Featured

Here’s what you need to know before you build a mobile wallet app

The worldwide market for online payments is one of the fastest growing fintech segments.

First, we saw people moving out of traditional norms of paying in cash into paying through internet banking and credit as well as debit cards. Then, again, due to the constant revolution in technology, we saw the emergence of a new player: mobile wallet apps.

Today, mobile wallet apps seem to be dominating the online payments market. The stories of PhonePe, Paytm, Mobikwik, and others have been truly inspiring.

Just look at Paytm! — right now, it has more than 300 million users registered, according to latest statistics.

While the above-mentioned mobile wallet apps are the prime players in India, it’s different if we take a look at the global scenario. WeChat Pay is leading globally with 600+ million registered users and followed by AliPay with 400 million registered users worldwide.

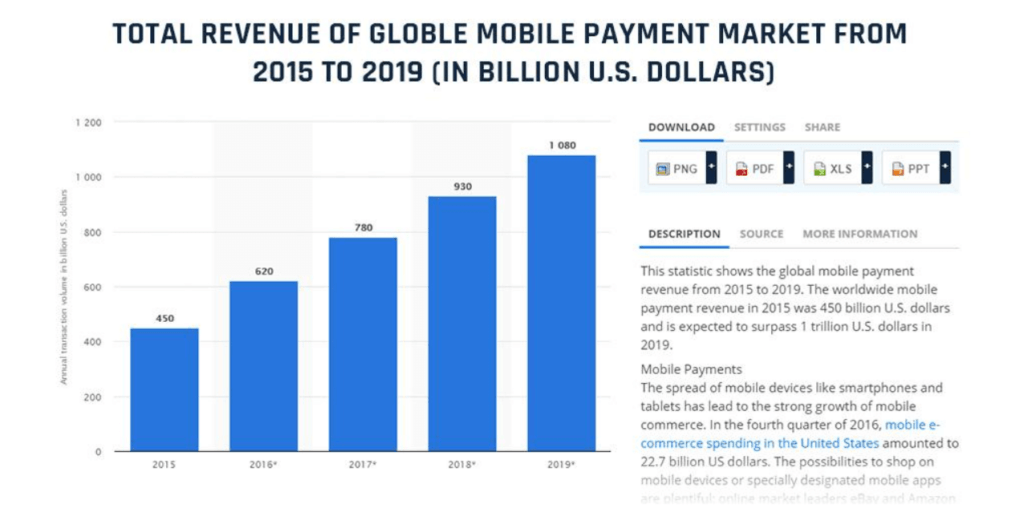

With these companies’ numbers, experts are predicting that the revenue from mobile wallet apps will rise to more than $1 trillion in 2019.

So, now that we’ve seen how successful mobile wallet apps could be, it’s time we start discussing

What exactly is a mobile wallet app?

While there is no precise definition of what a mobile wallet is, in the simplest terms, a mobile wallet stores cashless money and cards information digitally — just like how a physical wallet stores cash and cards.

It is a digital solution that allows individuals and businesses to send or receive money

These mobile wallet apps can be further categorized based on their capabilities. For instance, a simple mobile wallet app allows users to send/receive money, store multiple card details, redeem coupons, while an advanced mobile wallet app aids users with more complex features such as NFC-enabled payments, QR Code scanning, among others.

Why should you build a mobile wallet app?

Mobile wallet app Development is not new. There are dozens of mobile wallet apps already available in the market for a long time.

So, why should you build another one? Despite mobile wallets being a highly-competitive market, there is still an opportunity to make money.

According to a report, 64 percent of consumers used mobile devices for payment, while 39 percent of consumers have mobile wallet apps aside from Android/Apple/Samsung Pay last year. Not only that — the same study also forecasted that the digital transaction value will reach more than $6 billion in 2019.

These statistics clearly prove that the number of mobile wallet users is still increasing every year, making multi-utility mobile wallet apps a mainstream need.

However, this does not mean that because mobile wallet apps are mainly connected with money, they’re only helping finance industry to grow. There are many industries leveraging mobile payments technology.

Which industries can benefit from a mobile wallet app?

As mentioned above, mobile wallet apps are helping various industries it including:

1. E-commerce and retail

Nowadays, e-commerce, as well as retail businesses, are using mobile wallet payment to its fullest. Most businesses allow making payments through loyalty cards, coupons, bonuses, and much more.

Retail businesses, on the other hand, offer QR code to let users pay their bills using mobile wallets. In fact, global mobile retail spending amounted to $1.36 billion in 2017 and it is expected to reach $3.5 billion in 2021 worldwide.

2. Telecommunications

Most telecommunication companies today have integrated in-app payments to allow their customers to pay bills within their mobile app. Some telcos also allow users to send or receive money through a mobile app.

3. Event, food, and grocery

From ordering food to paying for movie tickets and shopping in a supermarket, mobile wallet apps have made customers’ life a lot easier in today’s hectic and busy world. Most food, event-booking, and supermarkets provide mobile payment services for cashless transactions.

4. Logistics and transportation

You know about Uber and Ola, right? The two biggest taxi booking startups allow their customers to pay through mobile wallets. Uber has integrated Paytm and Apple Pay in their app, while Ola has developed its own mobile wallet — Ola Money — in its taxi booking app to let riders pay for their ride digitally.

Now, we’re going to talk about the most important thing you need to know before you can start building it.

Mobile wallet regulatory requirements

Before you start building your mobile wallet app, you first need to assemble a good legal team who has knowledge in mobile wallet regulations. Now, these regulations vary extensively from country to country. Therefore, you’ll have to be up to date about all the regulations in your country.

For example, if you live in the U.S. and you want to launch a mobile wallet app there, then you can start by reading this article on mobile payments in

Similarly, if you’re from the U.K., you can go through the UK finance website to find out their mobile wallet regulations.

For any other country, please seek the help of a a local legal team.

In a nutshell, you must be prepared to meet the PCI (Payment Card Industry) Security Standards in whatever way they may apply in your chosen country. To learn more about these standards, please visit PCI Security Standards Council Website.

Vital features of a mobile wallet app

Once you have all the information on mobile wallet regulations for your country, it’s time to discuss the features which are absolutely necessary to make your mobile wallet app worthwhile.

To make it easy to understand, I’m going to divide features into the following categories:

- Essential user-side features

- Essential admin-side features

- Additional “nice-to-have” features

Essential user-side features

1. Registration: As with most apps, a user first has to register using an email address or phone number. Once either information is registered, user the would receive a verification code for confirmation.

2. Link cards or bank account: Before users can perform any transactions, they must link their bank accounts or credit cards with the mobile wallet app; only then can they send/receive money or make payments.

3. Add money to wallet: An option to add money into their wallet balance. For this, a user should be able to add money directly using their ATM card details and PIN.

4. Fund transfer: An option to send and/or receive money from someone by either typing phone number of the recipient or by scanning their QR code.

5. Passbook: Users must be able to see their transaction history along with advanced filters to help them search specifics.

6. Transfer wallet

7. Bill payments: Most wallet users nowadays prefer using apps to pay their monthly bills for gas, electricity, internet, and phone. So, this is also a necessary feature to attract users to download your mobile wallet app.

8. Discount and cashback

9. Reviews and ratings: Though it’s not really an essential feature, it’s good to ask users, especially the early adopters, to rate your app in app stores. Encourage them to write suggestions and feedbacks.

10. Multiple language

11. Refer a friend: Referral programs have always been a top marketing strategy for many popular mobile apps. It is basically a promotional feature where you ask a user to spread the word about your mobile wallet app, and in return, the user will receive rewards in the form of cashback or discount offers.

12. Customer support: You need to provide help to your users in case they face any problem. The best way to do that is by adding virtual chatbot assistant that interact on a basic level with users.

13. Order history: The order history feature basically shows all the orders the customer has paid for using your wallet app — be it paying the phone bill or shopping for grocery in the supermarket.

14. App setting: A settings feature enables users to customize the mobile wallet app according to their needs. This basically involves profile, payment, and security settings.

Essential admin-side features

1. Dashboard: The admin panel must have a dashboard showing overall information and data with real-time analytics about all registered users.

2. Add, remove, block users: The admin has the right to accept/reject or remove an existing user. They can also block a user from using your mobile wallet app in case he or she has violated any rules and laws.

3. Monitor daily transactions: Another job of the admin is to track and monitor on-going daily transactions occurring on the mobile wallet app.

4. Real-time analytics and reports: The admin should be able to view real-time data and generate customized reports which will be beneficial for planning future strategy.

Additional “nice-to-have” features

1. Push notifications: For some mobile wallet apps, this feature has become an essential one for keeping users engaged. You can regularly send push notifications on new coupons, discounts, and promos to entice them to make transactions using your wallet app.

2. Loyalty programs: Loyalty programs have also become a necessary app feature to include for keeping loyal users engaged. You can offer instant cashback deals to users who use your app to pay their monthly bills.

3.

4. Grocery shopping: In your mobile wallet app, you can offer online grocery shopping with additional categories such as electronic appliances, household items, and apparels.

5. NFC-enabled payment: This is basically a contactless technology which allows users to pay at any retailer having PoS devices. This technology works almost similarly to Bluetooth, but unlike Bluetooth that takes one-tenth of a second to connect, NFC connects immediately.

Your mobile wallet app will be used by common people so it’s important to keep them in mind when you design your mobile wallet app.

Simply put, the users of today prefer a simple process to access services. Therefore, ensure that your mobile wallet app development team makes your wallet app easy-to-use, lighter, and fully optimized.

(Featured image by LDprod via Shutterstock)

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Cannabis5 days ago

Cannabis5 days agoSouth Africa Proposes Liberal Cannabis Regulations with Expungement for Past Convictions

-

Biotech2 weeks ago

Biotech2 weeks agoVolatile Outlook for Enlivex Therapeutics as Investors Await Clinical Catalysts

-

Crypto10 hours ago

Crypto10 hours agoCrypto Markets Under Pressure as Vitalik Buterin Sells 17,000 ETH

-

Markets1 week ago

Markets1 week agoWeather-Driven Supply Outlook Lifts Coffee Markets in Brazil and Vietnam

![Kevin Harrington - 1.5 Minutes to a Lifetime of Wealth [OTC: RSTN]](https://born2invest.com/wp-content/uploads/2023/12/kevin-harrington-400x240.jpg)

![Kevin Harrington - 1.5 Minutes to a Lifetime of Wealth [OTC: RSTN]](https://born2invest.com/wp-content/uploads/2023/12/kevin-harrington-80x80.jpg)