Featured

USDA Production Estimates Influences Oats and Corn Futures Prices

Corn and Oats closed with moderate losses last week on selling seen in response to the latest USDA production and supply and demand estimates. Trends turned mixed on the daily charts for both markets. December Corn was also lower last week on ideas of solid harvest progress and ideas that farmers might be selling right off the combine. Support came from strong ethanol demand data.

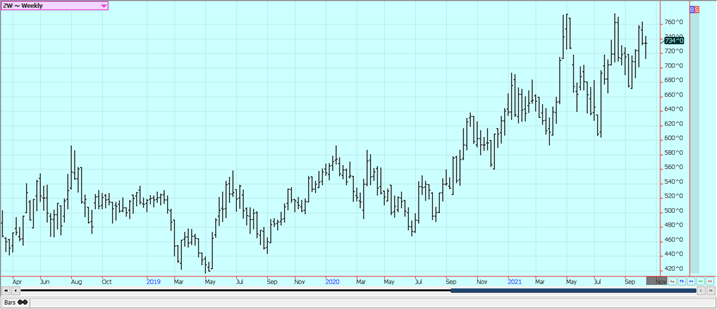

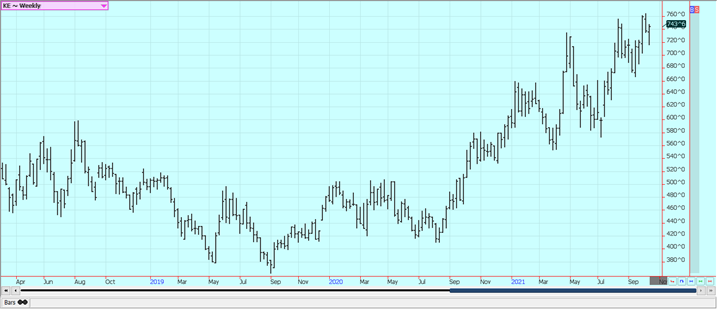

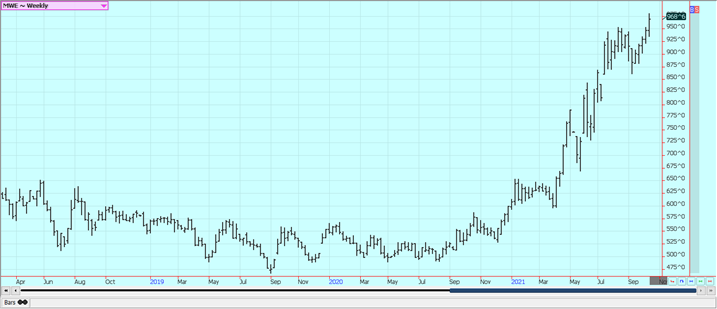

Wheat: Winter Wheat was lower last week and Minneapolis Spring Wheat was higher as are trends trying to turn up again on the daily charts. Trends are still up on the weekly charts. The US and Canada have reduced production this year and so do most exporters around the world. Production is less this year in Russia and internal prices have been strong. Dry weather in southern Russia as well as the northern US Great Plains and Canadian Prairies remains a supportive feature in the market although the weather has become old news. The Russian weather has been good for production in northern and western areas but is still trending dry in southern areas and into Kazakhstan. Siberian Spring Wheat conditions have been very good. Europe is expecting top yields in some areas but less yield in others and parts of eastern Europe and northern Russia are expecting strong yields. European quality is a problem due to too much rain in some areas and not enough in others.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

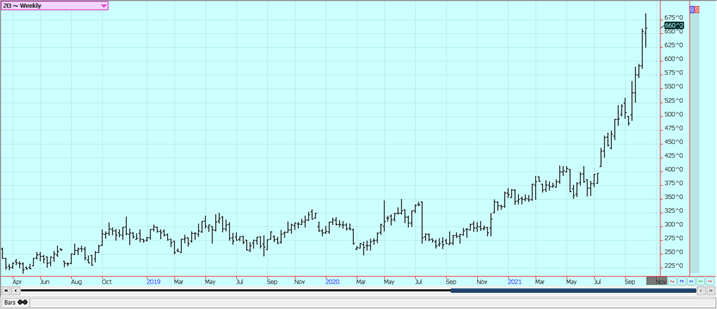

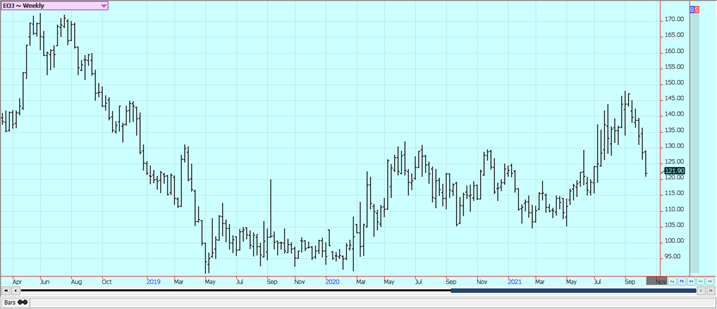

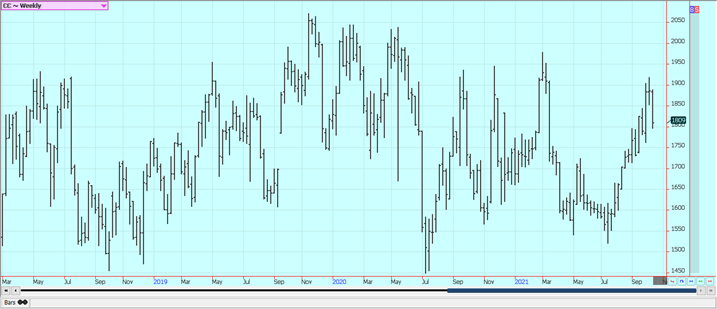

Corn: Corn and Oats closed with moderate losses last week on selling seen in response to the latest USDA production and supply and demand estimates. Trends turned mixed on the daily charts for both markets. December Corn was also lower last week on ideas of solid harvest progress and ideas that farmers might be selling right off the combine. Support came from strong ethanol demand data. USDA showed a slight increase in yields and production and increased ending stocks in the reports released on Tuesday. Demand will be an increasing feature in the trade moving forward as the harvest moves to its halfway point. Initial yield reports have been mixed, with some lower yields reported due to disease but some higher than expected yields reported in western areas. Most of the elevators along the Mississippi are exporting again which is good news for nearby demand. There are a lot of ideas that production and planted and harvested area will be significantly less next year due to the lack of fertilizers available and the cost of production. The Oats market knows that supplies will be tight due to a drought in the northern Great Plains and Canada. There will not be much in the way of high quality Oats for consumers to buy in the coming year.

Weekly Corn Futures

Weekly Oats Futures

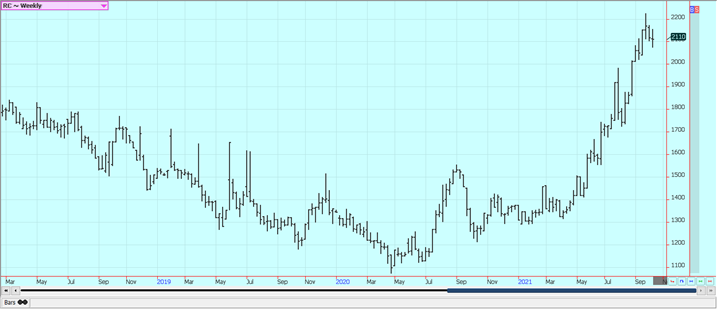

Soybeans and Soybean Meal: Soybeans were lower last week and the products closed a little lower despite recovery trading seen after a couple of hard down days from the latest USDA reports. The selling came in response to the USDA reports released on Tuesday and as chart patterns remain down. Speculators were the best sellers but turned buyers later in the week. USDA greatly increased yields and production and increased ending stocks levels on Tuesday and ideas are that further increases are coming. The weekly charts still show downtrends for all three markets, and the daily chart trends are down in Soybeans and mixed Soybean Meal. Chinese demand has been supportive until now as the country was active in the US Soybeans but China is on holiday this week so no sales announcements are expected. Harvest is moving to the halfway point for Soybeans and a harvest low might be seen during the second half of the harvest. Gulf port elevators are coming on line and exports are increasing.

Weekly Chicago Soybeans Futures:

Weekly Chicago Soybean Meal Futures

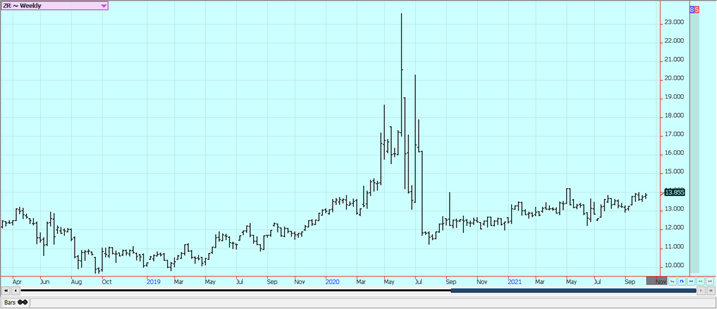

Rice: Rice closed higher last week and chart trends are turning up again. USDA increased yield very slightly but cut imports by quite a bit in its latest reports released on Tuesday. USDA also cut demand but ending stocks were reduced anyway. Ideas are that demand is not yet strong enough to take up the supply available to the market. The first crop has been largely harvested in Texas and in Louisiana, but the second crop is still in the field and is getting harvested now. Harvesting is about over in both states now. Mississippi and Arkansas producers are also almost done with the harvest. Yield reports and quality reports have been acceptable to many in Texas and are called good in Louisiana. The reports have been good in both Arkansas and Mississippi

Weekly Chicago Rice Futures

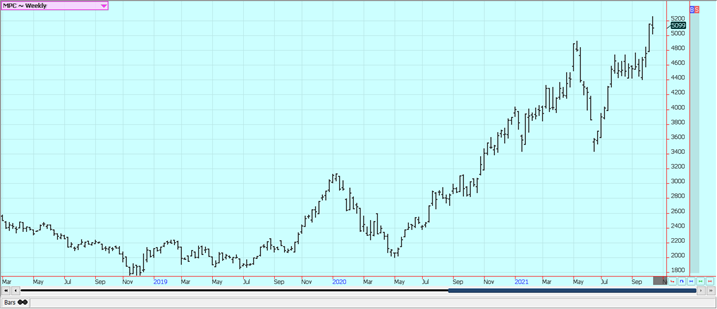

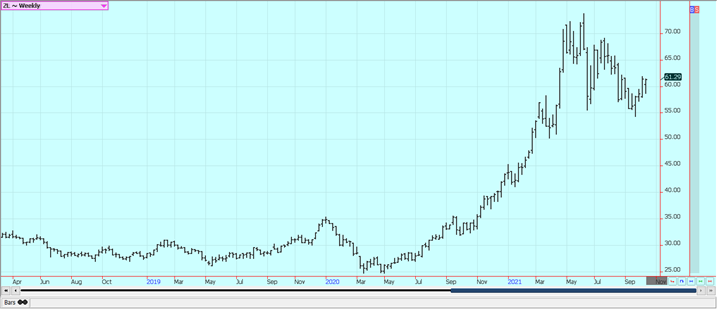

Palm Oil and Vegetable Oils: Palm Oil was higher on Friday but lower for the week on rallies in slow exports as reported by the private services. Support still comes from ideas that supply and demand are in balance or supplies are short. India was the major importer as the country reduced import taxes. It has also reduced import taxes now for Soybean Oil and Canola Oil and this has caused some demand worries for Palm. The weekly chart trends are up again. There are ideas of tight supplies due to labor problems. There are just not enough workers in the fields due to Coronavirus restrictions. Production has also been down to more than offset the export losses so prices have trended higher. Canola closed lower for the week as the harvest is continuing amid good conditions in the Prairies. Farmers are bullish and reluctant to sell and would rather work in the fields. The weekly chart trends are sideways. Production ideas are down due to the extreme weather seen in these areas. It remains generally dry and warm in the Prairies. The Prairies crops are in big trouble now due to previous hot and dry weather.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures:

Cotton: Futures were lower last week but held to the trading range of the previous week. USDA sent the markets lower with the production and WASDE reports on Tuesday. The USDA reports showed better production than anticipated but very good demand for US Cotton. Demand data was unchanged in the USDA reports Tuesday. Demand for US Cotton remains very strong and that is good news for sellers as the strong demand implies strong prices should continue. The demand is expected to be strong from Asian countries as world economies recover from Covid lockdowns. Analysts say the demand is still very strong and likely to hold at high levels for the future. Good US production is expected, but there are some questions about the overall production in Texas. There are ideas of less production from India due to recent adverse weather in Cotton areas there. Chinese Cotton areas have had too much rain as well, and Chinese demand is also strong as clothes makers use foreign Cotton to get away from domestic supplies that might have been produced by forced labor and might not be allowed in the US or other western countries

Weekly US Cotton Futures

Frozen Concentrated Orange Juice and Citrus: FCOJ closed lower last week on what appeared to be speculative selling as the hurricane season has passed its peak and the chances for a damaging storm to hit the state of Florida are dropping by the day. The weather remains generally good for production around the world. Brazil has some rain is in the forecast and flowering will be possible in the next couple of weeks. Weather conditions in Florida are rated mostly good for the crops with scattered showers and near-normal temperatures. Mexican crop conditions in central and southern areas are called good with rains, but earlier dry weather might have hurt production. Northeastern Mexico areas were too dry but have gotten good rains in recent weeks, and the rest of northern and western Mexico is rated in good condition. Florida is in the latter stages of the hurricane season but the storms have missed the state so far and crop conditions are good.

Weekly FCOJ Futures

Coffee: New York closed the week a little higher and London closed a little lower and trends are still up in New York and mixed in London. The rally is still supply-based. Coffee in Brazil reported smaller exports in September and this was the fundamental reason for the move. The lack of Coffee and freight to move the Coffee that is available is still supporting futures. It has been dry in Brazil and there has been a big freeze there. New York and London are both having trouble sourcing Coffee from any country due to a shortage of containers to carry the Coffee out of the origin country. Scattered showers are still in the forecast for Brazil and some flowering could occur. Scattered showers are now in the forecast for Southeast Asia and big rains are possible in Vietnam from a tropical system. Big rains were reported in Vietnam over the weekend and more are possible by the end of the week. Good conditions are reported in northern South America with above-average rains and good conditions are reported in Central America with near-average rains. Conditions are reported to be generally good in parts of Africa.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

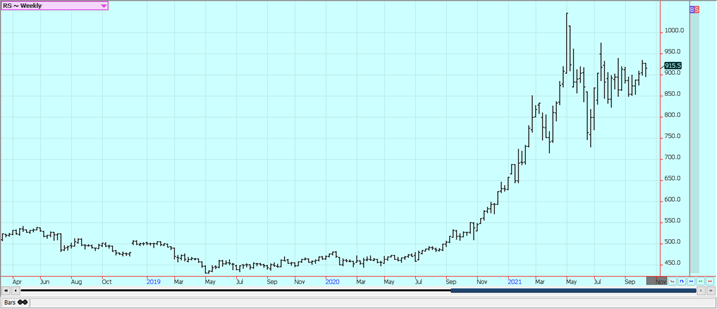

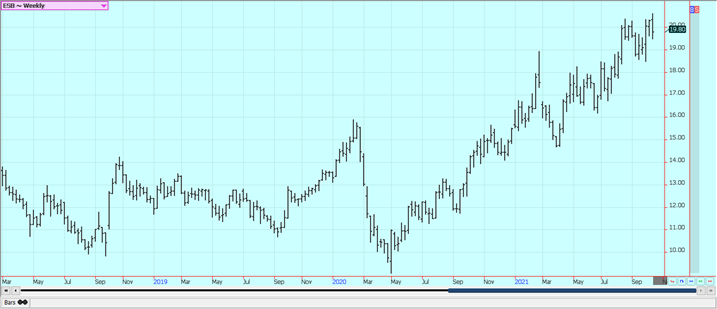

Sugar: New York and London were higher last week as supplies remain tight and demand is said to be improving. Trends are still trying to turn up again on the daily and weekly charts. Ideas are that the supplies available to the cash market are rather slim and that demand is increasing for both White and Raw Sugar. The reduced production potential from Brazil is still impacting the market. India is not offering as world prices are well below domestic prices and has had some weather problems of its own. Consumption of Sugar is said to be improving from previously low levels. Thailand is expecting improved production. It is raining in southern Brazil which will be good for the next crops there but the tight situation now must still be dealt with.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

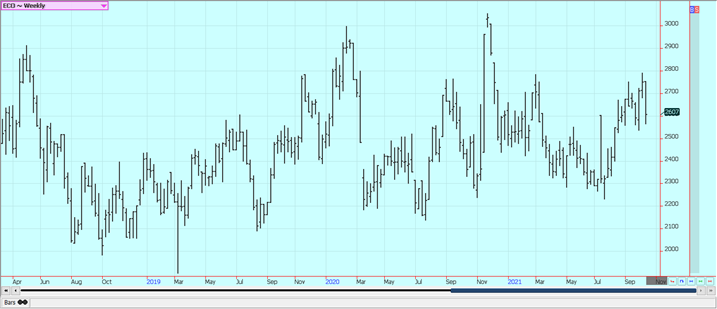

Cocoa: New York and London closed lower last week on what appeared to be speculative selling. Ideas of short West African production for the coming year are still providing the best support. There are increasing concerns that Ghana will have less production this year and it has been raining in the Ivory Coast to promote the return of disease to the pods. Ghana is the world’s second-largest producer behind Ivory Coast so reduced production in both countries could mean short supplies for the world market this year. World economies are starting to reopen after Covid and the open economies are giving demand the boost. Cocoa production in Ivory Coast is expected to drop by up to 11% in the 2021/2022 season that starts on Oct. 1 from the previous year.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

—

(Featured image by Lexian via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Crypto2 weeks ago

Crypto2 weeks agoRipple Launches EVM Sidechain to Boost XRP in DeFi

-

Impact Investing6 days ago

Impact Investing6 days agoShein Fined €40 Million in France for Misleading Discounts and False Environmental Claims

-

Impact Investing3 days ago

Impact Investing3 days agoVernazza Autogru Secures €5M Green Loan to Drive Sustainable Innovation in Heavy Transport

-

Cannabis2 weeks ago

Cannabis2 weeks agoCannabis Company Adopts Dogecoin for Treasury Innovation