Business

Brazilian coffee export expected to decline while sugar markets move higher

With El Nino in the forecast, Brazil could be affected by drought which could hurt its coffee production. Meanwhile, India will explore ethanol use for surplus sugarcane.

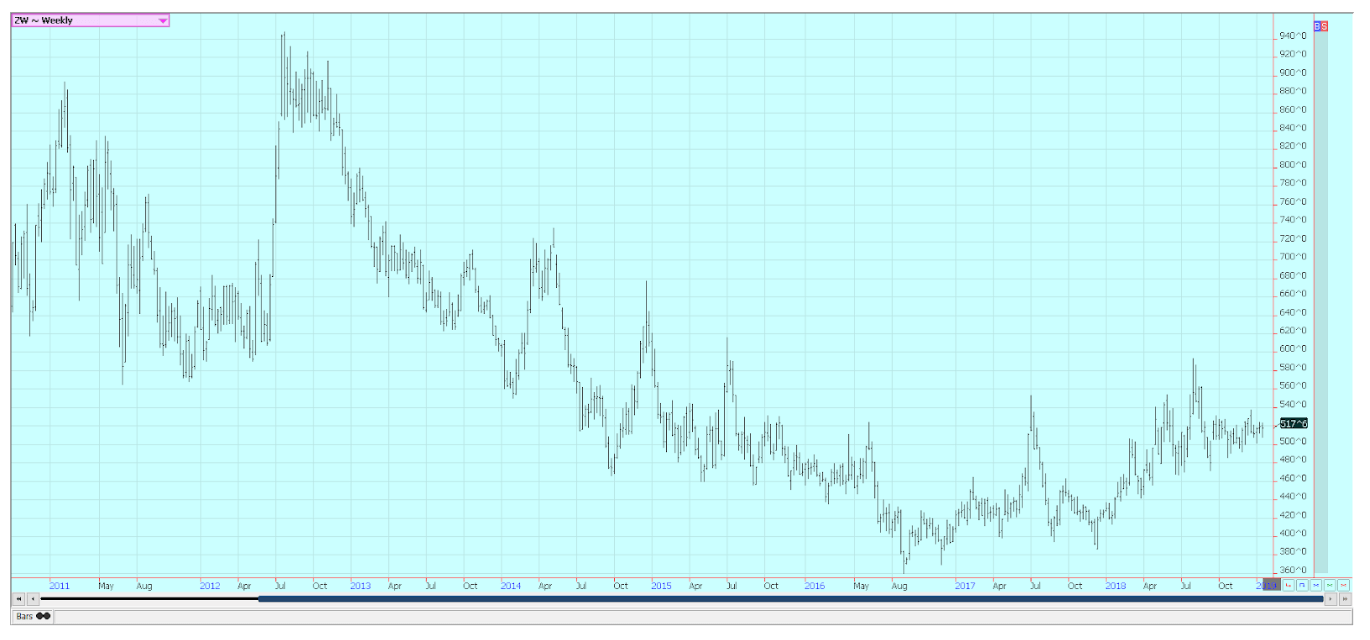

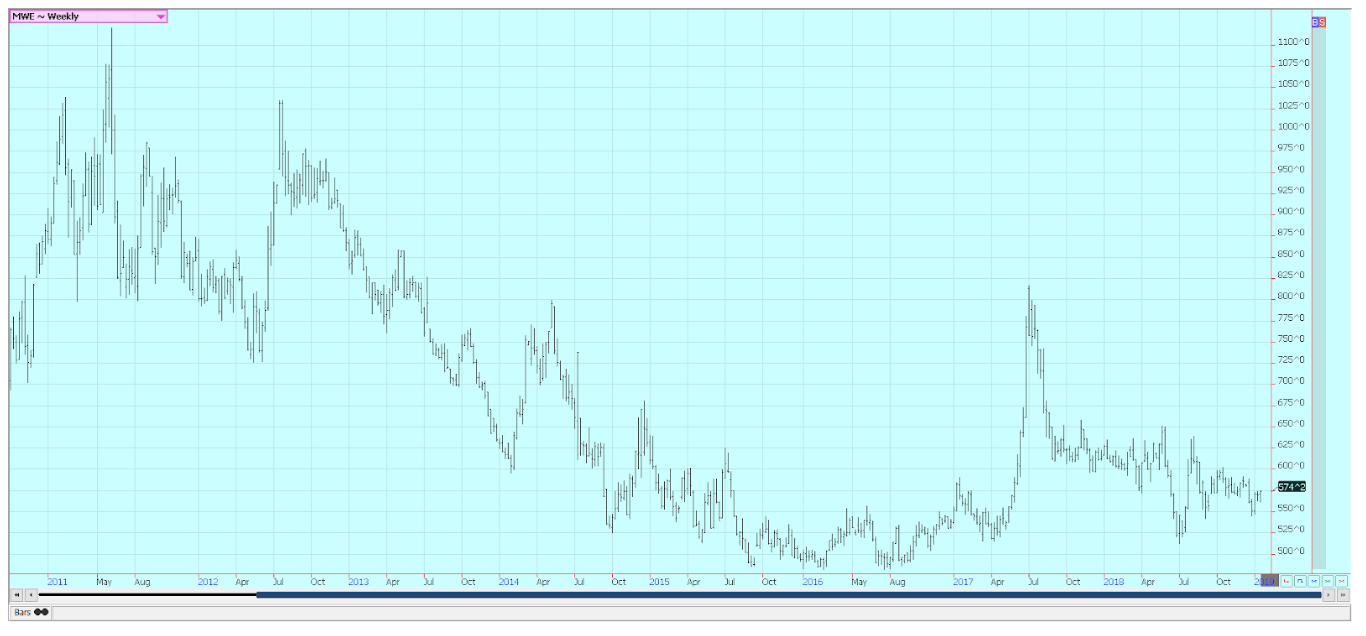

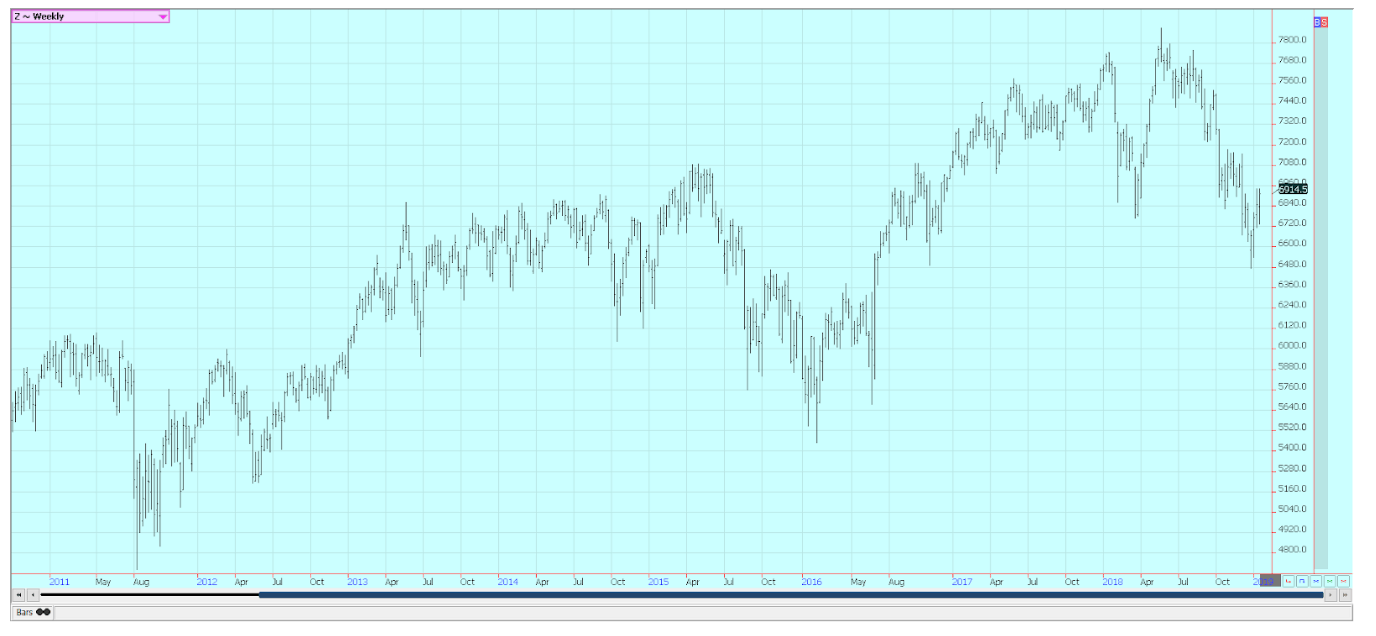

Wheat

Winter wheat markets were quietly mixed on Friday and quietly mixed for the week. Chicago SRW closed a little lower for the week, while Chicago HRW and Minneapolis Spring Wheat markets were a little higher. The price action has been positive and implies that higher prices are possible in the short to medium term. However, prices are working in a range for now.

News that Russia is working harder to restrict exports continues to support the market. The government is working to limit exports to about 18 million tons through the end of June. It might stop some exporters from selling wheat into the world market. Ukraine is also having trouble sourcing wheat for export, and the EU has been exporting less. Russia remains the largest wheat exporter in the world.

A weaker US dollar has been supportive to the US wheat price, but the lack of new demand news hurt. World markets were firm, and US FOB prices are at or below just about all of the competition. SRW wheat is still the world’s cheapest wheat. World crop reports continue to indicate less production and tightening supplies. Australian and European prices have also been relatively strong.

There was a lot of talk last week that the US and China are edging closer to a trade deal that would find China buying significantly more agricultural goods as part of a settlement. Wheat might be included in any buying.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

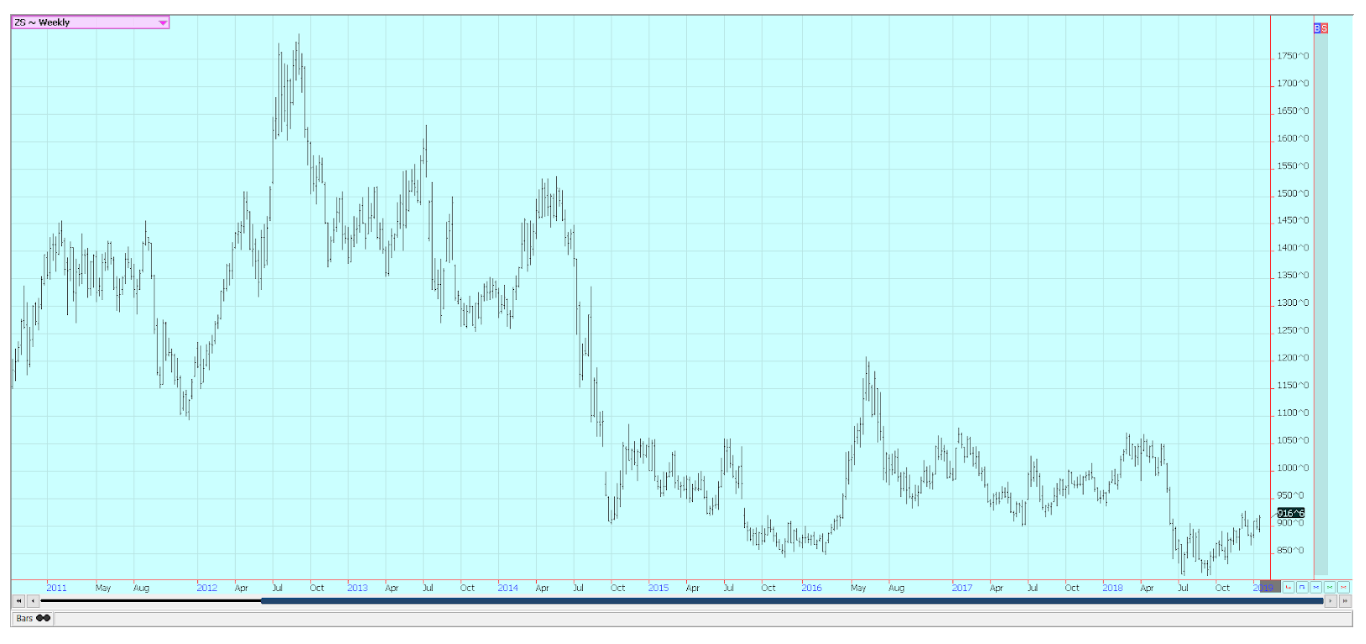

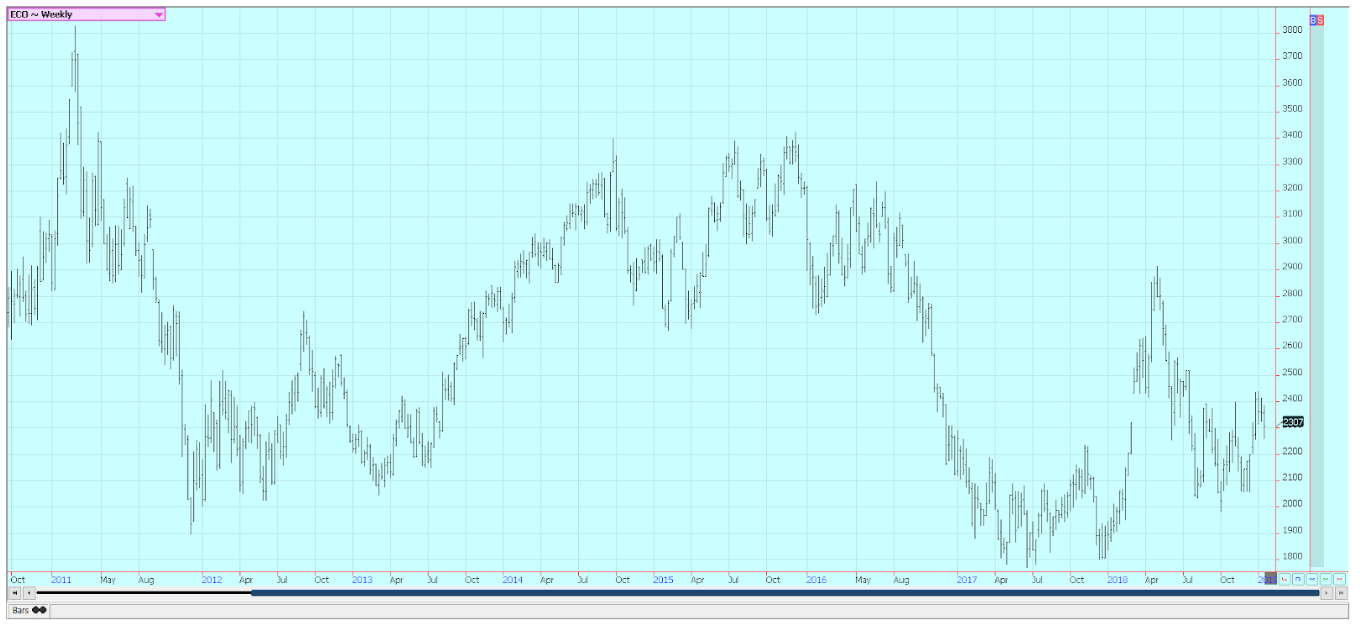

Corn

Corn was slightly higher on Friday and a little higher for the week on demand ideas. Oats were higher on follow-through buying. There has not been any talk of new corn export demand, but basis levels at the Gulf of Mexico have been firm and US prices appear to be very competitive in the world market. USDA is still shut down, so any demand news will have to wait or will come from the commercials.

But, there has been no talk of big sales anywhere, but big sales are possible due to the prices in the US and the uncertain growing conditions in South America. It remains dry and hot in central and northern Brazil, and some of the winter corn crops might not get planted unless weather patterns change soon. China has promised to buy a lot of US agricultural goods, possibly including corn, as part of a trade dispute settlement.

US ethanol markets are showing stronger prices as petroleum markets have apparently found a bottom. Corn demand for ethanol has softened in the wake of the crushing move to lower prices over the last couple of months in petroleum futures markets. Ethanol prices have also weakened as the crude oil and products markets have stayed weak. The corn market seems to found increased selling interest when prices get close to the 390 March area and it has been able to find support near 370 March. Trends are currently sideways on the daily charts and sideways to up on the weekly charts.

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

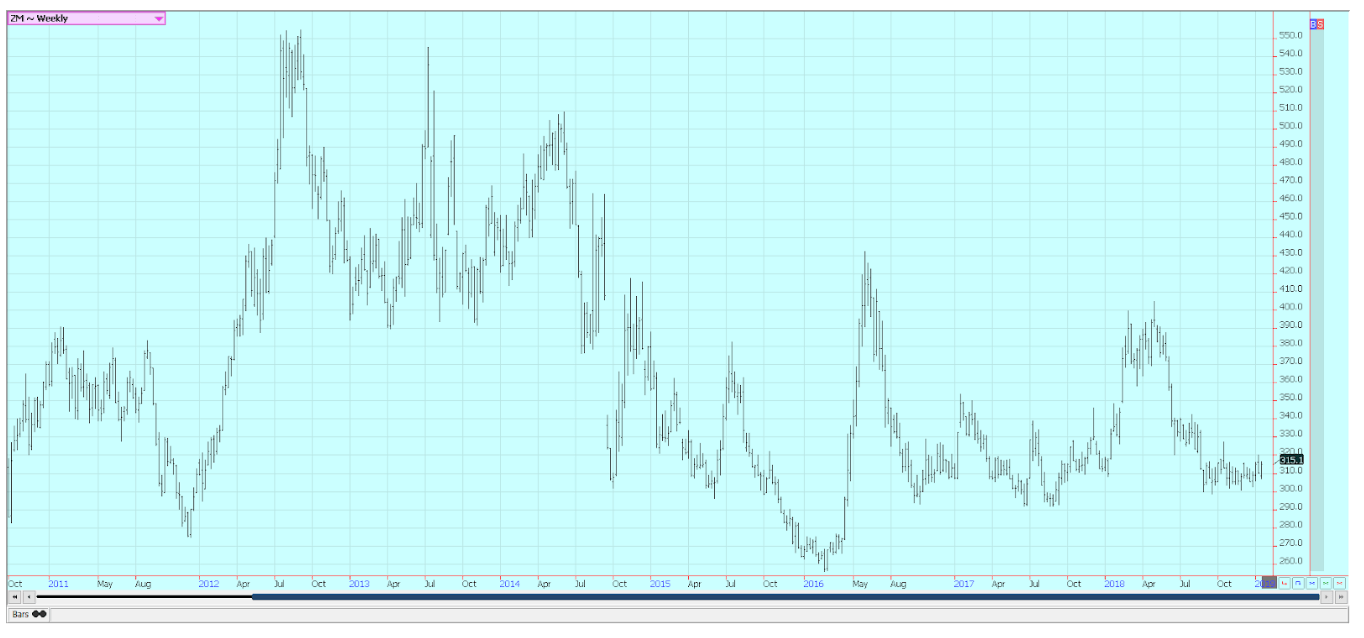

Soybeans and soybean meal

Soybeans and products were higher last week as movement was seen in the US-China trade dispute. Trends are still showing upside potential on the weekly charts for these markets, but the fundamentals of big supplies might keep rallies in check. Some talk last week that China might start buying again supported prices in both Soybeans and soybean meal. There are plenty of soybeans to sell from the US and South America.

Soybeans are in part a weather market. South American weather remains too wet in Argentina and southern Brazil and too dry in western Parana and parts of Mato Grosso and Mato Grosso do Sul. These weather trends continued last week and are expected to continue through the end of the month. There have been reports of losses in the early harvest areas of western Parana and Mato Grosso, but the expectations of a big Brazil crop remain. The harvest was reported to be just over 6% complete by private sources late last week. Private Brazil production estimates range from about 115 million tons to about 118 million tons.

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

Rice

Rice was higher for the week, in part due to the change from January to March on the weekly continuation charts. Prices here higher, anyway, as there seems to be demand in the market at current to lower prices. Weekly charts show that futures are near strong resistance areas, and the quiet tone in the cash market is reflecting the lack of farmer interest in selling. Demand from the mills is also said to be quiet, but the futures market is showing that the demand is bigger than any offers in the cash market.

Volumes traded remain very light and were very light again on Friday. Basis levels remain generally firm as the market needs a little rice and it is not getting many offers from the producers. Producers do not seem interested in further sales at this time, and prices are too cheap for them right now. Ideas are the export demand is holding relatively strong, and there is some mill demand.

South American weather has not been good for growing rice, and internal prices there have not interested producers. Ideas are that production will be less in Mercosur again this year. The weather is becoming a problem in the US as it has been too wet near the Gulf Coast for producers to begin fieldwork. There has been talk that China will now buy rice as imports of US rice are now permitted by the government, but no one thinks they will buy very much if they buy anything at all. They are expected to buy medium and short grain rice and only small amounts or no long grain.

Weekly Chicago Rice Futures © Jack Scoville

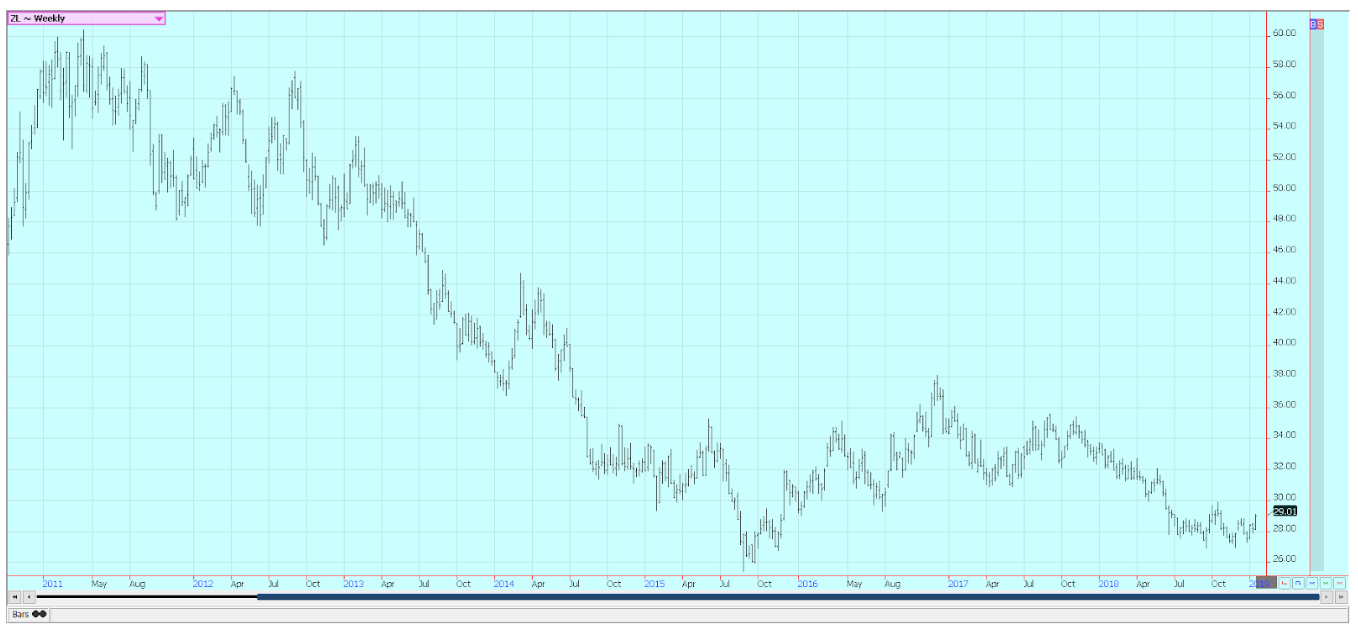

Palm oil and vegetable oils

World vegetable oils prices were higher on ideas that demand is set to improve. Ideas that price spreads between vegetable oils and biofuels is great enough now to afford profits to processors created stronger demand ideas. Palm oil and soybean oil were higher and canola was a little higher. All oilseeds are available to the market, and prices have been generally working lower until the last couple of weeks in search of demand.

Palm oil export demand in Malaysia has been much stronger so far this month as holidays are coming and China and India need to get supplies inside their countries. Malaysian export taxes are 0%, and Indian import taxes are currently very low and allow for imports at profitable prices. Daily charts show and weekly charts show futures mostly in sideways to uptrends.

Soybean oil closed higher in sympathy with soybeans and palm oil and on better demand ideas. Domestic and export demand is thought to be stronger due to biofuels demand as Soybean Oil is cheaper into some areas than palm oil. Canola was higher on late week buying. Demand is only routine. Canola is taking its cues from Chicago and the reports of an abundance of soybeans in the US and South America.

Weekly Malaysian Palm Oil Futures © Jack Scoville

Weekly Chicago Soybean Oil Futures © Jack Scoville

Weekly Canola Futures © Jack Scoville

Cotton

Cotton was higher last week and trends are turning up on the daily and the weekly charts. Weak overall demand continues to impact the US market, but word of smaller supplies is providing the support. World production and supplies are going still lower due to bad weather in the growing season for major producers around the world, including India, Pakistan, and Australia. India and Pakistan are expected to import more cotton this year to cover the short domestic production. China had problems with its growing weather, too, and has been forced to import a lot of cotton crop this year.

Demand for US cotton has been disappointing. China has not bought any US cotton this year and has been active in other markets, especially India. The US has had disputes this year with other major importers such as Turkey, and this could impact the demand for the US. US prices are down and China might start to look at the US crop, but there have been worries about the quality of the US crop due to some extreme growing conditions in Texas and the Southeast over the summer and fall.

Ideas are that the quality worries have kept some importers of US cotton away from the market. US producers report that there is still a lot of cotton crop out in the fields to be harvested, and the quality of the fiber is going down. At least some of the unharvested crop might have to be abandoned.

Weekly US Cotton Futures © Jack Scoville

Frozen concentrated orange juice and citrus

FCOJ was a little higher on Friday but slightly lower for the week. Trends are turning down on the daily charts and remain down on the weekly charts. The oranges harvest is active in Florida as the weather is warm and mostly dry. The fruit is abundant, but arrivals to packinghouses and processors are reported behind last year. Florida producers are seeing small sized to good sized fruit, and work in groves maintenance is active.

Irrigation is being used in all areas. Packing houses are open to process fruit for the fresh market, and all processors are open in the state to take packinghouse eliminations and fresh fruit. Mostly good conditions are reported in Brazil, but the weather there is turning hot and dry again.

Weekly FCOJ Futures © Jack Scoville

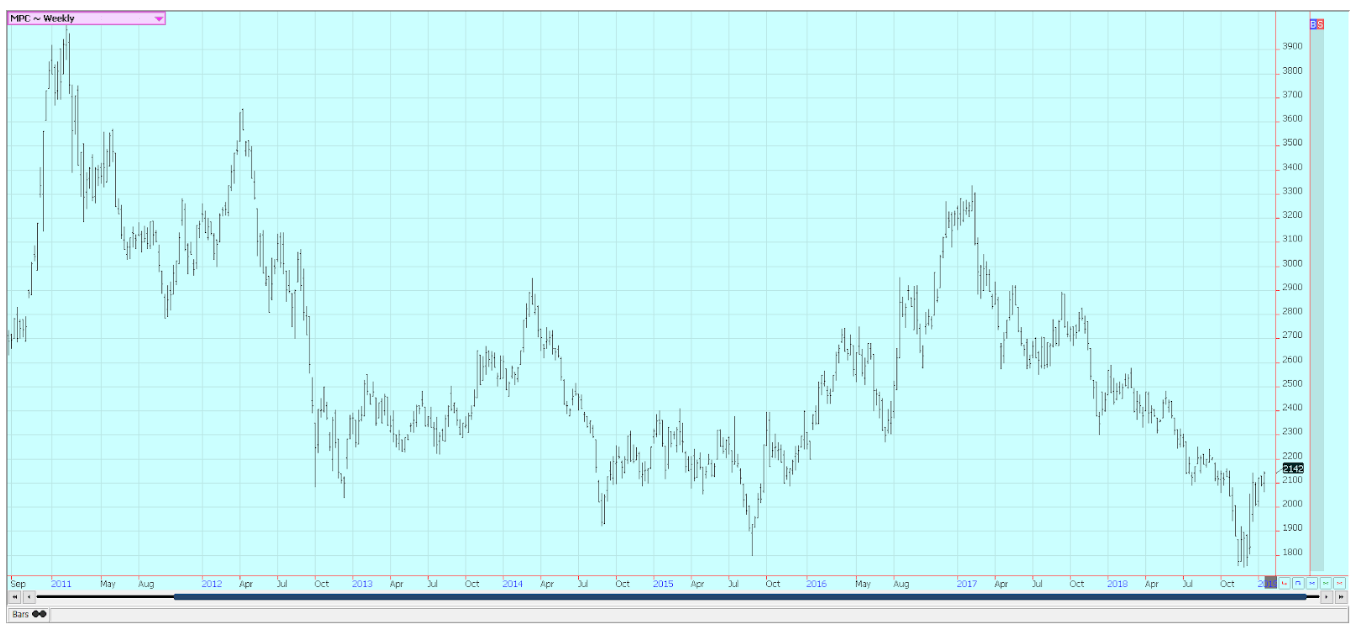

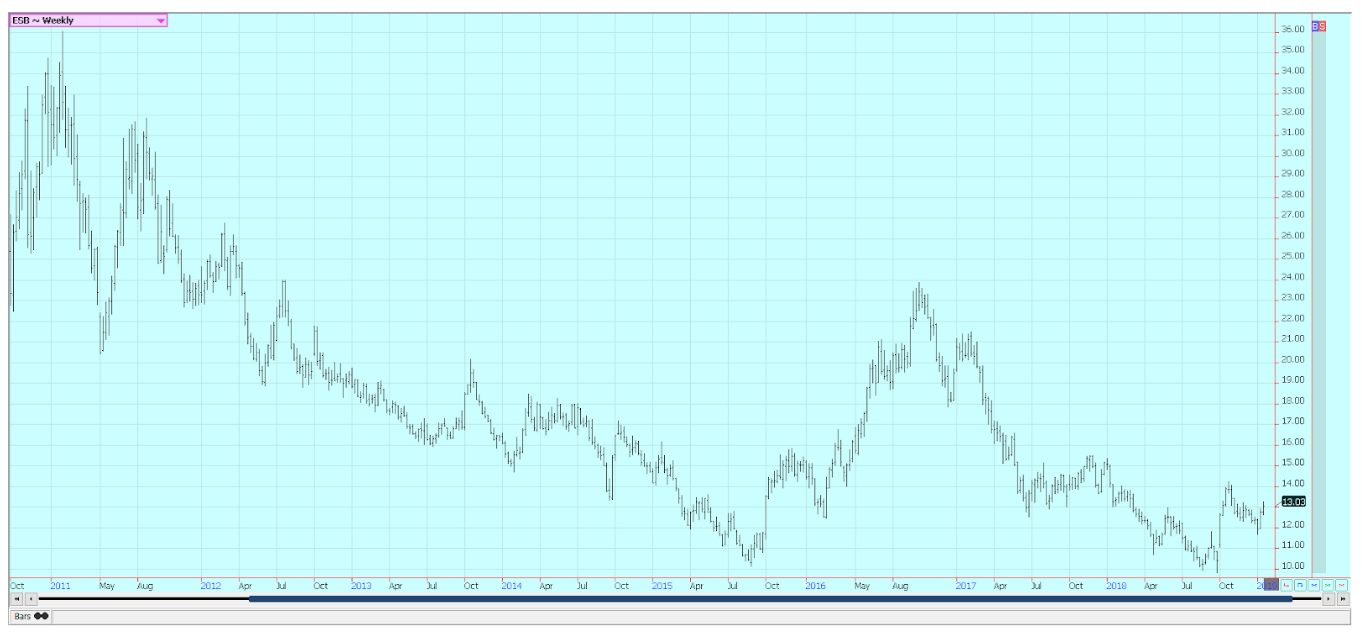

Coffee

Futures were higher on Friday and a little higher for the week in both New York and London. Weekly chart trends are trying to turn up in New York, but remain down in London. Brazil should be getting past the gut slot of its harvest, and the strong export pace from the country should start to turn down.

Brazil had a big production year for the current crop, but the next crop should be less as it is the off year for production. Ideas are that the current production of 62 or 63 or more million bags can become about 52 million bags next year. El Nino remains in the forecast and coffee areas in Brazil could be affected by the drought which could hurt production even more. Many areas are dry now, and the forecast calls for more dry weather. This is great for the harvest but bad for the production prospects for next year.

Vietnam is active in its harvest and middlemen were said to be active buyers of the harvest at levels just above the industry. Production in Vietnam is estimated at less than 30 million bags due to uneven weather during the growing season, but London is lower, anyway, as it absorbs harvest and speculative selling. The Coffee Association estimated production at about 25 million bags, but this will be considered a low ball estimate by the trade.

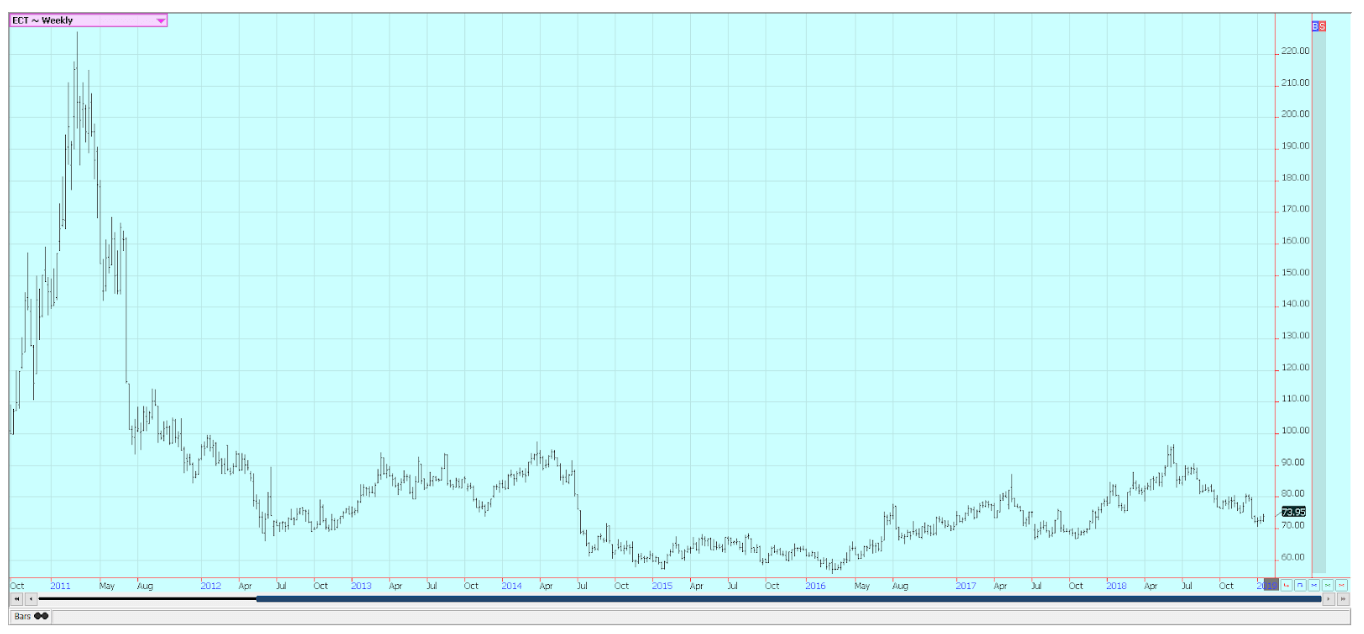

Weekly New York Arabica Coffee Futures © Jack Scoville

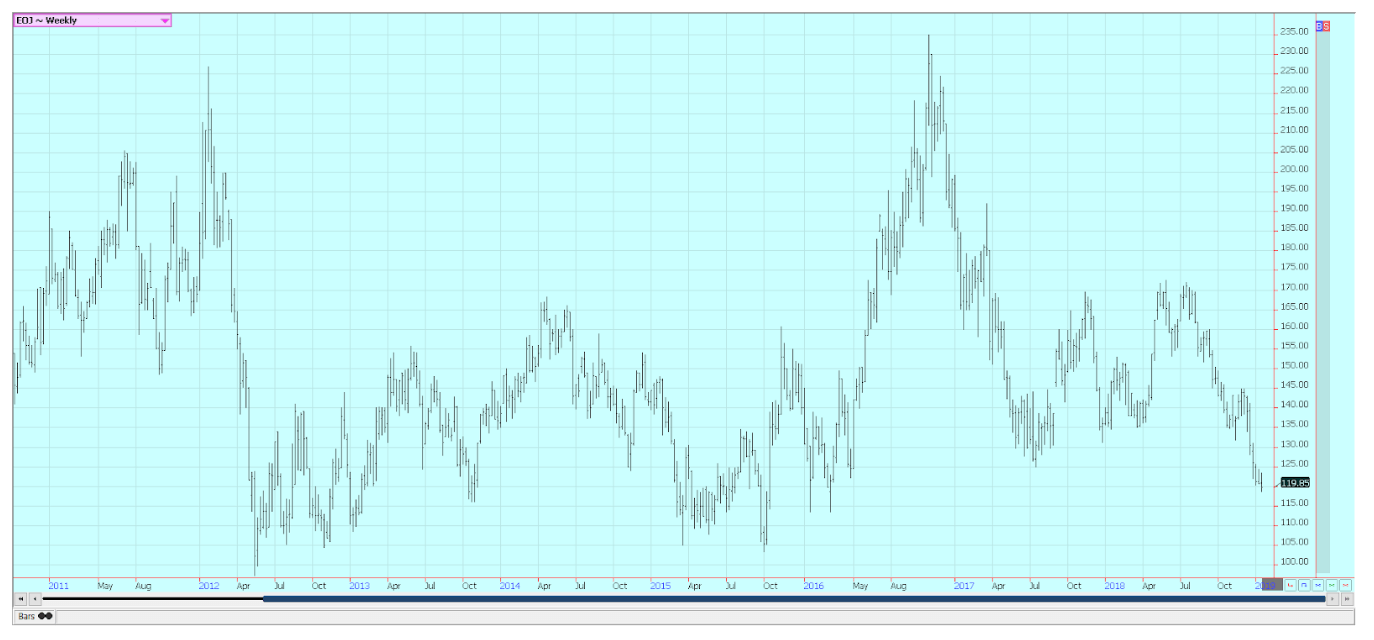

Weekly London Robusta Coffee Futures © Jack Scoville

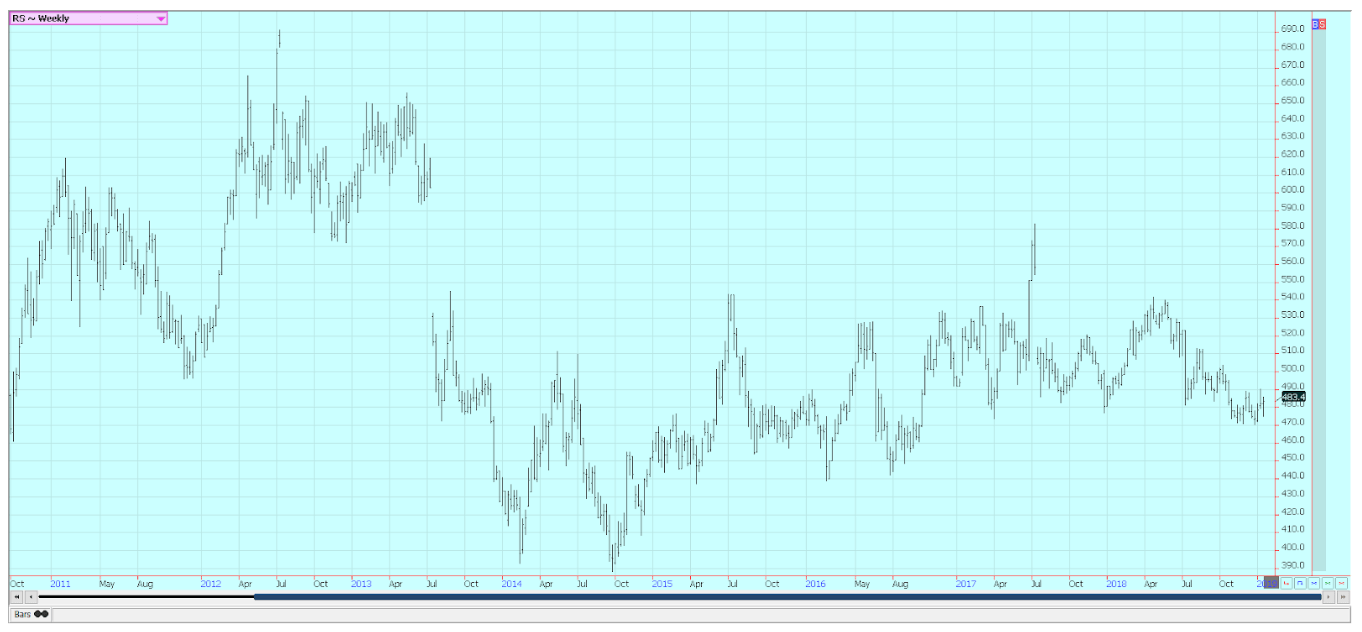

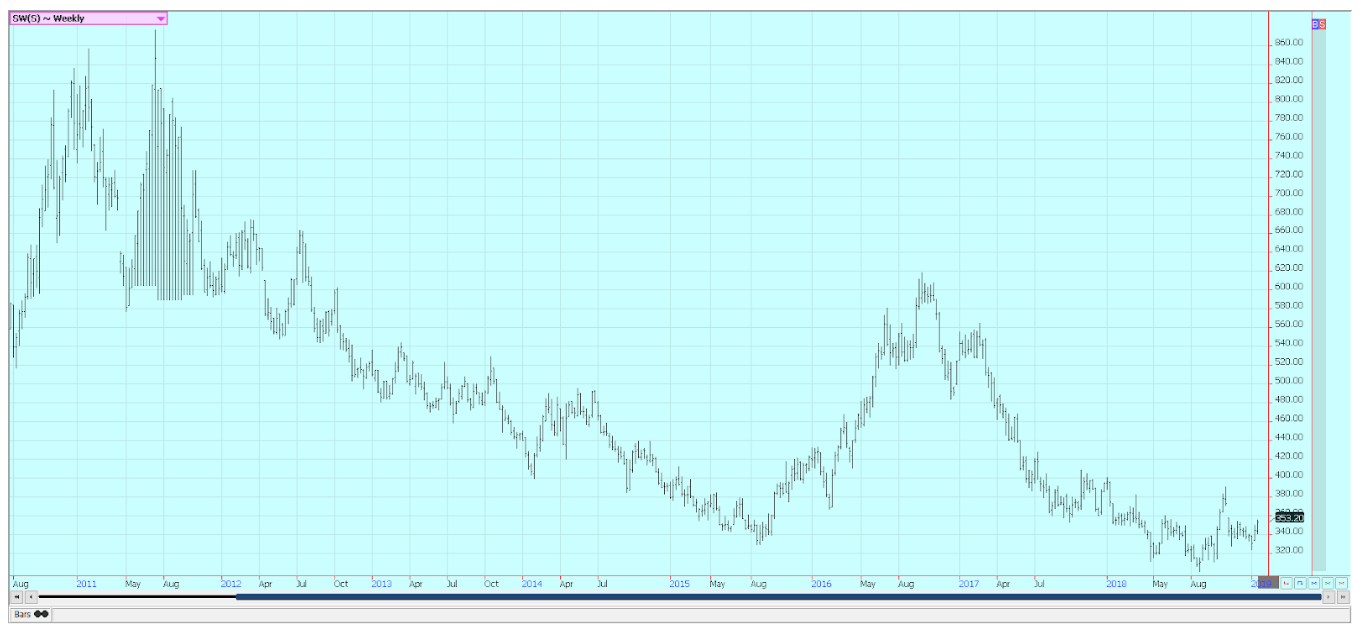

Sugar

Both markets moved higher again last week. The weekly charts in both markets show that trends could be turning up. Petroleum futures appear to have made some short term lows at this time, and petroleum futures strength seems to be helping change the tone in sugar. Brazil has been using a majority of its sugarcane harvest to produce ethanol this year instead of sugar, and there is some talk the mills might switch back to sugar unless petroleum prices improve soon.

There are doubts about just how much production will be seen this year in India. Northwest India had been experiencing hot and dry weather that could cut yields. It has not announced a reduction in its export goal of 5.0 million tons this year, but it appears that the country will not export nearly that much. Some industry sources told wire services that exports could be only half of the target. The government is now exploring ethanol use for the surplus.

Dry conditions continue in northern Brazil and there are frequent rains in the Rio Grande do Sul. Very good conditions are reported in Thailand, but the next production could be less as farmers might switch to other crops due to low prices for sugarcane. Thailand has crushed 45.1 million tons of sugarcane this year, from 34.6 million last year. It has produced 4.5 million tons of sugar, from 3.4 million tons last year.

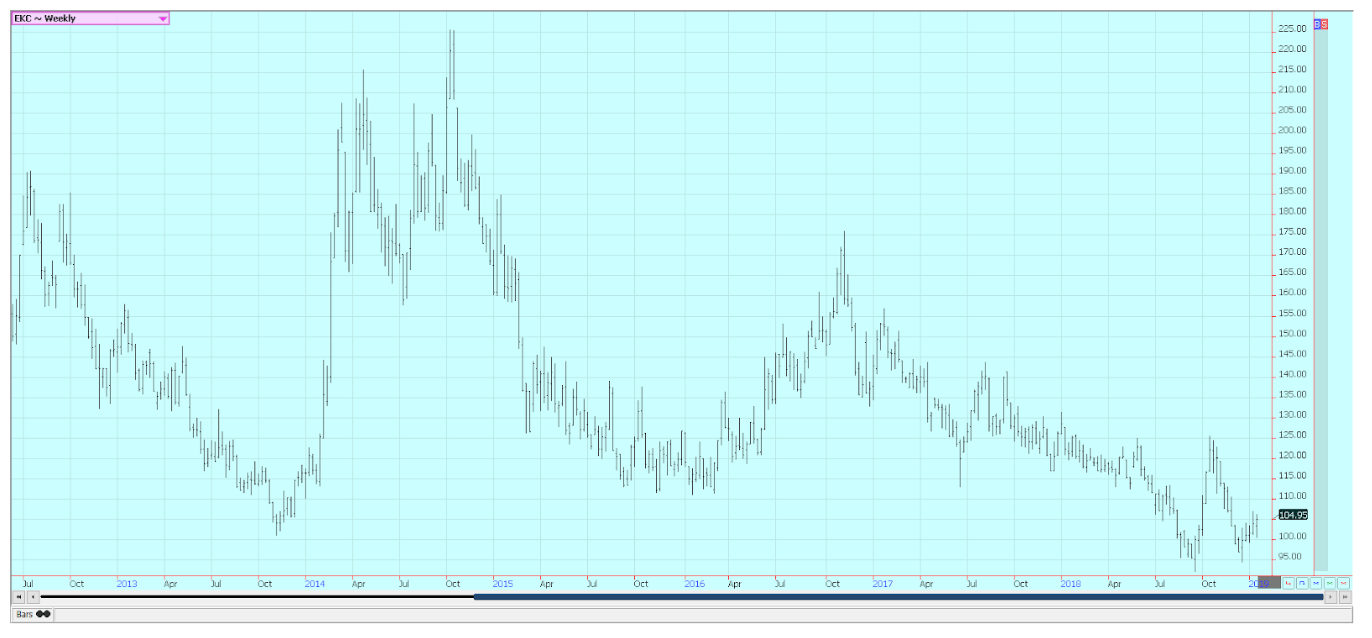

Weekly New York World Raw Sugar Futures © Jack Scoville

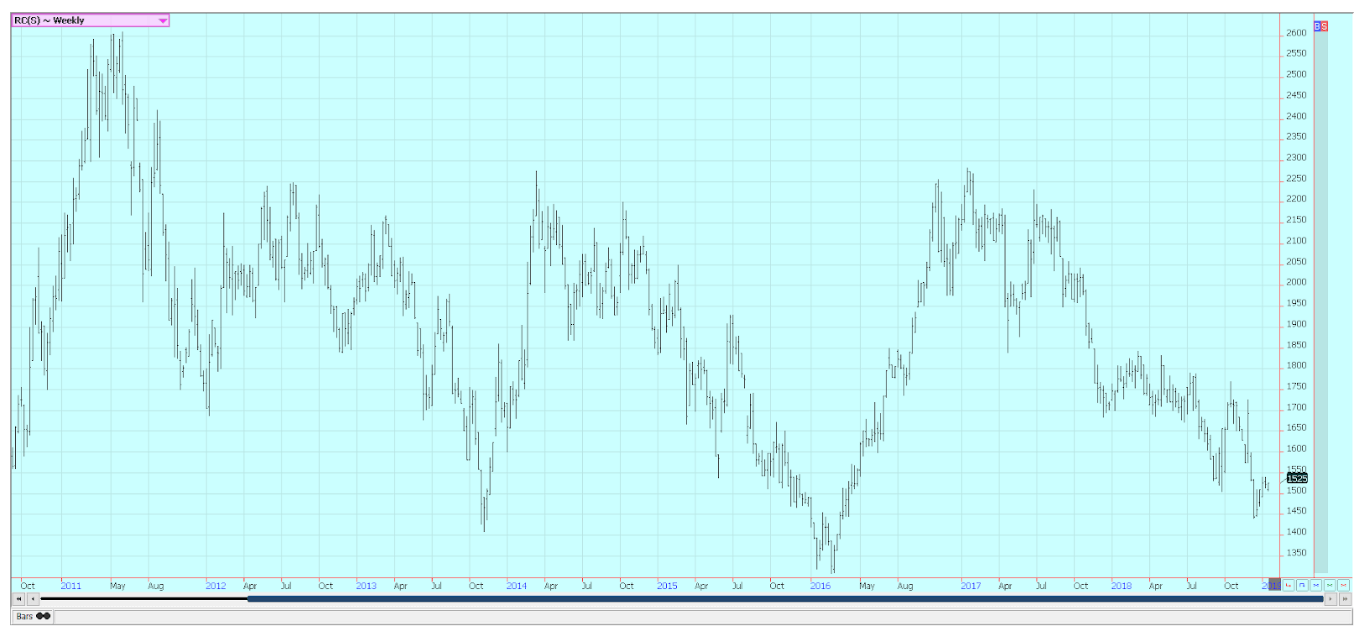

Weekly London White Sugar Futures © Jack Scoville

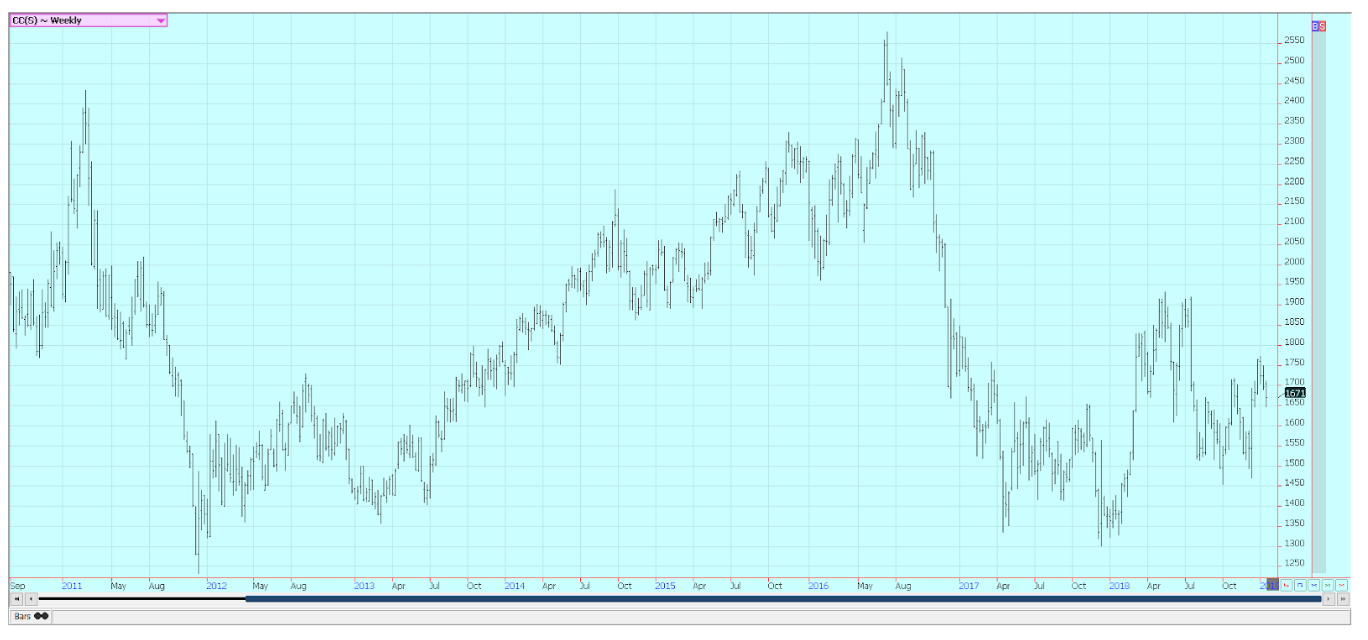

Cocoa

Futures closed lower for the week in New York and lower in London as the new main crop harvest comes to market in West Africa. The quarterly grind data was released, and the data indicated improved demand. The EU grind was 1.6% higher and the Asian grind was 6.3% higher. North American grind data was reported to be higher. Trends are now mixed. The outlook for strong production in the coming year is still around, and ports are said to have plenty of cocoa on offer.

The main crop harvest is active in West Africa. Main crop production ideas for Ivory Coast and Ghana are being reduced, with Ivory Coast now estimating its main crop production at 1.985 million tons, down from previous estimates just over 2.0 million tons. The crop production estimates might become smaller due to Harmattan winds and hot and dry conditions that have moved into West Africa. These conditions can take moisture out of the soil very rapidly and cause some very significant stress on the trees. Conditions appear good in East Africa and Asia. Demand is said to be improving as offers from the new harvest start to increase.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Impact Investing1 week ago

Impact Investing1 week agoVernazza Autogru Secures €5M Green Loan to Drive Sustainable Innovation in Heavy Transport

-

Markets4 days ago

Markets4 days agoRice Market Slips Amid USDA Revisions and Quality Concerns

-

Business2 weeks ago

Business2 weeks agoLegal Process for Dividing Real Estate Inheritance

-

Fintech13 hours ago

Fintech13 hours agoJPMorgan’s Data Fees Shake Fintech: PayPal Takes a Hit

You must be logged in to post a comment Login