Featured

What the Dot-Com Bubble Can Teach Us About Investing Today

Although we cannot know what the future may bring, reflecting on the past will allow us to make better predictions about what is to come. Based on the dot-com bubble era insights, we believe that investors, depending on their financial situations and risk/return goals, should consider one or more of the five investment approaches they can find in this article.

During 2022, many investors experienced losses amid volatile financial markets and economic turmoil and are now wondering where to invest in this economy. Although the losses were painful, the bear market may not be finished. However, successful long-term investors are no strangers to long-lasting bear markets and bursting bubbles, such as the dot-com bubble.

There are plenty of historical examples that mirror the current situation in the market. By incorporating key learnings from past bear markets, investors can change their approach to avoid losing as much in the future.

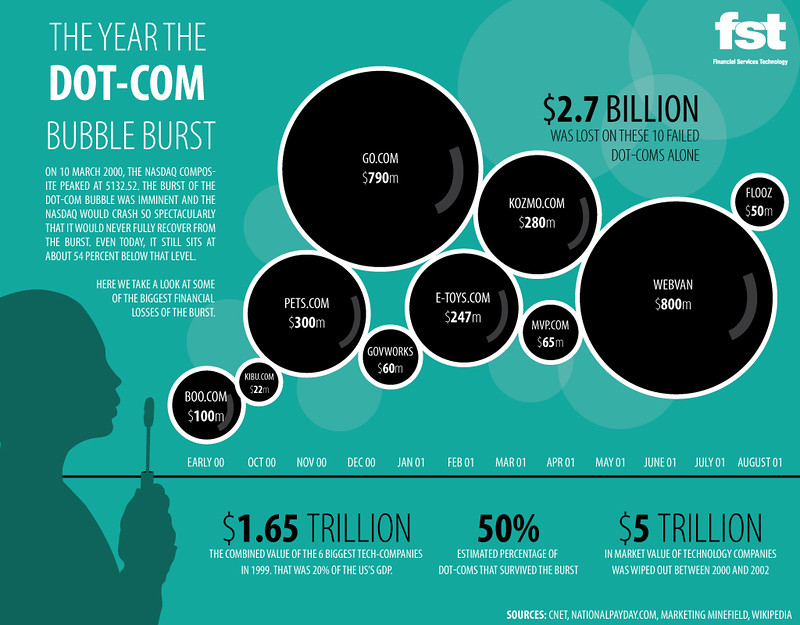

One specific historic event that comes to mind is the dot-com bubble. It collapsed in 2000, and the bear market lasted from 2000 through 2002. The current financial slump shares similarities and differences with this event; we can learn from both.

How the Current Landscape Resembles the 2000 Dot-Com Bubble Burst

In terms of similarities, there were and are rising interest rates, low unemployment levels, and excessive valuations with both tech and growth stocks. In geopolitics, 2001 was the year of 9/11, and in 2023, we are facing increasing geopolitical risk with Russia and China. In both cases, geopolitics materially affects the economy. In addition, now that the stock market bubble has burst, many publicly traded unprofitable, low-quality companies are dropping to $0, just like they did between 2000 and 2002. Lastly, the dot-com bubble burst happened within the span of a three-year bear market. Assuming that a recession is coming, we are in year two of the current bear market.

In terms of differences, current sovereign debt levels are at record highs, which will constrain and influence policy decisions in different ways. There is also a higher level of political division now than in 1999 as well as higher inflation rates which put more pressure on household budgets. Another factor that is different today than in 1999 is the power of the U.S. dollar, which was at its all-time strongest 20 years ago. Currently, dollar hegemony seems to be declining as nuclear powers like China and Russia look to develop alternative monetary options. Lastly, thousands of Baby Boomers enter retirement every day, whereas before, this generation was in its peak earning years.

It is safe to say that we can learn a lot of lessons from the dot-com bubble. The 2000 to 2002 bear market spread like a virus. It started with unprofitable, low-quality dot coms, then spread to internet infrastructure companies, large-cap growth stocks, and, eventually, the entire stock market. In the beginning, investors thought that the carnage would be limited to low-quality dot-com businesses or that these companies would bounce back, but lower asset prices caused an economic recession which, in turn, affected corporate earnings and stocks more broadly.

Similar to the dot-com bubble, misguided optimism exists today. There is a sense among many investors that the markets will rebound strongly. They believe all of the tech and growth stocks that performed so poorly in 2022 will return, and they will be off to the races again. Such investors may be disillusioned by the reality that interest rates and inflation are much higher, venture capital funding has dried up, corporate earnings are declining, the broader stock market in the U.S. remains significantly overvalued, and we believe a 2023 recession seems increasingly likely.

Investment Strategies for Long-Term Growth

Based on these dot-com era insights, we believe that investors, depending on their financial situations and risk/return goals, should consider one or more of the following five investment approaches. These strategies may help them reduce their portfolios’ carnage and take advantage of opportunities.

1. Move some risky investment money to short-term Treasuries that yield 5% or more.

2. Protect against a balance of payments crisis by owning a meaningful allocation to gold.

3. Own an overweight position in commodity-producing companies as it appears in our view that market leadership seems likely to move from tech stocks to commodity producers.

4. Sell or dramatically reduce exposure to passive index funds and start figuring out how to manage a portfolio more actively in order to have more control over where your money is going.

Although we cannot know what the future may bring, reflecting on the past will allow us to make better predictions about what is to come. Based on the current state of the economy, we believe a recession is around the corner. Even if it never comes, preparing for it will likely benefit investors in the long run.

__

(Featured image by GDS Infographics CC BY 2.0 via Flickr)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Fintech1 week ago

Fintech1 week agoRipple and Mercado Bitcoin Expand RWA Tokenization on XRPL

-

Crypto10 hours ago

Crypto10 hours agoXRP Hits New All-Time High Amid U.S. Crypto Policy Shift and Ripple’s Expansion

-

Impact Investing1 week ago

Impact Investing1 week agoItaly’s Electric Cars Market Rebounds, but 2030 Targets Remain Elusive

-

Cannabis3 days ago

Cannabis3 days agoGermany Moves to Tighten Medical Cannabis Rules Amid Surge in Private Use