Business

Cotton tops weekly charts; Orange juice and coffee on constant highs

Cotton production trends as demand and price are looking good for July futures. Orange juice and coffee rally due to the rainy season.

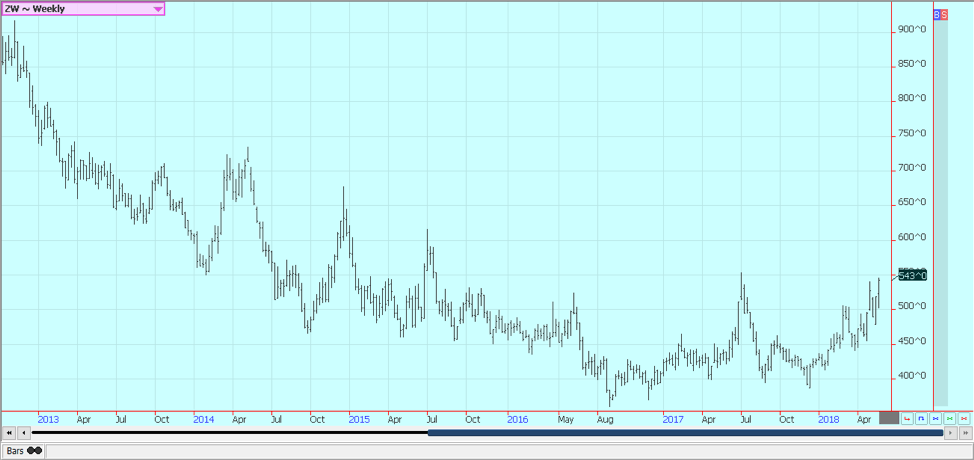

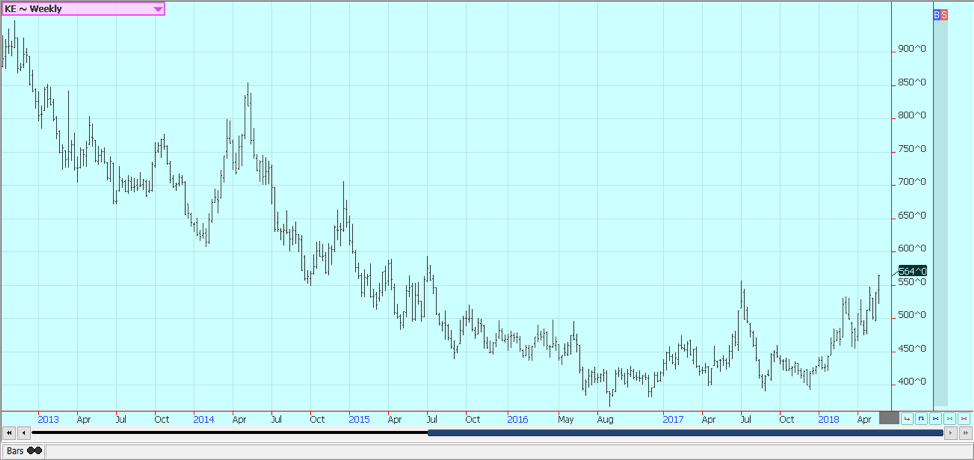

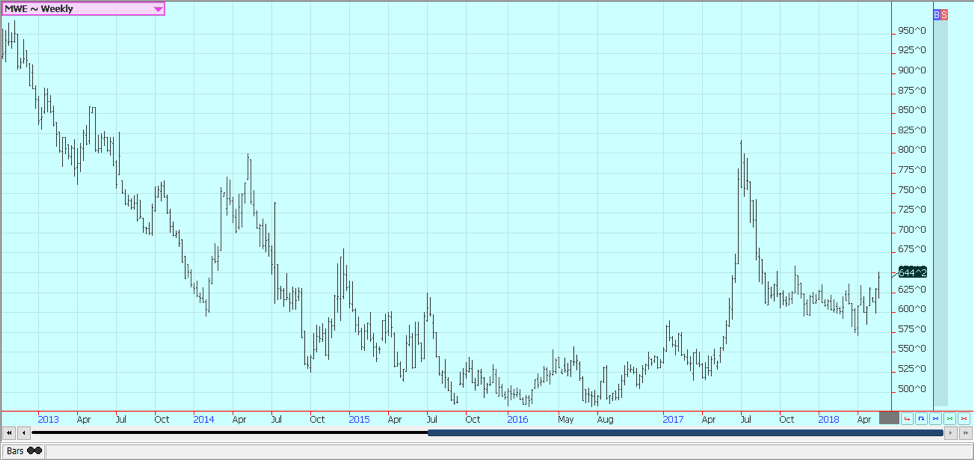

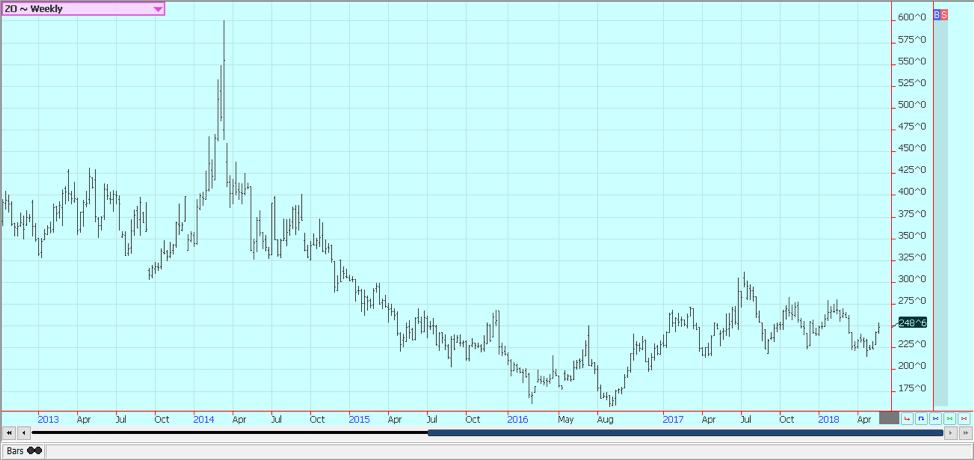

Wheat

Wheat markets were higher on uncertain production prospects at home and increasingly in other producing countries. The dry conditions in the western Great Plains, although Oklahoma saw a big jump in condition ratings last week due to some rains. Kansas also saw better ratings due to rains, and Texas has seen some storms. The weather focus is now mostly on the Black Sea area, or Ukraine and southern Russia and then into Kazakhstan. These areas are too dry and there is the talk of yield loss. Western Spring Wheat areas have been too wet and cold. Canada and Australia have been dry. India and Pakistan have been very hot. Wheat is also a market looking for some consumptive demand, but the weekly export sales reports remain poor. Black Sea prices remain cheaper but are now starting to turn higher due to the weather problems.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

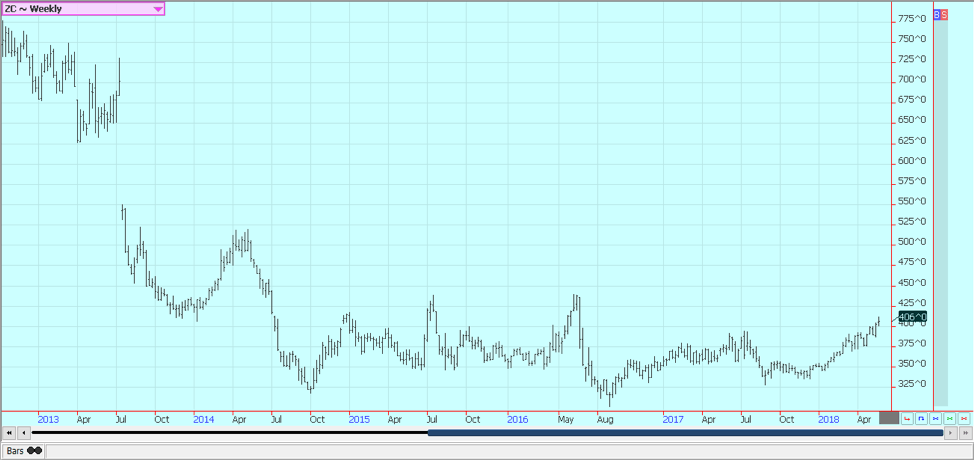

Corn

Corn closed higher on demand ideas and worries that some of the areas in the northwestern part of the Corn Belt might not get planted. Producers in most areas have been active and have been able to get most or all of the corn planted on intended area. This is not true, however, for parts of Wisconsin, Minnesota, and the Dakotas, where planting remains very far behind.

Quit dates for insurance purposes come in some cases by the end of this week and in others at the end of the month, so it is getting to crunch time for producers to get corn planted. On the other hand, parts of the southern and southwestern Midwest are turning dry just as the corn is emerging.

The export sales report last week was strong and showed that the demand for U.S. corn remains intact. There is not a lot of corn available from other world sellers right now, and U.S. corn is enjoying a significant price advantage over the competition.

Strong sales should remain a feature for a couple more months and maybe longer, depending on the production of the winter corn crop in Brazil. The Safrinha crop is in trouble in parts of Parana and Mato Grosso at a key time in its development cycle. It is pollination and kernel fill time, but the weather has already turned hot and dry. It could be that the rainy season has ended early. If so, yield potential will shrink dramatically as the development of the crop will be sharply reduced. Private estimates for corn production in Brazil have been lowered again with most ideas near 83 million tons for the total Brazil crop.

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

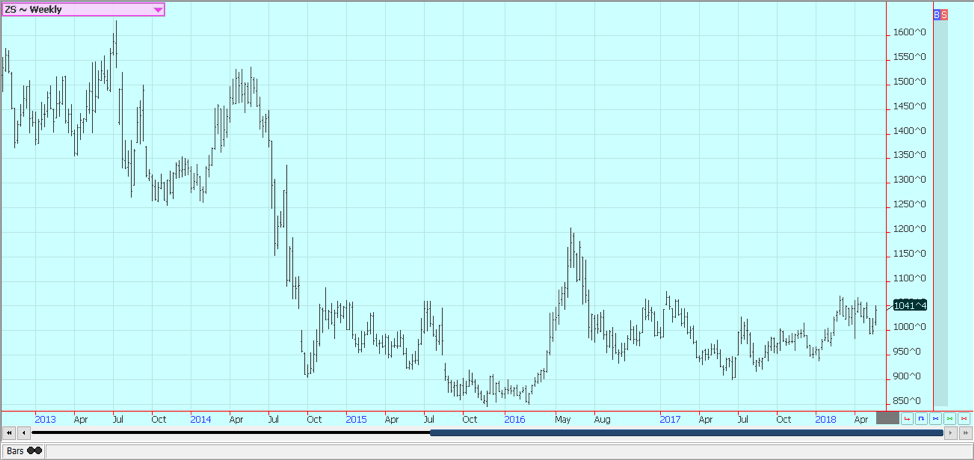

Soybeans and soybean meal

Soybeans were slightly higher and the products were lower last week. The U.S. and China have continued talks to try to resolve the trade dispute. The agreement was found on some issues in the first round of meetings, but there are still a lot of issues that need to be resolved, and the differences are said to be big on some of these items. The U.S. did say that enough progress had been made to waive the need for tariffs now, although they could be imposed later. China responded by starting to buy soybeans for the coming crop year. This allowed the soybeans to rally and to close at strong levels. There are very high-level meetings scheduled between the two sides this weekend. The trade also hopes for a peaceful solution to the NAFTA talks to keep Mexican and Canadian demand alive. Farmers in much of the southern Midwest are planting Soybeans. Planting of Corn and Soybeans will increase in the north this week.

Weekly Chicago Soybeans Futures © Jack Scoville

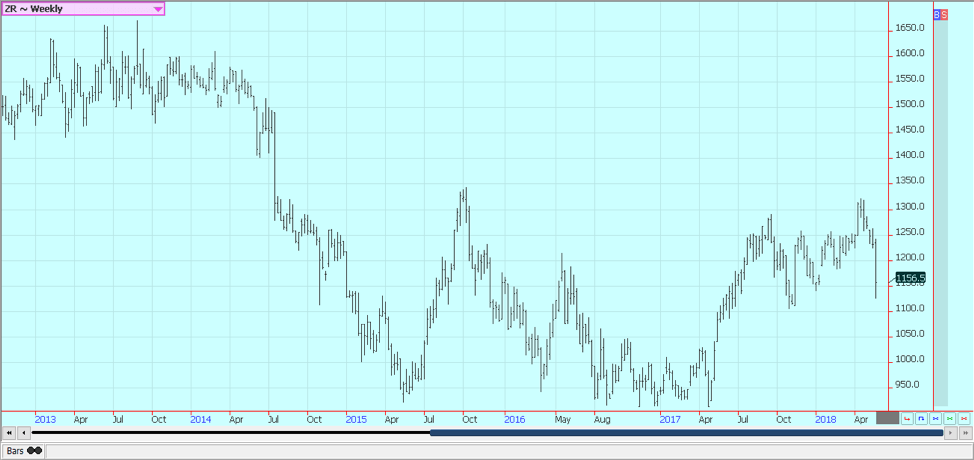

Rice

Rice was lower for the week and made new lows for the move on ideas that demand is waning and the crop is starting to progress. Much of the selling came in the last half of the week as some significant moves lower were made. The market had a washout and was able to recover slightly in late trading on Friday.

Meanwhile, domestic cash prices did not really respond to the futures moves and held mostly steady in quiet trading. Ideas are that domestic demand is now about covered and that export demand could be less. Sources in Arkansas say that planting has been active on warmer weather and that crops are finally starting to emerge. Some producers switched to soybeans for some of the areas due to price and the bad weather.

Planting is also about done along the Gulf Coast. It remains very dry in Texas and producers are having to flush crops more than normal. There are worries that are starting to be heard about yield potential for the state, but conditions and crops appear mostly good at this time. Ideas are that little old crop Rice is available in the cash market, and the situation is not likely to improve before the new crop becomes available late this summer as farmers are mostly sold out. Farmers have planted more rice this year, but the increase in planted area is not considered burdensome.

Weekly Chicago Rice Futures © Jack Scoville

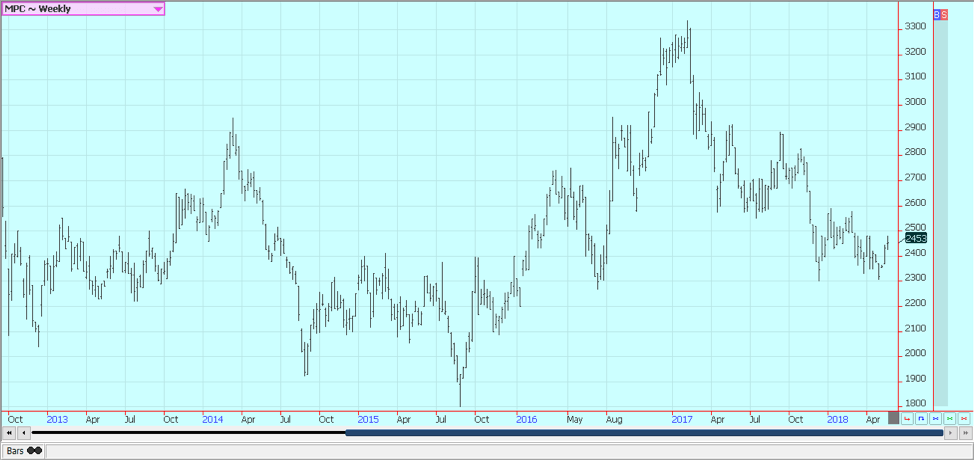

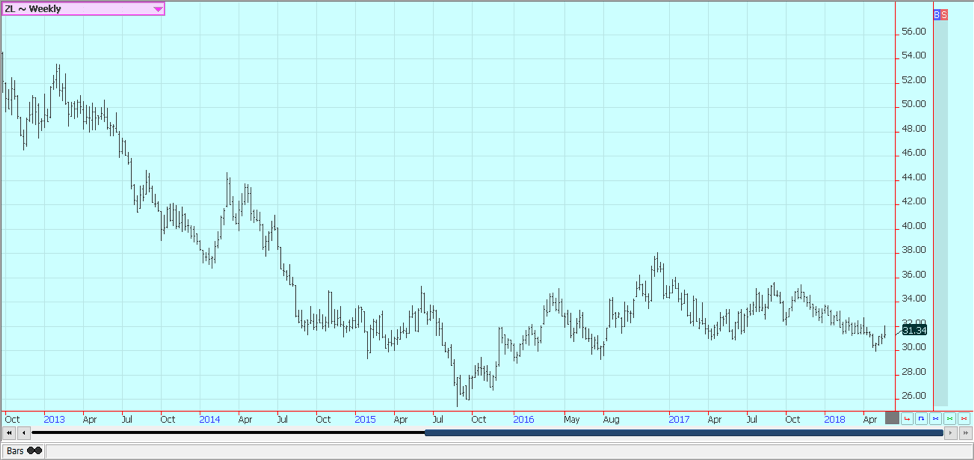

Palm oil and vegetable oils

World vegetable oils prices were a little higher again last week. Palm oil moved higher as the market hopes for increased demand. Demand reports from the private sources have been down this month, but the month is almost over. The market has held well despite the reduced demand and has held firm overall.

The US-China trade dispute could shift some of the demand to palm oil, especially since the soybeans and soybean meal market has been under pressure in China. China has been importing mostly from Indonesia and India is out of the market for now. China has been crushing a lot of soybeans and has been producing its own soybean oil. A weaker currency has also supported improved demand ideas. Soybean oil was locked in a sideways trend all week but closed higher.

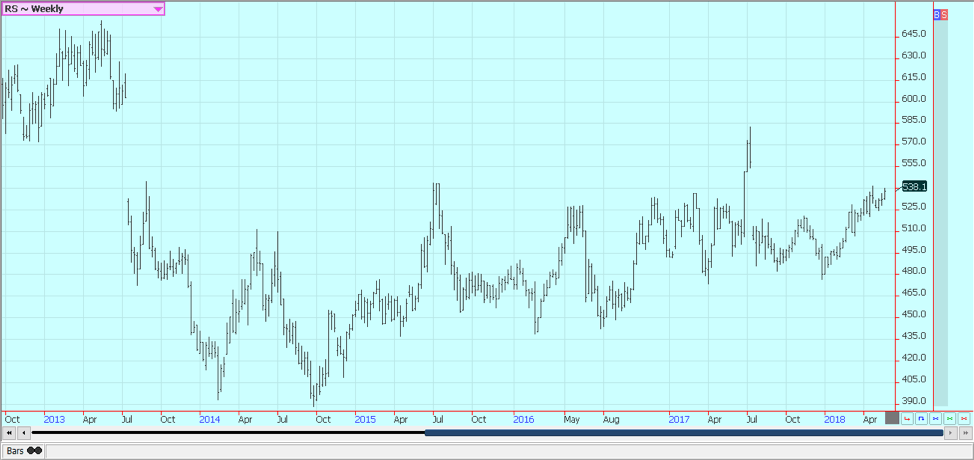

Canola found some support from the trade war and the weather. Farmers were active planting, although some parts of the Prairies have turned very dry. Offers from farmers were down last week as they plant and wait for higher prices.

Weekly Malaysian Palm Oil Futures © Jack Scoville

Weekly Chicago Soybean Oil Futures © Jack Scoville

Weekly Canola Futures © Jack Scoville

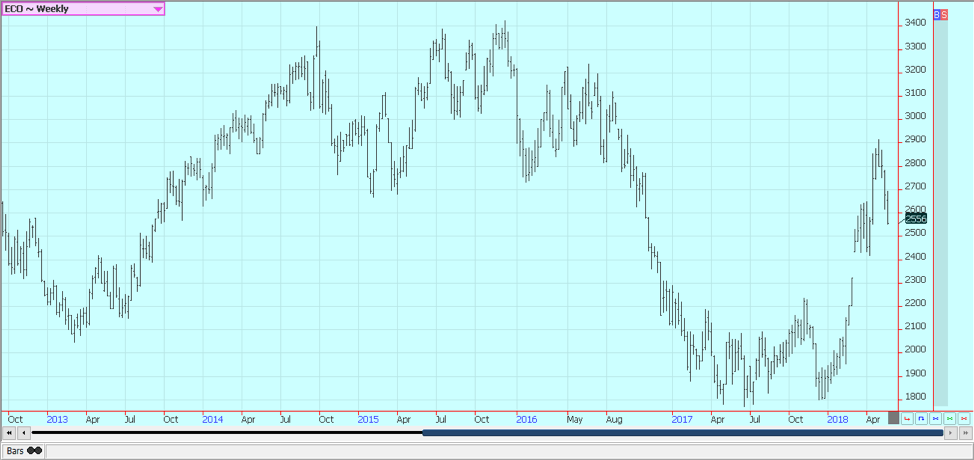

Cotton

Cotton was higher again last week, and trends are up on the weekly charts. Demand and stronger world prices are supporting July futures. Back months are holding firm on less than ideal crop conditions in West Texas and at other producing areas around the world. The weather is bad in India and China, with big heat seen in India and Pakistan and too much rain in China. Lost Chinese production could mean increased sales for the U.S., especially now since the U.S. will have the quality the Chinese need.

Futures traders are looking at a market that still has strong export demand and has seen some very uneven planting and growing conditions in the U.S. Much of the Southeast and parts of the Delta have seen big rains. Texas has seen some precipitation, but dryland areas are still very dry. Oklahoma and Kansas have improved conditions due to recent rains. It has been hot and dry on the Indian Subcontinent and also in China. There are ideas that the U.S. is now running short of high-quality cotton to deliver to the exchange and to overseas buyers. Demand remains strong in export markets.

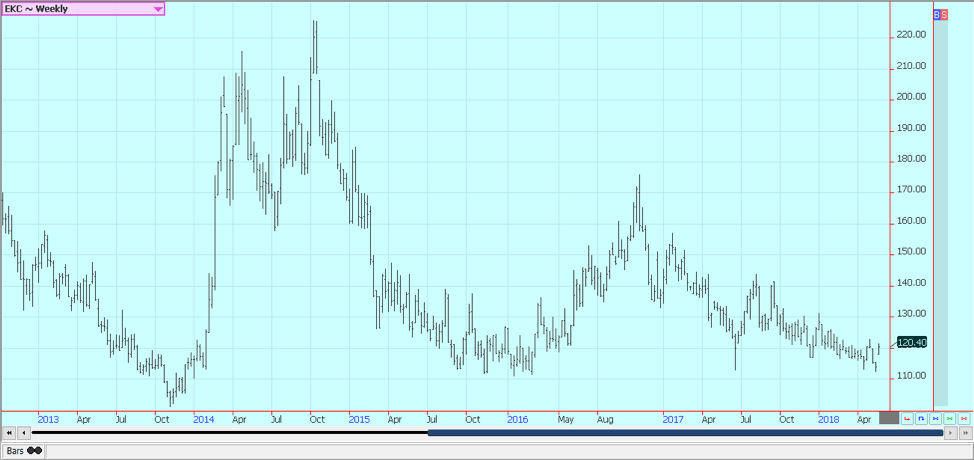

Weekly US Cotton Futures © Jack Scoville

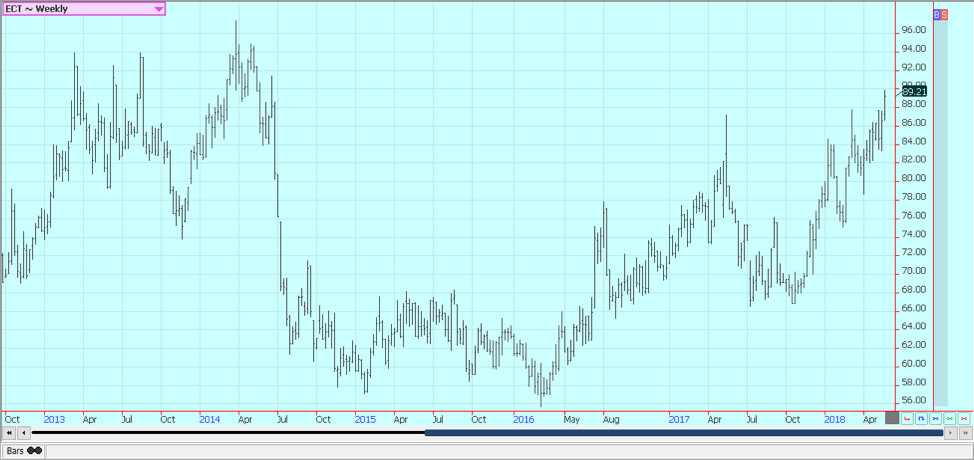

Frozen concentrated orange juice and citrus

FCOJ was higher. Most traders are focused on the weather as the hurricane season is just round the corner. Some drought-busting rains have been reported in Florida in the last week, and more big rains are expected this weekend from what could be a tropical or subtropical storm now forming in the Gulf of Mexico. The situation in the state should continue to improve as the rainy season appears to be underway. The market is still dealing with a short crop against weak demand.

Florida producers are seeing golf ball-sized fruit. Conditions are reported as generally good. Irrigation is being used, but less now after the rains. Brazil also could use more rain as Sao Paulo has been hot and dry. Generally good conditions are reported in Europe and northern Africa.

Weekly Frozen Concentrated Orange Juice Futures © Jack Scoville

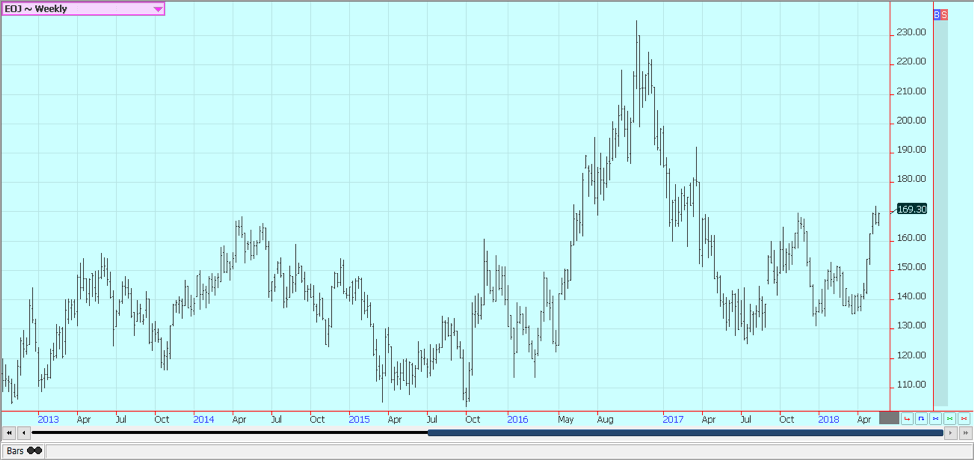

Coffee

Futures in New York were higher for the week. The cold weather in Arabica-growing areas and a truckers strike in Brazil that could delay shipments provided support. Southern growing areas into pars of Minas Gerais saw temperatures cold enough to potentially damage crops this week, but there have been few, if any, reports of damage.

It remains mostly dry in Arabica areas, but Conillan areas have seen some rains lately. Origin is still offering in Central America and is still finding weak differentials. Speculators anticipate big crops from Brazil and from Vietnam this year and have remained short in the market.

Robusta remains the stronger market as Vietnamese producers and merchants have not been willing to sell at current prices. Vietnamese cash prices are weaker this week with good supplies noted in the domestic market. Current rains in the country are favorable for the crops.

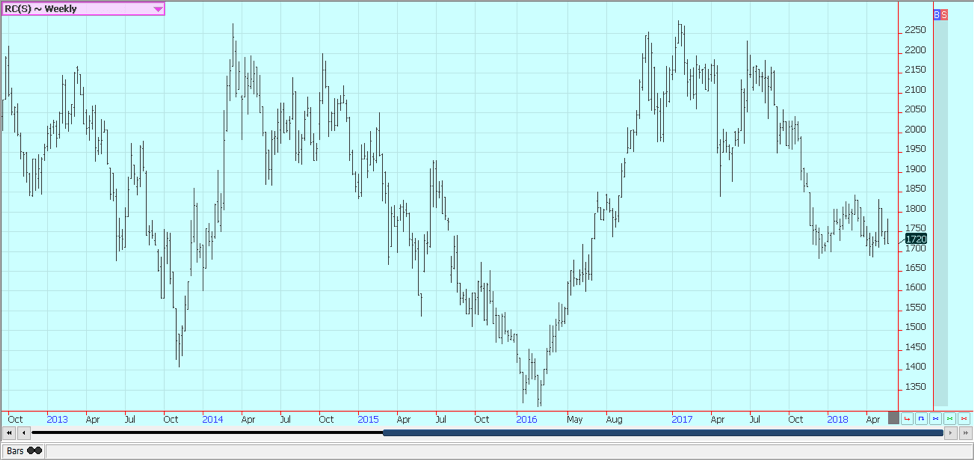

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

Sugar

Futures were higher in both markets for the week as Brazil was dry and cold. Both markets have formed bottoms on the daily and weekly charts. However, analysts remain bearish overall. Ideas of big world supplies against average at best world demand keeps the overall tone of the market weak, but the market acts sold out and in need of new sellers.

The Brazil season is off to a big start, causing the selling interest as the market now expects even more sugar to be available. There has been little in the way of positive news for traders in the last year as production estimates have climbed and demand estimates have not. The fundamentals remain little changed, and there does not seem to be much, for now, that can shake the market out of its current trend.

Ideas that sugar supplies available to the market can increase in the short term have been key to any selling. India is back to export sugar this year after being a net importer for the last couple of years. Thailand has produced a record crop and is selling. Brazil still has plenty of sugar to sell.

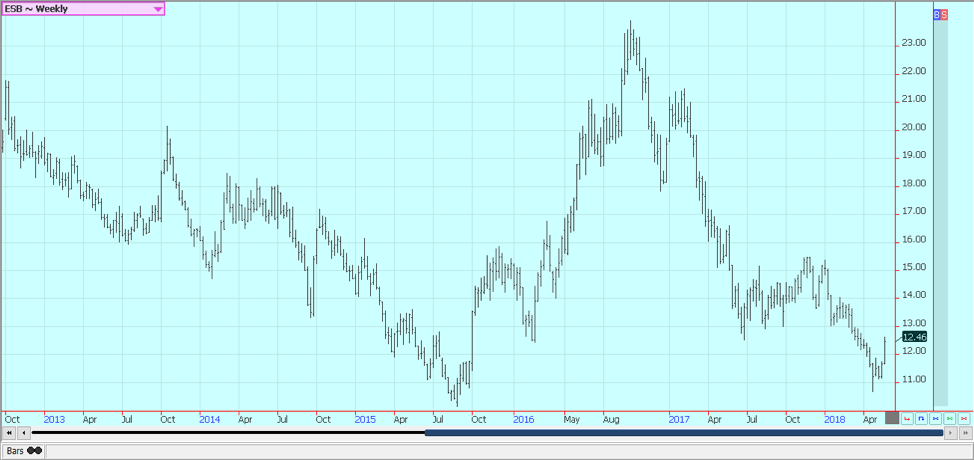

Weekly New York World Raw Sugar Futures © Jack Scoville

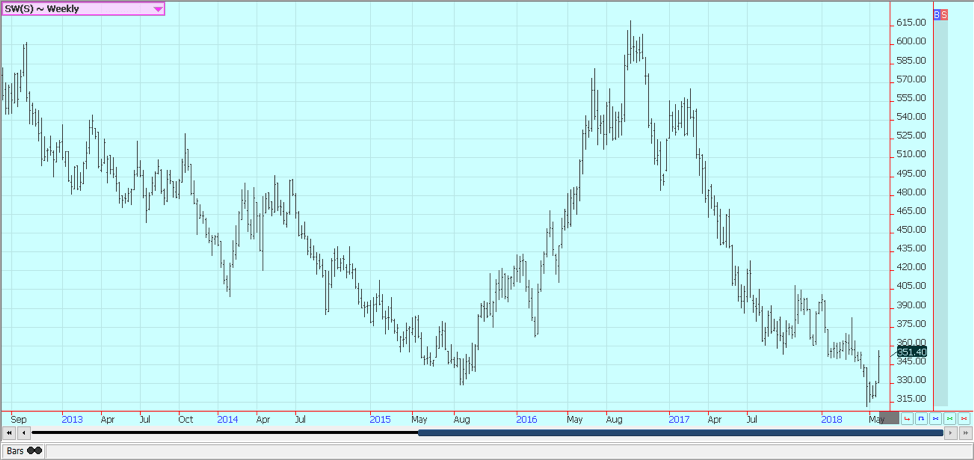

Weekly London White Sugar Futures © Jack Scoville

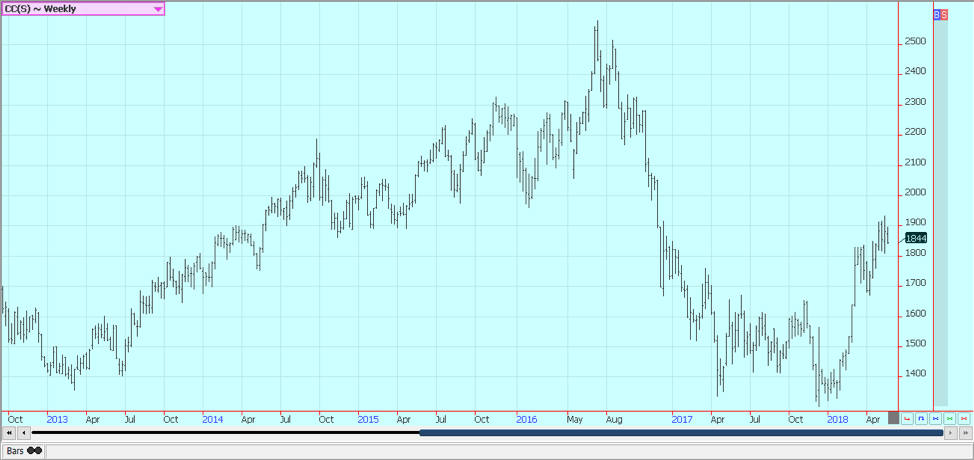

Cocoa

Futures were lower in New York, but little changed in London last week. The spread between New York and London has now begun to correct back to more normal levels as New York is losing its steam to move higher but as London continues to rally. The widespread is due to a fund buying in New York, and also due to the need to pay higher to attract African supplies. Asian supplies are now less available since Asian grinding capacity has increased, so New York has space for African Cocoa. Ideas that world production has been largely sold remain part of the rally. Showers and more seasonal temperatures have been seen in the last few weeks to improve overall production conditions in West Africa. The mid-crop harvest is active.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided in this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted.

The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Biotech2 weeks ago

Biotech2 weeks agoEcnoglutide Shows Promise as Next-Generation Obesity Treatment

-

Business2 days ago

Business2 days agoThe TopRanked.io Weekly Digest: What’s Hot in Affiliate Marketing [uMobix Affiliate Program Review]

-

Business1 week ago

Business1 week agoThe TopRanked.io Weekly Digest: What’s Hot in Affiliate Marketing [PureVPN Affiliates Review]

-

Crowdfunding4 days ago

Crowdfunding4 days agoPMG Empowers Italian SMEs with Performance Marketing and Investor-Friendly Crowdfunding

You must be logged in to post a comment Login