Africa

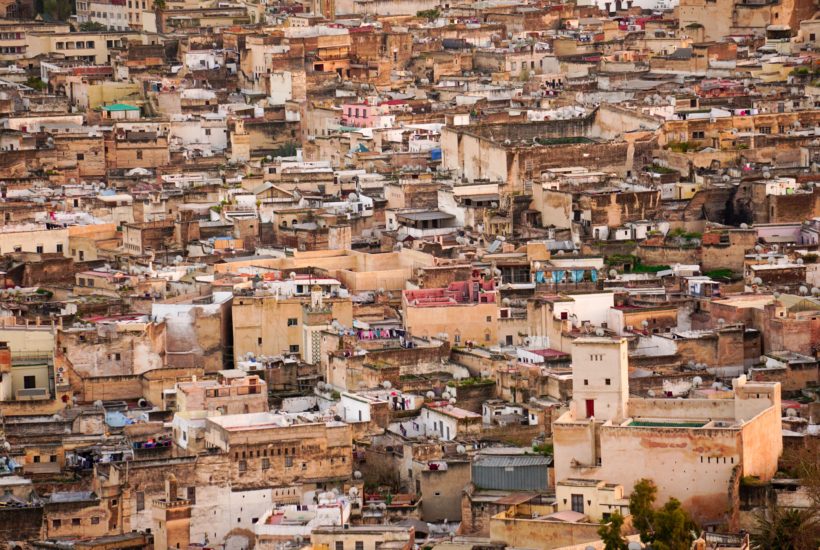

New investments in the Fez-Meknes Region

As part of the industrial revival strategy, the Fez-Meknes Region should welcome 95 potential projects identified in the project bank. These represent an investment of $875,000 (7.8 MMDH) for a potential turnover of $2.63 million (23.5 MMDH). It should be noted that 80% of these projects concern the food processing, textile and leather sectors.

The Regional Investment Center (CRI) Fez-Meknes is working hard to boost investment in the region. In this context, the CRI organized, Wednesday, February 17th, in partnership with the Ministry of Industry, Trade, Green and Digital Economy, Maroc PME, and the Moroccan Agency for Energy Efficiency (AMEE), a web conference around the theme “Project Bank and Tatwir program: investment opportunities in the Region Fez-Meknes.”

This meeting allowed the organizers to present, to investors and project holders in the region, the strategy implemented by the Department of Industry under the Industrial Recovery Plan, including the strategy of import substitution to promote the products Made in Morocco. “The aim was to present the investment opportunities in the region and the support system put in place, including the industrial project bank and the War Room, a unit dedicated to supporting investors,” said Yassine Tazi, Director General of the CRI Fez-Meknes.

The meeting also provided an opportunity to discuss the new features of the Tatwir program, launched by the Ministry of Industry, including its two versions Tatwir Green Growth and Tatwir Startup. The project bank and the Tatwir program are part of the Industrial Recovery Plan (PRI) 2021-2023 set up by the supervisory department. “As part of the industrial recovery strategy, the Fez-Meknes Region can capitalize on its assets to host the 95 potential projects identified in the project bank (200 projects).

These projects represent an investment of $875,000 (7.8 MMDH) for a potential turnover of $2.63 million (23.5 MMDH),” said the director of the CRI Fez-Meknes. Note that 80% of these projects focus on the food processing, textile and leather sectors. Among the 238 projects selected by the War Room as of December 31st, 2020, 8% concern the Fez-Meknes Region. For his part, the Managing Director of Maroc PME, Brahim Arjdal, emphasized the new generation of support programs for very small and medium enterprises, stating that the Tatwir program to support decarbonization aims to support the green growth of production units.

Read more about the projects in the Fez-Meknes Region and how much it will be invested there, with the Born2Invest mobile app. Our companion app brings you the latest finance news in the world so you can stay informed.

Three agreements to support investors

The meeting was an opportunity to sign agreements with the partners of the CRI Fez-Meknes. The first agreement signed between the center and the AMEE concerns the support of industrial companies in the region. Objective: to accelerate the transition to a low-carbon industry, in particular by conducting energy and environmental audits, setting up an energy management system and advising on how to benefit from the Tatwir Green Growth program funding. The second agreement was signed with the Moroccan Société Générale de Banque. It focuses in particular on assisting investors to access the Green Value Chain (GVC) financing program, which aims to improve the sustainable competitiveness of companies and support for the financing of SMEs operating in industrial ecosystems and wishing to integrate more efficient and higher value-added value chains.

The third convention was signed with the Attijariwafa bank Group. It mainly concerns the implementation of a support mechanism dedicated to industrial investors in the Fez-Meknes Region, through technical expertise, the design of customized financing solutions, the provision of digital platforms or the establishment of professional relations (business networking) of companies wishing to develop export, particularly in the African market.

__

(Featured image by Selina Bubendorfer via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

First published in LesEco.ma, a third-party contributor translated and adapted the article from the original. In case of discrepancy, the original will prevail.

Although we made reasonable efforts to provide accurate translations, some parts may be incorrect. Born2Invest assumes no responsibility for errors, omissions or ambiguities in the translations provided on this website. Any person or entity relying on translated content does so at their own risk. Born2Invest is not responsible for losses caused by such reliance on the accuracy or reliability of translated information. If you wish to report an error or inaccuracy in the translation, we encourage you to contact us.

-

Cannabis5 days ago

Cannabis5 days agoSouth Africa Proposes Liberal Cannabis Regulations with Expungement for Past Convictions

-

Biotech2 weeks ago

Biotech2 weeks agoVolatile Outlook for Enlivex Therapeutics as Investors Await Clinical Catalysts

-

Crypto9 hours ago

Crypto9 hours agoCrypto Markets Under Pressure as Vitalik Buterin Sells 17,000 ETH

-

Markets1 week ago

Markets1 week agoWeather-Driven Supply Outlook Lifts Coffee Markets in Brazil and Vietnam