Featured

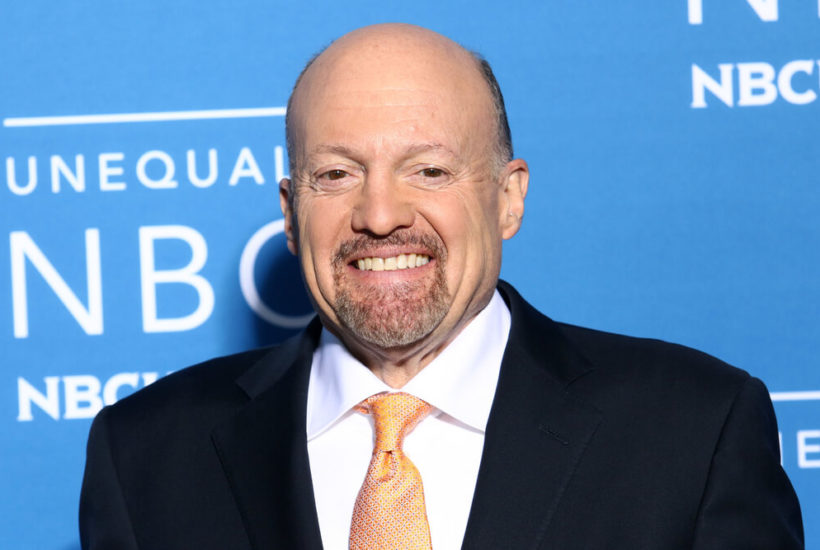

Should trading beginners listen to Jim Cramer?

Jim Cramer has a strong media presence compared of his time.

With all the market forecasters, gurus, and stock pickers out there, perhaps one of the most recognizable ones is Jim Cramer. He is almost always in the news. No matter what observers highly critical of him say, he still enjoys quite the popularity.

It’s not surprising, given that the ex-hedge fund manager’s “Mad Money” has been on the air for more than a decade now, regularly airing on CNBC. In addition, subscribers have always wanted to get inside his private calls with Action Alerts PLUS Club members where he discusses what stocks to buy, sell, or hold.

Cramer started out as a writer after college for news outlets. His initial assignments were serial murder coverage. That stint most likely developed his keen insights into people’s motive for behavior.

Later he earned a Harvard law degree. Along the way, he discovered the stock market until he met Martin Peretz who owned “The New Republic.” Cramer used his knowledge to help Martin earn a substantial profit on the stock.

Cramer tried practicing law for some time but the lure of the stock market soon pushed him to take a job as a stockbroker for Goldman Sachs. From there, he started his own hedge fund called Cramer and Co. He then set up the website TheStreet which remains to be up and running up to this very day. Cramer also has popular books under his belt.

Predicting the Great Recession

Cramer’s most significant forecast to date was his prediction of the Great Recession that took place in December of 2008. This has become an iconic moment in his career because he was the only one at the time who spoke about the looming market tragedy.

Cramer started warning officials and the Fed about the coming financial crisis since the year 2007. At the time, he kept on lambasting officials for not seeing the apparent signs of an impending market crash.

Early into 2008, Cramer was already telling investor to pull out their money from stocks, especially the money that they might need for the next five years.

“Whatever money you may need for the next five years, please take it out of the stock market right now, this week. I do not believe that you should risk those assets in the stock market right now,” he said at the time.

He kept telling that the best advice he could give at the time was all for investors to retreat because the worst financial condition was coming. He even estimated that bank lending default crisis may erode the stock market to as much as 20 percent.

No one listened to Cramer. Later on, it was found that the Fed had even laughed at his prediction during one meeting.

We all know what happened by the end of 2008.

Speaking about it later, this was what Cramer had to tell the Fed:

“Had the Fed cut rates dramatically at the time, as I suggested, we might not have had so many financial institutions go under or as many as $7 trillion in mortgages that subsequently went bad or needed to be modified,” he said.

Cramer’s embarrassing predictions

Cramer’s career as a forecaster, however, did not always go smoothly. While there is no available statistics of how many critics he has over the number of his true followers, his failed predictions were seemingly highlighted more spotlight more than his successful ones.

Two of his past predictions, in fact, were listed in 2015 as the most embarrassing predictions of all time and were even described as “legendary” mistakes. These two instances keep reverberating with all reviews and criticism against Cramer.

In 2012, he encouraged investors to dump shares of Hewlett-Packard. He said at the time that the company’s toxic corporate culture had been pulling HP down. Within six months, HP shares shoot up to 115 percent and the company amassed $8.5 billion in revenue.

He was also wrong about Best Buy when in 2015 he told shareholders to ditch its shares on grounds that its same-store losses would result to dramatic cash flow decline. Six months after, Best Buy shares 124 percent.

Should you be listening to Jim Cramer?

Between two wrong predictions in two companies and how he successfully predicted the recession and its dramatic repercussion to investors and financial institutions, you be the judge.

Additionally, as first-time investors, it is still best to listen to as many as market professionals that you can. Longtime traders said that the most common trait of credible forecasters is that they use the phrases “perhaps,” “however,” “on the other hand”, and other similar phrases when making their predictions as oppose to forecasters who sounded determined and sure. Those forecasters who often use “perhaps” etc. mean that they have looked into as many possibilities as they can.

Another trait to look for from forecasters is if they don’t mind admitting when they are wrong and adjust their estimates accordingly. This would mean that they don’t stop analyzing information as they come in, making sure that all relevant data are available for investors.

(Featured image by JStone via Shutterstock)

-

Impact Investing2 weeks ago

Impact Investing2 weeks agoBNP Paribas Delivers Record 2025 Results and Surpasses Sustainable Finance Targets

-

Impact Investing2 days ago

Impact Investing2 days agoCDP Approves €1.5 Billion Package to Boost Industry, Renewables, and International Development

-

Crypto1 week ago

Crypto1 week agoUniswap and BlackRock Partner to Launch BUIDL in DeFi

-

Biotech5 days ago

Biotech5 days agoNew Molecular Clues Explain Aggressive Neuroblastoma and Point to Targeted Treatments