Business

Orange juice market enjoyed increase in futures last week

Some grower associations said that Hurricane Irma almost destroyed the orange crops in many areas.

The frozen concentrated orange juice futures soared last week while its market expected from the report of the U.S. Department of Agriculture a decline in the production.

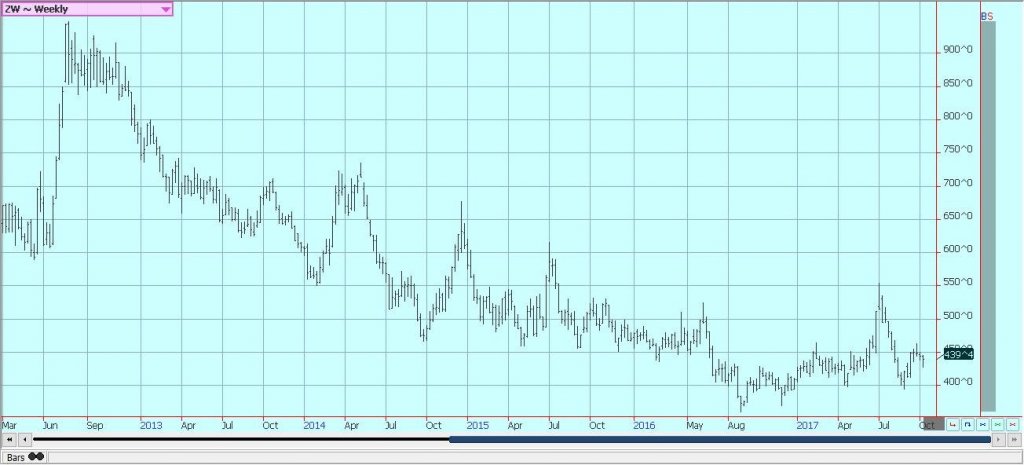

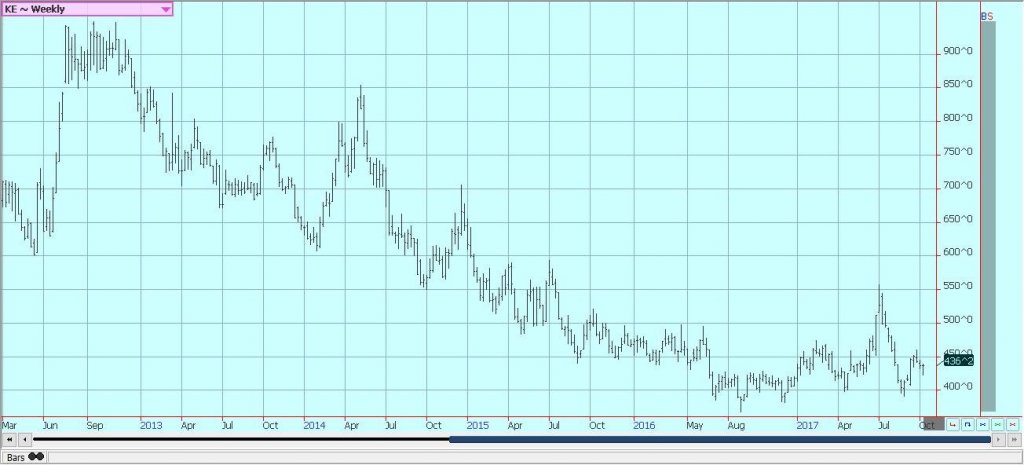

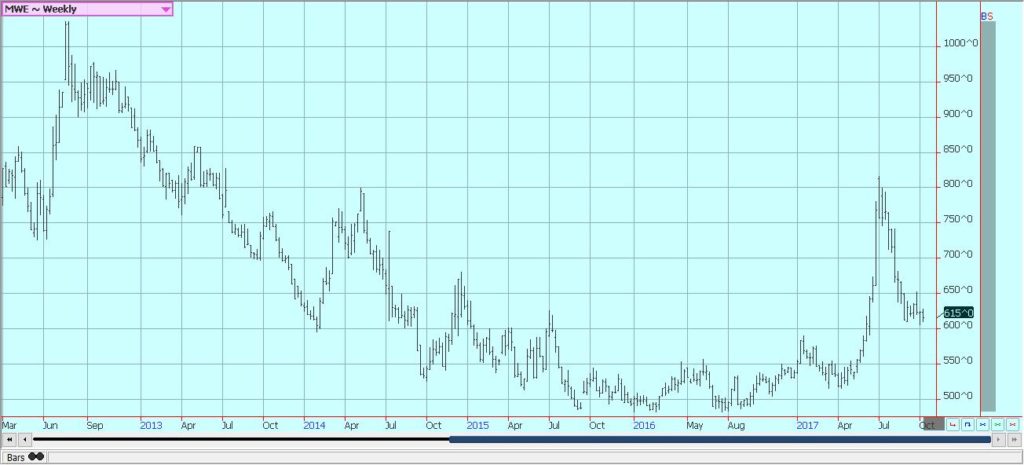

Wheat

US markets were higher on Friday, but a little lower for the week in all three markets. There were ideas that the late week price action could indicate a low as futures rallied despite poor weekly export sales on Friday and neutral to negative domestic and world ending stocks data released by USDA on Thursday. USDA showed increased production, mostly from Russia, and an increase in world ending stocks. The weekly charts show that futures moved close to some support areas and then bounced. It appears that follow through buying will be needed this week to create comfort that the market has indeed made a low.

Planting progress for the US Winter wheat crops will be watched along with any demand news. There has been a lot of rain in central and southern sections of the Great Plains, and producers are hoping for drier weather to get the crop planted. It rained over the weekend in the Midwest, but these rains were most welcome as it had been dry. Drier weather will return to the Midwest this week.

US wheat remains very competitive in world markets due to reduced production from about all origins except for Russia. Russia has been selling aggressively and has set the world price, but US prices are just as cheap right now. This is due to the weaker futures along with the weaker US Dollar. The export sales report was disappointing last week, but export sales have generally been in line with USDA forecasts. Wheat prices are cheap enough now and need not go lower. A big rally will probably be difficult without better demand.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

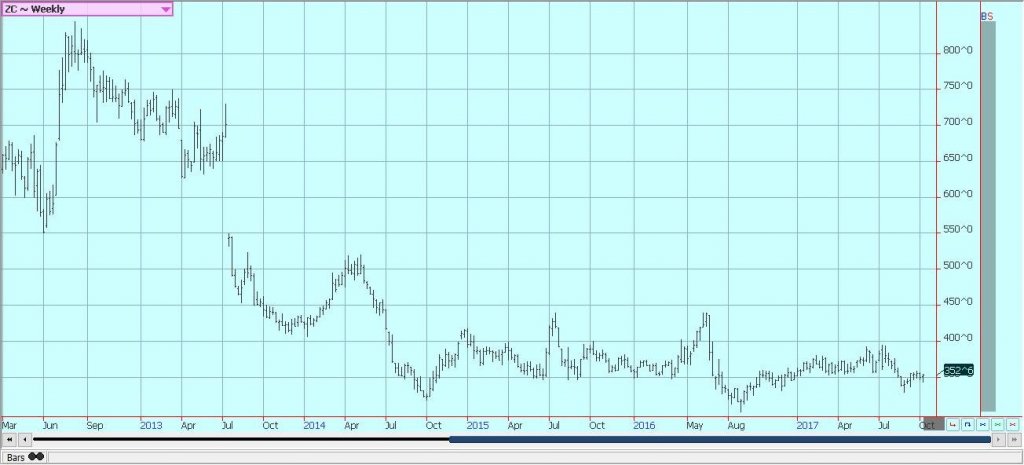

Corn

Corn and oats closed higher for the week as the US corn harvest expands in much of the Midwest. The export sales report on Friday was very strong for corn and was a reason to buy the market. The production and supply and demand reports from USDA released on Thursday showed big production at well over 14 billion bushels and ample supplies for any demand during the marketing year. It was mostly in line with little above trade expectations and was considered neutral to negative for prices. Basis levels remain very weak but could start to improve again.

The Mississippi and Illinois rivers have been low due to lack of rainfall and barge transportation has been difficult and very expensive. A lock on the Ohio River was closed for emergency repairs and that caused transportation problems on that river system. Some rains have been moving through the Midwest in the last week so river levels could start to improve in the short term, and that should ease pressure on freight prices and interior basis levels. More rain was seen in central parts of the Midwest over the weekend.

The market is hearing actual harvest results as activity moves north into central parts of the Corn Belt and also gets active in the east. Yields have been relatively strong, but the harvest pace has been a little slow as producers have been concentrating more on getting the soybeans harvested and letting the corn dry in the fields. Harvest results so far from the Delta and Southeast point to very good yields in these areas.

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

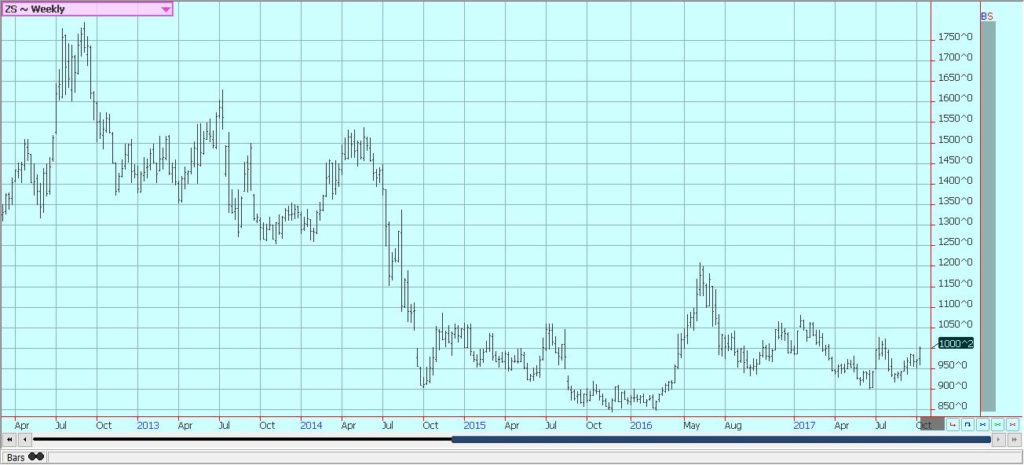

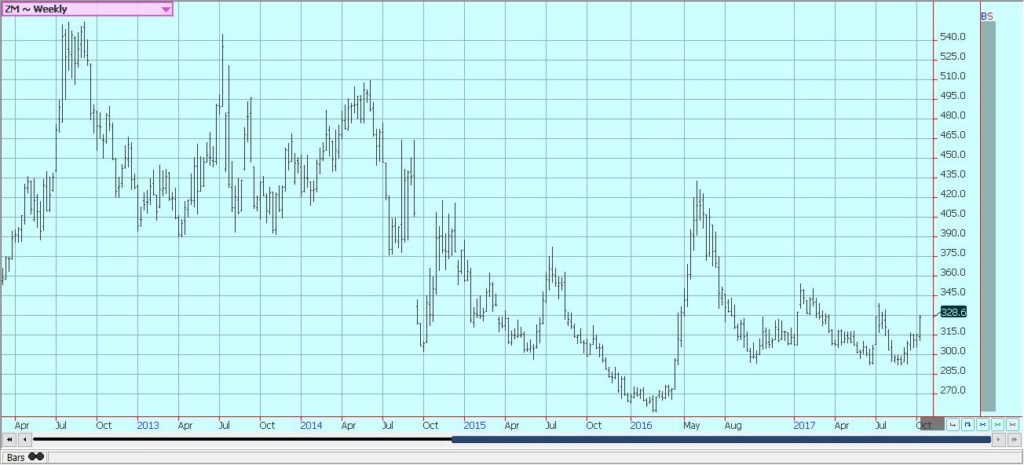

Soybeans and Soybean Meal

Soybeans and products were higher again on Friday on follow-through buying as USDA showed very strong export sales on Friday and showed reduced yield potential in the production reports and reduced ending stocks projections for the current marketing year on Thursday. The market is also watching the weather in Brazil and that remains unfavorable for good planting progress. The harvest is likely to stay slow this week as there are rains in the Midwest.

Rains moved through Chicago and central parts of the Midwest over the weekend. The harvest has been more active in areas east of the Mississippi River, while areas to the west of the river have very little work done. The yield data generally runs behind year-ago levels. However, producers had expected worse yields due to some extreme weather seen over the summer.

Producers are looking to harvest the soybeans before the corn as they hope to let the corn dry down in the fields and save on drying costs. Basis levels should start to improve as the river levels move higher due to recent rains. It remains too dry for best planting in the northern half of Brazil, while the southern half of Brazil and the northern half of Argentina get too much rain. It is planting time for soybeans there, but progress is very slow right now. Ideas are that the weather patterns there can start to change and more favorable planting weather will be seen near the end of the month.

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

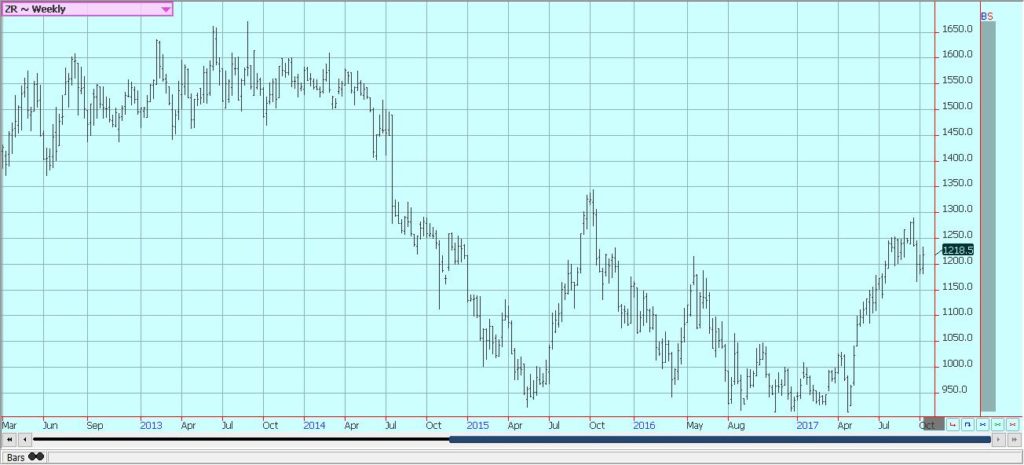

Rice

Rice closed lower on Friday on what seemed to be a mix of light volume speculative and producer selling. Futures were higher for the week in reaction to the USDA reports that showed less yield potential and less US production. The production data allowed USDA to cut US domestic ending stocks and was the lowest production estimate since the late 1990’s. The data implies that prices should stay strong and could move higher over time. However, the weekly charts show strong resistance at about 1`250 November, so that will be a key level for the market to watch this week.

The harvest is about over in the Delta and most rice has been put into storage to wait for higher prices. Reports from the country indicate good to very good yields and quality for the Delta as the harvest comes to a close in most areas. Interior cash prices are reported generally steady so far this week, and reports indicate that selling by producers has been limited as they hope for another push to higher prices. California will be the last to finish as the Delta harvest is about over now. Yields in California right now are lower than hoped for as the late start to planting appears to have created a short season and less yield potential.

Weekly Chicago Rice Futures © Jack Scoville

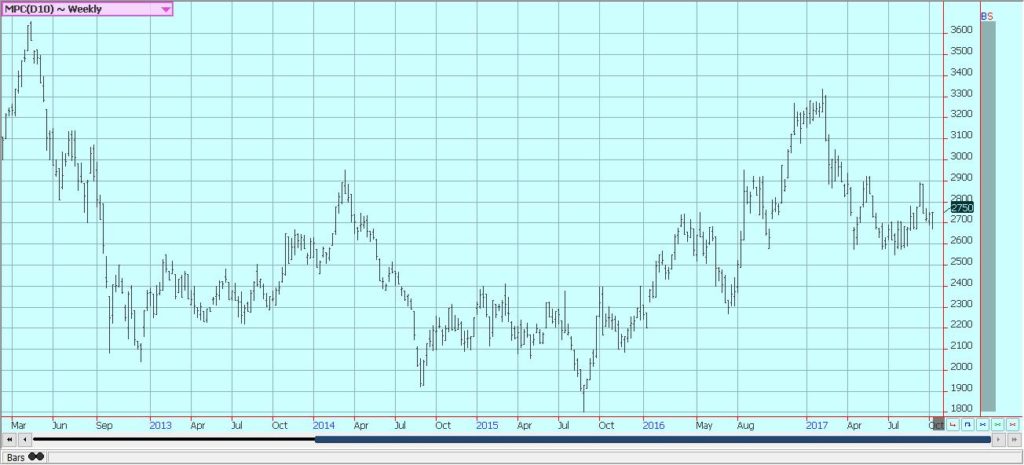

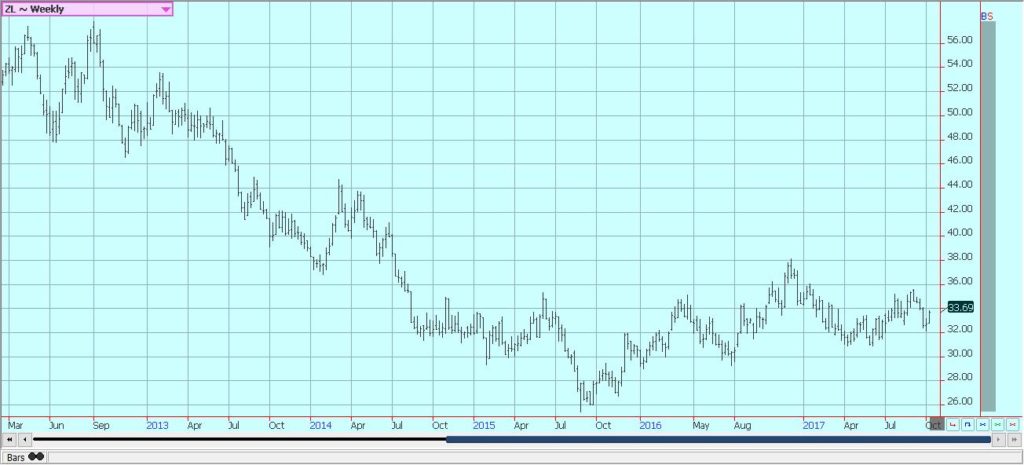

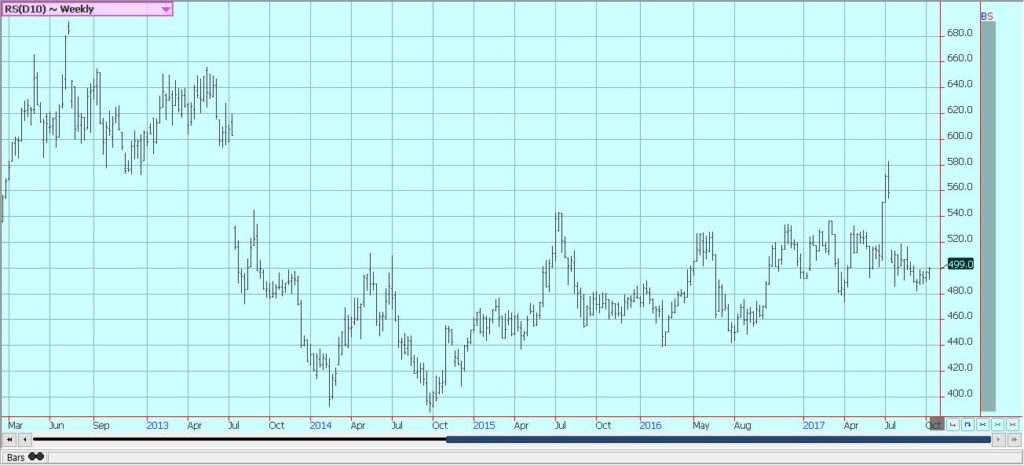

Palm Oil and Vegetable Oils

Palm oil futures moved higher last week, but weekly charts show that the market remains in a trading range. The price action was positive despite bearish MPOB data. MPOB showed that ending stocks levels were much above trade expectations due to strong production and weaker than expected demand. However, the market moved higher as data released by the private sources showed that exports for the first third of the month were very strong. China is back from its Fall holiday now and demand could get stronger.

Canola was higher as the weather hurt harvest progress and despite farm selling amid increasing harvest activity. Farmers have started to more actively sell and deliver as the harvest starts to move into its final stages. Yield reports yet imply a good but not great crop in just about all areas of the Prairies. Farmers in the Prairies are facing variable weather conditions that for now are somewhat too wet to promote a very active harvest. The biggest delays and risk of loss appears to be in Alberta.

Areas farther to the east are reporting average harvest progress and good farm selling. Soybean Oil was also higher as the Soy complex reacted to reduced yield estimates presented by USDA. Planting delays in South America have also been positive, but ideas that US production will get smaller in coming reports along with better demand caused by reduced imports of vegetable oils are supporting Soybean Oil more than other factors.

Weekly Malaysian Palm Oil Futures © Jack Scoville

Weekly Chicago Soybean Oil Futures © Jack Scoville

Weekly Canola Futures © Jack Scoville

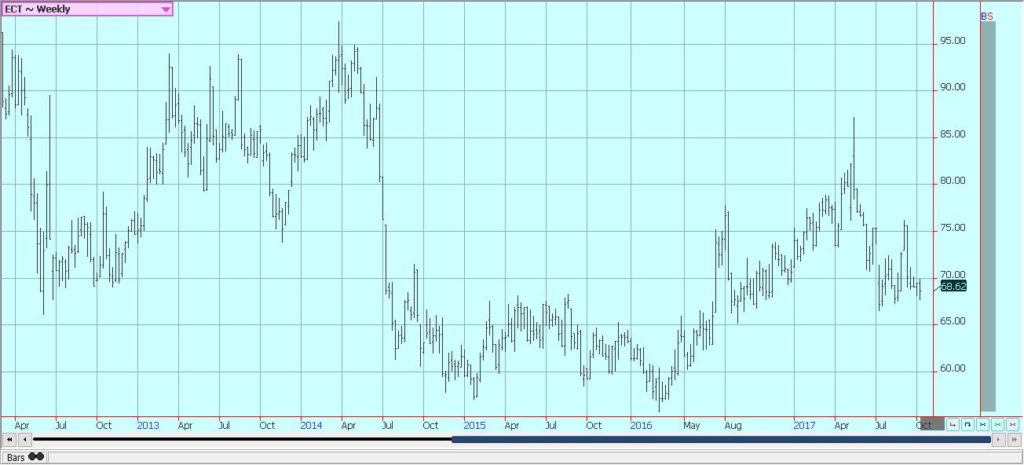

Cotton

Cotton was lower last week in reaction to the USDA reports that showed strong production potential at 21.12 million bales. Ending stocks were reduced to 5.8 million bales from 6.0 million in September, but still a big amount. The production was estimated lower than in September but remains strong in spite of the hurricanes that could have damaged crops in parts of Texas, the Delta, and the Southeast.

Futures appear to have broken an uptrend on the weekly charts, and a test of 6500-basis the nearest futures appears possible. Harvest is more active and will continue to expand as more and more of the crop comes to maturity, bolls are open or are opening now in just about all production areas, but harvest remains a little behind normal. West Texas conditions are called good and the Southwest should be good despite hot weather this year.

Demand has been OK but not really strong so far this year. Export sales will need to increase to absorb the big crop. There is strong production potential in Asia, and mostly in India and Pakistan due to improved monsoon rains. Some rains are expected in most areas this week amid relatively moderate temperatures. Chinese growing conditions are good. Areas to the south of Russia are in good condition.

Weekly US Cotton Futures © Jack Scoville

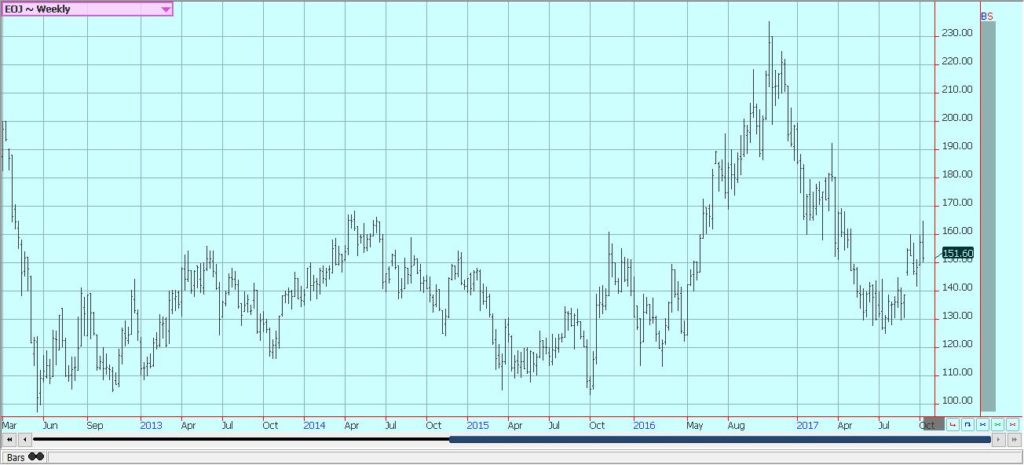

Frozen Concentrated Orange Juice and Citrus

FCOJ moved higher for the first part of the week as the market anticipated much-reduced production from USDA on the Thursday reports. Most private estimates had ranged from 50 to 60 million bags, but Florida Mutual Citrus estimated production at just 31 million boxes. The estimate caused futures to make new highs for the move. USDA estimated the crop at 54 million boxes, from 68 million last year and down sharply from initial ideas that ranged as high as 75 million boxes.

Futures collapsed on the estimate and weekly charts show that the market closed near some important support areas. There are ideas that USDA will reduce production in coming reports as it had limited time to survey all fields. Ideas remain that the Orange groves are badly damaged in Florida due to Irma. News reports from growers associations suggest that crops in many areas were almost completely destroyed.

Other areas suffered losses of 50% or more of the crop. Some growers say that trees will be stressed again next year due to the winds and rains from Irma. Florida weather is now drier, but showers are being reported. The demand side remains weak. Trees that are still alive now are showing fruits of good sizes, although many have lost a lot of the fruit. Brazil crops remain in mostly good condition.

Weekly FCOJ Futures © Jack Scoville

Coffee

Futures were lower in New York and in London last week, with commercials scale down buyers and speculators still the best sellers. The trends are down on the charts in New York as traders look at the potential for a big crop in Brazil. London trends turned sideways last week. The Brazil weather and tree condition is the main fundamental reason for lower New York prices. Rains appeared in Brazil a couple of weeks ago, then it turned dry again. These rains promoted flowering, and some reports indicate that flowering has been very good. Other areas have seen good flowering, but might not see much fruit as the trees have defoliated due to earlier stress. The rains will need to continue as it has been very dry and trees have been stressed for a year or more in some cases. Some were stressed after the production last year, while others suffered due to the dry and cold Winter. Even so, there are some hopes for a very good crop. Cash market conditions in Central America are more active as the next harvest continues. There is coffee to sell and offers are on the table for the next crop. Differentials have been stable but weak in the region. Colombia has reported some difficult growing conditions, but exports have held well as production appears to be good. Differentials have been stable and relatively strong.

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

Sugar

Futures were higher in New York and in London, and price trends are sideways in both markets. Both markets held support areas on the weekly charts and will probably try to extend gains this week. Support came from the UNICA data that showed less than expected cane processing and therefore less than expected sugar and ethanol production.

There was some talk of renewed interest in white sugar purchases to cause the buying in futures, and London has been the stronger market for the last couple of weeks. The market expects firmer prices over time as the Indian harvest could be delayed due to wet conditions that would delay sugarcane harvesting. There are questions about the Indian production this year as the distribution on monsoon rains was not uniform. Some areas saw flooding rains while others got well below normal totals.

The monsoon is starting to recede now. Overall upside potential is limited as there are still projections for a surplus in the world production, and these projections for the surplus seem to be getting bigger over time. Production potential in Thailand seems strong as monsoon rains have been better than last year.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

Cocoa

Futures markets were slightly higher in New York again last week, and are once again at the top end of a broad trading range. London was lower. Trends are starting to turn up on the weekly charts, and it could be that just about all of the bad news is now in the market. The weekly charts suggest that futures are completing what could be an important low at this time. Any new buying early this week could create a sharp short covering rally. The supply for the coming year would seem to be good and enough for the market.

However, the market is also now thinking of better demand as world economies start to improve. The European grind data was strong and above expectations in a release last week. Ideas are that the North American and Asian grind data can be just as strong when that data is released this week. Nigeria and Cameroon have both noted strong production from the initial harvest. Prices have been higher in both countries in the last couple of weeks as buyers have paid for better quality.

Ghana said it now expects higher production, and Ivory Coast is harvesting what is expected to be a bumper crop. The demand should continue to increase if prices remain relatively cheap and as retail prices continue to move lower in important consuming areas like Europe. World consumer markets, in general, seem to be getting better economically, also supporting better demand ideas. Grinders and chocolate manufacturers are able to make plenty of money with current differentials.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

Dairy and Meat

Dairy markets were lower again last week as futures move away from a short-term top. Milk and cheese demand has been mixed, but butter demand has weakened and prices in this market have moved sharply lower. Demand is good for cream, but cream has generally been available to meet the demand.

Cream demand for butter has been very good. Demand for ice cream has been mixed depending on the region but is becoming less now as the US summer comes to a close. Cheese demand still appears to be weaker and inventories appear high. US production conditions have featured some abnormally hot weather in the west that is hurting milk production. Production in the rest of the country has been strong.

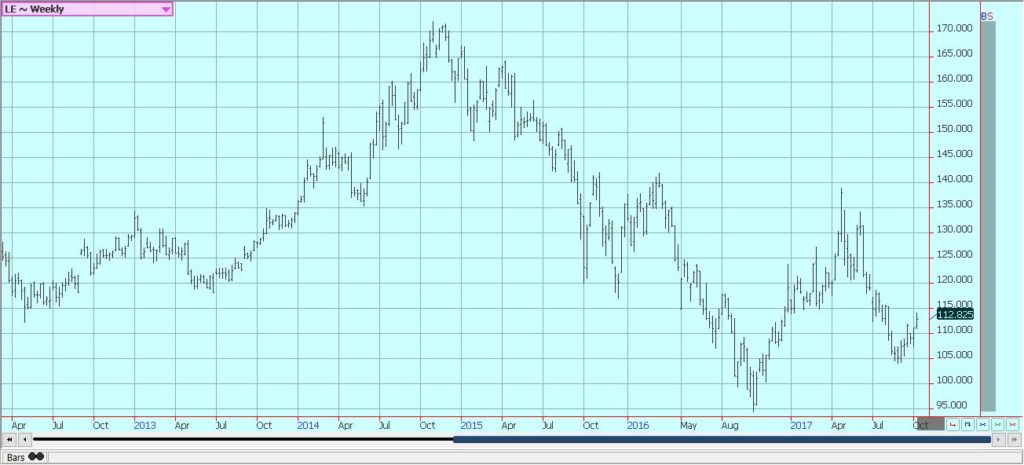

US cattle and beef prices were higher. Beef prices remain firm, and cattle traded about #2.00 per hundredweight higher last week. Ideas are that packers are still enjoying very strong margins at this time and can afford to pay more for cattle. This did happen last week. The beef market was somewhat better last week to support ideas that prices for cattle could continue to improve.

Cattle prices were steady to slightly weaker in early dealings and amid lighter than expected volume. It is the threat of increased supplies down the road that keeps the packers from buying aggressively. Feedlots are full, but ideas are that the big offer of Cattle has passed.

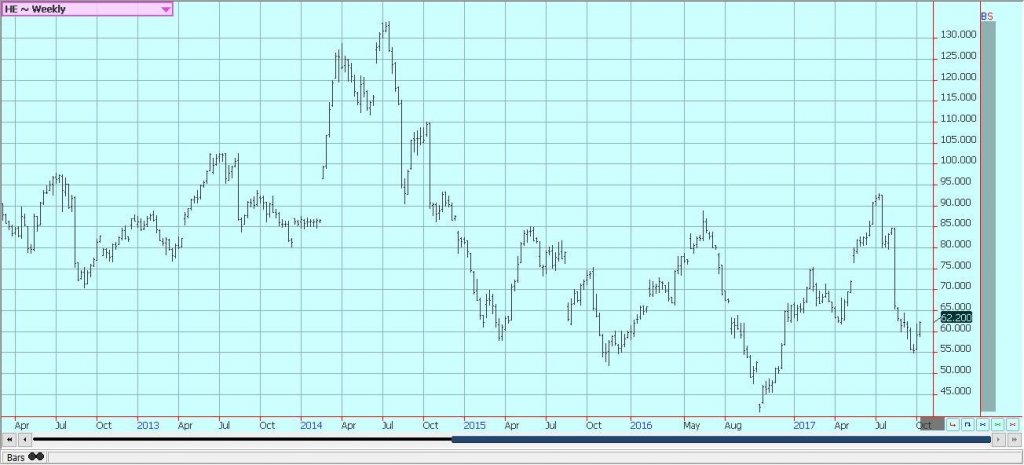

Pork markets and lean hogs futures were higher. Ideas are that futures are reflecting the weaker supply and demand fundamentals now, but the overall market seems to be improving. Demand has been improved for the last couple of weeks and this has affected pricing. There are still ideas of bug supplies out there, but the market seems to have the supply side priced. The weekly charts show that the market is trying to form a low at current prices, and futures have been cheap enough that a low is possible at this time.

Weekly Chicago Class 3 Milk Futures © Jack Scoville

Weekly Chicago Cheese Futures © Jack Scoville

Weekly Chicago Butter Futures © Jack Scoville

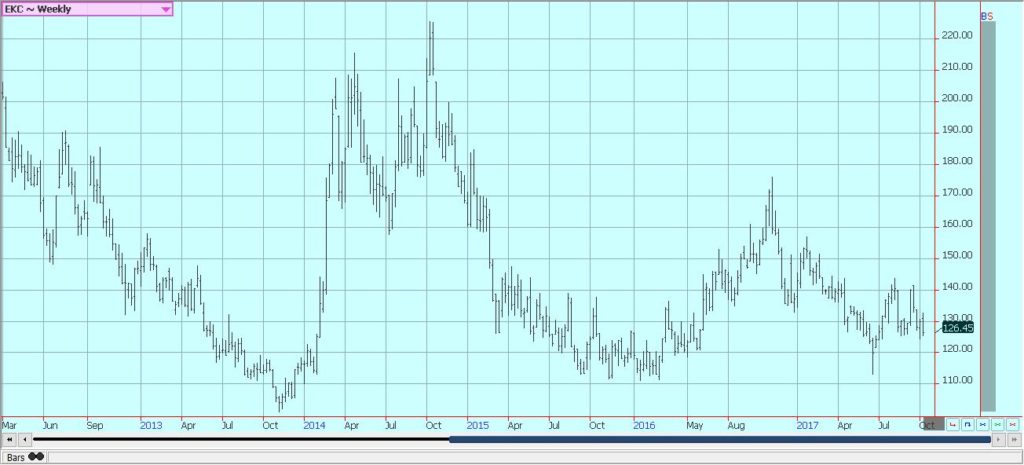

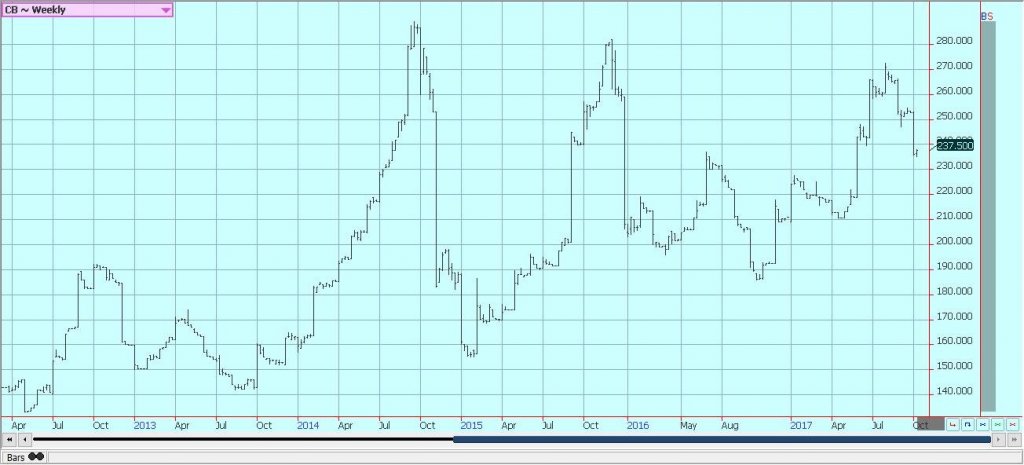

Weekly Chicago Live Cattle Futures © Jack Scoville

Weekly Feeder Cattle Futures © Jack Scoville

Weekly Chicago Lean Hog Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Markets1 week ago

Markets1 week agoCotton Market Weakens Amid Demand Concerns and Bearish Trends

-

Crypto2 weeks ago

Crypto2 weeks agoIs Strategy’s Bitcoin Bet Becoming a Dangerous House of Cards?

-

Fintech5 days ago

Fintech5 days agoFintech Alliances and AI Expand Small-Business Lending Worldwide

-

Crowdfunding2 weeks ago

Crowdfunding2 weeks agoSpain’s Real Estate Crowdfunding Boom: Opportunity, Access, and Hidden Risks

You must be logged in to post a comment Login