Business

Decrease in Brazil’s coffee export, India doubtful over sugar import

Brazil exported 2.6 million bags of Coffee in January, down 8.7% from December. Arabica exports were down 3.9% to 2.4 million bags and Robusta exports were down 71.7% at 22,118 bags.

Agriculture weekly: Less production of coffee is noted in Brazil this year, India continues to debate the need for imports of sugar, and much more.

Wheat

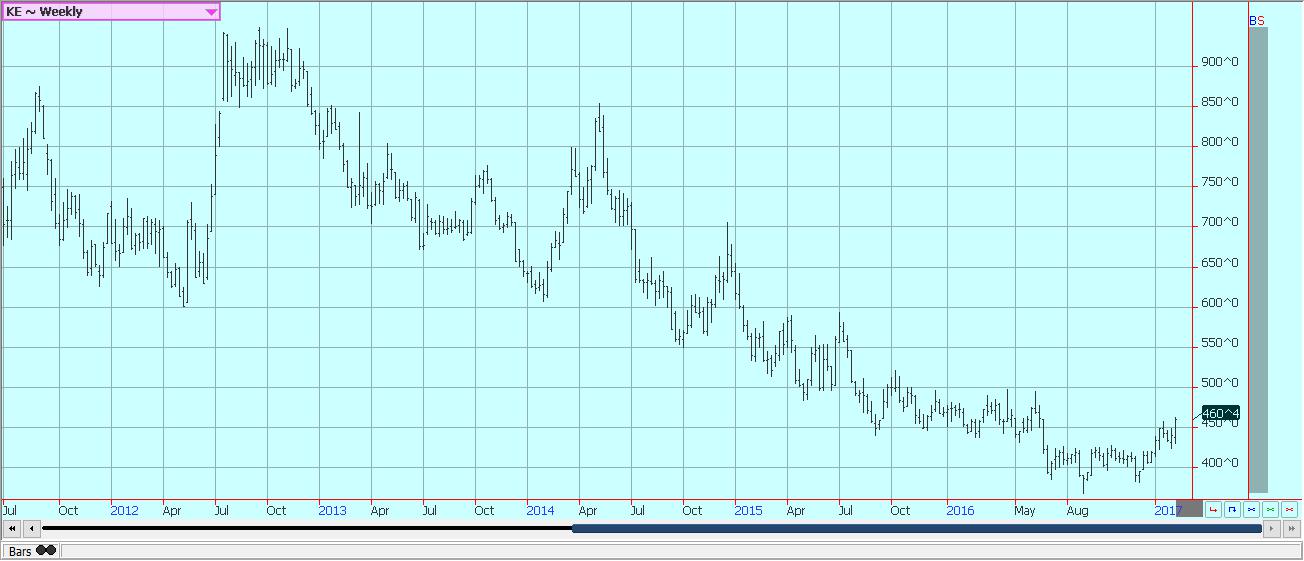

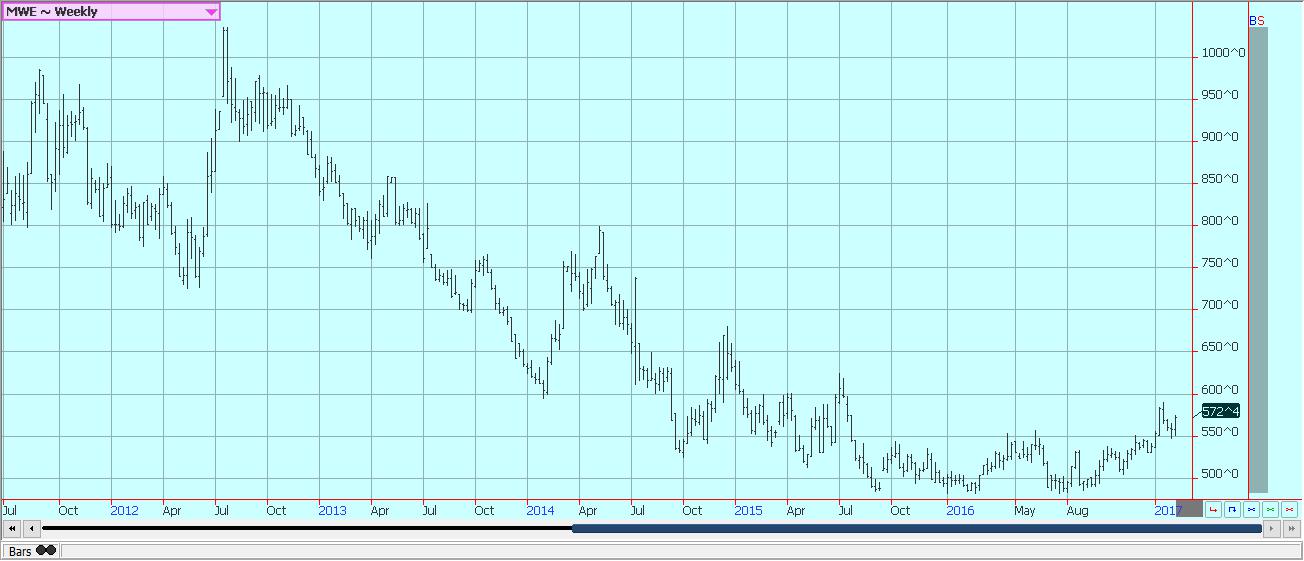

US markets were higher last week. Prices surged after the monthly USDS supply and demand updates were released. USDA increased US export demand by 50 million bushels and cut ending stocks a like amount. The ending stocks for the US are still projected to be high at 1.139 billion bushels. The big surprise came in the world data. USDA cut production and ending stocks for India and Kazakhstan and also world ending stocks. USDA cut world ending stocks estimates from 253.3 million tons to 248.6 million tons. The move was a surprise as the market had expected marginally lower world stocks levels. Export demand for US Wheat remains strong.

US export sales are primarily for HRW and HRS as the world seeks out quality Wheat. That has helped support HRS and HRW futures on spreads against SRW, where the demand has been much more limited. Chart trends have turned up, and SRW Chicago Wheat futures are now testing an important resistance area near 450 per bushel. This resistance area could hold for now. The big world supplies and competitive nature of the market continues to limit upside potential for futures prices. But, the reduced US planted area for Winter Wheat and the potential for reduced planted area worldwide due to the current depressed prices and an increased speculative appetite to own agricultural futures should keep prices trading with a firm tone.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Wheat Futures © Jack Scoville

Corn

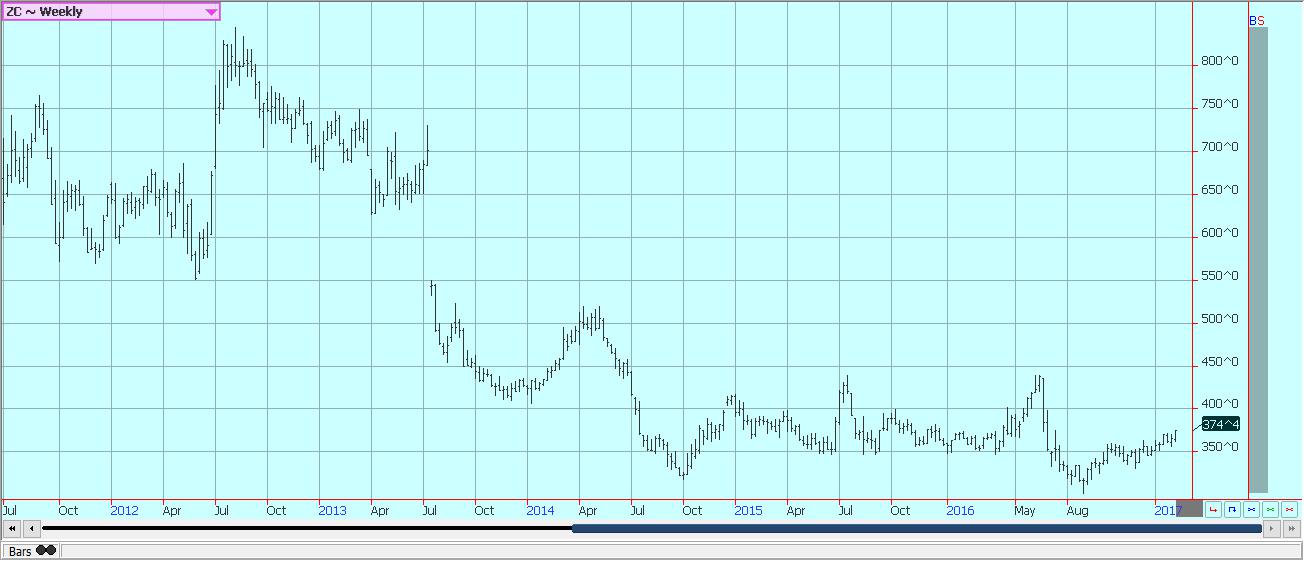

Corn closed higher for the week and pushed through some important resistance on the charts at the 370 area to close near the highs for the week. It was a very positive close and one that implied that more price gains are possible. USDA increased ethanol demand in its monthly supply and demand updates last week by 25 million bushels, but left export demand unchanged for now. Ending stocks re reduced to 2.320 billion bushels, which is still a lot of corn to have at the end of the year and the highest projected ending stocks level in decades. Demand for Corn has been stronger than expected, especially on the export and energy fronts. Export demand was strong again last week at almost 1.0 million tons.

USDA estimated world Corn ending stocks at 217.6 million tons, from 221.0 million in January US farmers appear undersold in Corn, but are said to begin selling in a much bigger way if the rally continues for another five to 10 cents per bushel in futures. They face little world competition as South America is still out of the market and is likely to be out of the market until this Summer. There is not much Corn there as Brazil ran out and used the extra Argentine Corn, so internal pipelines will need to be filled before much export can be made. Growing conditions are said to be good in Brazil, and the Safrinha crop is being planted as the Soybeans get harvested. Heavy rains are possible this week to slow the progress down. Conditions have improved in Argentina due to recent rains. Crop losses in Argentina are still expected from the previous bad weather.

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

Soybeans and soybean meal

Soybeans and soybean meal were higher last week. It was a higher week based on hopes for continued demand from potential harvest delays in Brazil and somewhat reduced production in Argentina. The harvest in Brazil has been moving right along despite reports of rains in areas ready for harvest. Mato Grosso is already over one third harvested, and harvest should be increasing around the rains in other states. Mato Grosso and surrounding areas are expected to get some heavy rains this week, but the rapid harvest pace until now should keep concerns to a minimum. Production ideas currently appear to be near or above 105 million tons. Argentina has seen improved crop conditions due to recent rains in southern areas and drier conditions in flooded areas.

These general weather trends are expected to continue this week. Production estimates for Argentina now range from 52 to 55 million tons, down from 55 to 57 million tons early in the growing season. USDA left its US supply and demand estimates unchanged last week and this was considered a disappointment for Soybeans traders. It cut Argentine Soybeans production to 55.5 million tons, from 57 million last month. Brazilian Soybeans production was unchanged at 104 million tons. World ending stocks were estimated at 80.4 million tons, from 82.3 million last month. Chinese buying has been reported to be very strong since the end of the holiday week, and bigger export sales are expected this Thursday after a disappointing week of export sales last week. The market has maintained a firm tone as US prices remain competitive in the world market. Brazil prices have been trending higher as farmers there hold back on sales due to the stronger Real. The Real has rallied from about 28.5 cents to about 32 cents since December.

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

Rice

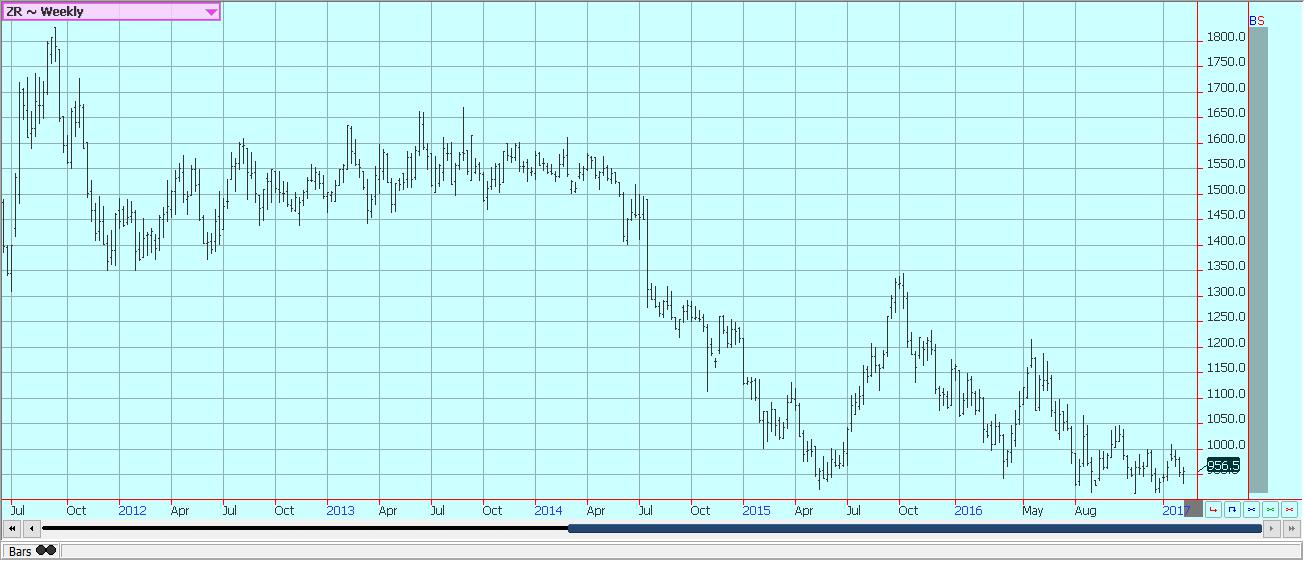

World markets were mixed last week. Asian prices should Vietnamese prices higher and the rest of the major exporters with steady to lower quotes. US markets were slightly higher for the week after a short covering rally on Friday. The slightly higher close was something of a victory for anyone who might be bullish the market. Anyone bullish is hard to find given the multiyear move lower. The market took increased ending stocks for the US as seen in the monthly USDA supply and demand updates in stride. USDA reduced long grain milled export demand by 2.0 million hundredweight and increased ending stocks by the same amount. The move was just facing reality as long grain milled exports have been the weak spot in the US export picture this year. World ending stocks levels were lower on lower ending stocks in India, Thailand, Burma, and Philippines. The domestic cash market remains generally slow, with both buyers and sellers not showing much interest. US farmers are still making final planting decisions and there is still widespread talk that those with alternatives will choose to plant other crops that appear to have better profit potential.

Weekly Chicago Rice Futures © Jack Scoville

Palm oil and vegetable oils

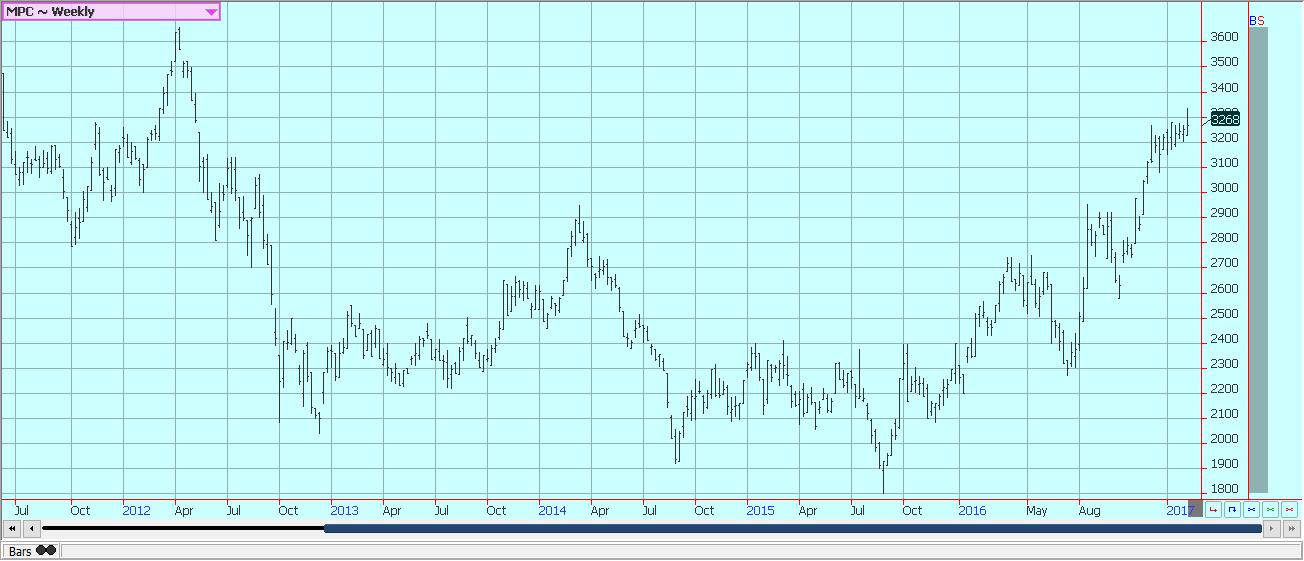

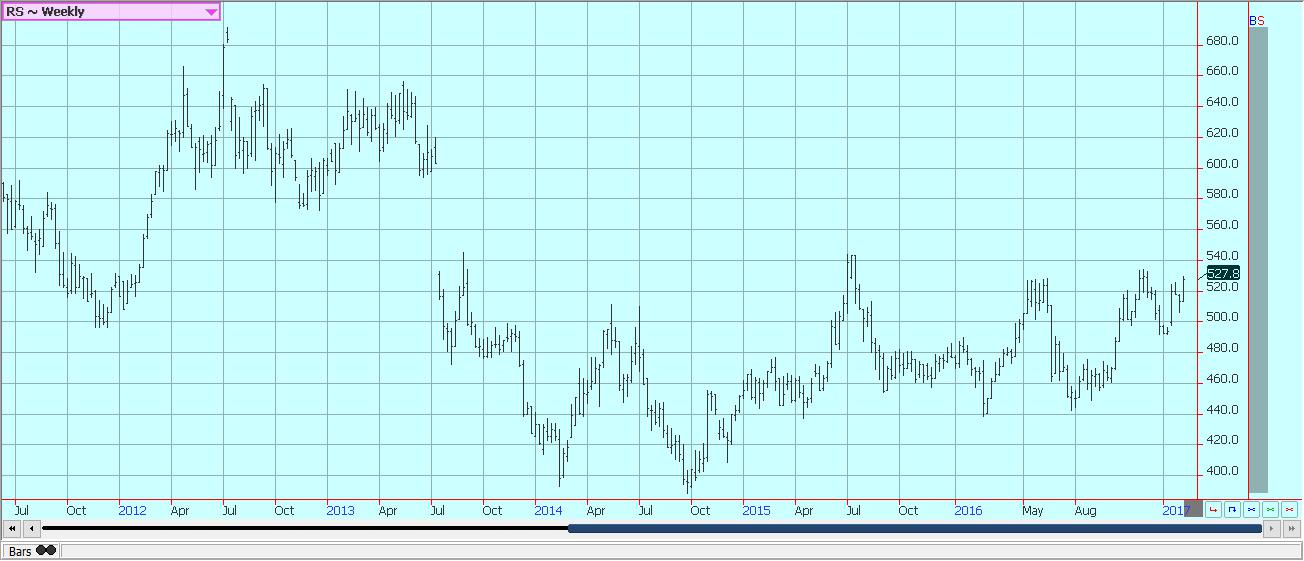

World vegetable oils markets were generally firm last week. Both Soybean Oil and Canola had strong weeks, but Palm Oil remained in a mostly sideways trade. MPOB released its monthly supply and demand statistics. Production was 1.28 million tons in January, from 1.47 million in December. Exports were 1.28 million tons, from 1.27 million tons in December. Ending stocks were 1.54 million tons, from 1.67 million the previous month. The data showed lower ending stocks levels due to lower than expected production. Exports were about as expected. However, the private surveyors showed that exports are off to a slower start this month. SGS said that Malaysian Palm Oil exports are 337,282 tons, from 338,777 tons last month. ITS said exports were 340,947 tons, from 351,907 tons last month.

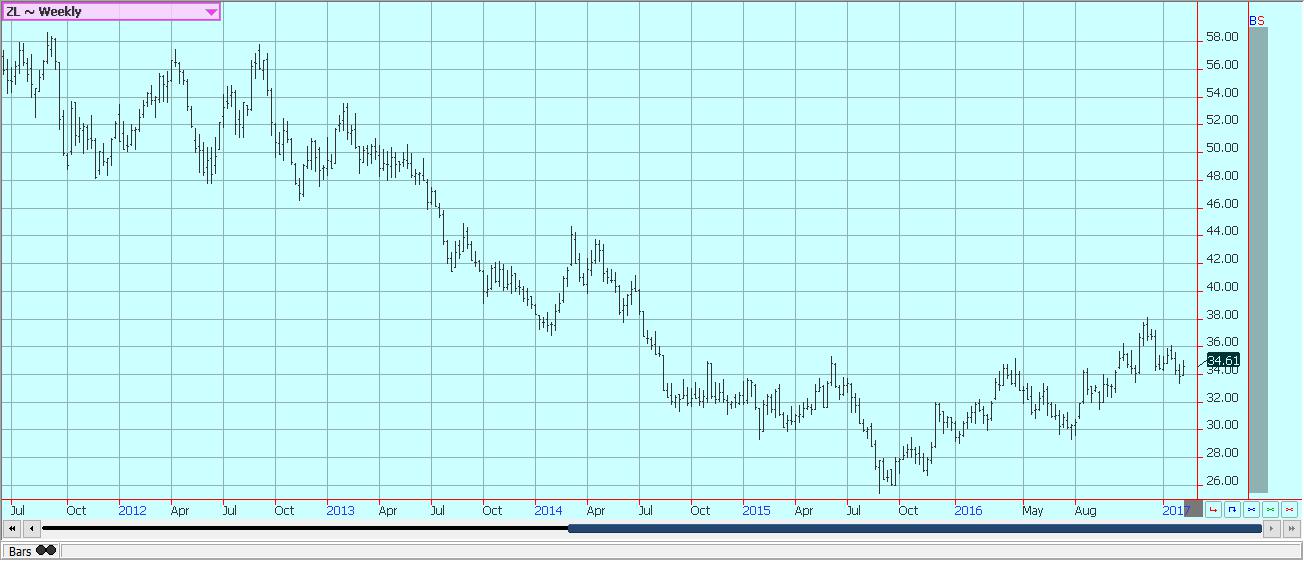

The export data appeared to be the more important factor in the price action on Friday. Meanwhile, Soybean Oil prices held and moved away from a support area on the weekly charts. US demand has been good, especially from the bio fuels sector. The bio fuels sector has also been importing from Argentina. The Argentine imports might stop in the near future as Congress is not expected to renew some tax credits that allowed the imports to happen. Biofuels demand should remain strong and should grow over time in the world market. Overall world vegetable oil demand should remain good. Soybean Oil should get more of this demand as it is relatively cheap on spreads to Palm Oil. Palm Oil production is expected to increase in the next few months as the trees there recover from El Nino, but the recovery has been slower than expected.

Weekly Malaysian Palm Oil Futures © Jack Scoville

Weekly Chicago Soybean Oil Futures © Jack Scoville

Weekly Canola Futures © Jack Scoville

Cotton

Futures were lower for the week. the weekly export sales were down from the last few weeks, but this could be reflecting the lost demand from China and Southeast Asia due to the Lunar New Year. USDA showed the export strength in its monthly supply and demand updates. Exports were increased by 200,000 bales to 12.7 million, and ending stocks were trimmed to 4.8 million bales from 5.0 million last month. World ending stocks levels were reduced, mostly due to less stocks in exporter countries as importer stocks are expected to increased slightly. Next target for the market is a weekly high at 7780 March, but chart patterns suggest that prices can now move over 8000 in the near term. The weekly charts show that the longer term uptrend remains intact. Speculators are the major longs and commercials are the major shorts. This may start to change as trade talk suggests that the commercials have to price a significant amount on call Cotton before First Notice Day for March contracts in the next couple of weeks. The commercials have been bearish the market due to ideas of big US domestic supplies, but the stronger than expected demand and ideas that more inflation is coming have been the main factor behind the buying by speculators.

Weekly US Cotton Futures © Jack Scoville

Frozen concentrated orange juice and citrus

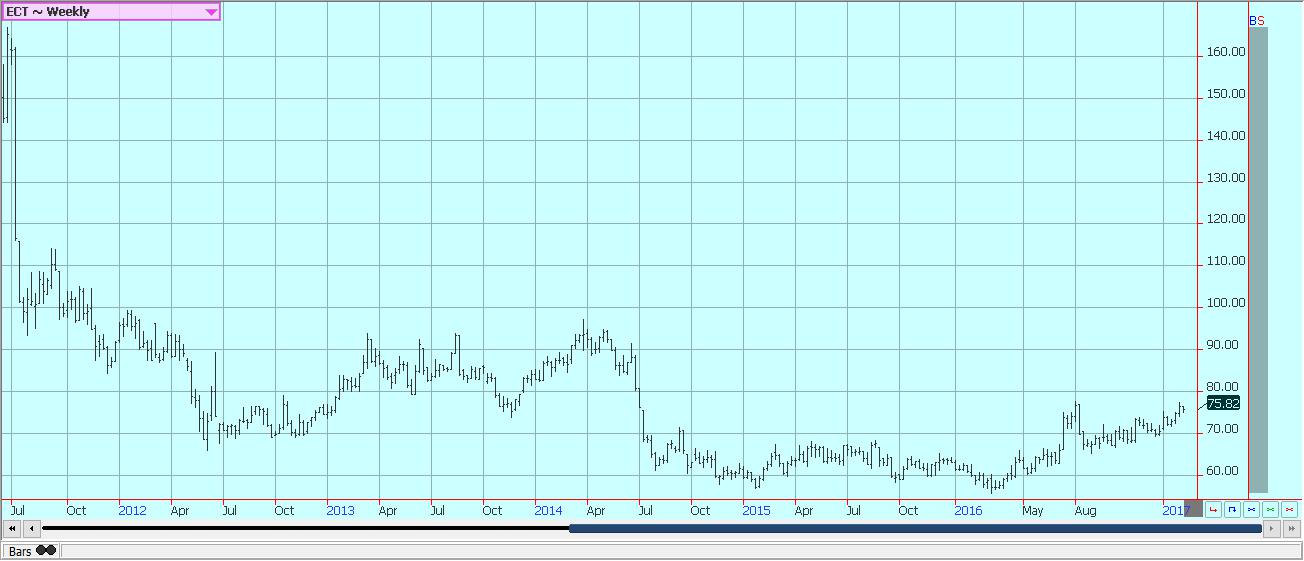

FCOJ closed a little higher last week, but held well within recent trading ranges. Chart patterns suggest that there is more down side potential with final objectives near or below 150.00 basis the nearest futures contract. USDA now estimates Florida Oranges production at 70 million boxes, a very low amount. The Greening Disease remains the overriding factor for reduced production, but the state has also been dry. Irrigation is being used to support blooms for the next crop. The Florida harvest remains active amid dry and warm weather conditions. Early and Mid oranges are being harvested for processing. The Valencia harvest is moving quickly. Demand for Orange Juice inside the US is still a big problem. It is currently at its lowest level since records started being kept in 2002, and there are no real prospects for improvement right now as consumers have plenty of alternatives. Sao Paulo state is getting good weather and crop conditions are called good. Brazil should be able to fill world demand this year and has been an active seller into the US in recent weeks. The Brazil imports are helping to keep inventories at comfortable levels, especially when the weaker demand is factored in.

Weekly FCOJ Futures © Jack Scoville

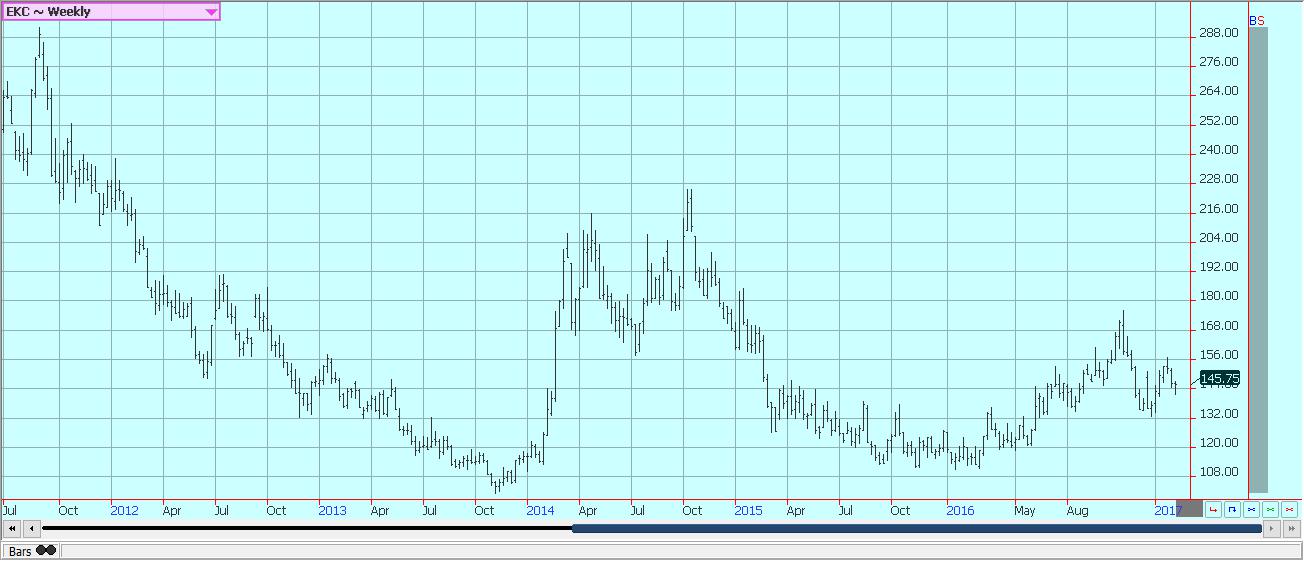

Coffee

Futures were a little lower again last week. The demand side of the market was quiet t the start of the week, but got more animated near the end of the week as futures prices started to hold and recover some of the losses. Futures in New York have seen selling pressure for a month now, and futures prices in London have felt selling pressure for a couple of weeks. There has not been any real change in the fundamentals. There is less production in Brazil this year, in part because it is the second year of the biennial cycle and in part due to the drought in northeast Brazil. Production ideas range from 45 to 50 million bags. Offers are less and seen at high prices from Robusta countries such as Vietnam, and has been a short crop there as well due to dry weather at flowering time. Vietnamese prices have started to drop a little bit as demand has shifted to other countries. The demand has been great for inferior qualities of Coffee from the rest of Latin America, although prices paid remain low and differentials paid remain weak. Differentials for better qualities are stable. Brazil exported 2.6 million bags of Coffee in January, down 8.7% from December. Arabica exports were down 3.9% to 2.4 million bags and Robusta exports were down 71.7% at 22,118 bags. The lower export pace from Brazil is being covered by other Latin American countries.

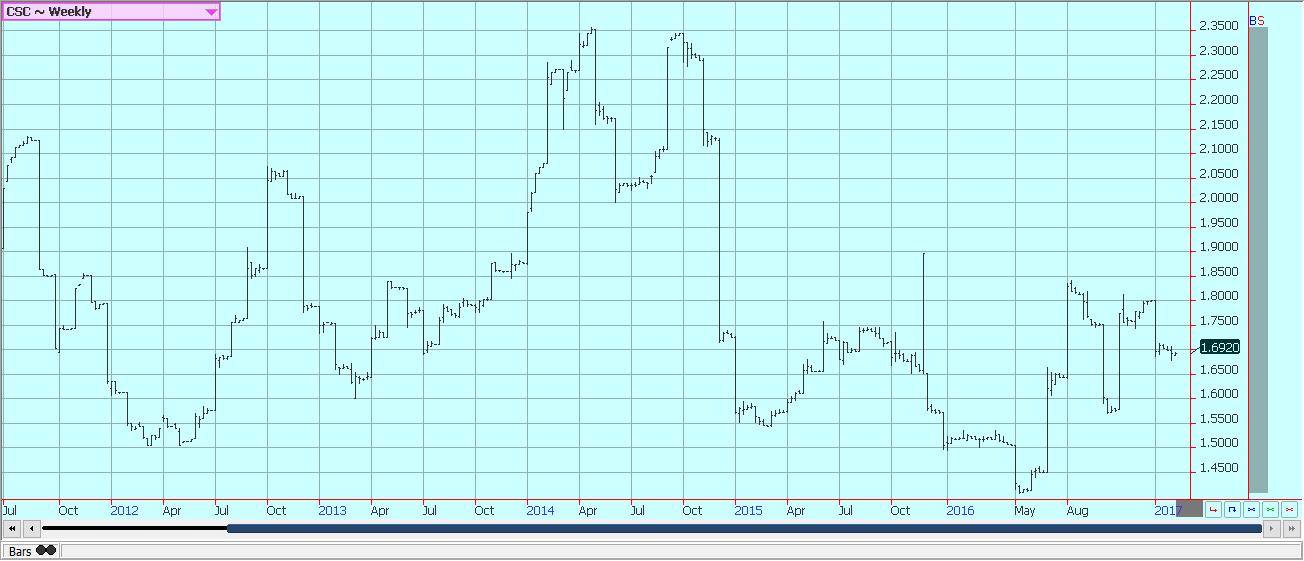

Weekly New York Arabica Coffee Futures © Jack Scoville

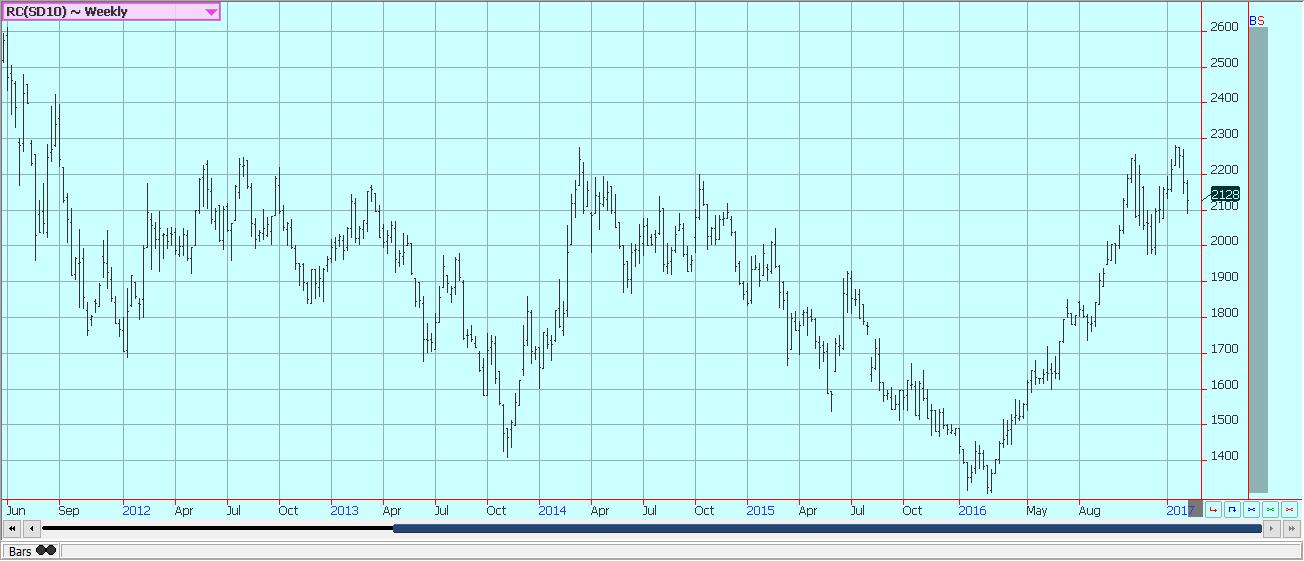

Weekly London Robusta Coffee Futures © Jack Scoville

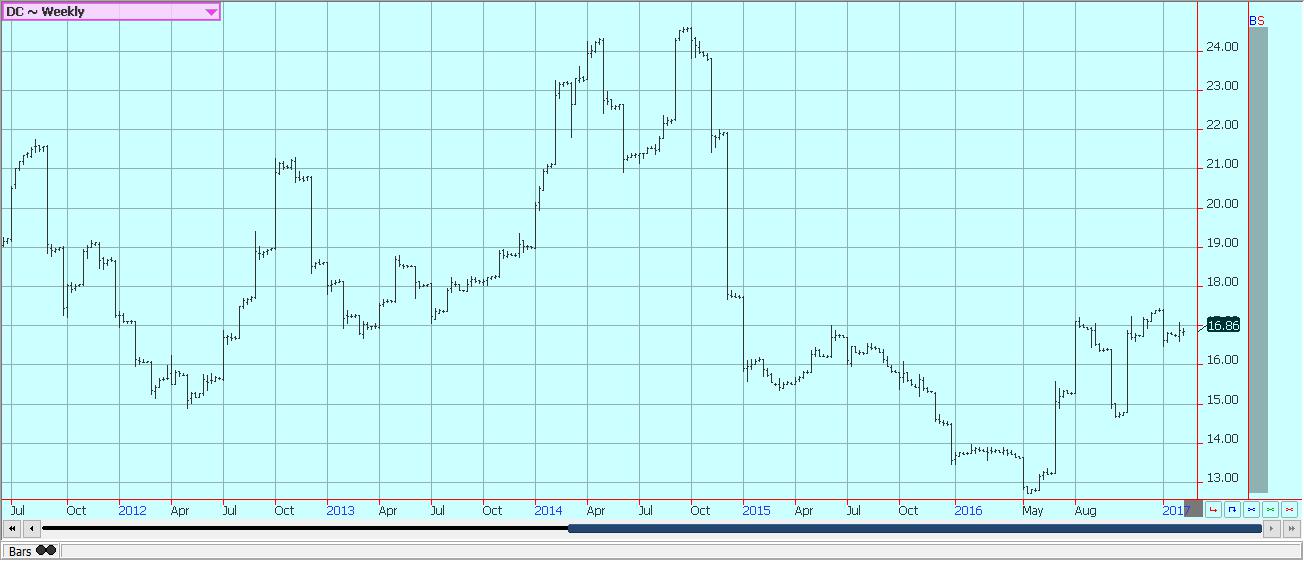

Sugar

Futures closed lower after failing to break out from resistance at the top end of the current trading range. New York closed within the range seen for the last month and a half, but London is now pushing through the support zone. Part of the selling is coming as the March contract will go into delivery in London this week and in New York at the end of the month. Long speculators are closing out positions, and for now the commercial is only providing partial buying interest. News of less than expected production in Brazil combined with less on offer from India and Thailand provide the best reasons for strong prices. India continues to debate the need for imports, and most analysts expect the country to import at least some Sugar. The government is still saying no imports are needed and has maintained a high import tariff. However, mills are closing early this year as there is little Cane to process. Internal prices are moving higher. China has imported significantly less Sugar as it continues to liquidate supplies in government storage by selling them into the local cash market. Demand from North Africa and the Middle East is consistent. The weather in Latin American countries away from Brazil appears to be mostly good, although northeast Brazil remain too dry. Northeast Brazil could see some very beneficial rains this week. Most of Southeast Asia has had good rains.

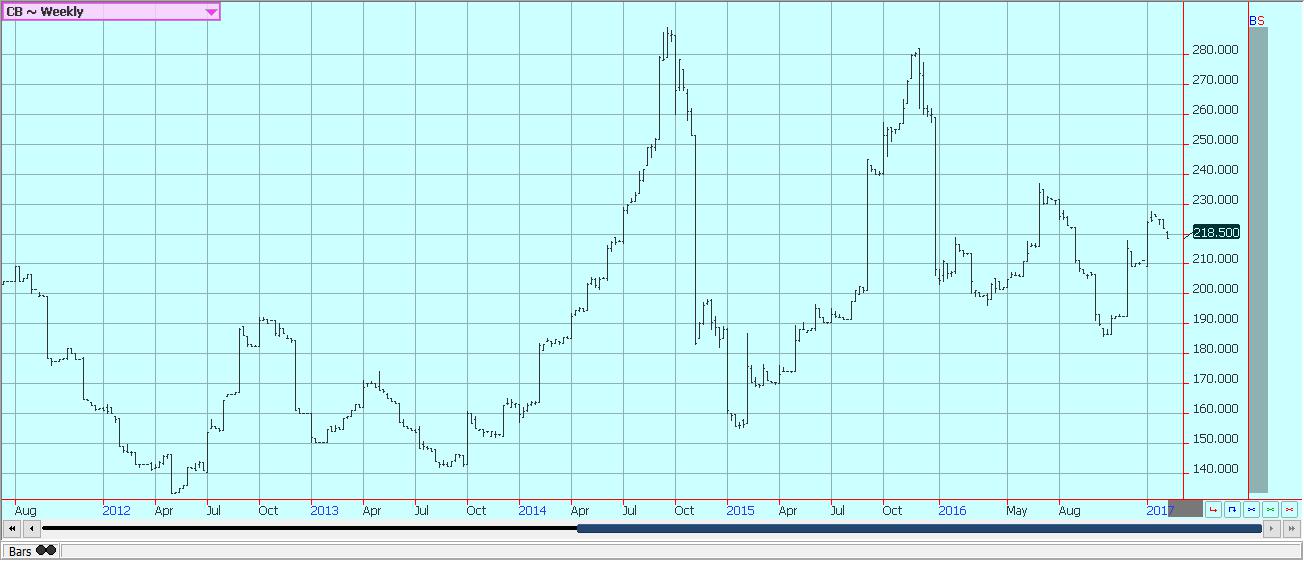

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures © Jack Scoville

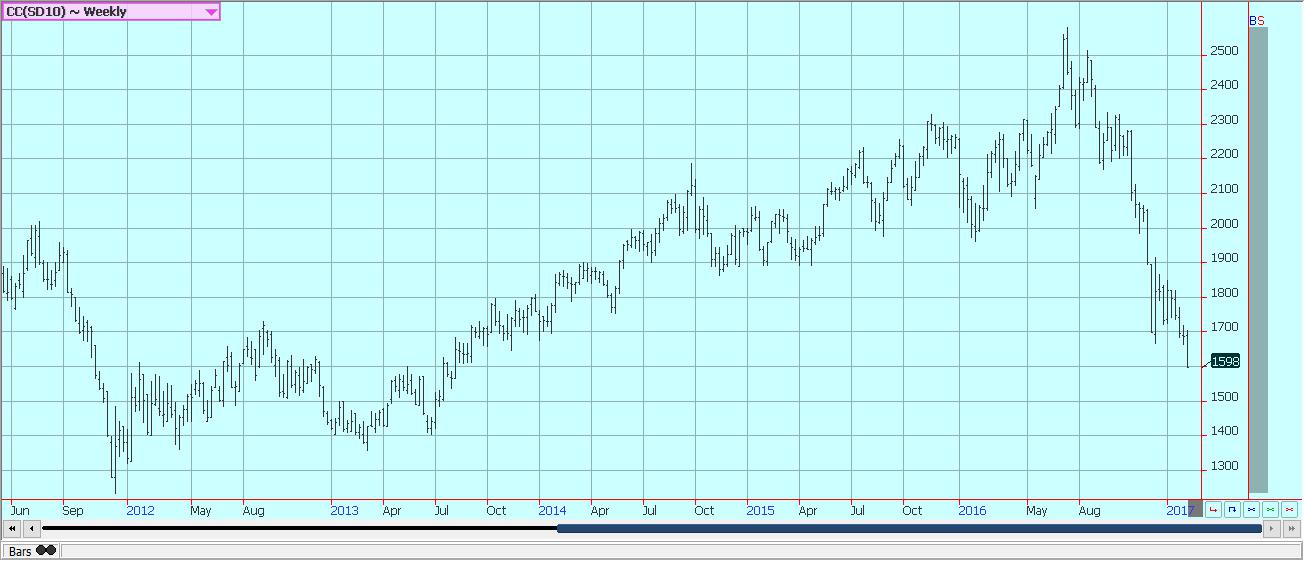

Cocoa

Futures markets were lower and moved to new lows on the charts in New York and in London. The lower prices are starting to hurt West Africa exporters who sold cheap and did not cover in domestic cash markets. The situation has hurt prices in Ivory Coast even more, and now some producers are leaving pods on trees and letting them rot as there is no money to be made by picking and processing. Overall price action remains weak as the main crop harvest continues in West Africa under good weather conditions. The demand from Europe is reported improved, but still weak over all, and the North American demand has been weaker than anticipated. Supplies in storage in Europe are reported to be very high. The next production cycle still appears to be big as the growing conditions around the world are generally very good. West Africa has seen much better rains this year and now getting warm and dry weather. Traders will watch now to see if Harmattan winds develop that could decimate the mid crop. East Africa is getting enough rain now, and overall production conditions are now called good. Good conditions are still being reported in Southeast Asia.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

Dairy and meat

Dairy markets were mostly a little lower as good supplies of milk remain available to the market. Demand is good for cream, but cheese makers have started to back away from the market. Bottled milk demand has been mostly strong, but the Midwest is reporting less demand. Production has been seasonally strong in the east and west and stable in the Midwest. Production has been lower in the mountains due to recent bad weather. Butter and cheese manufacturers report that inventories are starting to increase as there is a lot of milk available. This is especially true for Butter, where bulk supplies are going to storage. Cheese supplies are increasing and much of the production is going into aging coolers. Midwest cheese makers are pulling back on taking new milk. Butter manufacturers are mostly producing bulk butter for inventories. Aged inventories are increasing. Dried products prices are mixed. Whey prices are mixed to strong, and whole milk prices are stable. NDM prices are stable to weak. International markets are featuring higher prices due to reduced production. Production is less in Europe and Russia. Export demand for New Zealand has increased due to stronger demand from China. Production is in a short term decline due to poor pasture conditions. On the other hand, hay supplies in Australia are good even with reports of lower production in January. South American prices are firm as raw milk production goes into a seasonal decline. Argentina is seeing weaker production due to big storms in central and northern areas that has also affected production in parts of Uruguay. Export demand from both countries has been strong, especially from Brazil and Russia. Brazil production is down on hotter weather, especially in southern areas.

US cattle and beef prices were firm last week as packers reached for supplies. Feedlot offers were good, but weights are down, and there is talk that Cattle supplies might be light for the next several weeks. The Cattle on Feed and semiannual inventory reports showed that there is plenty of cattle out there. However, it appears that a lot of the cattle is not yet ready for market. Packers appear short bought. Ideas are that prices can hold at higher levels for now, but that weaker prices will be seen once feedlot offers start to increase in a few months. The supply and demand reports showed good demand for beef for the year. Australia has less to offer and very high prices. Herd culling has slackened in both Australia and New Zealand. Pasture conditions in both countries is better than a year ago on colder and wetter weather seen until now. Conditions in Australia are very good and surplus hay is reported in many areas. New Zealand now needs drier weather to promote growth.

Pork markets have been firm, and live hog futures trends are mostly up. Pork demand remains stronger than expected and ham prices have been contra-seasonally strong. The monthly supply and demand updates from USDA showed that strong pork demand can continue on the domestic and export fronts. The demand should help keep supplies available to the market under control at a time when hogs production remains very strong. Pork prices have trended higher in retail and wholesale markets. Export prices have been strong as well. Packer demand has been very good as packers move to meet the strong domestic and world demand. The charts show that the market could remain higher, and strong demand ideas should continue to support the market overall.

Weekly Chicago Class 3 Milk Futures © Jack Scoville

Weekly Chicago Cheese Futures © Jack Scoville

Weekly Chicago Butter Futures © Jack Scoville

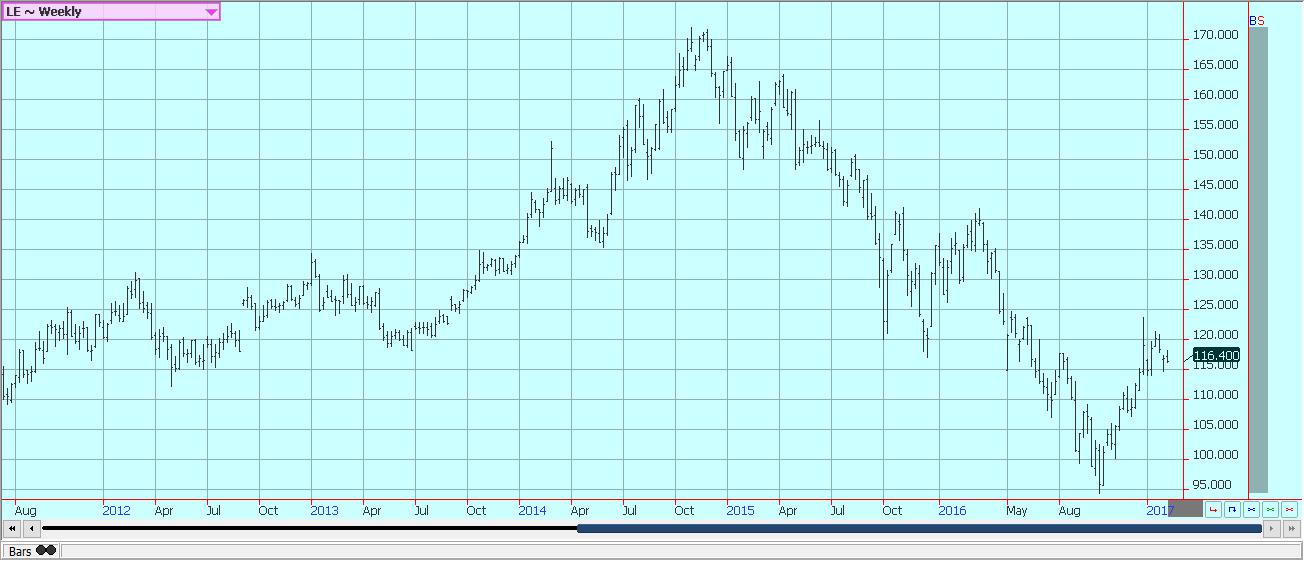

Weekly Chicago Live Cattle Futures © Jack Scoville

Weekly Feeder Cattle Futures © Jack Scoville

Weekly Chicago Lean Hog Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Biotech6 days ago

Biotech6 days agoVytrus Biotech Marks Historic 2024 with Sustainability Milestones and 35% Revenue Growth

-

Crowdfunding2 weeks ago

Crowdfunding2 weeks agoColombia Approves Terrenta’s Crowdfunding Platform for Real Estate Financing

-

Crypto16 hours ago

Crypto16 hours agoRipple Launches EVM Sidechain to Boost XRP in DeFi

-

Africa1 week ago

Africa1 week agoCôte d’Ivoire Unveils Ambitious Plan to Triple Oil Output and Double Gas Production by 2030

You must be logged in to post a comment Login