Business

US wheat markets remain high amid weather concerns

US wheat markets are up, dairy markets stayed steady while sugar futures were higher last week.

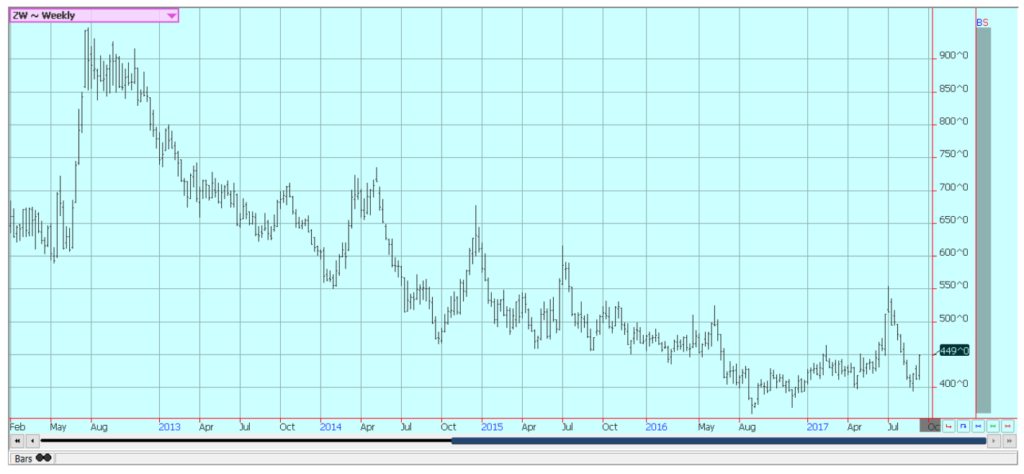

Wheat

US markets were mostly higher last week as the US and international weather concerns remained important. Minneapolis remains the weaker market as it is absorbing hedging from Canada and its harvest of Spring Wheat. Ideas are that current international price relationships will make for good demand for US wheat, but sales shown in the export sales report from USDA last week were not strong.

The market has been under pressure from ideas that there will be plenty of wheat available in the world market due to the big increase in production in Russia. Canada has also forecast better than expected production for the current year. Canada has suffered through conditions very much like the US, with hot and dry weather in western sections of the Prairies. Australia also suffered from the hot and dry weather at key times in the growing cycle, and less production has been forecast by ABARES and other sources. Production ideas are now near 21 million tons for the country, but ideas are dropping as it is still dry and the plants are trying to fill kernels.

Argentina has seen rains for the last few weeks and the crop is trying to get ready for harvest. There is a talk of yield and quality losses, and these losses are expected to get bigger in the short term if the rains continue as forecast. US export demand is reported to be improving again as US prices are very competitive in the world market, and the recent trend to a weaker US Dollar has helped. Demand for US Wheat remains primarily for HRW and HRS, the higher protein wheats grown in the US.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

Corn

Corn and oats closed higher despite the bearish USDA production-end supply and demand reports. The market absorbed bearish USDA production reports last week. US production and yield estimates were much higher than the average trade forecast and were at the high end of all estimates. A lot of traders think USDA is still too high with these estimates due to the uneven weather in much of the Midwest this year. The reports caused futures to dive when the USDA reports were released, but the move lower caught buying interest to push prices back up by the next day.

The market will now start to hear actual harvest results as the harvest of corn should start in parts of the Midwest this week or next. The crop is drying down quickly now, so the chances for the weather to help or hurt production potential is more limited. Variable growing conditions continue. The Midwest will see warm weather and better precipitation this week.

The crop needs warmer weather to return to help push development towards maturity. It also needs another good rain event to help push yield potential. Some crops in the Southeast were hurt from winds and rains left by Hurricane Irma, but the damage should be limited. The weekly charts suggest that prices should be able to move a little higher before finding much selling interest.

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

Soybeans and Soybean Meal

Soybeans and soybean meal were higher last week despite the bearish USDA reports. USDA showed much higher yield and production potential than had been expected by the trade, and futures moved lower in response. However, many in the trade are questioning the estimates as USDA used a very high pod weight in its estimates and this is not necessarily backed up by other tours or some initial harvest results.

The initial results posted by farmers in parts of central Illinois and central Indiana are below those of last year and also below the averages. It is still early and there is almost all of the harvest left to go. Most areas are still filling pods and turning color in preparation for maturity and harvest. There will be some warmer temperatures in the forecast this week, and the crop needs warm weather to realize its best production potential. Many areas need more rain to fill the pods well, but there is some rain in the forecast. The crop still has the potential for solid yields, but the current weather does not promote increasing or anywhere near record yields.

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

Rice

Rice closed higher for the week as USDA cut production estimates once again. Harvesting resumed in Texas and Louisiana after Harvey left, and field yield reports have been variable to good in Louisiana and good in Texas. Quality reports, in general, have been good to very good. Crops are being harvested in areas from Mississippi to Missouri. It has been cool, so the crop has been taking a while to get mature, but crops are getting to that point now.

Crop potential in these states is an open question due primarily to harsh weather at the start of the growing season and variable conditions for much of the year, but producers seem to expect good quality crops and hope for very good yields. The initial results in these areas are so far supporting the ideas of good quality and good field yields.

Asian prices remain soft. The Asian market has been weaker in the last few weeks as the next harvest comes closer in many countries. Growing conditions are improved in India as the monsoon has been better as monsoon rains have generally been good. However, Bangladesh has been hurt by flooding and is preparing to import a lot of Rice this year. Most of Indochina and Southeast Asia have seen good weather.

Weekly Chicago Rice Futures © Jack Scoville

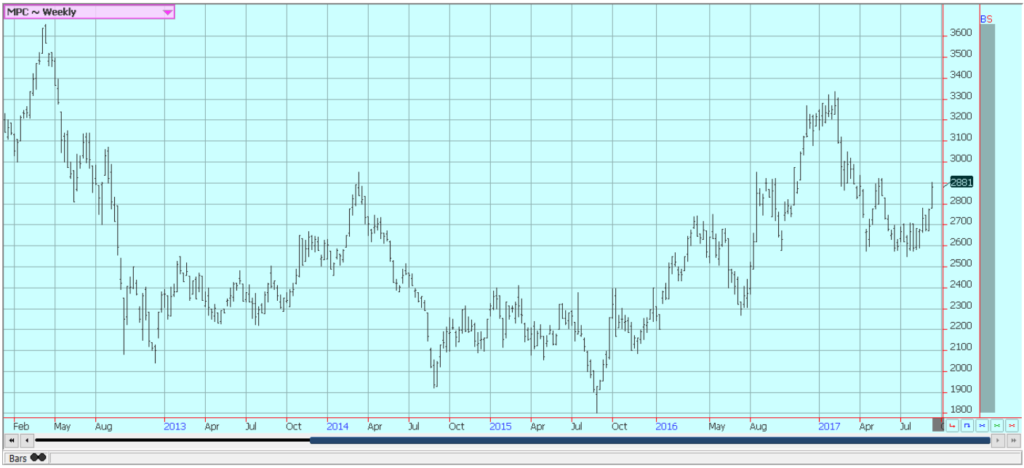

Palm Oil and Vegetable Oils

Palm oil futures moved higher on reports of strong demand and managed to ignore bearish monthly data from MPOB. MPOB released its latest supply and demand reports last week and showed higher than expected production and ending stocks. There are ideas that production has now topped out and that trends will be for lower monthly production for the next several months.

However, the private surveyors released demand reports for the first third of the month and the export pace was very strong and much above trade expectations. The demand overwhelmed any concerns about the production, and futures were able to move to new highs for the move.

Price trends remain up for palm oil. Soybean oil was near unchanged last week. Canola was lower in part on increasing harvest activity. Farmers have not really been selling yet, but probably will need to start soon as the futures market is showing that weaker prices are now possible. There have not been many yield reports yet, but those heard imply a good but not great crop. The Canadian Dollar remains generally strong against the US Dollar.

Weekly Malaysian Palm Oil Futures © Jack Scoville

Weekly Chicago Soybean Oil Futures © Jack Scoville

Weekly Canola Futures © Jack Scoville

Cotton

Cotton moved sharply lower to limit down in response to the USDA reports that showed much greater production potential than had been expected by the trade. USDA made no calculations for yield losses due to the hurricanes in its reports last week as it simply did not have time. There are still ideas of significant losses in parts of Texas and the Southeast from the storms, but there have been no real estimates released by anyone just yet. Reports should be heard this week, but it is possible that a million bales were lost between the two events.

USDA data implied that those losses can be managed. Harvest is active and will become more active as more and more of the crop comes to maturity, Bolls are open or are opening now in just about all production areas. West Texas conditions are called good and the Southwest should be good despite hot weather this year. The trade will monitor the condition reports released on Monday for clues to damage potential in the Southeast.

There is strong production potential in Asia, and mostly in India and Pakistan due to improved monsoon rains. Some rains are expected in most areas this week amid relatively moderate temperatures. Chinese growing conditions are good. Areas to the south of Russia are in good condition.

Weekly US Cotton Futures © Jack Scoville

Frozen Concentrated Orange Juice and Citrus

FCOJ closed lower on Friday and for the week as Hurricane Irma damaged the Florida production. Irma moved a bit farther west than originally expected and came up the west side of the state in the Gulf of Mexico, then moved into the Southeast.

No one is sure how much fruit was lost as many producers had to leave and were just coming back home late in the week. The losses could be major, and some have said there will be at least 10% of the production potential lost. There is potential for major production losses as the fruit is not yet mature, but is big and could be bigger than the initial trade ideas.

Improved year on year production had been expected this year, but this potential is probably gone. The demand side remains weak and there are plenty of supplies in the US. Brazil crops remain in mostly good condition and production estimates are high.

Weekly FCOJ Futures © Jack Scoville

Coffee

Futures were higher in New York and stable in London last week, with commercials scale down buyers and speculators buying to cover short positions in New York. The trends are down on the charts in London but are turning up in New York.

The Brazil weather and tree condition is the main fundamental reason for higher New York prices. There is still some concern about the dry weather there as early rains have caused the first flowering in many areas. There is some talk that the rains and flowering came too early and that at least some flowers could be aborted if an extended dry period arrives. However, it is normally a dry time, so the potential for losses is a matter of debate right now. It was dry last week and should be dry this week.

There are also reports that older trees in Brazil are defoliating or dropping leaves due to the stressful conditions of the last year. These trees will not produce much if this is true. Cash market conditions in Central America remain quiet as the next harvest is getting started. There is coffee to sell and offers are on the table for the next crop, but little buying interest from anyone. Colombia has reported some difficult growing conditions, but exports have held well as production appears to be good due to younger trees that are more vigorous and produce better under more stressful conditions.

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

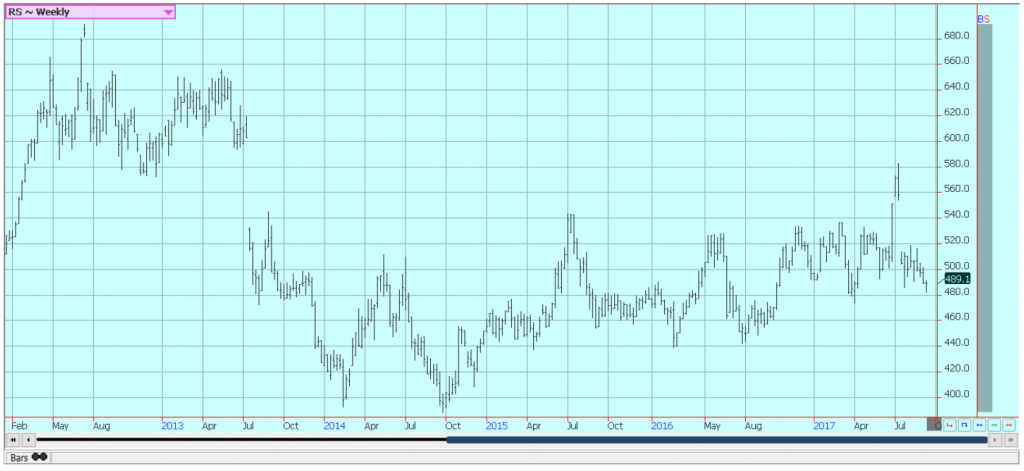

Sugar

Futures were higher in New York and in London, and price trends are turning up on the daily and weekly charts in New York. Hurricane Irma damaged some sugar production areas in Florida. These areas are near the lake and probably saw some extreme winds and rains. It has hurt some areas in the islands and any sugar in these areas was damaged or lost.

The market expects firmer prices over time in part due to the moves in Brazil to increase ethanol production through higher gas prices and as the Indian harvest could be delayed due to wet conditions that would delay sugarcane harvesting.

Overall upside potential is limited as there are still projections for a surplus in the world production, and these projections for the surplus seem to be getting bigger over time. Production potential in Thailand seems strong as monsoon rains have been better than last year. It is raining in much of India now as the monsoon is active, and reports indicate good to heavy rains in many areas.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

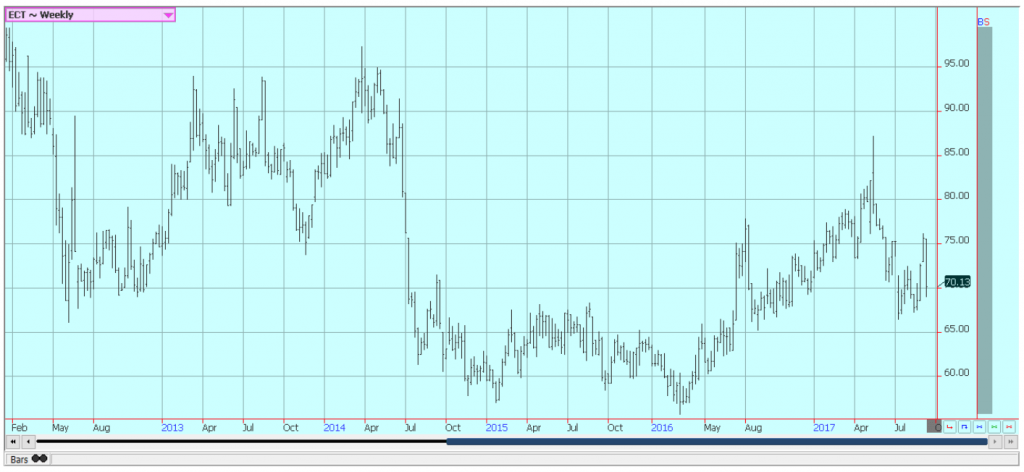

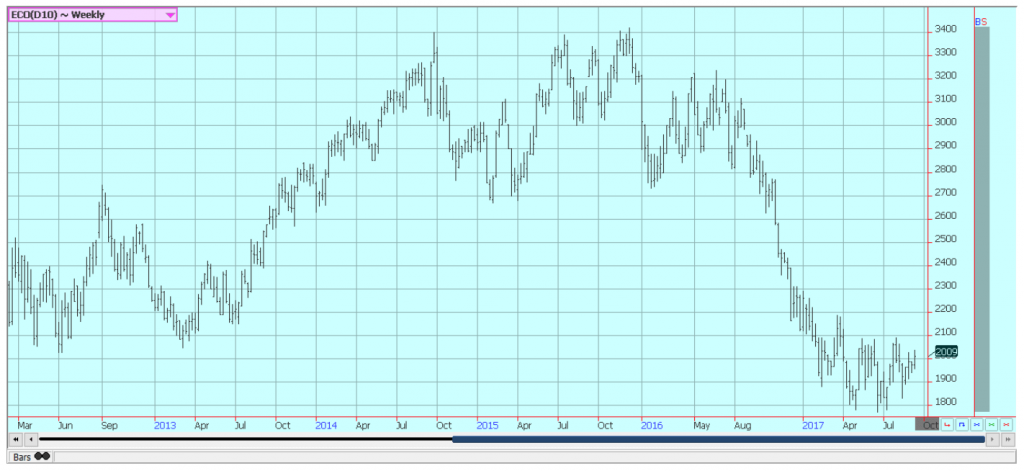

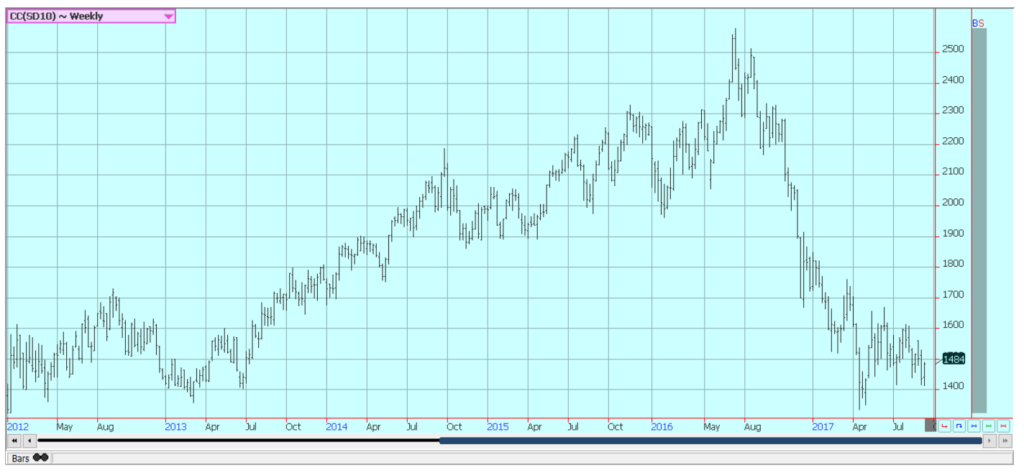

Cocoa

Futures markets were higher last week but remain in a broad trading range. The weekly charts suggest that futures are forming what could be an important low at this time. The supply for the coming year would seem to be good and enough for the market. Nigeria and Cameroon have both noted strong production from the initial harvest. Ghana said it now expects higher production than in initial estimates and above 800,000 tons.

The demand should continue to increase if prices remain relatively cheap and as retail prices continue to move lower in important consuming areas like Europe. World consumer markets, in general, seem to be getting better economically, also supporting better demand ideas.

Grinders and chocolate manufacturers are able to make plenty of money with current differentials. The next production cycle still appears to be big since the growing conditions around the world are generally good. Ivory Coast has already sold 1.32 million tons of cocoa into the world market, and selling is reported from other countries as the harvest has started.

East African conditions are too dry but there is still a crop growing and generally, good production is expected. Good conditions are still being reported in Southeast Asia as it has turned seasonally drier in growing areas of Indonesia and Malaysia.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

Dairy and Meat

Dairy markets were steady last week. Milk and cheese demand has been mixed, but Butter demand has been strong. The trade expects higher Butter prices due to very good demand and adequate supplies. Demand is good for cream, but cream has generally been available to meet the demand. Cream demand for butter has been very good.

Demand for ice cream has been mixed depending on the region but is becoming less now as the US summer comes to a close. Cheese demand still appears to be weaker and inventories appear high. US production conditions have featured some abnormally hot weather in the west that is hurting milk production. Production in the rest of the country has been strong.

US cattle and beef prices were higher. The beef market remains weaker in the last couple of weeks, although somewhat better last week. Cattle prices were tough to gauge last week as the cash market really did not trade. It is the threat of increased supplies down the road that keeps the packers from buying aggressively.

Feedlots are filled and cattle will continue to be offered to the cash market. However, ideas are that more supplies are coming as weight per carcass is high and more cattle is coming to the market. Demand will turn lower and will shift to roasts and things like that now that the summer is ending and there is less for the barbeque.

Pork markets and lean hogs futures were weaker on a seasonal trend to lower demand. Ideas are that futures are too cheap to cash and that the spread between the two need to come together more than they are now. Demand has been lower for the last couple of weeks and this has affected pricing. Demand starts to work lower as most of the Summer buying is done. Buying will start to shift away from grill items to items for the oven. There are plenty of supplies out there for any demand. The charts show that the market could work lower.

Weekly Chicago Class 3 Milk Futures © Jack Scoville

Weekly Chicago Cheese Futures © Jack Scoville

Weekly Chicago Butter Futures © Jack Scoville

Weekly Chicago Live Cattle Futures © Jack Scoville

Weekly Feeder Cattle Futures © Jack Scoville

Weekly Chicago Lean Hog Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Fintech2 weeks ago

Fintech2 weeks agoRuvo Raises $4.6M to Power Crypto-Pix Remittances Between Brazil and the U.S.

-

Impact Investing19 hours ago

Impact Investing19 hours agoMainStreet Partners Barometer Reveals ESG Quality Gaps in European Funds

-

Biotech1 week ago

Biotech1 week agoEurope’s Biopharma at a Crossroads: Urgent Reforms Needed to Restore Global Competitiveness

-

Africa4 days ago

Africa4 days agoFrance and Morocco Sign Agreements to Boost Business Mobility and Investment

You must be logged in to post a comment Login