Featured

Stock market volatility returns as gold soars and heads to super bull market

September is a notoriously bad month for stock markets, although we’ve had tops in September/October as well. The stock markets had a good week but a not so good a month. Gold put in a good month and now everyone is a bull. Could it be topping? As it soars, experts speculate that we could be on our way to a gold super bull a la the 1970s or the period 2008-2011. Meanwhile, volatility is back.

Is there a tsunami coming? No, we don’t mean a tsunami as in a wall of water caused by the displacement of large volumes in an ocean or a large lake, but instead a financial tsunami. A tsunami could be caused by an earthquake, a volcanic eruption, or an explosion above or below the water. A financial tsunami is associated with a market panic or bank run where fear is overwhelming. It usually results in a severe economic recession or depression.

There is a hurricane headed for the Florida coast. Hurricane Dorian has already been elevated to a category 5, a storm that packs a wallop at up to 180 MPH (285 KPH). Since everyone knows it is coming one can prepare for it. Well, only so much and the devastation could cost upwards of $10 billion or more, depending on where and how it hits. A tsunami? There’s a lot less warning and people are generally so fascinated watching the tide go out rapidly that they don’t fully comprehend the devastation that is about to hit them. Think of the tsunami on Boxing Day 2004 that devastated Indonesia and beyond, killing roughly 230 thousand people. Or the tsunami that hit Japan in March 2011, killing only 18 thousand but shaking the Daiichi Fukushima nuclear power plant and causing it to leak radioactive steam. They are still trying to clean up that mess. The cost exceeded $235 billion.

A financial tsunami? The 2008 financial collapse was a classic. Few realized it was coming even though the first signs were visible in 2006 when housing prices faltered after climbing relentlessly for years. As well, few understood the questionable lending practices of financial institutions that mortgaged people up for more than 100% of the value of the home. Fewer still understood the financial derivatives behind mortgage-backed securities that had been sold to thousands of investors, including mutual funds and pension funds. The derivatives helped drive up the demand. Even the Fed didn’t grasp that the sub-prime crisis would spread beyond the housing market. And finally, who would have thought that credit default swaps would blow up a reputable, nearly 100-year-old insurance company, American International Group (AIG).

There is an old saying, “no one rings the bell at the top.” But many make their living predicting the end of the world. Perma bears they are called. It may take some time, but eventually, markets do recover. It only took six years for the Dow Jones Industrials (DJI) to regain its 2007 high on both a nominal and inflation-adjusted basis. That’s pretty good. On the other hand, it took until 1954 for the DJI to regain its 1929 high. That wasn’t so good.

The 2008 financial crisis was bailed out with the biggest liquidity injection ever seen—quantitative easing (QE). On steroids, it seems. As well, interest rates were lowered to levels no one thought possible. Yes, we have enjoyed a ten-year bull market in stocks. But it has been driven higher on a wave of liquidity and ridiculously low-interest rates. The global economy has enjoyed significant growth but more significantly debt expanded even faster. Total U.S. debt (government, corporations, consumer) increased $23.6 trillion from 2008–2019. But U.S. GDP grew by $7.3 trillion only. It took $3.23 of new debt to purchase $1 of GDP. Globally, debt has increased by over $100 trillion, much of it issued in U.S. dollars to foreign entities. World GDP on the other hand only grew by about $23 trillion meaning it took over $4 of new debt to purchase $1 of GDP. Is that sustainable?

There has been growth over the past decade averaging roughly 2.4%/year. Asia (China, India) has led the way. The growth, however, has been unevenly distributed. A few gained a lot even as many faltered, stood still, or fell back. The chart below shows the comparison. From 1989 to 2018 the top 1% in the U.S. saw their wealth grow by $21.1 trillion. The bottom 50% saw their wealth actually fall by $0.9 trillion largely because of debt. Trump’s $1.9 trillion tax cut over 10 years largely benefitted the wealthy—both individuals and corporations. The bottom groups, not so much—indeed, very little. That’s not so good. Social inequality has helped give rise to anger and the rise of right-wing populist parties.

But, what now? Trade wars are raging, triggered by Trump. Stock markets rise and fall on a presidential tweet, a China retaliation, or China soothing words. Yield curves have inverted. Many are having a nervous breakdown because inverted yield curves have predicted recessions consistently over the past 60 years. But not every yield curve inversion has resulted in a serious stock market correction or deep recession. The early 1990s’ recession saw only a mild stock market pullback. Once it bottomed, the 1990s saw a spectacular bull market that ended when the dot.com/high-tech bubble burst in 2000.

The global economy is slowing, particularly in Asia (China, India) and the EU where Germany recorded negative growth in the most recent quarter. U.S. GDP growth for 2019 is expected to be a sluggish 2.2%, the EU 1.2%, and Japan 1.0%. Despite massive injections through QE in both the EU and Japan and now the potential for lower interest rates in the U.S., growth can only be described as very sluggish. Something is terribly amiss that years of lower interest rates and massive injections of liquidity through QE and debt did not produce more economic growth. However, the stock market went up.

The world has also seen the rise of negative yield bonds where the current estimate is $17 trillion making up a quarter of investment-grade bonds. Yes, that’s $17 trillion, up nearly $2 trillion in the last month alone. 80% (or more?) of German bonds are negative yield and the entire Danish government bonds are negative. There have been 50-year and 100-year bonds issued. Even negative-yielding corporate bonds have reached over $1.2 trillion. Mind-boggling. Anyone who thinks this is normal hasn’t read their history of financial collapses. See This Time is Different, Eight Centuries of Financial Folly, Carmen M. Reinhart & Kenneth S. Rogoff.

Yields on the 30-year U.S. Treasury bonds have fallen to record lows. Yet growth remains sluggish at best and is threatening recession. Negative yield bonds make absolutely no sense, yet pension funds are forced to buy them because of their liquidity requirements. That’s insanity on steroids. Negative yield bonds push investors into riskier assets, including the stock market. Gold, the ultimate safe haven, has been a major beneficiary. And what happens when interest rates inevitably rise? The belief seems to be that interest rates may be negative, but they could become even more negative. Financial folly knows no boundaries.

Total negative-yielding corporate bonds outstanding

Despite all the potential negatives and some inevitability of a recession following the longest period ever with no recession, there are pundits who believe the stock market will soar to even higher highs. Yes, they could be right. The claim is we are in a bubble. Except even we see few signs of the kind of euphoria that would normally accompany a bubble top. The huge amounts of liquidity injected into the financial system over the past decade because of QE and debt have helped fuel the stock market. Low and even negative yields on bonds have also helped push funds into the stock markets seeking higher returns.

Fear of an inverted yield curve?

The chart of the S&P 500 with the 10-year U.S. Treasury note/3-month Treasury bill spread shows that the record can be mixed. A negative yield curve in 1989 didn’t stop the market from going higher. The stock market decline took place from July to October 1990. The S&P 500 fell about 20%. The recession lasted from July 1990 to March 1991 with a U.S. GDP decline of 1.4%. The yield curve turned negative in July 2000. That largely coincided with the final top in the stock market.

The official recession lasted 8 months from March 2001 to November 2001 falling only 0.8%. The stock market didn’t bottom until October 2002. The yield curve went negative in August 2006; however, the stock market kept climbing, not topping until October 2007. By the time of the financial crisis of 2008 the yield curve had already reverted to positive. The Great Recession lasted from December 2007 to June 2009 and saw GDP fall 5.1%.

A negative yield curve is not necessarily a solid predictor of either a recession or the performance of the stock market. It can vary. And so, it might this time as well.

Our original question was, “Is there a financial tsunami coming?” The jury is out. It might be, but then again it might not be as bad as the doomsayers say or as easily dismissed as the ultra-bull market optimists view it. Even in a 2008 financial crisis where the DJI fell almost 54% the market today would only fall to around 12,500. That’s above the high of January 2000 and 12% below the high of 2007. The DJI potentially breaks down under 23,000. Until then the major long-term trend remains up.

Meanwhile, the current focus is on Hurricane Dorian, forest fires in Brazil, and the ongoing violence in Hong Kong. Now they are having a tsunami.

Markets and trends

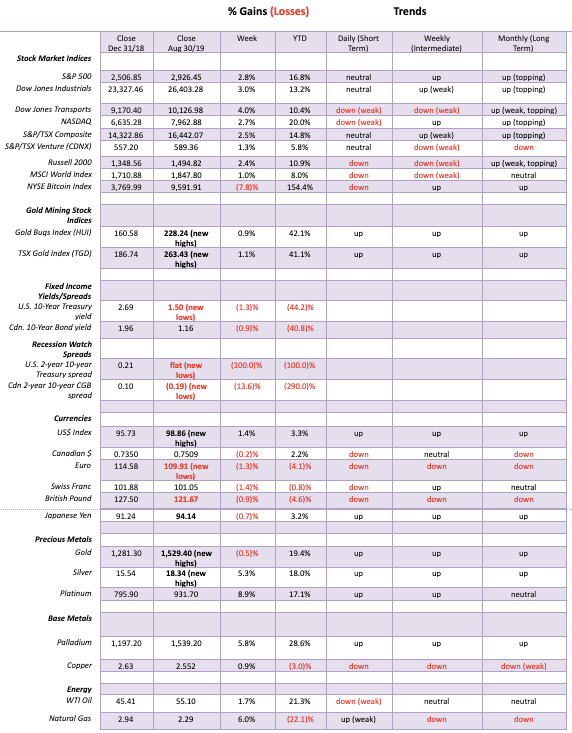

Markets enjoyed a solid up week. The S&P 500 gained 2.8%, the Dow Jones Industrials (DJI) was up 3.0%, the Dow Jones Transportations (DJT) jumped almost 4%, and the NASDAQ, even though it was the laggard, was still up 2.7%. The TSX Composite leaped 2.5% and the TSX Venture Exchange (CDNX) lagged, gaining 1.3%. In overseas markets the MSCI World Index gained 1%, the Boris Johnson and Brexit challenged London FTSE gained 1.9%, the Paris CAC 40 was up 2.9%, and the German DAX gained 2.8%. In Asia, China’s Shanghai Index (SSEC) was down a small 0.4% while the Tokyo Nikkei Dow (TKN) fell 1.2%. The beleaguered Hong Kong Hang Seng Index lost 1.7%.

After topping on July 26 at 3,027, the S&P 500 fell 6.8% into August. Since then, the index has consolidated in a trading range roughly between the lows at 2,820 and recent highs at 2,940. This trading range is not dissimilar to what was seen after the first decline from the January 2018 top and later the October 2018 top. Once the consolidation was complete the market broke down. The January/February decline saw the S&P 500 fall 11.9% while the October/December decline saw a 20.2% decline. They were the steepest declines since 2015/2016.

We suspect that they may have been the 4-year cycle low (range 3–5 years). If the market were to break down again below 2,800 then the S&P 500 could be on its way to the bottom of what we believe is a huge broadening channel. That could take the S&P 500 down to 2,200 for a total decline of 27%. That could either complete the 4-year cycle low or we could be witnessing the completion of a slightly longer 6.5-year cycle low (range 5–8 years). That is, however, less likely as the time frame so far is too short although arguably, we are roughly 8 years from the 2011 low and 10 years from the 2009 low.

One cannot rule out another run to new highs by October. At least not until we firmly break under 2,800 that would suggest we are on the next leg down. September is a notoriously bad month for stock markets ranking 12th since 1950. We are reminded, however, that some important tops can occur by October, most recently 2018 and more notably 2007. These highs came following lows in August. A firm breakout above 2,950 and especially above 3,000 could set the stage for a run to new highs. So far, the 50-day MA (2,945) is acting as resistance while the 100-day MA (2,910) has generally acted as support. The 200-day MA is down at 2,805.

While it is possible, we could rally from current levels the pattern would seem to favor a decline. We believe that once the S&P 500 falls to the bottom of the broadening channel or near it a more significant rally could get underway.

Despite the solid up week, the S&P 500 finished August down 1.8%. The DJI was down 1.7%, the DJT lost 5.4%, and the NASDAQ fell 2.7%. The small-cap Russell 2000 was down 5.1%. The long-term uptrends remain intact although the short-term trends wavered this past month. This past week’s gain put some of the indices in a more neutral position short-term. The intermediate weekly trends are wavering between neutral and up. The DJT and Russell 2000 intermediate trends are down as both trade under their 200-day MA.

This week will be key. If the S&P 500 can push up through 2,950, then the odds increase that we could be on our way to new highs. A failure at that level would return the focus to 2,800 support. For the DJI, the respective zones are 26,575 for resistance and 25,600 for support.

The failure for the small-cap Russell 2000 is cause for concern for the market. Small caps tend to be the leaders both up and down. So far, the Russell 2000 has been mostly leading to the downside. It topped back in July 2018 and saw a 27% decline into December 2018. The rebound rally has failed to regain back above 200-day MA. The current pattern has the look of a descending triangle, suggesting that the break could be to the downside. The Russell 2000 breaks down under 1,450 and could target down to 1,280.

Whether it’s a bull market or a bear market, we prefer that the indices do what they are supposed to do. The Russell should lead. However, it’s to the downside, suggesting a fall for the market. The same phenomenon is being seen between the DJI and the DJT. The DJT has failed to confirm the DJI. These divergences usually play out in the direction of the weaker index from tops.

The VIX volatility indicator has never reached levels we would normally associate with a significant bottom. The S&P 500 remains below its 50-day MA while the VIX is above its 50-day MA (the two trade inversely to each other). As long as the VIX stays above its 50-day MA, the odds favor the downside for the S&P 500.

The Philadelphia Semi-Conductor Index (SOX) continues to struggle. It appears to be forming a potential ascending wedge pattern (bearish). However, it does have considerable room to move higher within the wedge. So, in that respect, the chart of the SOX is an argument that the markets could still go higher before they break down. The SOX is trading above its 50-day MA. If it can take out 1,525, then the odds favor the upside. Worth keeping an eye on.

The NYSE advance-decline line is the bulls’ great hope for higher markets. The NYAD appears to have broken out once again to new highs. This will (and should) get the bulls all excited that we are headed once again to new heights. We have asked before: could the NYAD be misleading everyone?

Nonetheless, if the S&P 500 can break out over 2,950 and especially over 3,000 we’d comfortably say that new highs are probable. But we are late in the game. So, the question is – do you want to chase it, or sell the rally? The NASDAQ advance-decline line is nowhere near its highs. Thus it is diverging with the NYSE advance-decline line.

The NYSE new highs minus new lows have returned to the bull market side. Another sign that the market may actually be poised to move higher first into a potential top in October. We note as well (not shown) that the CBOE put/call ratio is once again favoring more puts than calls. That is often a bullish sign as the put buyers get it wrong at the bottom. The McClellan Summation Index (ratio adjusted) known as the RASI is around 300 neither bullish or bearish.

But, overall, breadth is not that great as the percentage of stocks trading above their 200-day MA is only at 60%. We’d feel better if the SPXA200R were trading above its 50-day EMA, currently at 63. But the signal is while the market could work its way higher into September/October the rally is narrow and it is being carried higher by a few.

Back in April, the TSX Composite barely made new highs above the one seen in July 2018. Since then, the TSX Composite has been in a trading range between 15,960 and 16,640. Like some other indices, the TSX Composite is poking its head above its 50-day MA but it does need to break out over 16,600 to suggest to us that new highs are possible. Major resistance can be seen at the top of what may be a broadening channel near 16,900. Note as well the declining volume.

That is not unusual given these sideway trading patterns. The pattern breaks down under 16,000 with the 200-day MA just below at 15,890. A breakdown could target down to 15,300. For the record, the TSX Composite was pretty flat in August, gaining a small 0.2%. The TSX Venture Exchange (CDNX) lost 0.4%. Sub-indices moving higher during August were: Income Trusts +3.2%, Consumer Discretionary +0.1%, Consumer Staples +4.5%, Materials +5.7%, Real Estate +2.6%, Information Technology +5.6%, Telecommunications +0.7%, and Utilities +4.2%. The big winner was Golds, up 16.1%. Global Mining was flat. Losers were Energy -6.1%, Financials -2.7%, Health Care -12.8%, and Industrials -0.1%.

The financials can’t get out of their own way. For that we should all be concerned as no matter how we cut it, if the financials don’t perform then it plays into the rest of the market and the economy. Actually, these charts of the TSX Financials and the KBW Bank Index look great when one compares them with the EU bank index. Both indices have failed previous highs. Both are pointed down. Not only has the KBW Bank Index failed to make new highs, but its all-time high was way back in 2006.

13 years and counting and investors in bank stocks are still underwater. At least Canadian financials reached new heights in January 2018. If there is a bullish argument the TSXFS could be forming a large head and shoulders bottom pattern with the left shoulder forming in 2018, the head the December 2018 low while we are working on the right shoulder. The breakout is above 310. It looks good unless it breaks under 286 the left shoulder low (recent low was 288). If that happens, then all bets could be off for a breakout. The focus would shift to the December low near 260.

Could China’s Shanghai Index (SSEC) be poised to break out to the upside? The SSEC has formed what appears to be a descending wedge (bullish) and may have completed an ABC-type correction from the high in April 2019. It is very close to breaking out. On the other hand, it could fall once again into the wedge triangle. The current bottom is around 2,700. This current rally could just be a 4th wave up. But it bears noting and watching. If the SSEC breaks out, then the odds favor that maybe the U.S. and China have come to some sort of deal.

The index of leading indicators from the Economic Cycle Research Institute (ECRI) is in negative territory. The most recent release is at 141.8. down 0.7 from the previous week. The year-over-year 4-week MA is -2.19%. That puts it just above where it was before the start of the previous 2007–2009 recession. The index peaked back in early 2017. Purchasing Managers Indices have been falling but are not as yet in recession territory (below 50). The current Chicago PMI was last at 50.4, hanging just above the key 50 level. Does all this mean that stocks can’t rally even in the face of deteriorating economic conditions? Of course not. But it is a warning.

Trade wars are shaking consumer confidence. The final August Michigan Consumer Sentiment Indicator came in at 89.8 down 8.6 from July. It was the largest monthly decline since December 2012. In surveys, most consumers mentioned the trade wars as a negative. Maybe Trump’s crazy negotiating manner works for trying to get a deal but it is unnerving the consumer. If the consumer sticks his hands in his pockets then the economy is sure to fall into a recession.

The U.S. 10-year Treasury note fell to a low of 1.47% this past week, the lowest level seen since July 2016 when the 10-year hit its record low at 1.37%. The decline has been rapid given it was at 2.60% back in April 2019. There is an argument that bond yields may have hit their trough; however, we cannot rule out even lower yields until the 10-year regains above 1.62% at least, the most recent high. Just testing the 50-day MA would take the 10-year back to 1.80%.

Bonds are being snapped up because of fear that they may actually go lower. A bond bubble? As well, investors from negative-yielding bond zones like the EU and Japan are snapping up U.S. Treasuries because of their higher yield. And they go unhedged as their currencies have been falling (the euro just hit new 52-week lows). The market may be tiring here, but there is nothing we see that might suggest we are about to turn higher again. We may even take out the July 2016 low.

Recession watch spread

Our 2-year–10-year recession watch spread briefly went negative this past week before rebounding and closing flat. No, this spread doesn’t even seem to be our main recession watch spread any longer because of the even more closely watched 10-year–3-month treasury spread. We covered that in our main essay so we won’t do it again. Still, even this one is just to be noted. As we have noted before, once the spread does turn negative it has taken on average 14 months before a recession actually arrives.

How low can we go? The 10-year German bund closed at negative 0.71% this past week. It’s complete insanity that investors are willingly going to lose money just to be in a liquid market. And many have no other choice but to buy them. Pensioners cannot be pleased as it may suggest that their pensions will eventually be cut. We suppose the good news is that the 10-year U.S. Treasury is 221 basis points above the bund. And Canada’s 10-year is 187 basis points above the bund. So, investors looking for a return buy U.S. or Canadian bonds—unhedged.

The US$ Index surged to new 52-week highs this past week, jumping 1.4%. The US$ is the safe-haven currency and capital flows into the U.S. buying U.S. treasuries or investing in the U.S. stock market. With the US$ Index hitting fresh 52-week highs, it was no surprise to see the euro fall to 52-week lows as it lost 1.3% this past week. Everybody lost, it seems, with the Swiss franc down 1.4%, the Brexit-challenged pound sterling off 0.9%. and the Japanese yen down 0.7%. The Canadian$ didn’t escape as it fell 0.2%. With this rise, one has to wonder whether it is possible to challenge the 2016 high at 103.82.

Certainly, the next potential target is for the US$ Index to rise to 100. The rise has been quite irregular and we confess it has been difficult to read it. Overall, it all still looks corrective to the decline that took place from December 2016 to January 2018. But if this is a B-wave up, they can return to the former highs.

The rising US$ Index seems counter to expectations that instead it would fall because of the Fed lowering interest rates and loosening monetary policy. But then, when both the EU and Japan have an even looser monetary policy and lower interest rates (see all those negative-yielding bonds), the spread with U.S. treasuries continues to make them more attractive. If there is a carry trade going on—i.e., borrow in a cheap falling currency and invest in a rising higher-yielding currency—then we do note that carry trades tend to end badly and unexpectedly.

The high U.S. dollar is playing havoc with borrowers of U.S. dollars in foreign countries as they have to pay back U.S. dollars but their earnings are in collapsing foreign currencies. That’s one reason we are concerned about debt defaults rising in countries other than the U.S. because of their high borrowings in U.S. dollars—China in particular. The market for U.S. treasuries is also the largest and most liquid in the world. And yields aren’t negative.

The US$ Index breaks its current uptrend at around 97.50 and breaks down under 96.

The broader trade-weighted U.S. dollar index has soared to new highs, currently at 130.5. This is a broader measurement of the U.S. dollar as it contains 26 different currencies vs. only six for the US$ Index. Each currency is weighted as to the value of U.S. trade with the country. Most follow the US$ Index for trading purposes but economists pay more attention to the trade-weighted dollar index. It is a truer measurement of the value of the U.S. dollar.

Despite a rising U.S. dollar, gold managed to make new 52-week highs this past week before turning down and closing the week down 0.5%. On the month, gold was up 6.4%. Silver gained 5.3% on the week and was up 11.8% on the month. Platinum finally came to life, gaining 8.9% this past week and finishing up 6% on the month. Finally, palladium closed up 5.8% this past week, gaining 1% on the month. Bullish sentiment for gold remains high at around 90% and the RSI is high, although it pulled back from over 70 this past week.

Gold hit the top of a channel with a high of $1,565. We are maintaining that gold still has the potential to rise further to targets around $1,590 to $1,600. Trouble would surface if gold were to fall back under $1,500 and a breakdown would be underway below $1,480. Sentiment may be extremely bullish for gold, but we have seen in the past high sentiment accompanied by constantly rising prices. Gold is considered a safe haven in times of economic uncertainty and loose monetary policy. Trump’s trade wars are golden for gold. Negative yielding bonds are also golden for gold as at least gold has a carry price that is not negative. The huge bottom that formed between 2013 and 2019 still suggests a potential move to $1,725–$1,750. Once gold broke out above $1,370 and especially above the 2013 rebound high of $1,434 it set gold on its current course.

During gold’s run from $681 the low in October 2008 to its ultimate high in September 2011 at $1,923, there were two significant corrections of 14% and 15%. Plus, there were several smaller pullbacks. So, it wouldn’t be unusual now to have a pullback before moving to another higher level. Gold fell from 2011 to 2015 then bounced around from 2015 to 2019 before breaking out. It is highly unlikely that this breakout is over in a mere three months. More likely it could last upwards of two years.

Gold’s run in the 1970s lasted three and half years from August 1976 to the high in January 1980, and the more recent gold rush lasted from October 2008 to September 2011—three years. Gold rising even as the U.S. dollar rises is a positive sign. If the U.S. dollar starts to fall, then gold’s rise could be even more pronounced.

The commercial COT for gold improved slightly this past week to 24% from 22%. Long open interest rose just over 15,000 contracts even as short open interest also rose by roughly 13,000 contracts. The commercial COT is still negative. The large speculators COT (hedge funds, managed futures, etc.) slipped slightly to 85% from 87%. Still exceptionally high. The commercials are as short as they were during the last months of the gold bull market 2008–2011. Could they get shorter? The only other period the commercials were this short was near the high of 2016. So, it is a warning sign.

Is platinum coming out of a long funk? Platinum has been a terrible performer vis-à-vis gold with prices down around where they were during the 2008 collapse. Platinum has broken out of a channel coming down from the 2016 top. Above lies the trend line from the 2008 top. Platinum has more work to do, but the breakout point appears to be above $1,000. Platinum prices are cheap vs. gold.

Given the strong U.S. dollar, it is no surprise that gold has been making record highs in numerous currencies—over 70 at last count. Gold in Cdn$ is no exception as the price recently broke above $2,000. Gold in Cdn$ has broken out of an 8-year symmetrical triangle. This should be quite bullish going forward. The symmetrical triangle suggests an ultimate price target of around $2,450. Currently, with a weekly RSI over 80, this needs a pull-back to regroup and work off a bit of the super-bullishness. But we’d only be concerned if gold in Cdn$ were to fall back under $1,800. With gold rising in all currencies we know we are in a global gold bull market. There may be pullbacks, but overall the charts are suggesting higher levels ahead.

Is silver finally starting to show some leadership? Silver has a habit of leading in both bull and bear markets. The gold/silver ratio which at one point had reached over 90 is finally back down a bit currently at 83. It has a long way to go to get to at least a more reasonable level at 70. If it were there now, silver prices would be $21.80. So, silver remains undervalued even at these levels. Still silver appears to have hit a top of a channel this past week as it made 52-week highs at $18.76.

Given the extreme bullish sentiment (over 90%) and high RSI over 70, a pull-back would be healthy. We could be forming an ascending wedge triangle, but even in its current state silver would appear to need more work at higher prices. Silver this past week finally broke above the trendline from the 2013 rebound high of $25.12. That trendline was a breakout above $18. What silver needs to do is build value above $18. A breakdown back under $17.80 would be negative and could suggest a fall-back towards $16.

Like gold, silver had a number of corrections from its low of $8.40 in October 2008 to its high of $49.80 in April 2011. Some were as steep as 25%. But given the fresh breakout, we wouldn’t expect a correction of that nature immediately.

The silver commercial COT fell this past week to 33% from 35% the previous week. Long open interest fell roughly 5,000 contracts while short open interest rose about the same. The large speculators COT rose to 70% from 66%. The commercials short position is as large as it has been since the bull market of 2016. So, it is a warning sign that we could be headed for a corrective period.

Gold stocks, as measured through the gold stock indices, rose to fresh 52-week highs this past week. The TSX Gold Index (TGD) rose 1.1% while the Gold Bugs Index (HUI) was up 0.9%. Both pulled back from the highs and from what appears to be the top of a bull channel. Both indices enjoyed a solid up month as the TGD gained 16.1% and the HUI jumped 14.5%. The TGD is now up 41.1% on the year and the HUI is up 42.1%. They’re shaping up to be stellar performers, considering both were at one point down on the year.

As with silver, the TGD appears to be forming a possible ascending wedge triangle. The breakdown point appears to be at 250. So, this does bear watching closely. One can’t go broke taking a profit.

The TSX Gold Index (TGD) TSX Composite (TSX) still looks enticing. The past few months have favored the TGD over the TSX, but one has to remember it is coming out of a deep hole. The ratio needs to break out over 0.02 to suggest that a more sustained move in favor of the TGD could be underway. This is a different look at the popular Dow Gold ratio.

Mr. Copper has been miserable. Copper is a sign of the economy and for the past several months copper has been on a downswing. But the chart is interesting as copper appears to be forming a descending wedge. This could suggest a potential breakout to the upside above $2.60. A bigger breakout occurs over $2.70. On the other hand, copper could continue deeper into the descending wedge before turning up. This past week’s action suggested a failure of just under $2.60.

We thought this interesting. This is a chart comparing the performance of gold vs. the S&P 500 Total Return Index. Data on StockCharts was only available from March 2006. Gold appears to have broken out of a long slumber not too dissimilar to the long-dated chart of gold. Meanwhile, the S&P total return has been faltering over the past several months.

Energy remains miserable. Oh, WTI oil managed to gain 1.7% this past week while the NY Arca Oil Index (XOI) was up 3.2%. The TSX Energy Index (TEN) gained 4.6%. It was a good thing they all put in gains this past week, as over the past month WTI oil fell 5.9%, the XOI was down 7.4%, and the TEN was off 6.1%.

Misery is the energy sector. Falling demand, too much supply, and no serious outbreak of war in the Middle East. Not even major tension in the Gulf of Hormuz despite the saber-rattling between the U.S. and Iran. These charts do not encourage bullishness either. Both are in downtrends and we see no sign of a bottom for the XOI while WTI oil appears to be forming a descending triangle (or at least a symmetrical one) that suggests once it breaks under $50 the fall could be down to $40.

The initial break would come with WTI oil under $54. Things may be miserable in Alberta’s oil patch, but they could soon be getting worse. And their oil is still landlocked with foreign companies leaving. As we noted, falling demand and too much supply.

Chart of the week

Could it be that the current gold market is somehow following the 1970s bull market for gold? How does one compare? The 1970s gold bull market got underway in 1971 when gold was pegged at US$35/ounce. It peaked in January 1980 at $US878.50/ounce. The current bull market in gold got underway in April 2001 when gold was trading at $US252.10/ounce. It has been underway for 18 years vs. only 9 years for the 1970s bull market.

In taking the time element out of the equation, Gold Charts R Us (GCRU) has given us a series of charts that effectively compares the two gold bull market runs. Despite the differences in length of time, there are some interesting comparisons. GCRU is, by the way, a fascinating collection of charts featuring gold and silver, but also including numerous charts on gold stocks, stock market indices, bonds, and more that cover the world. The web site is run by Nick Laird. Nick’s collection may be one of the most comprehensive seen anywhere. His work is highly valued in the community.

The 1970s gold bull effectively got underway when President Richard Nixon took the world off the gold standard in August 1971. Gold at the time was actually set at US$42.22 which was the statutory rate (USC 5116-5117). The U.S. government still carries its gold at that rate giving it a value of US$11.0 billion. Based on the current rate of $1,535 the value should be US$401.4 billion. The U.S. holds 261.5 million troy ounces of gold in its reserves, the world’s largest gold reserves held by a sovereign government.

Gold made its first top in February 1974 at US$195.20. Gold then suffered a mini-bear and bottomed in August 1976 at $US99.70 for a loss of 48.9%. Following the top in January 1980 at $US878.50 (a gain overall of 1,980% or 781% from the 1976 low) gold went into a long bear market, punctuated by four mini bull markets. The bottom is considered to have been made in April 2001 at US$255.80 (actual low was $252.10). The gold bull market ran for ten years topping in August/September 2011 at US$1888.70 (actual high was $1,923) for a gain of 638%. The mini-bear for gold played out over the next four years making its final bottom in December 2015 at US$1,049.60 (actual low $1,045) for a loss of 44.4%. As one can see the loss was very similar to the one seen in 1974–1976.

Since then, gold has recovered and, as we have noted, gold recently broke out of a 6-year trading range that had generally been capped at $1,370 with a high point seen in 2013 at $1,434. If the premise is correct, then this gold bull market could take a couple more years and see gold prices rise as high as $2,600 to $3,000. We base that off the relationships seen thus far between the gains during the 1970s bull market vs. the gains seen thus far in the 2001-present market. The gains won’t be as spectacular as those seen in the 1970s but could easily be at least one-third of those gains. The gain so far is roughly 47%.

Silver and the gold stocks would also benefit from this. Silver could rise back to US$50 once again or higher and the TSX Gold Index (TGD) could surpass its 2011 high of 455 (currently 263).

Below is a long-term chart of gold showing highs and lows (closes) over the years from 1970 to the present. It is interesting to note that gold has gained over 3,500% since Nixon took the world off the gold standard. The Dow Jones Industrials (DJI) by comparison has gained 2,800% in the same time period (before dividends).

__

(Featured image by DepositPhotos)

DISCLAIMER: David Chapman is not a registered advisory service and is not an exempt market dealer (EMD). We do not and cannot give individualized market advice. The information in this article is intended only for informational and educational purposes. It should not be considered a solicitation of an offer or sale of any security. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor before proceeding with any trade or idea presented in this article. We share our ideas and opinions for informational and educational purposes only and expect the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor.

-

Cannabis1 week ago

Cannabis1 week agoWhen a Cutting Becomes a Cannabis Plant: Court Clarifies Germany’s Three-Plant Rule

-

Africa4 days ago

Africa4 days agoMASI Surge Exposes Market Blind Spot: The SAMIR Freeze and Hidden Risks

-

Crypto2 weeks ago

Crypto2 weeks agoBitcoin Rebounds Above $70K as Crypto Markets Show Fragile Signs of Recovery

-

Crypto1 day ago

Crypto1 day agoIntesa Sanpaolo Signals Institutional Shift With Major Bitcoin ETF Investments