Featured

Dividend aristocrats—25 years you shouldn’t consider

What are dividend aristrocrats and how should you consider them when investing?

Many investors are watching out for dividend aristocrats. A consecutive increase of 25 years and more has a calming effect in a short-term erratic stock market.

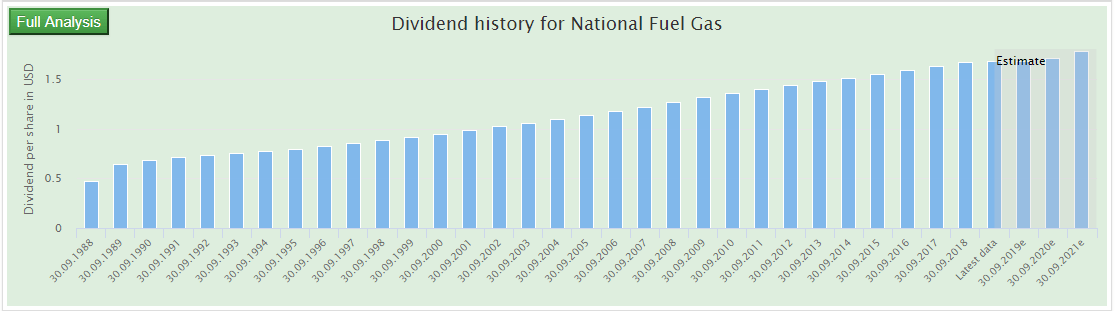

National Fuel Gas: a dividend streak like this looks reassuring © Torsten Tiedt

Contrary to the stock price, dividends are determined by the company, making them more predictable than capital gains in the short-term. Yet, in the long-run, profit-growth prevails over dividends for two reasons:

-

Dividends must be financed by profits (free-cash-flow). Otherwise, they reduce vital assets of the company.

-

Profits-growth is decisive for capital-gains and capital-gains contribute the lion’s share to your overall yield.

Hence, before investing, you need the full picture of the company including its long-term profit-growth. The chart below depicts dividend and profit growth of National Fuel Gas.

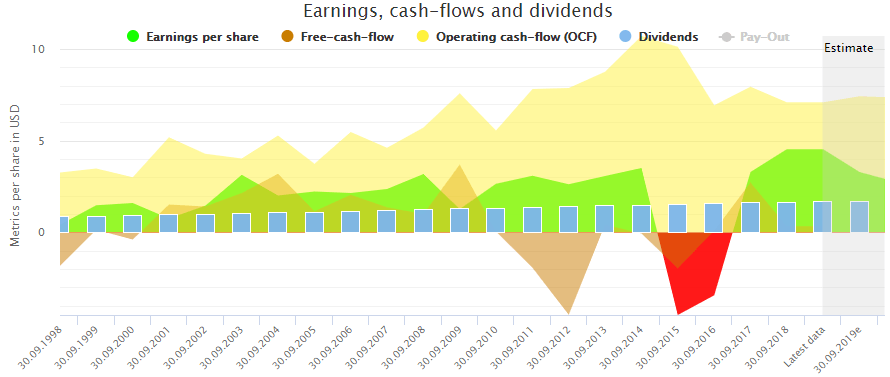

National Fuel Gas: missing long-term profit-growth © Torsten Tiedt

Missing profit-growth translates into missing capital gains and low dividend growth—maybe even a cut. That’s why investors should better watch beyond short-term metrics like the pay-out-ratio when evaluating dividend stocks for their long-term investments. Unfortunately, this is rarely done. In general, dividend-related metrics like consecutive years of dividend increase, growth or pay-out-ratio are preferred, suggesting that long-term profit-growth is of second importance.

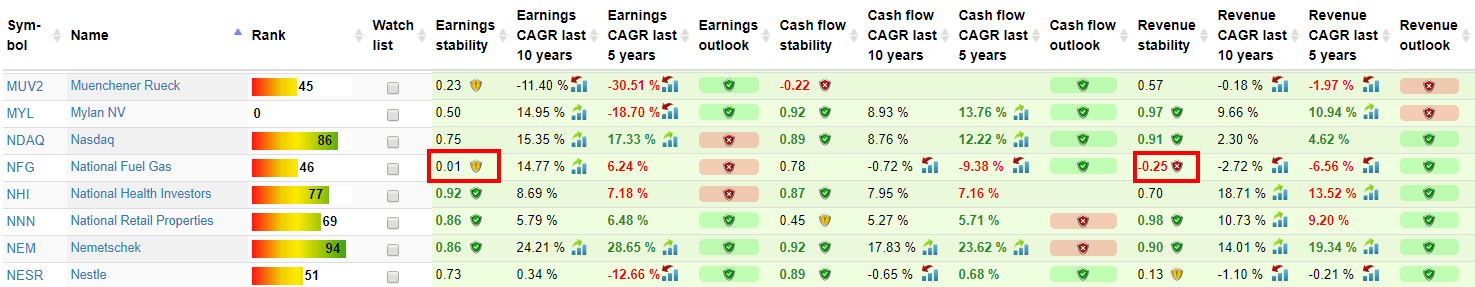

Yet, describing long-term profit-growth by metrics is possible. The stability of earnings-, profit- and revenue-growth can be quantified by calculating the correlation between the fundamental metric and time. The result is a number between -1 and +1.

In the case of National Fuel Gas, only operating cash-flows grow rather steadily. Yet, revenue, earnings and free-cash-flow don’t. Accordingly, capital gains in the last years do not exist. In 2008, the stock price was higher than it is today, and yearly dividend increases in the last 10 years are below 3 percent. Other dividend stocks with higher earnings and cash-flow stability performed much better.

National Fuel Gas: Low stability of earnings and revenues © Torsten Tiedt

Conclusion

As an investor, instead of focusing on dividends, better focus on stable profit-growth first and dividends second. When doing so, you’ll be surprised how much first-class dividend stocks for both dividend growth and income investors remain.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Markets2 weeks ago

Markets2 weeks agoNavigating the Fourth Turning: Cycles of Crisis and Opportunity

-

Cannabis4 days ago

Cannabis4 days agoIs Aurora Cannabis Stock a Risk Worth Taking?

-

Impact Investing2 weeks ago

Impact Investing2 weeks agoEU Eases CO2 Tax Burden on SMEs with Revised CBAM Rules

-

Business6 days ago

Business6 days agoAmerica’s Debt Spiral: A $67 Trillion Reckoning Looms by 2035

You must be logged in to post a comment Login