Crypto

How to invest and protect institutional money in cryptocurrencies

With prices of digital coins selling only a fraction of what they were worth in 2017, cryptocurrencies are hot commodities in the financial market today.

There has been a major shift on the cryptocurrency market since last year. In 2017, Bitcoin spearheaded an incredible bull run that took most cryptocurrencies to levels that no one had predicted. That development was mostly driven by private investors.

Since the price peak around Christmas last year, the market has fallen, and today, most cryptocurrencies are selling for a fraction of 2017’s record prices. As prices keep falling, more and more investors have decided to sell their assets, and this is where the switch happens. Lately, we have seen a lot of examples of “institutional money” taking over after private investors, and according to most, this is what will drive the market in the future.

What is institutional money?

Institutional money is a vague expression that includes everything from major banks and international financial firms to regular businesses that can invest more than the average private investor. According to predictions, corporate money has the potential to take the cryptocurrency market to levels private investors couldn’t, and in turn, that is helping to spread the interest to more businesses.

Investing in institutional money

Before I continue with some basic investment strategies, I want to clarify that the following tips are for people and companies that can invest large amounts of money in the industry. At least tens of thousands of dollars per investment is needed to qualify as institutional investments. If you’re a private investor with less money than that, I suggest you check out more appropriate strategies.

Buying cryptocurrencies on an exchange

The most common method used to buy cryptocurrencies are exchanges, and this method can be used by institutions as well. Today, most exchanges provide services that are catered to businesses in order to create better circumstances for institutions. Instead of signing up with a private investment account, you can register an account for your business. It’s similar to opening business accounts with stockbrokers.

For example, Binance, which is the largest cryptocurrency exchange in the world based on daily volume, offers a business account, and Bitfinex, which is also one of the largest exchanges, has a corporate account.

Using cryptocurrencies for payments

Another way for businesses to profit from the market is to start offering cryptocurrencies as payments for services and products. The cryptocurrencies that are received as payments can later be stored as investments with the potential of increasing in value, or the money can be reinvested into the company.

At this point, the most common cryptocurrency to use for payments is Bitcoin, although Ethereum, Bitcoin Cash, Litecoin, and Ripple XRP are becoming more popular.

Trading them as CFDs

A third and often overlooked way of trading cryptocurrencies is CFDs. CFD trading is speculative, meaning your company will never own the assets you trade with, instead you invest in predictions for market movements. Now, this method is best if you’re looking to invest institutional money and want quick gains.

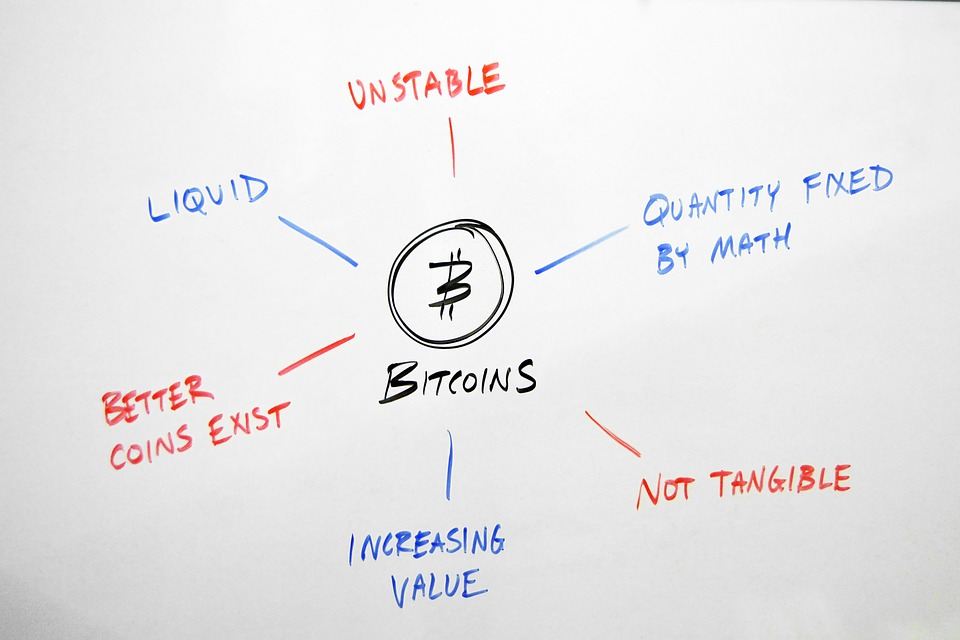

Before making any investment plans on cryptocurrencies, do a little research to give you an idea on what the market is all about. (Source)

The benefit of CFD trading is that it is as easy to buy long positions as it is to short-sell assets, especially compared to traditional exchanges that usually only allow you to benefit from increasing prices. Naturally, this means that you can benefit from the cryptocurrency market’s high volatility by betting against it. Also, all CFD trading is leveraged which could mean increased profits when handled right. One major benefit with this option is that you can use FCA or CySEC regulated brokers.

Like the exchanges mentioned above, most CFD brokers provide special business accounts for everyone looking to invest institutional money. And let’s not forget that CFDs can be used on more assets than cryptocurrencies.

Protecting your investments

No market is as volatile as the cryptocurrency market, and that makes it extra important to protect your investments. The risk of losing most of an investment in a short period of time is much higher when dealing with digital currencies than it is if you invest in stocks or commodities. The good news is that there are certain precautions one can take to try to limit the risk.

Education

The best way to protect your institutional cryptocurrency investment is to educate yourself. The more you know about the assets you want to buy and the market itself, the easier it will be to predict changes and find ways to adjust to those changes. Make sure you are educated enough to make your own decisions instead of blindly following other’s advice.

Diversify your portfolio

There are many benefits of having a diverse portfolio with several cryptocurrencies since some assets are better for certain conditions than others. Just remember to not spread too thin and to split your attention between 3 to 5 assets. For example, Bitcoin and Ethereum tend to be a solid investment when the market is thriving, NEO can give you GAS even when the market has stagnated, and USDT (Tether) provides protection when the market is falling. The trick is to learn when to focus on which cryptocurrency and to move your investment accordingly.

Short selling

Since the market is so volatile, we recommend that you look into your options to short sell cryptocurrencies. When the market turns and prices are falling, you can profit from the negative trends by short selling. The best way to short sell cryptocurrencies is to use CFDs and buy a sell position for the assets you think will fall in value.

Stop-losses and risk management

Obviously, you can use similar risk management techniques on the cryptocurrency market as you would when investing in stocks or other securities. We suggest always having an exit strategy even before you invest and you should always analyze the market properly, especially you need to know how to determine ICO scams when it comes to deciding whether to invest in any of them. Lately, stop-loss and similar features are becoming more common on the cryptocurrency exchanges and with CFD brokers, which can help you minimize your potential losses.

In the end, the most important thing to remember when investing institutional money in cryptocurrencies is to use common sense.

By the looks of it, 2018 will become the year when institutional money starts taking over more of the market’s trading volume. Banks, financial firms, corporate ventures, and small businesses are turning to the market for practicality reasons and potentially profitable opportunities.

If 2017 was the year private investors drove the cryptocurrency market, 2018 will be the year where the financial world will further establish the role of cryptocurrencies in society. That has everyone on notice that institutional money is ready to enter this market too.

If you’re looking to start investing institutional money you first need to understand the market well and you need to educate yourself on the available opportunities. Then you should learn how to best protect your investments, only after that can you reap the full benefits of institutional money in the cryptocurrency market.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Crypto2 weeks ago

Crypto2 weeks agoRipple Launches EVM Sidechain to Boost XRP in DeFi

-

Impact Investing6 days ago

Impact Investing6 days agoShein Fined €40 Million in France for Misleading Discounts and False Environmental Claims

-

Impact Investing3 days ago

Impact Investing3 days agoVernazza Autogru Secures €5M Green Loan to Drive Sustainable Innovation in Heavy Transport

-

Cannabis2 weeks ago

Cannabis2 weeks agoCannabis Company Adopts Dogecoin for Treasury Innovation

You must be logged in to post a comment Login