Featured

What’s decision fatigue and why it’s bad for business investment strategies

A long session of decision making often results in decision fatigue. It can affect investments and can lead to the struggle in meeting financial goals.

Many factors have a role in the process of decision making, but decision fatigue may have the most detrimental effects of all.

I’ve always struggled with making decisions. It just doesn’t come naturally to me.

I blame it on my mother, who was loving and good-intentioned, but a little heavy-handed in the parental decision-making department. My brothers and I never heard anything like, “What do you feel like for dinner tonight?”

Everything was always already decided for us: “Tonight’s spaghetti. Could you set the table for me?”

Needless to say, when I was grown and on my own, I had to figure out how to make decisions. And as I struggled through that process, I learned about the negative effects of what psychologists call “decision fatigue,” and how to overcome them.

The more I learn about decision fatigue, the more I’m convinced that it’s one of the primary reasons why most investors struggle to meet their financial goals – whether they (cough, you) realize it or not.

And I’m also convinced that systematic (“rules-based”) investment strategies are the perfect solution to the damaging effects of decision fatigue.

But before I make my case for systematic strategies, let me show you proof that decision fatigue is real (and really harmful)…

The most popular story used to explain decision fatigue is about hungry judges.

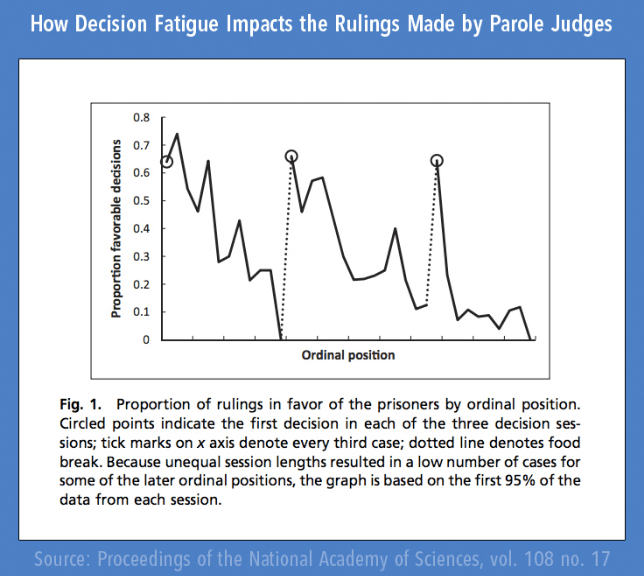

In 2010, Stanford researchers studied judges and their decisions to either grant or deny parole to prisoners coming before the court. They analyzed over 1,100 individual decisions, made throughout the course of a year.

In total, judges approved parole appeals in about one-third of the 1,100 cases studied – in line with known proportions. But the researchers discovered that time of day was a significant factor in judges’ decisions.

Essentially, prisoners who appeared before the court early in the day tended to get more favorable parole decisions, while those appearing just before lunch were more often than not denied parole.

Then, after lunch, the number of paroles granted jumped back up to the early-morning levels. But throughout the afternoon, the rate of paroles granted trended down again, hitting a low by the end of the day.

Here’s the chart (with the dotted line indicating food breaks)…

(Source: Proceedings of the Natural Academy of Sciences, vol. 108 no. 17)

Now, if judges were robots – unaffected by hunger, fatigue or mood – this chart would not exist. Instead, you’d see one steady rate of favorable parole decisions, regardless the time of day.

But judges aren’t robots (obviously).

Even though they’re generally smart, well-intentioned and ethical people… they still get tired, hungry, and moody, just like the rest of us. And, clearly, those “fatigue” factors have a dramatic impact on the decisions they make.

In the simplest terms, decision fatigue is the observation that people tend to make worse decisions the more decisions they make. And it affects everyone.

It taints decisions we’re faced with in all aspects of our daily lives – everything from what to make for dinner and, of course, what to do with your investments.

In fact, the decisions you must make about your money are endless.

Should I buy this or that?

Do I spend or save?

Cash or T-bills?

Stocks or bonds?

Passive or active?

Diversified or concentrated?

Growth or value?

Google or Amazon?

Sell (for a loss) or hold?

Sell (for a profit) or hold?

You get the idea…

As an investor (even as a consumer), every decision you make can be hugely consequential to your investment portfolio and to your family’s financial goals. And you’ll be up against decision fatigue every step of the way.

Now, to avoid the downside of decision fatigue… you’ve got to avoid decisions. Or, at least, you’ve got to greatly minimize the number of decisions you have to make.

And that’s where systematic investment strategies come into play.

Systematic, or “rules-based,” investment strategies minimize your role in the decision-making process. Therefore, they minimize the number of opportunities you have to make a foolish decision, caused by decision fatigue.

And that’s why I love systematic investment strategies.

I don’t have to make decisions all day long… I don’t have to face the same decision – “Do I buy? Do I sell? Do I hold?” – each and every day. I don’t have to second-guess myself.

Truly, committing to systematic investing is one of the best things I’ve ever done for myself. It’s taken the monkey of continual decision-making off my back – and with that, I’ve seen dramatic improvements in both my wealth and health.

It’s my sincere hope that you, too, will join me in appreciating the many benefits of systematic investing. That’s really what my trading services – Cycle 9 Alert and Project V – are all about.

We implement a “rules-based” strategy with discipline. And that allows us to avoid the pitfalls of decision fatigue, cognitive biases and our tendency to make “irrational” decisions with money.

Is this approach right for you?

Well, that’s something only you can decide.

But you should certainly give it a chance. I’m pretty confident that once you get the hang of it, you’ll never go back to discretionary investing again.

I know I won’t!

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Crowdfunding1 week ago

Crowdfunding1 week agoPMG Empowers Italian SMEs with Performance Marketing and Investor-Friendly Crowdfunding

-

Markets5 days ago

Markets5 days agoMarkets Wobble After Highs as Tariffs Rise and Commodities Soar

-

Markets2 weeks ago

Markets2 weeks agoThe Big Beautiful Bill: Market Highs Mask Debt and Divergence

-

Africa2 days ago

Africa2 days agoORA Technologies Secures $7.5M from Local Investors, Boosting Morocco’s Tech Independence

You must be logged in to post a comment Login