Business

FCOJ edges higher on demand prospects; Corn and soybeans rally

Hurricane season on some states causes speculative buying on FCOJ. Corn and soybeans are looking bright as both crops closed strong on Friday.

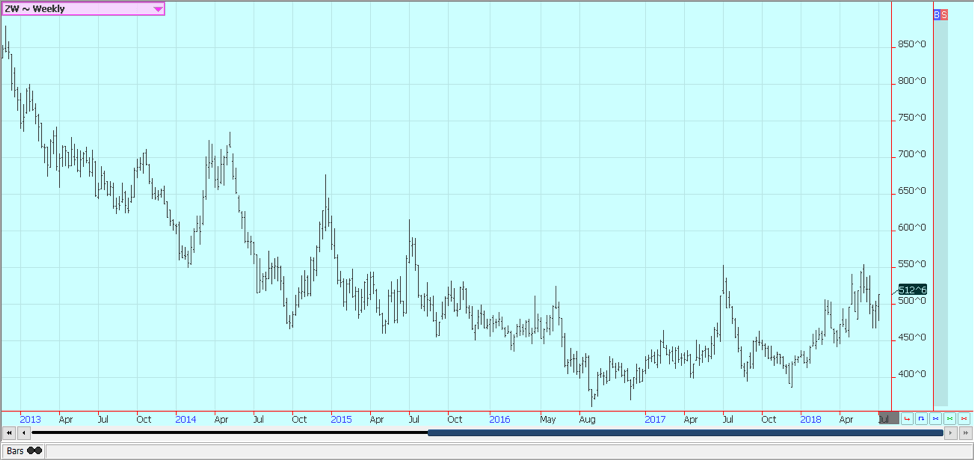

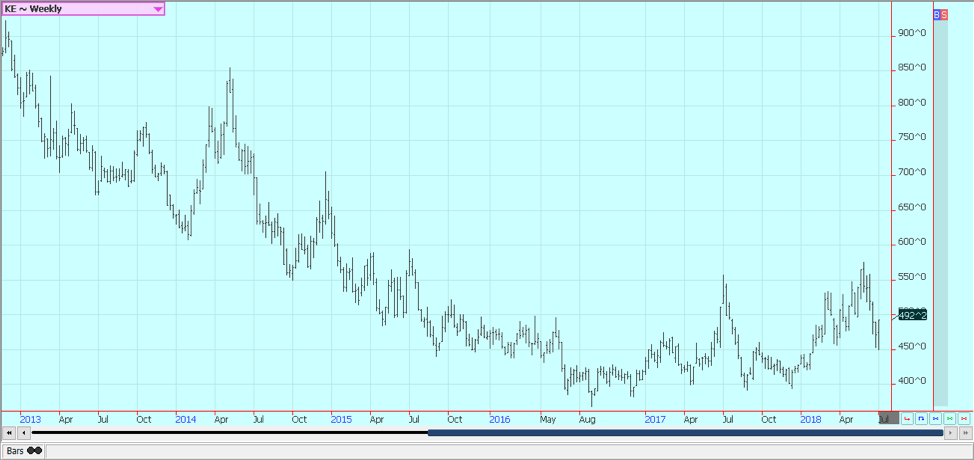

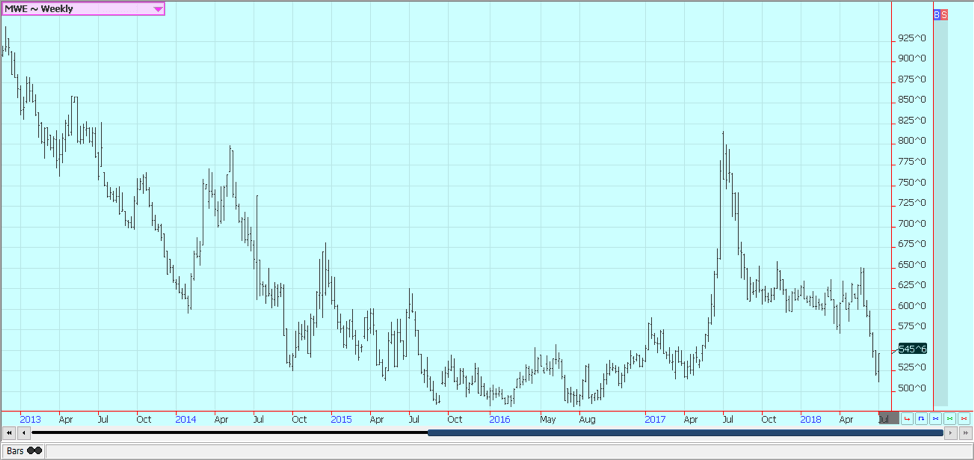

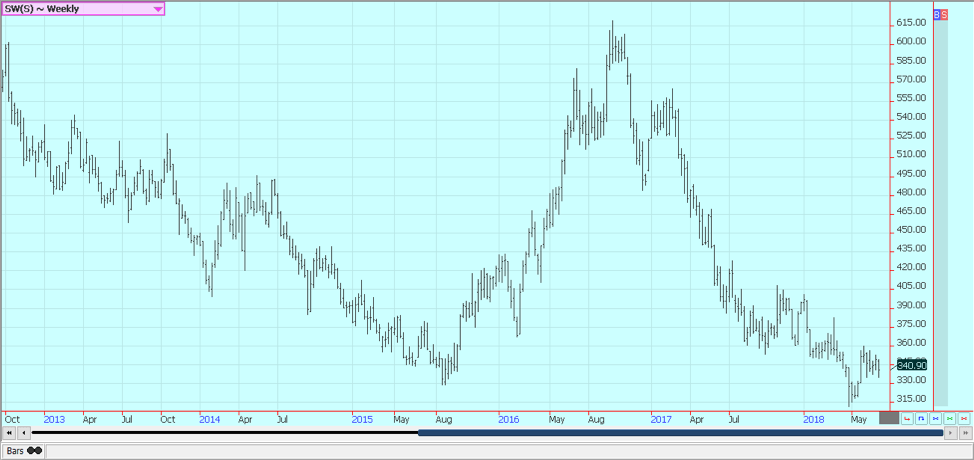

Wheat

Wheat markets were higher last week. Winter wheat markets are turning trends back to up on the daily and weekly charts, and Minneapolis spring wheat markets are now at the top end of a trading range and could complete a bottom this week. Winter wheat markets are supported by estimates from production losses overseas.

The EU crops are being downgraded. Private forecasters dropped French production estimates last week, citing too much rain initially and then hot and dry weather during the summer. German crop production ideas are also less due to hot and dry growing conditions there. Ukraine has also seen a hot and dry weather. Russian production estimates are lower due to hot and dry weather in southern areas and cold and wet weather in Siberia.

US prices are competitive again in world markets due to the reduced production potential from overseas and world prices that have been increasing from previous levels. US winter wheat production appears to be a little higher than expected. Great Plains yields are down from averages, but appear to be a little higher than had been estimated coming into the harvest. USDA is expected to increase US winter wheat production estimates by about 30 million bushels in its next reports this week.

Spring wheat growing conditions are rated very high in the northern Great Plains and a big crop is expected based on the weather and the surprise increase in the planted area reported by USDA at the end of last month. Canadian acreage is also higher and conditions have improved there, although some western areas remain a little too dry.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

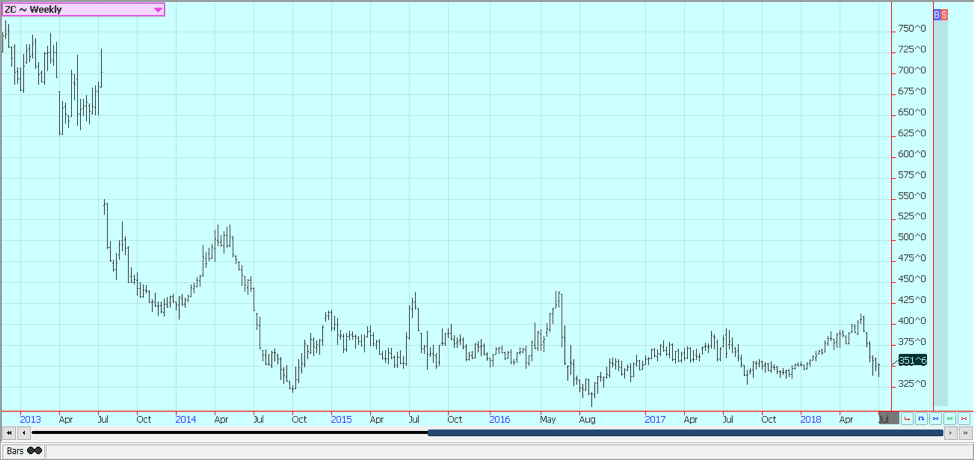

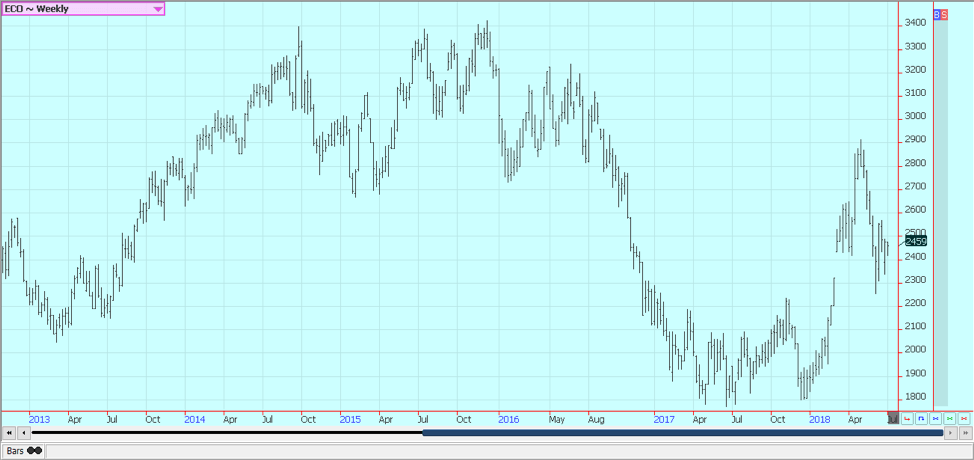

Corn

Corn closed lower for much of the week again last week but closed with a strong rally on Friday. The market had been pushed lower by ideas that corn crops are in good condition in the Midwest and as trade fears created by the US government continue to affect demand ideas. USDA said a week ago they intend to include revised demand projections in its monthly supply and demand updates if the tariffs are imposed this week.

However, export demand until now has been very strong, and it is very likely that USDA will need to raise export demand estimates in the monthly supply and demand updates this week. Plus, the word from Washington is that NAFTA talks are proceeding well and a favorable outcome is expected. Even so, Mexico and Canada have been slapped with some tariffs and have retaliated against US agricultural imports.

The Mexican tariffs have caused some loss in feed grain demand, but have really hurt meat and pork and dairy demand. Mexico is the largest buyer of US corn and could start to look elsewhere for supplies if the tariffs and counter tariffs are continued for the longer term. Ideas that corn crops are in good condition in the Midwest also keep some selling interest alive. USDA condition ratings have been very high and should remain high as the crop has been planted and is mostly emerged and growing well.

There has been too much rain in some northern areas, and some southwestern Midwest areas have been too dry. There will be some hot and dry weather in the forecast for the next couple of weeks. Domestic demand remains strong, and demand for ethanol is expected to remain strong. USDA will increase new crop production estimates in its next round of supply and demand estimates based on higher than expected planted area combined with its calculated yield.

However, trade ideas are that USDA will be underestimating yield and that a national yield near 180 bushels per acre is possible, implying that production estimates will be forced higher as the growing season progresses and if conditions stay good.

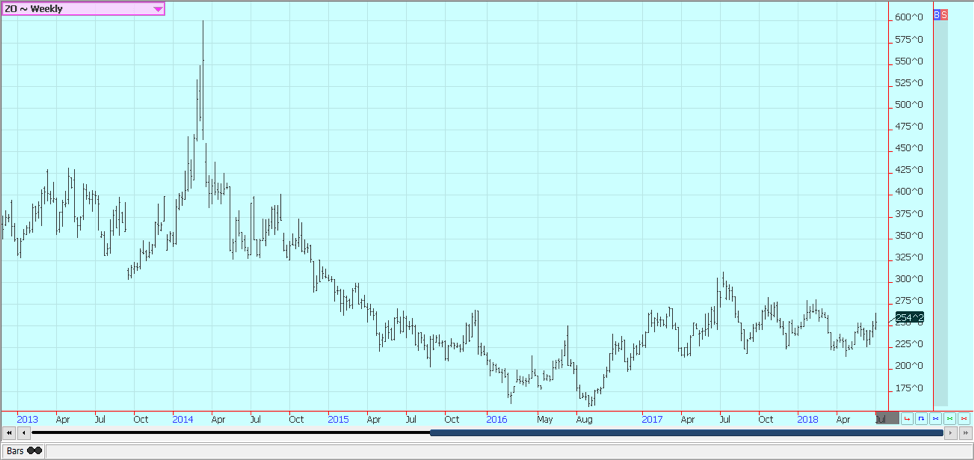

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

Soybeans and soybean meal

Soybeans and products were lower again last week due to ideas of good weather and on continuing fears about new Chinese demand. Soybeans and soybean meal rallied sharply on Friday in a classic sell the rumor and buy the fact situation. There does not appear to be much movement on either side right now, and some reports suggest that China is preparing for a trade war by telling crushers and other users of soybeans to expect to import less in the coming season.

The issue of intellectual property rights seems to be a big problem to get resolved, and it might be difficult as the Chinese say they are abiding by all agreements in the area. USDA said that it will account for the potential changes to export demand starting with the July monthly supply and demand data. Export demand will be trimmed, but this demand loss could be partially offset by increased domestic crusher demand. The soybean crops have been very wet in the Midwest, and soybeans prefer drier weather. Condition ratings remain high, but started to slip last week and could be a little lower again this week.

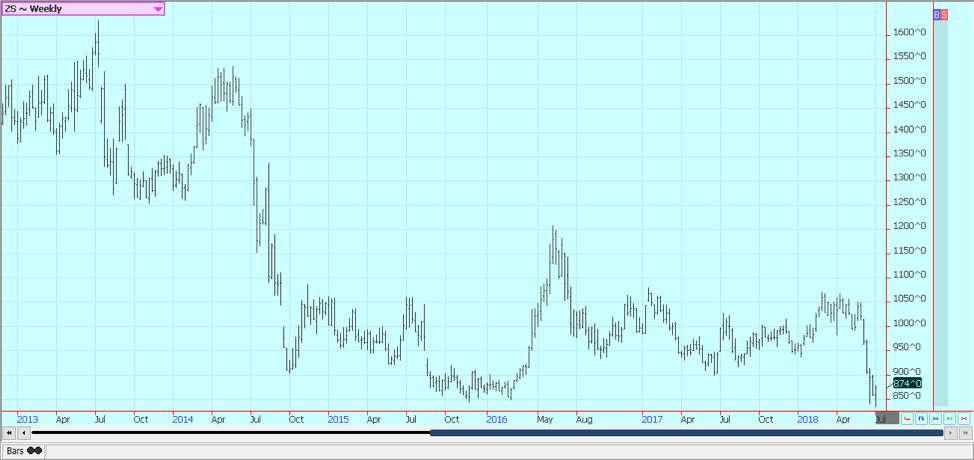

Weekly Chicago Soybeans Futures © Jack Scoville

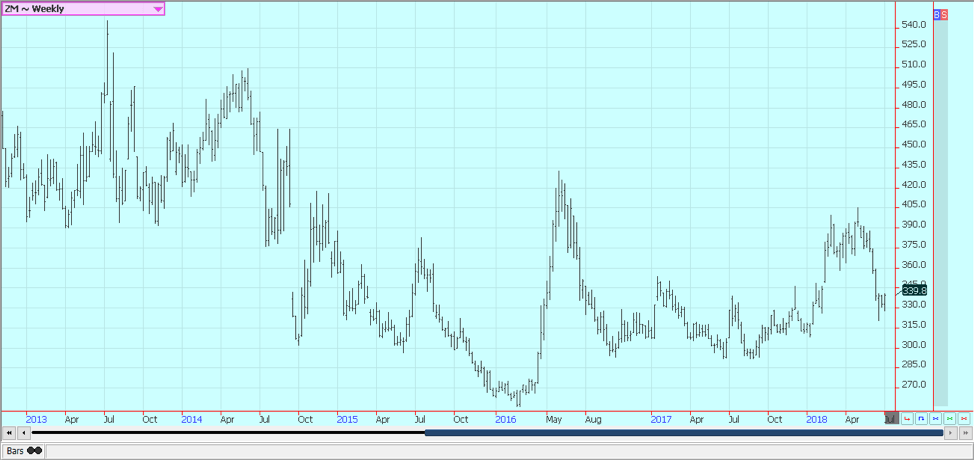

Weekly Chicago Soybean Meal Futures © Jack Scoville

Rice

Rice was trapped in a range on the weekly charts but moved to provide a strong test of resistance on the daily charts. The market has held its strength due to tight domestic supplies. The quarterly stocks report showed that there is very little rice left in first hands and that there is barely enough available to meet projected demand into the new crop harvest. Rice is growing in all areas right now and condition ratings, in general, are strong. The weather along the Gulf Coast has been hot and that has pushed crop development.

Producers in Texas and Louisiana are pleased with the crop condition and expect good yields. Crops farther north into Arkansas and Missouri are also reported in good condition, but crop development is behind the normal pace due to late planting caused by bad spring weather. Rice yield ideas are high at this time. Futures have been supported in large part by speculators who are trying to cover short positions.

The lack of rice in the cash market and the lack of farmer and commercial selling has made covering these short positions very difficult and has been a big reason for futures to move significantly higher. The July-September spread moved to a high above 260 before the delivery period started, and is still trading at a premium. September-November could also provide some fireworks depending on how much new crop rice is harvest and available to the market by the start of the September delivery period.

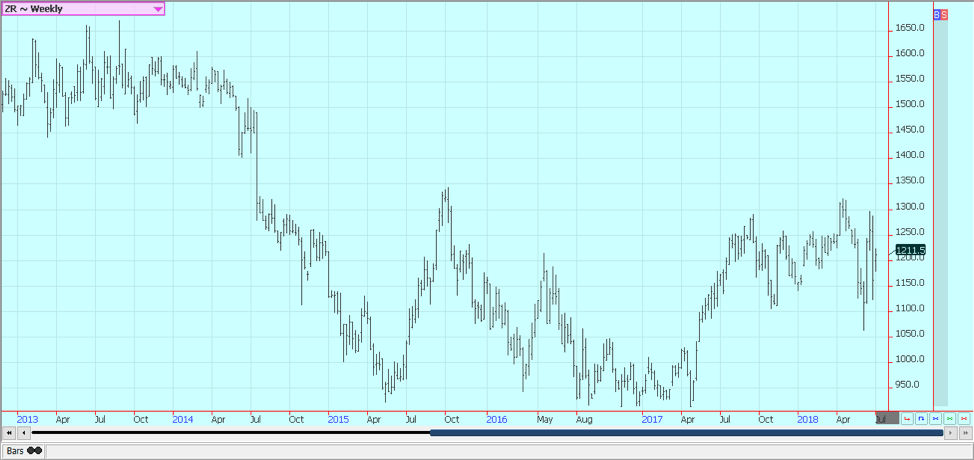

Weekly Chicago Rice Futures © Jack Scoville

Palm oil and vegetable oils

World vegetable oils prices were stable to lower last week. The markets show the potential to work lower as production ideas remain generally high and as world vegetable oils demand has turned soft. Palm oil is still hearing weaker demand reports from the private sources, nut hopes for reduced production from the monthly MPOB supply and demand update later this week.

The market has held well despite the reduced demand and has held firm overall. The weekly charts show that futures are mostly trending lower. The US-China trade dispute could shift some of the demand to palm oil, especially since the soybeans and soybean meal market has been under pressure in China. China has been importing mostly from Indonesia. Soybean oil was locked in a sideways to lower trend all week and closed lower.

Trends are sideways to down in the market. Canola found some support from the trade war and the weather and closed a little higher for the week. Some parts of the western Prairies saw some beneficial rains last week, but many areas were missed. Offers from farmers were down last week as they wait for higher prices and as they work in the fields.

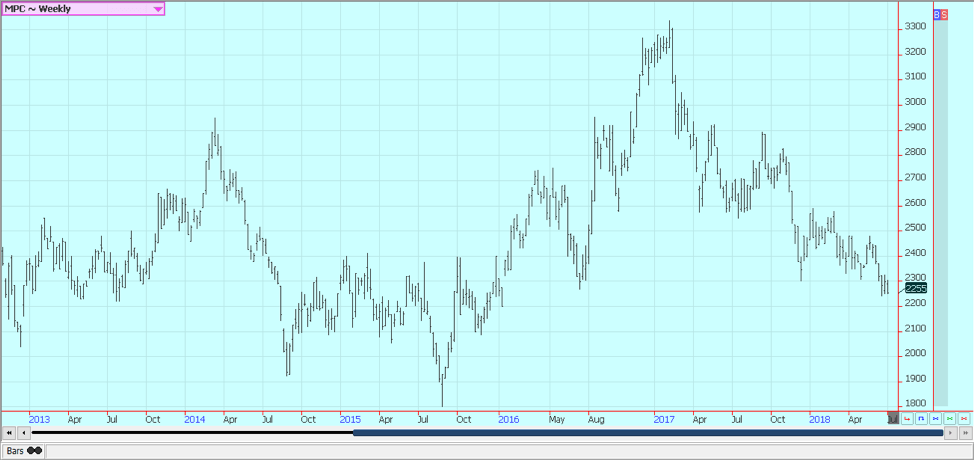

Weekly Malaysian Palm Oil Futures © Jack Scoville

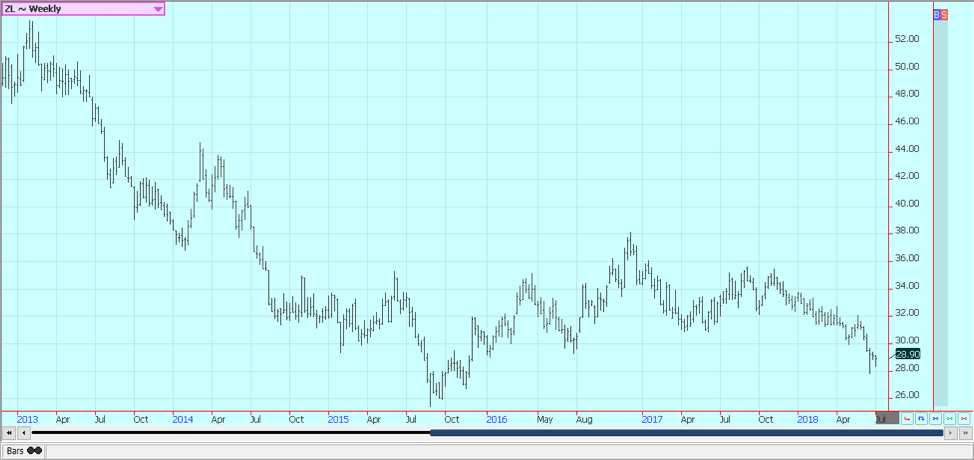

Weekly Chicago Soybean Oil Futures © Jack Scoville

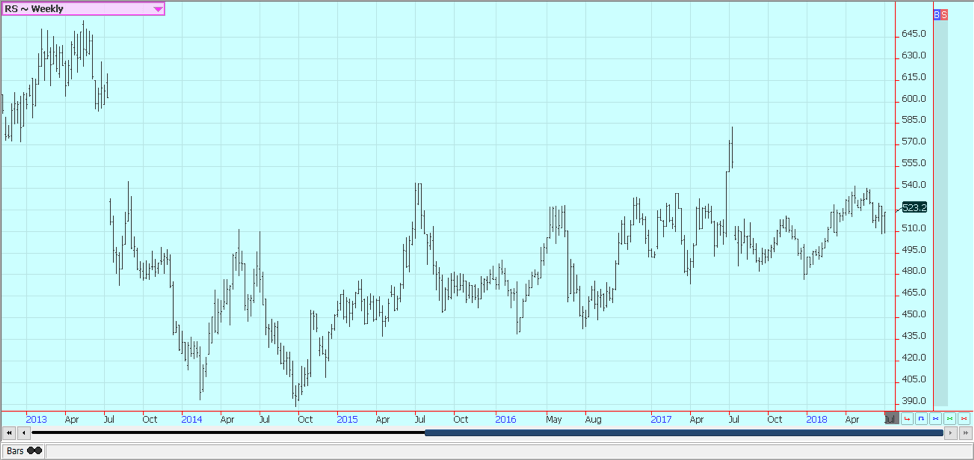

Weekly Canola Futures © Jack Scoville

Cotton

Cotton was lower for much of last week on Chinese trade fears and later on ideas of improving conditions for the crops. Futures closed with strong gains on Friday as the market reacted to the imposition of tariffs by both the US and China. It was a sell the rumor and buy the fact situation. However, US cotton demand in the export market will be lost due to the tariff war. Cotton is another product subject now to Chinese import tariffs on the US. China is now buying Indian cotton at the expense of the US. Demand from Southeast Asia can improve, but the Chinese demand loss is big.

Ideas are that US cotton especially is in a bad spot due to the extreme weather in western Texas, but a few showers have been reported. The Southeast US began to dry out last week. The weather has improved in India and China. Lost Chinese production could have meant increased sales for the US, especially now since the US will have the quality the Chinese need. Drought conditions are developing in Pakistan, but the monsoon has arrived in southern India and has started to spread through the subcontinent. Pakistan and Northwest India should start to see precipitation this week.

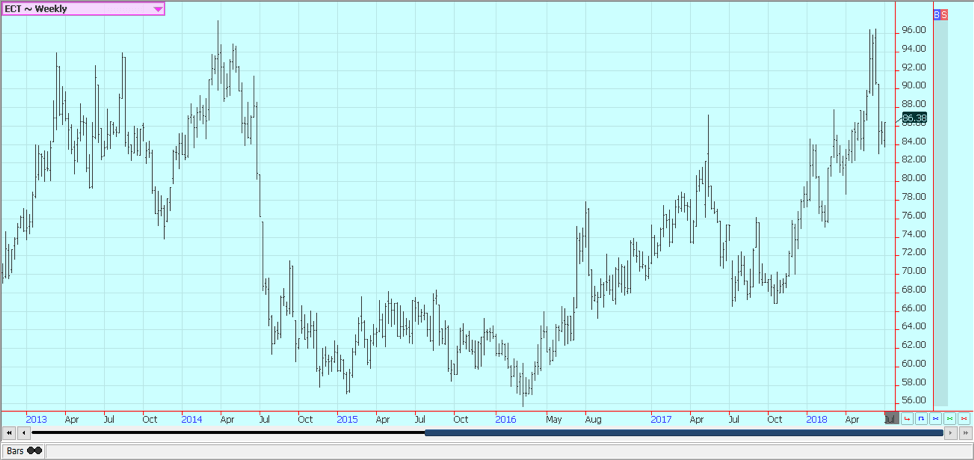

Weekly US Cotton Futures © Jack Scoville

Frozen concentrated orange juice and citrus

FCOJ was higher as Florida weather remains good and demand prospects do not. The hurricane season has started, and the potential for big storms to hit the state like they did last year has caused some speculative buying. Some tropical waves have started to cross the Atlantic. None of them appears likely to produce a damaging tropical storm, but the waves are coming so the risk of damage is somewhat more elevated. Traders will watch them both, with on located already in the Gulf of Mexico and the other just off the African coast.

Traders are worried about demand and are noting improved production prospects for Florida. The tariff wars between the US and Canada, Mexico, and the EU are hurting export demand ideas. The EU imports a lot of FCOJ and these exports could be hurt by any retaliation made by Europe. The EU has indicated that FCOJ will be on the list of items subject to increased tariffs and that the measures will be enacted next month. The growing conditions in Florida should continue to improve as the rainy season appears to be in full force.

The market is still dealing with a short crop against weak demand. Demand is bad enough that year on year inventories are increasing even with the very bad production last year. Florida producers are seeing golf ball sized or larger fruit. Conditions are reported as generally good. Brazil could use more rain as Sao Paulo has been hot and dry. Generally, good conditions are reported in Europe and northern Africa.

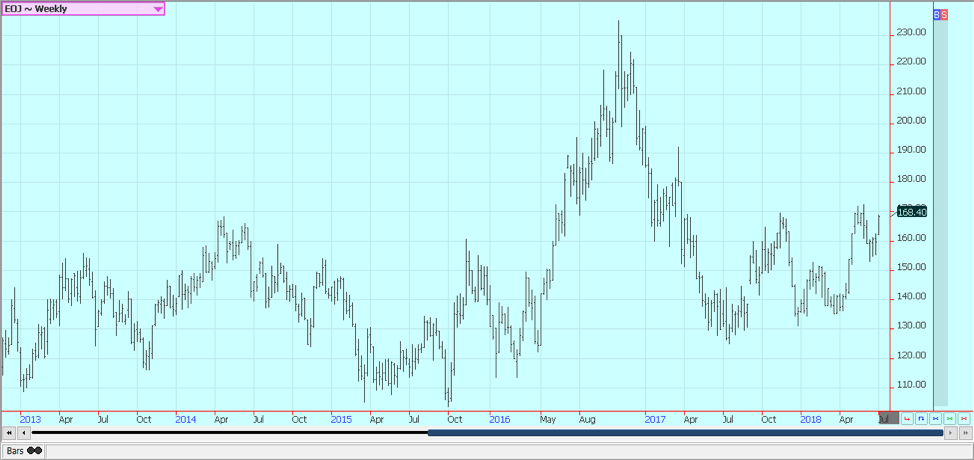

Weekly Frozen Concentrated Orange Juice Futures © Jack Scoville

Coffee

Futures in New York and London were lower for the week but closed strong on Friday. The move on Friday was partly technical as the charts show that New York futures were making four-year lows. New York was the weaker market on Brazilian currency weakness, but could now turn higher as the US Dollar has turned weak and might have formed a top on the charts. Brazil remains in focus as the harvest is underway. A very big crop is expected.

It remains mostly dry in Arabica areas, and there is no rain in the forecast for the next week. The truckers strike has delayed shipments for a significant amount of coffee just as the harvest is beginning. However, it does not appear that buyers are looking for alternatives right now as some coffee is moving. Origin is still offering in Central America and is still finding weak differentials. It has been a little dry so far this year in the region.

Speculators anticipate big crops from Brazil and from Vietnam this year and have remained short in the market. Robusta remains the stronger market as Vietnamese producers and merchants have not been willing to sell at current prices. Reports indicate that supplies in the country are less on lower than expected production. Vietnamese cash prices are weaker this week with good supplies noted in the domestic market. Current rains in the country are favorable for the crops, and production for the coming year is expected to recover.

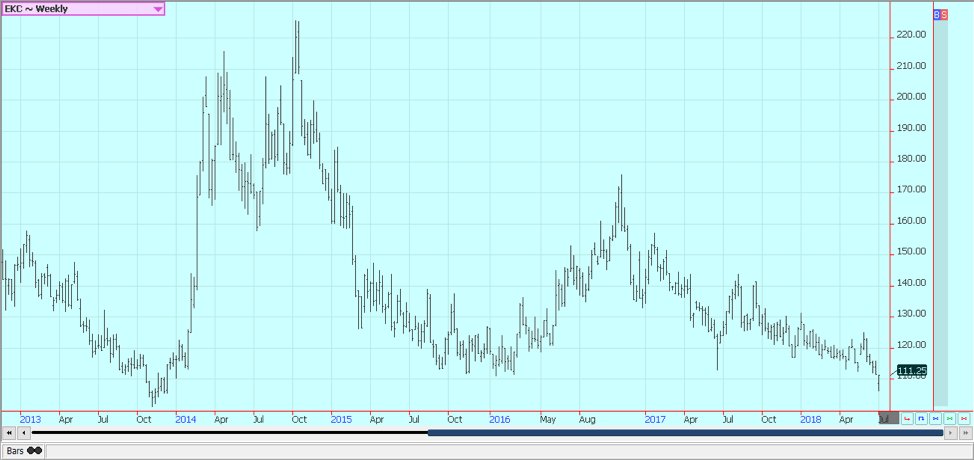

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

Sugar

Futures were a little lower in both markets again last week on ideas of ample world supplies. Both markets have formed bottoms on the daily and weekly charts, but have also failed at resistance areas. New York is trying to set up a trading range. Prices have been supported by the dry weather in Brazil and stronger energy prices that encourage ethanol production. It is dry in parts of Brazil, including some sugarcane production areas, and there is some talk of losses to the crop in the near future unless rains return soon.

There are no real rains in the forecast for now. However, the initial harvest has been big and processing has been more active than last year. India is back to export sugar this year after being a net importer for the last couple of years. The government is subsidizing industry and producers to help maintain an active market flow and to prevent the buildup of sugar in storage. However, the moves announced by the government would not cover much of the problem.

Storage would be provided for about a third of the available sugar and the funds will not be enough to solve the financial problems of many mills. India has announced a deal to sell a significant amount of the surplus to China. Thailand has produced a record crop and is selling. The Middle East and North African buyers are reported to be buying normal or less than normal amounts of Sugar in the world market right now.

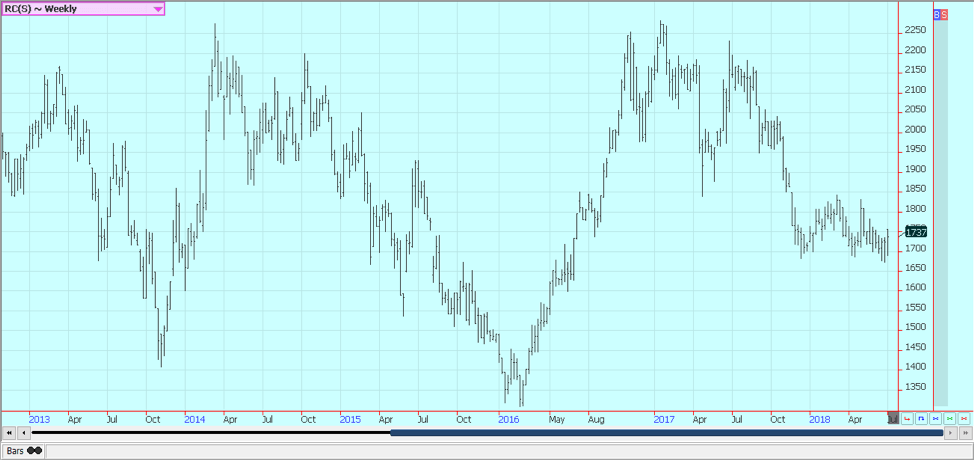

Weekly New York World Raw Sugar Futures © Jack Scoville

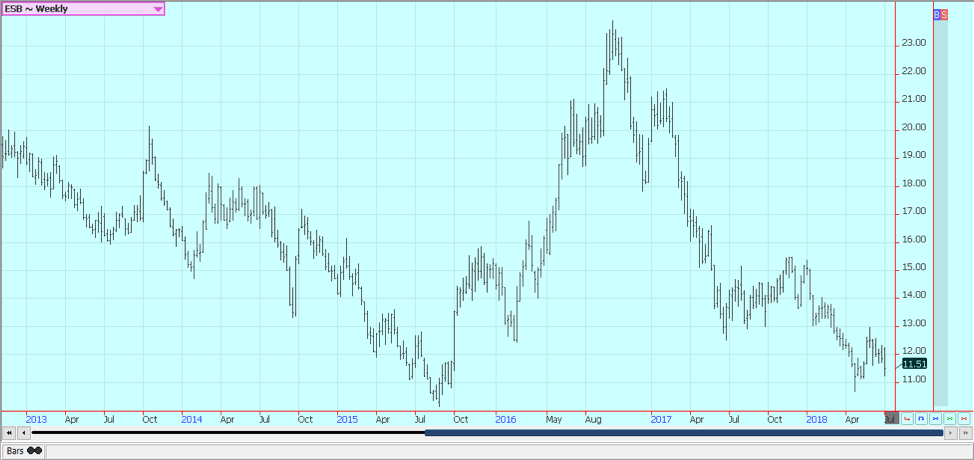

Weekly London White Sugar Futures © Jack Scoville

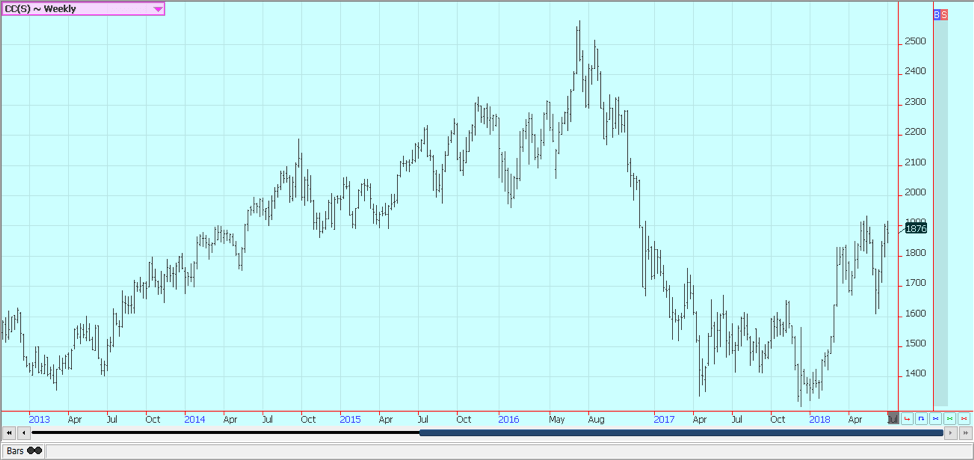

Cocoa

Futures were lower in both markets last week. Longer term trends remain down, so upside potential, if any, this week might be limited. It is possible that cocoa has now made a significant top in both markets. Funds have turned sellers and appear ready to continue to liquidate long positions due in part to the trend change.

Fears that developed about the EU economy over the weekend spilled into cocoa as Europe is the largest per capita consumer of chocolate in the world. Italy is having problems again and there are fears that the problems there could spread to other EU states. Showers and more seasonal temperatures have been seen in the last few weeks to improve overall production conditions in West Africa. Conditions also appear good in East Africa and Asia.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Fintech2 weeks ago

Fintech2 weeks agoDruo Doubles Processed Volume and Targets Global Expansion by 2026

-

Business18 hours ago

Business18 hours agoDow Jones Stalls Near Record Highs as Inflation-Fueled Rally Awaits Next Move

-

Business1 week ago

Business1 week agoTopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [Health Trader Affiliate Program Review]

-

Africa6 days ago

Africa6 days agoAir Algérie Expands African Partnerships

You must be logged in to post a comment Login