Featured

Rice Demand Was Improved Last Week Over the Previous Week

Rice closed higher last week and chart patterns are positive once again. Ideas are that demand is not yet strong enough to take up the supply available to the market. The first crop has been largely harvested in Texas and in Louisiana, but the second crop s still in the field and is getting harvested now. Harvesting is winding down in both states now. Mississippi and Arkansas producers are at harvest now.

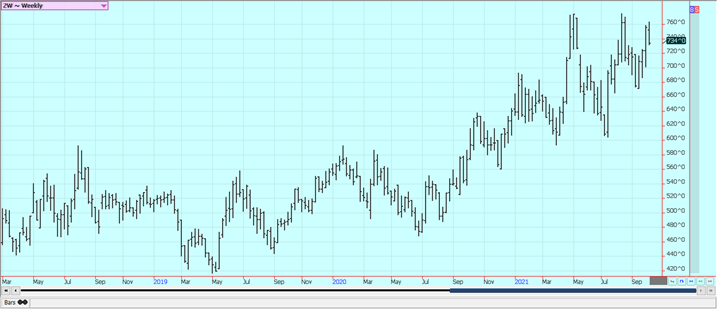

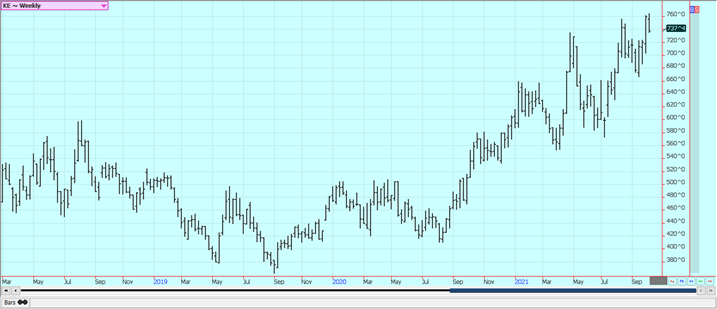

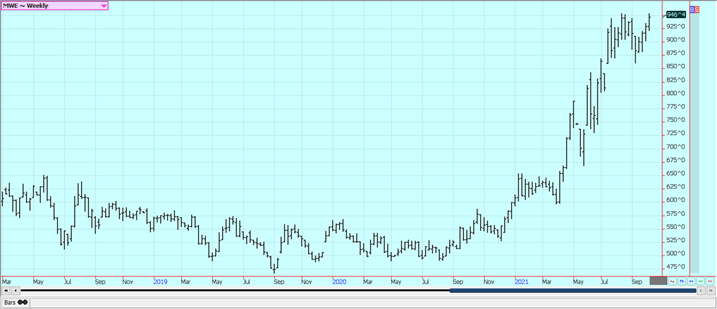

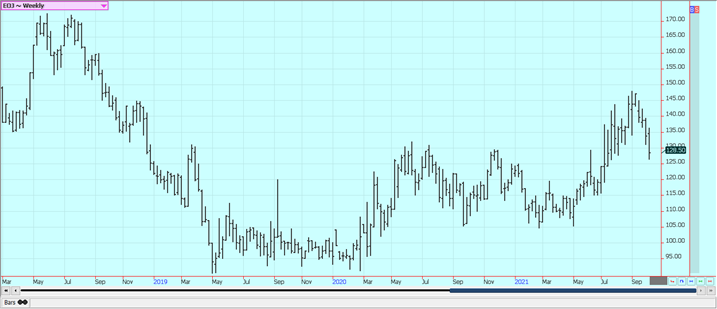

Wheat: Winter Wheat was lower last week and Minneapolis Spring Wheat was higher as are trends trying to turn up again on the daily charts. Trends are still up on the weekly charts. The US and Canada have reduced production this year and so do most exporters around the world. Production is less this year in Russia and internal prices have been strong. Dry weather in southern Russia as well as the northern US Great Plains and Canadian Prairies remains a supportive feature in the market although the weather has become old news. The Russian weather has been good for production in northern and western areas but is still trending dry in southern areas and into Kazakhstan. Siberian Spring Wheat conditions have been very good. Europe is expecting top yields in some areas but less yield in others and parts of eastern Europe and northern Russia are expecting strong yields. European quality is a problem due to too much rain in some areas and not enough in others.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

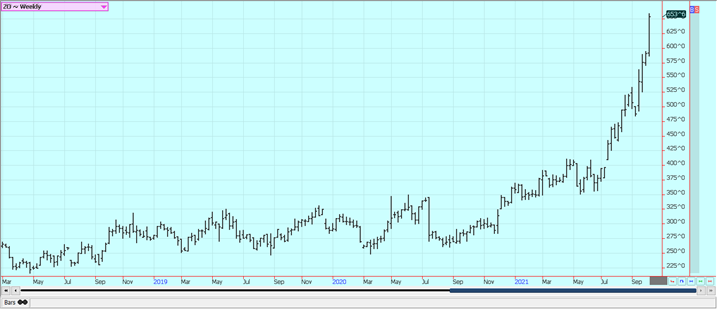

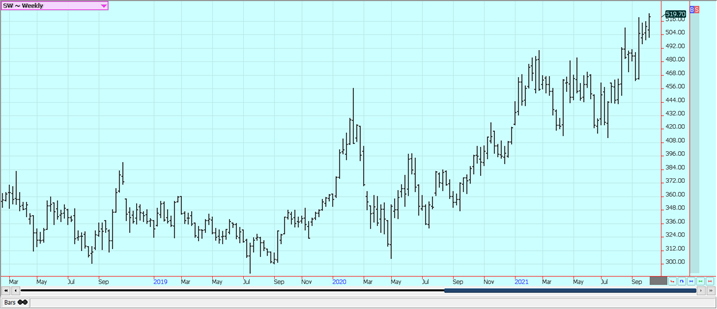

Corn: Corn was lower last week in consolidation trading. The weekly export sales report was positive. Demand will be an increasing feature in the trade moving forward as the harvest moves to its halfway point. Trends are mixed to up on the weekly charts and are mixed on the daily charts. Initial yield reports have been mixed, with some lower yields reported due to disease but some higher than expected yields reported in western areas. There are still the drought-reduced crops in the northwestern Corn Belt and northern Great Plains to be counted as well. Most of the elevators along the Mississippi are exporting again which is good news for nearby demand. Oats were higher as the market knows that supplies will be tight due to a drought in the northern Great Plains and Canada. There will not be much in the way of high-quality Oats for consumers to buy in the coming year.

Weekly Corn Futures

Weekly Oats Futures

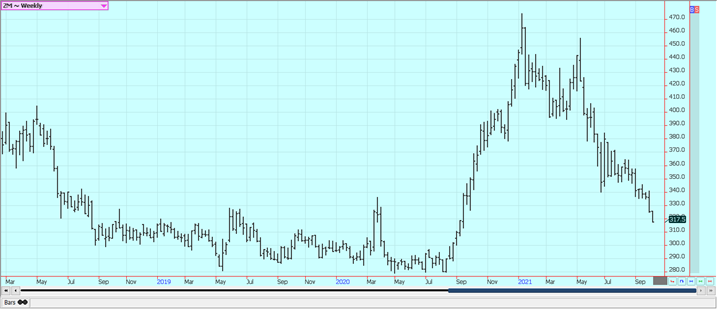

Soybeans and Soybean Meal: Soybeans and Soybean Meal closed lower last week as the US is at harvest. Many producers are harvesting Soybeans first to avoid any potential weather problems. Some are selling to elevators or delivering on contracts. The US hopes to get China to buy more ag products here in the US. The weekly charts still show downtrends for all three markets, and the daily chart trends are down in Soybeans and Soybean Meal. Chinese demand has been supportive until now as the country was active in the US Soybeans but China is on holiday this week so no sales announcements are expected. Harvest is moving to the halfway point for Soybeans and a harvest low might be seen about that time. Gulf port elevators are coming on line and exports are increasing.

Weekly Chicago Soybeans Futures:

Weekly Chicago Soybean Meal Futures

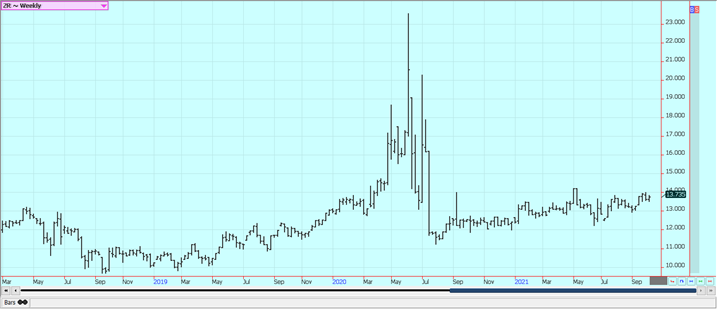

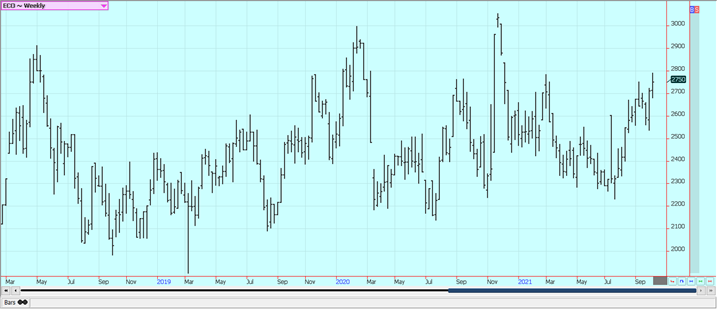

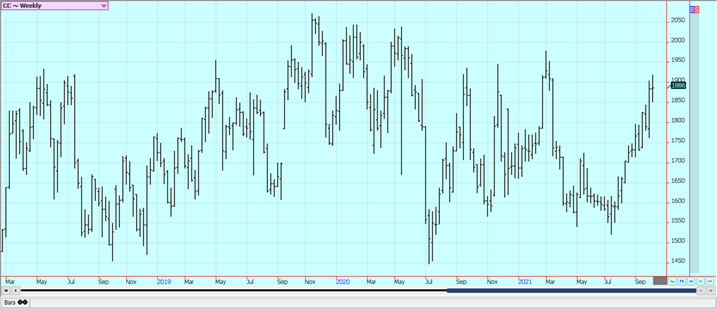

Rice: Rice closed higher last week and chart patterns are positive once again. Ideas are that demand is not yet strong enough to take up the supply available to the market. The first crop has been largely harvested in Texas and in Louisiana, but the second crop s still in the field and is getting harvested now. Harvesting is winding down in both states now. Mississippi and Arkansas producers are at harvest now. Yield reports and quality reports have been acceptable to many in Texas and are called good in Louisiana. The reports have been good in both Arkansas and Mississippi. Demand was improved last week over the previous week but demand must show consistently strong numbers to give anyone any comfort.

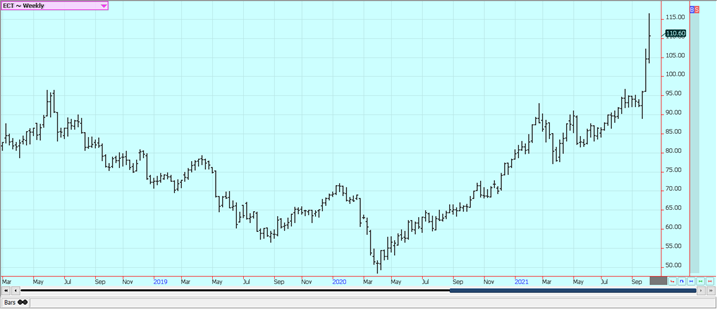

Weekly Chicago Rice Futures

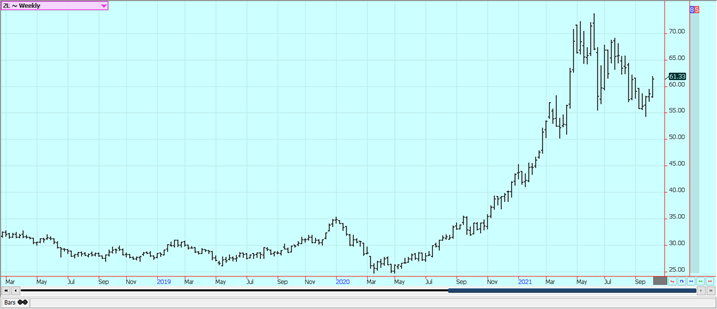

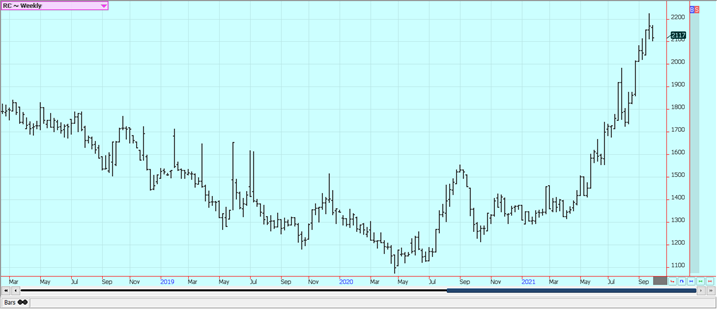

Palm Oil and Vegetable Oils: Palm Oil was higher for the week as export demand remains very strong and production remains weaker due primarily to Covid restrictions inside both Malaysia and Indonesia. India has been the major importer as the country reduced import taxes. The weekly chart trends are up again and Palm Oil has made new highs for the move and new multi-year highs. Canola closed a little lower on Chicago price action as the harvest is underway amid good conditions in the Prairies. The losses were very moderate when compared to the price action in Soybeans. Farmers are bullish and reluctant to sell and would rather work in the fields. The weekly chart trends are sideways. Production ideas are down due to the extreme weather seen in these areas. It remains generally dry and warm in the Prairies. The Prairies crops are in big trouble now due to previous hot and dry weather.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures:

Cotton: Futures were higher last week on ideas of strong demand and questions about supply. The US and China are talking again and the US is pressing China to complete its Phase One trade deal agreements. Demand for US Cotton remains very strong and that is good news for sellers as the strong demand implies strong prices should continue. The demand is expected to be strong from Asian countries as world economies recover from Covid lockdowns. Analysts say the demand is still very strong and likely to hold at high levels for the future. Good US production is expected, but there are some questions about the overall production in Texas. There are ideas of less production from India due to recent adverse weather in Cotton areas there. Chinese Cotton areas have had too much rain as well, and Chinese demand is also strong as clothes makers use foreign Cotton to get away from domestic supplies that might have been produced by forced labor and might not be allowed in the US or other western countries

Weekly US Cotton Futures

Frozen Concentrated Orange Juice and Citrus: FCOJ closed lower last week and chart trends are turning down as the weather remains generally good for production around the world. Weather concerns, especially for Brazil but also for Florida and Mexico, remained important. A freeze hit Sao Paulo state several weeks ago and reports of significant losses are being heard. It is now warm and dry, but some rain is in the forecast and flowering will be possible in the next couple of weeks. Weather conditions in Florida are rated mostly good for the crops with scattered showers and near-normal temperatures. Mexican crop conditions in central and southern areas are called good with rains, but earlier dry weather might have hurt production. Northeastern Mexico areas were too dry but have gotten good rains in recent weeks, and the rest of northern and western Mexico are rated in good condition. Florida is in the middle of the hurricane season but the storms have missed the state so far and crop conditions are good.

Weekly FCOJ Futures

Coffee: New York and London closed lower last week on forecasts for better rains for Brazil Coffee areas. The lack of Coffee and freight to move the Coffee now is still supporting futures. The rains will be spotty but just about all areas will get some rain and some areas will get enough rain over the next week or two to promote flowering. New York has found support from the lack of Coffee available in Brazil after extreme weather events. It has been dry in Brazil and there has been a big freeze there. London is having trouble sourcing Coffee from Vietnam due to a shortage of containers to carry the Coffee out of the country and as the country suffers from a resurgence of the Covid epidemic. Scattered showers are now in the forecast for Southeast Asia and big rains are possible in Vietnam from a tropical system. Good conditions are reported in northern South America with above-average rains and good conditions reported in Central America with near-average rains. Conditions are reported to be generally good in parts of Africa.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

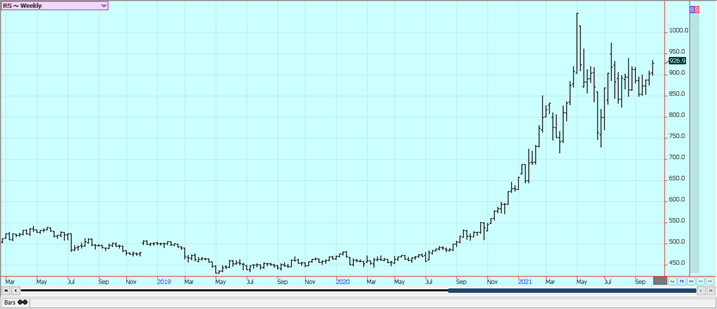

Sugar: New York and London were higher last week as supplies remain tight and demand is said to be improving. Trends are still trying to turn up again on the daily and weekly charts. Ideas are that the supplies available to the cash market are rather slim and that demand is increasing for both White and Raw Sugar. The reduced production potential from Brazil is still impacting the market. India is not offering as world prices are well below domestic prices and has had some weather problems of its own. Consumption of Sugar is said to be improving from previous low levels. Thailand is expecting improved production. It is raining in southern Brazil which will be good for the next crops there but the tight situation now must still be dealt with.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

Cocoa: New York and London closed higher in consolidation trading. Ideas of short West African production for the coming year are still providing the best support. There are increasing concerns that Ghana will have less production this year and it has been raining in the Ivory Coast to promote the return of disease to the pods. Ghana is the world’s second-largest producer behind Ivory Coast so reduced production in both countries could mean short supplies for the world market this year. World economies are starting to reopen after Covid and the open economies are giving demand the boost. Cocoa production in Ivory Coast is expected to drop by up to 11% in the 2021/2022 season that starts on Oct. 1 from the previous year. Ivory Coast arrivals are now 2.193 million tons, up 5.6% from last year.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by Kanenori via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Cannabis6 days ago

Cannabis6 days agoSouth Africa Proposes Liberal Cannabis Regulations with Expungement for Past Convictions

-

Biotech2 weeks ago

Biotech2 weeks agoVolatile Outlook for Enlivex Therapeutics as Investors Await Clinical Catalysts

-

Crypto1 day ago

Crypto1 day agoCrypto Markets Under Pressure as Vitalik Buterin Sells 17,000 ETH

-

Markets1 week ago

Markets1 week agoWeather-Driven Supply Outlook Lifts Coffee Markets in Brazil and Vietnam