Business

USDA weekly charts report a higher trade of wheat market for Chicago

Increased wheat trade was observed in Chicago but Minneapolis’ market closed lower. Production remains steady despite consistently low demands.

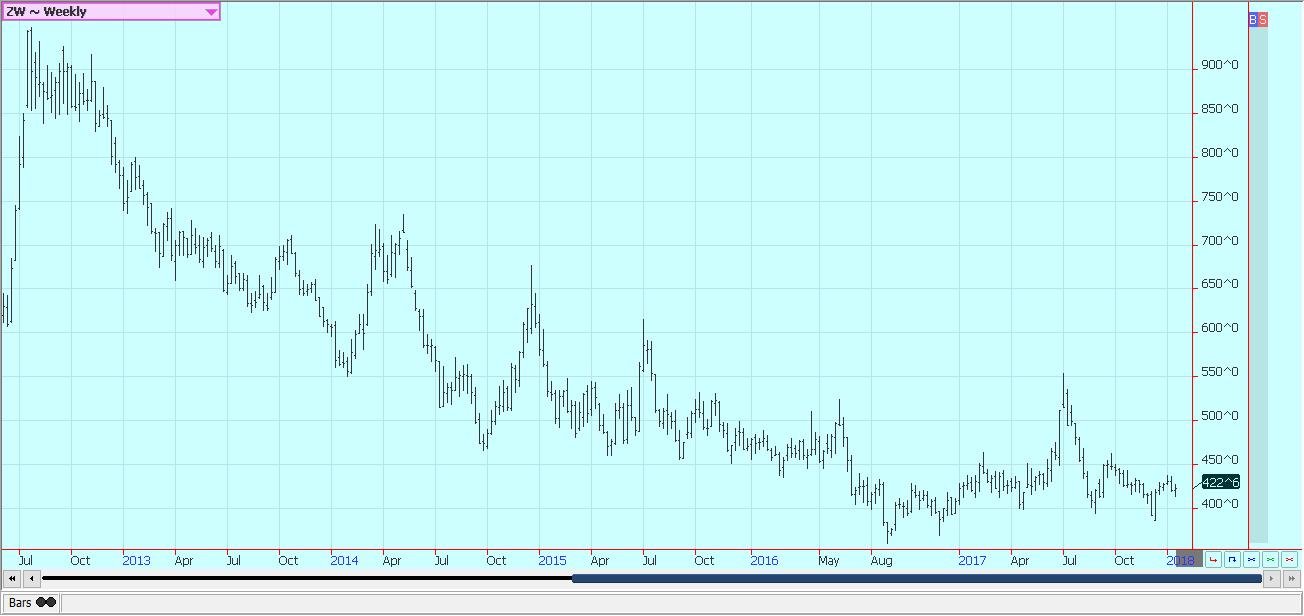

Wheat

Chicago winter wheat markets closed slightly higher for the week, but Minneapolis closed a little lower. It was a slow week as the market kept an eye on the weather in the US Great Plains and on the world price. Russian prices have been somewhat firmer lately due to a strong ruble. However, US prices have not been able to rally and export demand, for US wheat has remained bad even with the US Dollar weakness. There has been no demand spark for a rally. The market is noting dry conditions in western Kansas and other parts of the western Great Plains and the La Niña winter weather forecast. A drought remains in the region and has become more serious, especially in Oklahoma and Texas. The crop has not established itself well due to the dry weather. World estimates, in general, remain large, and even reduced US production cannot change this fact very much. US prices will need to remain competitive with European and Russian prices to get much business, and US demand is not strong right now. The weekly charts show that both winter wheat markets and Minneapolis spring wheat markets remain in sideways trends.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

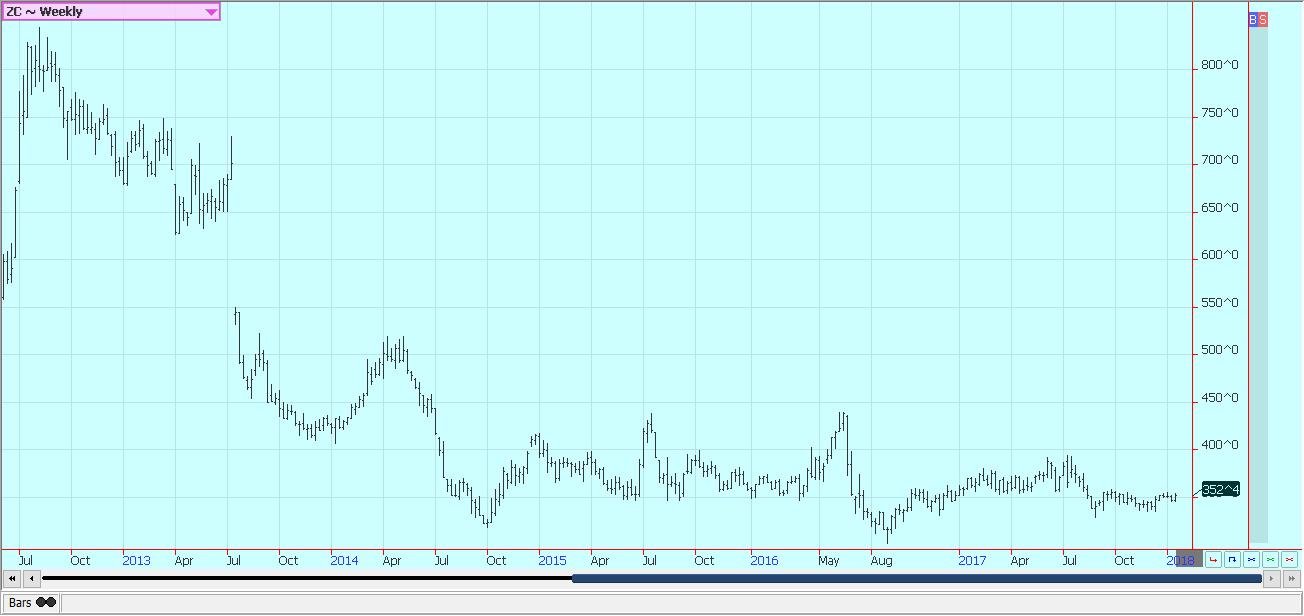

Corn

Corn and oats closed higher last week. Corn futures found support from speculative buying as funds and other speculators move to cover short positions. There does not seem to be a real fundamental trigger for the move, but the market did not really move down in response to some bearish production estimates from USDA in the annual reports, and that could be an indication that all the bad news is now in the market. Overall demand for corn remains good, and demand for other feed grains such as sorghum and oats is strong. Demand in the US has been very strong from the ethanol sector, and USDA will still likely need to increase corn consumption from this sector again this month in the supply and demand updates that will be released next month. Questions continue about corn demand from the feed sector, but the animals are out there to feed. The trade is still looking at the dry weather in southern Brazil and Argentina. Forecasts for this week are hot and dry again, with the biggest problems in Argentina. Reports indicated that the weather is good enough right now in Brazil. Farmers have reportedly sold some corn on the rally for cash flow reasons and due to bearish market ideas. They think there is too much corn around to have prices move significantly higher. Not much selling is reported in South America. US prices are cheap now, and trends in the market are sideways. Prices are probably cheap enough, so any problem could produce a strong rally sooner or later as market attitudes have been bearish but the market has not really been going lower.

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

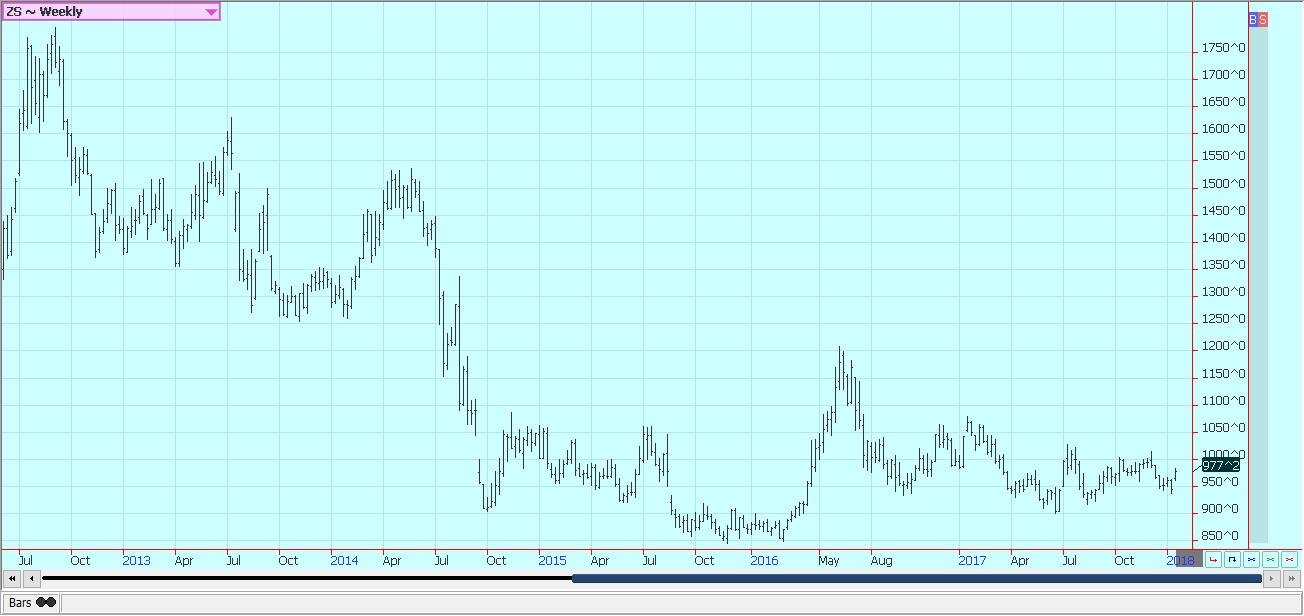

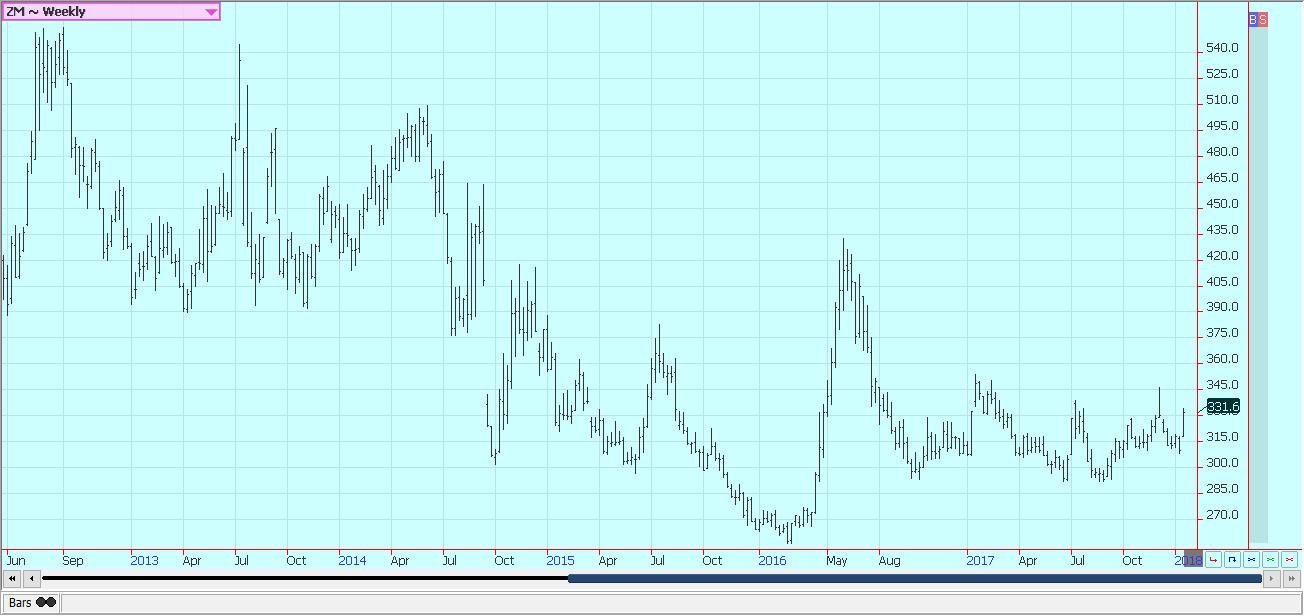

Soybeans and Soybean Meal

Soybeans and soybean meal were higher last week, with soybean meal the strength of the market. Chart trends turned up on the weekly charts for soybean meal, but the market is already close to swing targets for the move. Meanwhile, soybeans weekly charts have a firm look to them even if the trends are not up for the longer term. The charts give indications that futures can test the highs above 1,000 in the near term. It seems that the market has anticipated the bearish news for the market. Traders had expected bearish reports for soybeans from USDA earlier this month, with many saying that US ending stocks levels could be well over 500 million bushels because of the weak demand. USDA has accounted for the weaker demand and still kept ending stocks levels at much more moderate levels than the most bearish trade expectations. Ideas that soybean production in southern Brazil and Argentina are still suffering from dry weather are still the main features of the market. However, there are rain forecasts for next week in the driest areas, so some of the recent buyers started to sell. The main focus now will be on Argentina, where the threat of drought returning over the next 30 days seems to be most likely. Northeast Brazil has also been dry and is missing out on the current rains.

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

Rice

Rice closed higher in reaction to the USDA reports. USDA cut production estimates and also current supplies in the data released earlier in the month. The monthly supply and demand updates showed that less export demand should be expected, so ending stocks were lower on a month to month basis but not as much as the reduced production and current supplies would have implied. Market focus is back on the current supply situation in response to the USDA reports, but producers are also looking at the coming season and are trying to decide how much rice to plant and what price level to start selling. There is a lot of talks that acreage can be increased significantly this year due to the current strong prices and on stronger prices now in Southeast Asia. That means that producers should start looking for ways to sell some of the next crops on any strong rallies from here as a way to get started. The daily and weekly charts suggest that higher prices are coming in nearby contracts as the market works through a tight supply situation.

Weekly Chicago Rice Futures © Jack Scoville

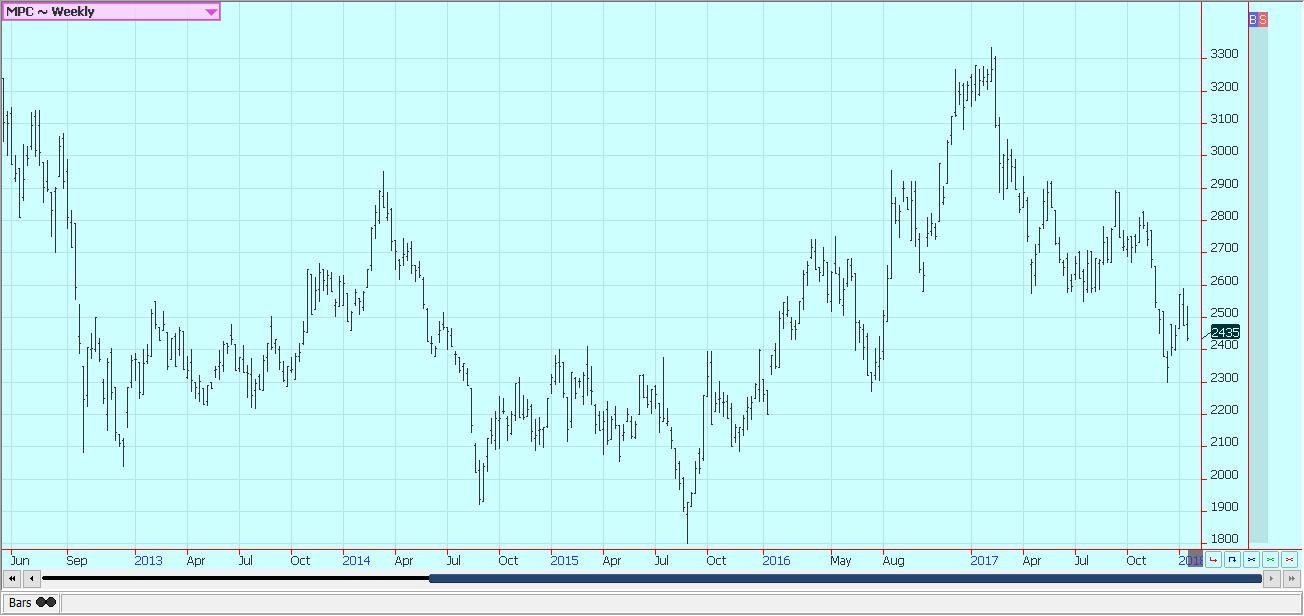

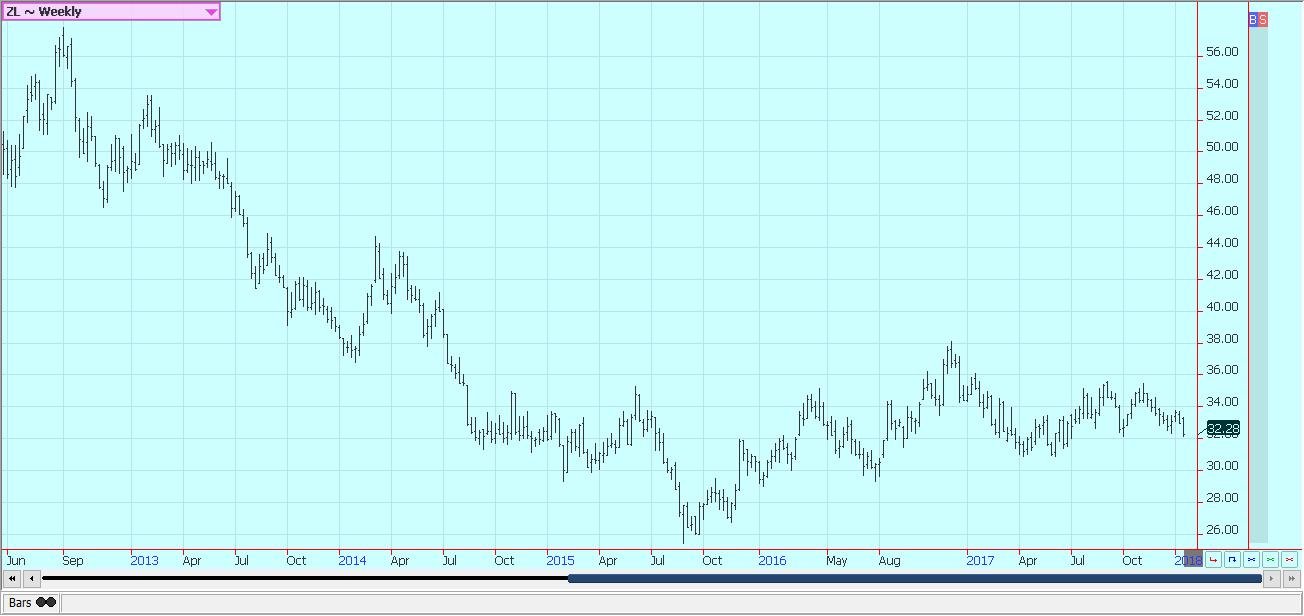

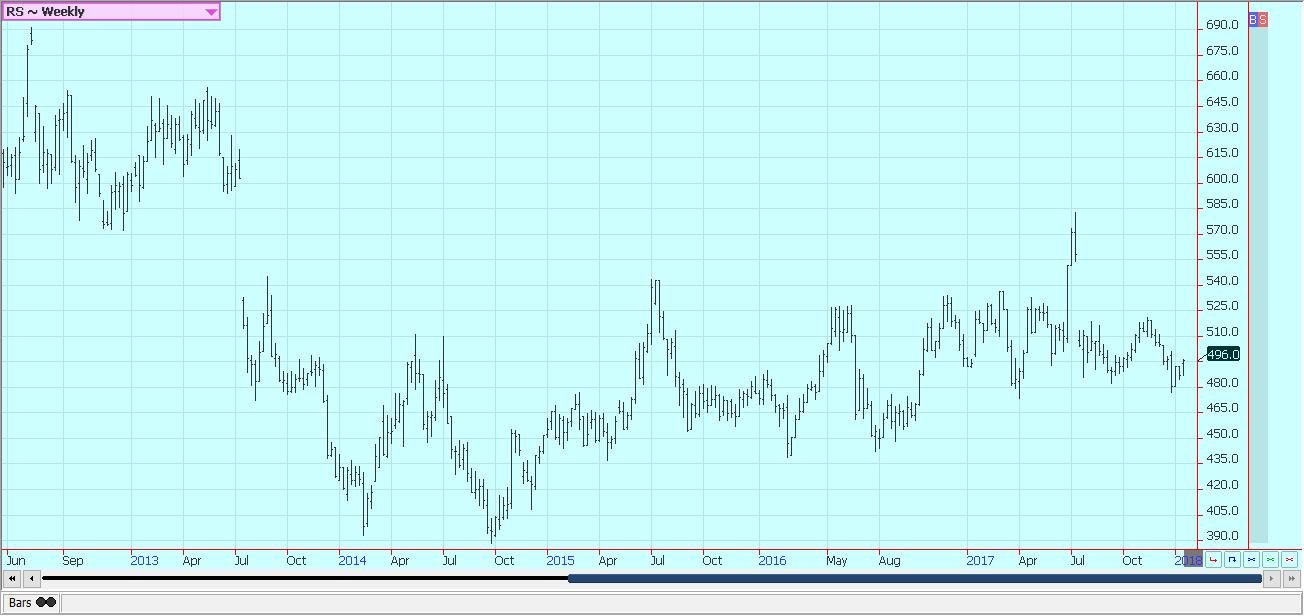

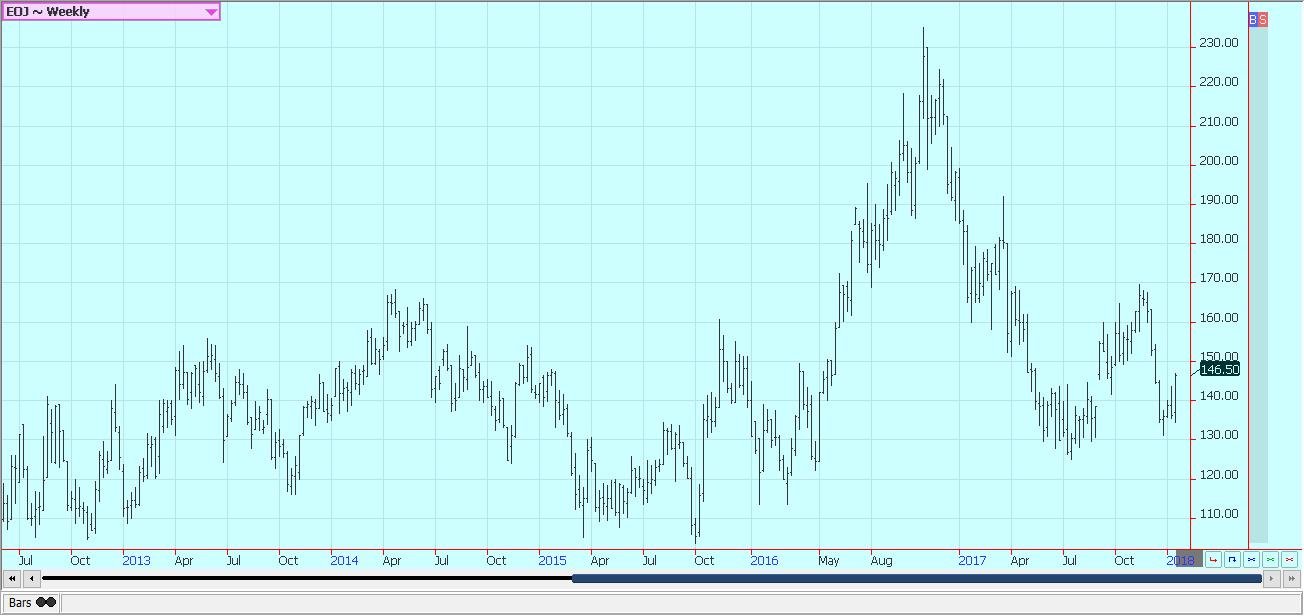

Palm Oil and Vegetable Oils

World vegetable oils prices were generally lower last week. Palm oil charts show the most potential for weakness as the weekly charts suggest that a big bear flag has been completed. The trade is looking for palm oil production to decrease in line with seasonal trends. However, the demand side is very uncertain at this time. The EU has approved mandates for 35% use of biofuels by 2030 but specifically excluded palm oil as a feedstock for the fuels. Export demand was solid in December but has been slower this month. The Lunar New Year is coming, so a demand bump is possible in the short term as buyers get covered before the holidays. Trends in palm oil are down on the daily charts. Canola markets have firmed and could turn into a trading affair. The market broke higher last week and appears to have completed a bottom on the charts. It is warmer in the Prairies this week and the harvest is over, so farmers are more willing to sell. However, deliveries to elevators have been strong due in part to forward selling earlier in the year. US demand for soybean oil in biofuels should remain strong as the US moved to put punitive tariffs on imports from Indonesia and Argentina. Soybean oil is testing the recent lows on the weekly charts.

Weekly Malaysian Palm Oil Futures © Jack Scoville

Weekly Chicago Soybean Oil Futures © Jack Scoville

Weekly Canola Futures © Jack Scoville

Cotton

Cotton was higher again last week. Trends remain up, and the tone of the market remains positive. Current buying is reflecting the fact that merchants need to buy futures to cover on-call positions. The weekly on-call report issued on Friday showed that more cotton needs to be bought in the futures market. The classings report showed that there is plenty of Cotton here, but getting it out of producers’ hands has been difficult, and prices have been much higher than most commercials had expected. Commercials are being forced now to buy cotton at higher levels to cover the big on-call position of unpriced cotton that they have contracted for. The classings also show worse than normal grading data. The hurricanes and the freeze appear to have really damaged quality, and the quality losses have forced mills and exporters to pay up for better quality cotton. Producers remain limited sellers at best.

Weekly US Cotton Futures © Jack Scoville

Frozen Concentrated Orange Juice and Citrus

FCOJ closed higher and made new highs for the move as the trade assessed the potential for damage to crops from the cold weather that hit Florida last week. Trends are up on the daily charts as futures held support and then rallied to new highs for the move. There is no more cold weather in the forecast for Florida, so the damage is done. Any fruit damaged this week by a freeze will now be sent quickly to processors to be made into FCOJ, but the colder temperatures should be mostly beneficial in helping with acid content and fruit color. The current weather is good as temperatures are turning warmer and there is little rain around, but the crop is small. The harvest is progressing well, and the fruit is being delivered to processors and the fresh fruit packers. Trees in Florida that are still alive now are showing fruits of good sizes, although many have lost a lot of fruits. Florida producers are actively harvesting and performing maintenance on land and trees. Processors mostly getting field-run fruit.

Weekly FCOJ Futures © Jack Scoville

Coffee

Futures were lower in New York and higher in London. New York traders are noting the good weather currently being reported in Brazil and expect another bumper crop. CONAB estimated the crop near 48 million bags last week. That estimate was higher than expected by the trade and in line with many private estimates. CONAB is usually a lower estimate, so there are fears that the crop could be significantly bigger now. Internal prices in Vietnam remain at high levels compared to London. The situation seems to have changed a little in Latin America. There are reports of short crops in parts of Central America and some areas in South America due to the lack of farmer investment from the low prices. However, Honduras has been a very active exporter and appears to be in position to make up the difference in exports from reduced offers in the rest of Central America and Colombia.

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

Sugar

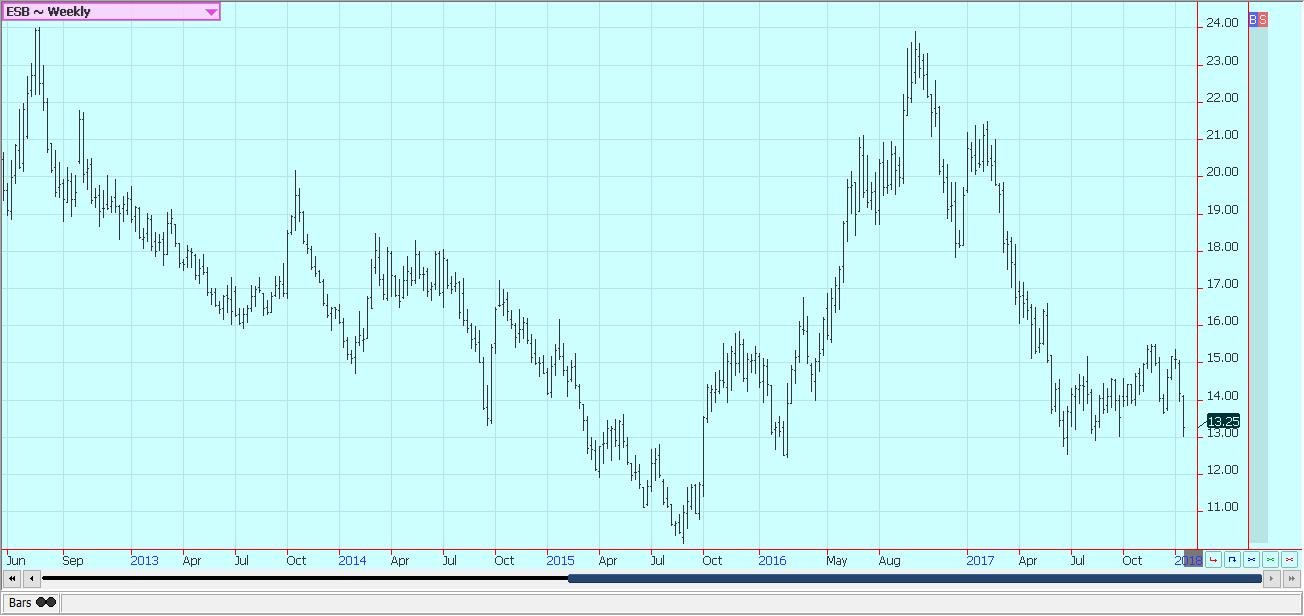

Futures were lower last week, and trends are down on the daily and weekly charts. Ideas that sugar supplies available to the market can increase in the short term have been key to the selling. Brazil is considering the end of import tariffs on US ethanol, and this has triggered selling in sugar as more cane can now be processed into sweetener. The move comes as ethanol prices in Brazil are very high. It wants lower ethanol prices to help control energy prices in the domestic market. Price action had been strong due to the strong demand for ethanol that has diverted some Brazil mill production away from Sugar. However, prices fell apart as resistance on the charts could not be breached and on forecasts for excessive production from the ISO and from private analytical firms. Mills in Brazil have decided to make more ethanol as world crude oil and products prices have been very strong. Ideas are that these prices can continue strong as OPEC and Russia have agreed to keep production constrained compared to world demand.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

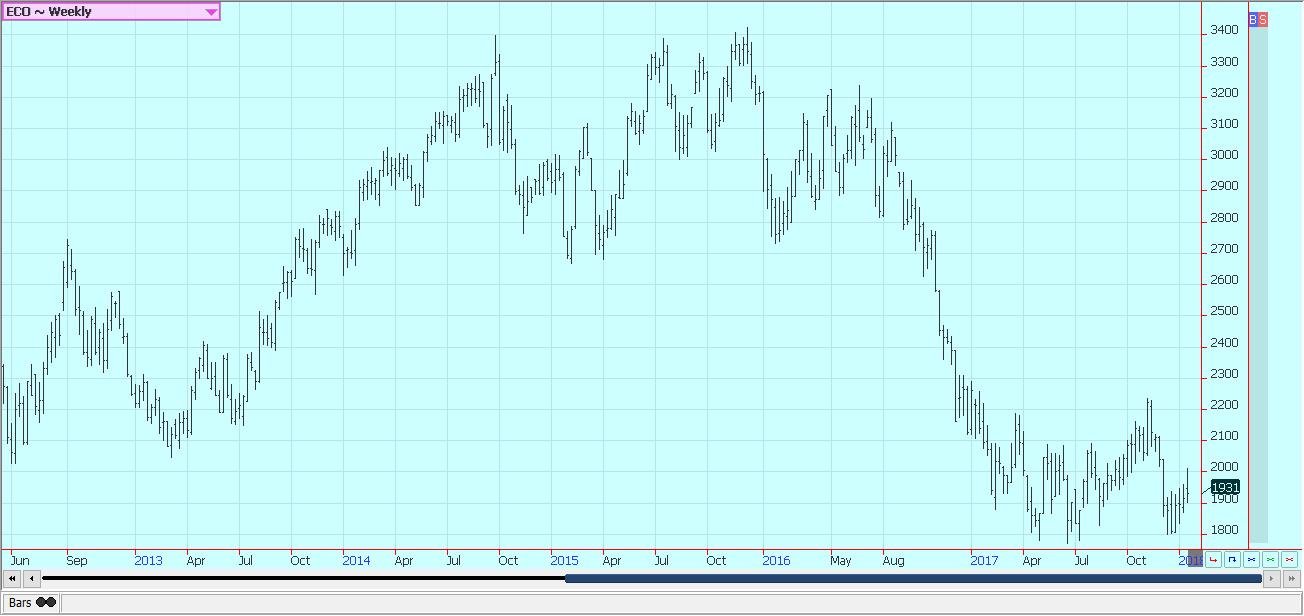

Cocoa

Futures closed lower in New York and lower in London last week. Trends are sideways in both markets for the short term. The North American grind data released on Thursday showed a lower grind and should be negative for the trade this week. The West African main harvest has started to wind down, and focus is shifting to the next round of grind data and the weather for the West African mid-crop. Ideas are that cocoa demand from grinders can be strong this quarter due to the weaker prices and that the EU grind was strong and above trade expectations. The market is also on alert for the Harmattan winds that can suck moisture from the soil and trees and really hurt bean quality and production. These winds have not developed as of yet, but they could emerge at any time. It has become hot and dry in many parts of West Africa, so conditions are very good for the winds to form. Some crop losses might be possible if the current conditions persist even without the winds. Arrivals in West Africa remain behind year-ago levels when they were expected to be above year-ago levels.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

_

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Cannabis1 week ago

Cannabis1 week agoAurora Cannabis Beats Expectations but Faces Short-Term Challenges

-

Crowdfunding5 days ago

Crowdfunding5 days agoSavwa Wins Global Design Awards and Launches Water-Saving Carafe on Kickstarter

-

Biotech2 weeks ago

Biotech2 weeks agoAsebio 2024: Driving Biotechnology as a Pillar of Spain and Europe’s Strategic Future

-

Business11 hours ago

Business11 hours agoDow Jones Nears New High as Historic Signals Flash Caution

You must be logged in to post a comment Login