Featured

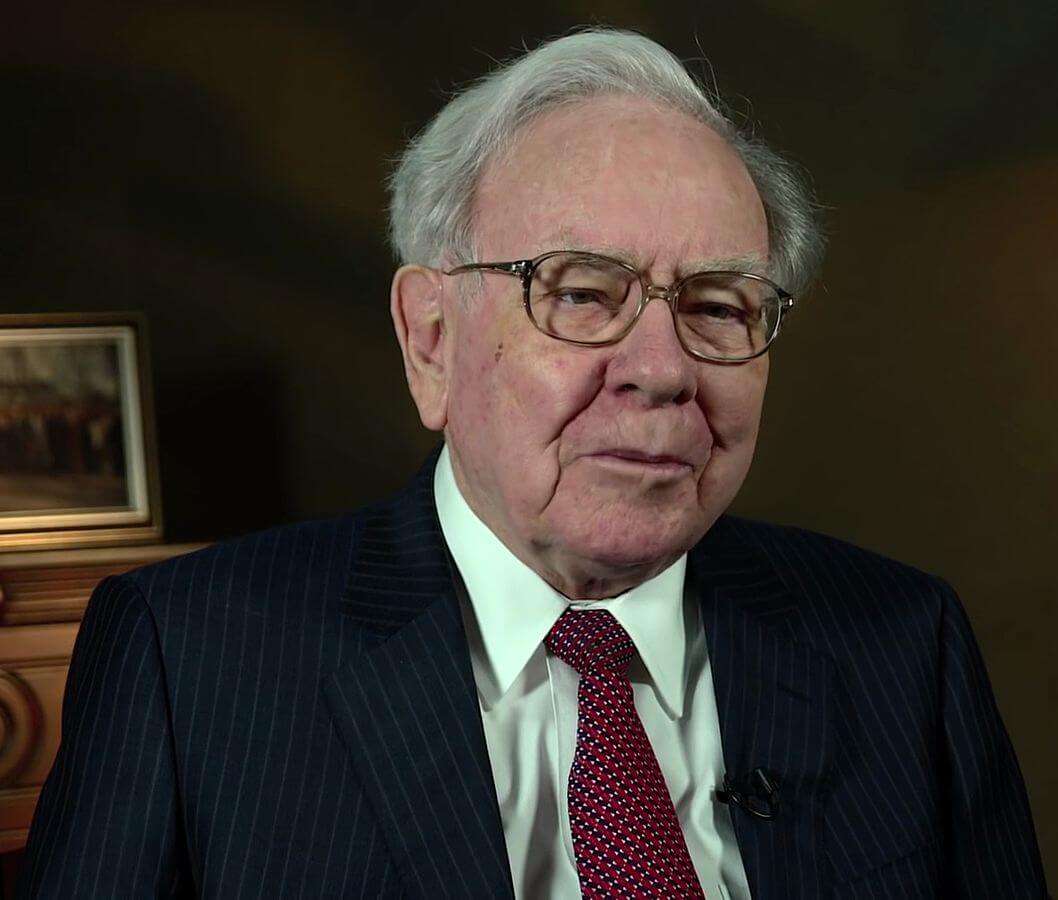

Here’s why Warren Buffett does not want $100B in cash

Warren Buffet’s cash pile is getting bigger but finding worthy investments prove to be a hard task for the Oracle of Omaha.

Warren Buffett is born with a knack for seeing things beyond the superficial. He has been successful because of his selective investments. However, as his wealth nears $100 billion in cash, it presents a concern for the Oracle of Omaha.

According to Bloomberg, the pile of cash means the money is not invested somewhere else. This also means, they are not earning and just sits idly. Although Buffett is selective to where he will put his money, he has broadened the selection this year. He made investments in Apple Inc., real estate investments, and mortgage lender.

The billionaire is looking for investments that can be a good choice in the bull market for the coming years. However, holding out and waiting patiently for the right time to make investments could also prove to be beneficial for Buffett.

Interestingly, two of the top five investments Warren has made are international companies. As Fortune reported, aside from Wells Fargo and Berkshire Hathaway, the companies which give him the highest annual average rate of return include PetroChina, which yields a total return of 720 percent, and BYD with 671 percent. The former’s annual average compounded return stands at 52 percent while the latter’s is 41 percent.

Warren Buffett cash: A cash pile worth $100 billion worries Warren Buffett. (Source)

Unknown to many, not all of what Buffett touches turn to gold. He has also made costly blunders in the past. Per Business Insider, he admits his mistakes investing in energy industry, oil and textile business. On the other hand, this proves he is still a human but what separates him from the rest is, he learned from them, moved forward and tried again.

VICE News reports that amid the record-setting numbers the stock market is eclipsing daily, Warren Buffett’s Berkshire Hathaway seems to be struggling. As mentioned above, the piles of cash are mounting and sitting idly and its Q2 profits plunged by as much as 15 percent. Should experts be worried? The answer as of now is no, as other investments have reported gains.

Should Buffet worry? The answer is not yet. The financial guru knows what he is doing. He has been on the top of his game for decades. He will make a move soon, and just like what he did before, it will surely be a good one.

-

Biotech5 days ago

Biotech5 days agoBiotech Booster: €196.4M Fund to Accelerate Dutch Innovation

-

Markets2 weeks ago

Markets2 weeks agoCoffee Prices Decline Amid Rising Supply and Mixed Harvest Outlooks

-

Crypto2 days ago

Crypto2 days agoBitcoin Traders Bet on $140,000: Massive Bets until September

-

Crypto1 week ago

Crypto1 week agoCaution Prevails as Bitcoin Nears All-Time High

You must be logged in to post a comment Login