Business

Orange juice tops weekly charts, oils curb as demand wanes

The orange juice market makes headlines this week as it surpasses other crops. Vegetable and palm oils dropped due to lesser demands.

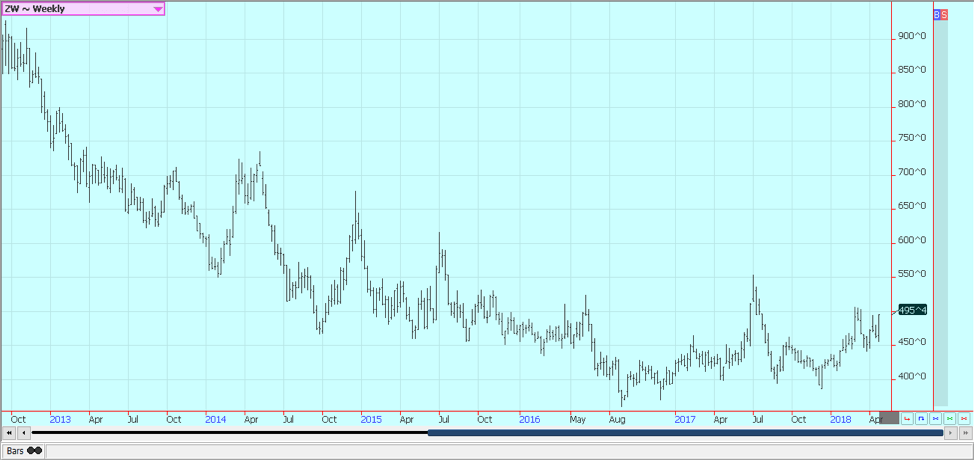

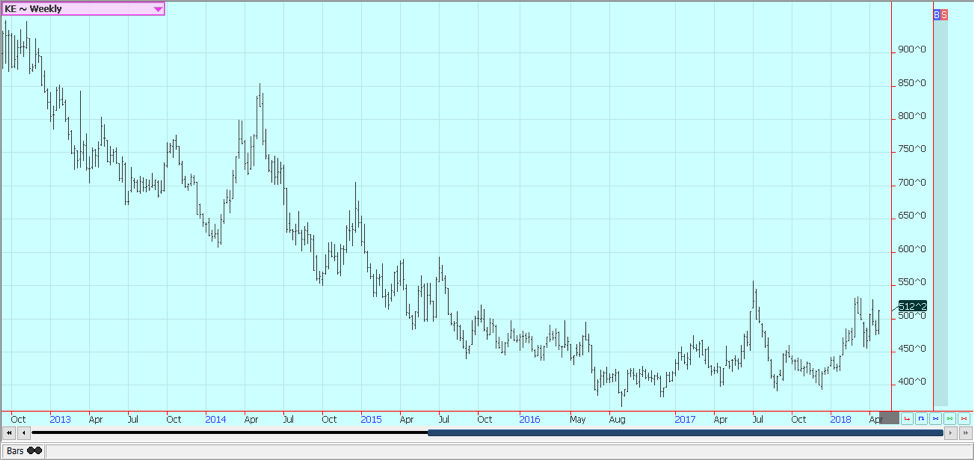

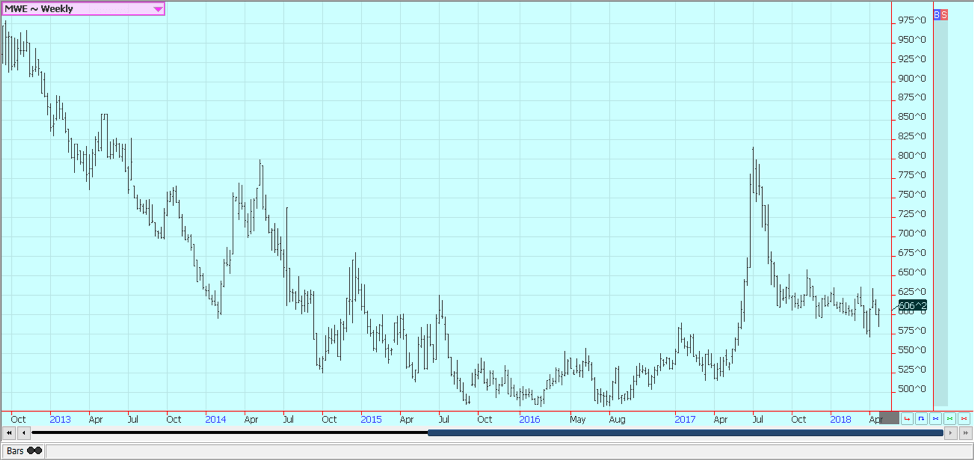

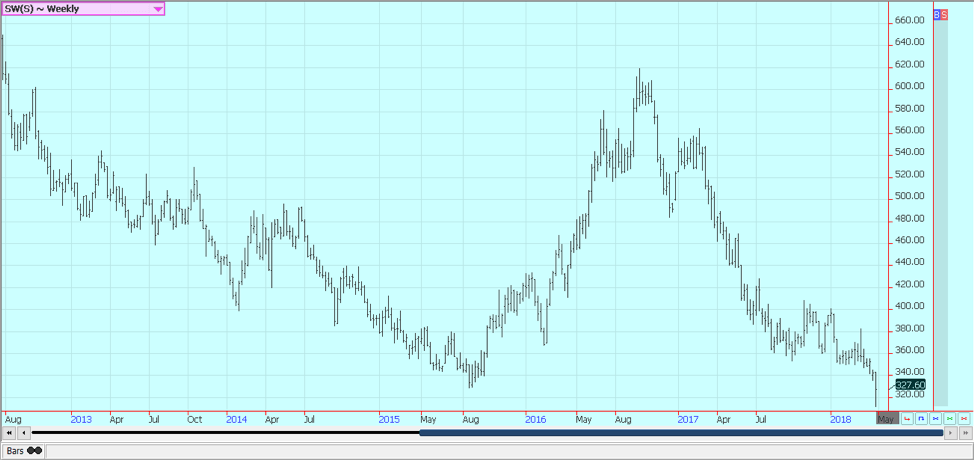

Wheat

Wheat markets were higher as weather and demand remained the dominant factors in the market. It remains very dry in western parts of the Great Plains, and crop conditions remain poor. The Kansas Crop Tour is this week and should find crops with very low yield potential and with little hope for improvement as the overall weather situation remains poor. Warmer and drier weather is expected for the Midwest to help speed crop development, and Midwest conditions are good. Warmer weather should also move into the northern Great Plains and Canadian Prairies to allow for some fieldwork to start in Spring Wheat areas.

USDA showed generally poor crop ratings in its crop progress and condition reports last week, and no real improvement is likely this week. The weekly export sales report was improved, but cumulative sales and shipments remain behind the pace needed to meet USDA targets. The daily charts for all three markets show stability in prices. The weekly charts show that there were bullish closes last week that imply that higher prices are coming. Minneapolis Wheat charts are the weakest of the three markets. The markets seem to be cheap enough due to the ongoing weather problems in the Great Plains.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

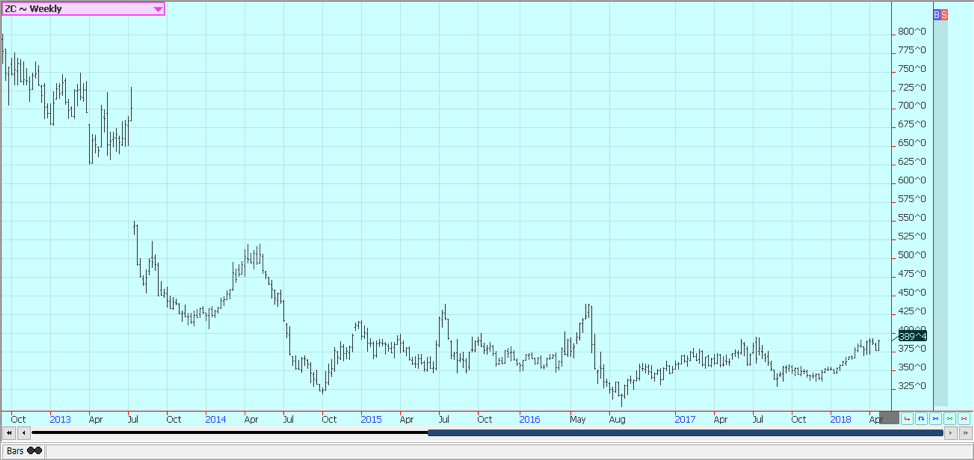

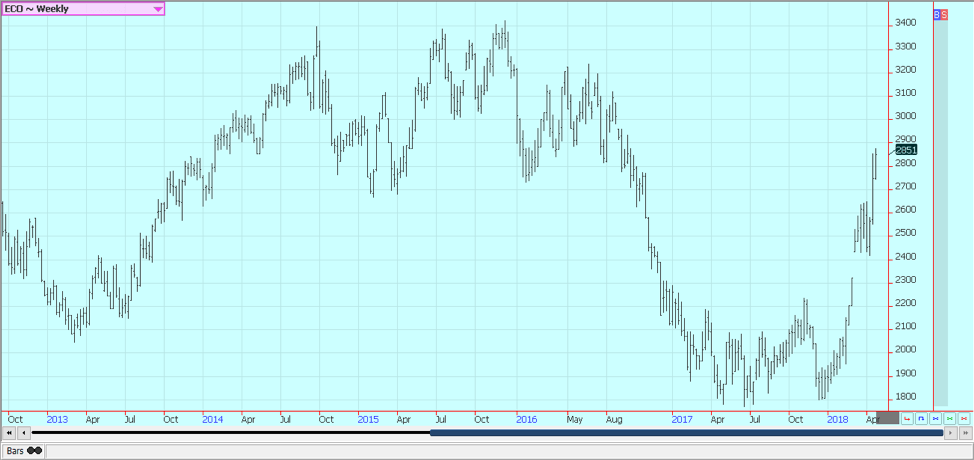

Corn

Corn closed higher for the week as the trade started to worry about second crop corn production potential in Brazil. The Safrinha crop is in trouble in parts of Parana and Mato Grosso at a key time in its development cycle. It is pollination and kernel fill time, but the weather has already turned hot and dry. It could be that the rainy season has ended early. If so, yield potential will shrink dramatically as the development of the crop will be sharply reduced.

Forecasts for better weather conditions to start planting in the Midwest were responsible for market price weakness. Strong domestic and export demand ideas remain the best support for futures, but there is increasing talks of stronger competition from South America and Ukraine. The worries of less demand are a direct result of the Trump administration threats against trading partners in world markets. Weather in the Midwest remains too cold and wet, but warmer and drier weather is expected this week to promote increasingly active fieldwork. It will take some time for areas north of Interstate 80 to thaw, but the trend to more seasonal conditions appears to have finally started.

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

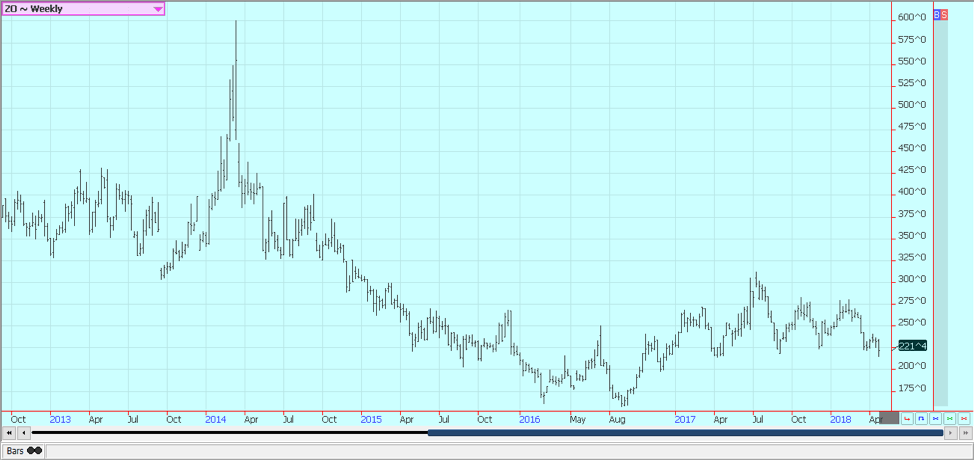

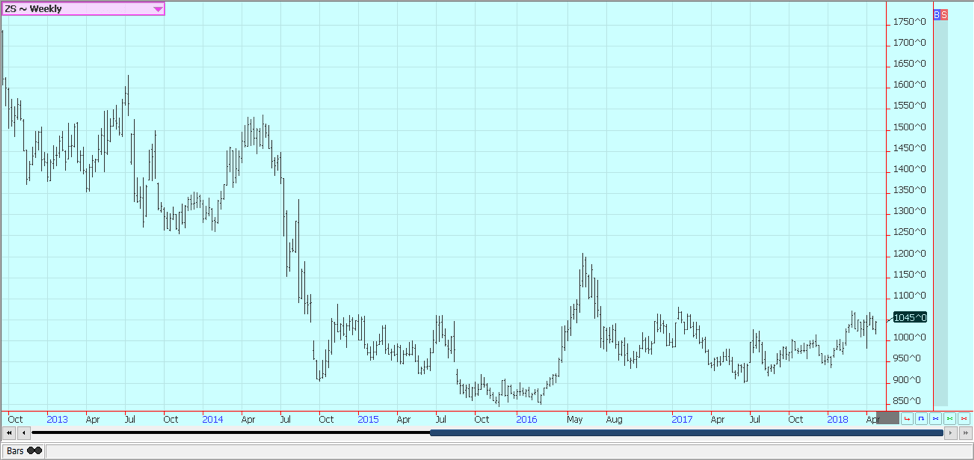

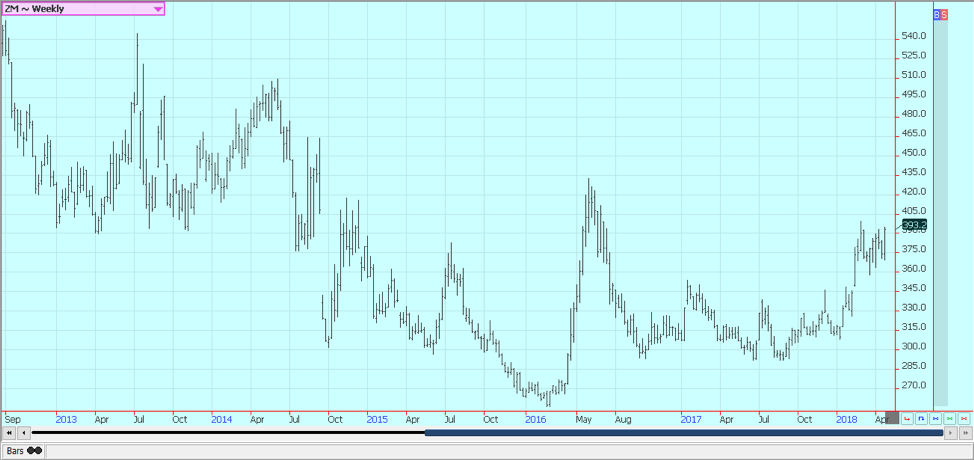

Soybeans and soybean meal

Soybeans were higher again on Friday in sympathy with grains as forecasts for weather this week offered hopes for a lot of fieldwork to get done. They also rallied on news that a cargo ship had hit a dock in one of the Rosario ports in Argentina last week and that this particular dock would need repairs. The news created some buying, but it is still not known how much damage was done and what might happen to demand for Argentine goods. Demand has been an issue with traders ever since the tariff threats with China remain alive, but there are now hopes that the issues with China can be resolved before any punitive tariffs are enacted. There are very high-level meetings scheduled between the two sides this week.

The trade also hopes for a peaceful solution to the NAFTA talks to keep Mexican and Canadian demand alive. China still prefers Brazilian soybeans due to the tariff threats and as the new crop Brazil harvest is now available, and the U.S. stands to lose demand in coming weeks from that buyer and maybe others as Brazil expands market share. USDA showed almost no planting progress in its reports last week and might not show much progress this week, but progress is increasing now.

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

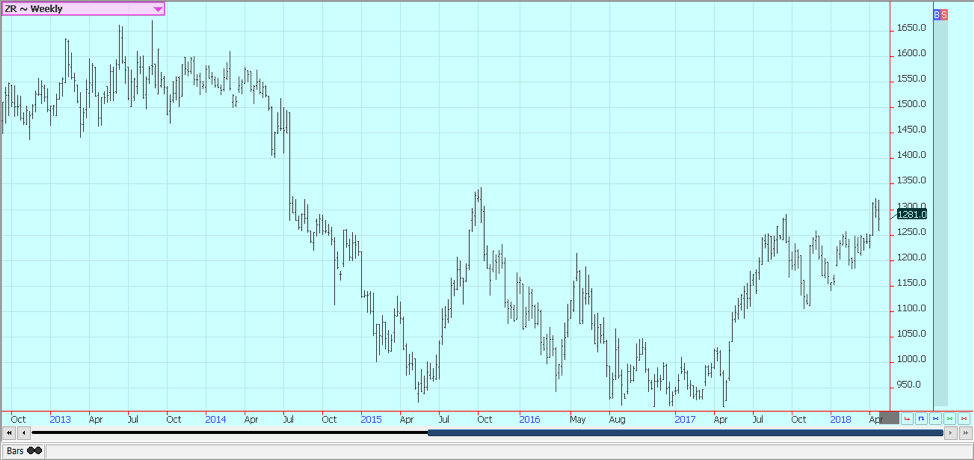

Rice

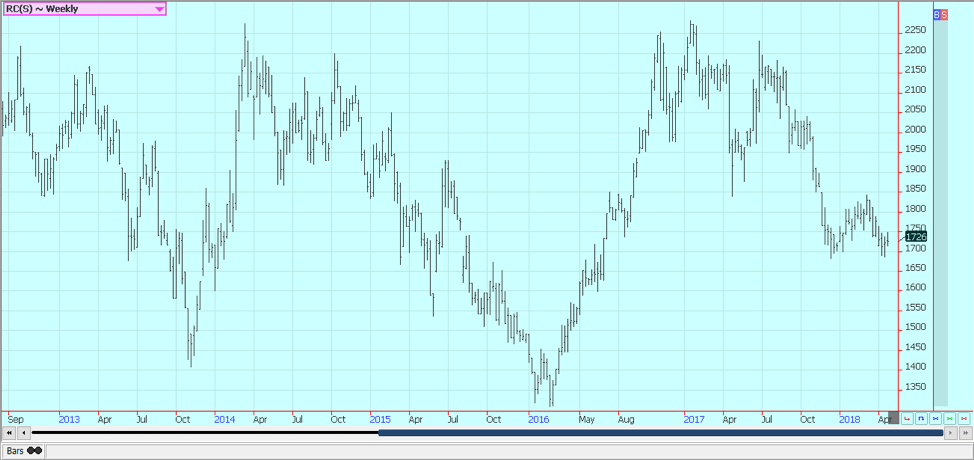

Rice was lower for the week but held above major chart support at 1250 basis the nearest futures contract. Trends are mixed for the short term but still up on the weekly charts. The weekly charts are bullish and imply that further gains are likely in coming weeks as the domestic market works with very tight supplies. Farmers are planting along the Gulf Coast and are trying to get the last of the crop in. It remains too cool for many to plant farther to the north in Arkansas, but some fieldwork is underway.

Warmer and drier weather is forecast for this week, and there is a chance for significant planting progress to be made. Ideas are that little old crop Rice is available in the cash market, and the situation is not likely to improve before the new crop becomes available late this Summer as farmers are mostly sold out. Farmers will plant more Rice this year, but the increase in planted area is not considered burdensome. China imported 274,049 tons of Rice in March, down 33 percent from last year. Calendar-year-to-date imports are now 765,789 tons, down 11 percent from last year.

Weekly Chicago Rice Futures © Jack Scoville

Palm oil and vegetable oil

World vegetable oils prices were mostly lower last week. Palm oil moved lower as export demand started to wane in Malaysia. There were hopes for a lot of new Chinese demand, but China has been importing mostly from Indonesia. It imported 479,718 tons of palm oil in March, up 27 percent from last year. Indonesia exported 347,390 tons to China on the month, and Malaysia exported 132,196 tons. Total calendar year Chinese imports of Palm Oil are now 1.321 million tons, up 5.5 percent from last year. China has been crushing a lot of soybeans and has been producing its own soybean oil.

The weekly charts show that palm oil remains in a trading range as the better demand is being met by reports of better production. A sideways trend can continue. Soybean oil was locked in a sideways trend all week until moving lower on Friday. Canola found some support from the trade war and also from the very cold weather in the Canadian Prairies. The cold weather has made any fieldwork impossible at this time. The region looks to turn warmer this week. StatsCan showed that Canadian farmers plan to reduce oilseeds plantings this year and increase grains plantings. That could keep canola relatively firm compared to soybeans and soybean oil.

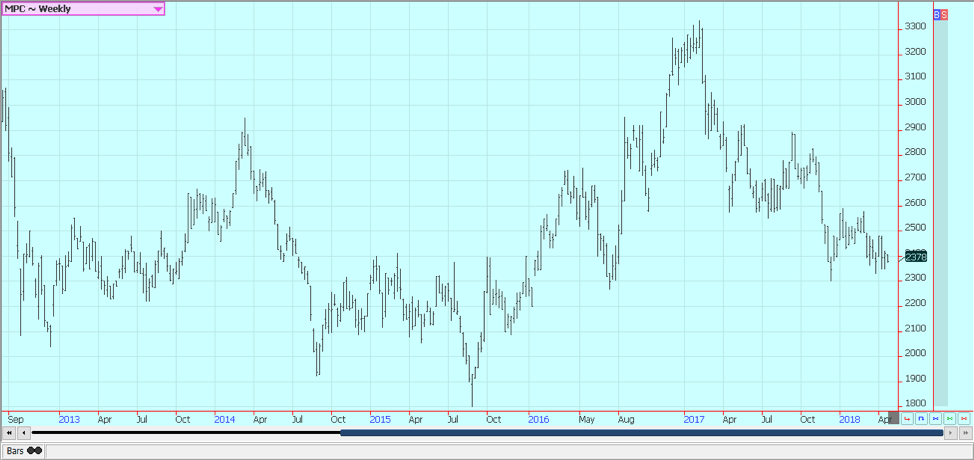

Weekly Malaysian Palm Oil Futures © Jack Scoville

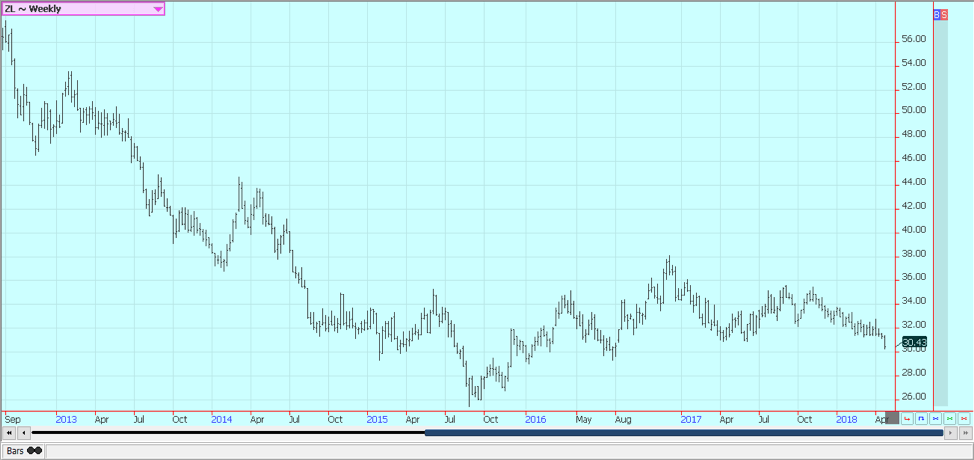

Weekly Chicago Soybean Oil Futures © Jack Scoville

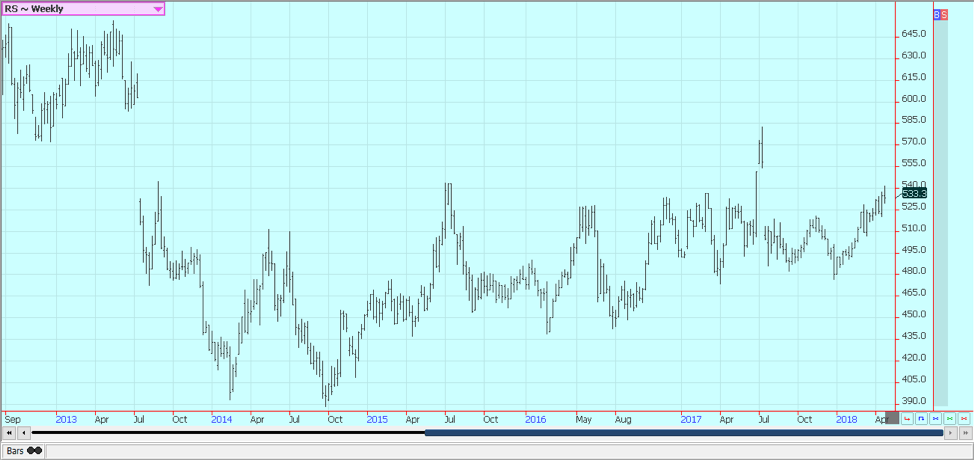

Weekly Canola Futures © Jack Scoville

Cotton

Cotton was slightly lower last week, but prices recovered from a sharp move lower in the middle of the week. Demand remains strong in export markets as the weekly export sales report showed much-improved volumes of sales for both the current crop year and the next crop year. Chart trends have been sideways to up on daily and weekly charts. The weather in the western Great Plains remains very dry, although some light precipitation has fallen in some areas.

U.S. farmers in just about all production areas plan to plant more cotton, and the precipitation will help farmers in those areas get started. In contrast, farmers in the Delta and Southeast have seen too much rain and have had delays as soils dry out. Planting progress has been generally slow but should start to increase this week if it stays drier as forecasted. The fundamentals point to a high sometime this summer, then lower prices into harvest as bigger supplies will come into the market.

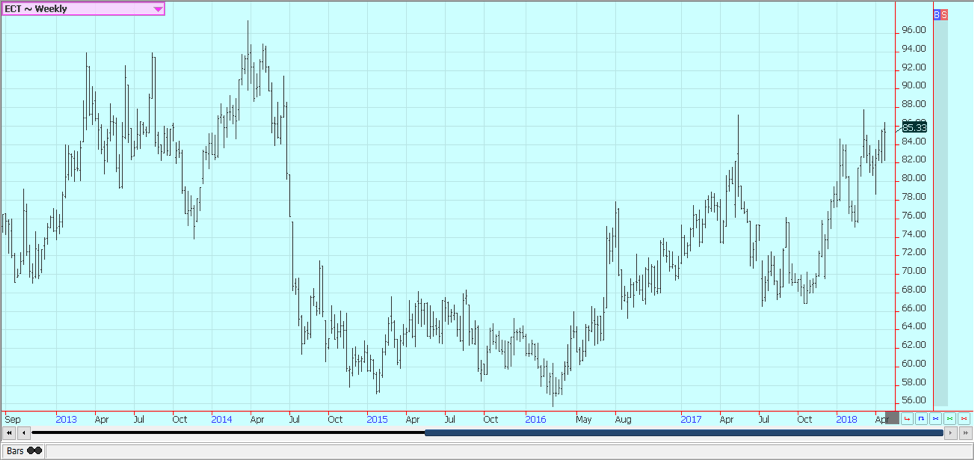

Weekly US Cotton Futures © Jack Scoville

Frozen concentrated orange juice and citrus

The frozen concentrated orange juice was higher, and trends are now up on the charts. The market is still dealing with a short crop against weak demand, and the weekly Movement and Pack report in Florida is showing higher inventories year on year. Even so, the market is feeling buying interest and very little selling interest at this time. The current weather is good as temperatures are warm and it is mostly dry, but some light to moderate rains were reported over the last week.

The harvest is progressing well, and fruit is being delivered to processors. Producers are now into the Valencia crop. Florida producers are seeing pea- to marble-sized fruit. Conditions are reported as generally good, although most producers would like more rain. Irrigation is being used. Brazil also could use more rain. Variable conditions are reported in Europe and northern Africa.

Weekly FCOJ Futures © Jack Scoville

Coffee

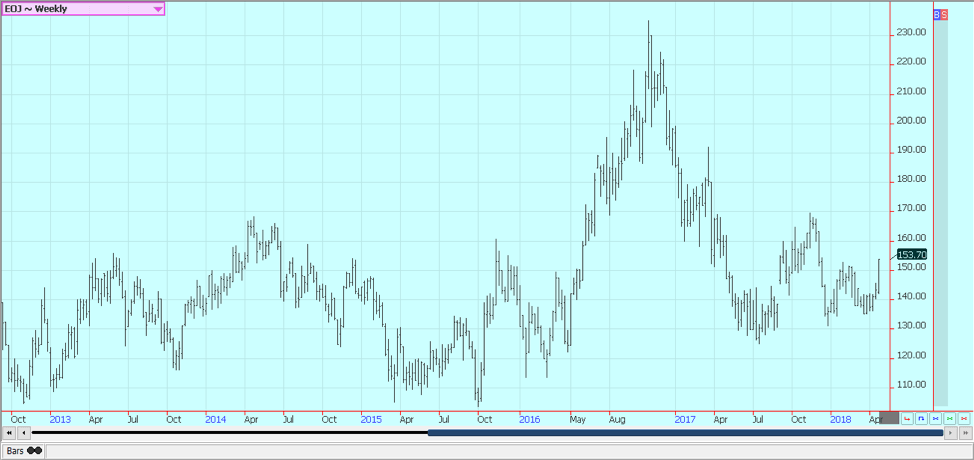

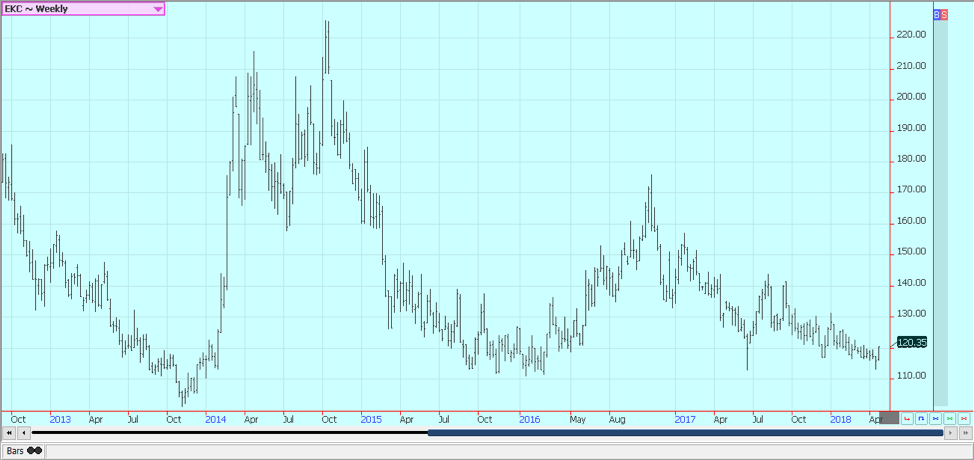

Futures in New York were higher on Friday and also for the week due to strong commercial buying along with speculative short covering. The weekly charts show that a reversal might have happened last week. A weaker dollar helped create new buying interest as well as some fund short covering. London was a little higher. More talk is being heard about the size of the net short speculative position, with ideas around that it has become way too big.

More and more traders are now looking for the market to reverse as the speculator gets out of the way and tries to book profits, Some traders now think a significant rally is just around the corner. Origin is still offering in Central America and is still finding weak differentials. Good business is getting done, and exports are active. Traders anticipate big crops from Brazil and Vietnam this year and have remained short in the market.

New York traders are talking about good weather currently being reported in Brazil and expect another bumper crop. Robusta remains the stronger market as Vietnamese producers and merchants are not willing to sell at current prices and are willing to wait for a rally. Vietnamese cash prices were steady again last week with good supplies noted in the domestic market.

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

Sugar

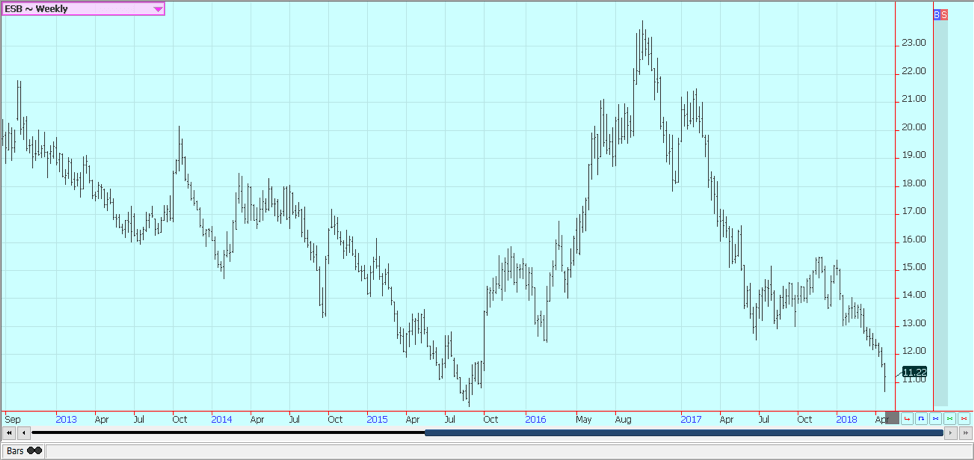

Futures were higher in both markets on Friday but lower for the week. Both markets made new lows on the weekly charts before showing a small recovery. Reports in the first part of the week that the Brazil season was off to a big start caused the selling interest as the market now expects even more sugar to be available. There has been little in the way of positive news for traders in the last year as production estimates have climbed and demand estimates have not.

The fundamentals remain little changed, and there does not seem to be much, for now, that can shake the market out of its current trend. Traders hear about big production from the world producers and little in the way of special demand that could absorb some of the surplus. Ideas that sugar supplies available to the market can increase in the short term have been key to any selling.

India is back to export sugar this year after being a net importer for the last couple of years. They hope to export two million tons this year but will have a surplus that is double that amount. Thailand has produced a record crop and is selling. Brazil still has plenty of sugar to sell, and even the EU has had overproduction in the past year.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

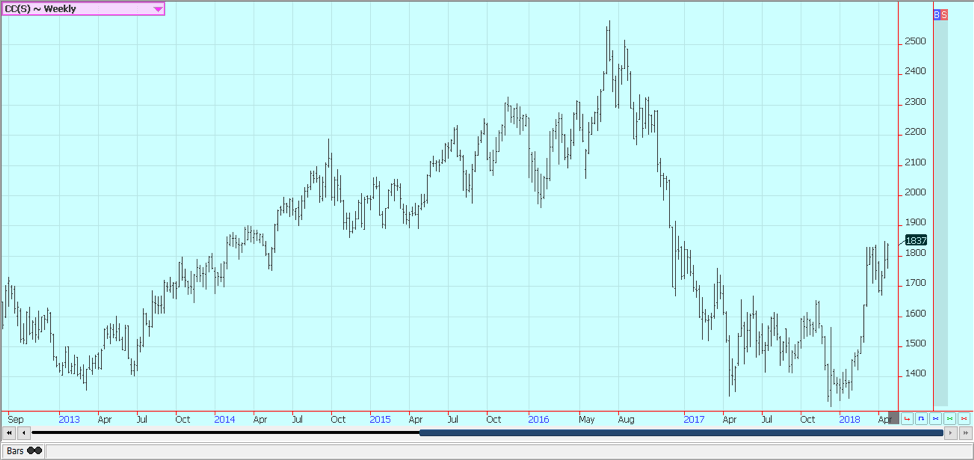

Cocoa

Futures were higher in both New York and London. Ideas that world production has been largely sold remain part of the rally. Showers and more seasonal temperatures have been seen in the last few weeks to improve overall production conditions in West Africa. The mid-crop harvest is starting, and wire reports indicate that some initial mid-crop harvest is underway in all countries. No yield reports have been seen yet, but estimates imply that variable yields can be expected. The harvest should begin soon in Ivory Coast and Ghana.

Bloomberg reported last week that the difference between New York and London prices is historically large. This is due not only to fund buying in New York but also to increased Cameroon offers in Europe. European buyers do not like Cameroons cocoa, so the supplies have been certified in London for delivery. So the longs in London are leaving the market to avoid having to take Cameroons cocoa. The big spread implies that African cocoa can make it to New York for delivery and generate profits for sellers. Asian supplies are now less available since Asian grinding capacity has increased, so New York has space for African cocoa.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Crypto2 weeks ago

Crypto2 weeks agoXRP vs. Litecoin: The Race for the Next Crypto ETF Heats Up

-

Crypto1 day ago

Crypto1 day agoCrypto Markets Surge on Inflation Optimism and Rate Cut Hopes

-

Biotech1 week ago

Biotech1 week agoSpain Invests €126.9M in Groundbreaking EU Health Innovation Project Med4Cure

-

Biotech4 days ago

Biotech4 days agoAdvancing Sarcoma Treatment: CAR-T Cell Therapy Offers Hope for Rare Tumors

You must be logged in to post a comment Login