Featured

How Freetrade.io redefines the future of trading stocks

Equipped with a software tailored to an operating brokerage, Freetrade.io introduces a new and affordable way to manage brokerage fees.

Fintech has seen explosive growth in recent years, and this year, Open Banking regulations have caught traditional commercial banks off guard, and the sweeping changes happening with the full rollout of AI, Big Data, Hyper-personalization and so much more that is the latest wave of FinTech startups.

Today, we want to talk about Freetrade.io, a company we have been watching in recent months, and with an upcoming launch, we wanted to help spread the word while taking a closer look at the impact this small startup will have on the current execution-only services.

© Karl Ahlstedt

Providing access to the every-man (or woman)

A long-standing problem for individual novice investors with ambitions of trading stocks and shares has always been the brokerage fees. This barrier to entry is significant, as it forces participants to take position sizes of £10,000+ to be able to effectively recoup the execution fees. This is the fees charged by the broker to execute a buy order, and the fees charged to execute a sell order, i.e., a round trip trade of buying, holding and then selling a particular stock.

Here is the breakdown in current fees:

Traditional full-service broker:

Hargreaves & Lansdown: £12 per trade execution totaling £24 per round trip.

Discount execution only broker:

X-O: £6 per trade execution totaling £12 per round trip.

FinTech mobile-first startups:

Robinhood – Free trade execution and generates profit by collecting interest on the cash left in your brokerage account that is not invested.

Freetrade.io – Free trade execution and generates profits through Alpha subscription service that allows instant trades as opposed to trades being executed at the end of play at £10/month. Investors can also perform instant trades without an Alpha subscription for £1 each transaction. Additionally, it rolls in other services such as an ISA for £3 per month without an Alpha subscription.

To put this into context, as a new investor who has invested £250 each into four companies.

- Company A – £250

- Company B – £250

- Company C – £250

- Company D – £250

From these investments, we will need to purchase one buy order execution and one sell order execution, assuming we are planning to buy a stock, hold a stock, and then sell it at a profit.

The first thing to note is the fees, at £6 per trade, this is 8 trades x £6 = £48.

Should we have used H&L, HSBC or similar, this would have been 8 trades x £12 = £96.

This highlights that we would need to see gains of between 48 (4.8 percent) and 96 (9.6 percent) just to break even and not lose money.

Considering the best hedge fund managers in the world exceed more than 7-9 percent per year averaged out, it is incredibly easy to see the overwhelming barriers for a novice investor who is looking to invest around £250 per company. This simple analysis excludes the power of compounding.

The fees simply kill any reasonable expectations of making a good rate of return on capital invested.

It is true that this scenario has forced many new and inexperienced investors to take position sizes of £5,000 and up in individual companies, which from our experience leads to a distinct lack of diversification and traders taking on more risk than we are, frankly, comfortable with.

This has been the constant trade off — the more a trader is willing to invest per position, the lower (as a percent) the commission will be.

In the past, we have recommended XO as the broker to use due for new investors, primarily due to its low execution costs. We firmly believe that the fees charged by brokerage firms can make or break investors in the long term, and that’s why the cost is so important.

As we move into the FinTech future, disruptors such as Robinhood have existed for well over a year now, but due to its exclusivity to North America, it has been out of reach for those of us in Europe. This is really where Freetrade comes into play. It is by and large the European equivalent of Robinhood, albeit with a tweaked business model (which for what it’s worth, I think is better).

Who are Freetrade.io anyway? A UK alternative to Robinhood

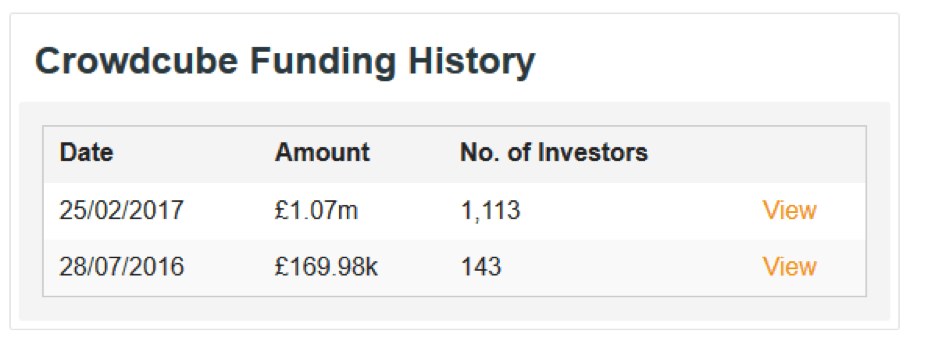

Freetrade.io was founded over two years ago in a “tiny London bedroom” by Adam Dodds, former KPMG manager involved in M&A corporate finance and auditing. Since starting in 2016, Adam has raised over £4.4 million across three funding and currently has a launch date for within the next few months.

© Karl Ahlstedt

This is remarkable progress, and it is noteworthy that Freetrade decided to build in-house the full software stack that supports the backend and behind the scenes technical infrastructure of operating a brokerage.

Looking ahead: Launch and beyond

The business model of Freetrade is genuinely free in that dividends are retained by the investor.

The only cost to this is having to wait until the end of the trading day for orders to be executed, this will generally result in spending slightly more (or less!) than having an instant trade, but functionality to support stop loss orders will be released at or very soon after the initial launch.

Admittedly, this is potentially a make or break major issue for short-term technical traders, the solution for this group of generally veteran traders? The Freetrade Alpha Subscription.

The overall model for generating revenue is from the premium subscription service Alpha. This service provides instant trades of U.S. companies for free, and U.K. companies at £0.50 per trade. It costs £10 a month and will be readily used by those who trade on extremely short-term time horizons and even long-term investors.

—

DISCLAIMER: This article expresses my own ideas and opinions. I am in no way affiliated with the brokerages mentioned above. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Impact Investing2 weeks ago

Impact Investing2 weeks agoItaly’s Listed Companies Reach Strong ESG Compliance, Led by Banks and Utilities

-

Fintech2 days ago

Fintech2 days agoFindependent: Growing a FinTech Through Simplicity, Frugality, and Steady Steps

-

Impact Investing1 week ago

Impact Investing1 week agoCDP Approves €1.5 Billion Package to Boost Industry, Renewables, and International Development

-

Impact Investing5 days ago

Impact Investing5 days agoThe Sustainability Revolution: Driving a Net-Zero, Nature-Positive Economy

You must be logged in to post a comment Login