Featured

Wheat and Corn prices take a nose dive threatening Agricultural markets

Corn moved a little lower last week. Oats were lower for most of the week and closed near the weekly lows. The main driver was the Coronavirus that has threatened world trade in all agricultural goods. World vegetable oils markets were also lower. Frozen Concentrated Orange Juice and Citrus ( FCOJ )was higher for the week. Futures act as if it could work higher despite bearish fundamentals.

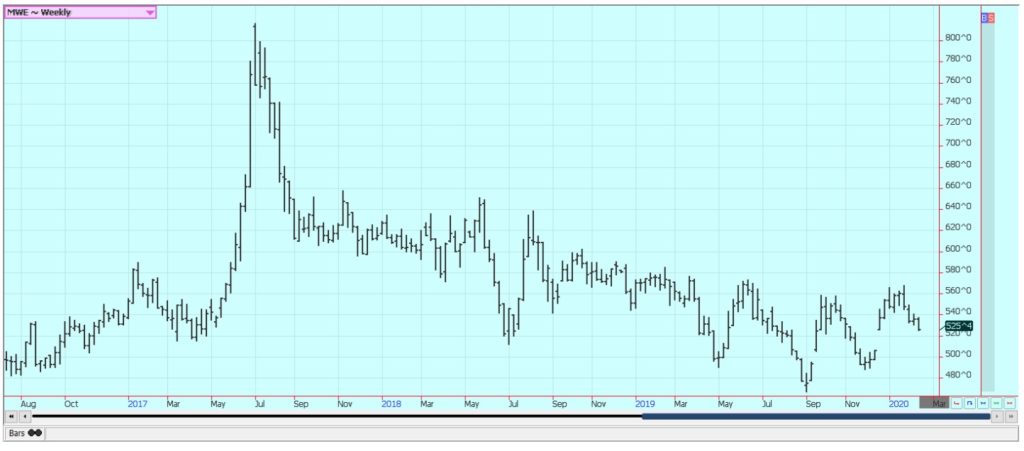

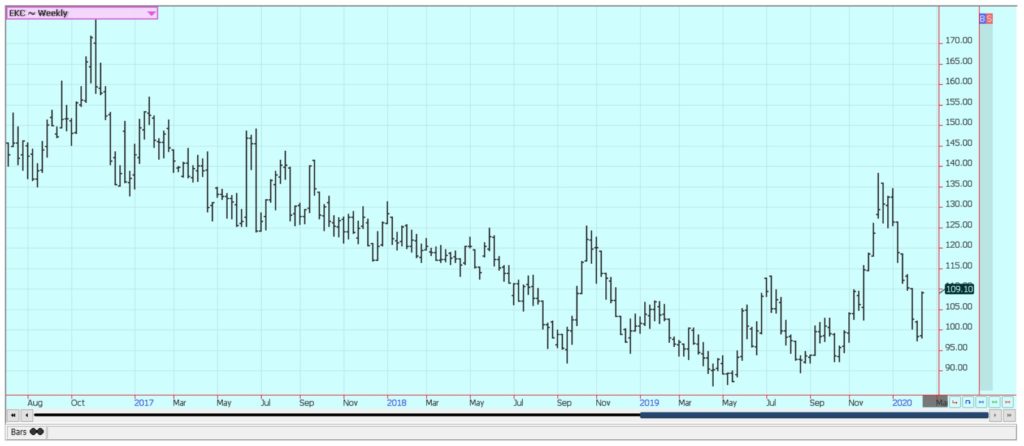

Wheat

Wheat markets were lower for the week with Chicago SRW and Chicago HRW taking the brunt of the down move and Minneapolis Spring markets also lower. The weekly charts show that tops have been established but that futures markets have come close to initial swing targets for the move lower.

The move lower comes amid weaker world prices for Wheat. Russia has been lowering its prices in an effort to stimulate sales. East and West Europe have weaker prices as well. The good news is that sales of US Wheat continue to move along at a good pace.

So, the US is participating in the world market even with all of the competition from Russia and also Europe. The competition for sales is strong as seen in the Russian and European pricing and this is what has hurt the futures prices recently. The good US Sales should help to keep future prices from falling too much and initial chart indications suggest that some sideways trading is possible now.

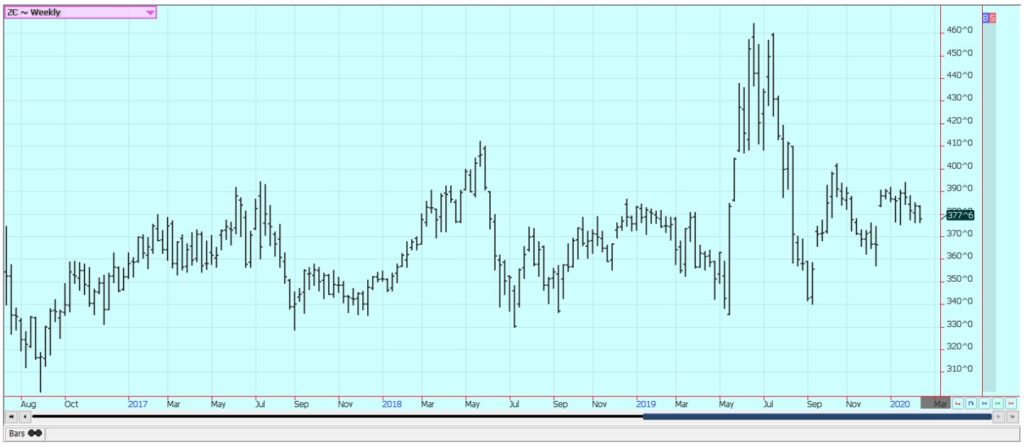

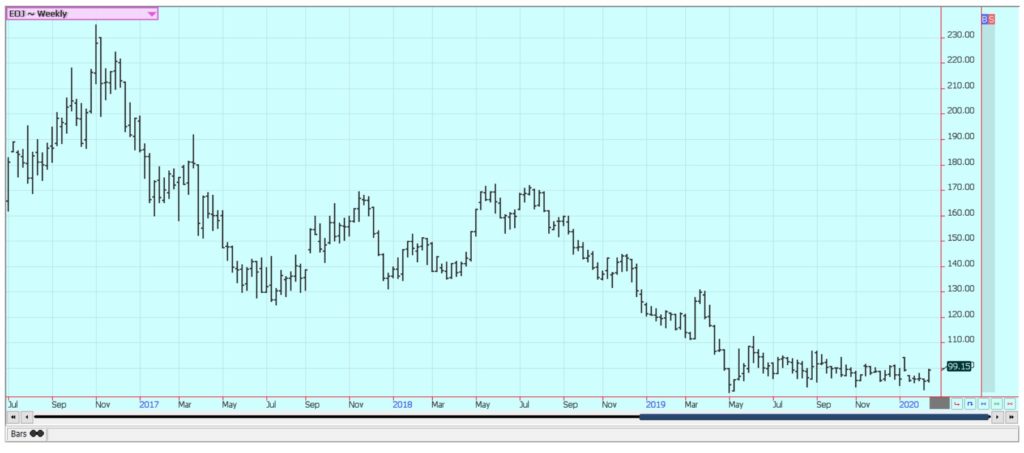

Corn

Corn moved a little lower last week. Oats were lower for most of the week and closed near the weekly lows. The main driver was the Coronavirus that has threatened world trade in all agricultural goods. Export demand has been disappointing, but it was solid last week, and ethanol and other industrial demand has started to improve but faces an uncertain road ahead. Export demand remains an open question despite the big sales in the last few weeks and the trade deals consummated in the last couple of weeks with Canada, Mexico, and China. Much of the improved ethanol demand will be seen if and when China starts to buy. Feed demand is improved.

Soybeans and Soybean Meal

Soybeans and Soybean Meal both closed a little higher. The price action was especially strong in Soybeans and came on the back of potentially encouraging demand news. The news that the Phase One deal that covered agricultural goods was scheduled to get started this week was a little bullish for the markets. China has not yet asked for a modification of the terms due to the Coronavirus outbreak currently decimating the south central area of the country. There are hopes that China will start to buy in earnest from the US starting this week. A lot will depend on the price of US Soybeans and those from Brazil and Argentina. Lower prices there will hurt overall demand here, and lower prices are very possible in Brazil. Brazil is harvesting now and yield reports from the field indicate that a bumper crop is coming. Argentina has been dry but is now getting some very timely rains.

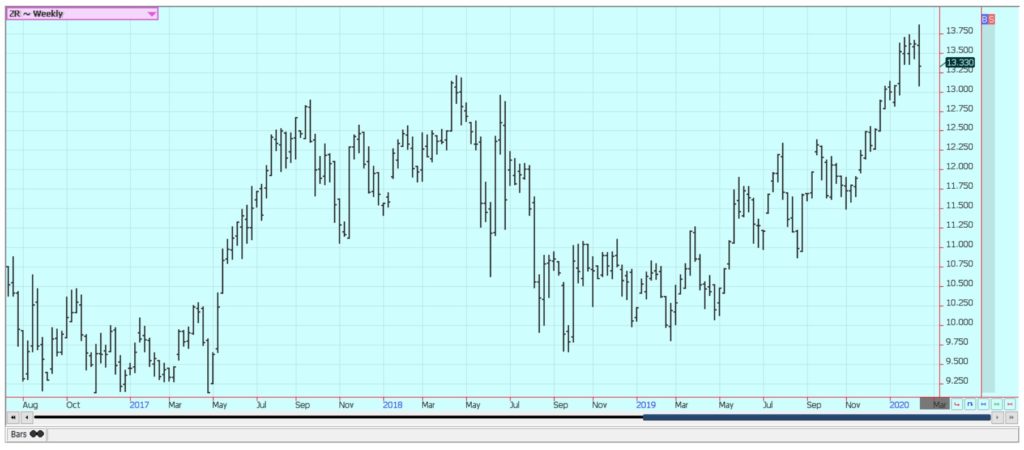

Rice

Rice was lower and the weekly charts show that futures made an outside week down for a key reversal to the downside. It was a very bad move for a market that still has mostly bullish fundamentals. Some producers are selling the next crop and the trade and open interest in the September contract is relatively large for the time of year. More selling from producers of the next crop is expected on any further rally attempts. Demand for US Rice remains generally positive and the export sales pace in general has been very good. The US domestic market is now quiet with the harvest mostly done and no one real interested in selling. Mills and exporters are thought to be covered for now but will need to step into the market to buy again soon.

Palm Oil and Vegetable Oils

World vegetable oils markets were lower. The downside leader was Palm Oil that gaped lower after being closed for the first couple of days of the week. Soybean Oil closed lower after finding some selling interest on competition from Argentina and the weakness in Palm Oil. Palm Oil was hurt by the political spat between India and Malaysia as well as the potential for lost sales to China. Demand for Palm Oil from China could take a hit with the new trade agreement between the US and China, but Malaysian authorities expect to send good volumes of Palm Oil there. Those ideas got hurt by the outbreak of the Coronavirus that is threatening trade across a very wide range of agricultural and other kinds of goods between China and the rest of the world. The trends in Palm Oil remain down on the weekly charts. Soybean Oil trends are also down, and Canola trends are down.

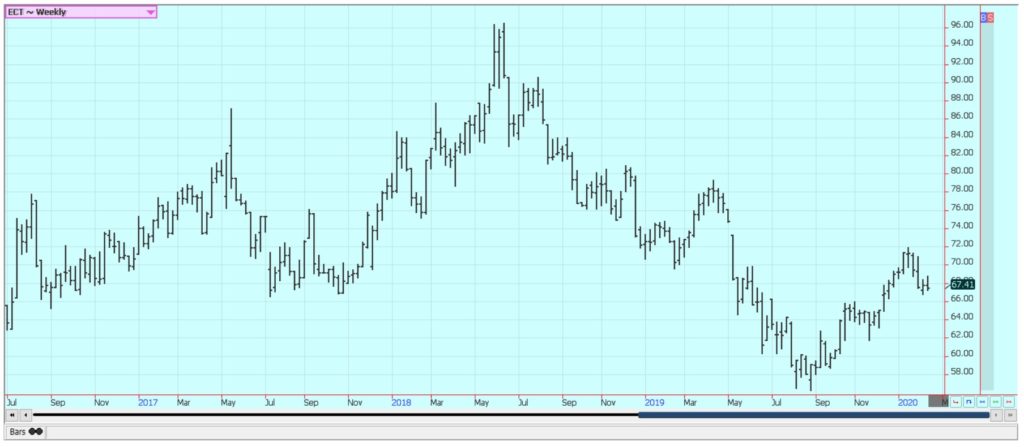

Cotton

Cotton was lower in narrow range trading last week. A catalyst for any rally attempt has been the trade deal between the US and China. China has been buying Cotton from the US and Brazil as it needs higher quality Cotton to blend with its domestic production. It has not bought from the US in the last few weeks but will probably resume buying now that the trade deal is signed. Big buying from China could rally the market, but futures have already moved significantly higher in anticipation of any Chinese buying and the actual buying could become anti climatic. The Coronavirus has the chance to hurt trade in Cotton between the two countries. Chinese buyers might need less Cotton now as factories inside ther country were closed for an extended holiday. All are reopen now.

Frozen Concentrated Orange Juice and Citrus

FCOJ was higher for the week. Futures act as if it could work higher despite bearish fundamentals. There is a big crop of Oranges out there with not many outlets for consumption. Good growing conditions and increased oranges production estimates by USDA this season have been bearish. The weather has been great for the trees as there have been frequent periods of showers and no severe storms so far this year. Many areas have been dry lately and irrigation is being used. Crop yields and quality should be high for Florida this year. Inventories of FCOJ in the state are high and are more than 26% above last year.

Coffee

Futures were higher in New York and in London on a lack of news and despite ideas of good growing conditions in Brazil. Support came from a lack of supply in Brazil at this time and on concern that previous bad growing conditions have hurt production potential in the Cerrado, home of about 10% of all Brazil production. The chart trends are mixed to up in New York and mixed in London due to the big production ideas, and futures could form a bottom in the current trading range. Cecafe noted reduced exports from Brazil in January. The ICO noted that demand remains very strong in the world market and that demand could outstrip supply in the next few weeks. Rains were reported in Brazil Coffee areas over the weekend and showers are continuing through this weekend. It is dry in other parts of Latin America. Central America has had less than normal rains, especially in Honduras. The Asian harvest is underway but producers do not seem to be selling on ideas that prices are too low. Vietnam exports remain behind a year ago, but the market anticipates bigger offers. Vietnamese crops are expected to be big despite uneven growing conditions earlier in the year.

Sugar

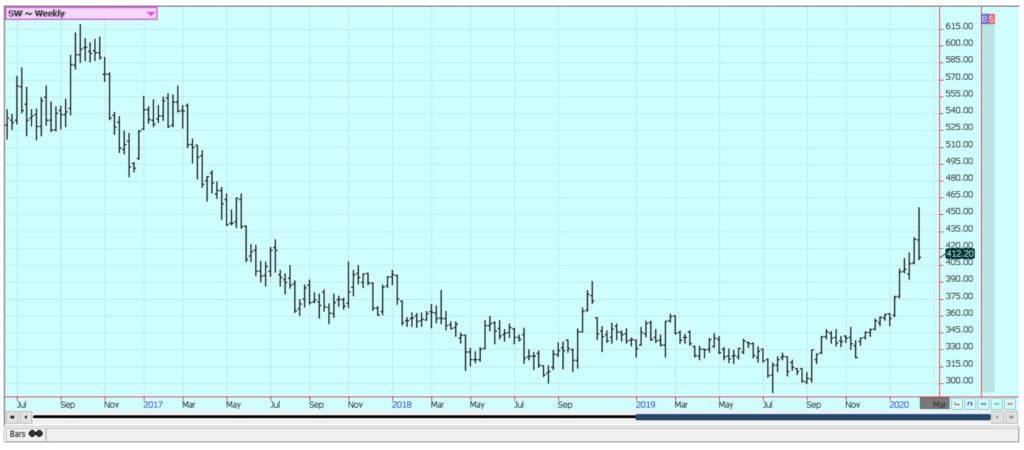

New York closed higher and London closed lower after making new highs for the move. It was a dramatic week and one that implies that the current rally might be over. Reports indicate that little is on offer from India. Thailand might also have less this year due to reduced planted area and erratic rains during the monsoon season. Losses in both countries would affect the White Sugar market more than New York. Reports of improving weather in Brazil imply good crops there. Farmers have been selling to mills but the harvest is now almost over so the supplies will start to tail off. Brazil mills continue to favor ethanol in the production mix, but current higher prices for Sugar make it economic to open more processing to Sugar instead of ethanol at this time.

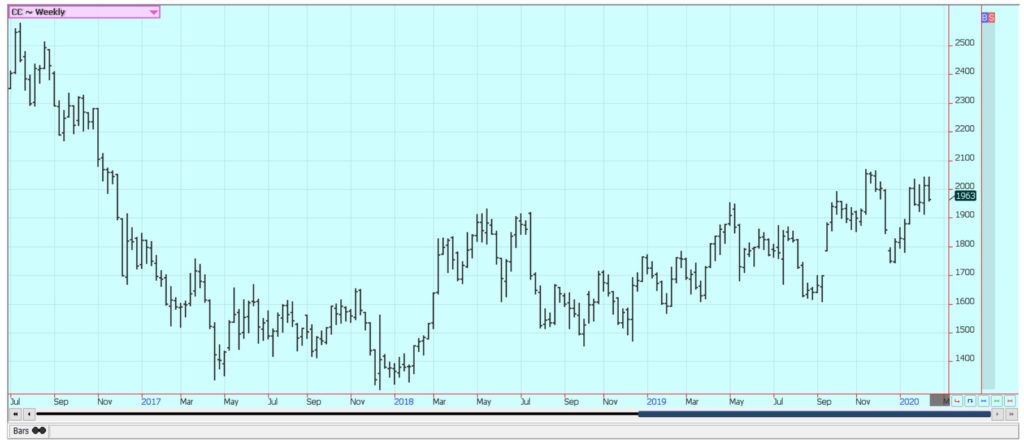

Cocoa

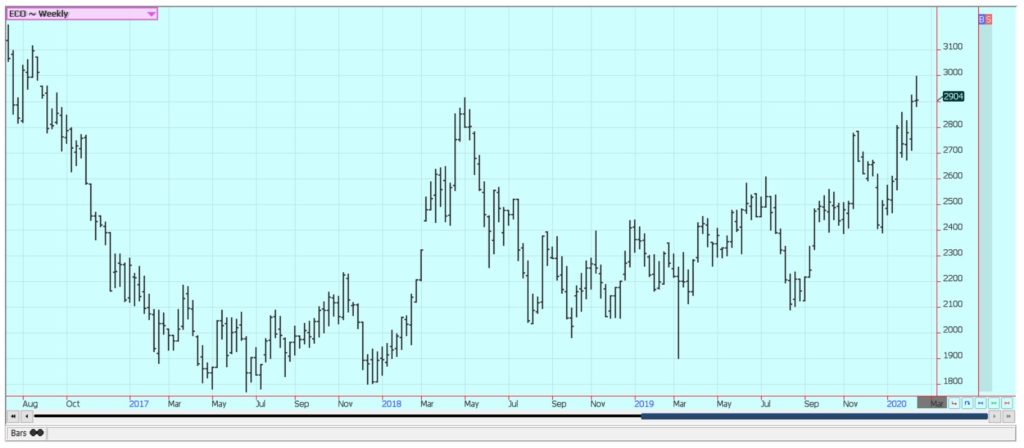

New York closed slightly higher for the week and London closed lower after the recent big rally in prices. Funds and other speculators were more two sided in trading. Producers were sellers in both markets. Harvest is now active in West Africa and the results so far are very good. Ideas are that demand is currently very strong due to the current price action. The reports from West Africa imply that a big harvest is possible in the region. Ivory Coast arrivals are strong and are above year ago levels. The weather in Ivory Coast is good. The weather is too dry in Nigeria and there are fears that the mid crop is not developing well at this time.

—

(Featured image by Joao Marcelo Marques on Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Business2 weeks ago

Business2 weeks agoTopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [Hosting.com Affiliates]

-

Crypto7 days ago

Crypto7 days agoEthereum Pushes AI Integration With ERC-8004 and Vision for Autonomous Agents

-

Biotech2 weeks ago

Biotech2 weeks agoByBug Turns Insect Larvae into Low-Cost Biofactories for Animal Health

-

Business2 days ago

Business2 days agoDow Jones Near Record Highs Amid Bullish Momentum and Bearish Long-Term Fears