Crypto

Thought XRP Was Hot? You Won’t Believe What’s About to Happen to RWA Tokenization Pioneer OXBR

XRP took off like a rocket last week. And now, with SEC chair Gary Gensler on the way out (confirmed last week), it’s only going to go higher. However, while XRP should 20-30x, there’s even bigger gains to be had in RWA tokenization on the Ripple blockchain. Here’s why, and how you can invest in it right now for 100x gains with RWA issuers like Oxbridge Re’s [NASDAQ: OXBR] SurancePlus.

Rising tides lift all boats.

We all know that.

So what just happened with XRP last week should come as no surprise.

For those who missed it, here’s what happened.

But here’s something that will come as a surprise.

Right now, there’s a 100x opportunity bubbling beneath the surface of all this that almost nobody knows about.

And no, that’s not a typo.

There really is a 100x opportunity here.

Now, I’m going to spend the rest of the article going over the whole who/what/when/why/how. But, since I don’t want to bury the lede, I’m just gonna tell you what this opportunity is right now:

- RWA Tokenization player SurancePlus (a subsidiary of Oxbridge Re [NASDAQ: OXBR]) is about to pop off in a major, king-making way.

Seriously.

The gains I’m talking about here are ludicrous. And I have very good reason to believe there’s a better than 90% chance that this will happen.

Here’s why.

First, Let’s Catch You All Up on XRP

Before we get to the why, let’s have a little XRP catch up.

If you’ve been following along with the XRP story already, then you can probably skip this section.

But, for those who missed it, here’s the tl;dr.

- Trump wins election == good news for crypto.

- $BTC and $ETH took off for the moon.

- Half the crypto market followed behind.

Now, of course, there were some hold-outs.

XRP was one of them.

With the whole SEC/Gary Gensler drama still lingering, it seemed most people were holding out for confirmation that Gensler really was resigning/getting fired.

And that just happened last week.

Gensler rubbed one out in public wrote a self-congratulatory letter that more or less confirmed his SEC career’s coming to an end.

The rest, as they say, is history.

XRP shot off like a rocket.

Next stop — the moon.

XRP Will 20-30x… But for 100x, I’m Betting on SurancePlus/Oxbridge Re

If you remember the last time crypto popped off in a BIG way, then you’ll probably remember what the real talk of the town was.

Yep.

It was NFTs — the last real 100x+ opportunity.

This time ‘round, something similar (but different) is in the works. And it’s going to be just as big.

It’s called RWA Tokenization.

And, just like how NFTs found their home on the Ethereum blockchain, RWA tokenization’s home will be Ripple.

Oh, and PS, if any of this is news to you, here’s a quick overview of why RWA tokenization will be huge and why Ripple will dominate. That article will also fill you in on what RWA tokenization is, just in case you’re really lost here.

Anyway, back to the story.

By now, most of us should be all on the same page. RWA tokenization’s the next big thing, and it will all take place on Ripple.

“But where’s the 100x opportunity?”, I hear you ask.

Well, let’s get one thing straight. It’s probably not XRP.

Now sure, XRP’s definitely going to the moon.

After all, if people are going to be buying a bunch of RWA tokens on the Ripple blockchain, then they’re gonna need XRP to do that.

And, well, you know… Econ 101… limited supply… unlimited demand… you get the gist.

But here’s what I’m predicting — this will play out a little like 2020-21 did for $ETH.

So, expect XRP to 20-30x.

Which is huge, I admit.

But, if you want even bigger gains, then it’s time to play it like it’s 2020-21.

That means, this time around, you gotta buy directly into RWA tokenization.

And yeah, I know, that’s easier said than done.

For the moment, most of this RWA stuff’s only available to “accredited investors”. (Although, now Gensler’s on the way out and Trump’s replacing him with a crypto maximalist, expect this to change soon.)

Also, there’s another problem with RWA tokens.

Since they’re tied to real-world assets, most of them just aren’t going to skyrocket in the same way that more speculative digital assets did… that is, unless you can make a case for why real estate/insurance contracts/etc. will all go 100x in 2025.

But here’s what you can do instead — buy shares in companies issuing RWA tokens today.

Or, more precisely, buy the companies issuing intangible assets as RWA tokens. You know, non-physical stuff like insurance contracts. (These companies are about to get the closest thing to a money-printing machine I’ve ever seen… I’ll get to why later.)

So, wanna know where to start?

Here’s your best shot today — Oxbridge Re [NASDAQ: OXBR]. Its SurancePlus subsidiary is hot property right now.

And when 2025 ticks over, it’s gonna go for a 100x ride.

Why SurancePlus?

Before I get into why Oxbridge Re [NASDAQ: OXBR] and its SurancePlus subsidiary are going to take us for a 100x ride, I wanna clear up any doubts first.

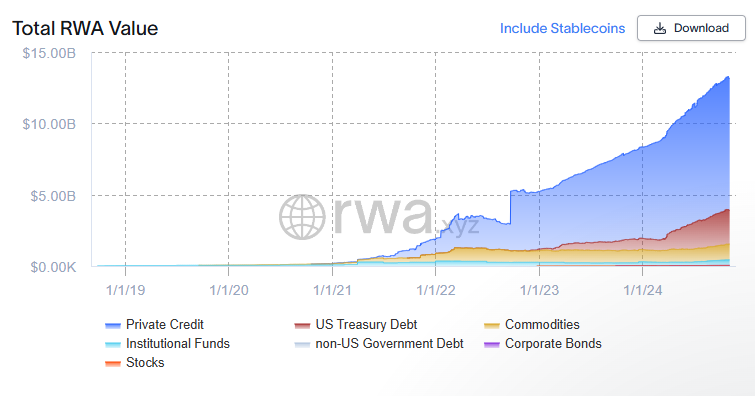

If you still don’t believe that RWA tokenization is going to be huge, take a look at this chart here.

See how that uptick’s turning exponential?

Now, what do you think’s going to happen when XRP goes to the moon and crypto goes haywire?

Yep, RWA tokenization will explode.

Majorly.

And just in case you still have any doubts, go take a look at how big/smart money investors (BlackRock, a16z, Goldman Sachs, etc.) are pouring trillions of dollars into RWA tokenization.

Yeah, this is going to be huge.

And, as it turns out, SurancePlus is the only publically traded stock on the Nasdaq that’s got any skin in the RWA tokenization game.

Or, more precisely, SurancePlus’s parent company, Oxbridge Re [NASDAQ: OXBR], is the only publicly traded company on the Nasdaq in the game.

And that, in a nutshell, is part one of the case for why it’s going to 100x.

When XRP’s rising tide pulls RWA tokenization along behind it and everyone suddenly wants in, where do you think they’re going to turn?

Yep, they’ll all pile into one of the only options available to them.

But let’s not get ahead of ourselves — I wouldn’t recommend SurancePlus if the fundamentals weren’t there either.

So let’s take a look at the fundamentals.

Now, remember how I said RWA tokenization players issuing intangible assets are effectively getting a license to print money?

Here’s why that applies to SurancePlus:

- SurancePlus issues reinsurance contracts as RWA tokens.

- Demand for reinsurance contracts, in the right market, is booming. (E.g., see how Florida’s state-backed insurance is driving people back to the private market.)

- Thus, Oxbridge Re [NASDAQ: OXBR] is experiencing huge demand for its reinsurance contracts.

- But, capital requirements and whatnot put a limit on its growth.

- Therefore, Oxbridge Re created SurancePlus to issue reinsurance contracts as RWA tokens which private investors can buy.

- SurancePlus skims a 20% off the non-preferred profit its RWA token holders realize.

- With strong demand for its reinsurance contracts from the private insurance market, SurancePlus’s ability to issue its RWA tokens is only limited by the number of private investors with enough capital to buy its tokens.

Essentially, SurancePlus has a money-printing machine.

It’s maybe not quite as easy-peasy as issuing NFTs was back in the day. But, crypto’s growing up, and this time around, this is the closest thing to it.

And that, more or less, sums up why Oxbridge Re [NASDAQ: OXBR] is such a solid bet — its SurancePlus subsidiary is basically a money-printing machine that’s about to hitch a ride on the back of XRP.

But Wait, There’s More

Alright, so we’ve got crypto and XRP creating the rising tide for all the RWA tokenization boats.

And we’ve got an RWA tokenization player with a seriously strong case to be made for it — SurancePlus.

But, there’s one more thing that’s really going to make this thing pop off big time.

Ripple has been partnering with and investing in the RWA ecosystem like it knows something’s about to happen.

For instance, Ripple’s partnered with Zoniqx. And Zoniqx happens to be the technology/platform provider for SurancePlus.

Now, why’s this big?

Well, for now, a lot of this is speculation. But, it’s speculation based on some solid evidence. So here goes.

This is big because I expect to see Zoniqx acquire SurancePlus in 2025 with a little help by way of investment from Ripple.

Hear me out.

For starters, Zoniqx and SurancePlus have been spending a lot of time together lately. Most recently, they were seen presenting together at Digital Assets Week in Singapore. But they’ve been doing a bunch of appearances like this for a while now.

Secondly, Oxbridge Re recently announced that it is seeking “strategic alternatives” for its SurancePlus subsidiary. That’s the sort of lawyer-approved, Gensler-pleasing stuff that companies who have to keep the SEC happy say when something big’s about to happen.

And finally, did I mention that Ripple recently partnered with Zoniqx?

I did?

Ok, but did I mention that Ripple has a habit of investing in companies that are “driving market formation and enabling the creation, storage, and movement of value.”

Sounds like SurancePlus, right?

In any case, this is all just speculation (backed up by a few rumors I’ve heard from a number of sources). So don’t take my word for it just yet.

Of course, with that said, you can still take my word for everything else.

RWA tokenization is going to be huge.

And if that alone doesn’t give SurancePlus at least a 100x ride, then I don’t know what will.

__

(Featured image by Rūdolfs Klintsons via Pexels)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Business2 weeks ago

Business2 weeks agoThe TopRanked.io Weekly Digest: What’s Hot in Affiliate Marketing [NordVPN Affiliate Program Review]

-

Cannabis7 days ago

Cannabis7 days agoCannabis Company Adopts Dogecoin for Treasury Innovation

-

Biotech2 weeks ago

Biotech2 weeks agoPfizer Spain Highlights Innovation and Impact in 2024 Report Amid Key Anniversaries

-

Business1 day ago

Business1 day agoLegal Process for Dividing Real Estate Inheritance