Business

Bulgarian sunseed market growth to be explored more

The Bulgarian sunseed crop production has increased but exports appear to be dropping.

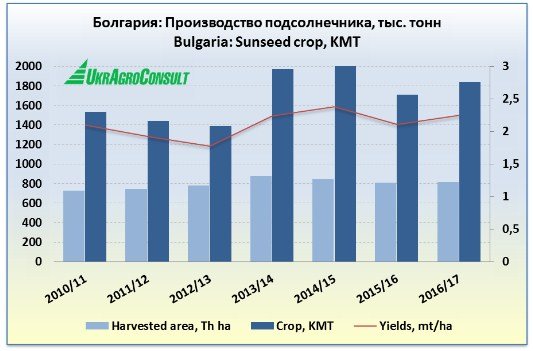

The Bulgarian sunseed crop increased to 1.8 MMT in the 2016/17 season (up 7.5 percent year-on-year). As a reminder, the reasons included an expansion of sunflower plantings (up 0.6 percent year-on-year) and a higher yield (up 6.6 percent).

© UkrAgroConsult

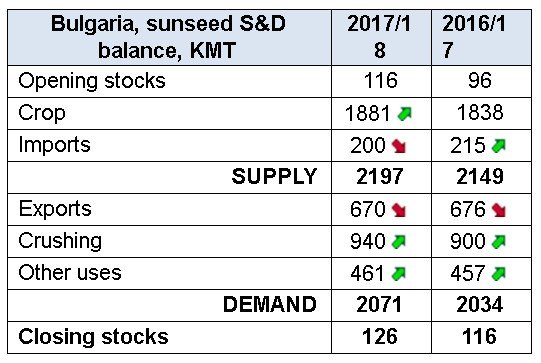

Unusually, Bulgaria stepped up sunseed imports to a record 215 KMT in the 2016/17 season, including 131 KMT, or some 61 percent purchased from EU countries.

In view of quite high sunseed carryovers in Bulgaria (96 KMT), aggregate supply of the commodity expanded to 2149 KMT – this could not but affect the sunseed consumption pattern. Please note that domestic sunseed consumption increased considerably in MY 2016/17 against the previous season. Its growth exceeded the wildest forecasts (up 302 KMT) in view of dropped exports (down 44 KMT).

So, 2016/17 export statistics indicate a fall in sunseed shipments to foreign markets (down 5.8 percent year-on-year at 676 KMT).

© UkrAgroConsult

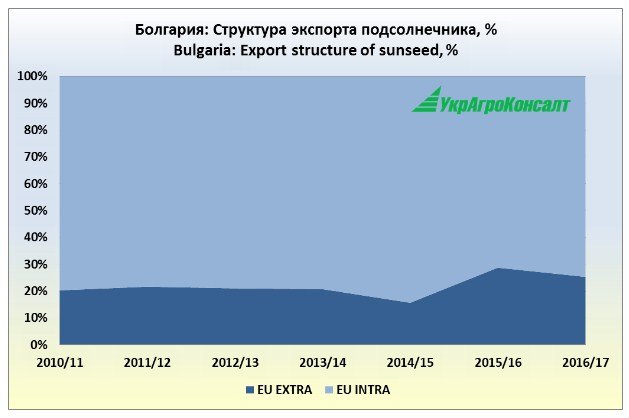

Noteworthy is that Bulgarian sunseed exports have been sinking since MY 2013/14. The export share in the gross sunseed crop shrank to 36.8 percent in MY 2016/17, whereas 60-65 percent or even a larger portion of its volume was shipped abroad just a few seasons ago.

Bulgaria: Sunseed production and exports © UkrAgroConsult

The trade with non-EU countries has been expanding over the last two seasons. Among them, the top buyer of Bulgarian sunseed is Turkey, which absorbs more than 50 percent of the commodity shipped beyond the EU. The sunseed trade with non-EU countries was boosted to 171 KMT in the 2016/17 season (up 4.4 percent year-on-year).

© UkrAgroConsult

UkrAgroConsult estimates that the new 2017/18 season will witness a sunseed crop increase to 1.9 MMT. According to current information of Bulgaria’s Ag Ministry, sunseed was harvested from 808 Th ha (99.7 percent of forecast) by November 10. Its crop already exceeded 1.8 MMT with a yield of 2.28 MT/ha.

The new marketing year is expected to feature a drop both in sunseed imports and exports (200 KMT and 670 KMT, respectively). Simultaneously, domestic crushing will continue growing (940 KMT) at the expense of more significant carryovers and the crop increase.

© UkrAgroConsult

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Impact Investing1 week ago

Impact Investing1 week agoGreen vs. Brown Stocks: Climate Policy, Capital Costs, and the Battle for Market Returns

-

Africa1 hour ago

Africa1 hour agoMorocco’s Banking Shift: From Digital Adoption to Digital Expectation

-

Africa1 week ago

Africa1 week agoSouss-Massa Council Approves Budget Surpluses and 417M Dirham Loan for Infrastructure and Water Projects

-

Business2 weeks ago

Business2 weeks ago2.5 Billion People Watch Quiz Shows Every Day. Masters of Trivia (MOT) Is Letting Them Compete

You must be logged in to post a comment Login