Business

Demands are high, but the prices of rice still remain low

Demand for Corn has been stronger than expected, especially on the export and energy fronts.

Latest news in the agriculture sector: Demand for rough rice has been good, and the mills in export position have been suffering. There are widespread expectations of reduced acreage due to current unprofitable prices.

Wheat

US markets were lower last week. Chicago SRW closed slightly lower, but HRW and Minneapolis closed 8.5 cents per bushel lower. Prices trade both sides of unchanged and overall volumes were on the quiet side. It is a little ironic that the higher protein wheats finished that much weaker as the weekly export sales report showed very good demand for HRW and HRS, but very little demand for SRW. It was the best week for sales for the US in many weeks. Egypt bought over 400,000 tons of Russian Wheat on Friday. They paid between $192.00 and $194.00 per ton FOB, compared to the lowest US offer for SRW at $197.00 per ton. World Wheat markets remain in control of the buyers as there is still plenty of Wheat available in export markets all over the world. The market is still feeling a little support from the low planted area report from USDA just over a week ago. The report showed the lowest Winter Wheat planted area in 107 years and created ideas that the long slide in prices might be coming to an end. The focus of the trade to start the week will be on Russia. It will be very cold in southern areas and there is the possibility of Winterkill or damage. The market will respond to more demand news if it appears and will keep a close eye on the trade policies of the new US government. The weekly charts still show a generally positive price picture.

Weekly Chicago Wheat Futures © Jack Scoville

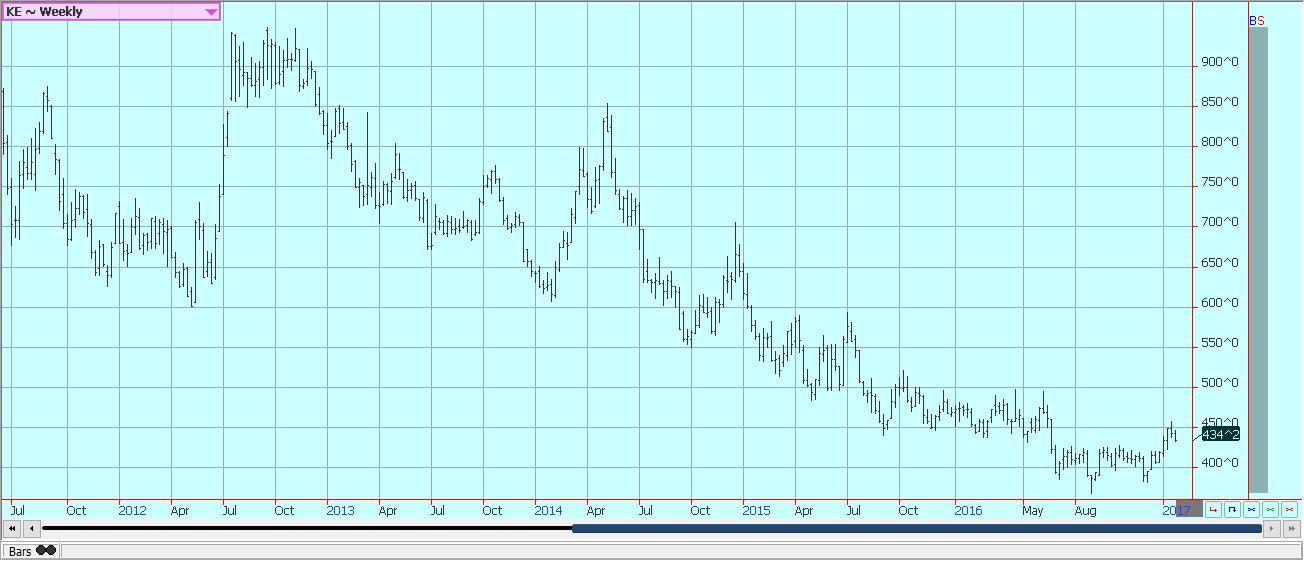

Weekly Kansas City Wheat Futures © Jack Scoville

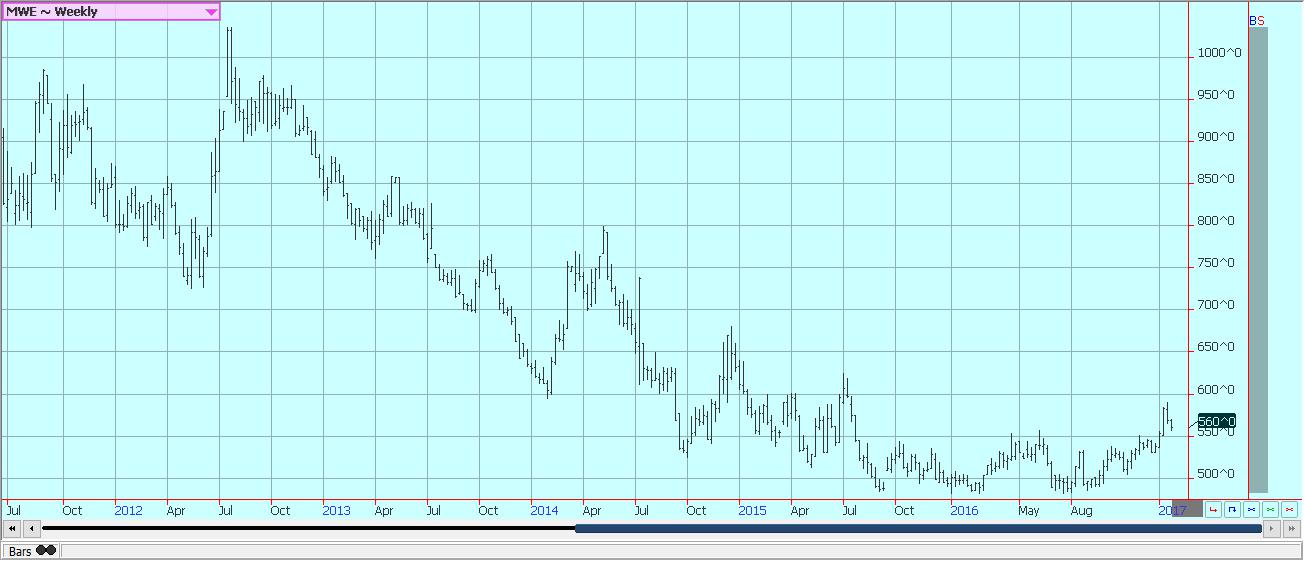

Weekly Minneapolis Wheat Futures © Jack Scoville

Corn

Corn closed lower after failing to hold above $3.70 per bushel in the March contract last week. It looks like the farmer is willing to start selling above that level. However, the weekly charts show that the market is holding above an important support level at about $3.60 per bushel in the March contract. Chart trends remain up as futures move back to the support line. Demand for Corn has been stronger than expected, especially on the export and energy fronts. Export demand was strong again last week and more analysts now expect USDA to increase export demand by at least 25 million bushels in the updates next month. Ethanol demand has been running at record levels the last couple of weeks, and it looks like USDA will be forced to increase this demand by up to 50 million bushels in the next updates.

The demand is coupled with tight farmer holding patterns, although Corn is leaking each day into the market. More Corn might have to move soon as there is still a lot of Corn on pads or the ground outside that must be moved before it gets too warm. It is not known just how much is outside, so the amount of selling pressure to come is difficult to gauge. However, US farmers appear undersold in Corn. They face little world competition as South America is still out of the market and is likely to be out of the market until this Summer. There is not much Corn there and internal pipelines will need to be filled before much export can be made. Growing conditions are said to be good in Brazil, and the Safrinha crop is being planted as the Soybeans get harvested. Heavy rains are possible this week to slow the progress down. Conditions remain difficult in Argentina as it has turned hoy and dry. The wet areas are turning drier, but the dry areas further south are now being stressed.

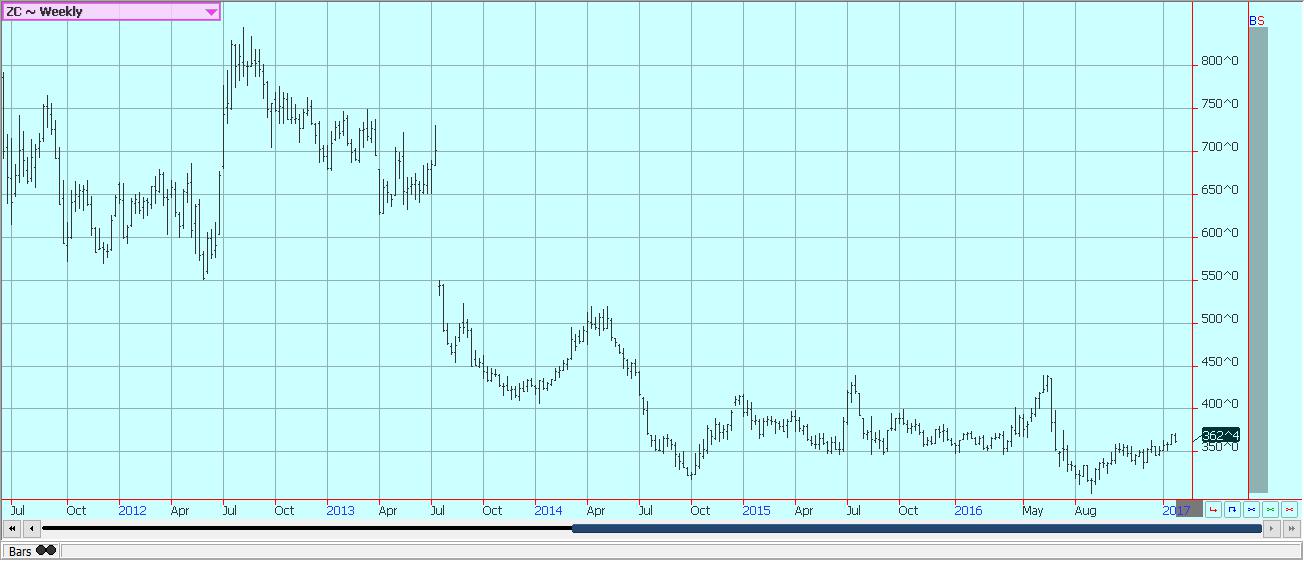

Weekly Corn Futures © Jack Scoville

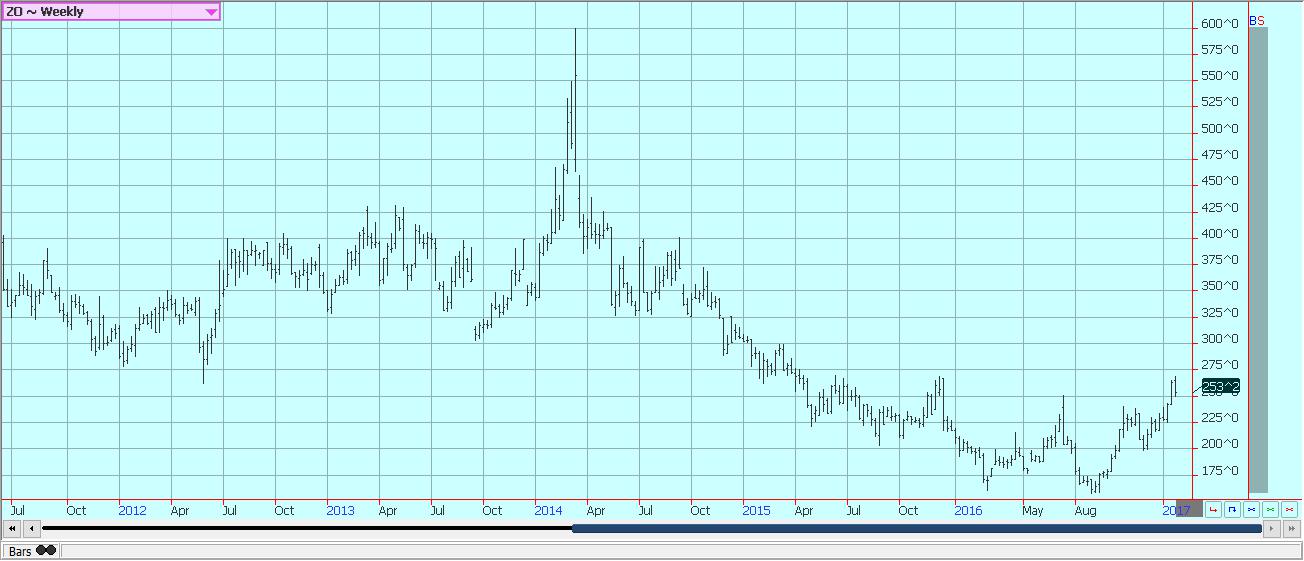

Weekly Oats Futures © Jack Scoville

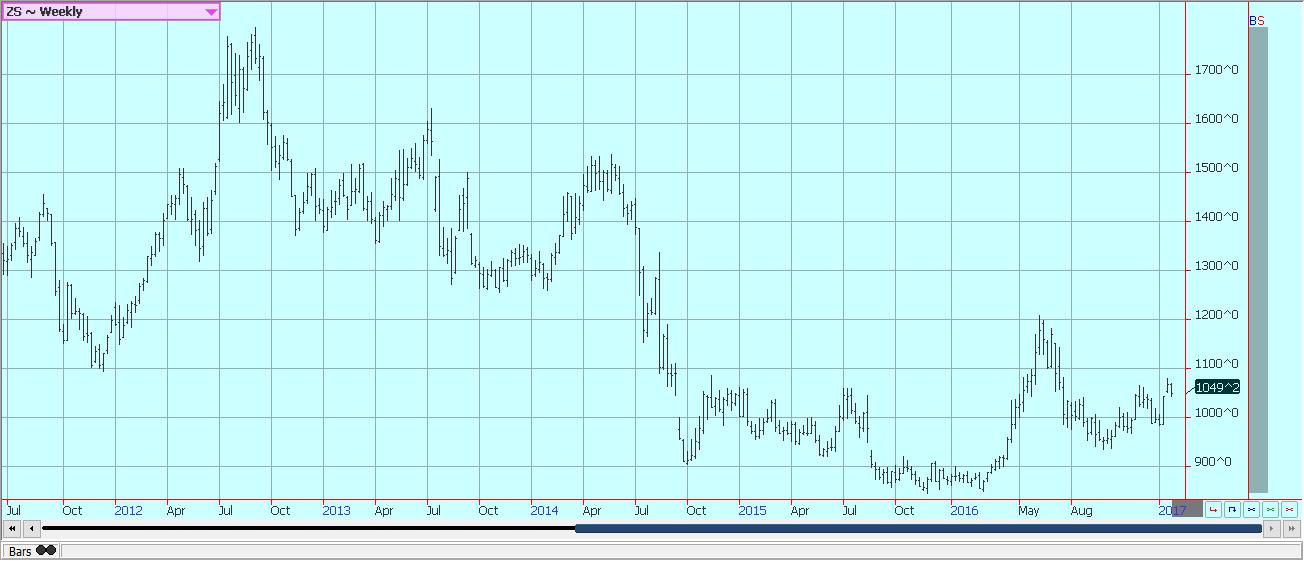

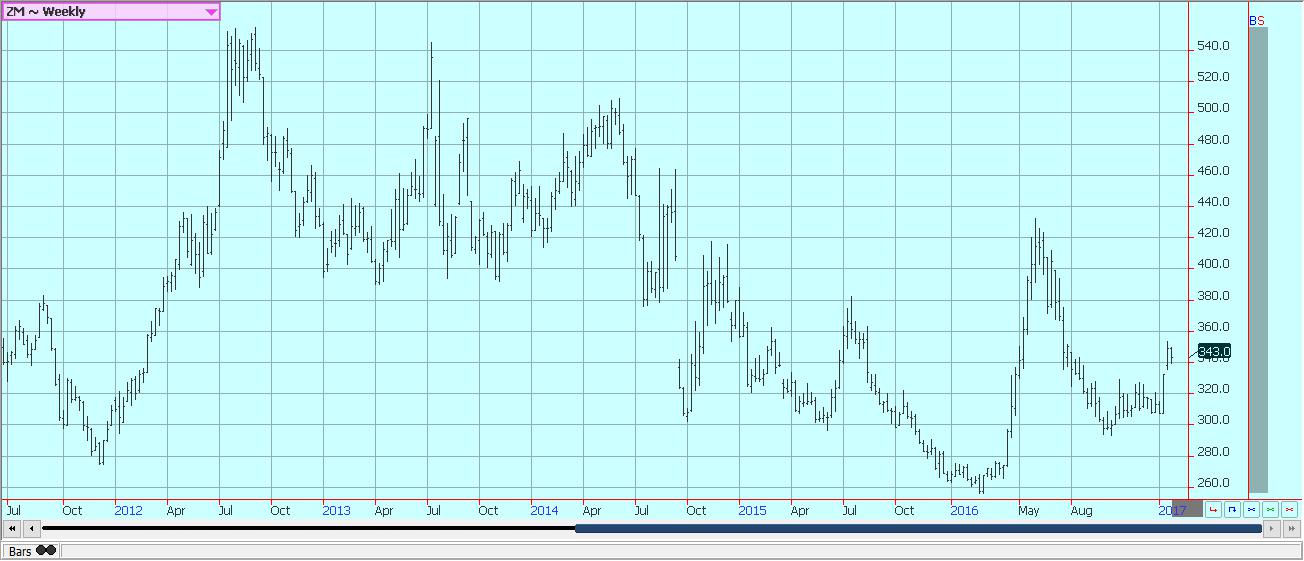

Soybeans and soybean meal

Soybeans and Soybean Meal lower last week in slow trading. Chinese demand is starting to drop from the US, but China imported over 8 million tons of US Soybeans in December. That is a lot of Soybeans. Some of the selling resulted from the war of words that President Trump is having with China and Mexico, the two biggest buyers of US Soybeans. No one thinks that either country is in a position to switch demand as world demand remains huge, but Trump’s initial actions and words have concerned Soybeans producers a lot. Things seem to calm a bit Friday afternoon when the US and Mexico both said that any discussions of mutual relations would be conducted in private. Export markets should be quiet this week due to the Lunar New Year that will keep China and much of Southeast Asia away from the office and trading. Growing and initial harvesting conditions have been good in Brazil, although some cold weather earlier in the season has caused some delayed maturity of Soybeans in Parana. Harvest progress is very good to the north and a few days ahead of normal. There are forecasts for some heavy rains in northern areas this week that should slow the harvest progress. Argentina remains hot and dry, stressing any crops in southern growing areas. Northern areas trying to recover from flooding rains are welcoming the drier weather now but might suffer further crop stress and losses if the hot and dry conditions continue. Production estimates for Argentina now range from 41 to 54 million tons, down from 55 to 57 million tons early in the growing season.

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

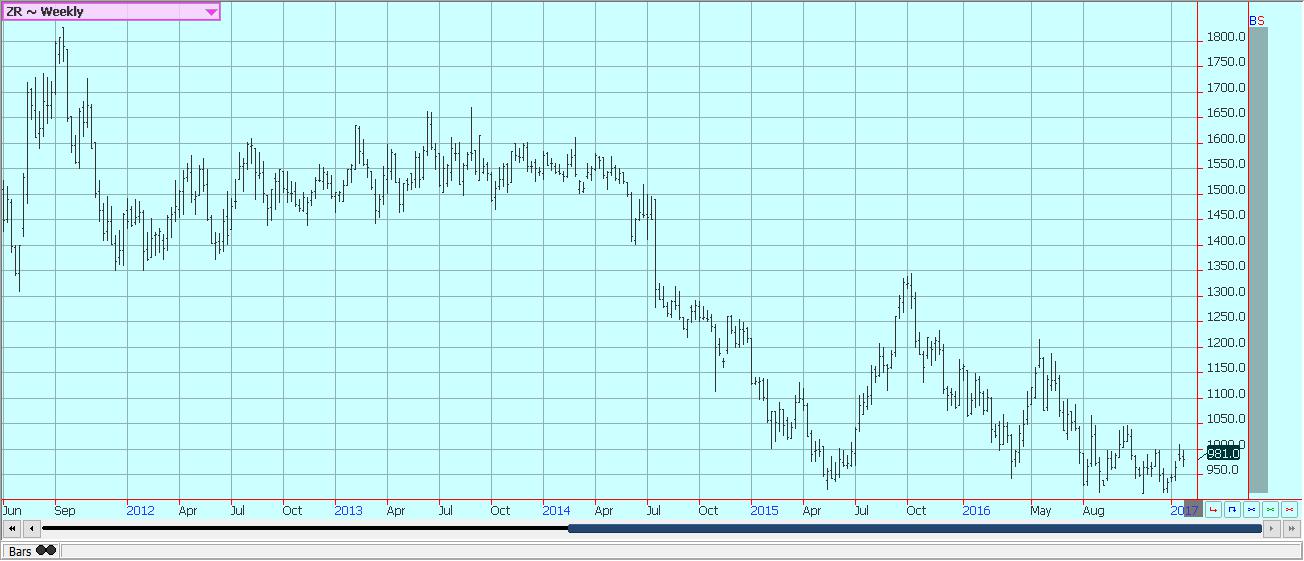

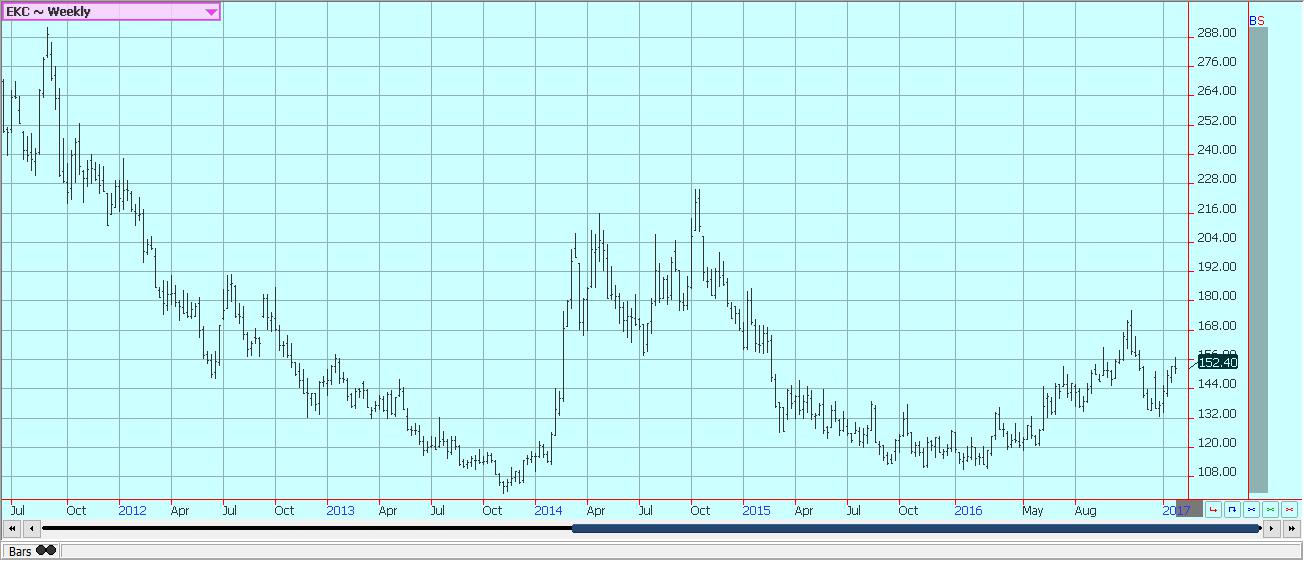

Rice

World markets were firm last week and US futures were about unchanged. Futures trading remains slow and with little interest. The Commitments of Traders reports show that there is value in this area as the commercials are long and the speculators are mostly short. Deliverable receipts have been canceled in the last few weeks as some commercials use futures to originate Rice. Cash market offers remain few and far between as producers are unhappy with prices. There are big supplies to move in the US and that has been the big fundamental reason to keep prices lower. Demand has been good, but everyone is looking for more due to the large size of the last crop. Demand has been mostly for rough rice, so the mills in export position have been suffering. The stale market conditions now have pushed attention ahead to the next crop. There are widespread expectations of reduced acreage due to the current unprofitable prices. Many think the area could be reduced by an average of 15%. The charts show that the market has been in a trading range for a few months now so a move one way or another should be coming soon. Bullish traders look for reduced area and production this year to spike prices, while bearish traders look for lower short-term prices due to the lack of cash market activity and the amount of Rice in the country left to sell.

Weekly Chicago Rice Futures © Jack Scoville

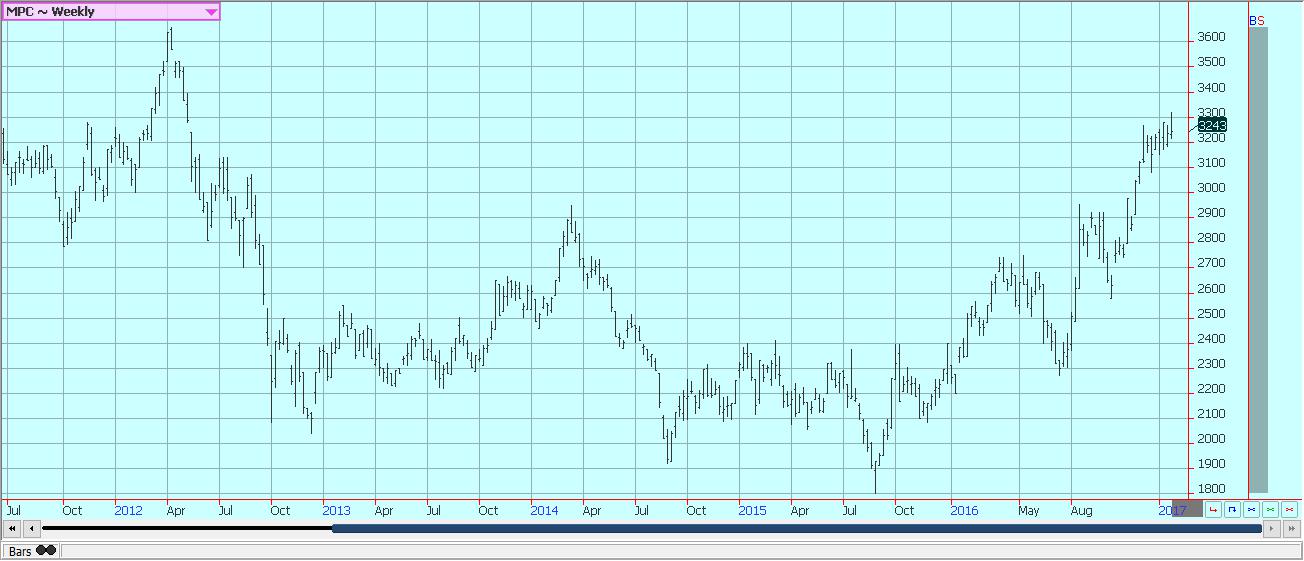

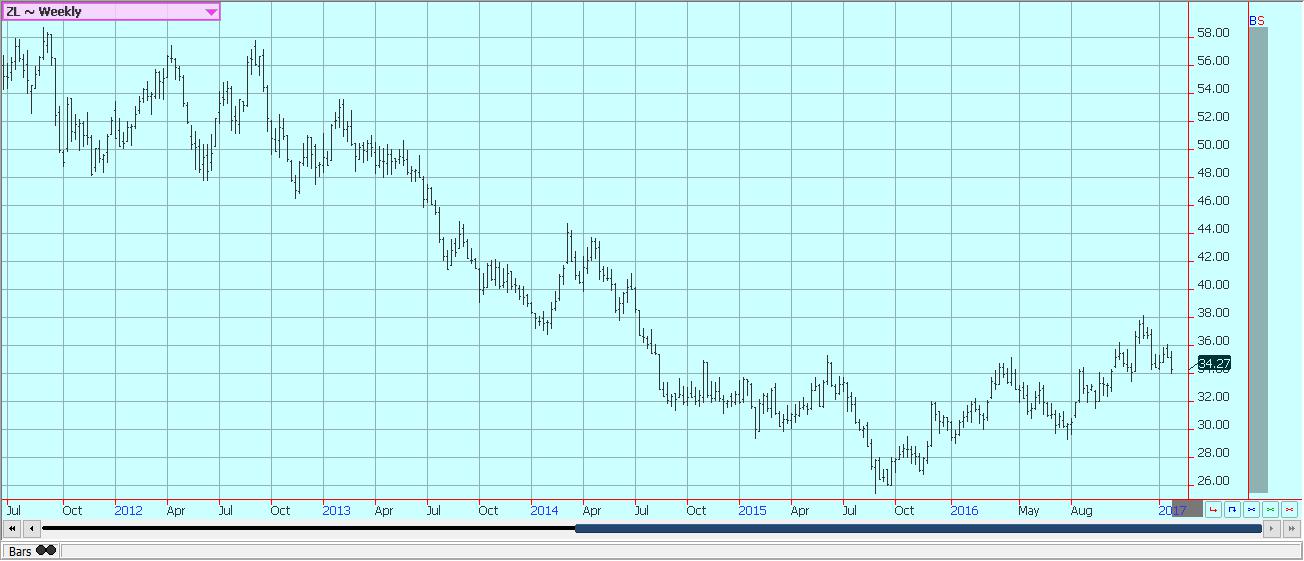

Palm oil and vegetable oils

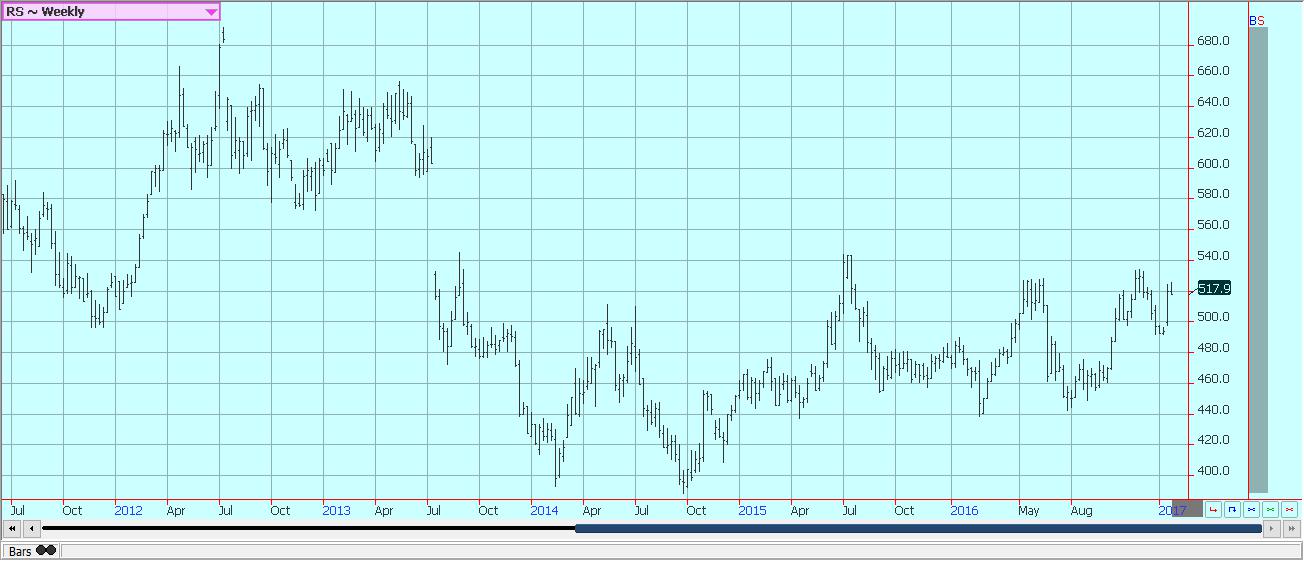

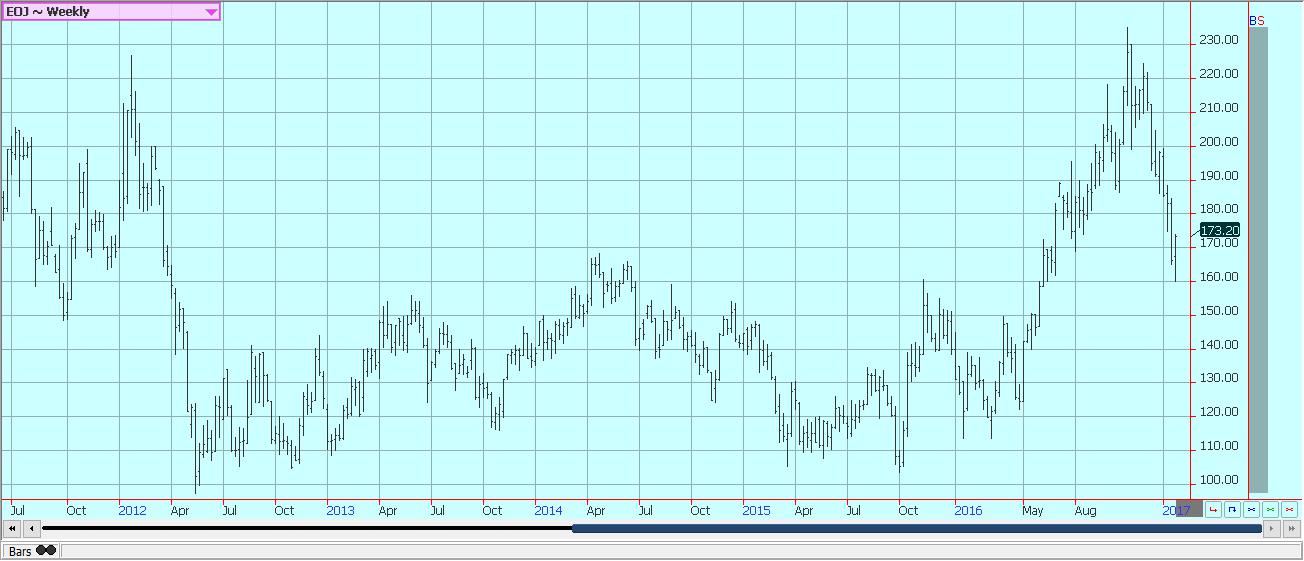

World vegetable oils markets were mixed again last week. Soybean Oil turned weaker, and Canola was a little lower in narrow range trading. Soybean Oil is at an important support area on the charts and faces a decision this week. Palm Oil was a little higher but remained caught between competing fundamentals. Palm Oil futures are closed today for the Lunar New Year, and the holiday could curb trading interest much of the week. Export demand has really jumped this week and has been running about 20% above last month, according to data from the private sources. Ideas are that production will start to increase in the next few months for seasonal reasons. The rains have greatly improved this year after the El Nino induced droughts of last year and these better rains are expected to result in improved production. Production normally starts to increase in the Spring due to the effects of the rainy season. Just about all major analysts are calling for significantly increased production this year, with many looking for at least a 10% jump in production. Palm Oil markets have run a long way since the middle of 2015 when prices were as low as 1800 Ringgit per ton. The weekly charts still show up trends but futures could not hold a move to new highs last week. Final targets for the move are at about 3500 Ringgit per ton.

Weekly Malaysian Palm Oil Futures © Jack Scoville

Weekly Chicago Soybean Oil Futures © Jack Scoville

Weekly Canola Futures © Jack Scoville

Cotton

Futures were higher and held close to important resistance at 7500 March when the market closed on Friday. The price action implied that futures can move higher this week. The weekly charts show that the longer-term uptrend remains intact. The market found buying interest as export demand remained very strong at over 450,000 bales. It was the strongest sales week in months as buyers from Southeast Asia and the Middle East were seen. The strong buying comes as the second biggest exporter in the world, India, remains mostly out of the market due to its internal currency changes. There is Cotton moving in the internal market, but it is not making its way to the export market in a big way yet. Export buying interest will be less this week due to the Lunar New Year holidays that will keep China closed almost all week and Southeast Asia closed for a couple of days. The weekly USDA classings report suggests that the harvest is about over now as classings are getting closer to USDA production expectations. The reports have shown that about 71% of the Cotton has been tenderable this year, but the quality is tailing off as the harvest comes to a close as is normal. Speculators are the major longs, but appear justified as demand remains strong.

Weekly US Cotton Futures © Jack Scoville

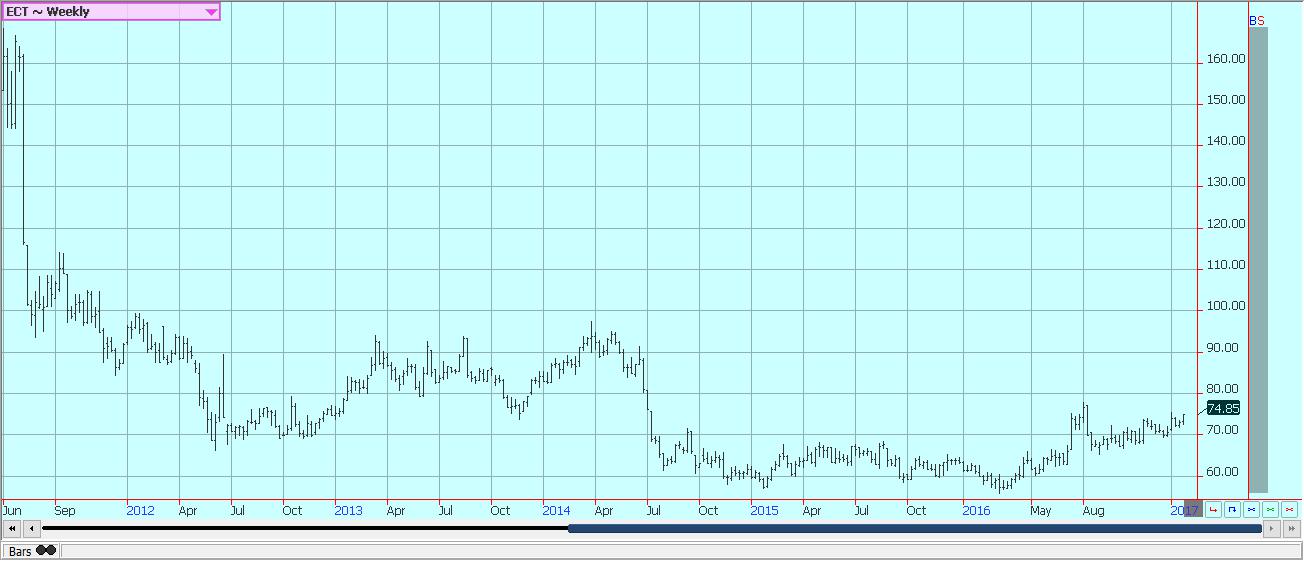

Frozen concentrated orange juice and citrus

FCOJ closed higher last week as futures had become very oversold. Chart patterns suggest that there is more downside potential with final objectives near or below 150.00 basis the nearest futures contract. The Florida harvest was active amid good weather conditions. Early and Mid oranges are being harvested for processing. The Valencia harvest is starting. Harvest conditions are good amid dry and warm weather. It is still too dry for the trees and irrigation is being used frequently. Demand for Orange Juice inside the US is still a big problem. It is currently at its lowest level since records started being kept in 2002, and there are no real prospects for improvement right now as consumers have plenty of alternatives. Sao Paulo state is getting good weather and crop conditions are called good. USDA said last week that Oranges production in Brazil should recover sharply to 1.968 million tons, from 1.617 million last year. World oranges production should be 49.61 million tons, from 47.075 million last year. Juice production is expected at 1.222 million tons, from 848,000 tons last year. Consumption is estimated at 1.86 million tons, from 1.892 million last year. Ending stocks are estimated at 516,000 tons, from 447,000 tons last year. It remains too cold in Europe and some damage to citrus trees is expected.

Weekly FCOJ Futures © Jack Scoville

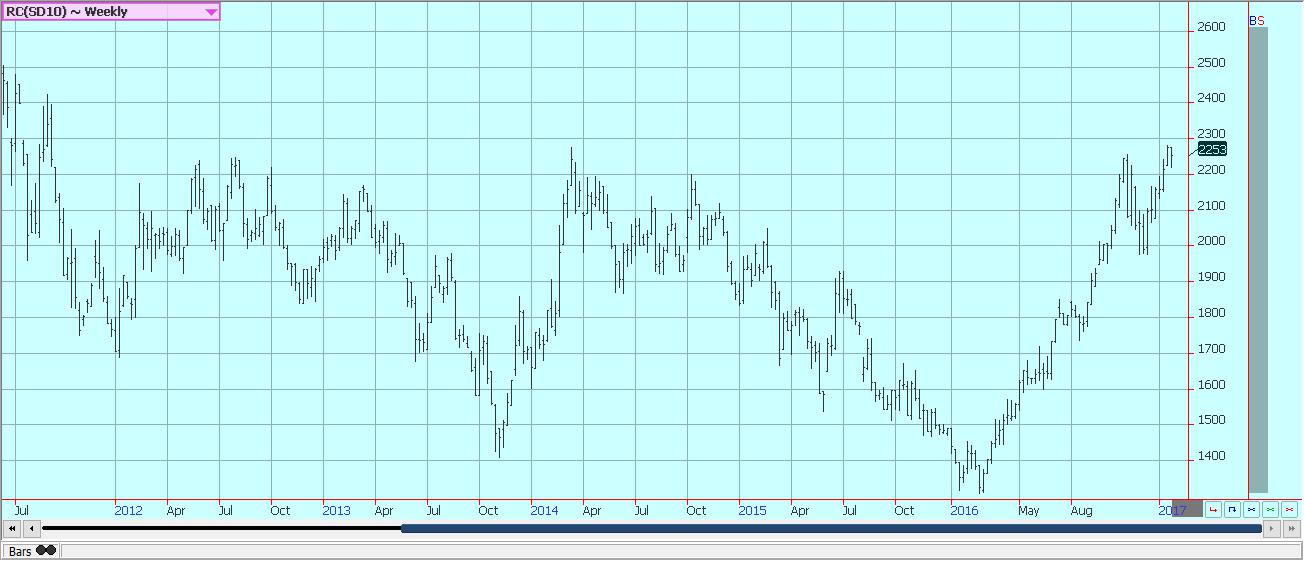

Coffee

Futures were quiet and a little lower last week. The theme of less production and good demand remains the support for prices. There is less production in Brazil this year, in part because it is the second year of the biennial cycle and in part due to the drought in northeast Brazil. Production ideas range from 45 to 50 million bags. Offers are less and seen at high prices from Robusta countries such as Vietnam, and has been a short crop there as well due to dry weather at flowering time. That has created the best demand in years for inferior qualities of Coffee from the rest of Latin America, and business volumes being traded are starting to increase. Prices paid for these coffees are low but could start to firm in the short term. So far the buying has been done at weaker differentials. Differentials for better qualities are stable to the firm. The charts show that both New York and London have been rallying and that these rallies can continue in the short term. This is turning into a demand led market that has been created by the short production. GCA data shows that there is plenty of Coffee in the US, but the demand for new coffee is getting much better. Firm to higher prices should continue for the short to medium term.

Weekly New York Arabica-Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

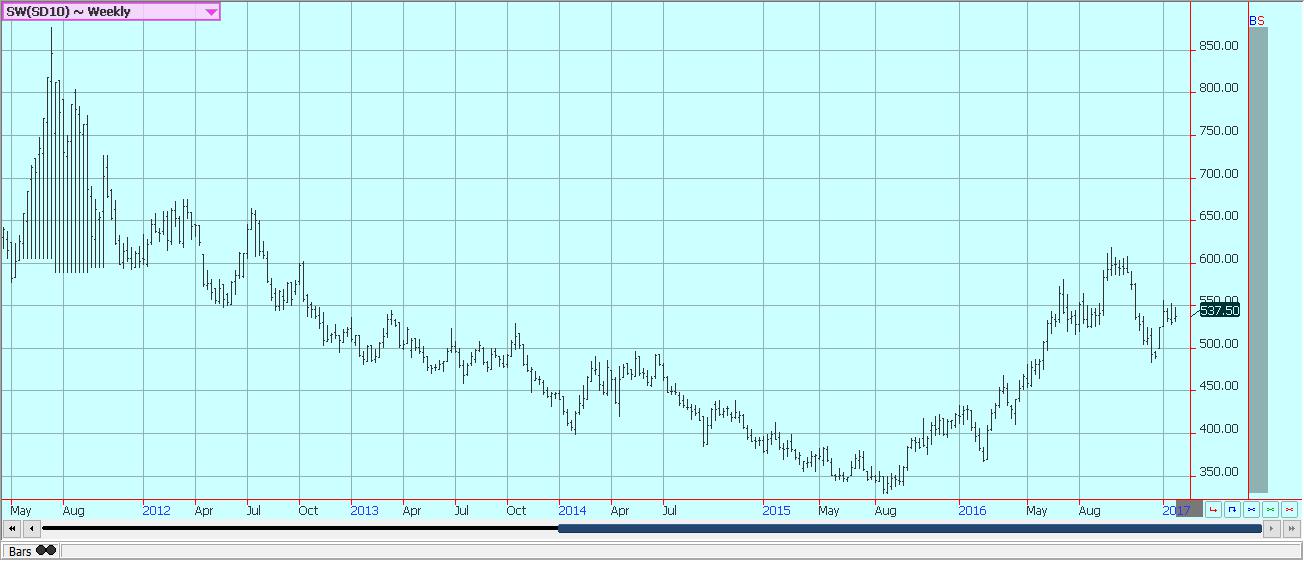

Sugar

Futures are in a trading range right now and trying to decide on the next direction of the move. It is possible that the market is finding a secondary top and could move lower in coming weeks. It seems like a lot of the supply side news is in the market. News of less than expected production in Brazil combined with less on offer from India and Thailand provide the best reasons for higher prices. Thailand did offer Raw Sugar from government storage last week and sold the entire tender. China was also active as the government auctioned Sugar into the internal market. India continues to debate the need for imports. The government is saying no imports are needed and has maintained a high import tariff. However, mills are closing early this year as there is little Cane to process. The Sugar Association there thinks that imports would happen if the government would lower tariffs. Internal prices are moving higher. China has imported significantly less Sugar as it continues to liquidate supplies in government storage by selling them into the local cash market. Demand from North Africa and the Middle East is consistent but normal. The weather in Latin American countries away from Brazil appears to be mostly good, although northeast Brazil remains too dry. Most of Southeast Asia has had good rains.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

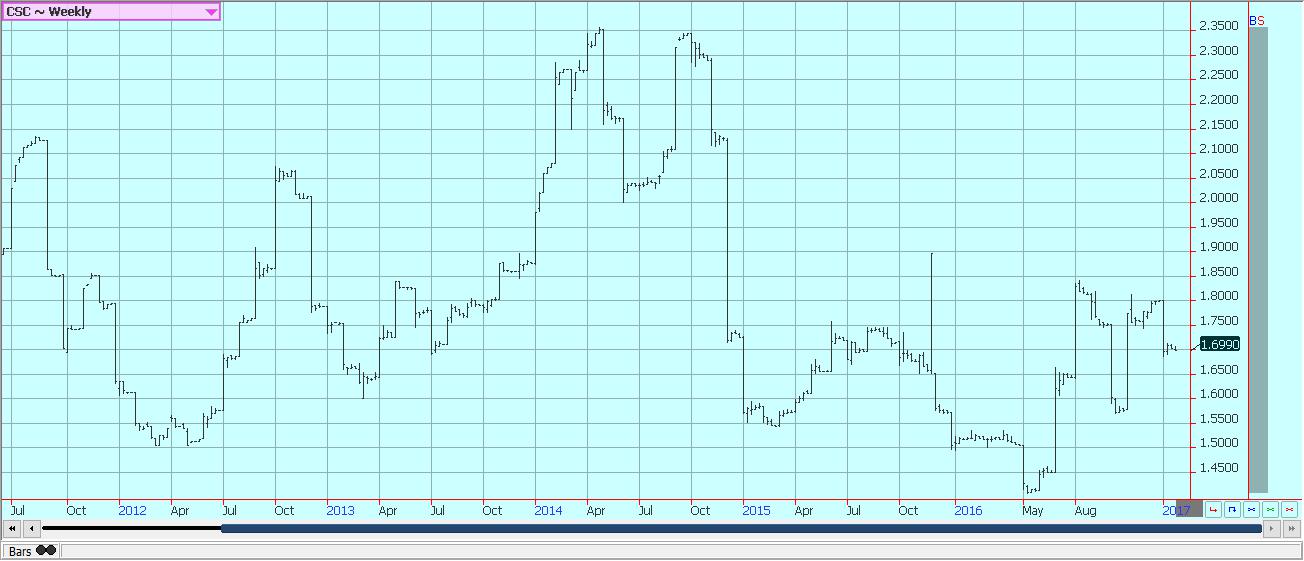

Cocoa

Futures markets were lower and moved to new lows on the charts in New York and to the lower reaches of the trading range in London. The big bearish news came from an expert working group inside the ICCO that found in a survey that the production deficit against demand was only 13,000 tons instead of the overall ICCO projection at 150,000 tons. The ICCO said in response that the survey did not take into account a reduction of hidden stocks and that it was maintaining its forecast for a q50,000 ton deficit for now. It will issue an official revision in February. Overall price action remains weak as the main crop harvest continues in West Africa under good weather conditions. Reports exporters have bought a lot and have plenty of product to sell. Many can no longer buy as storage in West Africa has been filling up and as demand in consuming countries has not been all that strong. The demand from Europe is reported improved, but still weak overall. Supplies in storage in Europe are reported to be very high. The Asian Cocoa grind data for the quarter was strong and stronger than expected, but the North American data was weaker than expected. The next production cycle still appears to be bigger as the growing conditions around the world are generally improved. West Africa has seen much better rains this year and now getting warm and dry weather. East Africa is getting enough rain now, and overall production conditions are now called good. Good conditions are still being reported in Southeast Asia.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

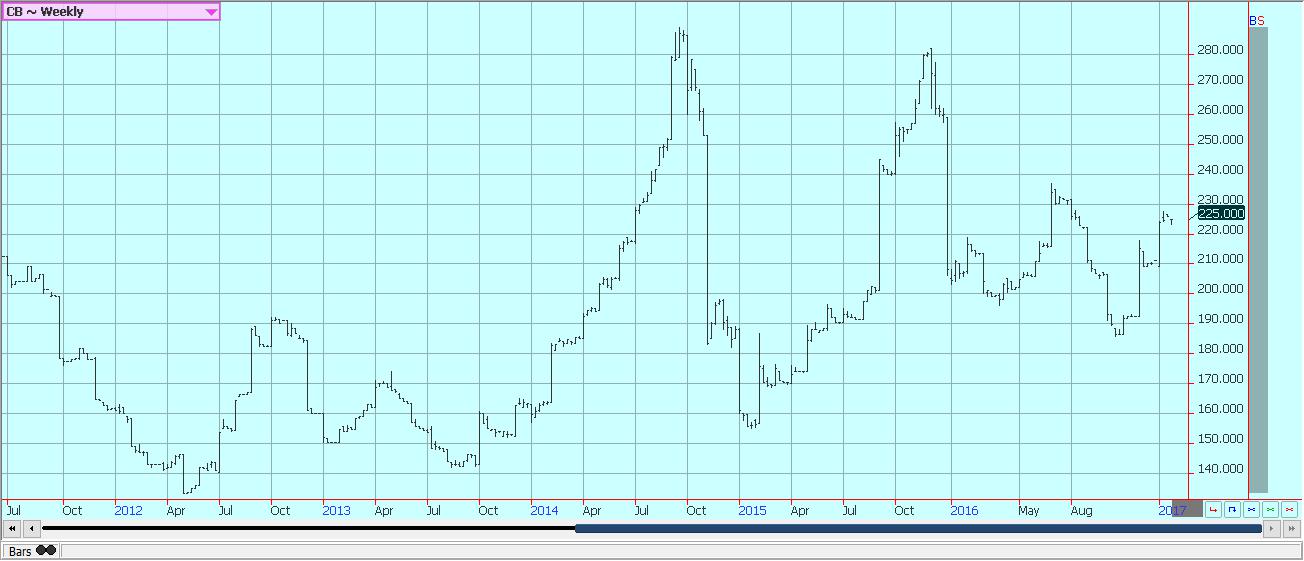

Dairy and meat

Dairy markets were under pressure amid good supplies of milk available to the market. Demand is good enough to meet current production, but prices have started to trend a little lower on worries about export demand. Production has been seasonally strong in eastern and central areas, but weaker in the west due to the recent storms. Butter and cheese manufacturers report strong demand, but inventories are starting to increase as there is a lot of milk available. This is especially true for Butter, where bulk supplies are going to storage. Cheese supplies are mostly in line with demand right now. Demand has been at least as good as expected for butter and especially cheese as many retailers buy ahead of the Super Bowl and Spring holidays. Butter manufacturers are mostly producing bulk butter for inventories, but there is increasing print butter production. Cheese demand is being met with adequate to strong milk supplies and manufacturing is active.

This is especially true for Mozzarella before the Super Bowl. Dried products prices are mixed to firm. Whey prices are mixed to strong, and whole milk prices are stable. NDM prices are stable to the firm. International markets are featuring higher prices due to reduced production. Production is less in Europe and Russia. Export demand for New Zealand has increased due to stronger demand from China. Production is in a short-term decline due to poor pasture conditions. On the other hand, hay supplies in Australia are excellent to surplus and milk production is strong. The Global Dairy Auction featured lower prices. South American prices are firm as raw milk production goes into a seasonal decline. Argentina is seeing weaker production due to big storms in central and northern areas that have also affected production in parts of Uruguay.

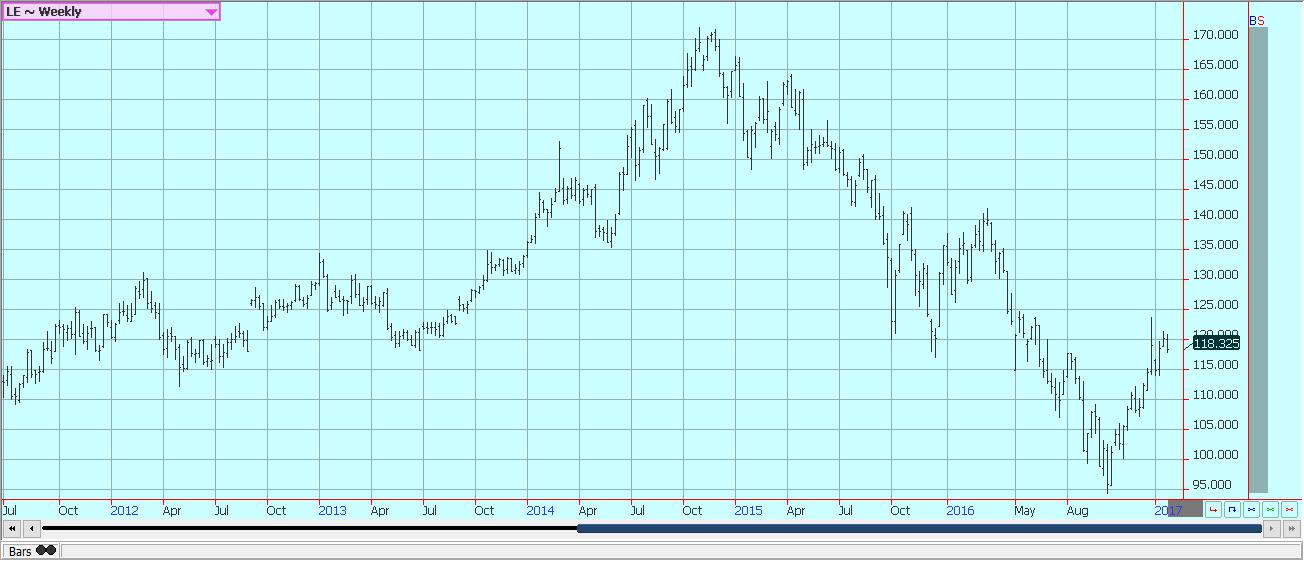

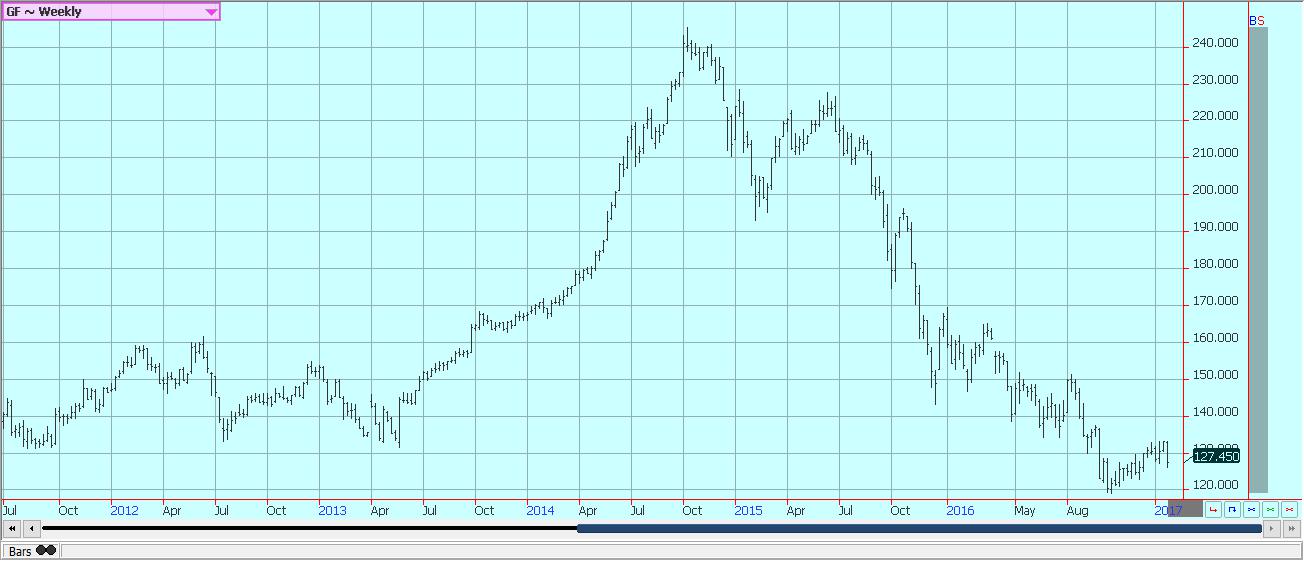

US cattle and beef prices were stable much of last week. Auction markets in the Great Plains were steady to higher with good volumes traded. Beef prices were steady to weaker, and packer margins are in the red. The Cattle on Feed report showed on feed and marketings at the high end of expectations and placements well above expectations. The report should be bearish for prices this week. Next up is the semi-annual cattle inventory that is expected to show a lot of cattle getting ready to come to the market. It will be released early this week. Australia has less to offer and very high prices. Herd culling has slackened in both Australia and New Zealand. Pasture conditions in both countries are better than a year ago on colder and wetter weather seen until now. Conditions in Australia are very good and surplus hay is reported in many areas. New Zealand now needs drier weather to promote growth.

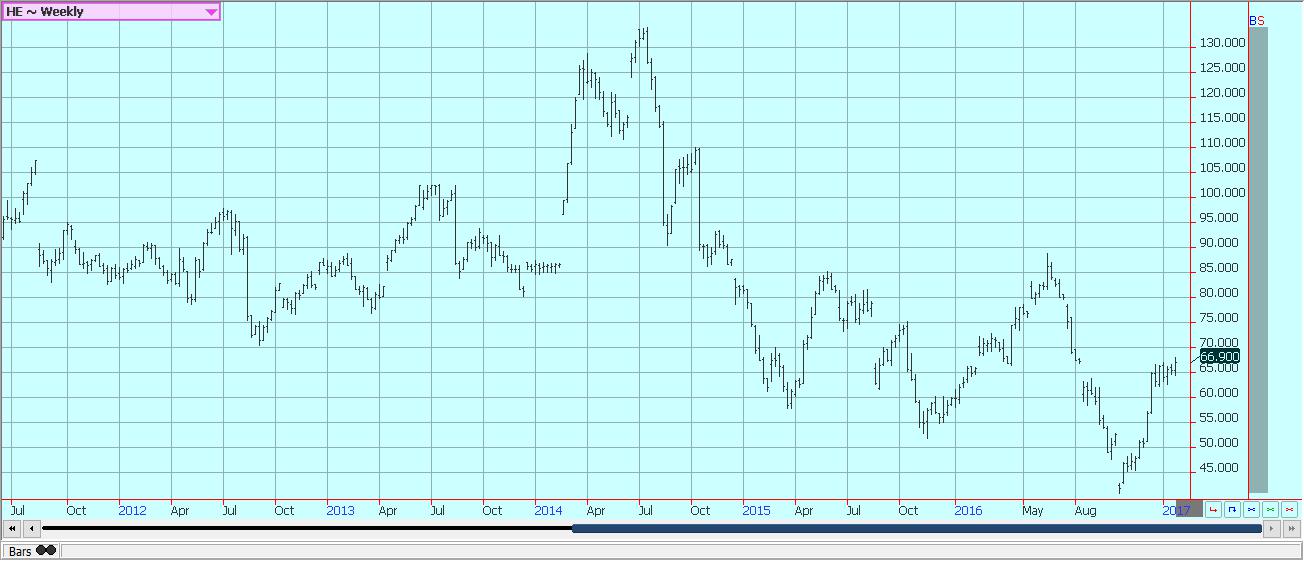

Pork markets have been firm, and live hog futures trends are sideways for the short term, but still higher for the longer term. Pork demand remains stronger than expected and ham prices have been contra-seasonally strong. Pork prices have trended higher in retail and wholesale markets. Packer demand has been stable as many packers expected reduced supplies of Hogs for the next several weeks. This is a seasonal tendency. The charts show that the market could remain higher, but seasonal studies indicate that futures could make an intermediate high soon.

Weekly Chicago Class 3 Milk Futures © Jack Scoville

Weekly Chicago Cheese Futures © Jack Scoville

Weekly Chicago Butter Futures © Jack Scoville

Weekly Chicago Live Cattle Futures © Jack Scoville

Weekly Feeder Cattle Future © Jack Scoville

Weekly Chicago Lean Hog Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Crowdfunding2 weeks ago

Crowdfunding2 weeks agoBSG Stahl Riesa Launches Crowdfunding for New Floodlights

-

Impact Investing3 days ago

Impact Investing3 days agoEU Industrial Accelerator Act: Boosting Clean Industry and Resilient Supply Chains

-

Cannabis2 weeks ago

Cannabis2 weeks agoSnoop Dogg Searches for the Lost “Orange” Cannabis Strain After Launching Treats to Eat

-

Cannabis6 days ago

Cannabis6 days agoBrewDog Sale Leaves Thousands of Crowdfunding Investors Empty-Handed

You must be logged in to post a comment Login