Featured

Export Demand for Rice Was Stronger This Past Week

Rice was higher last week and closed strong. There is a lot of concern about the high costs of raising rice and that there could be less acres planted in the US for this reason. Trends are up on the daily charts. The cash market is showing that domestic mill business is around everywhere in good volumes. Export demand was stronger this week, and has been stronger overall, especially for Rough Rice.

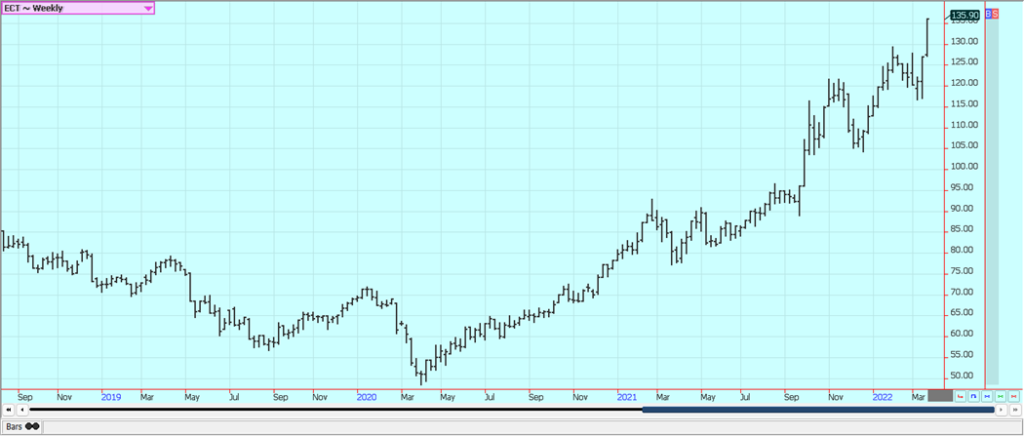

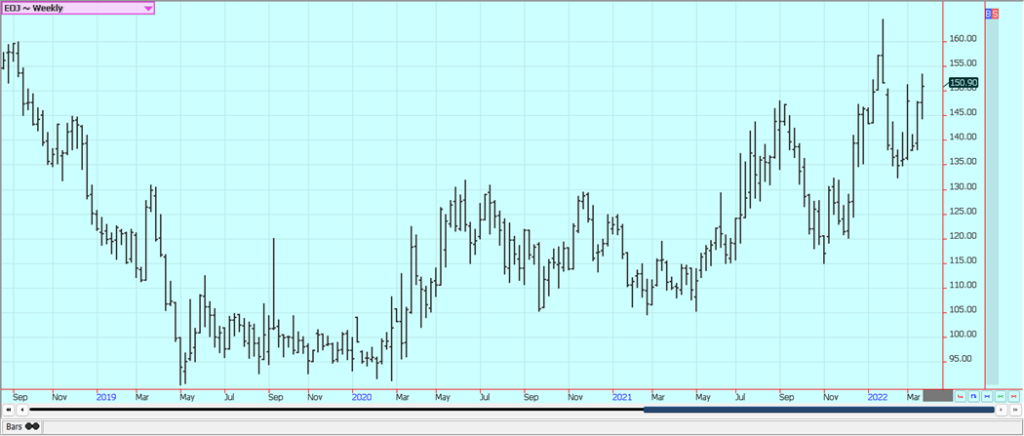

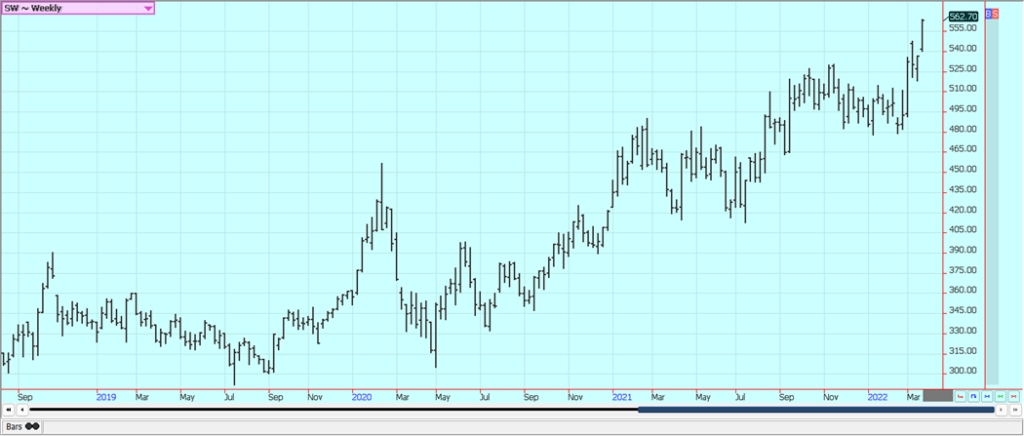

Wheat: Wheat markets were higher last week as the war between Ukraine and Russia continued and looked to last a long time. The weekly export sales report showed slow business for the US once again, but Egypt announced it was talking to the US and other countries about filling the void in the marketplace left by the lack of Ukrainian or Russian offers. Trends are sideways on the daily charts. Ports are closed in Ukraine and Russian shippers and exporters are not offering in part due to sanctions but mostly due to the war and the chance to lose ships. Ukraine can rail the exports to the EU for shipment but the amount that can be moved is very limited. The US is revoking Most Favored Nation trading status for Russia. Higher prices seem likely down the road. Ukrainians have no interest in living under Russian occupation so the war could be deadly and very costly to both sides. Russia and Ukraine are both major Wheat exporters.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

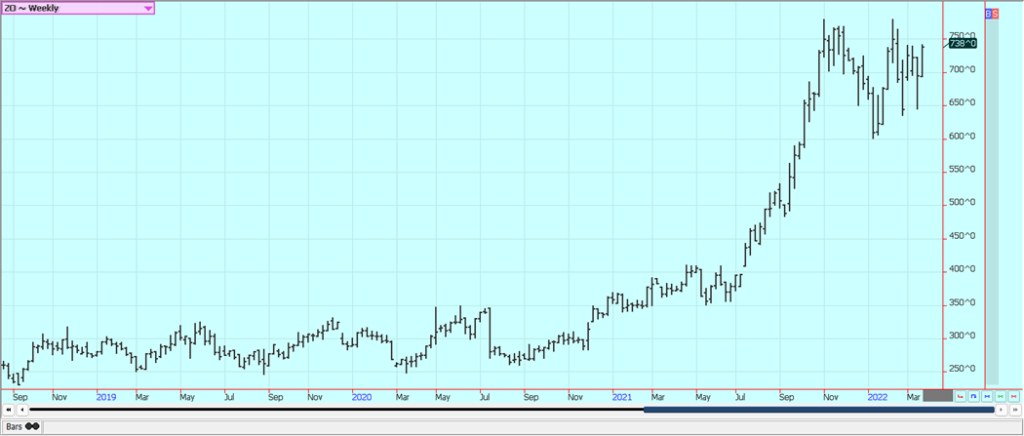

Corn: Corn closed higher last week and trends are sideways on the daily charts as Russia remains bogged down in its war with Ukraine. There was little new to send prices higher but the war and ideas of good demand helped keep prices supported. The export sales report showed demand just below a million tons in the weekly report released yesterday and this is down from recent weeks. The potential loss of Ukraine exports of Corn makes the world situation tighter and could be enough to keep Corn prices trending higher for now. Ukraine might not plant much if any Corn this Summer and already has trouble exporting it or Wheat. The ports remain closed and Ukraine can rail out to the EU in limited amounts. Russia is also a Corn exporter and no product is moving from either country at this time Crop losses in South America are noted. The summer Corn crop in South America has been hurt by drought, but some rains are reported now. Corn has been slow to react because the bigger crop is the Winter crop in Brazil and that is expected to be large. China has a Covid outbreak again and has closed some cities and some ports in response. The moves are harsh but China has a no-tolerance policy regarding the pandemic. The closings of cities and ports will hurt the economy as people can’t make or spend money and hurt imports as there will be fewer places to unload cargoes.

Weekly Corn Futures

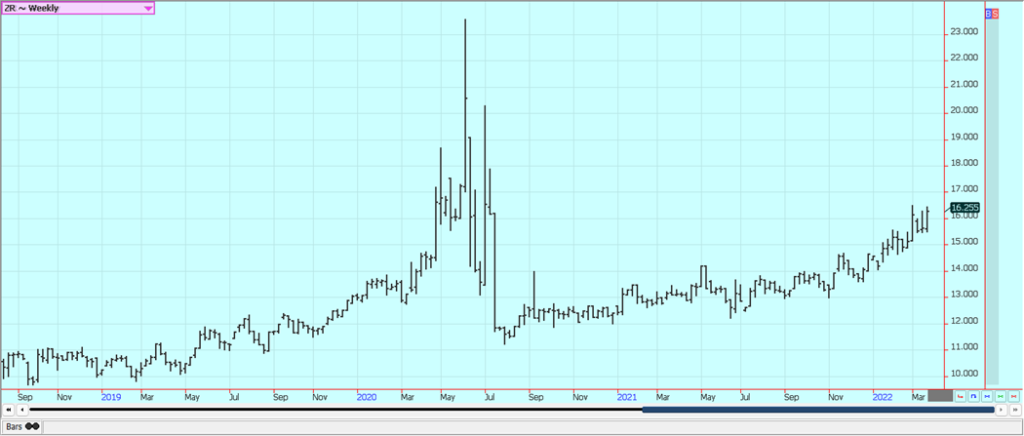

Weekly Oats Futures

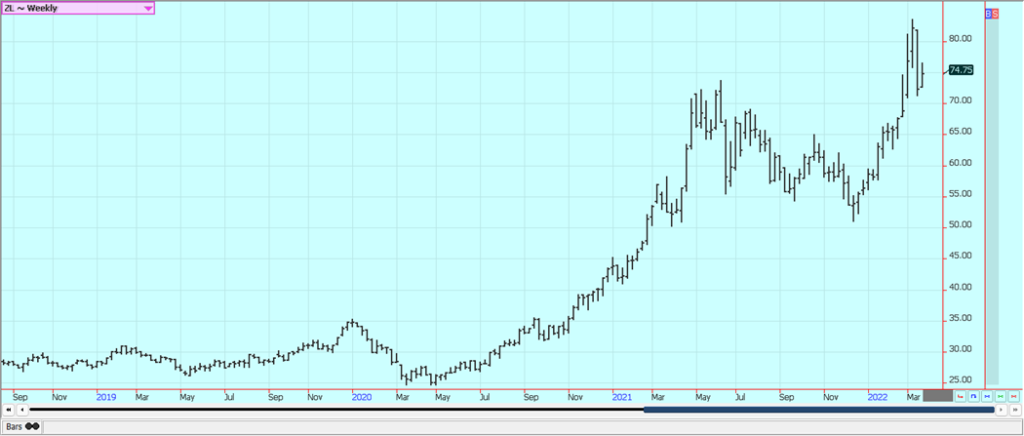

Soybeans and Soybean Meal: Soybeans and the products were higher last week on better demand for US Soybeans caused by dry weather in South America and as the war in Ukraine dragged on and as supplies available to the export market from South America remain limited. The weekly export sales report showed demand below 500,000 tons for Soybeans and negative net sales for Soybean Oil. China has been a major buyer of US Soybeans this year after a very slow start due to the problems in South America. They are buying for this year and already have booked a large amount of new crop Soybeans to cover future needs. Ideas are that the Chinese economy could slow down due to the Covid lockdowns there and cause the country to purchase less Soybeans in the world market. Shanghai has said it will remain open but asked office workers to work from home in a hybrid format. The Ukraine-Russia war has supported Soybeans and world vegetable oils as Russia and Ukraine both export Sunflower Oil. The two countries account for about 80% of all world Sun oil exports. Russia is also a major exporter of Crude Oil. The US is now curbing Russian exports as part of the sanctions but nothing is moving from either country as the companies effectively embargo themselves from doing business in either country. The world situation is still tightening as Brazil and Argentina are getting into the harvest of less Soybeans. Paraguay might import Soybeans this year from Argentina. Higher Soybeans prices are still possible due to the war and the overall supply and demand situation.

Weekly Chicago Soybeans Futures:

Weekly Chicago Soybean Meal Futures

Rice: Rice was higher last week and closed strong. There is a lot of concern about the high costs of raising Rice and that there could be less acres planted in the US for this reason. Trends are up on the daily charts. The cash market is showing that domestic mill business is around everywhere in good volumes. Producer sales are reported to have been way ahead of average early in the marketing year so stocks on hand in first hands are reported to be lower than normal. Export demand was stronger again this week, and has been stronger overall, especially for Rough Rice.

Weekly Chicago Rice Futures

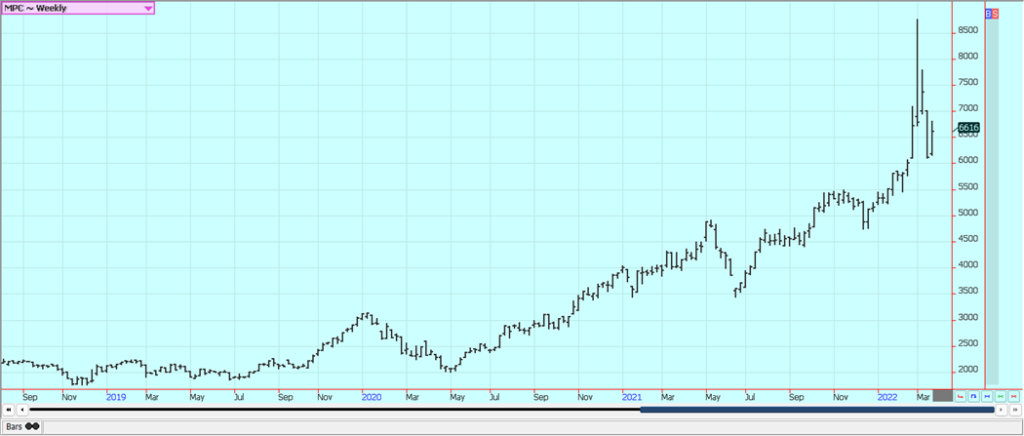

Palm Oil and Vegetable Oils: Palm Oil was higher last week on what appeared to be speculative buying tied to ideas that prices had become relatively cheap. Demand in Malaysia could improve soon as Indonesia is expected to keep most Palm Oil at home. However, production from Malaysia is expected to increase as well as the Covid lockdowns finally go away and as the weather is good for production. Indonesia is once again making moves to cut the availability of Palm Oil for export as it manages high internal prices. Canola was higher and closed at new highs for the move last week despite the selling seen in Chicago Soybean Oil and on ideas of reduced Sunflower export potential from Russia and Ukraine due to the war The Canadian Dollar moves were more important. The market is worried about South American production as well. Canada produced a very short crop of Canola last year so supplies are tight. Prices are still in the latest trading range but at the top end of the range and appear poised to work higher.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures:

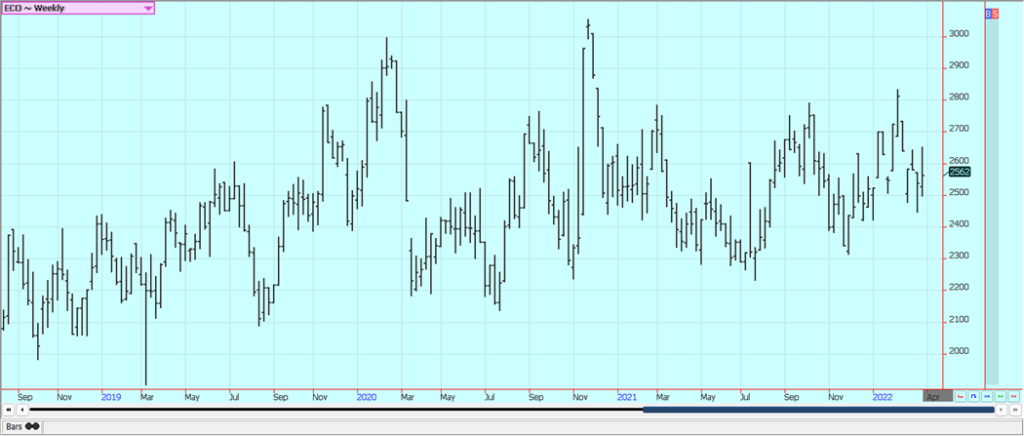

Cotton: Cotton futures surged to new contract highs last week on ideas that good demand can continue despite ideas of Chinese import problems. China has been buying even with the port closures and domestic difficulties. The Russian invasion of Ukraine continued and shipments of Crude Oil and products from Russia are interrupted and in fact, are banned now in much of the west. That means higher Crude Oil prices and higher polyester prices for the world. Traders are worried about Chinese demand moving forward. China has closed two ports for imports due to Covid and is also closing down a number of cities as Covid spreads through the nation. However, Shanghai said it would stay open and asked office workers to follow a hybrid model used here in the US. The US Dollar has been moving higher in the past week due to the war and the stock market has worked lower. It is too dry in west Texas and planting and initial growth could become difficult. Short term trends are up.

Weekly US Cotton Futures

Frozen Concentrated Orange Juice and Citrus: FCOJ was higher last week and posted a new high close for the move as the rally continued. The weather remains generally good for production around the world. Brazil has some rain and conditions are rated very good. Weather conditions in Florida are rated mostly good for the crops with a couple of showers and warm temperatures. Mexican crop conditions in central and southern areas are called good with rains. Northern and western Mexico is rated in good condition.

Weekly FCOJ Futures

Coffee: New York and London were lower with London caught in a trading range on the weekly charts as the US Dollar and Brazilian Real both rallied and as a lack of deliveries from Brazil and Indonesia are still supporting the futures market. Good growing conditions for the next crop in Brazil are still noted. The logistical and production problems in Brazil from the last year are still around. The dry weather and then the freeze in Brazil have created a lot of problems for the trees to form cherries this year. Containers are increasingly available in Brazil to ship the Coffee.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

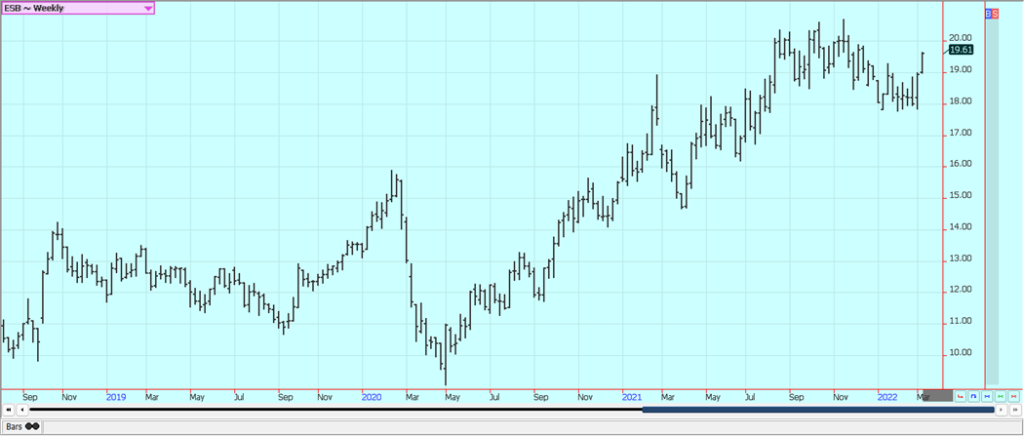

Sugar: New York and London were higher last week as these markets were influenced once again by the price action in Crude Oil futures. Ethanol prices are currently lower than gasoline prices in Brazil. Crude Oil rallied. Current peace talks between Russia and Ukraine are yielding at most slow progress and that kept Crude Oil supported overall. President Biden indicated a couple of weeks ago that Russian energy imports would be curtailed due to the war and now the EU is talking about banning Russian imports. New sanctions on Russia have been imposed at the NATO meetings being held this week. News reports indicate that little export activity is taking place from Ukraine or Russia with the Black Sea and Azov Sea ports basically closed. Some of the oil giants have pulled operations out of Russia in response to the war, but others are still working there. Traders expect bigger offers from India if the price stays strong.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

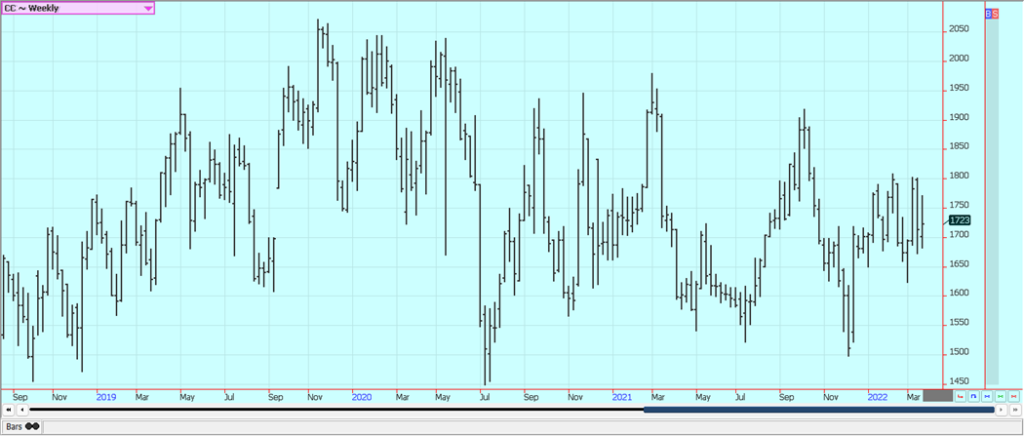

Cocoa: New York and London closed a little higher last week but well off the highs of the week as what appeared to be speculative long liquidation hit the pits late in the week as the weather is improving in West Africa. Some showers are in the forecast for West Africa and have been for a couple of weeks. Chart trends are still up in New York and are up in London despite improved crop conditions and in part despite demand fears as Europe is the leading per capita consumer of Chocolate and demand could drop if the war in Ukraine expands or even if it doesn’t. Demand fears have eased as the rest of Europe is not harmed yet. The weather is good in Southeast Asia. The dry conditions in West Africa are now disappearing due to scattered showers in the region. Ideas are that demand will only improve slightly if at all and production in West Africa appears to be good this year.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by lightluna94 via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Biotech4 days ago

Biotech4 days agoAdvancing Sarcoma Treatment: CAR-T Cell Therapy Offers Hope for Rare Tumors

-

Impact Investing2 weeks ago

Impact Investing2 weeks agoShein Fined €40 Million in France for Misleading Discounts and False Environmental Claims

-

Impact Investing1 day ago

Impact Investing1 day agoNidec Conversion Unveils 2025–2028 ESG Plan to Drive Sustainable Transformation

-

Impact Investing1 week ago

Impact Investing1 week agoVernazza Autogru Secures €5M Green Loan to Drive Sustainable Innovation in Heavy Transport