Featured

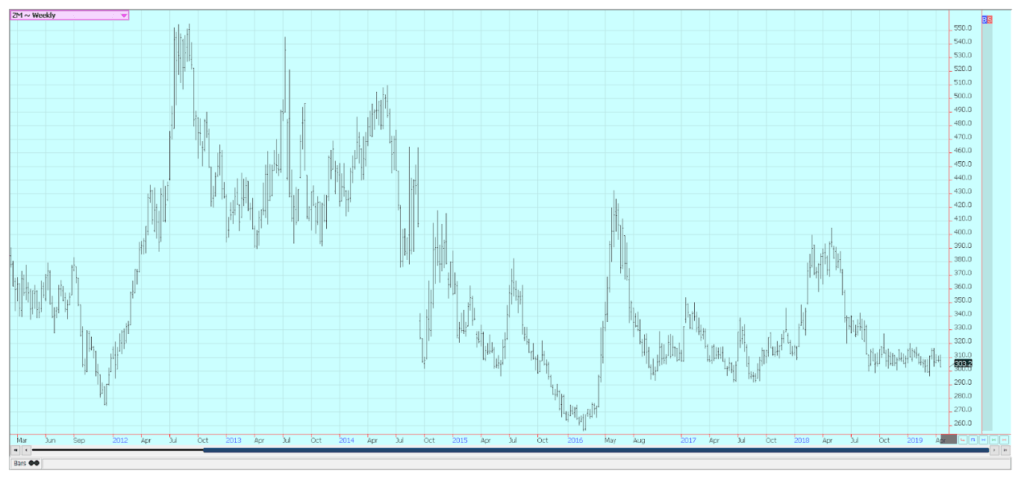

Crop markets struggle amid weaker Canada-China relations

US spring wheat planting progress has been slow while there is weak demand for U.S. cotton.

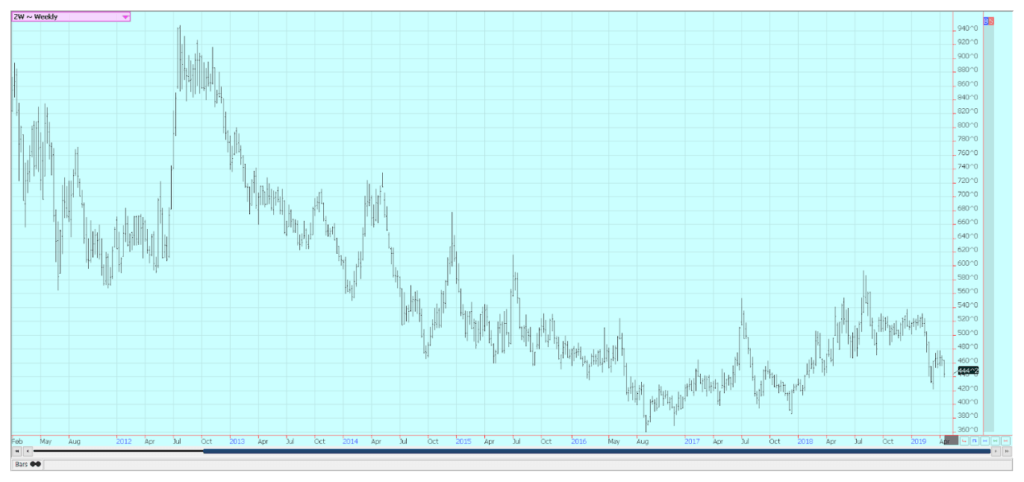

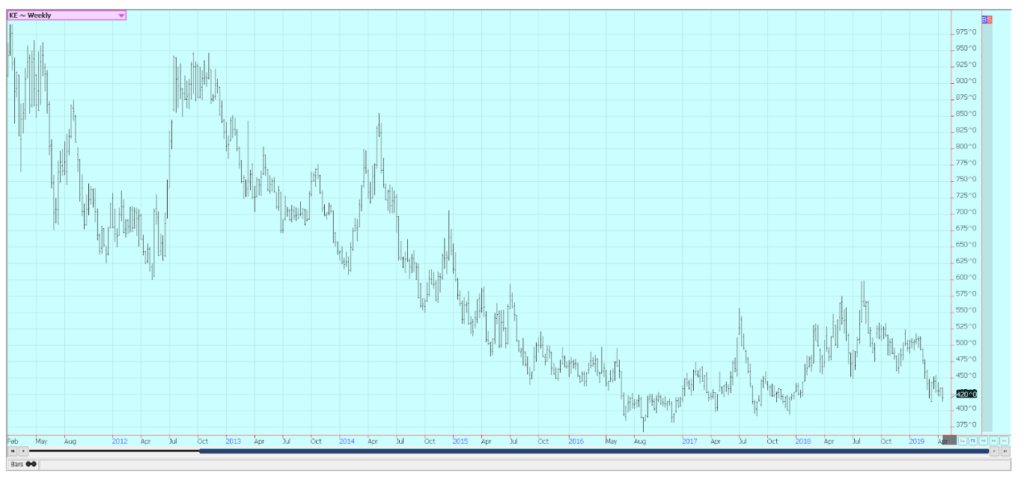

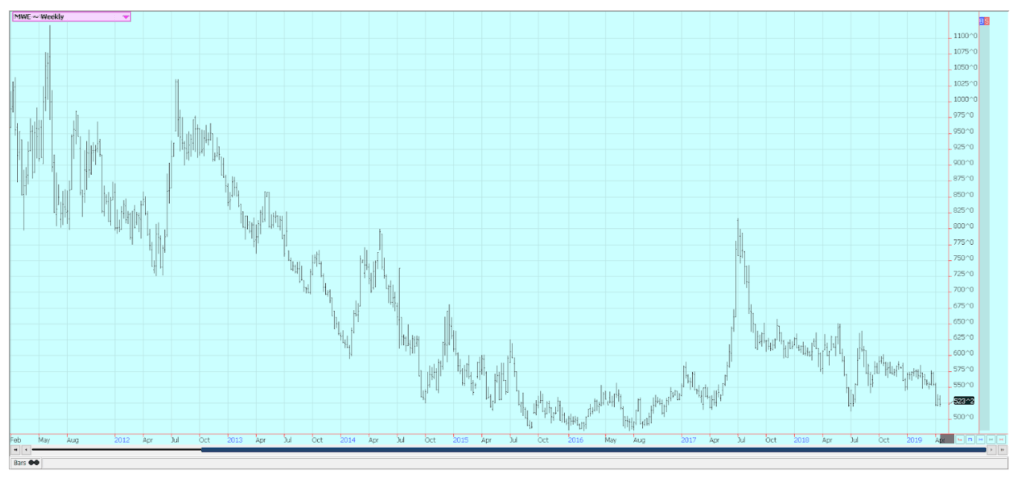

Wheat

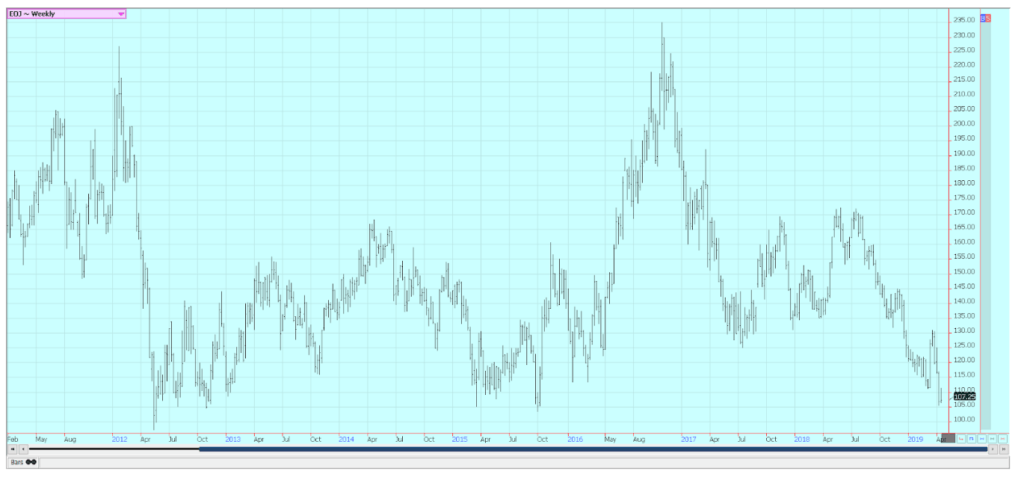

Winter wheat markets were lower last week and Chicago SRW completed a top and started a new downtrend on the weekly charts. Minneapolis and Chicago HRW remain pinned near recent lows and look weak. Trends in HRW and Minneapolis remain down. Minneapolis remained weak on fears of a dramatic increase in planted area to spring wheat in Canada. Canada and China continue to have weaker trade relations. The canola demand from China has been decimated. Spring wheat prices have lost a lot and could go lower in the short term to price in the potential increase in planted area.

On the other hand, some reports from Canada indicate that producers there would rather stick with the normal rotation rather than make any big changes in order to maximize yield potential now and over time. That implies that any switching of crops planted area might be minor. The US spring wheat planted area was projected to be significantly down in the coming year, but the increased area in Canada could be more important. The US spring wheat planting progress has been slow as producers wait for the snow to melt and for the ground to dry. Any major planting delays now could mean that some US spring wheat area lies fallow or is planted to soybeans, especially with the current weaker prices. Demand remains a problem as export sales remain weaker.

Weekly Chicago Soft Red Winter Wheat Futures ©Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures ©Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures Winter Wheat Futures ©Jack Scoville

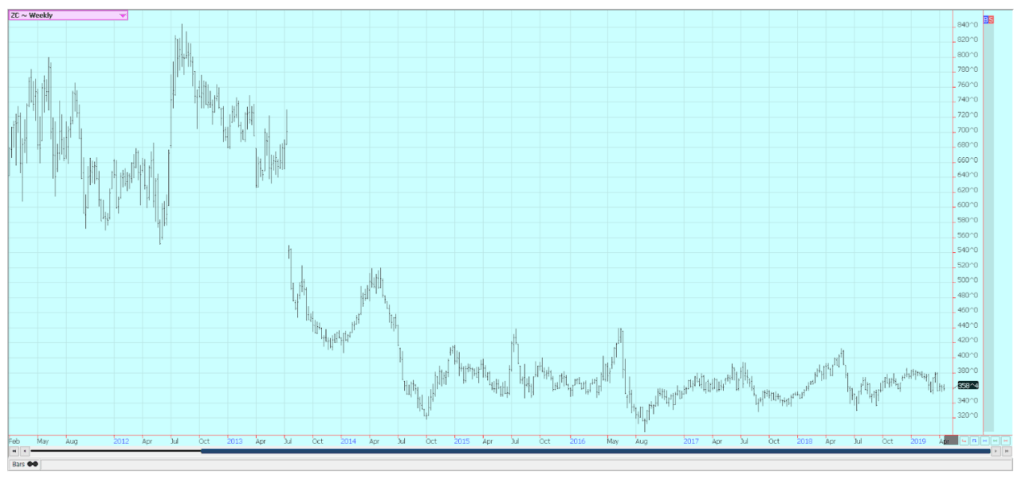

Corn

Corn was a little lower last week and remains in a trading range overall. It has held the lows from last fall, but has been unable to sustain any rally attempt. There is enough supply out there for current demand, but initial planting weather has not been good and fieldwork and planting is getting off to a slow start. The market is holding support on ideas that prices are cheap enough for this time of year. Oats traded higher and then collapsed on Thursday. Weekly chart patterns are still up, but the price action Thursday signals that the market might have seen the highs for now.

US weather remains cool and wet for most of the Midwest. Some big rains moved through many central and southern growing areas last week, and there was some wet weather in northern areas in the middle of the week. The forecasts for this week maintain a generally wet outlook. There is some work going on in some areas, but most producers appear sidelined for now. Many were unable to do much fall fieldwork, either, so there is extra soil preparation to be done in anticipation of planting. It is more and more likely that the crop overall will be planted late, and this fact increases the likelihood that there could be a little yield loss and that some area could be switched to soybeans.

Brazil winter corn appears to be in good condition as the crop develops and moves to pollination. Crop estimates are high and have shown a tendency to increase as the crop develops. Most areas have seen enough rain for now. Corn prices are reported to be weakening in South America as the summer production from both Brazil and Argentina is now available. US demand has held well given the potential competition and Gulf basis levels have been steady.

Weekly Corn Futures ©Jack Scoville

Weekly Oats Futures ©Jack Scoville

Soybeans and soybean meal

Soybeans and soybean meal were lower last week. The weekly export sales report showed poor sales of Soybeans and Soybean Meal and big sales of pork to China once again. The big purchases of US pork by China in recent weeks despite very high tariffs on US goods showed to many just how bug the Asian swine flu epidemic is in China. The government reports that at least 18 percent of its hog herd has been lost and private estimates show much higher loss potential. It is an indication of the very strong demand potential from China for hogs and pork and products and also an indication that soybeans and meal demand could be significantly less in the coming year as China works to eradicate the disease and then repopulate its herds. The soybeans demand could take several years to recover as it will take time to rebuild the herds.

Export differentials from the US and South America have been under pressure for this reason and also as the South American crop is now available. Prices are a little lower in Brazil than in the US despite a lack of farmer selling in Brazil. They are unhappy with the price and nervous over economic changes going on in Brazil as the new president works to overhaul the public pension system and finds strong resistance from the Brazilian legislature. Some shifting of business back to the US could happen if the Brazil farmer holding patterns are strong enough and soybeans become more scarce in Brazil ports, but basis levels right now do not indicate any shortages there.

Weekly Chicago Soybeans Futures ©Jack Scoville

Weekly Chicago Soybean Meal Futures ©Jack Scoville

Rice

Rice was slightly lower for the week. Planting has been active near the Gulf Coast and in Texas, and initial reports show that crops there are in good condition. Planting progress has been more sporadic to the north due to cool and wet conditions, but some planting has been done. Producers in Texas and Louisiana reported some impressive rains last week that will help flush the crop and aid in germination. USDA has shown average progress in its reports. The weekly export sales report was very strong last week and showed big sales of long grain paddy into Central America.

The market seems content to trade in a wide trading range for now and this implies that somewhat higher prices are possible over the next couple of weeks. The domestic market is using price breaks to extend forward coverage as the mills push to own Rice into the next harvest. Prices have been firm in Texas due to good demand for limited supplies. Much of the rice is moving to Mexico. Prices have been firm in Arkansas due to a lack of producer selling as they wait to get the next crop planted. Some in the trade are disputing the planted area estimates from USDA. They think the planted area will be less in part due to the weather but mostly due to the prices. Current supplies are high and bearish traders point to this fact as a reason to keep prices relatively cheap or at least in a trading range.

Weekly Chicago Rice Futures ©Jack Scoville

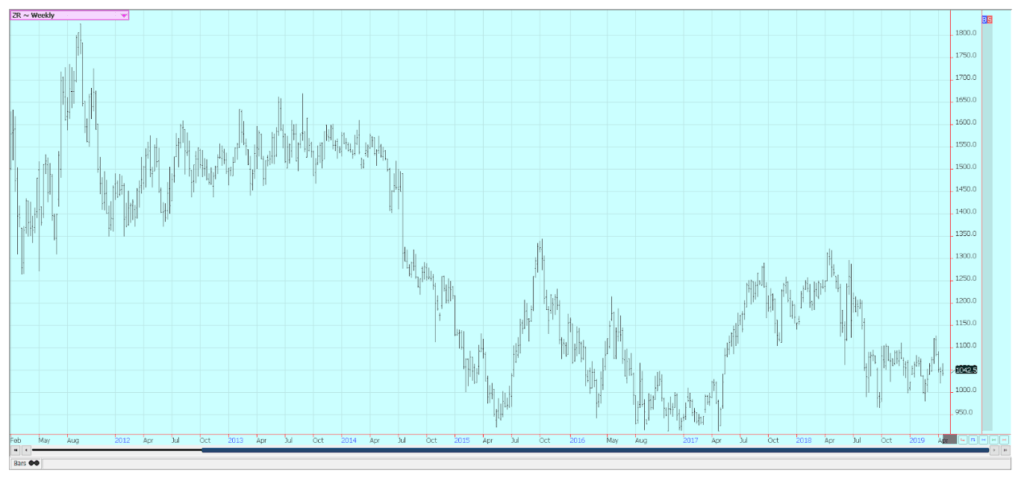

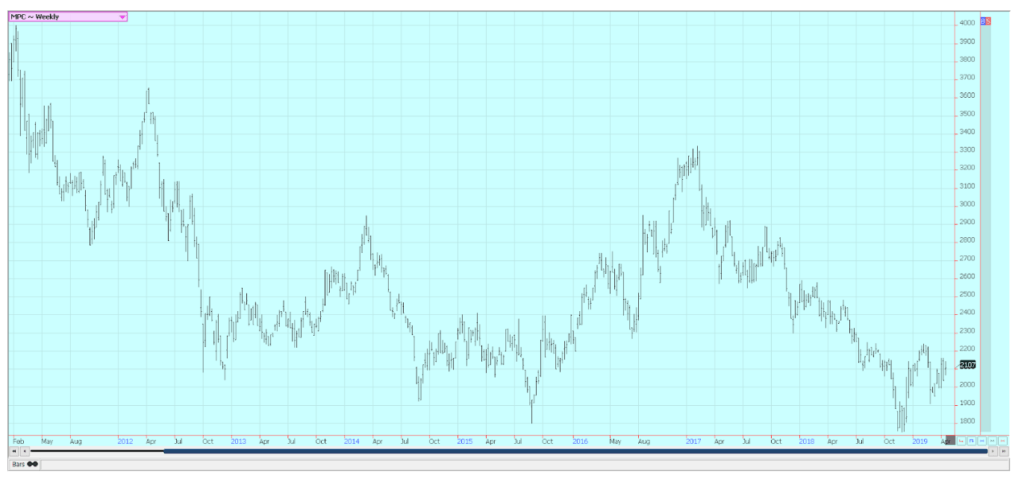

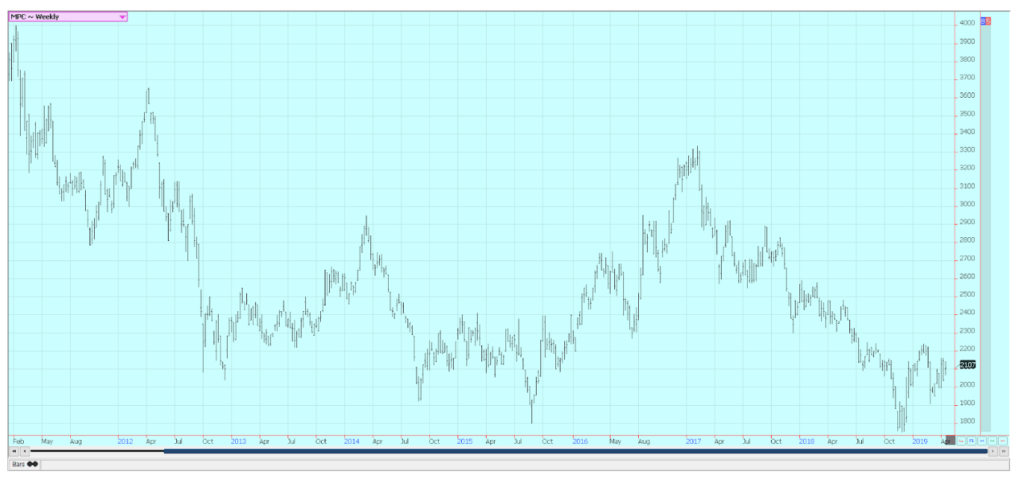

Palm oil and vegetable oils

It was a mixed week for world vegetable oils markets. Palm oil was higher on positive data from MPOB and strong exports so far this month. March palm oil production was 1.671 million tons, from 1.544 million in February. The production was strong at a time when production normally starts to decrease. Demand was much improved on the month at 1.617 million tons, from 1.321 million in February as many buyers started to buy ahead for the spring festival season. Ending stocks were down at 2.917 million tons, from 3.059 million in February. The positive data was not enough to keep the short term uptrend going and prices fell to support areas on the weekly charts by the end of the week. This week will be an important week for determining the short to medium term direction of the market.

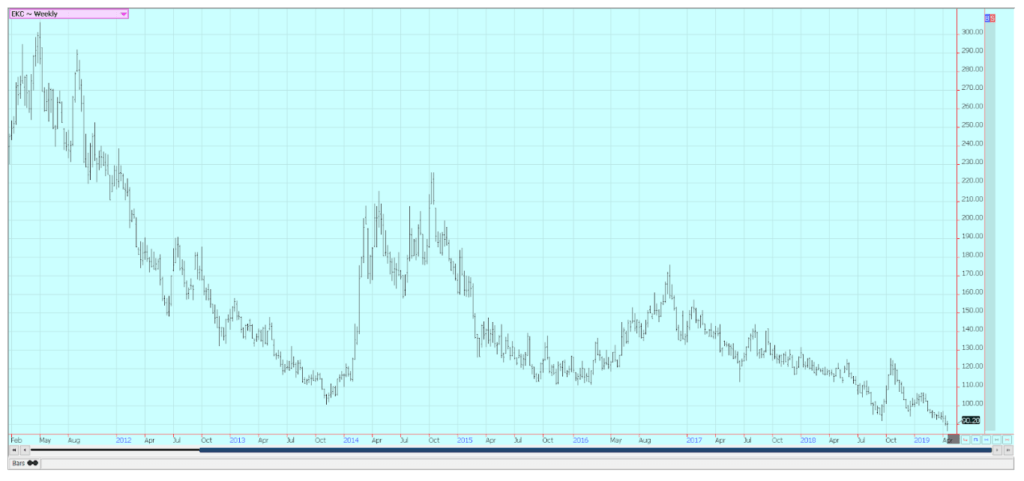

Canola was lower last week and made new contract lows as supplies in the country remain high and demand has softened. The court case in which a Chinese national could be deported to the US on industrial espionage charges remains a major issue between Canada and China, and China has basically cut off purchases of Canadian canola due to the trial. The market has tried to become more stable in recent weeks but faces strong headwinds in getting demand flowing again and avoiding big ending stocks. Worries that low production and low planted area this growing season have started to support new crop prices. Soybean oil was lower. It was a narrow range week as traders showed limited interest in buying or selling. US soybean oil faces increased competition in world markets from Argentina as its soybeans are harvested and processed. Argentina will look to reclaim its position as the largest exporter of soybean oil in the world.

Weekly Malaysian Palm Oil Futures ©Jack Scoville

Weekly Chicago Soybean Oil Futures ©Jack Scoville

Weekly Canola Futures ©Jack Scoville

Cotton

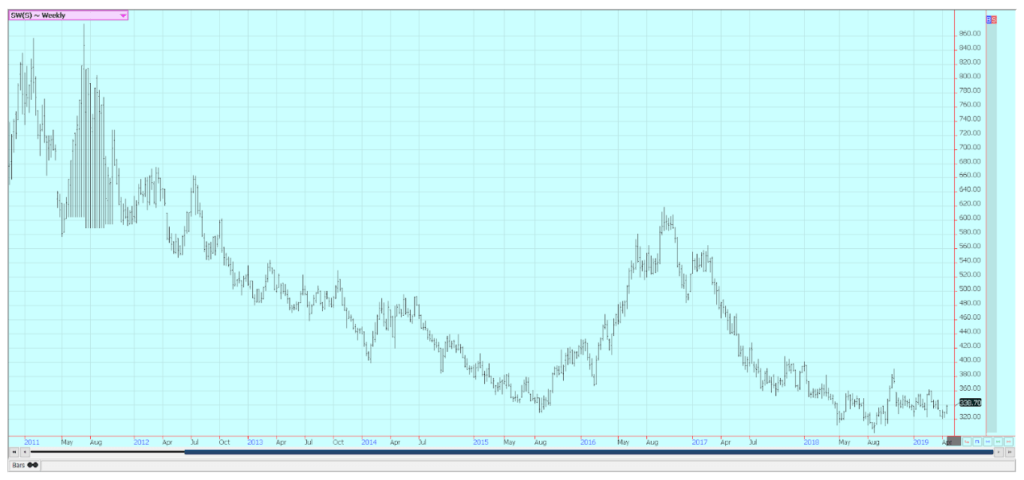

Cotton was lower after trading mostly sideways for the week. The daily charts show that futures are developing a short term trading range. The weekly charts show that an uptrend is still intact. The weekly export sales report showed a weaker demand for US cotton. There is still talk that the US can have strong sales with other major exporters starting to run low on supplies. USDA showed that planting progress was good. Most of the progress this week will be in Texas after some big rains were reported over the weekend in the Delta. The Southeast also got some big rains. It is likely that planting progress will start to slip behind the five-year average due to all of the recent rain.

The daily charts still imply that the market can move to or above 82.00 cents per pound. US sales have suffered so far this year in world markets, but have started to improve as other sellers run out of supplies. There are expectations that cotton planted area can increase this season as farmers could be attracted to cotton instead of grains such as corn or rice due to relative pricing. Anecdotal reports imply that the industry is preparing for more production as new facilities such as gins are being opened. Cotton production is poised to make a comeback in the Delta and Southeast, and the wet weather implies less corn planted and more cotton or Soybeans planted.

Weekly US Cotton Futures ©Jack Scoville

Frozen concentrated orange juice and citrus

FCOJ was a little higher last week and futures held the contract lows. Trends are down on the weekly charts as the market looks at a big oranges crop and little demand for FCOJ. Trends are sideways on the daily charts. USDA this month estimated the production of oranges in Florida at 76.5 million boxes, slightly less than its previous estimate but still a huge recovery from the small crop of the previous year. News that the EU and the US are moving slowly in trade negotiations hurt futures as did the news of good production potential for oranges and FCOJ in Brazil. Brazil will most likely remain the major and almost exclusive supplier of FCOJ to the EU.

Ideas continue that production remains strong and demand does not. Inventories inside the state are significantly higher than a year ago. The oranges harvest remains active in Florida as the new crop begins to develop. The Early and Mid harvest is over and producers are concentrating on harvesting Valencias. Fruit is developing and ideas are that the next crop is off to a very good start. Irrigation is being used frequently to help protect crop condition. Mostly good conditions are reported in Brazil.

Weekly FCOJ Futures ©Jack Scoville

Coffee

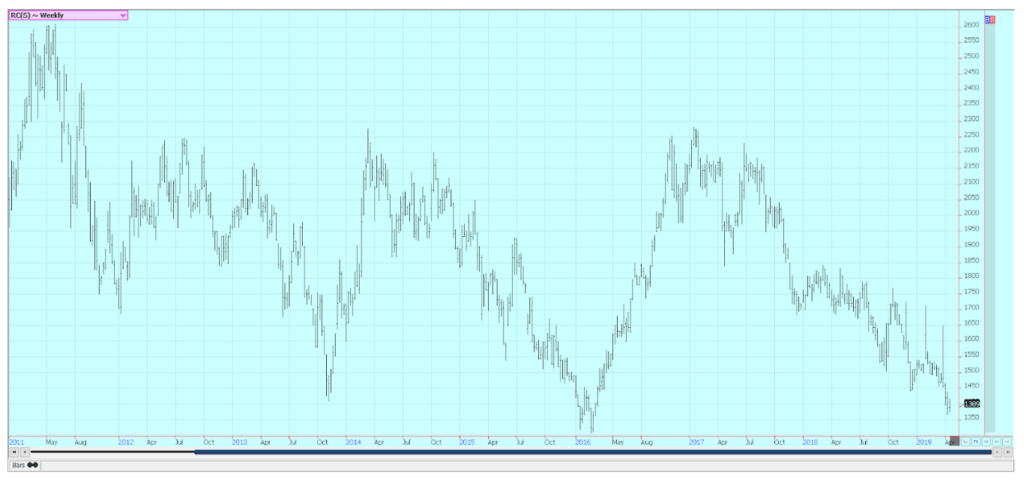

Futures were near unchanged for the week after a strong rally on Thursday. Weakness in the Brazilian Real caused some speculative selling earlier in the week in New York, while reports of steady offers from Asia hurt Robusta in London. The trade is still worried about big supplies, especially from Brazil and low demand. Brazil is dominating the market, and other exporters are having a lot of trouble finding buyers. Roasters were scaled down buyers on the extended down move and now have more than ample supplies in-house or on the way.

Prices are generally below to well below the cost of production for world producers, and prices are getting to that point for producers in Brazil and Vietnam. The inventory data from ICO and others shows ample supplies in the world market. Brazil had a big production year for the current crop, but the next crop should be less as it is the off year for production. Ideas are that the next crop might still be big as the weather has been good for the trees so far. Mostly dry conditions are in the forecast for this week. Vietnam is active in its harvest and the export pace has been good so far this year.

Weekly New York Arabica Coffee Futures ©Jack Scoville

Weekly London Robusta Coffee Futures ©Jack Scoville

Sugar

Futures were little changed last week as the trade waits for news of some kind to trigger a move. Chart patterns on the weekly charts are sideways in New York and sideways in London. The fundamentals still suggest big supplies, and the weather in Brazil has improved to support big production ideas. Brazil weather is improving in all areas as there is less rain in southern areas and more to the north. However, it has turned drier in northern areas and there is a concern that the dry season is starting early this year.

Brazil has been using a larger part of its sugarcane harvest to produce ethanol this year instead of sugar, but Thailand has shown increased production this year. Ideas that production in India and Pakistan is being hurt by news that Indian mills are asking the government not to force them to sell sugar into a depressed world market in order to try to maintain some control over operating losses. Very good conditions are reported in Thailand. Demand for Sugar has been good, and the demand for ethanol is reported to be increasing.

Weekly New York World Raw Sugar Futures ©Jack Scoville

Weekly London White Sugar Futures ©Jack Scoville

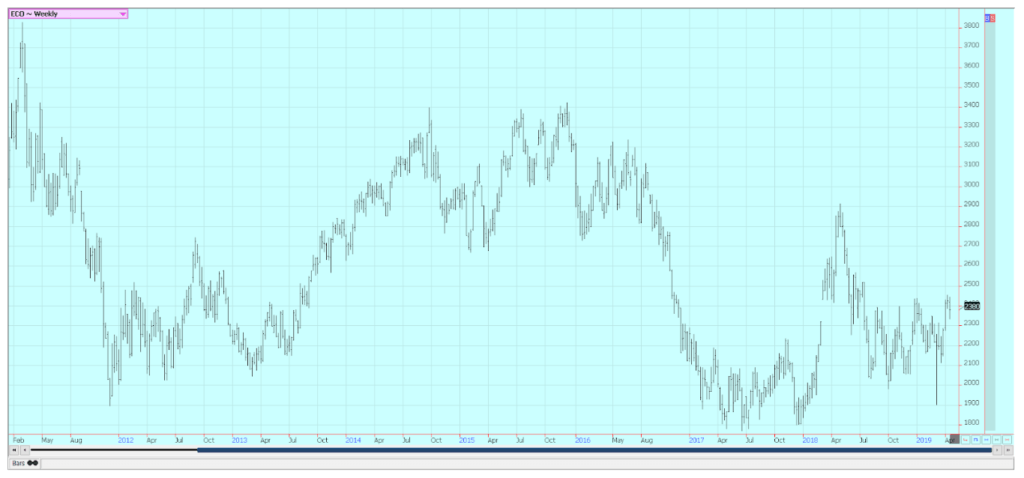

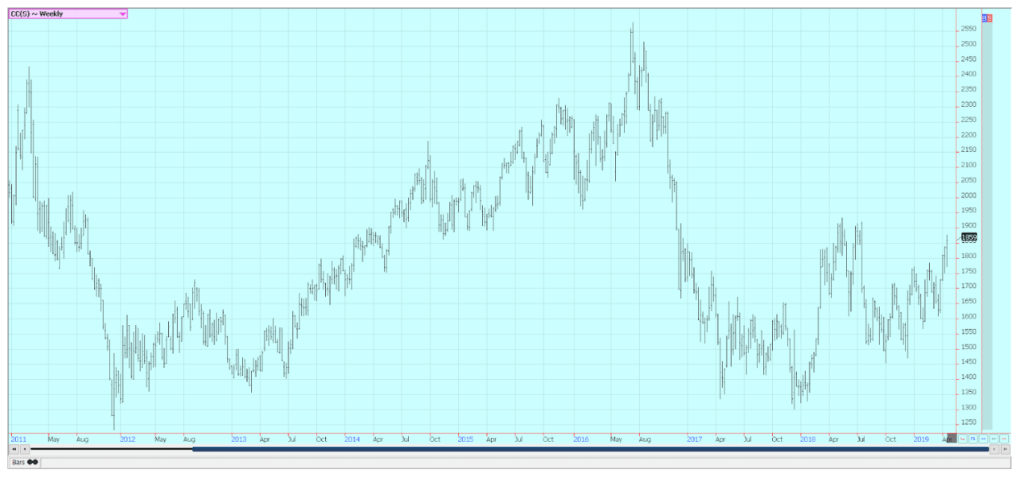

Cocoa

Futures closed lower in both markets. Trends are still up. The main crop harvest should be about over and mid-crop harvest is still a month or more away. Ivory Coast arrivals are strong, as are the exports. The weekly arrivals pace is about 10 percent higher than a year ago and is holding this level. Arrivals were reported strong in the rest of West Africa as well. Demand appears strong and the market is expecting stronger grind data when the quarterly grind is released in the EU, North America, and Asia over the next couple of weeks. Growing conditions are generally good in West Africa. Some early week showers and cooler temperatures were beneficial, and most in West Africa expect a very good mid-crop harvest. Cameroon and Nigeria are reporting less production and prices there are reported strong. Conditions appear good in East Africa and Asia, but East Africa has been a little dry as has Malaysia.

Weekly New York Cocoa Futures ©Jack Scoville

Weekly London Cocoa Futures ©Jack Scoville

(Featured image by FabreGov via Shutterstock)

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Crypto2 weeks ago

Crypto2 weeks agoCrypto Markets Under Pressure as Vitalik Buterin Sells 17,000 ETH

-

Cannabis1 day ago

Cannabis1 day agoCBD and CBG Show Promise in Reducing Fatty Liver and Improving Metabolism

-

Impact Investing1 week ago

Impact Investing1 week agoGreen vs. Brown Stocks: Climate Policy, Capital Costs, and the Battle for Market Returns

-

Africa5 days ago

Africa5 days agoSouss-Massa Council Approves Budget Surpluses and 417M Dirham Loan for Infrastructure and Water Projects