Business

3 tips to help graduates settle student loans faster

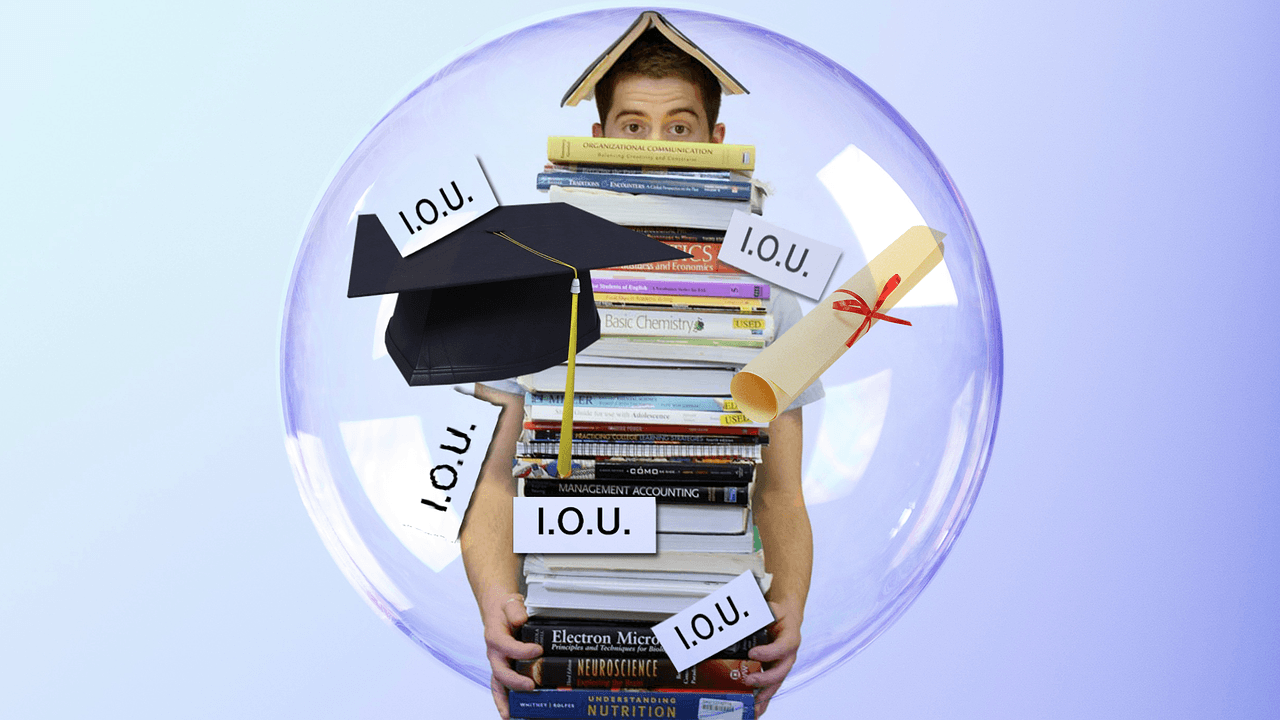

To settle student loans, planning and commitment are required. One needs to learn how to handle debt to be able to plan the payments properly.

Student loan debts have become a burden nowadays. This type of loan can be difficult to settle responsibly and many still struggle due to a lack of financial training to handle debt.

Per Reuters, the average student loan a graduate has to settle is at $27,000 in 2013. This number is higher today due to inflation. Student loan collectors—federal or otherwise—offer multiple options on how you can settle your debt. You don’t have to be an expert when it comes to debt management. Here are three tips to settle student loans faster:

1. Immediately create a plan to pay off your student loans

Make a long-term plan on how to pay off your student loans in three to five years. Prioritize those that have higher interest rates. The important thing is to pay according to your capacity to make payments. You may choose to pay double the minimum or make payments twice a month.

According to Entrepreneur, getting part-time jobs while still in school can help even if a little. Your main aim is for the loan not to get into a default and keep interest rates at a minimum.

Student loans are keeping fresh graduates from reaching their full potential. (Source)

2. Execute this plan and stick to it.

Now that you have a plan, the next step is to execute it. Set and follow a strict budget and keep track of your spending. Bills, rent, and credit card payments should be considered here. Be sure to include basic expenses for transportation, food, and retail. If a purchase is unnecessary, it is better to leave it. Just remember that being frugal doesn’t mean you have to live a cheap life.

3. Use money management apps.

It is now easier to handle your finances with the help of money management apps. Keep track of your finances and payments online. Mint, Pocket Expense and HomeBudget are some technologies that help you manage your money. With readily available data and information at your fingertips, you can now make better and informed decisions about your money.

Additionally, reading the fine prints also helps. It is better to know everything that you are signing in for. Research and understand the terms. Knowing the terms of the agreement can save you time and money in the long run since possible consequences of late payments can be avoided.

Settling student loans require a plan and the commitment follow through. After all, there is no better feeling than settling any kind of debt and just living life to the fullest without anything that holds you back.

-

Crypto2 days ago

Crypto2 days agoBitcoin Surges Toward $110K Amid Trade News and Solana ETF Boost

-

Fintech1 week ago

Fintech1 week agoMuzinich and Nao Partner to Open Private Credit Fund to Retail Investors

-

Crypto5 days ago

Crypto5 days agoBitcoin Traders on DEXs Brace for Downturn Despite Price Rally

-

Business2 weeks ago

Business2 weeks agoDebt-Fueled Markets, Zombie Corporations, and the Coming Reckoning

You must be logged in to post a comment Login