Business

Why investors should not ignore Greece’s golden visa program

A golden visa gives holders the right to travel freely across the EU, while owning a “safe haven” asset, and profiting from the investment.

There are several ways to gain residence in the European Union (EU), including obtaining a wealth visa, which obliges applicants to change their tax residency, opening a business, or marrying an EU national. These strategies work for those who plan on moving there. However, many people want to obtain residency for other purposes, such as to facilitate interaction with foreign banks, travel freely across the EU, or as a safety precaution in case of an urgent need to emigrate (this being one of the major motives among Turkish, Iranian, Russian and Chinese nationals).

A good option in such cases is the so-called golden visa, which are residence permits issued to buyers of real estate or other assets above a certain value. This is the easiest and the quickest way to obtain a residence permit. The most accessible immigration programs in the EU are those offered by Latvia, Portugal, Spain, Greece, and Malta.

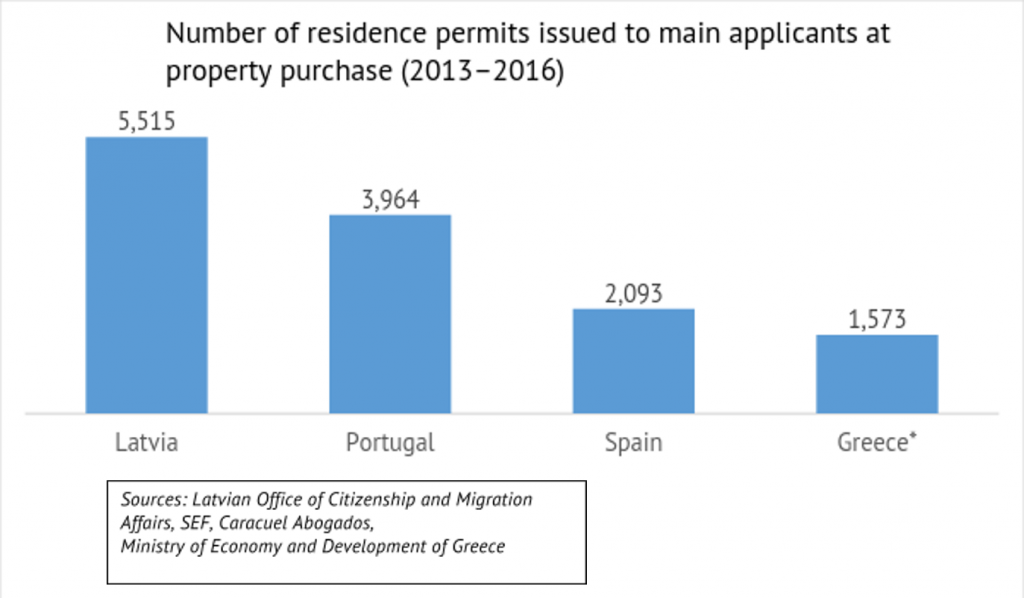

Latvia, the leader in the number of residence permits issued, was extremely popular with investors until, in 2014, when country’s parliament voted to increase the investment threshold. Spain and Portugal have always been popular among affluent immigrants, while Malta, which introduced its own golden visa program in August 2015, is only beginning to grow in popularity.

Greece’s golden visa program has received fewer applicants than Spain, Portugal, and Latvia for the 2013-2016 period.

Greece’s golden visa program lags behind the other countries in terms of residence permits issued because of the lack of trust in the Greek economy, prompted by the country’s sovereign debt crisis. However, Greece’s economy is starting to look better—unemployment has been decreasing since 2013, and, according to the International Monetary Fund (IMF), the country’s GDP will grow by 2.8% in 2017.

According to Tranio experts, Greece’s golden visa offers the most beneficial terms for investors for a number of reasons.

1. Low investment threshold

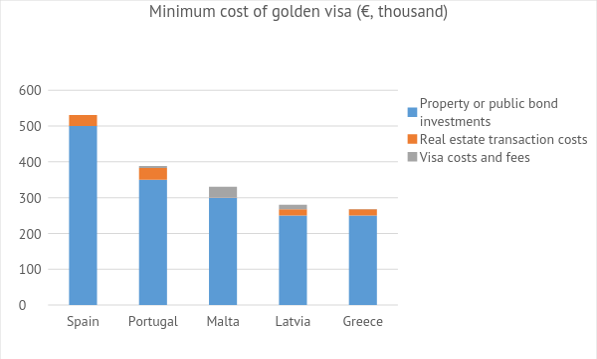

Greece offers the cheapest residence for investment. Applicants must buy one or several properties totaling at least €250,000. The same amount is specified in the Latvian program, but, under its conditions, investors must pay a 5% non-refundable fee, which increases the investment threshold to €262,500.

In Malta, a mandatory condition, along with buying (from €270,000 or €320,000 depending on the location) or leasing (from €50,000 or €60,000 in 5 years) a property, is to invest €250,000 in public bonds and pay a €30,000 fee. Therefore, the minimum investment amount is €330,000.

A residence permit in Portugal can be obtained by purchasing a property worth €350,000 if built over 30 years ago or located in areas of urban regeneration, or €400,000 if situated in low population density areas. More liquid properties must cost at least €500,000. Spain offers the same starting price in its program.

Greece’s golden visa costs compared to other EU countries that offer it.

2. Opportunity to buy several properties or participate in a large project

The Spain, Portugal and Greece’s golden visa programs allow the purchase several properties to meet the minimum investment threshold. Latvia allows this only in small cities, with the exception of the popular Riga and Jūrmala, while Malta only allows investing in one property. The Greek and Portuguese programs also allow collective investments, provided that the applicants’ investments are not less than the established threshold values.

3. Low prices and growth potential

The price of real estate in the centers of large Greek cities, which average €1,300 per square meter, is the lowest among the five countries, and almost twice cheaper than in Spain and Malta, and 1.5 times cheaper than in Portugal.

The price difference between Greece and Latvia is not so significant (about 10%), but the price growth potential is higher in Greece. According to official data, real estate in Greece is 44% cheaper compared to its 2008 peak, while in Latvia it is 27% cheaper. It should be noted that since the global financial crisis, property prices in Latvia have already experienced volatility (associated with the activity of Russian buyers). Property prices in Spain are approaching peak levels, while prices in Portugal and Malta have already exceeded pre-crisis figures by 2% and 10% respectively.

4. Rental income

Golden visa holders often do not need the purchased real estate and instead lease it to compensate for the investment. In Greece, Latvia, Spain, and Portugal, investors are free to do so, while Malta prohibits the lease of such properties during the first five years of ownership. In this case, the most lucrative scenario for owners of property in touristy locations would be to rent out their properties for short terms, as this type of lease returns higher yields compared to long-term rentals.

Golden visa requirements in Greece, Latvia, Portugal, Spain, and Malta

| Greece | Latvia | Portugal | Spain | Malta | |

| Minimum property value (€) | 250,000 | 250,000 | 350,000 | 500,000 | 300,000

(5-year lease + bond investments) |

| Minimum transaction costs (€) | 17,600 | 17,600 | 32,700 | 31,000 | 400 |

| Visa costs and fees (€) | 500 | 12,700 | 5,700 | 100 | 30,000 |

| Property type | Any | Any, except for undeveloped land | Any | Any | Residential only |

| Opportunity to buy several properties | Yes | In certain locations only | Yes | Yes | No |

| Opportunity to take out a mortgage | Yes

(complicated in practice) |

Only for the part of the value that exceeds the minimum threshold | Yes | Yes | Only for the part of the value that exceeds the minimum threshold |

| Need to apply personally | Yes (one visit to the country is enough) | ||||

| Need to reside in the country | No | Need to spend 1 week in the country during the first year, and 2 weeks during each of the next 2 years. | No | ||

| Tax residency | When living over 183 days per year in the country | ||||

| Visa validity | 5 years, renewable every 5 years | 5 years, renewable every 5 years | 1 year, renewable twice for 2 years | 1 year, renewable every 2 years | Indefinite |

| Asset holding period | As long as the holder needs residence | 5 years | As long as the holder needs residence | 5 years | |

| Visa issuance period | 8 weeks | 3 weeks | 1 to 6 weeks | 6 to 7 weeks | 12 to 16 weeks |

| Family members´ eligibility for residence | Spouses, children under 21 years of age, parents | Spouses, children under 18 years of age, dependants | Spouses, children under 18 years of age, dependants | Spouses, partners, children under 18 years of age | Spouses, children, parents, grandparents |

| Right to work | No (investment activity only) | Yes | |||

| Permanent residence | After 5 years if the investor spends at least 183 days per year in the country | After 5 years | After 5 years if the investor spends at least 183 days per year in the country | The Golden Visa is already a permanent residence permit | |

| Citizenship | After 10 years of permanent residence (period of holding a golden visa is not taken into account) | After 10 years of permanent residence | After 6 years | After 10 years of permanent residence | Cannot be granted |

(Sources: Discus Holdings, Enterprise Greece, Henley Global, Tranio, Hellenic Ministry of Foreign Affairs, Ministry of Foreign Affairs and Cooperation of Spain, Foreigners and Borders Service of Portugal, Latvian Office of Citizenship and Migration Affairs)

According to World Tourism Organization (UNWTO) statistics, Greece outnumbers Portugal twice and Latvia by 10 times in terms of international tourist arrivals. International tourists visit Spain approximately three times more often, but thanks to a difference in prices per square meter, Greece yields a higher investment profit: about five percent after tax and management company expenses. While rental rates for flats in Athens oscillate between €50 and €70 per night and between €70 and €90 in Barcelona or Lisbon, real estate prices in these cities differ by almost three times: the average price per square meter is €1,265 in the center of Athens, €3,317 in Lisbon and €4,399 in Barcelona.

Therefore, Tranio believes that the most reasonable choice for investors wishing to obtain a golden visa would be to buy tourist apartments in central Athens for short-term leases. This allows them to obtain Greece’s golden visa and to secure a “safe haven” asset, and also a potential income of five percent in foreign currency.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Fintech1 week ago

Fintech1 week agoRuvo Raises $4.6M to Power Crypto-Pix Remittances Between Brazil and the U.S.

-

Biotech6 days ago

Biotech6 days agoEurope’s Biopharma at a Crossroads: Urgent Reforms Needed to Restore Global Competitiveness

-

Crowdfunding2 weeks ago

Crowdfunding2 weeks agoAWOL Vision’s Aetherion Projectors Raise Millions on Kickstarter

-

Africa2 days ago

Africa2 days agoFrance and Morocco Sign Agreements to Boost Business Mobility and Investment

You must be logged in to post a comment Login