Crypto

How is cryptocurrency different from fiat currency?

At the moment, cryptocurrencies are still considered new in the global market. It is an industry that is still in its budding stage. Investors constantly experiment different ways to get a sense of how and why the prices move in this industry. Currently, scarcity is one of the major factors behind the fluctuation of cryptocurrency prices in the market.

Right since their launch in 2009, cryptocurrencies have proved to be the most volatile topics around the world. Currently, there are an estimated 5,392 cryptocurrencies worldwide with a market capitalization of around $201 billion, as per the latest statistics in April 2020. These cryptocurrencies are extremely tough to predict in terms of their price movement and keep fluctuating every now and then.

Trading enthusiasts have time and again tried to discover the reasons why cryptocurrencies fluctuate in the market in order to get a successful investment out of it.

Now here’s a thing, trying to crack the code of different types of cryptocurrencies is a tough ask, considering the fact that the industry has established itself as one of the most difficult to gauge. So let’s try and uncover how the price of cryptocurrencies currently moves in the market.

However, before we do that, let’s draw parallels between cryptocurrencies and fiat money.

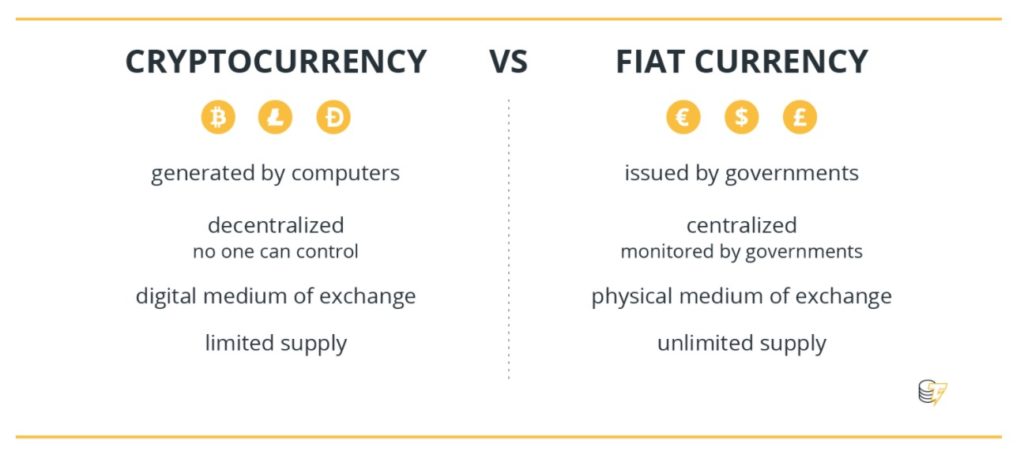

Here’s what you need to know about the comparisons between cryptocurrencies and fiat currency

- While fiat currency is backed by the central government, cryptocurrency was launched in order to eliminate the government’s autonomy over the funds.

- In the case of inflation, the supply of fiat currency is controlled by central government banks while the supply of cryptocurrency is fixed, and hence, the devaluation is virtually non-existent with crypto.

- One of the most notable similarities between cryptocurrencies and fiat money is that both can be used as a medium to exchange products and services. The difference is, while cryptocurrencies are a digital medium, fiat is a physical medium of exchange.

Here’s a quick lookup on the comparisons between the two.

Why do the prices of cryptocurrencies fluctuate?

Cryptocurrencies are still considered new in the global market today. It is an industry that is still in its budding stage. Investors constantly experiment different ways to get a sense of how and why the prices move in this industry.

The result of that is the fluctuation of prices every now and then. Perhaps we can take an example of the fluctuation in Bitcoin’s market price.

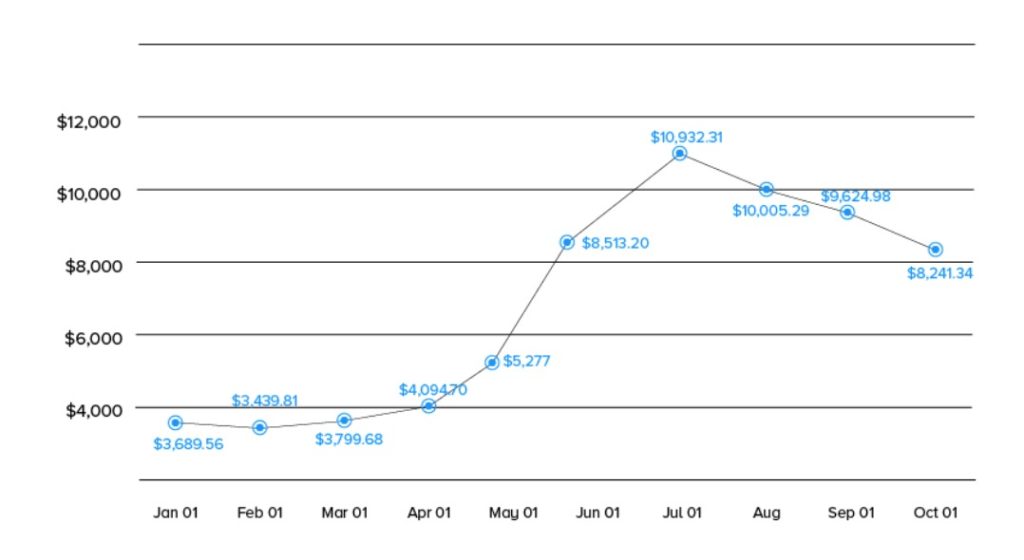

In the year 2019, Bitcoin saw a staggering resurgence in its prices in early June when the cryptocurrency burst to around the $10,000 mark. However, history repeated itself, and prices fell back by about $3000 by the end of the year. Have a look.

Since then, there has been constant volatility recorded in Bitcoin’s prices which continues even today. In fact, as per the latest news from the crypto market, Bitcoin’s price again fluctuated recently in March 2020 when the price rose to $8,740 only to drop down a few hours later to $8,410. This fluctuation was an estimated 1.1%. So let’s have a look at the factors that do affect cryptocurrency prices in the market.

Factors affecting the prices of cryptocurrencies today

Here’s our take on the factors that directly or indirectly affect the variations in crypto prices in the market.

1. Scarcity of Supply

At the moment, scarcity is one of the major factors behind the fluctuation of cryptocurrency prices in the market. We can perhaps understand it in terms of economics. Whenever there’s a stable supply for any product in the market, its value surges in the long run, and with that, the demand for the product is assumed to rise too. However, in the case of cryptocurrencies, that leads to scarcity as there are only a few coins available for the investors, and less supply of coins leads to an increase in the value.

2. Rate of Adoption

Adoption is another factor that leads to a massive surge in the prices of cryptocurrencies today. But let’s understand it with the example of Bitcoin. Over the years, whenever the adoption of Bitcoin happened on a mass scale, its value automatically went up with the pace. Think of early 2019 when the cryptocurrency was in huge demand and its prices crossed a whopping $10,500 mark.

Likewise, any bad news can develop fear amongst the investors and the adoption rate can plunge down. Think of the well-renowned bankruptcy of Mt. Gox that shocked the investors including the high-profile users of Bitcoin.

3. The effects of Fiat Money

One factor that moves the prices of cryptocurrencies in the market is the price of fiat currency. Whenever there’s a deflation in the prices of fiat currency, the prices of cryptocurrencies automatically surge in the market as investors start looking for other options like Bitcoin and other cryptos. This generally happens due to political and economic events when investors lose confidence.

4. The assured value of projects

Currently, the value of any cryptocurrency depends upon how the market deems its value and the factors which are at the center of its project development. Besides, here’s an insight into the factors that affect the value of project development.

- The project should be able to achieve its milestone.

- The partnership of bigger giants in the market.

- Launch of a beta version.

What is vital to note here is that any cryptocurrency price would also depend on the growth of the cryptocurrency market. If the growth gains pace, the price value automatically soars.

5. The effect of regulations

Today, governments around the world have begun setting up regulations on the use of cryptocurrencies. The pace at which the developments are happening is allowing investors to potentially look for adoption on a larger scale, and this, in turn, is leading to a steep rise in the value of cryptos. As long as the regulations continue to exist, the mass adoption of cryptocurrencies will continue to happen.

In a Nutshell

Volatility has become a key element of cryptocurrencies and investors continue to find ways of cracking the code behind such fluctuation. From a point of mass adoption to the scarcity of supply, the factors mentioned above are amongst the primary ones that affect the price movement of cryptocurrencies today.

So if you’re one of the investors and wanting to understand the price movement of cryptocurrencies, staying afloat with these constantly altering factors is the key to a successful investment.

—

(Featured Photo by Eftakher Alam via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Crypto2 weeks ago

Crypto2 weeks agoTariff Turmoil Sends Bitcoin and Ethereum Lower as Crypto Markets Face Mounting Pressure

-

Crypto2 days ago

Crypto2 days agoBitcoin Surges Past $72K as Crypto Market Rallies and Kraken Secures US Banking License

-

Crypto1 week ago

Crypto1 week agoEthereum Outlook: Key $2,190 Resistance, Whale Accumulation, and Buterin’s Push for True DeFi

-

Biotech4 days ago

Biotech4 days agoShingles Vaccine Linked to Significant Reduction in Dementia Risk