Business

Smart ways to teach your children about investing and income

The first thing we need to teach our children is WHY you are investing money. Is it for a new bike, for college, for a new home?

How to teach your children the basics of investing and income? Here are some smart ways to educate the little ones on these subjects through games.

The job of a parent has always been challenging, but with times changing so rapidly, the challenges are becoming more daunting. The Internet has ushered in so many changes and has revolutionized every aspect of our lives, including how we invest our money and how we teach our kids about the subject of investing. In this article, I would like to offer suggestions on how to teach our children the basic principles of investing, along with sharing resources that I use to educate my children on issues pertaining to money.

Investing is practically non-existent in the public school system, and the responsibility of educating our children often falls upon the parents. The problem that most parents encounter is that they were never taught sound financial principles. Parents need to take control of their own financial picture and begin to pay attention to how they discuss money matters with their kids. These words, whether they are negative or positive, will leave an indelible mark on our children.

Let me offer an example. I was in business with my parents for over 20 years. My father was entrenched in the “old school” mentality of running a business. What do I mean by old school? Work your butt off, treat your business as your life, and be happy with whatever you make. It had worked for him for countless years, and he was able to create a wonderful life for my family. My problem with this strategy was that his business was funding his lifestyle. I wanted my lifestyle to fund my business, a huge paradigm shift. I wanted a business where I felt passion and contribution were qualities that I could achieve, along with generating income.

Around the time of the Great Recession of 2008, business began to shift dramatically. Consumer spending habits were changing (they didn’t have any money) and the Internet was transforming how and where consumers were purchasing products. All I heard from my mom was “We have to stay small and try not to take any risks!” Now mind you, I am a middle-aged man who is constantly hearing this negative self-limiting belief. I began to believe what mom was spewing, although I understood intuitively that her message was the opposite of what we should be doing.

Fortunately for me, I was able to extricate myself from my business and go in another direction. I knew I would never be able to grow the business to achieve the level of success I was aiming for. I decided to shed the limiting belief of playing it small and focused my attention on the multifamily real estate, where I was able to accumulate a large portfolio within a short period.

The point to the story is that we need to be careful how we talk to our kids. It took me years to be able to leave my business and pursue real estate. Our kids should never be told “It takes money to make money” or “Money doesn’t grow on trees” or “What do you think, I’m made out of money!” Those are three of my dad’s favorite quotes.

Parents should put some thought on how they talk to kids, especially about money matters. (Source)

The first thing we need to teach our children is WHY you are investing money. Is it for a new bike, for college, for a new home? I use the analogy of investing as driving a vehicle to take you from point A to point B. You need to know where you are going and what you are trying to accomplish before you can choose your vehicle (real estate, stocks, bonds, etc.).

Most adults commit this mistake of not creating a plan that will allow them to invest in the proper assets. Whenever you enter an investment, always consider the end result. For instance, are you buying the home to fix and flip for a profit, or are you going to rent it out for cash flow? These are two hugely different strategies, and your success will depend upon what you are trying to achieve.

Earned income

The next topic we need to teach our children is the three different types of income. First and foremost, there is Earned Income. This is the most popular type of income and is earned at a job. Unfortunately, this type of income is taxed at the highest rate and allows for very few deductions. The goal is to turn earned income into passive income.

Portfolio income

The second type of income is called Portfolio Income, income that is derived from stocks, bonds, and mutual funds. This type of income is easier to manage than real estate and is more popular with the masses. Handing over the reins to a mutual fund company is rather simple and takes very little financial intelligence.

Passive income

The third type of income is Passive Income. This type of income includes money from royalties, real estate earnings, and multilevel marketing. There are huge tax advantages to earning passive income, and if you decide to call in sick at the office, the money continues to roll in.

The majority of Americans rely solely on earned income, and that leaves them in a risky situation. If a person loses their job or becomes disabled, their ability to generate income will be greatly affected. It is our job to discuss the other two types of income to our children.

So how do we teach our children about the different types of income?

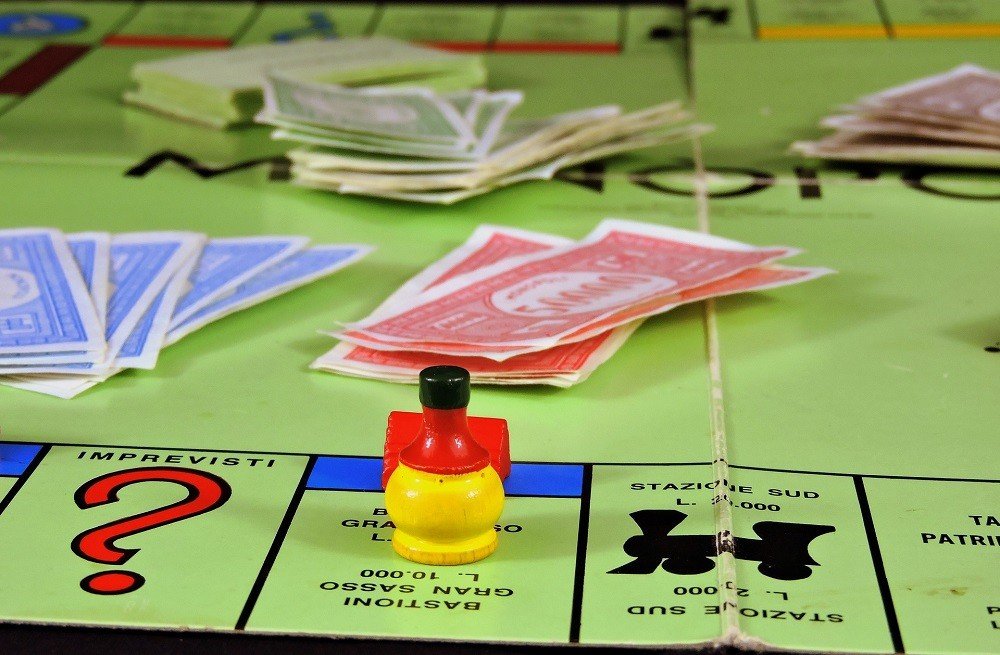

My favorite place to start is playing games, specifically Monopoly and Cash Flow by Robert Kiyosaki. Children learn best when playing games, and you would be surprised how much you will learn. Cash flow’s objective is to get out of the rat race, and participants have to fill out an income statement and balance sheet. Players choose a profession and their focus is to create more passive income than their monthly expenses. The game is very entertaining while teaching the children about investing in all types of assets. The board game is expensive, but I guarantee it will be worth the investment.

Kiyosaki has also written countless books on investing. I would recommend Rich Dad Poor Dad and Rich Dad Poor Dad for Teens. On our podcast, the majority of guests credit Kiyoskai with opening their eyes and creating the necessary paradigm shift to begin to take investing seriously. I enjoy having discussions with my children about the concepts that Robert teaches throughout his books.

Task

Investing needs to become a priority in your life. Begin to educate yourself on the subject and choose a specific niche that you would like to concentrate on. Be careful with the words you use with your children. Start to play games centered on investing, and introduce new terms and concepts to your children, but make sure that it is fun and entertaining.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Business2 weeks ago

Business2 weeks agoThe TopRanked.io Weekly Digest: What’s Hot in Affiliate Marketing [NordVPN Affiliate Program Review]

-

Cannabis7 days ago

Cannabis7 days agoCannabis Company Adopts Dogecoin for Treasury Innovation

-

Biotech2 weeks ago

Biotech2 weeks agoPfizer Spain Highlights Innovation and Impact in 2024 Report Amid Key Anniversaries

-

Business1 day ago

Business1 day agoLegal Process for Dividing Real Estate Inheritance

You must be logged in to post a comment Login