Business

The fuse has been lit in commodity prices

As much as we all love seeing Wall Street’s bulls dancing with happy feet, a fuse has been lit in consumer prices. If current trends in commodity prices isn’t reversed, it’s only a matter of time before interest rates and bond yields begin to rise uncontrollably. That will put massive downward pressure on financial market valuations, while the Federal Reserve stands aside, impotent from doing anything to stop Mr Bear.

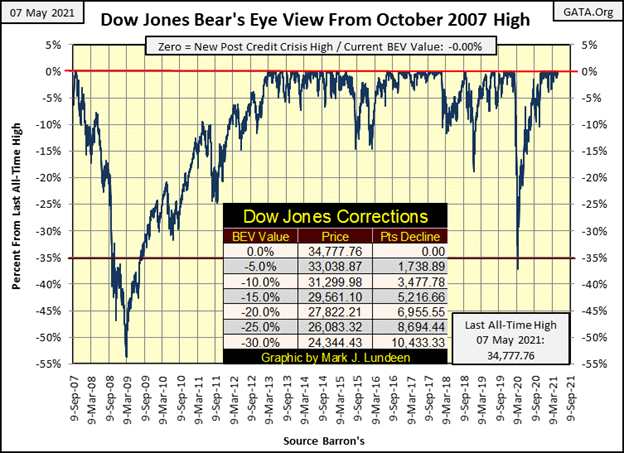

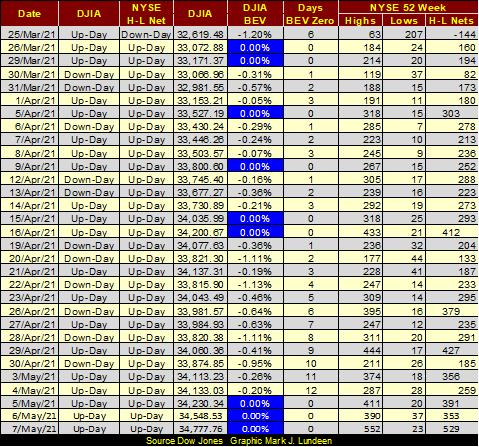

This week the market saw lots of excitement, like the Dow Jones seeing three new BEV Zeros from Wednesday to Friday. These three new all-time highs pushed the Dow Jones up 903 points, or 2.67% above last week’s close.

However, a BEV plot by design underplays advances into record territory. The Dow Jones could have closed above 50,000 this week and its BEV chart above would look no different. So, let’s see what the Dow Jones (Blue Plot) looks like with its 52Wk High (Green Plot) and 52Wk Low (Red Plot) below.

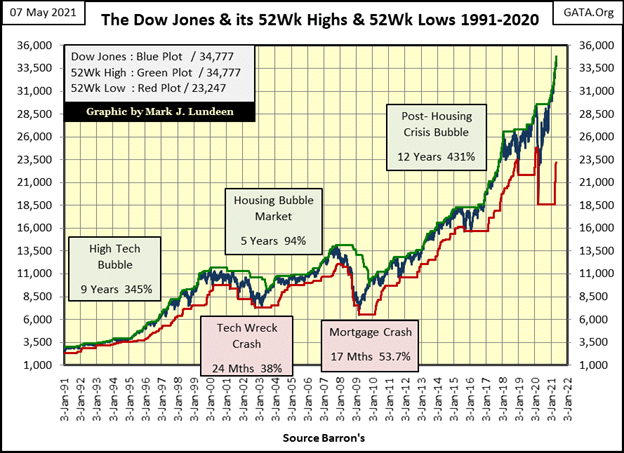

First and foremost, in the chart below we see the effect of monetary inflation flowing from the FOMC has on historical market valuations. The Housing Bubble bear market was the Dow Jones’ second deepest percentage decline (54%) since 1885; impressive! This epic bear market decline induced panic not just in the market, but in Government too.

Still, due to monetary inflation flowing from the FOMC these past thirteen years, inflating the Dow Jones’ valuation by 28,230 points from its 09 March 2008 bottom, the second deepest percentage decline in the Dow Jones seen below doesn’t seem like such a big deal today.

Maybe, when compared to what the pending bear market might look like, (possibly a repeat of the Great Depression’s 90% market deflation), the 2007-09 54% market decline is tame stuff. From this week’s close, a 90% market decline would be a 31,300 point loss for the Dow Jones, the Dow Jones would close at 3,478. So, maybe in the years and decades to come, the Housing Market crash isn’t destined to be a big deal.

Golly gee Mark, you are always too bearish! In my defense, I have to say that inflation from the FOMC isn’t just inflating market valuations, it’s also creating debt burdens on corporate, government and individual balance sheets that are crushing. When the economy enters another recession, which it will, the debt burdens it must carry will amplify its deflationary effects many times, as defaults and bankruptcies bloom like flowers in spring.

How’s that for putting a positive spin on a bad situation!?

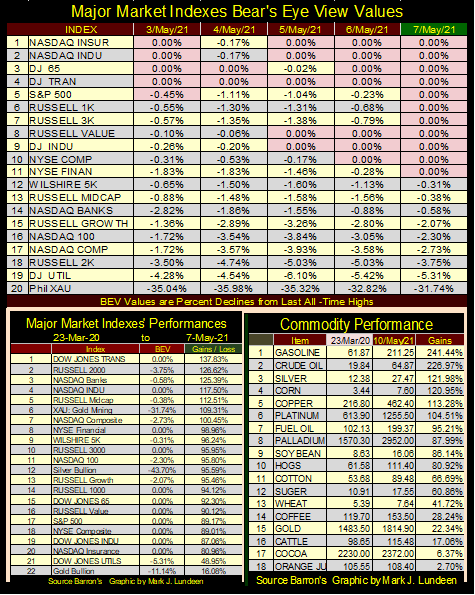

Now let’s look at the Bear’s Eye View values for major market indexes I follow in the table below. And for your information, it’s not just the valuation for the Dow Jones that has inflated greatly from their March 2009 bottoms. Looking at these market indexes’ BEV values we don’t get a clue of that. Still this week we saw lots of new all-time highs (BEV Zeros) in the table below.

I also note the XAU (Gold & Silver Mining) is about to break above its BEV -30% line, something not seen since January 2013. In a good market, a market that saw gold and silver bullion making big strides towards their all-time highs, the XAU could be at new all-time highs by August. That’s not a prediction, just a comment on the potential for the mining shares in the months to come.

When we look at these market indexes’ gains off their 23 March 2020 lows in the table above (left side), the XAU is already at #6 in the list. Silver is #12, and gold remains tail-end Charlie at #22.

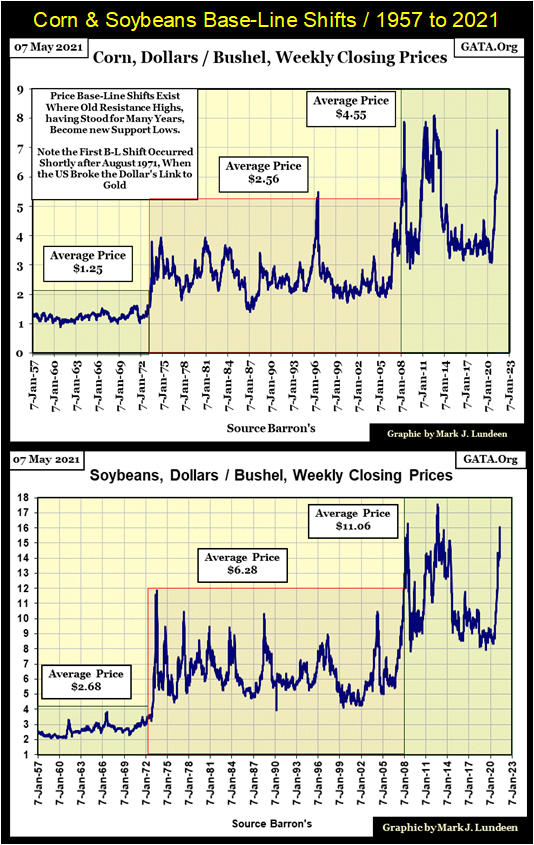

These double- and triple-digit percentage advances in the stock market since March 2020 are amazing. But then the Federal Reserve has expanded its balance sheet by 88% since February 2020 too. Market valuations have benefitted from this. The alarming thing about the FOMC’s current bout of inflation is to be seen in the table above (right side) listing commodity price increases off their March 2020 bottoms.

I go into more detail below, but keep in mind increases in energy prices (#1&2 right-side above) far exceed gains in the stock market, as basic food prices such as grains and meats are all up by double digit percentages. That isn’t just bad for the stock market, but potentially fatal for the bond market too should these trends continue.

The NYSE 52Wk H-L Nets continue to break above my threshold of +300. On Friday the NYSE saw a 52Wk H-L Net of +529 – wow! So, to Mark Lundeen from the bulls on Wall Street – you and your commodity prices can kiss off! We’re running wild and free on Wall Street, and loving it!

As much as we all love seeing Wall Street’s bulls dancing with happy feet, a fuse has been lit in consumer prices. If current trends in commodity prices isn’t reversed, it’s only a matter of time before interest rates and bond yields begin to rise uncontrollably. That will put massive downward pressure on financial market valuations, while the Federal Reserve stands aside, impotent from doing anything to stop Mr Bear.

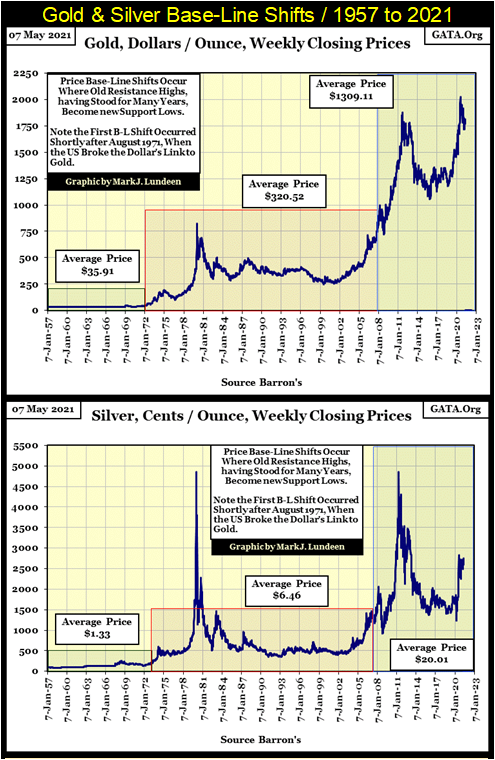

What fuse is that? As seen below, since 1957 the commodity market is seeing another, the third of its post Bretton Woods’ base-line shifts (BL Shift) developing.

What’s a base-line shift? A BL Shift has occurred when old price resistance levels (high prices that have not been exceeded for years or decades) become new price support levels; low prices the market refuses to fall below.

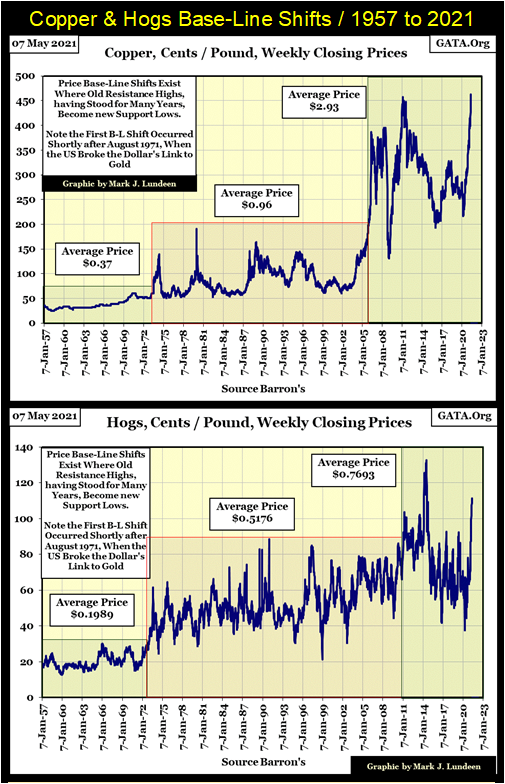

Take a quick look at the six commodities plotted below, and what happened after:

- August 1971 when the US took the dollar off the Bretton Woods $35 gold peg,

- October 2002 when the “policy makers” decided to reinflate the stock market after the Dot.Com bubble popped, by inflating yet another bubble in the single-family home mortgage market.

Both these “monetary initiatives” resulted in a base-line shift in commodity prices, with the second BL Shift shifting into high gear after 2008 when Dr. Bernanke implemented his QEs. And now, fourteen months after Chairman Powell began his Not QE#4, a “monetary initiative” that “injected” over $1 trillion dollars into the financial system in the single month of April 2020, and $3.34 trillion in total since, price trends in these commodities strongly suggest a third BL Shift is currently developing.

Silver’s last all-time high may still be January 1980, nevertheless it’s obvious the price structure of the silver market has been impacted by the FOMC’s post high-tech bear market “monetary policy”; from 2002 to today. When silver takes out its highs of 1980 & 2011, expect big things in the price of silver.

The case for a BL Shift in the hog market may not be made yet. But looking at the advance in hogs since January 2020, I expect a year from now hogs will be selling for well over 140, and not looking back.

Most of the above markets have yet to break into new all-time highs, but given time they will as “liquidity” flowing from the FOMC can no longer be contained inside the financial markets, but is now also flowing into consumer prices. Why this, if not this week or this month will ultimately prove to be detrimental to the bulls in the stock, bond and real estate markets can be seen below.

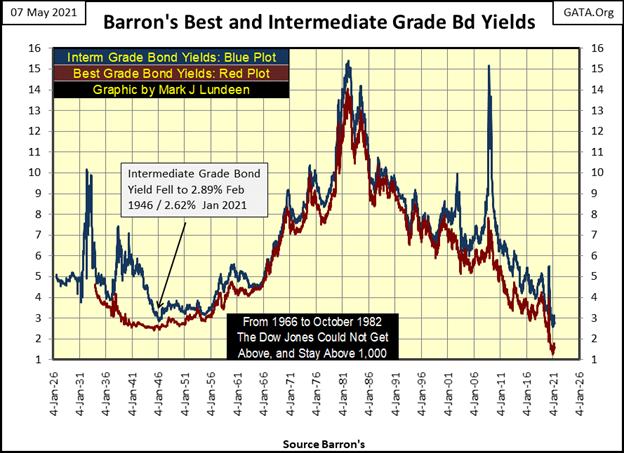

As was the case from the late 1950s to 1981 (below), rising bond yields (deflating bond prices) were driven by rising Consumer-Price Inflation (CPI), and the bond market’s reaction to rising CPI was to demand an ever increasing inflation premium.

Bonds are fixed-income instruments, instruments-of-debt that are obligated to payout only so many dollars per year, and no more to their owners. When prospective bond buyers do the math, and see annual consumer-price inflation rates soaring above yields currently offered by the market, they go on a buyer’s strike. They refuse to buy bonds until bond prices are discounted down to a level that will offer them an acceptable current yield that compensates them for CPI inflation losses.

That’s how it should go. But Chairman Powell’s FOMC is now buying corporate bonds to “stabilize” market valuations. Is he willing to allow natural market forces to drive down bond prices to force bond yields higher? We’ll have to wait to see how that changes things in the debt markets.

From 1955 to 1982 below, what we are seeing is the bond market’s reaction to rising CPI inflation; rising yields / deflating prices.

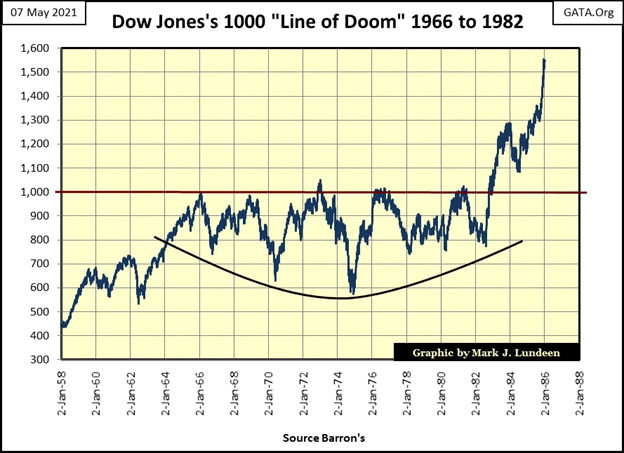

This wasn’t a great time to be in the stock market either. As noted in the chart, from 1966 to October 1982 the Dow Jones could not rise above, and then stay above 1,000 for these sixteen years, though it attempted to do so five times. See chart below.

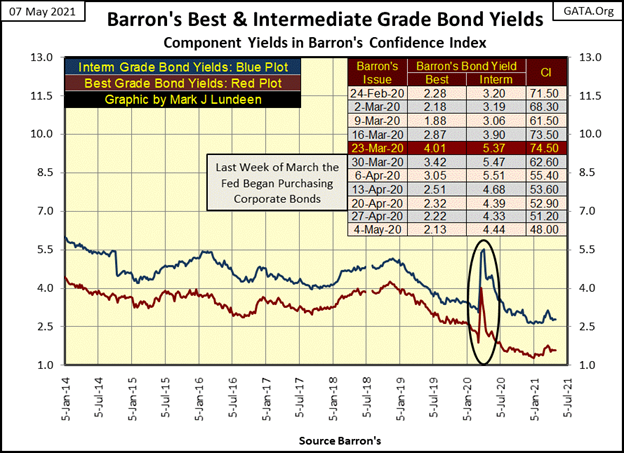

Let’s see what a fix Fed Chairman Powell placed us in with this shorter-term chart of Barron’s Best & Intermediate Grade Bond Yields (below). From Barron’s 09 March 2020 to its 23 March 2020 issue (see table), corporate bond yields spiked during a selling panic in the debt market. Exactly what motivated bond holders to sell their bonds in a panic is unknown to me. The financial media predictably blamed it on the CCP Virus. Whatever the cause, a selling panic in the bond market did happen fourteen months ago.

It was in these March 2020 Barron’s issues one would also see the sharp 38% decline in the Dow Jones. March 2020 had all the makings of another huge market debacle.

In a press release dated March 23rd, Fed Chairman Powell announced that for the first time the FOMC was going to “monetize” corporate bonds. The panic in the financial markets subsided as “liquidity” flowing from the FOMC placed a floor on prices in the bond market. Bond prices soon recovered thanks to FOMC purchases in the corporate bond market, FOMC purchases I suspect continues to this day.

Commodity prices rising at rates as small as 5-7% annually will at some future point become a concern to bond buyers, buyers who now see bonds yielding below 3%. Should commodity prices continue to rise, we will see another yield spike in the chart above sometime in our very uncertain future.

Most corporate bonds trading today having interest-rate derivatives bundled with them. So, rising corporate-bond yields (deflating bond prices) will prove devastating to Wall Street, when the Big Banks’ counterparties demand specific performance on their interest-rate derivative contracts. Potential liabilities for Wall Street could be in the tens and maybe in the hundreds of trillions of dollars. Small wonder Chairman Powell acted so swiftly in March 2020 as corporate bond yields spiked.

I read Ayn Rand’s Atlas Shrugged – twice. It’s not for everyone, but for some it’s a real page turner. Ayn was born in Tsarist Russia in 1905, and lived through the Bolshevik Revolution, something she never got over. She eventually emigrated to the United States, and like Aleksander Solzhenitsyn (who unlike Ayn, spent many years in Stalin’s gulag), saw the danger socialism presented to America and anywhere else it established itself.

Ayn Rand was at the center of a little group of New York City anti-communists whose circle included Robert Bleiberg, who became Barron’s Executive Editor some years later, and a jazz-clarinet player from the Bronx named Alan Greenspan.

Here’s a quote from Ms. Rand’s Atlas Shrugged, on gold as money;

This quote on gold could have been, and was said by many, including Warren Buffett’s father, Howard, a Congressman from Nebraska in the late 1940s.

“So far as I can discover, paper money systems have always wound up with collapse and economic chaos.”

– Congressman Howard Buffett (Father of Warren Buffet) from a 1948 issue of the Commercial and Financial Chronicle.

***

“When you recall that one of the first moves by Lenin, Mussolini, and Hitler was to outlaw individual ownership in gold, you begin to sense that there may be some connection between money, redeemable in gold, and the rare prize known as human liberty.”

– Congressman Howard Buffett

These quotes are from over seventy years ago. At the dawn of our economic era, where all payments will soon become digital, these quotes on the connection between gold as money and personal liberty are even more relevant.

If there was to be anything surprising to Congressman Buffett about the abandonment of the gold standard, I don’t think it would be the horrendous inflation of paper and digital dollars seen since the late 1940s. But that the “policy makers” could keep this illegal scam going into the third decade of the 21st century.

Inflation flowing from the FOMC has reshaped our world to the point where a digital alternative to dollars, such as Bitcoin, and other cryptocurrencies have become widely accepted by the public as alternatives to currencies issued from central banks.

No doubt from his concerns for the public’s financial welfare, Bank of England’s governor Andrew Bailey warns the public of their “lack of intrinsic value.” It’s always good seeing a central banker who can maintain his sense of humor, as the paper currencies they manage are inflated to worthlessness.

Do I like cryptocurrencies? I don’t dislike them. But the thought of an EMP event wiping out my position in Bitcoin as the electrical grid and internet network catches on fire doesn’t appeal to me. Anyway, the big money has already been made in this market, which is why they are now so popular with many retail investors who historically always insisted on buying at a top and selling at a bottom – sad but true!

What do I like? I like gold and silver, assets I can hold in my hand that have zero counter-party risk.

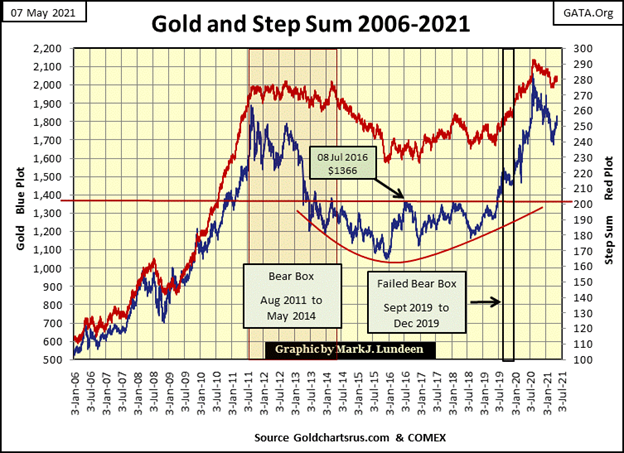

Looking at gold’s BEV chart below, what a difference a week makes. Last week I was concerned gold might make a move down to its BEV -20% line. On Friday’s close of this week gold almost broke above its BEV -10% line.

What’s to come next week for gold in its BEV chart below? I don’t want to jinks myself and say gold will close above its BEV -10% line ($1885), but if it did, I wouldn’t be surprised.

After all, since June 2019 when gold finally managed to break above, and stay above its BEV -26.5% level ($1366) for the first time in six years, gold saw a few corrections on its advance to its last all-time of $2061.44 seen last August. These corrections seen below on gold’s way to its last August BEV Zero were short and sweet pauses in the advance. But the correction seen following last August’s BEV Zero, let’s call it #4 below, was a major market event that shook out the weak hands in the gold market.

It looks to me, the post August 2020 battle between the bulls and the bears, correction #4 has been won by the bulls. I think its important to note the bears failed to drive the price of gold down to its BEV -20% line, which for gold isn’t much of a correction. And now the bulls are taking gold back up to historic valuations in the BEV chart above.

I’m making no predictions here. But just looking at gold’s BEV chart, and noting the price performance of commodities covered earlier in this article, I have good feelings on precious metals assets in the months to come. Should the bond market see another spike in yields this summer, the precious metal complex and their miners may kick in their afterburners and astound the world.

Here is gold and its step sum below. Both plots have turned the corner and are advancing nicely. Look at the nine-year correction gold saw off its August 2011 highs. This is a powerful market set up for making serious history in the gold market. A run up of several thousand dollars in the price of gold from current market prices is clearly in the making. It may take years to complete, and no one can say when this pending advance will actually begin. Maybe not until 2022. But gold is poised to make serious market history from here.

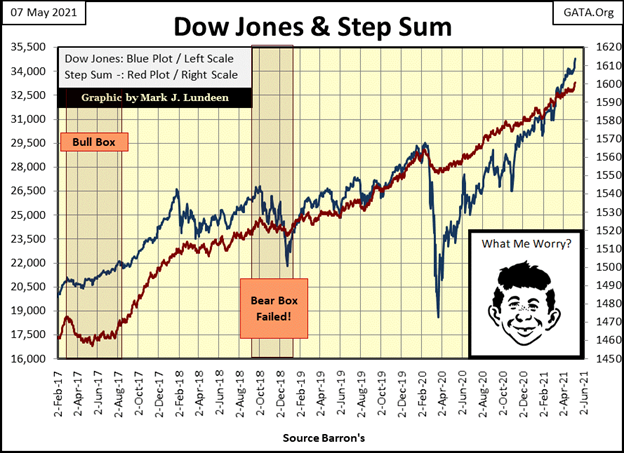

Look at the Dow Jones and its step sum chart below; what’s there not to like about it? First of all, since its 23 March 2020 bottom the Dow Jones has advanced by 88% without much of a correction. That’s a concern to me. And I don’t like how the Dow Jones advanced this 88%; pure market manipulation by the FOMC. Should the FOMC stop “injecting liquidity” into the market, I’d expect to see the stock and bond markets begin to crash in a very depressing, 1930s sort of way.

Other than that, the Dow Jones and its step sum is looking good.

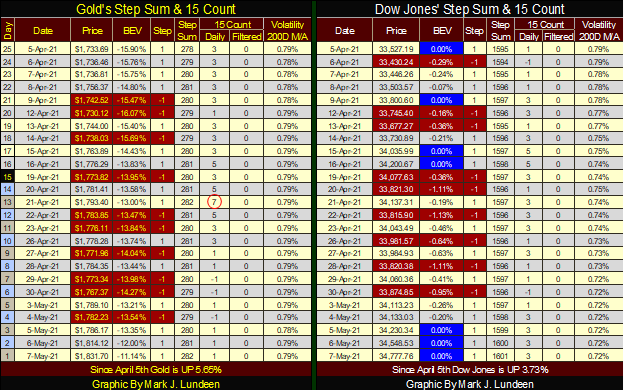

Moving to gold’s step sum table below; look at how gold worked off its overbought condition (15 count of +7) on April 21st. The bears came in and made sure gold saw more daily declines than advances for a few weeks. But for all that work the bears failed to drive the price of gold down much.

Then starting this week, the bulls took over and almost took gold over its BEV -10% level ($1855) as its 15 count closed the week at a neutral +1. Looking at my technical work above and below, gold is a market that’s setup to make big advances in the weeks to come. Whether it does or not is something we’ll just have to wait to see.

That’s the problem with markets, one can never really be sure of future trends. So, it’s always a bit of a gamble whether or not one should risk a position in a market. But as for gold, silver and their miners, for people with patience, buying precious metal assets at current levels is a better-than-house-odds-wager. In the markets, you’ll never get better odds than that.

For the Dow Jones side of the table, it continues making new BEV Zeros, and its step sum is advancing nicely too. But how much longer is the question I have in my mind. Maybe for longer than I think. Sitting high up in the peanut gallery, I don’t care one way or the other as watching market history being made is a damn fine show to watch – go bulls!

The second quote by Ayn Rand concerns the legal system of a totalitarian state; laws everywhere, and all of them selectively enforced depending on who you are.

—

(Featured image by geralt via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Crypto6 days ago

Crypto6 days agoCrypto Markets Under Pressure as Vitalik Buterin Sells 17,000 ETH

-

Markets2 weeks ago

Markets2 weeks agoWeather-Driven Supply Outlook Lifts Coffee Markets in Brazil and Vietnam

-

Impact Investing23 hours ago

Impact Investing23 hours agoGreen vs. Brown Stocks: Climate Policy, Capital Costs, and the Battle for Market Returns

-

Business2 weeks ago

Business2 weeks agoTopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [Best Technology Affiliate Programs]