Featured

Cocoa demand in Europe has been slow

New York and London cocoa markets closed lower with much of the selling seen on Friday. Trends started to turn down in both markets late last week. The main crop harvest is over in West Africa and the mid crop harvest is active. Ports in West Africa have been filled with Cocoa. European demand has been slow as the quarterly grind data showed a 3% decrease from a year ago in grindings.

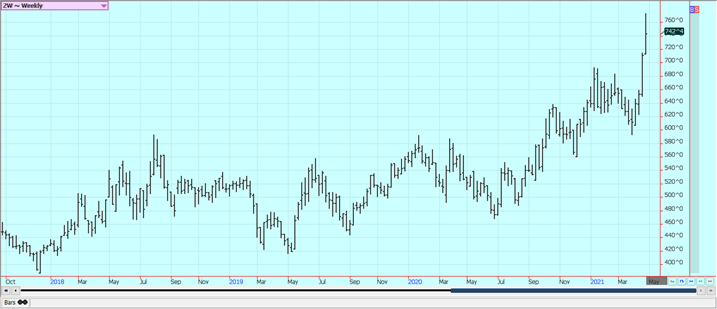

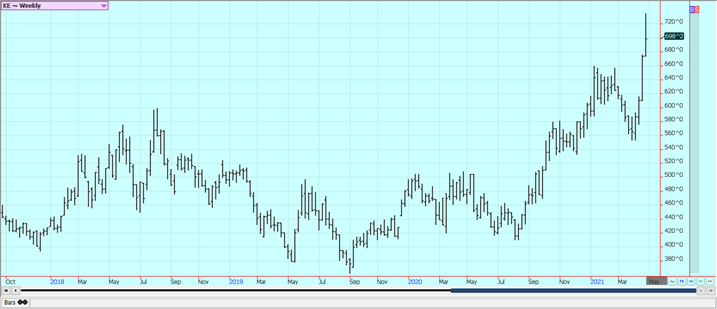

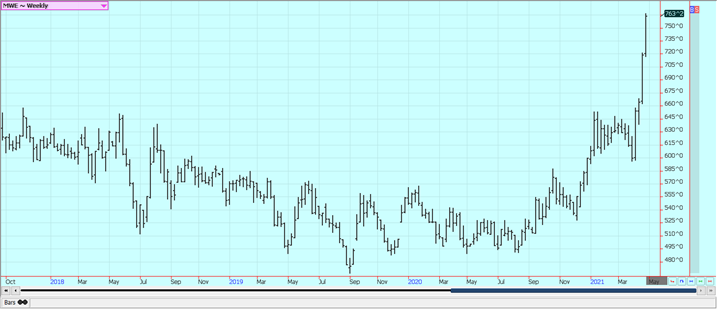

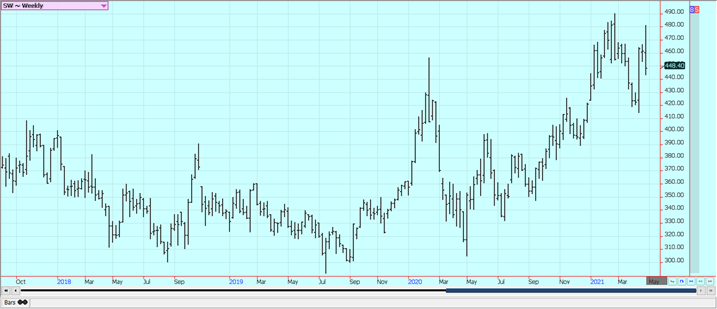

Wheat: Wheat markets were higher on Friday and higher for the week. The move came despite forecasts for some precipitation over the weekend. Any showers in southern and central areas stayed mostly east of Wheat production zones. Wheat remains a weather market, but the sellers were worried about the demand side being very weak. The weather remains too dry in the northern Great Plains and in the Canadian Prairies and farmers have planted into dry soils. Some showers are possible in both areas over the next week. It has been very cold and some Winterkill was possible in the central and southern Great Plains as well as the Midwest. It has been mostly dry in these areas. The Great Plains should stay mostly dry but some big rains are forecast for the southern Midwest over the next few days. Demand remains disappointing but the production might not be there for better demand in the coming year. Corn prices are high so demand for feed wheat could increase.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

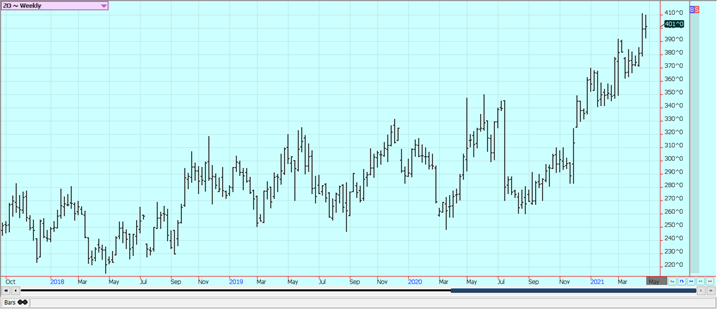

Corn: Corn closed higher on Friday and higher for the week as supply and demand fundamentals remain bullish. Ideas of strong demand and long-term weather outlooks for warm and dry weather west of the Mississippi River continue to offer support. Temperatures will be warmer this week but there will be precipitation to keep farmers from the fields after a cold week last week. Overall planting conditions should improve over the next week, however. There are also concerns about the production potential for the Safrinha crop in Brazil as growing areas have been warm and dry and look to stay that way longer term. It is drier in central and parts of northern Brazil, and farmers have finally harvested the Soybeans area and planted the Winter Corn. The Winter Corn crop progress is well behind normal and it has been dry in major growing areas. There are worries that US Corn is priced out of the world market as US Corn is the highest price of any offering nation. Demand for US Corn has been coming at a stronger pace than estimated by USDA and it looks like US ending stocks can be significantly less than current projections by the end of the year. Demand for US Corn is expected to drop now due to price spreads between the US and South America.

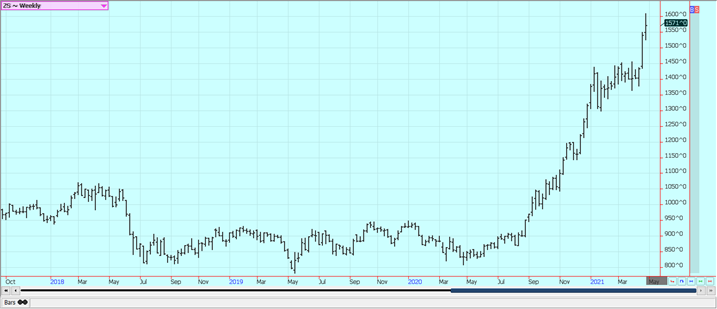

Weekly Corn Futures:

Weekly Oats Futures

Soybeans and Soybean Meal: Soybeans were higher and Soybean Oil was higher. Soybean Meal closed the week lower. There is still crush demand and export demand even though the demand is less now than before and the market thinks the US is going to run out of Soybeans unless demand can be rationed with high prices. Some of that rationing is going on as US prices are much above offers from South America. The US does not have a lot of Soybeans in the country anymore as most producers have already sold. Buyers are scrambling for what is left. Brazil is rapidly exporting Soybeans. Harvest activities are done now. China has been buying for next year here but now is buying mostly in South America. US internal demand has been strong. Soybean Meal is under pressure due to the big buying seen in Soybean Oil causing more production of Meal as well. Production of DDG can increase in the near future as ethanol demand improves and more people start driving again.

Weekly Chicago Soybeans Futures:

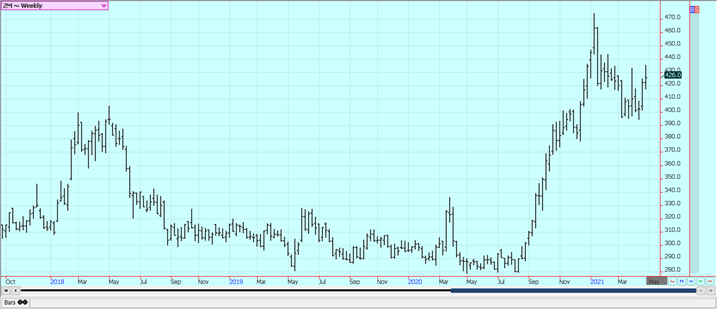

Weekly Chicago Soybean Meal Futures

Rice: Rice prices drifted a little higher on Friday but closed the week slightly lower. Ideas of weakening demand hurt the nearby months. The cash market has not felt any increased demand lately and mill operations are reported to be on the slow side. Texas is about out of Rice, but there is Rice available in the other states, especially Arkansas. Asian and Mercosur markets were steady to lower last week. New crop months were a little lower. New crop Rice is about planted in Texas and in Louisiana. Mississippi and Arkansas are actively planting.

Weekly Chicago Rice Futures

Palm Oil and Vegetable Oils: Palm Oil was lower on Friday but a little higher for the week on good demand and price action in the other competing markets. The private sources showed that export demand is running well ahead of last month so far this month, but the market fears the loss of Indian demand due to the big Coronavirus outbreak there. Ideas of tight supplies are still around but MPOB did show higher than expected ending stocks in its March data. Ideas are that production can seasonally increase. The production of Palm Oil is down in both Malaysia and Indonesia. Canola was higher on ideas of tight supplies combined with a drought in the Canadian Prairies. Canada has bought a couple of cargoes of Rapeseed from Ukraine and might buy more due to price spreads between the two producing countries. Worries about South American production are supporting both markets as is cold and dry weather in the Prairies. Demand is thought to be great with crush margins favoring a lot of production of vegetable oils to feed the demand. The demand for biofuels is about to increase and is one reason to see much stronger Soybean Oil and Canola prices.

Weekly Malaysian Palm Oil Futures:

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures:

Cotton: Futures were higher on Friday and for the week with support coming from dry weather in Texas and resistance from weaker demand as seen in the weekly export sales report. The demand for US Cotton in the export market was weaker last week, but has been strong even with the Coronavirus causing disruptions at the retail level around the world. The US stock market has been generally firm to help support ideas of a better economy here and potentially increased demand for Cotton products. It is dry in western and southern Texas and the planting of Cotton is being delayed. Some showers are reported in western areas to help there, but it is still dry overall.

Weekly US Cotton Futures

Frozen Concentrated Orange Juice and Citrus: FCOJ closed slightly lower in range trading. The price action was bad last week and futures act as if lower prices were coming soon. The demand for FCOJ is said to be weaker. The weather has turned warmer so less flu is around and the increased vaccination pace means that the coronavirus is less. Moderate temperatures are expected for Florida this week. The weather in Florida is good with a few showers or dry weather to promote good tree health and fruit formation. The hurricane season is coming and a big storm could threaten trees and fruit. That is still a couple of months away. It is dry in Brazil and crop conditions are called good even with drier than normal soils. Stress to trees could return if the dry weather continues as is in the forecast. Mexican crop conditions in central and southern areas are called good with rains, but earlier dry weather might have hurt production. It is dry in northern and western Mexican growing areas.

Weekly FCOJ Futures

Coffee: New York and London closed lower on Friday as what appeared to be speculative profit taking hit the pit. Futures were higher last week as the fears of dry weather impacting the Brazil production continued. It remains generally dry there and there are no forecasts for any significant rains in Coffee areas. Some cooperatives and the export association are calling for a significant reduction in production with a 30% loss in production potential mentioned. It was dry at flowering time as well. It is also the off year in the two year production cycle. Production conditions elsewhere in Latin America are mixed with good conditions reported in northern South America and improved conditions reported in Central America after devasting floods early in the growing cycle. Conditions are reported to be generally good in Asia and Africa.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

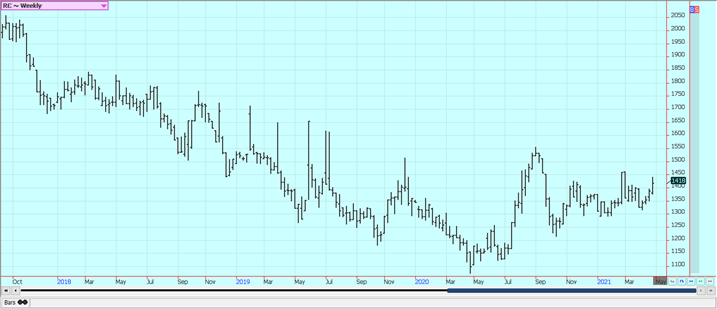

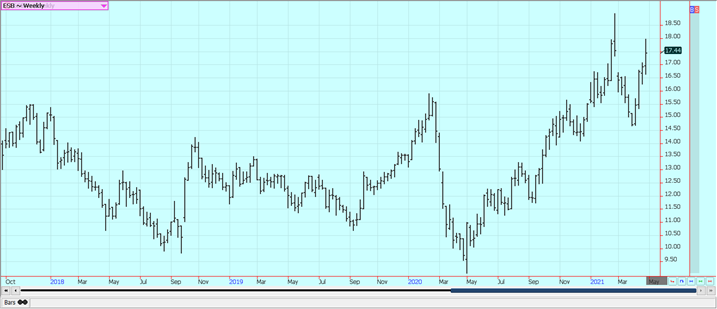

Sugar: New York was higher last week as the drought conditions continued in Brazil. London closed lower on reports of selling from India. Fears of dry Brazilian weather continued. The seasonal crush is off to a slow start and Sugar content of the cane is reduced in initial industry reports from the center-south of Brazil. Ideas of stronger Ethanol demand helped support Sugar prices last week as the competition is back for crushing and refining use. Current Sugar demand is called average. The primary growing region has been dry in Brazil. Production has been hurt due to dry weather earlier in the year. India is exporting Sugar and is reported to have a big cane crop this year. Thailand is expecting improved production after drought induced yield losses last year. Exports are expected by USDA to be higher in the coming year. The EU had big production problems last year but is expecting much better production this year.

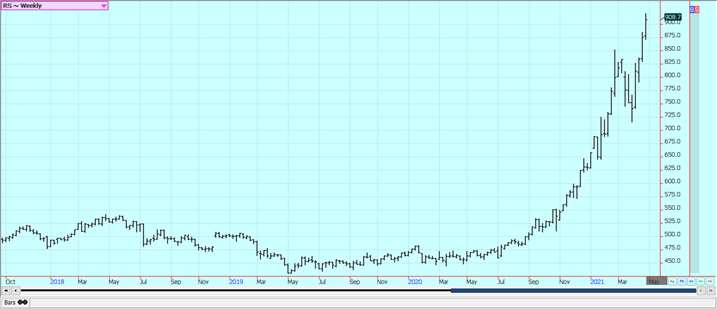

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

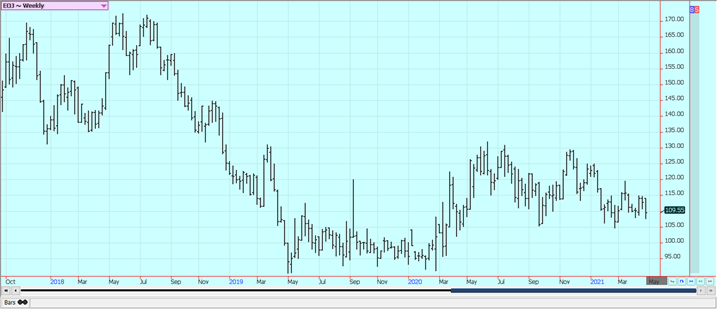

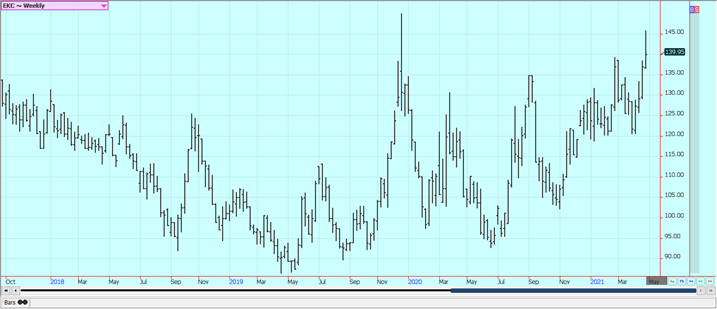

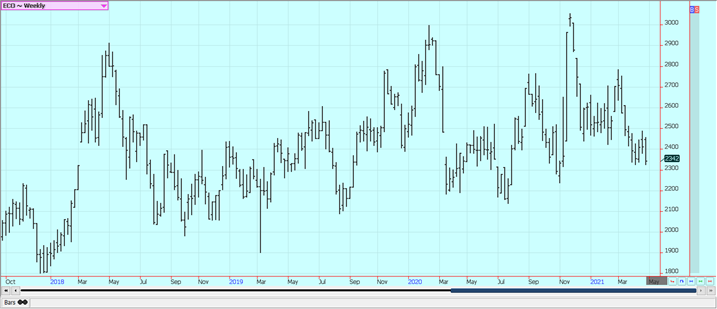

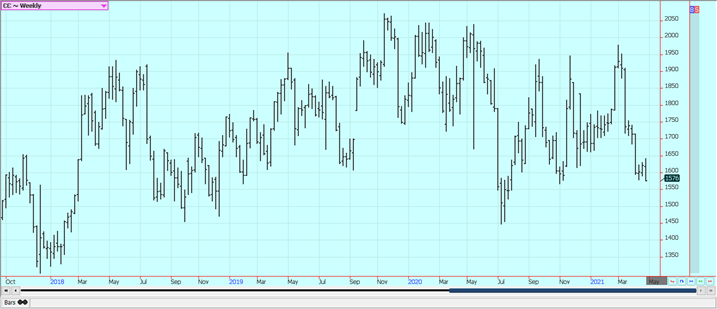

Cocoa: New York and London closed lower with much of the selling seen on Friday. Trends started to turn down in both markets late last week. The main crop harvest is over in West Africa and the mid crop harvest is active. Ports in West Africa have been filled with Cocoa. European demand has been slow as the quarterly grind data showed a 3% decrease from a year ago in grindings. This has been caused by less demand created by the pandemic. Asian demand improved. North American data showed improved demand.

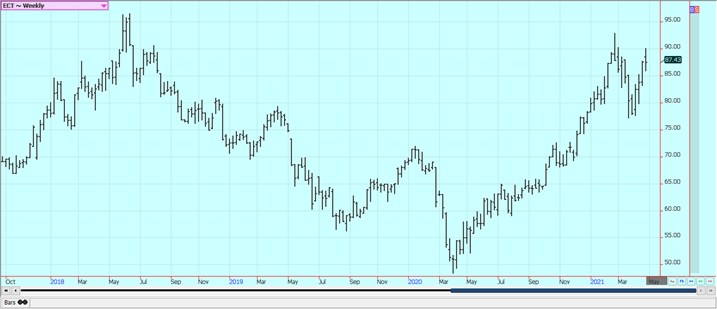

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

—

(Featured image by Platus via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Crowdfunding2 weeks ago

Crowdfunding2 weeks agoBSG Stahl Riesa Launches Crowdfunding for New Floodlights

-

Impact Investing3 days ago

Impact Investing3 days agoEU Industrial Accelerator Act: Boosting Clean Industry and Resilient Supply Chains

-

Cannabis2 weeks ago

Cannabis2 weeks agoSnoop Dogg Searches for the Lost “Orange” Cannabis Strain After Launching Treats to Eat

-

Cannabis6 days ago

Cannabis6 days agoBrewDog Sale Leaves Thousands of Crowdfunding Investors Empty-Handed