Business

The financial guide for newlywed millennials

There are currently 80 million millennials living in America, the largest generation in the population. They are the first to be encumbered in student loan debt, $29,800 for the average graduate costing $393 month. In regard to retirement, 82% of millennials contribute to workplace retirement plans, more than any other generation. Here are a few tips for millennials to control their finances.

She says, “I do”, and then the planning begins. Getting ready for a wedding can sometimes be stressful, but hopefully is remembered as one of the most exciting and heartwarming phases of a couple’s journey through life. There are plenty of decisions to be made… the venue, the menu, the guestlist, where to honeymoon, etc. However, once the dust settles from the most memorable, and probably expensive, day of your life, what happens next?

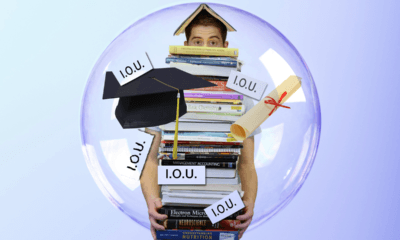

There are currently 80 million millennials living in America, the largest generation in the population. They are now getting married and starting families in droves. Amidst juggling these new roles, millennials are starting financial plans in very unique circumstances. They are the first generation to be encumbered in student loan debt, $29,800 for the average graduate costing $393 month. Despite being financial novices with unprecedented debt, millennials have a higher savings rate than any other age group at 14%. In regard to retirement, 82% of millennials contribute to workplace retirement plans, more than any other generation. They also really want to be homeowners, 85% of them list buying a home as their primary goal. Studies show these young professionals prefer experiences to materials when making purchases, and enjoy eating out more than ever before, five times per week on average.

With this data in mind, here are a few tips for newlywed millennials to get on the right financial track:

Customize your wedding registry

As mentioned earlier, experiences seem to outweigh materials. Perhaps add a local outfitter who can plan a cool excursion. Consider a couple’s massage, coffee or wine subscription, or savings towards a flight. This can avoid the hassle of opening five sets of Tupperware the day after your wedding.

Stop eating and drinking out so much

The average millennial spends $65 monthly on coffee alone. Remember, not only are you losing $65 monthly, which is $780 annually or $39,000 over the next 50 years, not even counting for inflation; but you’re also losing its lost opportunity cost, all the earnings you could have had on that money had it been invested or used otherwise.

Consider refinancing student loans

Once you’ve settled into your career and developed a monthly budget, you’ll have a clearer picture of what student loan repayment plans fit you best. The current low-interest-rate environment may allow you to refinance to a lower rate, costing less in interest over time. However, beware that federal loans refinanced through a private lender may forfeit certain forgiveness options and protections against death or disability.

Don’t buy too much house

Financial experts agree that a mortgage payment should not exceed 15% of gross household income. Remember, the bigger the house, the bigger the bills- higher utilities, maintenance, property taxes, etc. Becoming “house rich, cash poor” is a common mistake among millennials that often prompts a liquidity crunch and those dreaded credit card balances.

Buy individual disability insurance

According to the US Social Security Administration’s Fact Sheet, one in four of today’s 20-year-old’s will be disabled at some point in their careers. Social security payments can be modest and often difficult to qualify for. Group Disability Insurance, if your company even offers it, often is not portable, covers 40-60% of salary, and contains restrictive language for receiving a then taxable benefit. Individual “True Own Occupation” coverage is the best way to protect your income should the unexpected occur. You cannot be in denial of the odds and pretend you’ll never be that one in four.

Be careful of FIRE

The recent fad of Financial Independence, Retire Early (FIRE), can be a bit unrealistic. This cohort believes in saving 50% of income with the hope of retiring around age 40. Advocates often have high salaries, and are single with no dependents. Not to mention, leaving work at age 40 could mean over 50 years in retirement, meaning inflation could erode your purchasing power by half, twice.

Look into whole life insurance

A recent study shows that 81% of the most financially confident Americans own whole life. This is a life insurance product which can offer a permanent death benefit with growing cash values that are uncorrelated to the stock market and accessible while living.

Budget

Devise a systematic savings plan in which every month a portion of your income is going towards both short-term and long-term goals. Maintain six months of expenses in cash and try to save at least 20% of your gross income each year.

Following these steps can help all the newlywed millennials control their financial future. Please take ownership of the process and build upon what can go down as one of the best saving generations ever.

—

(Image by nihan güzel daştan via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Africa1 week ago

Africa1 week agoMASI Surge Exposes Market Blind Spot: The SAMIR Freeze and Hidden Risks

-

Cannabis49 minutes ago

Cannabis49 minutes agoSnoop Dogg Searches for the Lost “Orange” Cannabis Strain After Launching Treats to Eat

-

Crypto1 week ago

Crypto1 week agoIntesa Sanpaolo Signals Institutional Shift With Major Bitcoin ETF Investments

-

Biotech2 weeks ago

Biotech2 weeks agoEurope Launches Personalized Cancer Medicine Initiative