Business

US wheat market ended the week with a drop following a slight increase

The U.S. wheat market started well last week but ended with a decrease due to the USDA small grains production reports.

After a good start with prices trading a little higher throughout the previous week, the American wheat market concluded the week on a whimper as a reaction to the USDA production reports.

Wheat

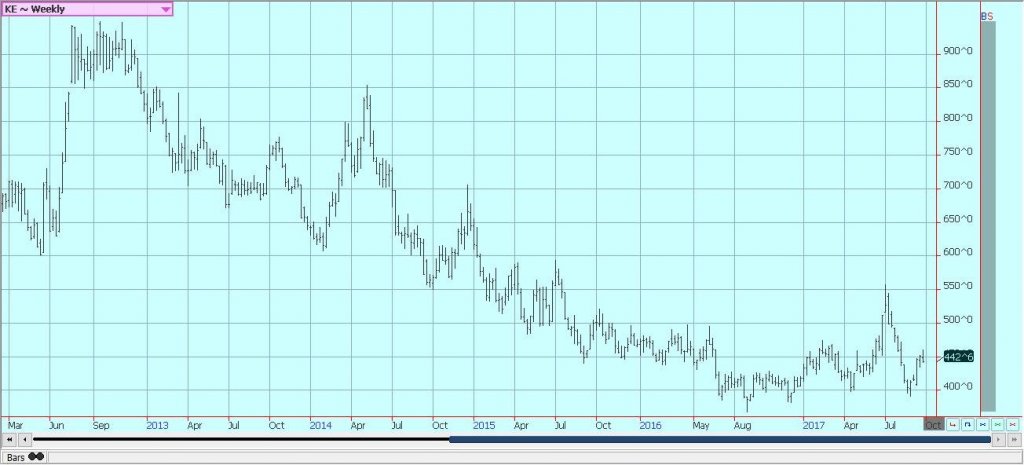

US markets were little lower to finish the week. Prices had been trending slightly higher for much of the week but fell on Friday in response to the USDA annual small grains production reports. The reports found more Spring Wheat than expected by the trade, and it was the Minneapolis market that fell more than the others. Spring Wheat production was estimated higher than last month at 416 million bushels.

Soft Red Winter Wheat production was lower and Hard Red Winter was a little lower, so overall production of wheat for the year was estimated at 1.741 billion bushels, from 1.739 billion last month. Quarterly stocks were also higher than trade estimates at 2.253 billion bushels. The price action on Friday hurt the upside potential for the short term in the Chicago markets and kept a weak tone alive in Minneapolis. Russian prices continue to firm now due to the demand there and farmer holding.

Australia still suffers from the hot and dry weather at key times in the growing cycle, but rains were forecast for Queensland that could have moved into important growing areas of New South Wales over the weekend to bring some much-needed relief. Production ideas are now near or below 20 million tons for the country, but ideas are dropping as it is still dry and the plants are trying to fill kernels. Argentina has suffered from too much rain, but some forecasts call for drier conditions starting this week which would be beneficial.

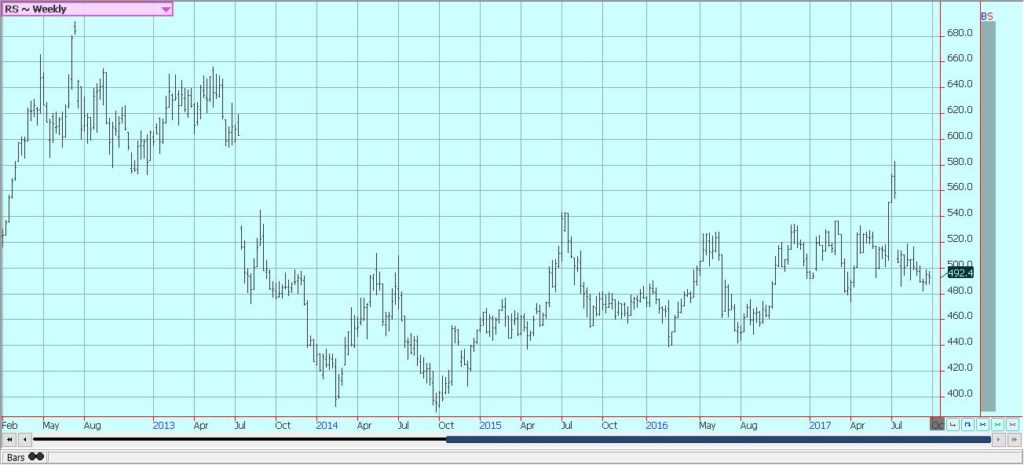

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

Corn

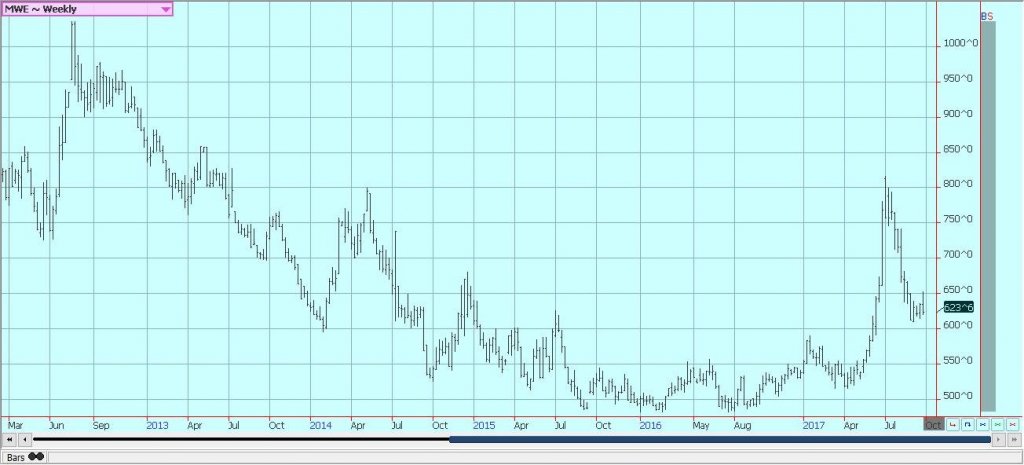

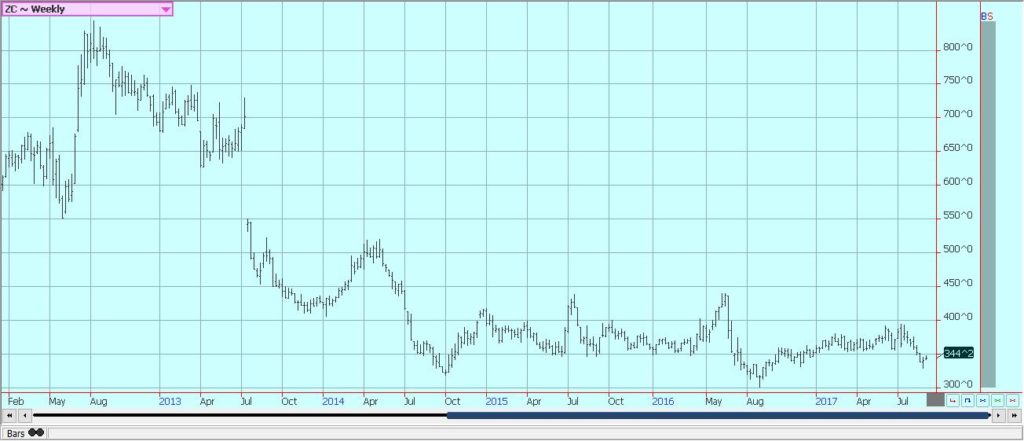

Corn held to its trading range and oats closed higher as the US corn harvest starts to expand into parts of the Midwest. The market is hearing actual harvest results as activity moves north into central parts of the corn belt and also gets active in the east. Yields so far have been relatively strong, but the harvest pace has been a little slow as producers have been concentrating more on getting the soybeans and letting the corn dry in the fields. The warmer and frequently drier weather of the last couple of weeks pushed the corn to maturity and aided in solidifying yield potential. Harvest results so far from the Delta and Southeast point to very good yields in these areas.

Corn harvest is still in its early stages, so many more yield reports will be heard over the next few weeks. Many traders expect more variable yields to be reported as the harvest moves forward and anticipate that USDA might have to cut its yield estimate slightly in coming production reports. Export demand has been a sore spot for the market and less than had been hoped for. USDA showed good domestic demand in its quarterly stocks report. The report was considered bullish

The report was considered bullish for corn prices as it implied much stronger feed demand than had been anticipated by anybody. The oats annual production report was supportive to higher prices for that market as production was a little less than expected. The weekly charts suggest that prices should be able to move a little higher before finding much selling interest.

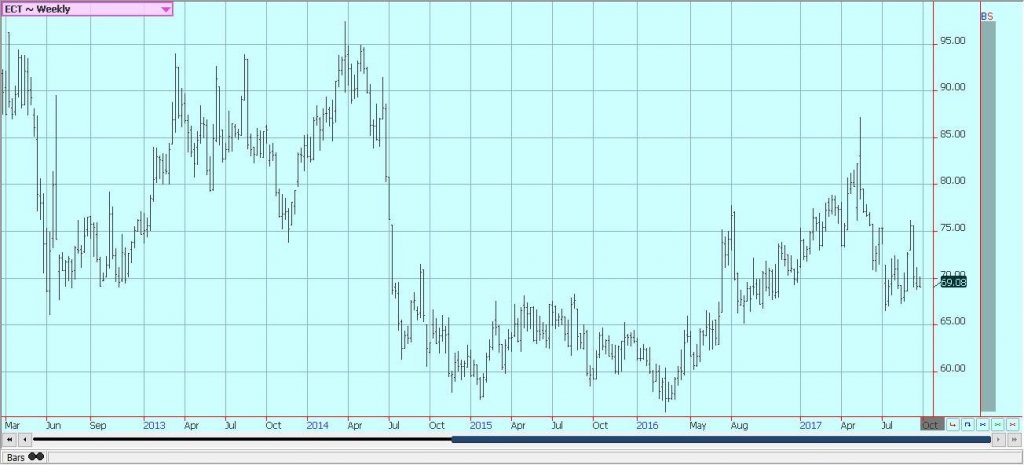

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

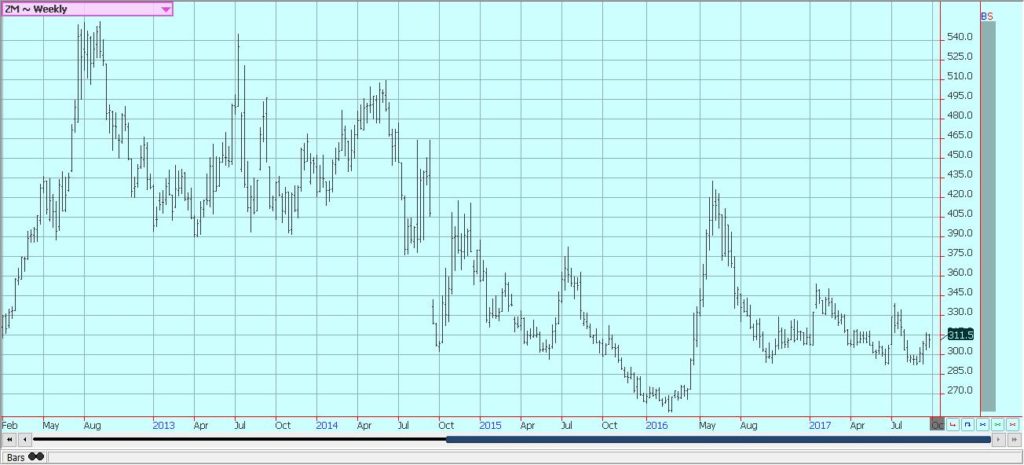

Soybeans and Soybean Meal

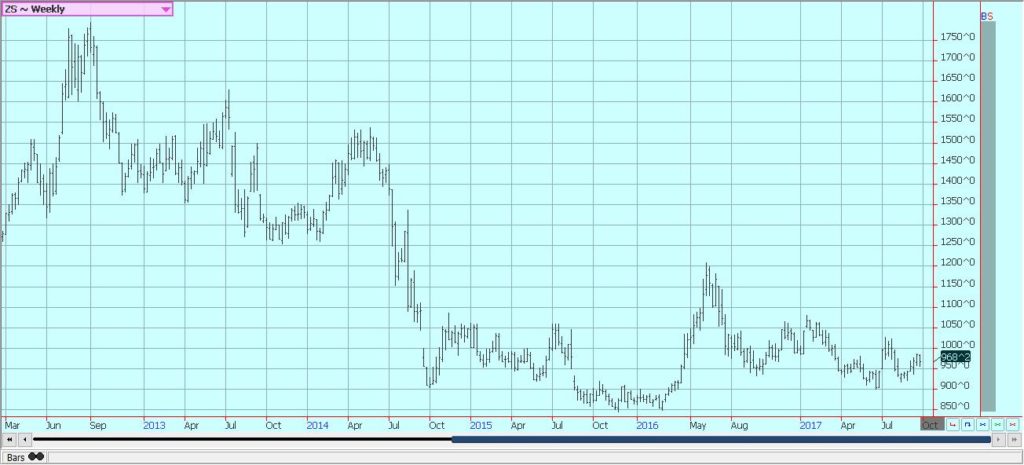

Soybeans and soybean meal were a little lower last week as demand dropped off. China is on holiday this week and buying has been cut back. This should be temporary, and strong buying interest could develop later this week or next week as the industry there returns to work. The quarterly stocks report released by USDA on Friday was considered bullish for prices.

Stocks were much lower than any trade estimate at 301 million bushels. USDA also released a new production estimate from a special survey, and the production estimate was lower instead of higher as had been anticipated by some in the trade. USDA reported very strong sales in its weekly report, but sales this week should be much less due to reduced buying interest from China. The sales have countered any harvest pressure as the harvest starts to expand in the Midwest.

Initial harvest yield reports have been generally strong in the Midwest, but some traders expect more variable yield reports to develop later. For now, the estimates would imply that the USDA yield and production estimates are not all that far off and that a strong crop is coming to market. There will be some warmer temperatures in the forecast this week after a cool weekend. Brazil got some beneficial precipitation over the weekend and planting can get started in many areas. It should be drier again this week. Temperatures there have been warm.

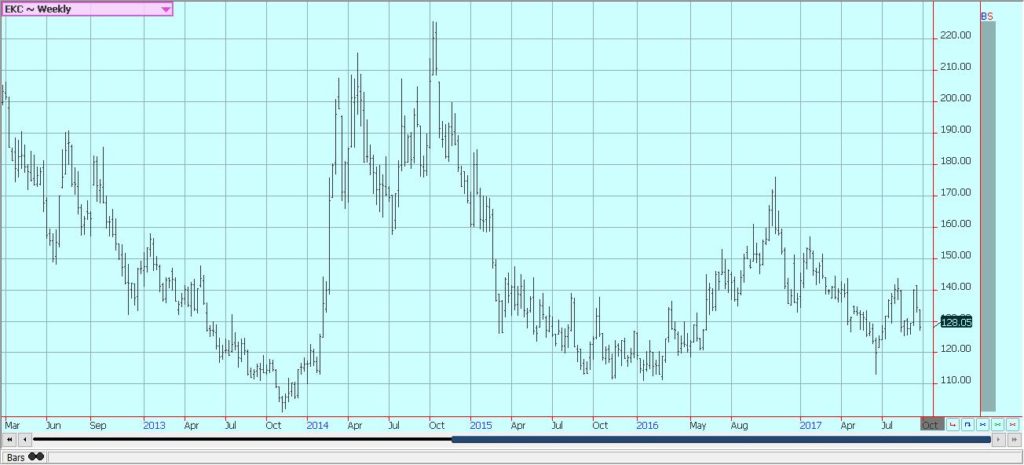

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

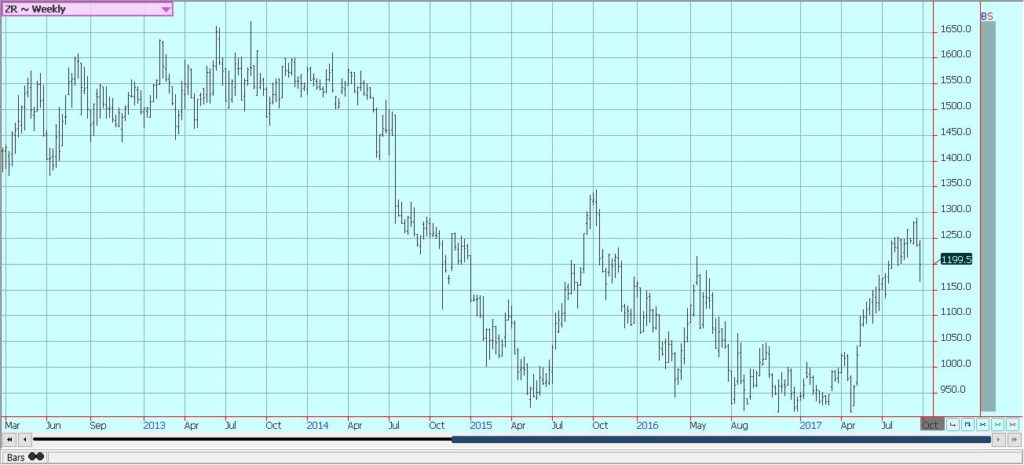

Rice

Rice closed lower last week after a big move lower that developed in the overnight market on Monday. Most in the trade awoke to sharply lower prices and no one really knew why that had to happen. Cash market prices in the US interior showed no response to the move in futures and held steady. Some buying surfaced in response to the down move and futures were off the lows for much of the week and closed off the lows on Friday. The selling was enough to turn trends down on the daily charts. Harvesting is mostly over in Texas and Louisiana, and field yield reports have been variable to good in Louisiana and good in Texas.

Quality reports, in general, have been good to very good. Crops are being harvested in areas from Mississippi to Missouri. Crop potential in these states is apparently pretty good, with good quality crops and generally good yields. Harvest progress is rapid now and it is likely that the harvest can be done in just a few weeks. California is harvesting, and yield reports are down from trade and USDA forecasts, apparently due to the shorter growing season caused by somewhat delayed planting.

Asian prices remain soft. The Asian market has been weaker in the last few weeks as the next harvest comes closer in many countries. Growing conditions are improved in India as the monsoon has been better as monsoon rains have generally been good. However, Bangladesh has been hurt by flooding and is preparing to import a lot of Rice this year. Most of Indochina and Southeast Asia have seen good weather.

Weekly Chicago Rice Futures © Jack Scoville

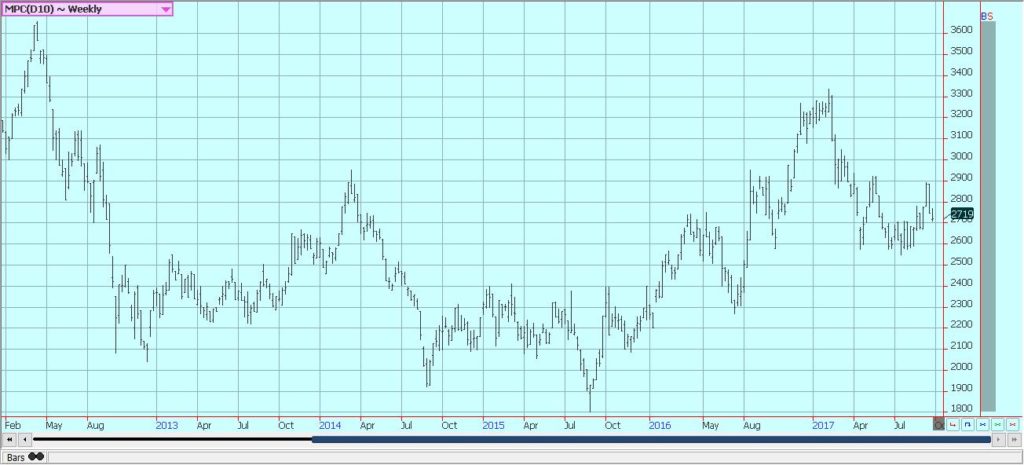

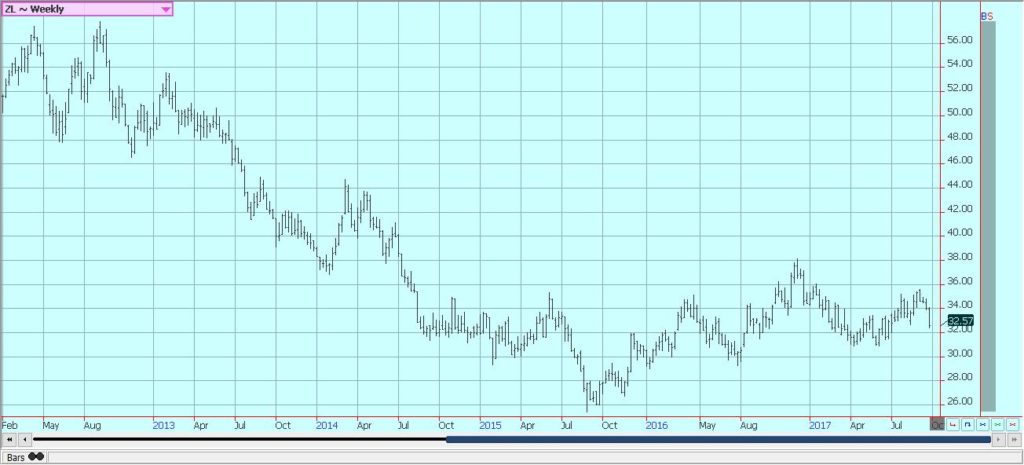

Palm Oil and Vegetable Oils

Palm oil futures moved lower again last week and have now given back all the gains from the recent rally. Demand is lower as China has moved into a holiday, and some ideas of changes in biofuels regulations in the US hurt demand ideas for both palm oil and soybean oil. Soybean oil was also lower last week. Both markets are trading with a weak tone, but both markets are now at some interesting support areas on the charts.

Both markets will start to look ahead now to the monthly supply and demand statistics and projections that will be out next week. Soybean oil got some relatively positive supply side news on Friday from the USDA quarterly stocks data that showed a smaller Soybeans inventory and smaller production last year than had been anticipated by the trade. Palm oil traders expect MPOB to show somewhat reduced production that is a normal seasonal occurrence.

Canola was higher in part on little farm selling despite increasing harvest activity. Farmers have not really been selling yet, but probably will need to start soon as the futures market is showing that weaker prices are now possible. There have not been many yield reports yet, but those heard imply a good but not great crop. Farmers in the Prairies are facing variable weather conditions that for now are somewhat too wet to promote a very active harvest.

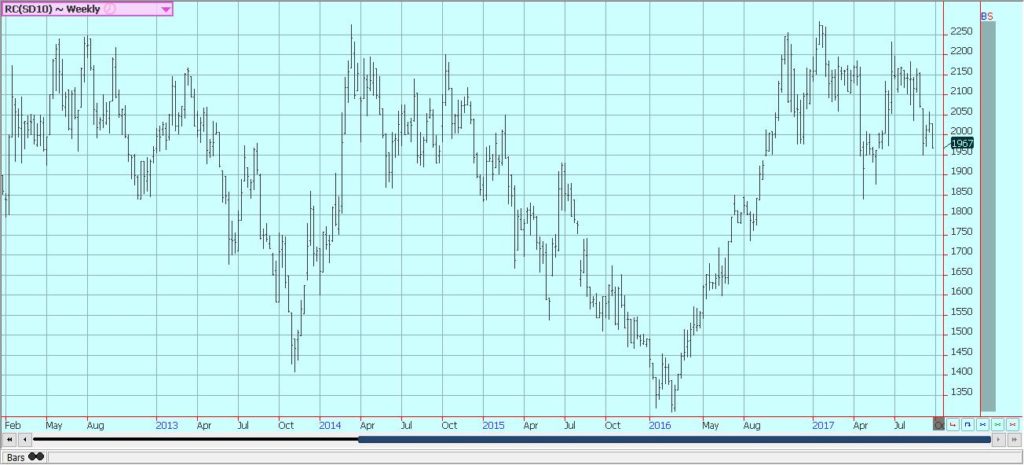

Weekly Malaysian Palm Oil Futures © Jack Scoville

Weekly Chicago Soybean Oil Futures © Jack Scoville

Weekly Canola Futures © Jack Scoville

Cotton

Cotton was little changed last week in narrow range trading. It looks like the market is content to let the harvest come to it right now as futures show no real chart formation to go up or down in a big way. How big a crop is out there and what the export demand might remain the important topics. There are still ideas of losses in parts of Texas and the Southeast from the storms, and USDA has shown some lower crop conditions in its past few weekly updates.

Harvest is more active and will continue to expand as more and more of the crop comes to maturity, Bolls are open or are opening now in just about all production areas. West Texas conditions are called good and the Southwest should be good despite hot weather this year. Demand has been OK but not really strong so far this year. Export sales will need to increase to absorb the big crop.

There is strong production potential in Asia, and mostly in India and Pakistan due to improved monsoon rains. Some rains are expected in most areas this week amid relatively moderate temperatures. Chinese growing conditions are good. Areas to the south of Russia are in good condition.

Weekly US Cotton Futures © Jack Scoville

Frozen Concentrated Orange Juice and Citrus

FCOJ closed higher, but still act as if a further price recovery is possible. The weekly charts show that futures closed slightly higher after partially filling a chart gap left a few weeks ago. The lows of last week might hold for quite a while due to the loses to crops in Florida due to the hurricane. Ideas remain that the orange groves are badly damaged in Florida due to Irma.

New reports from growers associations suggest that crops in many areas were almost completely destroyed. Other areas suffered losses of 50% or more of the crop. Some growers say that trees will be stressed again next year due to the winds and rains from Irma. Florida weather is now drier. The demand side remains weak and there are plenty of supplies in the US. Trees that are still alive now are showing fruits of good sizes, although many have lost a lot of the fruit. Brazil crops remain in mostly good condition and production estimates are climbing after recent rains.

Weekly FCOJ Futures © Jack Scoville

Coffee

Futures were lower in New York and in London last week, with commercials scale down buyers and speculators willing to sell on forecasts for improved rains in Brazil. The trends are down on the charts in both markets as traders look at the potential for a big crop in Brazil. The Brazil weather and tree condition is the main fundamental reason for lower New York prices.

Rains appeared in Brazil late last week and continued over the weekend. These rains should be enough to promote new flowering. The rains will need to continue as it has been very dry and trees have been stressed. Even so, there are some hopes for a very good crop. Current weather forecasts call for drier weather to return this week once the rains pass through.

Cash market conditions in Central America remain quiet as the next harvest is getting started. There is coffee to sell and offers are on the table for the next crop. Colombia has reported some difficult growing conditions, but exports have held well as production appears to be good due to younger trees that are more vigorous and produce better under more stressful conditions.

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

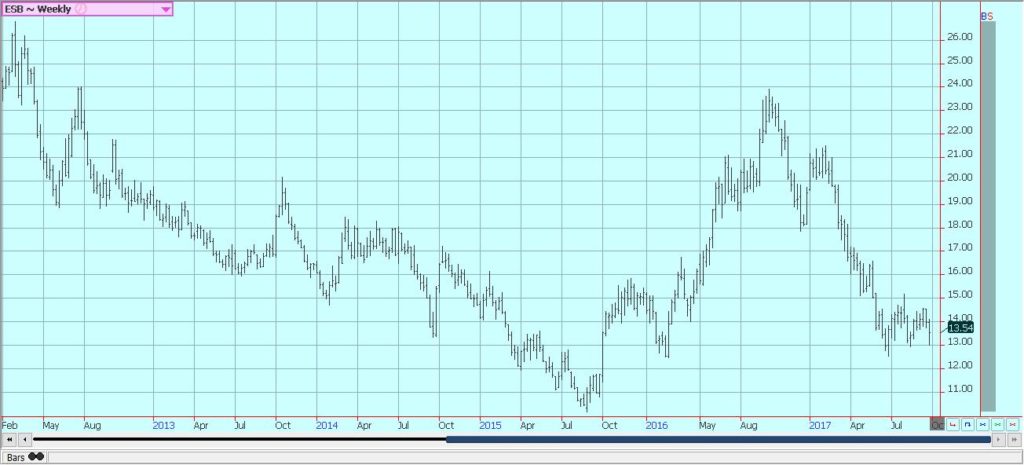

Sugar

Futures were a little higher in New York and in London, and price trends are sideways to down in both markets. New York was able to recover from significant losses last week, and London showed a partial recovery as both markets closed on a firm note. The market expects firmer prices over time as the Indian harvest could be delayed due to wet conditions that would delay sugarcane harvesting.

There are questions about the Indian production this year as the distribution on monsoon rains was not uniform. Some areas saw flooding rains while others got well below normal totals. The monsoon is starting to recede now. Overall upside potential is limited as there are still projections for a surplus in the world production, and these projections for the surplus seem to be getting bigger over time. Production potential in Thailand seems strong as monsoon rains have been better than last year.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

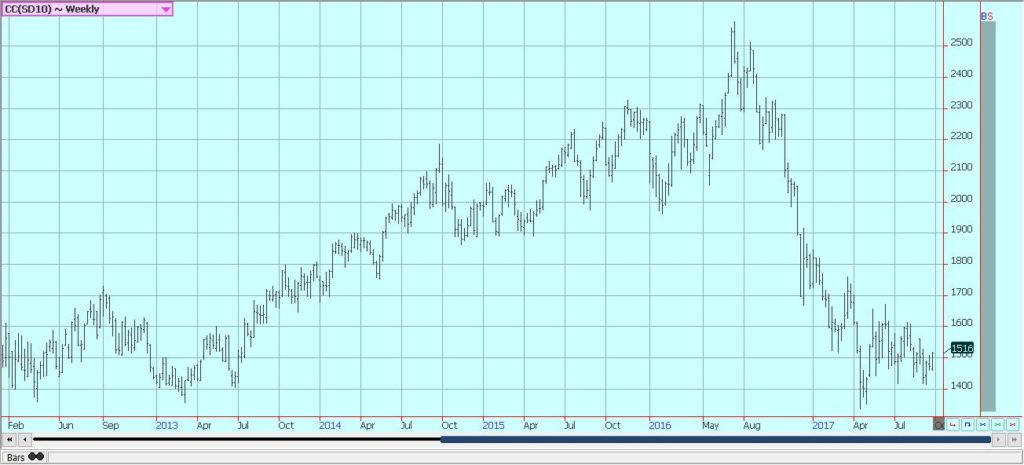

Cocoa

Futures markets were higher again last week, and are once again in a broad trading range. The weekly charts suggest that futures are forming what could be an important low at this time. Futures are now at the top end of the range, and any new buying early this week could create a sharp short covering rally. The supply for the coming year would seem to be good and enough for the market.

Nigeria and Cameroon have both noted strong production from the initial harvest. Prices have been higher in Nigeria in the last couple of weeks as buyers have paid for better quality. Ghana said it now expects higher production above 800,000 tons, and Ivory Coast is harvesting what is expected to be a bumper crop. The demand should continue to increase if prices remain relatively cheap and as retail prices continue to move lower in important consuming areas like Europe.

World consumer markets, in general, seem to be getting better economically, also supporting better demand ideas. Grinders and chocolate manufacturers are able to make plenty of money with current differentials. The next production cycle still appears to be big since the growing conditions around the world are generally good. Ivory Coast has already sold 1.32 million tons of cocoa into the world market, and selling is reported from other countries as the harvest has started.

East African conditions are too dry but there is still a crop growing and generally, good production is expected. Good conditions are still being reported in Southeast Asia as it has turned seasonally drier in growing areas of Indonesia and Malaysia.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

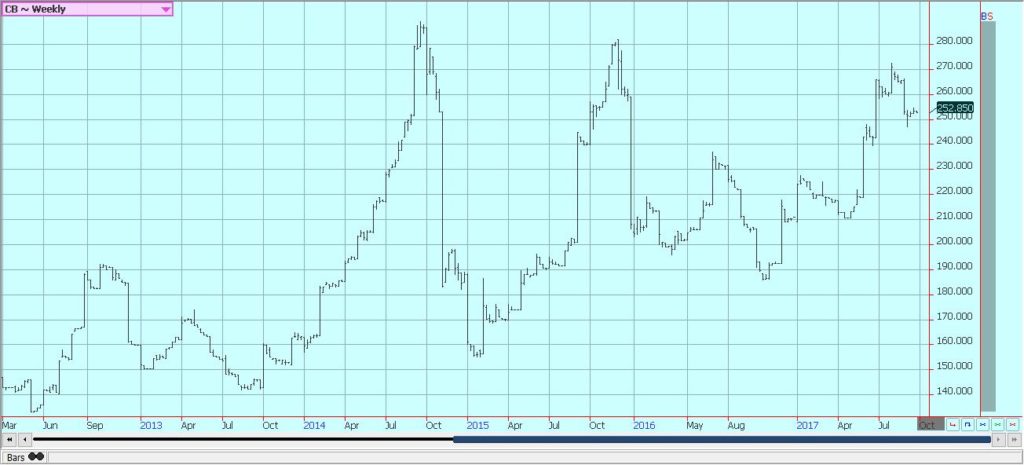

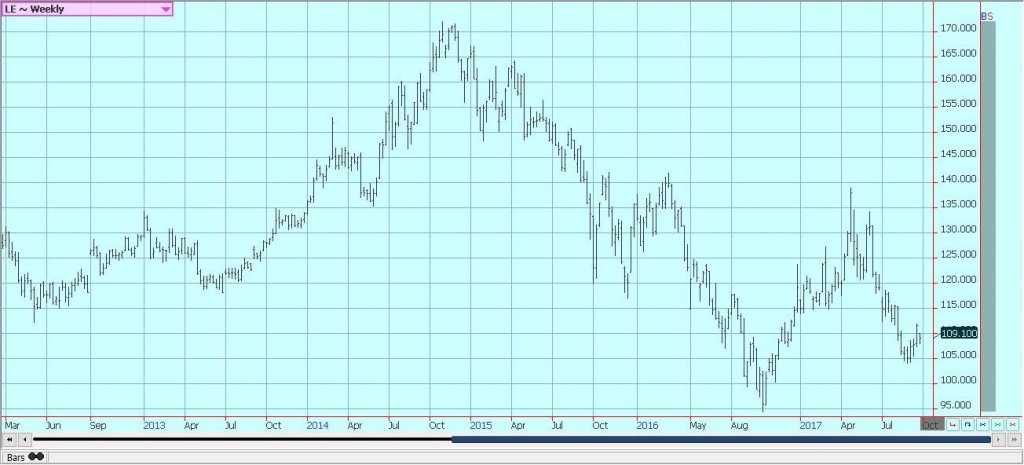

Dairy and Meat

Dairy markets were lower last week as futures appear to have made a short-term top. Milk and cheese demand has been mixed, but butter demand has weakened and prices in this market have moved sharply lower. Demand is good for cream, but cream has generally been available to meet the demand. Cream demand for butter has been very good.

Demand for ice cream has been mixed depending on the region but is becoming less now as the US summer comes to a close. Cheese demand still appears to be weaker and inventories appear high. US production conditions have featured some abnormally hot weather in the west that is hurting milk production. Production in the rest of the country has been strong.

US cattle and beef prices were mixed to higher as traders anticipated better cash market conditions. Ideas are that packers are enjoying strong margins at this time and can afford to pay more for cattle. The beef market was somewhat better last week to support ideas that prices for cattle could start to improve. Cattle prices were steady to slightly weaker in early dealings and amid lighter than expected volume. It is the threat of increased supplies down the road that keeps the packers from buying aggressively. Feedlots are filled and cattle will continue to be offered to the cash market. However, ideas are that more supplies are coming as weight per carcass is high and more cattle is coming to the market.

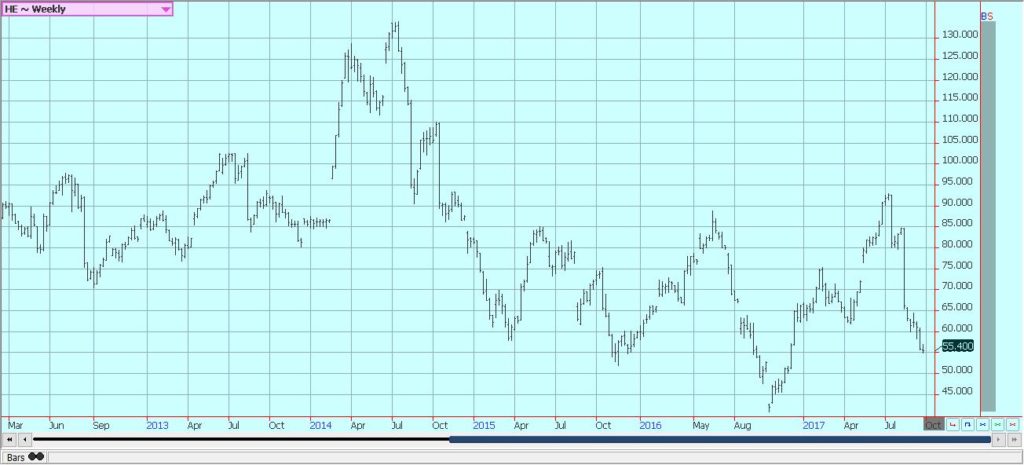

Pork markets and lean hogs futures were weaker on a seasonal trend to lower demand. The market made new lows for the move on Thursday, then recovered as the market absorbed the inventory report. The report showed higher current supplies and higher supplies in the pipeline but was mostly as anticipated by the trade. Ideas are that futures are reflecting the weaker supply and demand fundamentals now. Demand has been lower for the last couple of weeks and this has affected pricing.

Weekly Chicago Class 3 Milk Futures © Jack Scoville

Weekly Chicago Cheese Futures © Jack Scoville

Weekly Chicago Butter Futures © Jack Scoville

Weekly Chicago Live Cattle Futures © Jack Scoville

Weekly Feeder Cattle Futures © Jack Scoville

Weekly Chicago Lean Hog Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Fintech1 week ago

Fintech1 week agoImpacta VC Backs Quipu to Expand AI-Driven Credit Access in Latin America

-

Impact Investing5 days ago

Impact Investing5 days agoClimate Losses Drive New Risk Training in Agriculture Led by Cineas and Asnacodi Italia

-

Biotech2 weeks ago

Biotech2 weeks agoWhy Bioceres Shares Slide Into Penny Stock Territory

-

Crowdfunding1 day ago

Crowdfunding1 day agoReal Estate Crowdfunding in Mexico: High Returns, Heavy Regulation, and Tax Inequality

You must be logged in to post a comment Login