Featured

Keeping up with grain and other essential food commodity markets

While many analysts focus on high value commodities such as gold or silver, it is important to study the trends in more essential commodities which provide key insights but too often go ignored. We examine the stories behind price behavior in nine crops, seeking to explain and understand the trends, especially the impact of the Covid-19 virus on supply chains and demand in the short and long term.

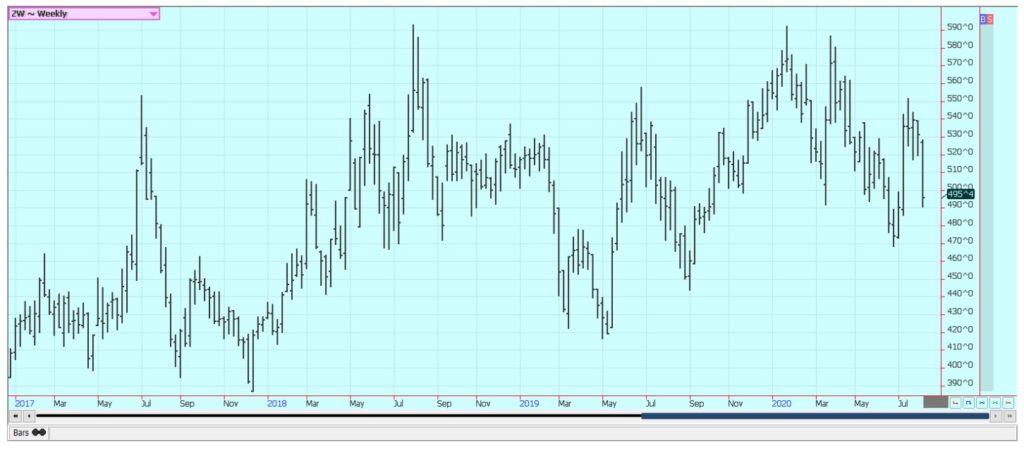

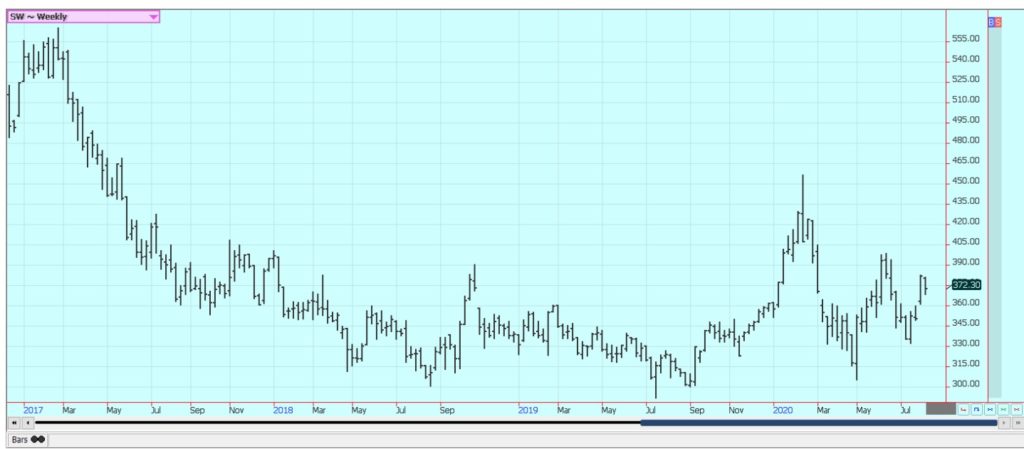

Wheat

Winter Wheat markets were lower last week on report of weak world demand and improving production potential from Russia. Wheat has traded in a choppy fashion all week as the market tries to decide which way Wheat prices are going here and overseas. Spring Wheat was developing under good growing conditions in both the US and Canada. Yield reports from the central and southern Great Plains have been variable, but generally a little better than expected. Soft Red Winter yields are high. The Winter Wheat markets are in down trends on the weekly charts. It is still dry in France and Russia and now Spring Wheat areas of Russia are being affected. Russian Winter Wheat yields have improved over time as harvesters move into areas that had better growing conditions. Australia remains in good condition and is getting beneficial rains in the east. The west is too dry. About half of the Argentine Wheat belt is too dry.

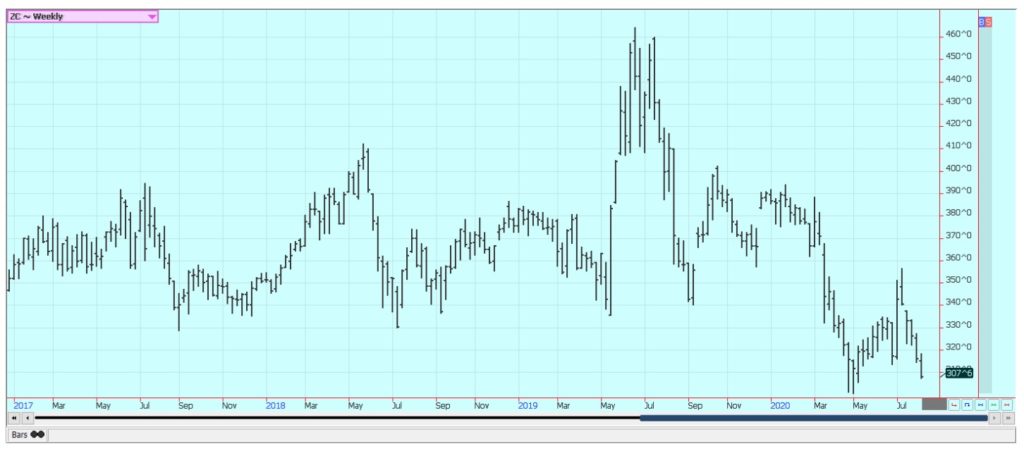

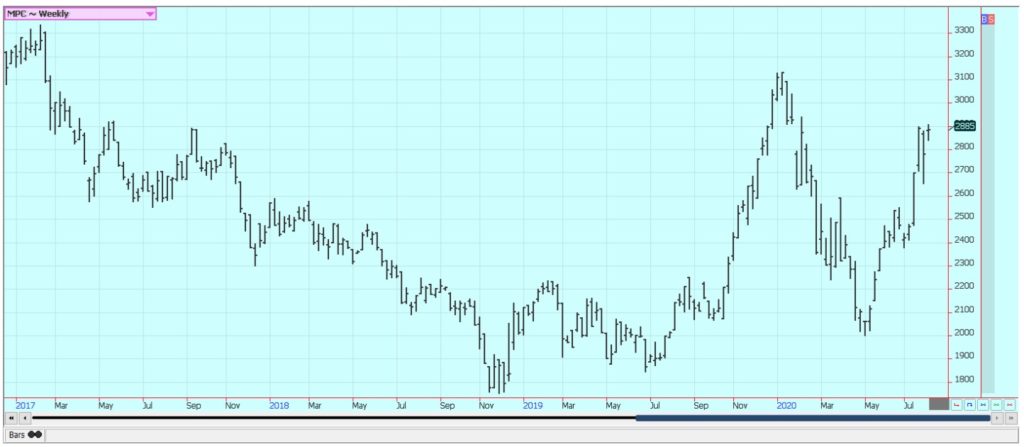

Corn

Corn was lower. It is still a weather market. Rains fell in many of the drier areas of the Midwest again last week and greatly benefited the crops. It has turned cooler and is considered good for kernel fill. Trends are down in Corn. Meats processors are back and are operating at close to capacity. Meats wholesale and retail prices are stable. Recent reverses by some states on opening orders are hurting demand ideas for ethanol, but ethanol demand has been increasing. US prices are high in the world market so export sales of Corn are expected to be less. A tour of Central Illinois showed less ear populations than expected. It is a very good crop with good color, but the smaller than expected ear populations will make it hard for the production to be a record as is anticipated by many traders.

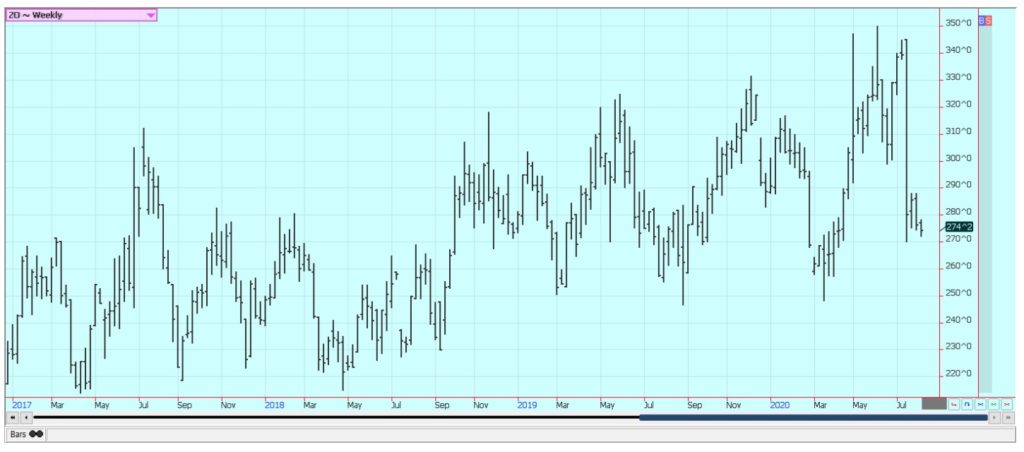

Soybeans and Soybean Meal

Soybeans were a little higher on better Chinese demand. USDA noted that China had bought a lot of new crop Soybeans in its weekly sales report on Thursday. China has become a much more active buyer of Soybeans here in the US and has promised to ramp up purchases in order to comply with commitments it made under the Phase One trade deal. Its commitments have been thrown into doubt by the continued political tensions between the two countries. China has remained a very active buyer in South America even as it has increased Soybeans buying here in the US, so the overall amount taken from the US might not match the hopes of the trade. Brazil prices are higher for the rest of the world as it starts to run out of Soybeans to export, so China and the rest of the world will look to the US for additional supplies. The US weather is considered good for growing Soybeans with cooler temperatures and beneficial rains. A tour of Central Illinois revealed good looking crops with good color, but the plants were short and might not produce enough pods to make some of the higher production expectations of the trade.

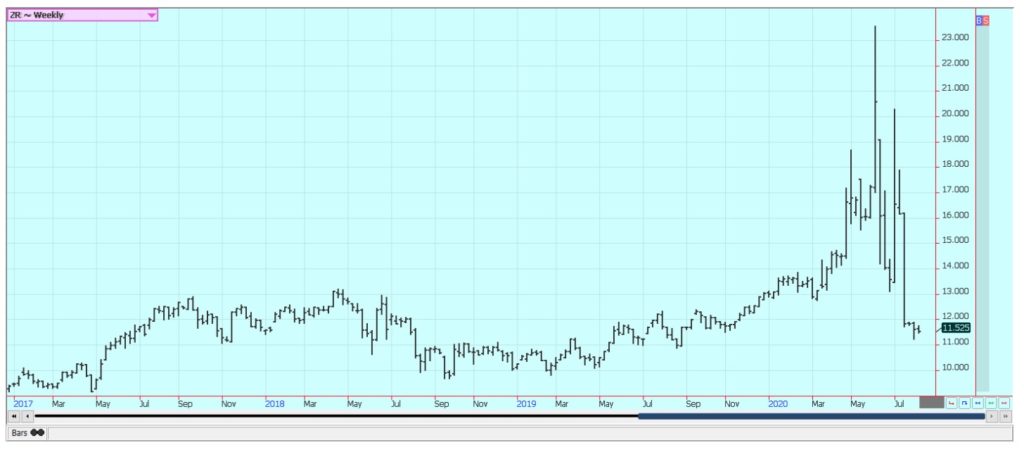

Rice

Rice was a little lower last week as the harvest is active near the Gulf Coast. New crop prospects appear solid for increased production in the coming year. The area is larger and the growing conditions are mostly good. The combination of good export buying in general and the buying inside the US due to Covid-19 has made the market short old crop Rice. There are ideas that the mills are well covered into new crop, but little Rice is available from producers. The crops are called in good condition in Mississippi, Arkansas, and Missouri. Texas and southern Louisiana field yield reports are strong. Export demand for the new crop Rice has been slow to develop as buyers wait for lower prices.

Palm Oil and Vegetable Oils

Palm Oil closed higher on news of renewed demand interest from India and China and on reports of less production from Malaysia and Indonesia. Flooding and a lack of workers for the plantations have been the reasons to see less production. Higher world petroleum prices helped with ideas of increased bio fuels demand. Palm Oil has been hoping for better demand from importers as world economies slowly open after being closed by the Covid-19 epidemic. Indonesia continues to focus its Palm Oil on internal demand for bio fuels. Soybean Oil was and Canola was lower. Soybean Oil found support on increased demand ideas. Canola closed lower on good growing conditions in Canada and thee stronger Canadian Dollar. The strength in the Canadian Dollar is more about weakness in the US Dollar than anything going on in Canada. Crop conditions are mostly good and farmers have been selling old crop supplies. The weather has been warmer the past couple of weeks and most areas have seen rain.

Cotton

Cotton closed a little lower with all of the weakness in prices seen on Friday. West Texas weather remains detrimental for crop development. Export demand for US Cotton has been poor for the last few weeks. The world is starting to slowly recover from the Covid-19 scare and some stores are starting to open again after being closed for weeks. Economic improvement in the US was thrown into doubt as Covid cases surged higher in states that had reopened. The retail demand has been slow to develop as many consumers got hurt economically due to stay at home orders during the height of the pandemic and have little disposable funds to spend on clothes. Demand will slowly improve but the industry should have plenty of supplies to work with in the short term. The US weather situation is mixed, with good rains noted in the Southeast and good conditions in the Midsouth. However, it has been very hot and dry in West Texas and crops there are suffering.

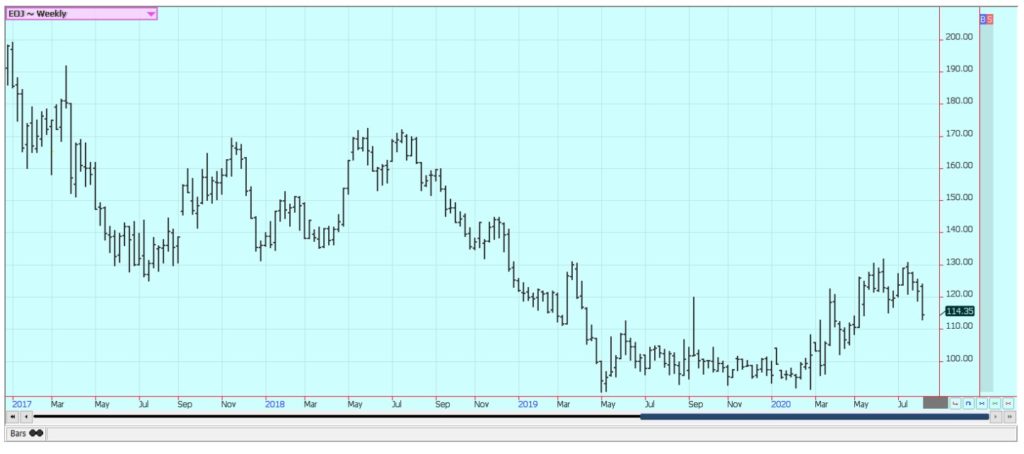

Frozen Concentrated Orange Juice and Citrus

FCOJ was lower. The Covid-19 is still around and is still promoting the consumption of FCOJ at home. But, restaurant and food service demand has been much less as no one is really dining out. Florida production prospects for the new crop were hurt by an extended flowering period, but the weather is good now with frequent showers to promote good tree health and fruit formation. Import demand to the US should be minimal as US prices remain below those of Europe. Brazil has been too dry and irrigation is being used.

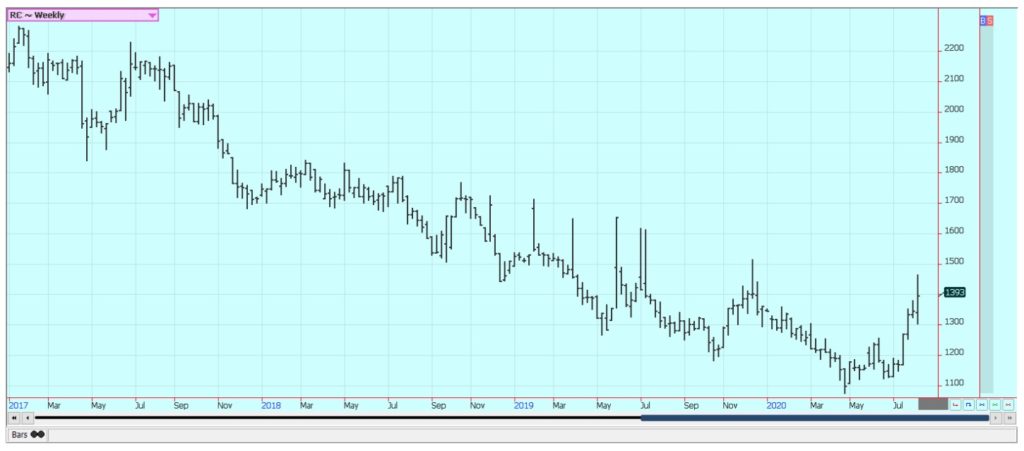

Coffee

Futures were lower in New York and higher in London. Chart trends remain up for at least the short term. There are renewed concerns about the weather in Vietnam. It was dry during flowering time and is dry again. Production ideas are lower. Vietnam is also reported to be having problems with shipping due to lockdowns from the Covid-19 pandemic. Demand overall remains down with the US still locking down due to the Covid resurgence in some states. The demand from coffee shops and other food service operations is still at very low levels. Consumers are still drinking coffee at home and the return of the Covid-19 outbreaks will keep things that way. Europe is emerging from lockdowns. The Brazil harvest is active but shipping and collection have become very difficult due to the widespread outbreak of Covid there. Even so, the pickers are showing up for work and ports are operating normally. Ideas are that production will be very strong this year as it is the on year for the trees. The strong production ideas are coming despite hot and dry weather seen in the country at flowering time.

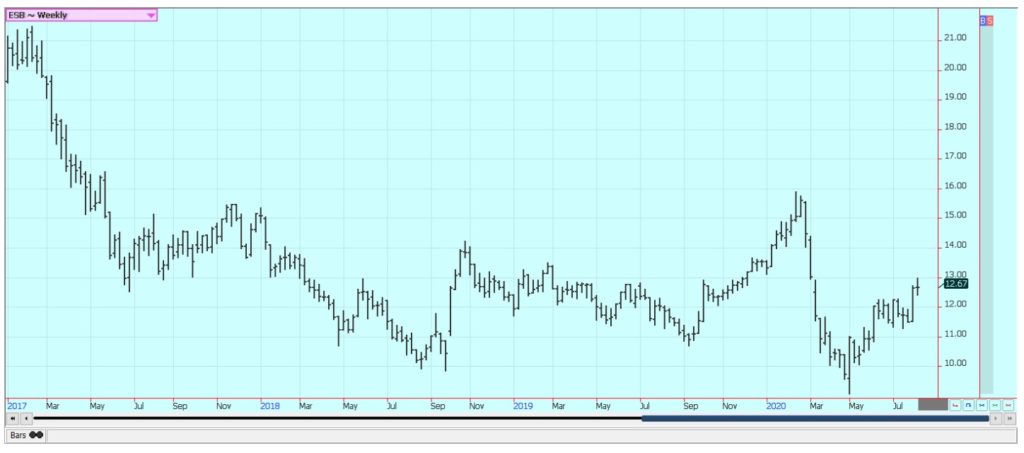

Sugar

New York closed slightly higher but London was lower. Ideas are that there is plenty of Sugar for the world market. Getting the Sugar moved is becoming more difficult with the widespread Covid outbreak in both Brazil and India. Brazil mills have shifted part of the crush to Sugar production due to less ethanol demand. India is thought to have a very big crop of Sugarcane this year but getting it into Sugar and into export position has become extremely difficult due to Covid lockdowns. Thailand might have less this year due to reduced planted area and erratic rains during the monsoon season. There are reduced flows from rivers from China to hinder irrigation of the crops.

Cocoa

New York closed higher and London closed higher. The weaker US Dollar has allowed New York to rally as has the news that the West African harvest is now about over. That means less selling pressure from origin. There are a lot of demand worries as Covid-19 is not going away and could be making a comeback in the US. Europe is still trying to open its markets again but Covid is still around and consumers are reluctant to buy. Harvest is now over for the main crop in West Africa and the results are very good. The reports from West Africa imply that a big harvest in the region. Arrivals are on a pace about the same as last year. Ideas are that Southeast Asia also has good crops.

—

(Featured image by Pierre Sudre via Pexels)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Business1 week ago

Business1 week agoTopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [EKSA Affiliate Program Review]

-

Fintech2 weeks ago

Fintech2 weeks agoSwissHacks 2026 to Launch Inaugural Swiss FinTech Week in Zurich

-

Impact Investing3 days ago

Impact Investing3 days agoOceanEye: EU Launches €50 Million Initiative to Strengthen Global Ocean Monitoring

-

Cannabis1 week ago

Cannabis1 week agoColombia Moves to Finalize Medicinal Cannabis Regulations by March