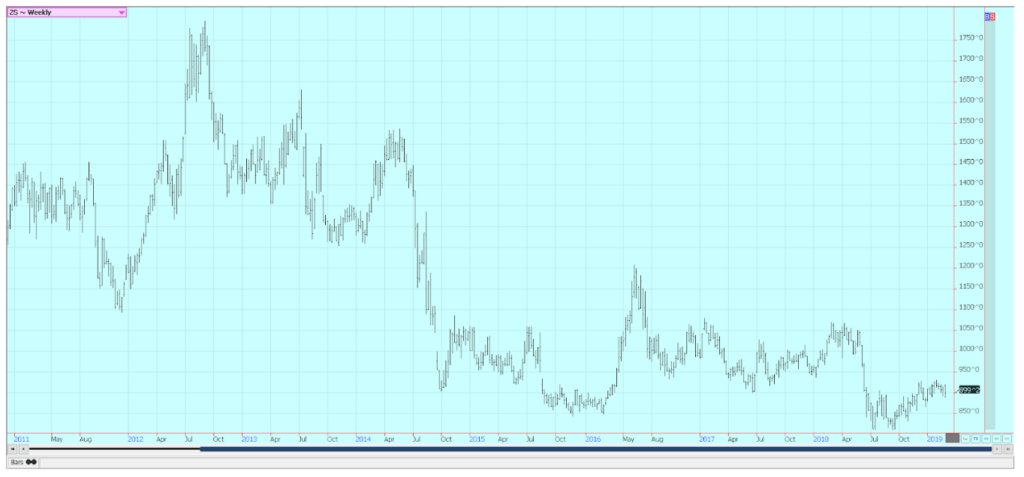

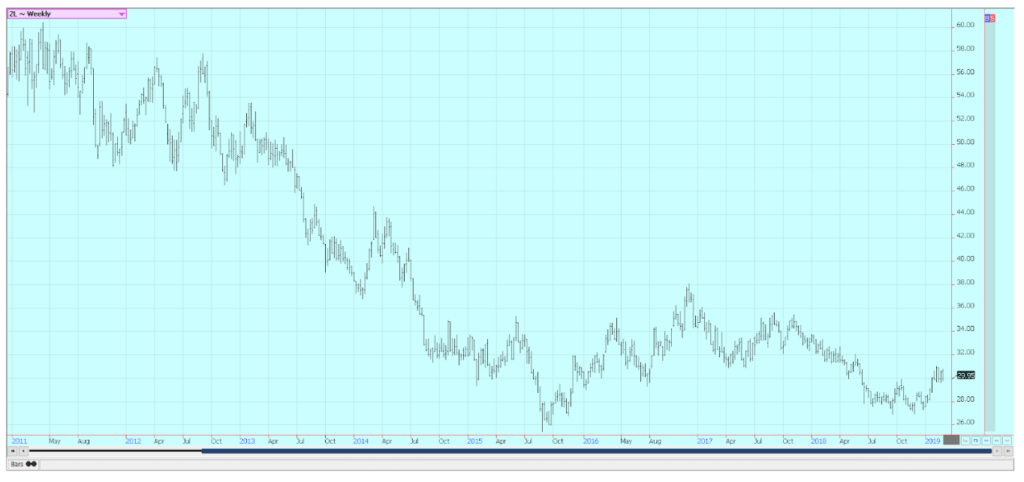

Corn

Corn closed lower last week despite signs of good progress in the trade talks. Traders are worried about demand even though the weekly export sales reports have been strong. However, ethanol demand has been dropping with weaker petroleum prices and demand for animal feed has been weak for a year and remains weak.

South American weather is generally good as more showers are reported in central and northern Brazil. The winter corn crop is being planted as soybeans get harvested, so the rains are very beneficial after an extended dry season. US farmers are still trying to decide on their planting mix this year. Corn planting should be starting in areas near the Gulf Coast, but fieldwork in many cases has been delayed by excessive rains in the past few weeks. The pattern of big rains every few days does not seem to be changing for this week. Weekly chart trends in corn are down with targets of 353 and 338 on the nearest futures contract. Weekly chart trends in oats are down with objectives of 322 and 282 basis the nearest futures contract.

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

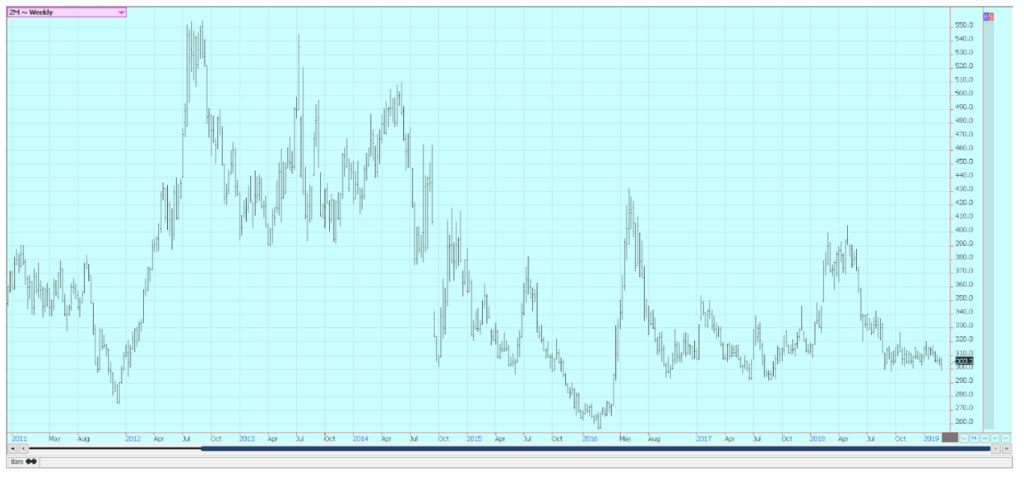

Soybeans and soybean meal

Soybeans and soybean meal were slightly lower last week. Soybean oil was higher and the strength of the complex. Demand for US soybeans was strong in the world export markets again last week. The US sold more than 2.0 million tons to various buyers including China. Brazil is about half done with its harvest now and should start to show increased offers and very competitive prices soon. Argentina also looks to export this year as crops there are much better. Ideas are that the US export sales pace will fall seasonally in the near term.

The weather in the US is very cold in the north and very wet in the south. Very little fieldwork is getting done, and planting delays are possible for corn and rice. This could force more acres to soybeans unless the weather changes in the next month. Weekly chart trends are mostly sideways in soybeans and soybean meal, with soybean meal still holding at important support areas near 300.00-basis the nearest month.

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

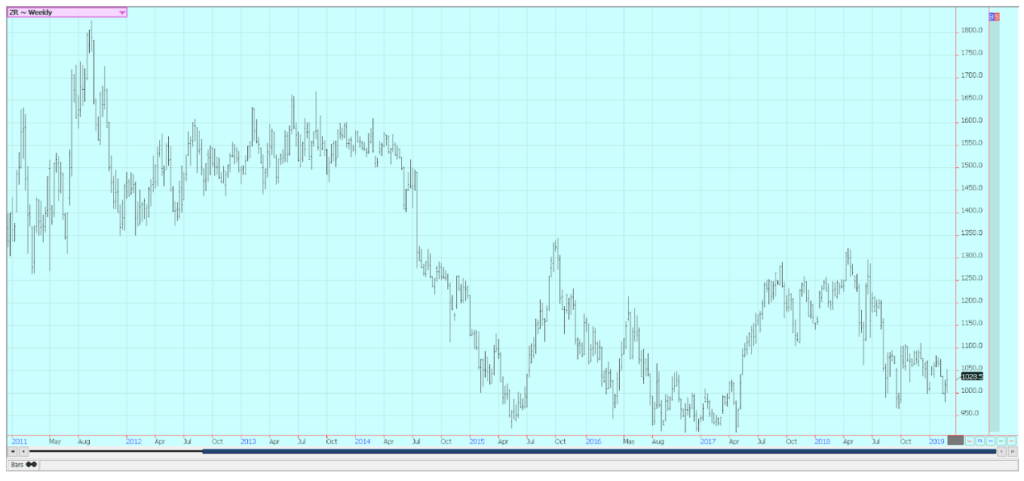

Rice

Rice was a little lower on Friday, but higher for the week. Rice is becoming a weather market. It is still raining in most rice production areas, and initial fieldwork is not really getting done. Planted area estimated by USDA at its Outlook Conference was lower than the trade had expected, and might go lower yet unless the weather gets better or the prices show significant improvement. USDA showed improved yield potential in its estimates, but production of all rice was estimated lower at 203 million hundredweight. Domestic demand estimates are unchanged from a year ago, but export demand was increased for an overall increase in demand. Ending stocks are estimated lower than the current year at 41.9 million hundredweight, but will be large enough to suggest that there will not be any shortages of rice for the coming year. Private sources suggest that domestic mills are slowly but surely getting covered on needs for the current crop year. Cash prices in the country are reported to be stable by most producers.

Weekly Chicago Rice Futures © Jack Scoville

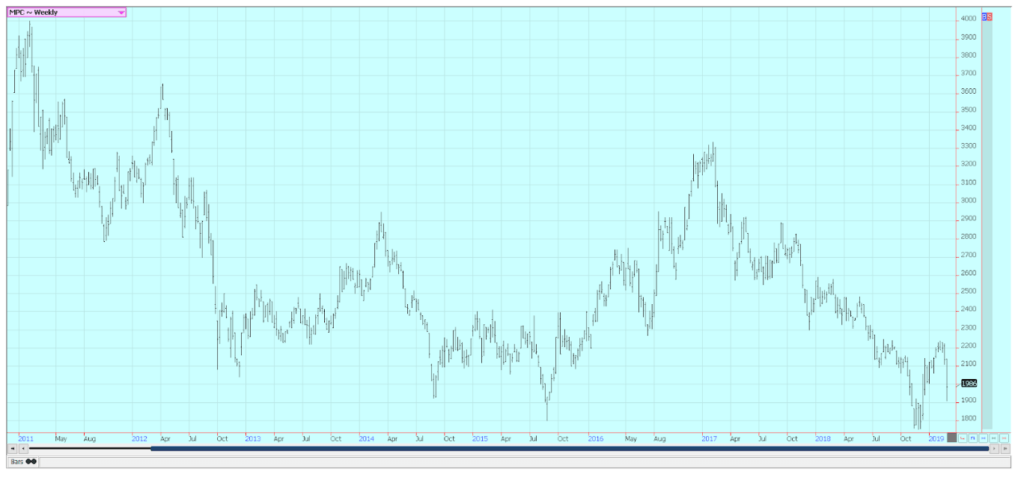

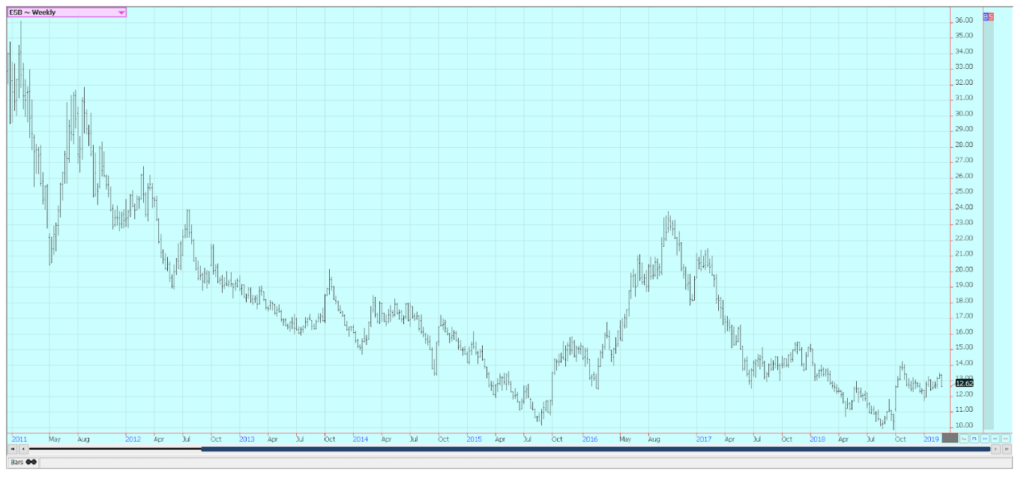

Palm oil and vegetable oils

World vegetable oils prices were mostly lower last week. Weekly chart trends are down for palm oil and canola, but prices fell so much last week that both markets are at some important support areas and should hold these areas for now. Chart trends in soybean oil are sideways. Palm oil crashed as demand reports from the private surveyors showed that palm oil demand really slipped in the second half of the month. There were some reports that production in Malaysia was holding better than expected. Production usually trends lower at this time of year due to seasonal factors, but reports from the country indicate that production has held closer to unchanged. MPOB will confirm or not this talk in its monthly updates.

Meanwhile, futures are now against previous lows and can hold for now. Canola also fell apart as supplies in the country remain high and demand has softened. Compounding the problem for canola is a court case in which a Chinese national could be deported to the US on industrial espionage charges. The hearings on the case are underway in Canada now and the hearings and entire case have caused friction in the relationship between Canada and China.

Soybean oil held its range again last week. It will have trouble holding unless the other markets can recover. US soybean oil also faces increased competition in world markets from Argentina as its Soybeans are harvested and processed. Argentina will look to reclaim its position as the largest exporter of soybean oil in the world.

Weekly Malaysian Palm Oil Futures © Jack Scoville

Weekly Chicago Soybean Oil Futures © Jack Scoville

Weekly Canola Futures © Jack Scoville

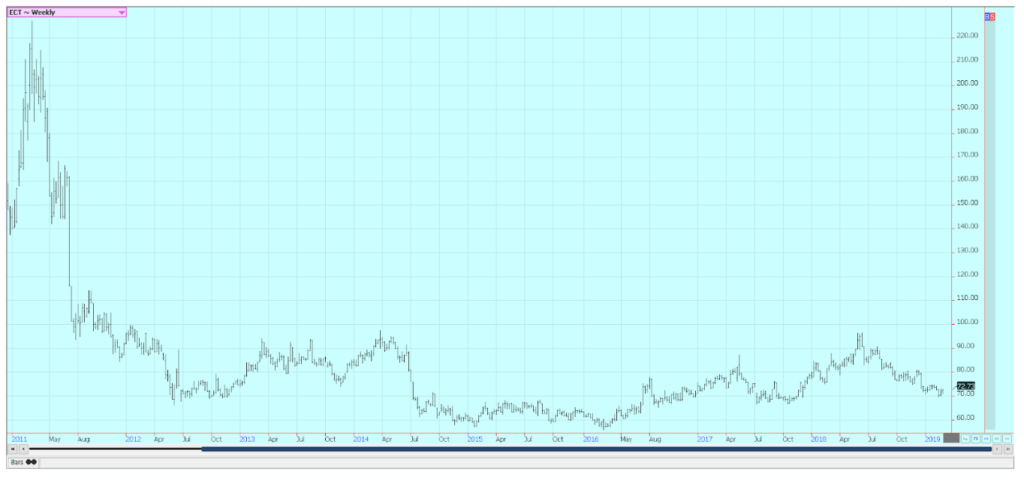

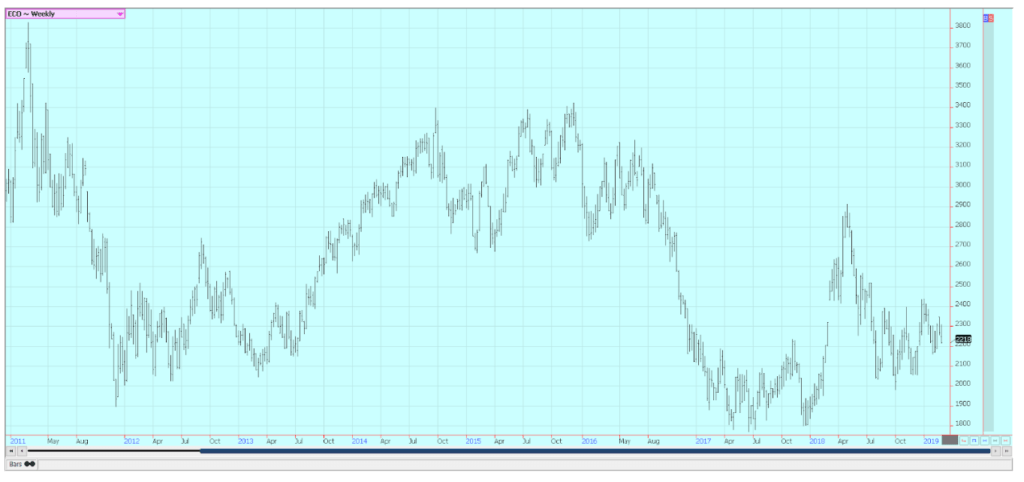

Cotton

Cotton was higher last week, with much of the buying coming on Friday. Trends are still mostly down on the daily and the weekly charts. The weekly export sales report showed weaker demand for US cotton again, but the market seemed more impressed with what was going on in Washington and in growing areas of the US.

There had been talk of less production from exporter countries like India. Indian and Pakistani sources will continue to insist that production is less than projected by USDA. India and Pakistan downed jets after a car bomb exploded in Kashmir, but no one wants to see an escalation of hostilities and things were calm over the weekend. The US weather continues to feature a lot of rain in the south, and fieldwork and initial planting in far southern areas are mostly delayed. Trends remain sideways to down on the weekly charts.

Weekly US Cotton Futures © Jack Scoville

Frozen concentrated orange juice and citrus

FCOJ was lower and closed near the recent lows on the daily and weekly charts. Trends are turning down on both sets of charts. The market has absorbed speculative long liquidation and producer selling through the winter as no freeze has developed. Futures can now move seasonally higher most of the time, but earlier rally attempts have failed and trends are turning down again as traders search for demand and look at a big harvest coming to market. It will turn colder this week in Florida, but not cold enough to damage crops. Longer range forecasts show that there is little chance for a freeze to develop this month, and then it will be getting to be too late for a freeze to be seen in the state of Florida. The oranges harvest remains active in Florida as the weather is mostly dry.

The fruit is abundant. Florida producers are seeing small sized to good sized fruit, and work in groves maintenance is active. Irrigation is being used in all areas. Packing houses are open to process fruit for the fresh market, and all processors are open in the state to take packinghouse eliminations and fresh fruit. Mostly good conditions are reported in Brazil, and some beneficial rains should be seen this week.

Weekly FCOJ Futures © Jack Scoville

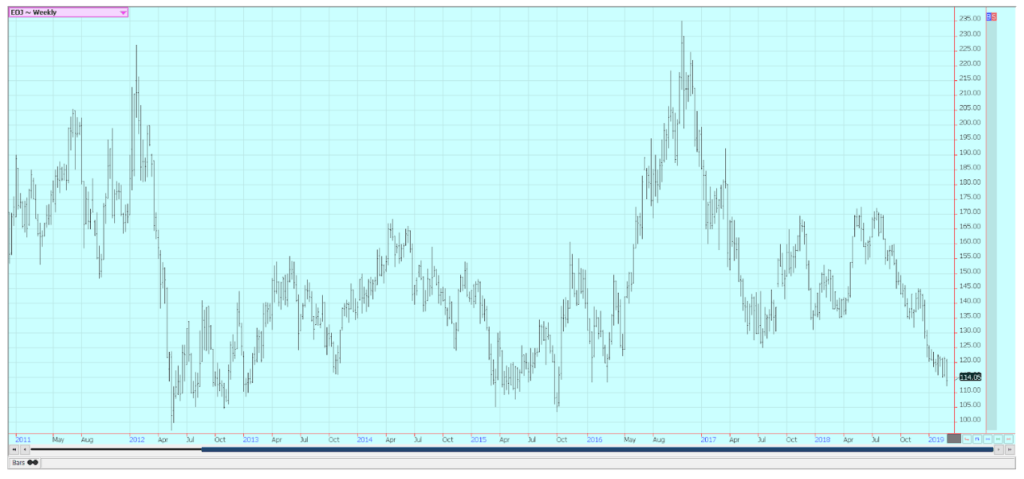

Coffee

Futures were a little higher for the week in New York after making new lows for the move and closed unchanged for the week in London. New York trends are down. Weekly chart trends are sideways in London. Speculators are keeping the pressure on the New York market as they fear big supplies of Arabica with not enough demand. The ICO has forecast a surplus year again this year, and inventory data from ICO and others shows ample supplies. Prices are moving below profitable levels for Colombia, and have been below profitable levels for producers in Central America.

Further weakness will cause farmers in Brazil, Peru, and Vietnam to start losing money as well. Brazil had a big production year for the current crop, but the next crop should be less as it is the off year for production. Ideas are that the current production of 62 or 63 or more million bags can become about 52 million bags next year. El Nino is fading but remains in the forecast, and coffee areas in Brazil could be affected by the drought that could hurt production even more. Showers are in the forecast for this week. Vietnam is active in its harvest, but producers are not willing to sell at current prices. Production in Vietnam is estimated less than 30 million bags due to uneven weather during the growing season.

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

Sugar

Both markets were lower for the week. Chart patterns on the weekly charts in both markets imply that trends are sideways. The fundamentals still suggest big supplies, but the turn in the trends on the weekly charts might be a signal that a change in the fundamentals is coming. Reports that Brazilian mills might pause and give Sugarcane production a chance to improve helped support the market. Brazil weather is improving in all areas as there is less rain in southern areas and more to the north. Brazil has been using the majority of its Sugarcane harvest to produce ethanol this year instead of sugar and the world sugar production surplus seems to be less. Ideas that production in India and Pakistan was not as strong as expected also helped play a role in ideas of smaller surpluses. The ISO now estimates the world sugar surplus at 641,000 tons in 2018-19, from its previous estimate of 2.17 million tons. Very good conditions are reported in Thailand.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

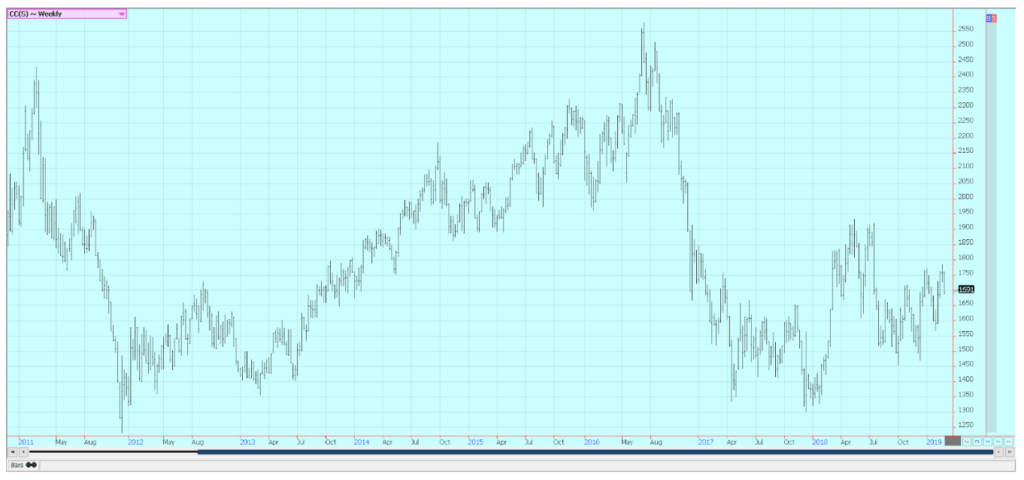

Cocoa

Futures closed lower in both markets, and chart patterns are turning down. The main crop harvest should be about over and mid-crop harvest is still a month or more away. The main crop harvest is active in West Africa, and Ivory Coast arrivals are strong. However, arrivals have started to fade. The weekly pace just a month or two ago was about 15 percent ahead of a year ago and now is under 10 percent of a year ago. Growing conditions are generally good in West Africa. Some early week showers and cooler temperatures were beneficial, it is warmer now and mostly dry.

Nigeria is reporting losses to its crops due to recent dry weather. Cameroon is also reporting less production and prices there are reported strong. Conditions appear good in East Africa and Asia. Port data showed that Ivory Coast has exported 701,530 tons of cocoa so far this marketing year, up about 12 percent from last year. Exports of products are now 148,086 tons, down about two percent from last year.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

(Featured image by nirapai boonpheng via Shutterstock)

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Crypto2 weeks ago

Crypto2 weeks agoCaution Prevails as Bitcoin Nears All-Time High

-

Fintech3 days ago

Fintech3 days agoOKX Integrates PayPal to Simplify Crypto Access Across Europe

-

Africa1 week ago

Africa1 week agoBridging Africa’s Climate Finance Gap: A Roadmap for Green Transformation

-

Business1 week ago

Business1 week agoThe TopRanked.io Weekly Digest: What’s Hot in Affiliate Marketing [uMobix Affiliate Program Review]