Business

Wheat and sugar stocks look bleak while cocoa soars

La Niña and winterkill hit stocks of U.S. wheat. Cocoa’s on the rise and is on demand, while sugar closed lower this week despite the cheaper pricing.

Wheat

Chicago Winter Wheat markets were sharply higher and Minneapolis closed a little higher last week. The US remains a weather market, with La Niña conditions affecting the production potential for Hard Red Winter areas.

Drought remains in the region and has become serious, especially in Oklahoma and Texas, where the crops are now leaving dormancy. The crop did not establish itself well last fall due to the dry weather. The state crop reports released last week showed that the deterioration has become very serious, although the overall crop conditions were down just a little bit from the previous month. All of the reporting states in the Great Plains showed that very little of the crop can be rated in good to excellent condition. A large part of the crop still has ratings from poor to very poor. Black Sea prices have been firm in the last couple of weeks due to currency considerations and some logistical problems in Russia and throughout most of Europe. Russia and Europe have seen some very cold weather, and traders expect to hear reports of Winterkill and production losses from both areas this week. The cold weather has made transportation of all goods, including grains, to ports and loading onto ships more difficult. The weekly charts show that both Winter Wheat markets are now in uptrends and that Minneapolis Spring Wheat markets remain in sideways trends. The crop in Canada seems to be bigger than any trade estimates, so more Spring Wheat is available to the market. The market also anticipates increased planted area for Spring Wheat this year due in part to the potentially very short Winter Wheat crop in the U.S.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

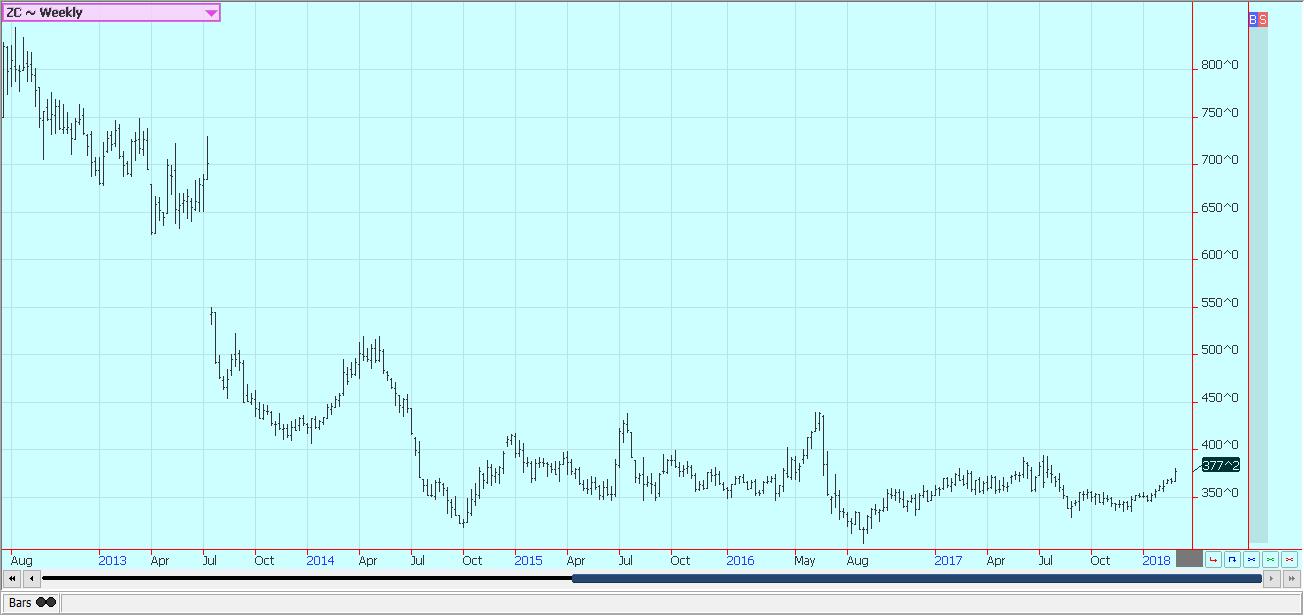

Corn

Corn closed higher for the week. Some important resistance areas were taken out on the daily charts, and trends are up. Corn remains mostly a demand market. The weekly export sales report was strong once again, and the sales’ pace is still well above USDA projections for the marketing year. Some data presented by other analysts shows that the export sales for corn over the last six weeks have been about 24% of the expected total sales for the year. Ethanol demand also remains very strong. The US dollar still appears to be in a longer-term downtrend, so additional export demand is possible and is appearing. More demand is expected due to the problems in South America that emerged because of the weather. Brazil is not offering corn, while Argentina continues to struggle with dry weather problems caused by La Nina. Brazil has been too wet in central and northern areas to get the corn planted well. Overall demand for other feed grains such as sorghum and oats is strong, although sorghum demand ideas got hurt when China announced an investigation into imports of U.S. sorghum a few weeks ago. US.. farmers have reportedly sold quite a bit corn on the rally as they have held the corn in farm storage for too long. These sales are less now as farmers are now operating with much more manageable supplies in storage. Not much if any selling is reported in South America.

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

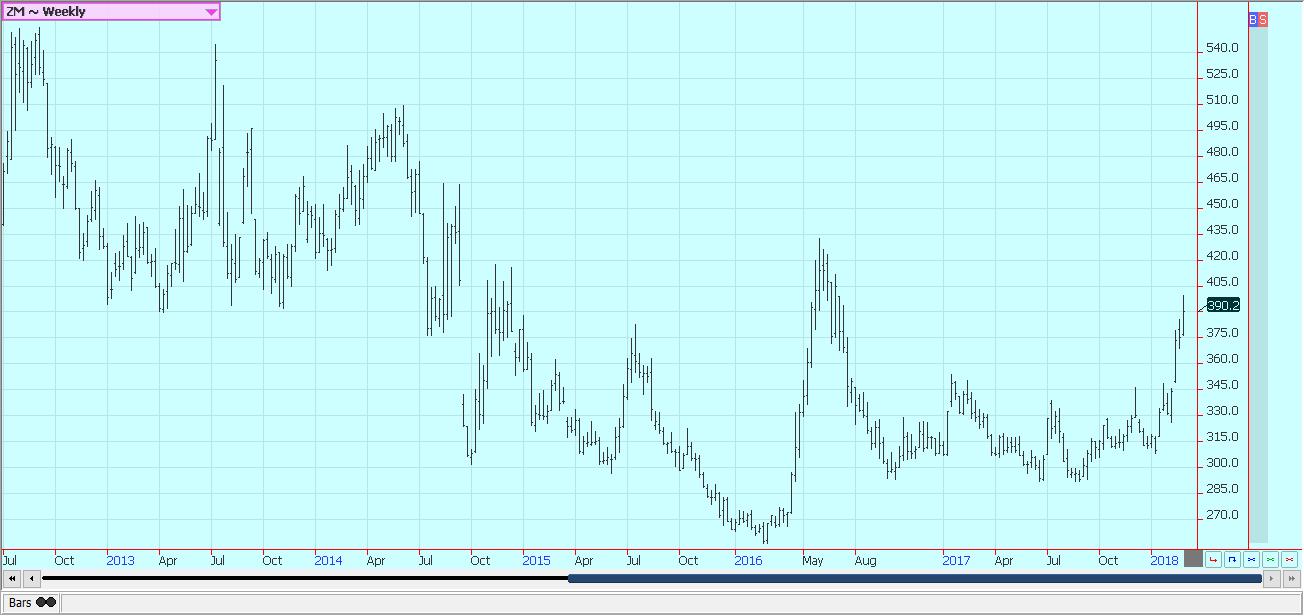

Soybeans and Soybean Meal

Soybeans and soybean meal were higher last week. Futures prices remain supported due to high prices in South America that have come from the drought in Argentina. Significant corn production potential has already been lost in that country, and more dry weather now in the forecast implies that soybeans production losses will be significant as well. Some demand has finally started to shift to the U.S. as the Argentine cash market offers are very high priced and Brazil ports are operating at near capacity already. The U.S. is the net place to turn for soybeans and products, and they are available and getting bought. Stronger domestic demand has helped support soybeans and soybean meal. Ideas that soybean production in Argentina is still suffering from dry weather still support prices in the market, but production estimates for Brazil remain high at near 114 million tons. Some talk of Brazil’s production at or above 117 million tons. Argentine production estimates now range from 45 to 50 million tons, from closer to 55 million at the start of the growing season. Forecasts are drier again, with Argentina likely to be most hurt by any return to hot and dry conditions. Central and northern Brazil are now forecast to get excessive rains this week.

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

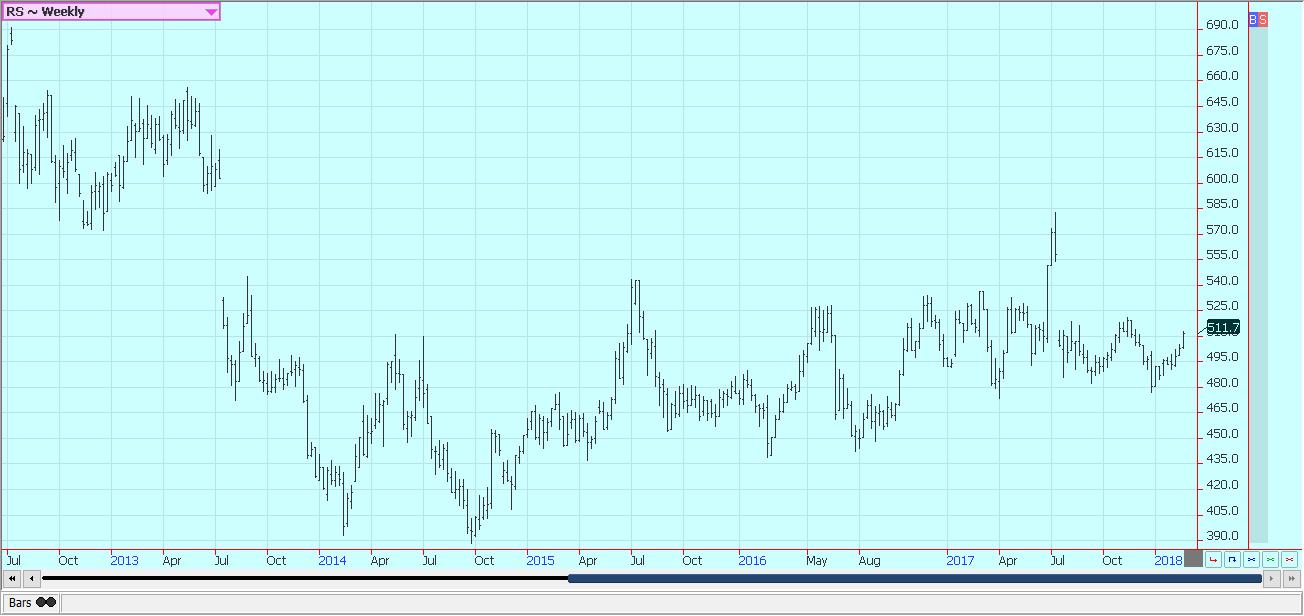

Rice

Rice closed higher for the week. Export demand was strong as Colombia bought a significant amount of rice. Iraq was supposed to tender for U.S. Rice, but the tender was reportedly postponed late last week. Cash market bids remain generally strong amid tight supply availability. Reports indicate that Texas producers are about sold out for the marketing year. Limited amounts of rice are reported to be owned by farmers in Louisiana and Mississippi as well. The amount of rice still owned by farmers in Arkansas and Missouri is less clear, but the cash market indicates tight conditions. Cash market traders suggest that the commercials are still short bought, and it looks like they are finally moving to get covered. Planted area is expected to increase in the coming year as the tight domestic supply situation has created rather favorable nearby prices. The amount of the increase is being tied to the price spreads between rice and competing crops, with some rice areas in the Delta expected to plant more soybeans as well.

Weekly Chicago Rice Futures © Jack Scoville

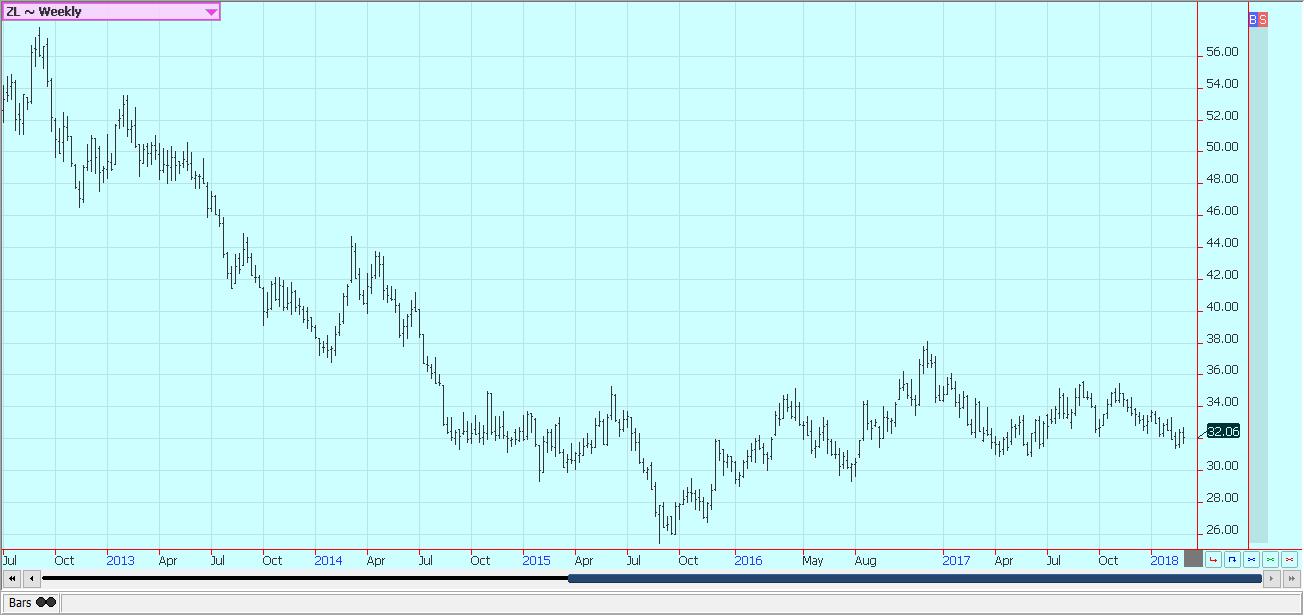

Palm Oil and Vegetable Oils

World vegetable oils prices were mixed last week as they have had trouble holding strength in the last couple of weeks on ideas of big supplies despite the drought and lack of offer from Argentina, the world’s largest soybean oil exporter. In particular, the market sees big supplies of palm oil right now in both Indonesia and Malaysia. Palm oil and soybean oil charts show a sideways trend, but trends in canola are up. The trade is looking for palm oil production to continue decreasing in line with seasonal trends, and this expectation has provided the primary support. However, the demand side is very uncertain at this time and has generally been weaker for the last few months. Demand ideas got hurt again last week as India increased import tariffs by a significant amount in order to cut the import demand and encourage the use of internal production. The Malaysian ringgit has been moving higher against the U.S. dollar, and this has firmed up prices for palm oil in the world market in dollar terms. Canola markets remain mostly in uptrends. Deliveries to elevators have been strong due in part to forward selling earlier in the year. U.S. demand for soybean oil in biofuels should remain strong, and stronger export demand is anticipated due to the threat of reduced production in Argentina.

Weekly Malaysian Palm Oil Futures © Jack Scoville

Weekly Chicago Soybean Oil Futures © Jack Scoville

Weekly Canola Futures © Jack Scoville

Cotton

Cotton was higher for the week. The weekly charts show that futures are now pushing against some big downtrend lines, so the market is entering an important period. Demand remains strong, and merchants have had trouble finding the cotton in domestic cash markets. The weekly sales of upland cotton showed continued strong demand for U.S. cotton and were considered bullish to prices. The downside could be limited if the U.S. dollar keeps working lower. USDA will issue its next round of supply and demand reports this week, and ideas are that demand can increase and that ending stocks can be cut slightly. Prices overall have been much higher than most commercials had expected. Prices could remain strong until closer to harvest. There have also been quality concerns left over from the hurricanes and the freeze during the growing season. USDA expects demand to remain very strong. The trade will also look for ideas of plantings as spring is not that far away. Plantings could be higher than USDA projections due to the big problems with the Winter Wheat crops in the western Great Plains.

Weekly US Cotton Futures © Jack Scoville

Frozen Concentrated Orange Juice and Citrus

FCOJ was lower again on Friday as the weather remains mostly good for the crops. Futures remain in a trading range, and Florida stays mostly warm and dry. Trends are starting to turn down on the daily charts, and the market is still dealing with a short crop against weak demand. USDA estimated the crop at about 45 million boxes in its last report, and there does not seem to be any reason to expect a big production increase in its data for the marketing year. The current weather is good as temperatures are warm and it is mostly dry, but the crop is small. The harvest is progressing well, and the fruit is being delivered to processors and the fresh fruit packers. Trees in Florida are showing fruits of good sizes, and producers are now into the Valencia crop with the early and mid-harvest completed. Florida producers are actively harvesting and performing maintenance on land and trees. Some early flowering has been reported in the groves, and some fruit is forming. Irrigation is being used.

Weekly FCOJ Futures © Jack Scoville

Coffee

Futures were lower on Friday and a little higher for the week in New York. London was slightly lower on Friday and was little changed for the week. Both markets are looking for news to cause a move in either direction. The charts present a sideways appearance for now, and speculators remain very short but have been starting to reduce part of those positions. However, they anticipate big crops from Brazil and from Vietnam this year and have seen no reason to cover the short position in a big way. New York traders are noting the good weather currently being reported in Brazil and expect another bumper crop. However, ideas of a huge crop might now be part of the futures price. There were reports from London of increased Vietnamese selling, and Robusta is now more available. The situation seems little changed in Latin America. There are reports of short crops in parts of Central America and some areas in South America due to the lack of farmer investment from the low prices. Honduras has been a very active exporter, and offers from most other countries are seen. Differentials in Central America are low, and the buy side is quiet.

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

Sugar

Futures were a little lower for the week but held the recent trading range. Trends are sideways on the daily and weekly charts. London remains at important support areas. The overall feel of the market is that prices, for now, are cheap enough, but both New York and London appear to need a catalyst to work higher in a big way. Ideas that sugar supplies available to the market can increase in the short term have been key to the selling. India will export up to one million tons of sugar this year after being a net importer for the last couple of years. Thailand has produced a record crop and is selling. Mills in Brazil have decided to make more ethanol as world crude oil and products prices have been very strong. The ISO expects production to outstrip demand by more than five million tons this year as the market recovers from a 2.5 million ton production deficit last year.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

Cocoa

Futures were higher for the week. Trends are up in both markets on the daily and weekly charts. It has been hot and dry in many parts of West Africa, so conditions are good for the winds to form. Some crop losses might be possible if the current conditions persist. There have been reports of some showers in West Africa, so perhaps the season is changing now. The gut slot for offers from the main crop is passing, and the sales by the government suggest that offers down the road can be less. The mid-crop harvest is starting in some areas. The recent grind data was weaker for North America but positive for Europe and Asia. Demand is not universally strong but has been improving and is likely to continue to improve as long as prices stay generally weak as processing margins are said to be very strong.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

_

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Cannabis4 days ago

Cannabis4 days agoSwitzerland Advances Cannabis Legalization with Public Health Focus

-

Crypto2 weeks ago

Crypto2 weeks agoBitcoin Surges Toward $110K Amid Trade News and Solana ETF Boost

-

Crowdfunding6 hours ago

Crowdfunding6 hours agoEquity Crowdfunding in Europe Surges to €160M in H1 2025 Amid Market Resilience

-

Fintech1 week ago

Fintech1 week agoRipple and Mercado Bitcoin Expand RWA Tokenization on XRPL

You must be logged in to post a comment Login