Crowdfunding

ITS Lending Benefits from the Growth of Real Estate Lending Crowdfunding

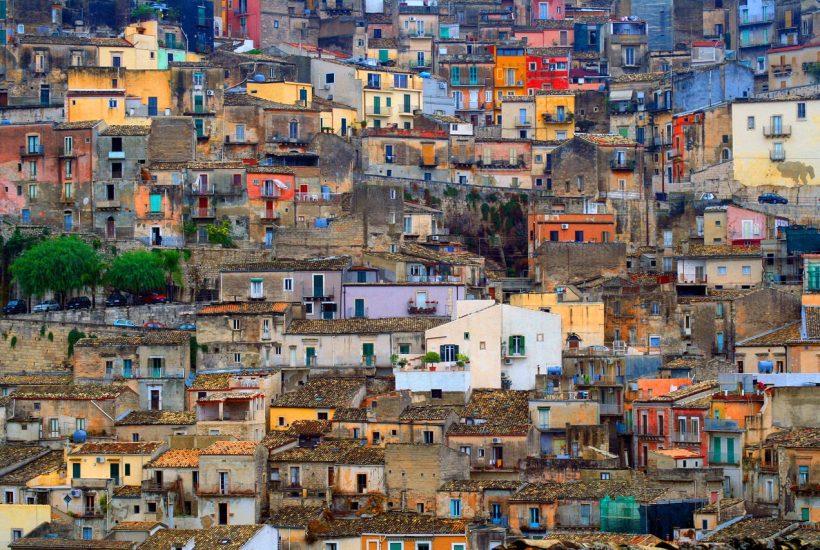

ITS Lending, one of the latest among real estate lending crowfunding platforms, is the only one focused on real estate projects strictly related to the regeneration of small Italian villages. These are almost always small renovation projects that have, therefore, very low requirements. The size of the loans offered on the platform is in fact almost always between €20,000 and €100,000.

ITS Lending, a real estate lending crowdfunding portal dedicated to the regeneration of Italy’s boroughs, in less than a year since its launch in November 2021, has repaid six loans, returning a total of €265,000 plus accrued interest, and closed 20 campaigns for €1.2 million.

Read more about ITS Lending and find the most important business news of the day with the Born2Invest mobile app.

Real estate lending crowdfunding on the rise

At a time of economic uncertainty such as the current one and the difficulty for retail investors to identify profitable investments, real estate lending crowdfunding stands out as a profitable and in-demand investment.

According to data from Crowdfunding Buzz, the segment grew by 61 percent in the first 8 months of 2022, compared to the same period in 2021, raising €56 million, for 202 financed real estate projects. The average funding also grew (from €220,000 per transaction in 2021 to €278,000in 2022) and so did the investors, who, if in August 2021 there were about 22,000, in the same period this year there were 35,000. The average gross loan remuneration rate of about 10 percent on an annual basis is probably one of the reasons for the success, combined with the average loan term of just under 12 months.

The specificity of ITS Lending

ITS Lending, one of the latest among real estate lending crowfunding platforms, is the only one focused on real estate projects strictly related to the regeneration of small Italian villages. These are almost always small renovation projects that have, therefore, very low requirements. The size of the loans offered on the platform is in fact almost always between €20,000 and €100,000, with a very short duration, between 6 and 12 months. This allows investors a high rotation of their portfolio and, at the same time, an alternative asset class compared to the lending crowdfunding industry itself.

The portal also offers a degree of security: the properties to be renovated have already been acquired by the real estate company proposing the opportunity, and a final buyer is always identified before it is presented on the platform, who advances a deposit. If the purchase is waived, additional mechanisms will be activated to secure the investment, including a willingness on the part of the real estate company receiving the loan to still repay principal and interest within the stipulated terms.

ITS Lending’s achievements in its first 10 months

The portal has so far closed 20 real estate transactions, in southern and central-northern Italy, for a total collection of €1.2 million and an average of 24 investors, who contributed an average investment of €2,000 and an average gross rate on an annual basis of 9.3 percent.

The loans repaid to date are 6, all within the predefined timeframe, and concern structures for residential use, small and medium-sized (two- or three-room apartments), two of which are located in Sicily, two in Tuscany, and two in Puglia, where the loan for the intervention on a building in Caprarica di Lecce was repaid most recently.

__

(Featured image by tiburi via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

First published in Crowdfunding buzz, a third-party contributor translated and adapted the article from the original. In case of discrepancy, the original will prevail.

Although we made reasonable efforts to provide accurate translations, some parts may be incorrect. Born2Invest assumes no responsibility for errors, omissions or ambiguities in the translations provided on this website. Any person or entity relying on translated content does so at their own risk. Born2Invest is not responsible for losses caused by such reliance on the accuracy or reliability of translated information. If you wish to report an error or inaccuracy in the translation, we encourage you to contact us.

-

Business4 days ago

Business4 days agoLegal Process for Dividing Real Estate Inheritance

-

Markets2 weeks ago

Markets2 weeks agoStock Markets Surge Amid Global Uncertainty, But Storm Clouds Loom

-

Fintech2 days ago

Fintech2 days agoPUMP ICO Raises Eyebrows: Cash Grab or Meme Coin Meltdown?

-

Africa1 week ago

Africa1 week agoMorocco Charts a Citizen-Centered Path for Ethical and Inclusive AI