Featured

What Trump’s tariff tax cuts could mean to China

With the ongoing trade wars between the U.S. and China, the newly imposed tariffs could do more harm than good in terms of Chinese exported goods.

China appears to have more to lose from a trade war with the U.S. simply because the math behind surpluses and deficits renders the Bubble Blowers in Beijing at a big disadvantage. When you get right down to the nuclear option in a trade war, Trump could impose tariffs on all of the $505 billion worth of Chinese exported goods while Premier Xi can only impose a duty on $129 billion worth of U.S. exported goods—judging by the announcement on July 10 of additional tariffs on $200 billion more of China’s exports to the U.S., we are well underway toward that end. However, this doesn’t mean China completely runs out of ammunition to fight the battle once it hits that limit.

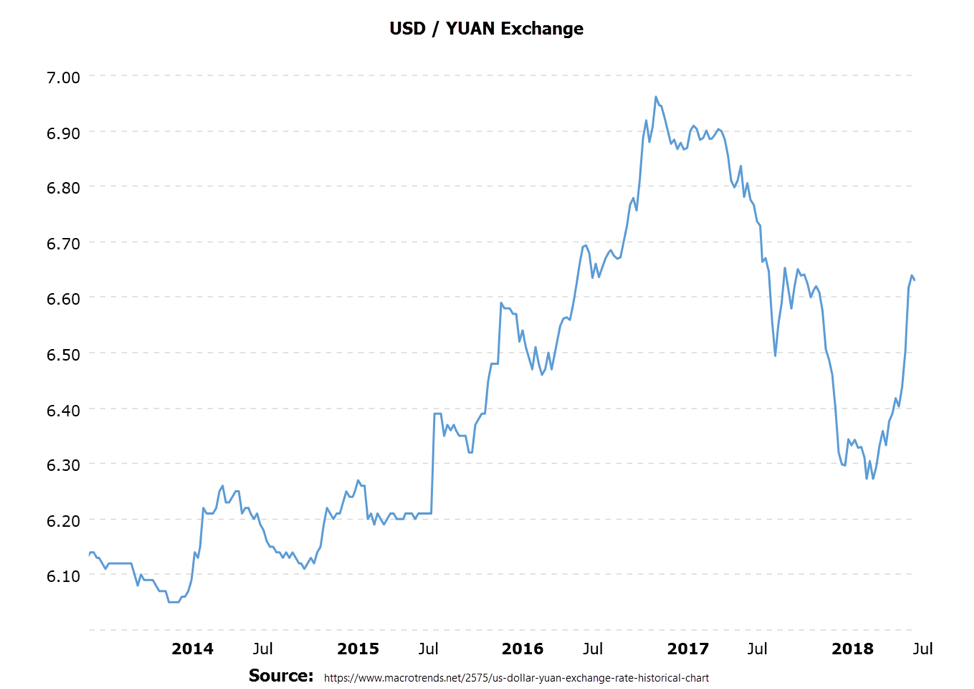

The Chinese could seek to significantly devalue the yuan once again, as the nation did starting in the summer of 2015. Indeed, it could be exactly what they are doing right now.

© Michael Pento

This would partially offset the effect of the tariffs placed on its exports. However, it would also increase the debt burden on Chinese, and other Emerging Market (EM) dollar-based loans, which total over $11 trillion in. If EM countries that conduct trade with China allowed their currencies to appreciate greatly against the yuan, their exports would become uncompetitive. Therefore, in order to maintain a healthy trade balance with China, these nations would have to devalue their currencies alongside the yuan; causing a contagion effect. The last time China devalued the yuan was in 2015, and it caused chaos in global currency and equity markets.

China could also dump $1.2 trillion worth of its US Treasury holdings. The timing for this would hurt the U.S. particularly hard because deficits are already projected to be over $1 trillion in fiscal 2019 that begins in October. When you add to this to the Fed’s reverse Quantitative Easing (QE) plan of selling $600 billion worth of Mortgage Backed Securities (MBS) and Treasures, you get a condition that could completely overwhelm the private sector’s demand for this debt. Of course, a trade war with China also means there will be less of a trade surplus to recycle back into U.S. markets. And if the incipient trade war leads to a recession in the U.S., deficits would soar much further than the already daunting $1 trillion level.

When you combine the baseline fiscal 2019 deficit of over $1 trillion, with $600 billion from Quantitative Tightening, with a potential Chinese dumping of hundreds of billions from its $1.2 trillion worth of Treasury reserves, along with hundreds of billions dollars more added to the deficit arising from the reduced revenue from a slowdown in global commerce, the potential total deluge of debt that needs to be absorbed by the public in the next fiscal year could easily breach $3 trillion!

If you’re looking for the pony behind that dung pile, you could say that the yield curve perhaps would not invert in this scenario as quickly as it is now—maybe—but the spread between the two to 10-Year Note has collapsed from 265 basis points (bps) in 2014 to just 27 bps today. Hence, the next 25bp rate hike from the Fed in September could be enough to flatten out the curve completely. Nevertheless, the resulting yield shock would be much worse than your typical inversion because runaway long-term bond yields are the last thing this massively overvalued equity market, which sits on top of record debt levels, can endure.

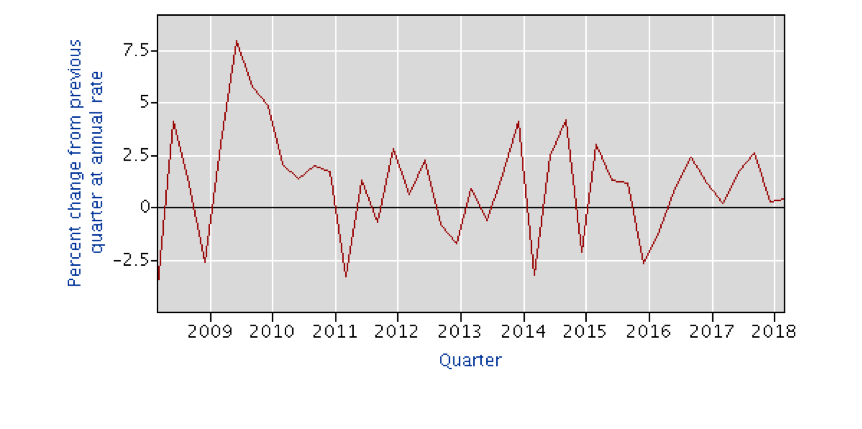

In other words, this upcoming tsunami of debt issuance would equate to a giant black hole that would suck all available investment capital from the private sector and send it toward the wasteful arms of government—the opposite effect of a tax cut. This would virtually guarantee a sharp slowdown in productivity and GDP growth. In truth, a productivity slowdown is something the U.S. economy cannot afford at this time because non-farm productivity increased by a paltry 0.4 percent annual rate in Q1.

© Michael Pento

Since GDP is the sum of the labor force plus productivity growth, a further slowdown in productivity from here would be extremely recessionary, especially given the slowdown in U.S. immigration and fecundity rates.

The major takeaway here is that China has more bullets in the chamber other than just putting a tariff on all U.S. exports. And even though China has more to lose on face value, an all-out trade war is an extremely negative sum game for all parties involved. The resulting global recession, which is already approaching due to the impending complete removal of central banks’ bid for inflated asset prices on a net basis, is becoming expedited and exacerbated by the trade war.

Debt-fueled tax cuts have greatly boosted earnings growth on a one-time basis. And this has been completely priced in by the Wall Street carnival barkers. However, the global trade war and the bursting of the bond bubble—with its effect on record debt and asset prices—should more than offset the benefit from tax cuts in the coming quarters. The next recession/depression is approaching quickly and will finally cause the greatest financial bubble in history to unwind in spectacular fashion.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Impact Investing1 week ago

Impact Investing1 week agoClimate Losses Drive New Risk Training in Agriculture Led by Cineas and Asnacodi Italia

-

Crowdfunding5 days ago

Crowdfunding5 days agoReal Estate Crowdfunding in Mexico: High Returns, Heavy Regulation, and Tax Inequality

-

Africa2 weeks ago

Africa2 weeks agoAgadir Allocates Budget Surplus to Urban Development and Municipal Projects

-

Cannabis2 days ago

Cannabis2 days agoSouth Africa Proposes Liberal Cannabis Regulations with Expungement for Past Convictions

You must be logged in to post a comment Login