Business

How to invest in a bear market: Why small-cap gold producers like Inca One belong in your precious metals investment portfolio

While the markets have rallied we’re still officially in a bear market. This creates a unique challenge for investors who are looking to avoid getting caught in a bull trap. There are certain investments that will hold an investor in good stead regardless of whether the market is a bull or bear and one excellent example is Inca One Gold Corp. (TSXV: IO.V, OTC: INCAF, FRA: SU92.F).

U.S. futures have spiked on the news of better than expected employment figures and the S&P 500 began Q3 ahead of its 200 day moving average. On paper this is great news but it doesn’t mean that we’re out of a bear market yet. There are significant risks for investors on the horizon, particularly rising tensions with China and a fresh COVID-19 outbreak in Japan. Despite this there are some investments that offer a safe harbor in troubled times, for example gold companies like Inca One Gold Corp. (TSXV: IO.V, OTC: INCAF, FRA: SU92.F).

Are we in a bull or bear market?

Officially we are still in a bear market. Stocks enter a bull market once they’re up at least 20% from a market’s low, a bear market typically starts after a 20% drop from the high. The problem with this definition is that bear market’s are typically punctuated by powerful rallies that loose steam as investors look to sell before the curve and shift their assets.

A better definition comes from Sam Stovall, the chief investment strategist at research firm CFRA. According to Stovall, a bull market can only become official if there are gains of 20% over a span of six months without the market undercutting its prior low. Taking that definition into account it seems likely that we will remain in a bull market for some time to come.

A more pressing question for investors is how they can protect and grow their assets in uncertain times. A traditional answer would often be safe haven investments like Gold, defensive stocks, or currencies like the Swiss Franc. Investors are essentially looking for security before opportunity but many don’t realize that there is a way to get the best of both worlds.

Gold producers like Inca One Gold are a unique investment opportunity

Gold is definitely a strong investment during times of recession but gold producers are the real opportunity. Instead of just benefiting from the increased price of gold in your portfolio you benefit from the increased stock of an entire company. Of course not all gold producers are equal and some are uniquely well placed to take advantage of what is set to become a positive market for gold. The perfect case study for this is Inca One Gold Corp. (TSXV: IO.V, OTC: INCAF, FRA: SU92.F).

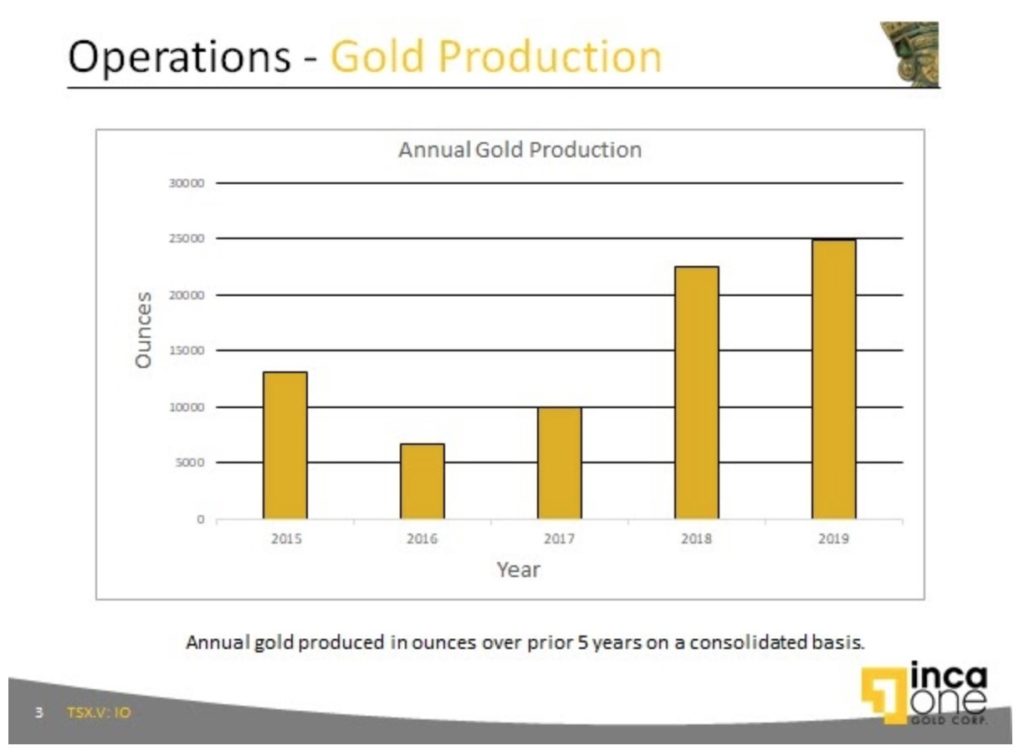

Inca One Gold is a small-cap gold producer based in Canada with a focus on Peru. The Peruvian gold mining sector is one of the most important in the world and an effective regularization campaign will provide a boost to the sector over the coming years and Inca One Gold has positioned itself to help nurture this important sector and grow with it.

The company has two fully integrated plants, Chala One and Kori One, and is permitted to process 450 tonnes of ore per day in Peru. Inca One is currently using just 35% of its licensed capacity and is focused on providing its services to Peru’s bustling artisanal mining sector.

As the Peruvian economy has opened up from COVID-19 lock downs the company has begun to rapidly ramp up production. The company took advantage of reduced mining production to fine-tune its operations and is now preparing to help small-scale ore miners sell their existing stock so that they can kick start operations.

One of the company’s key value propositions is its investment in the Peruvian gold mining sector. Inca One was the first publicly traded company to complete the Peruvian government’s permitting process and has actively promoted the process. As the Peruvian gold sector grows, so does Inca One, and their investor’s portfolios.

Going direct to consumer with an online gold bullion store

Another key reason that Inca One Gold Corp. (TSXV: IO.V, OTC: INCAF, FRA: SU92.F) is so interesting is the company’s intention to open a gold bullion store. Gold producers are often at the mercy of large purchases, who may offer prices under spot. By selling gold directly you are in control of the prices you sell your reserves at.

Additionally it provides Inca One the ability to take advantage of the gold coin premium. High quality gold coins always have a premium over the prevailing spot price. For example the one-ounce American Gold Eagle has a premium of around $71 over gold price and the Gold Maple Leaf a premium of around $49.

By operating an online gold bullion store Inca One Gold Corp. (TSXV: IO.V, OTC: INCAF, FRA: SU92.F) achieves a few key goals. It is able to help promote Peru as a gold mining center by using iconic Incan style designs. Additionally the company will be in more control of the price it sells its gold at, and therefore be able to increase its value to shareholders.

In difficult times investors are looking for a safe bet

While we may eventually enter a bull market that is far from certain. At the moment the watchword for many investors is “security”. In this kind of climate a focus on comparatively safe investments with significant long term potential is prudent. Inca One Gold Corp. (TSXV: IO.V, OTC: INCAF, FRA: SU92.F) is one of the few offerings on the market that currently offers exactly that and represents an unique opportunity for troubled times.

—

(Featured image by Thanks for your Like • donations welcome via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Impact Investing2 weeks ago

Impact Investing2 weeks agoFrance’s Nuclear Waste Dilemma Threatens Energy Future

-

Fintech1 week ago

Fintech1 week agoKraken Launches Krak: A Game-Changing Peer-to-Peer Crypto Payment App

-

Impact Investing3 days ago

Impact Investing3 days agoEuropeans Urge Strong Climate Action Amid Rising Awareness and Support

-

Cannabis2 weeks ago

Cannabis2 weeks agoRecord-Breaking Mary Jane Fair in Berlin Highlights Cannabis Boom Amid Political Uncertainty