Business

Which of these 5 loans is right for you?

A credit is not always a bad thing, and you can actually use it to your advantage. Here are five personal loans you can choose from.

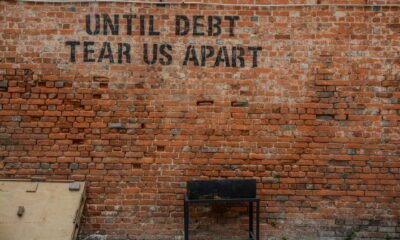

When I was growing up, I believed that I would never let myself go into debt. Credit was evil, and would destroy my life if I ever dared to open the door to it. This belief came from watching my parents struggle, making bad decisions which only dug them deeper into debt. It seemed like they’d never get out of it alive.

As soon as I had some money of my own, I realized two things. Debt is not always the result of bad decisions. And credit makes the world go round. If I wanted to buy a car, house, or start a business, I would need to embrace credit.

The fact is that owing money doesn’t have to be a bad thing. It definitely doesn’t have to be a downward spiral. As long as you stay away from quick fixes and payday loans, you can use credit to your advantage.

Still, they don’t teach you how to get a personal loan in school or college. Chances are, you know very little about the different types of personal loans if you even know there are different types.

To help you understand a little more about which to choose, the following are five common types of personal loans.

1. Bank Loans

Banks, in something approximating their present form, have existed for centuries. The first place most people think of when considering getting a loan is their bank. Banks are reliable (barring the odd catastrophic crisis). You already have bank accounts, which makes it easier to keep track of and pay your installments. One major concern people have about banks is that their procedures have not caught up to the twenty-first century. Getting a loan can take ages, and most banks lack flexibility in what they offer.

2. Peer-to-Peer Loans

A relatively new innovation, peer-to-peer loans are presented as a modern alternative to banks. Rather than going with your bank’s rigid options, you match up with an individual who is willing to loan out a certain amount of money. It is quick and easy, and you have much more room to negotiate conditions. However, you do need a very strong credit score, as there is a lot at risk for the loaner.

If you can pay your credit from a zero-interest card on time, you essentially get a free loan. (Source)

3. “Zero-Interest” Credit Cards

A credit card doesn’t seem like the wisest loan option. After all, they charge high interest rates and come with few protections. Credit cards are useful for added buying power, not for paying off debt or acquiring assets. However, there are many credit cards that have zero-interest offers. They give you a grace period during which you pay no interest, and if you can pay it all back in that time, you essentially get a free loan. This should only be an option if you know you can pay the money back soon. Otherwise, it will leave you further in debt.

4. 401(k) Loan

Loaning money from your own pension fund has its drawbacks but it also has some appeal. You’re loaning money from yourself, and any interest you pay at least goes back to you. If you have good reason to believe you’ll be able to pay it back in due course, this can be a handy option in urgent situations. But beware of sabotaging your own future.

5. Credit Union Loans

Finally, credit unions are a natural place to look for a loan. They’re some of the most competitive, with low interest rates and fees. Credit unions are more attractive than banks, as they operate as nonprofits. They are technically owned by their customers. Becoming a member of a credit union is a smart move when looking for a personal loan. This is where you will find some of the best options around.

(Featured image by DepositPhotos)

-

Cannabis4 days ago

Cannabis4 days agoCannabis Use and Brain Aging: What a Major Study Reveals

-

Africa2 weeks ago

Africa2 weeks agoFrance and Morocco Sign Agreements to Boost Business Mobility and Investment

-

Business1 day ago

Business1 day agoThe TopRanked.io Weekly Digest: What’s Hot in Affiliate Marketing [Discover Cars Affiliate Program]

-

Fintech1 week ago

Fintech1 week agoFindependent: Growing a FinTech Through Simplicity, Frugality, and Steady Steps

You must be logged in to post a comment Login