Business

Painting Startups By Numbers Part 1: An Overview Of Metrics

In the early days of a startup, it’s easy to get carried away in the romance of saving the world from some overbearing existential threat. The only problem is, once a product hits the market and investors are sought, cold hard reality often differs from expectations. This is where a solid understanding of metrics comes in handy, both for understanding and shaping a startup’s direction.

This is the first in a multi-part series about metrics in startups. This first installment will provide a brief overview of the categories of metrics available, and make a few generalizations about what they can tell us. In future installments, we’ll take a deeper dive into how the metrics are calculated and used.

Startups are often busy doing important disruptive work. And those that aren’t… well, they’re usually at least convinced that they are. Thus, it’s no surprise that, when speaking to the average founder, we’re going to hear about how great what they’re doing is. They’ll wax lyrical about the problem that they’re solving, the tech they’re solving it with, and how the world not only needs, but wants this solution. Basically, we’ll hear about everything except the fundamental numbers underpinning the entire business.

How do we know if a startup’s ideas are working out?

Of course, a focus on the big ideas is fine to a certain extent. Sometimes it’s even necessary—nobody cares how much runway a startup has if its big idea is selling air guitar accessories. The business is going to collapse eventually (although I’d love to be proven wrong here!). All a couple of numbers are going to tell us is if that collapse will be sooner or later.

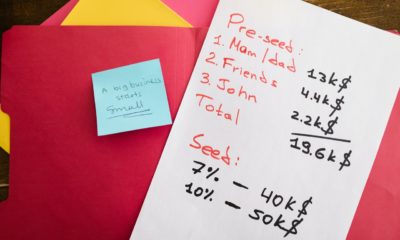

However, assuming all the ‘big idea’ stuff checks out, a startup’s metrics are some of the most powerful tools it has at its disposal. They help shape strategy, then determine its success or failure. They can tell a startup how fast it’s growing, and if its user acquisition costs are sustainable. And let’s not forget that they can make a big difference come fundraising time. The difference between startups snagging big-time lead investors and those who can’t even scrape together a piecemeal cheque can be as simple as a couple of numbers.

Startup metrics are simple if you can find your way through the weeds

The only problem with metrics is there’s an entire jungle of them out there full of CAGRs and CACs and things that go bump in the night. Trying to navigate them without any sort of guidebook is just going to lead to going around in circles and getting lost.

Fortunately, after beating through the sea of jargon and acronyms, the underlying principles are generally quite simple to grasp. All that’s required to get a good handle on most metrics applied to startups is a reasonable grasp of 4th-grade math seasoned with a little common sense.

It’s also surprisingly simple to navigate through the plethora of metrics that have cropped up everywhere. All that’s needed is a bird’s eye view and a few subtle pointers in the right direction.

Navigating the weeds

Startup metrics fall into three broad categories: Financial, User Acquisition, and Sales. This is, of course, generalizing a lot. There are crossovers between all categories, and sometimes the categorization of one metric into just one category will seem arbitrary. But it helps to direct focus and to understand what the numbers are trying to tell you.

Financial Metrics

Having a clear view of finances is crucial for any business, but perhaps even more so for growth-focused startups. Often with a singular focus on some growth-based “North Star Metric,” many startups find themselves on something of a kamikaze mission where the only chance for a bail-out is to secure more funding. And fast. Determining how long a startup has until a financial crash landing is one of the roles that financial metrics play.

But counting down the days until a startup’s death is a pretty grim way of looking at things. It’s also kind of missing the point and can lead to a preservation mindset. Remember, generally, startups are on a growth-at-all-costs mission. Preserving cash like life depended on it (even if it does) doesn’t serve growth. Ultimately, the goal is to make it to the next round of funding with just enough fuel left in the tank to survive any unforeseen delays.

Besides this, financial metrics also provide an insight into the future viability of a given product. Having a clear grasp of a product’s margins, for example, are vital. While any old product can survive on a diet of debt and VC, only the fundamentally profitable ever have any hope of surviving once cash injections dry up.

Sales Metrics

In theory, sales metrics are rather self-explanatory. Sales are good. More sales are better. How do we measure them? Count the units of stuff we sold and the beans collected. Simple… right? Well, not quite. As with many simple things in life, scratching the surface reveals a world of hidden opportunities.

Sales metrics also entail measuring things like the lifetime value of a customer, how long it took to acquire that customer, how much that customer puts in their basket, and how often they refill that basket… just to name a few.

The point of all this is to transform a few relatively static statistics into tools that can deliver valuable information about the business. If average basket sizes are falling, usually it’s not an isolated random event. It’s also useful to know for other reasons. A corresponding increase in customers can offset any revenue losses from declining basket sizes, effectively masking any problems that might exist.

Marketing and User Metrics

If a change in basket size can be masked by corresponding changes in the user base, the inverse also applies. Changes in the user base can also be masked if it’s not measured independently. This forms the basis of marketing and user acquisition metrics—measuring the number and growth rate of users.

Of course, like sales metrics, counting raw units only goes so far. Failing to peek beneath the hood leaves a wealth of information untapped.

The obvious place to start looking is user satisfaction. Acquiring users is great until they’re unhappy. Then user acquisition just becomes a euphemism for doing bad PR. And it goes without saying, doing the inverse of this is what every company—startup or not—should aspire to do.

The reason for marketing metrics being thrown into the mix here is that often user acquisition and marketing are one and the same thing. The end goal of marketing efforts is to acquire users. Thus, this category of metrics also involves looking at the cost of acquiring users and the channels from which they’re arriving.

Metrics are becoming increasingly important in startup investment

Taking a moment to state the obvious here, metrics alone do not make a startup. But they are shaping up to begin playing an increasingly important role in investment decisions after a year where countless investors let hype and FOMO get the better of them.

Already, due diligence on the business underlying an idea is becoming a bigger theme. Esports investors, as one example, are reported to have a greater appetite than ever before, but are also more reluctant than ever to enter into investments without doing thorough due diligence first. More broadly, we’re also starting to see startup events like the Startup Supercup put an emphasis on bringing quality startups to the event. This stands in stark contrast to the quantity over quality ethos that has historically allowed some thoroughly questionable startups to snag funding they were barely qualified to receive.

The challenge now is how to use metrics to objectively evaluate any given startup. Startups are necessarily different from ordinary businesses and, at times, traditional analysis and accounting principles can prove to be utterly useless. This is where a good understanding of the specific metrics available and how to combine them can come in handy, which is something we will touch more on in part 2.

—

(Featured image by RODNAE Productions via Pexels)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

A majority of the source material for this article was obtained via BBC. In the case of any discrepancies, inaccuracies, or misrepresentations, the source material will prevail.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Fintech2 weeks ago

Fintech2 weeks agoFintower Secures €1.5M Seed Funding to Transform Financial Planning

-

Impact Investing1 day ago

Impact Investing1 day agoItaly’s Listed Companies Reach Strong ESG Compliance, Led by Banks and Utilities

-

Impact Investing1 week ago

Impact Investing1 week agoBNP Paribas Delivers Record 2025 Results and Surpasses Sustainable Finance Targets

-

Crypto5 days ago

Crypto5 days agoUniswap and BlackRock Partner to Launch BUIDL in DeFi