Business

Coffee futures fall amid ideas of strong production in Brazil and Vietnam

Coffee futures are under selling pressure on ideas of strong production. Wheat and corn edged higher for the week while other crops were lower.

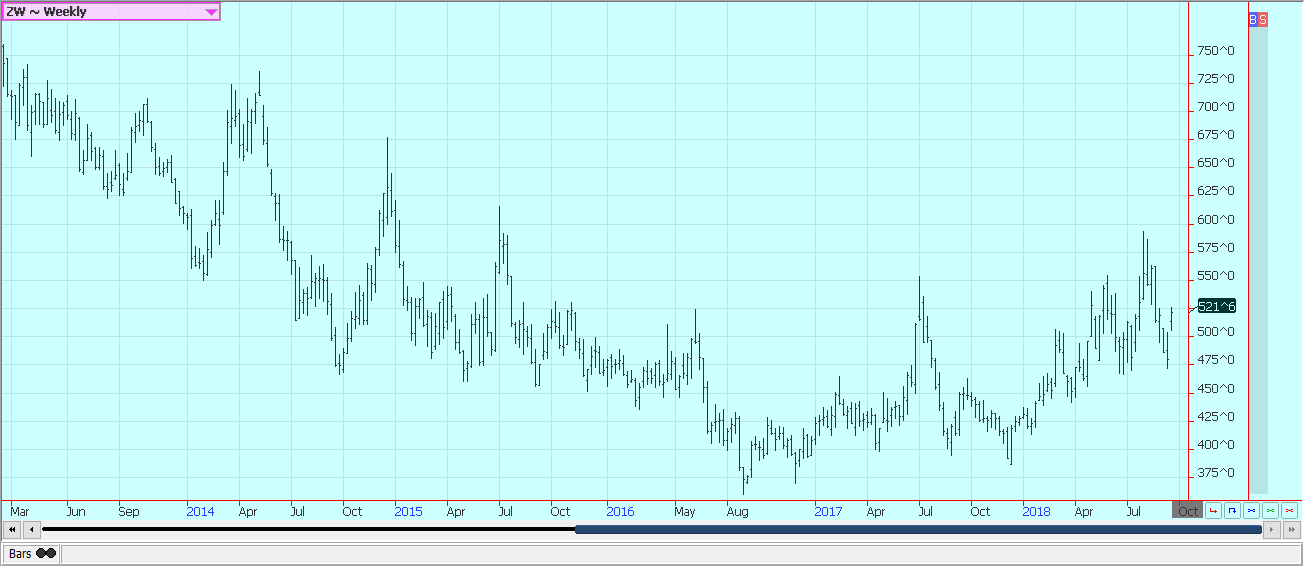

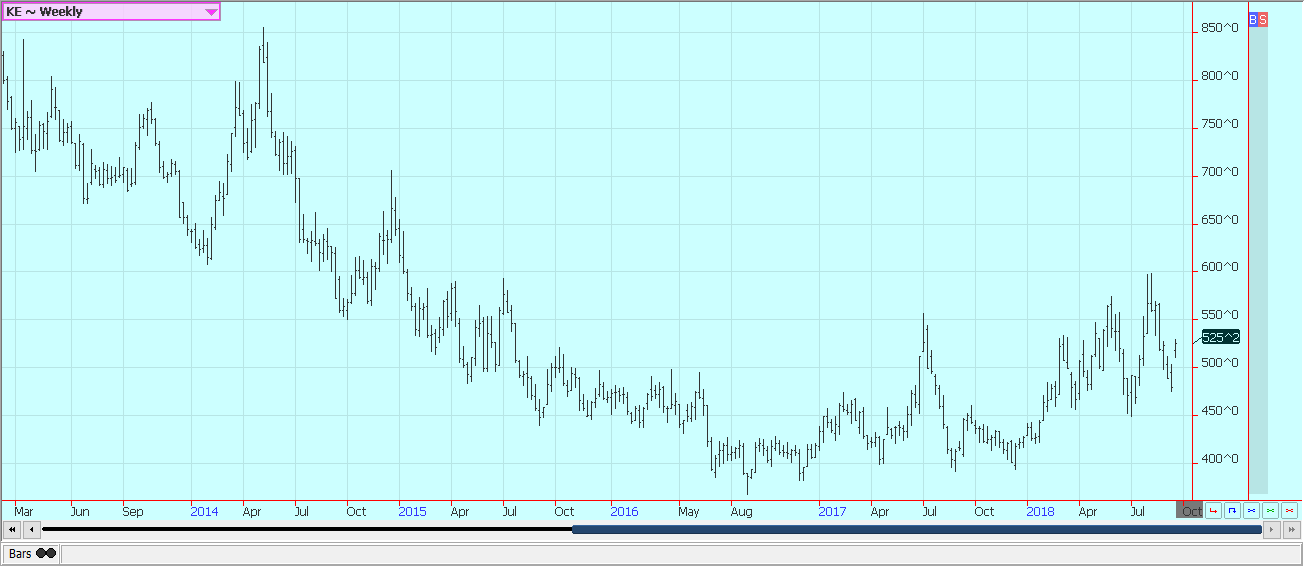

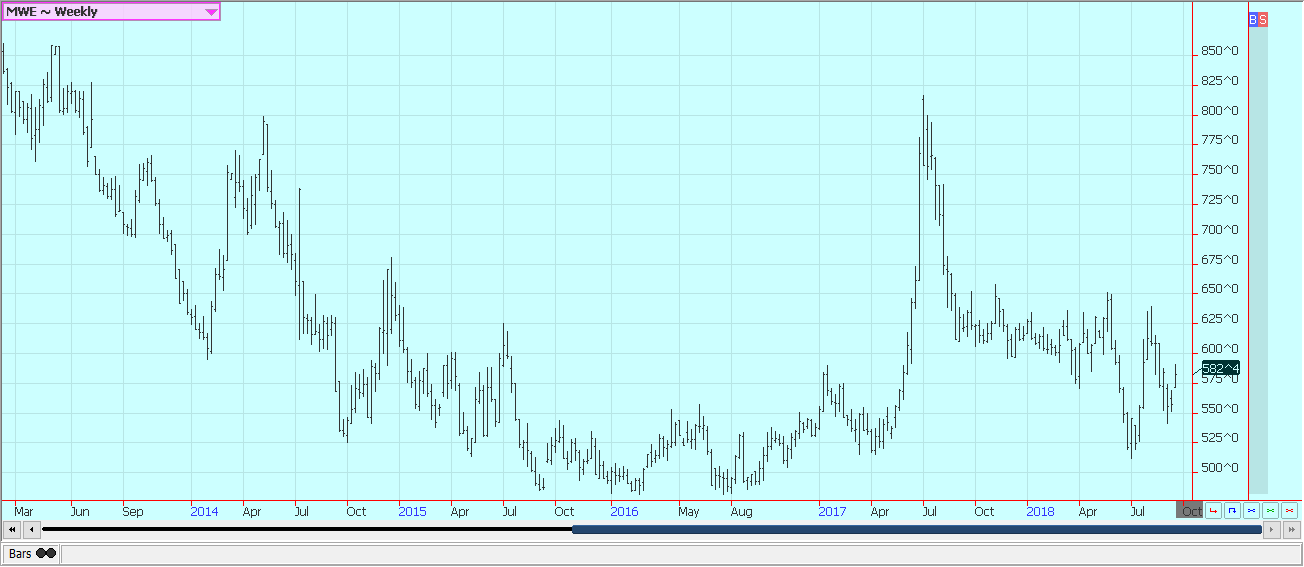

Wheat

Wheat markets were higher as September went off the board and December assumed front-month status. Indications that the Russian government might finally be making moves to make exports more difficult remain a part of the market, but the trade wants to see a significant increase in the volumes of export sales before pushing U.S. prices much higher.

The charts still show down trends on the daily charts, but the weekly charts show reversal formations due to the change in months and the expiration of September futures. The market keeps its focus primarily on Russia and the prices it sells wheat into the world market, and especially to Egypt. Russian wheat exports have been very strong so far this year despite perceptions of a small crop.

Meanwhile, U.S. export sales continue at an average pace and will need to increase to create some speculative buying enthusiasm. The weather in the U.S. is improved for planting the next winter wheat crop as much of the Great Plains has seen rains in the last couple of weeks. The U.S. and Canadian spring wheat harvests are moving forward, and the trade expects a smaller crop this year due to stressful growing conditions during the summer.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

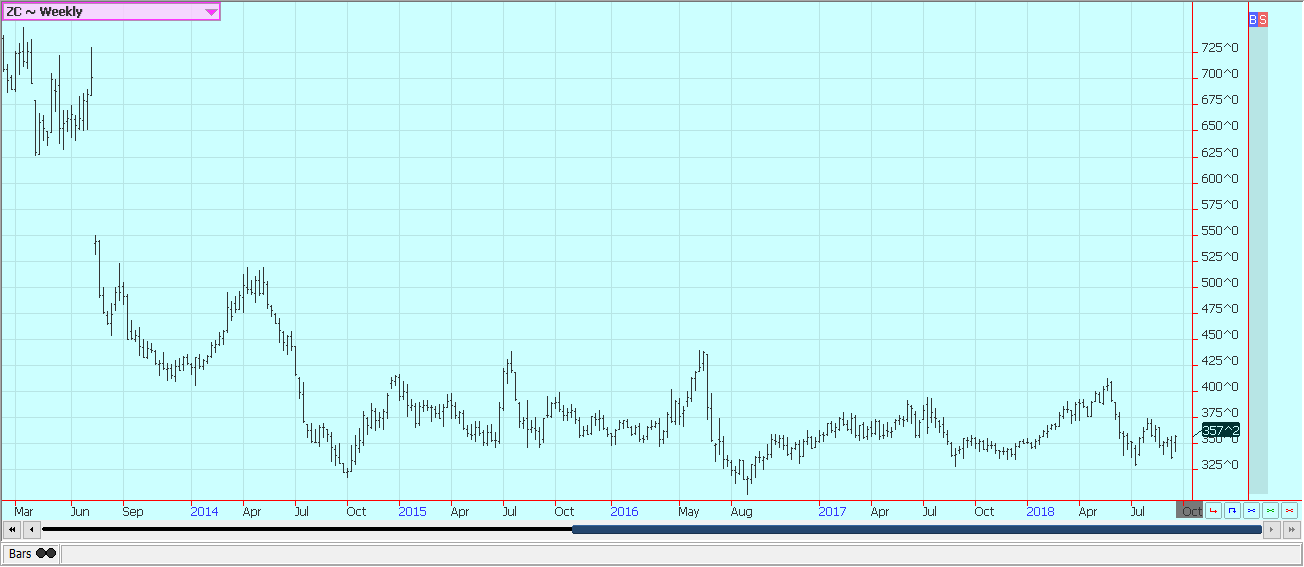

Corn

Corn was higher for the week as the trade questioned the USDA production estimates and as demand remained very strong for U.S. corn in world markets. USDA surprised the market on Wednesday when it increased production and ending stocks estimates.

The trade is already questioning some of the yield projections made by USDA as the state comparisons show a sharp increase in productivity in the eastern corn belt and increased productivity in the west. The trade continues to monitor reports from the field and will adjust their ideas according to that data and how it relates to the USDA projections.

The reports so far indicate a very good crop, but the big increases in yields projected by USDA have been met with variable reports from the field. The Midwest could feature variable, but somewhat disappointing yields once the harvest gets more active.

Rainfall patterns have been very tropical this year, and have featured excessive rains in some areas and dry weather in others. It has been a warm summer as average temperatures have generally been a few degrees above long-term averages. The warm temperatures have kept plants active and have pushed maturity forward by up to two weeks or so. This usually means less yield at harvest and is the opposite of last year, when cool weather allowed the corn to mature slowly and add test weight and yield to the plants.

U.S. corn export sales remain very strong and were over 1.0 million tons again last week. Mexico has remained in the market and remains the largest buyer of U.S. corn in the world market.

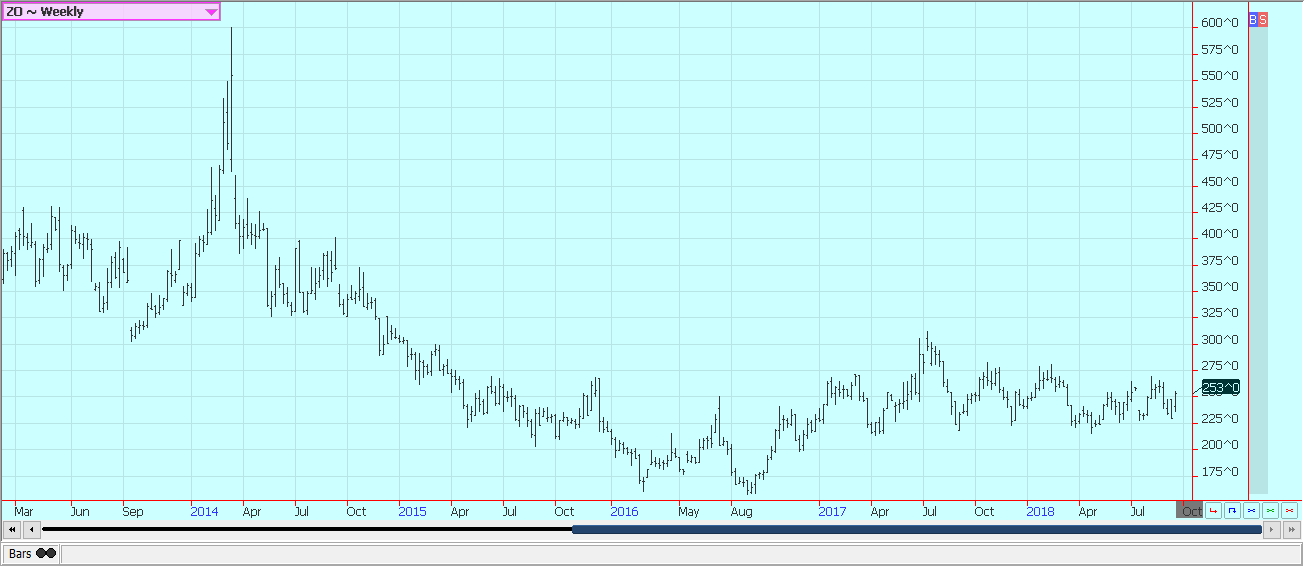

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

Soybeans and soybean meal

Soybeans were higher last week while soybean meal was lower. There is a big crop coming, but perhaps not as big as feared by the trade, and a relief rally was seen on Wednesday after the report was released.

The trade war with the Chinese continues, but other importers have been buying in the U.S. in a big way as U.S. prices are very cheap. They are cheaper than South American prices even with the 25 percent tariffs. The big loser in all of this is the U.S. farmer, who is getting far less for his soybeans than any other producer in the world. USDA has announced supports, but the supports will cover only a part of the losses.

China reportedly bought from Argentina last week and has reportedly bought from Canada recently. Those countries might have turned back to the U.S. to cover supplies needed internally. And, China will most likely look for as many other sources for soybeans in the short term and long term as possible, even though they will still need to buy some soybeans here. They will buy as little as possible here while the ramp up efforts in places like Africa to develop agriculture to feed their people. The U.S. farmer is the big loser in the Trump trade wars, and could be a loser in the battles for both the short and the long term, as supplies should be very high and prices will remain very low.

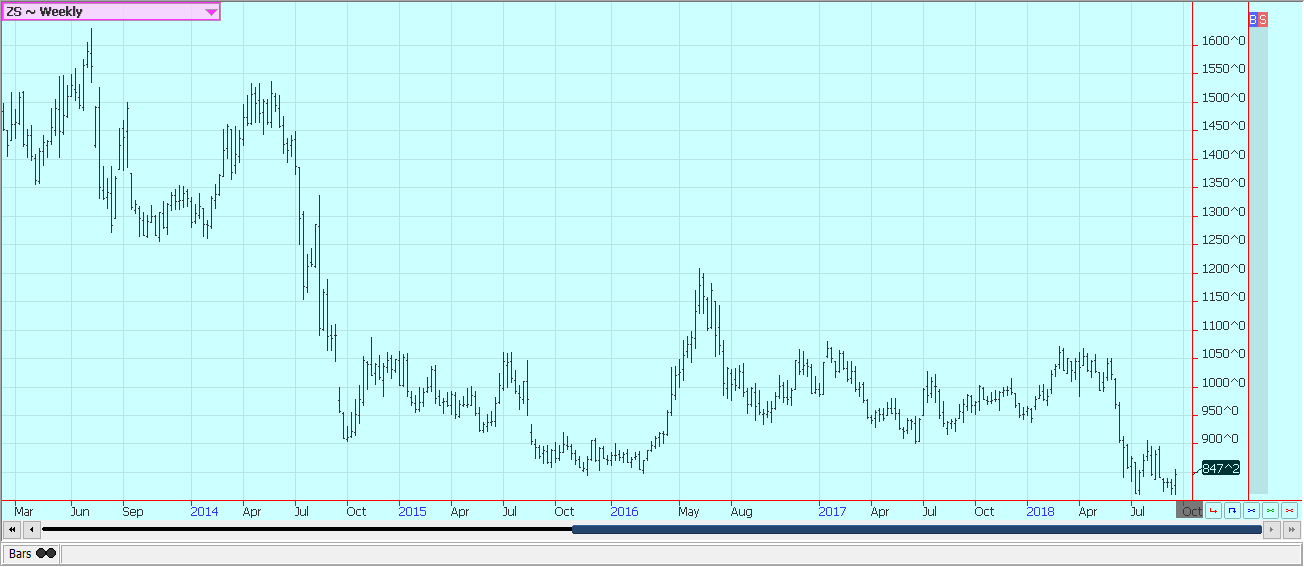

Weekly Chicago Soybeans Futures © Jack Scoville

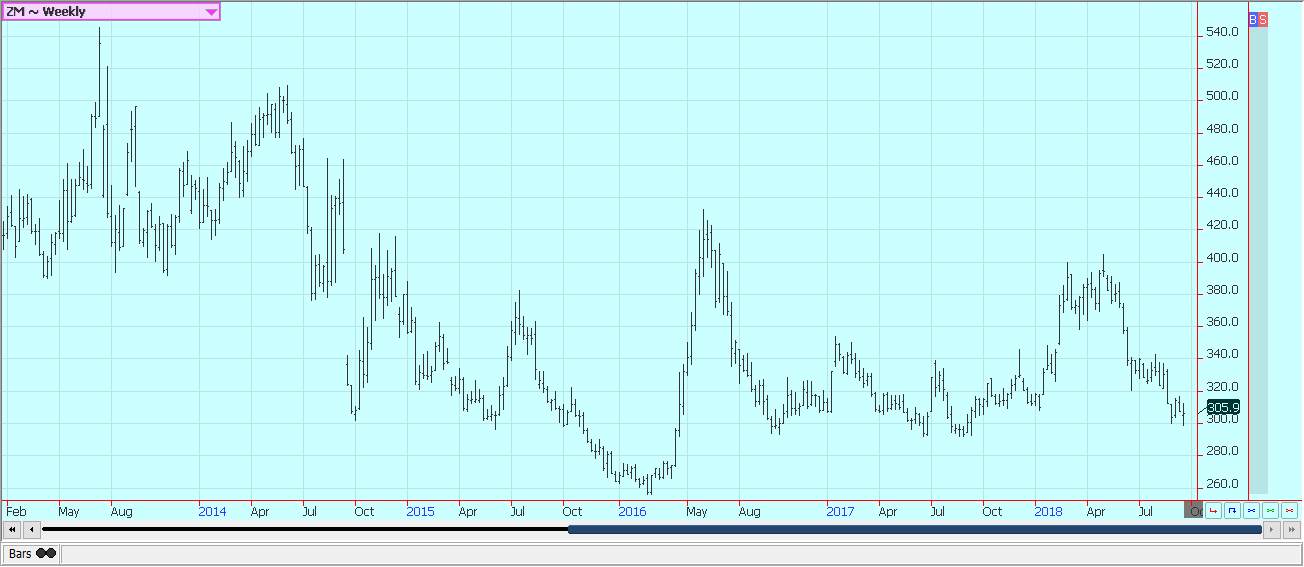

Weekly Chicago Soybean Meal Futures © Jack Scoville

Rice

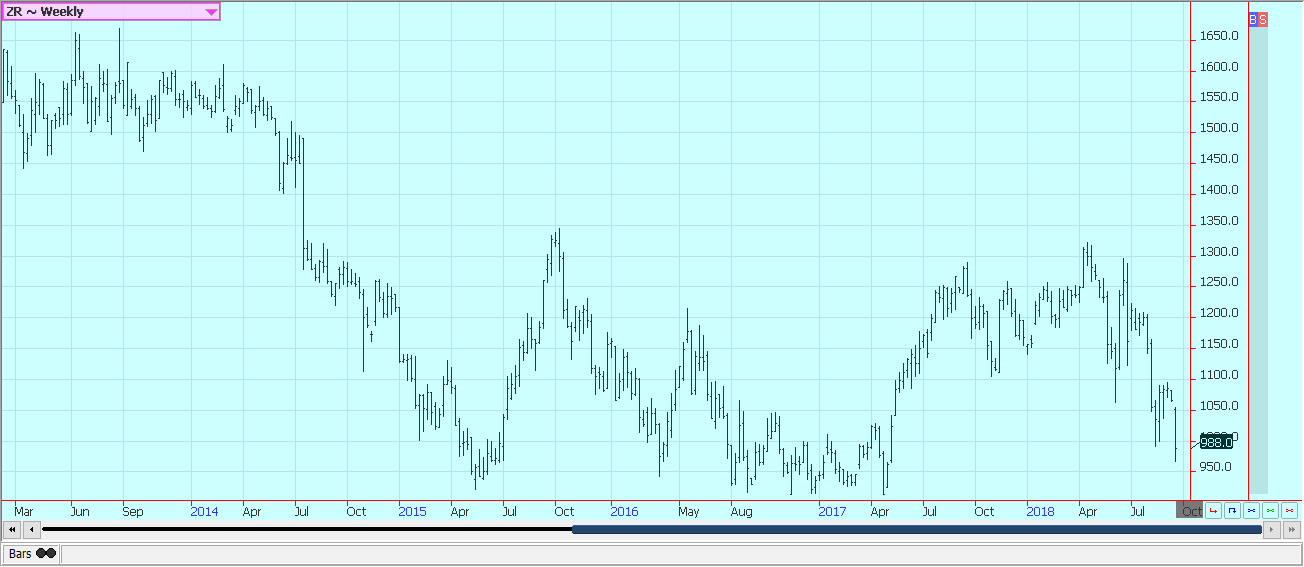

Rice was lower as the harvest moved past the halfway point. Good to excellent yields have been reported in Texas and Louisiana so far, and the first crop harvest is about done in these areas. Cash prices are slightly weaker as mills and elevators fill up, but have held well considering the weakness in futures. Ideas are that they have bought enough rice to cover commitments at this time. Most or all storage facilities in Texas are full, so farmers will have to store whatever is still left. Milling yields have been acceptable or mostly very good. The harvest is active this week in Mississippi and to the north into Arkansas. The quality should remain strong overall.

Weekly Chicago Rice Futures © Jack Scoville

Palm oil and vegetable oils

World vegetable oils prices were mostly lower last week. Palm oil was lower on the week as traders reacted to the strong export estimates for the first 20 days in September from the private sources. However, the MPOB monthly export data was poor and bearish for the market. MPOB showed much less demand than anticipated, and production was higher as anticipated.

Ending stocks for the month were much higher than anticipated, and the market sold off in response to the news. Ideas are that September data will show much bigger production as well. Soybean oil closed lower. Trends are now down in the market, and prices could work lower as soybeans stay weaker.

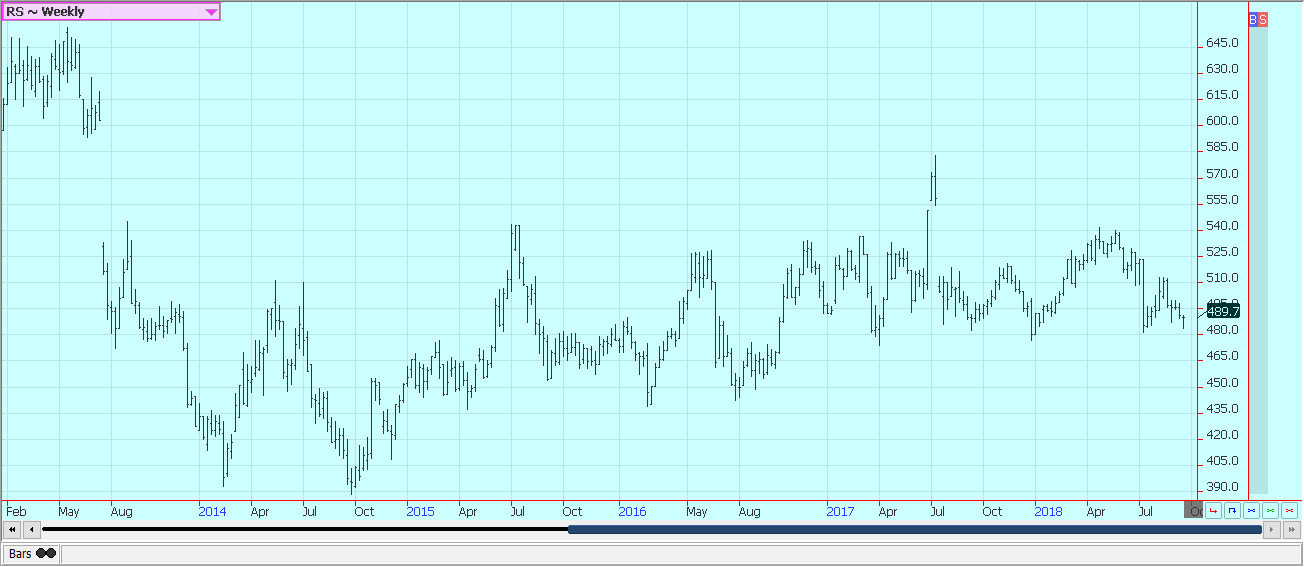

Demand for biofuels has been strong, but export sales were nonexistent last week. Canola was lower as the harvest is getting started. Early reports indicate variable and somewhat disappointing yields in the south, but better than expected yields in the north. Ideas are that the recent StatsCan estimates could be too low. Yields have been coming in generally above trade expectations.

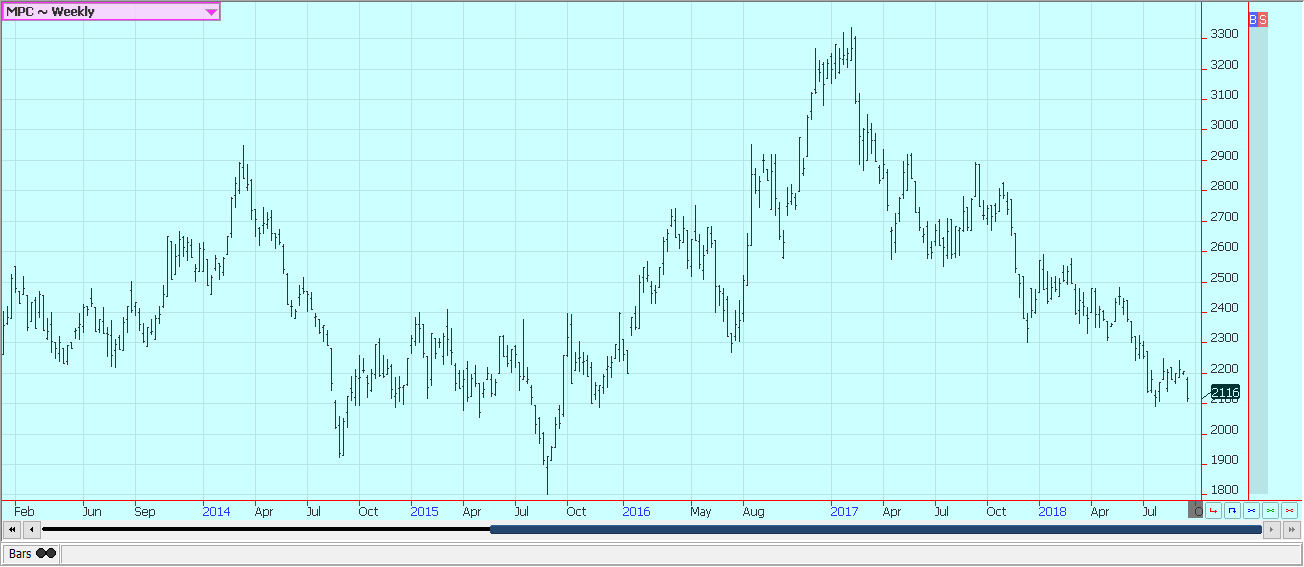

Weekly Malaysian Palm Oil Futures © Jack Scoville

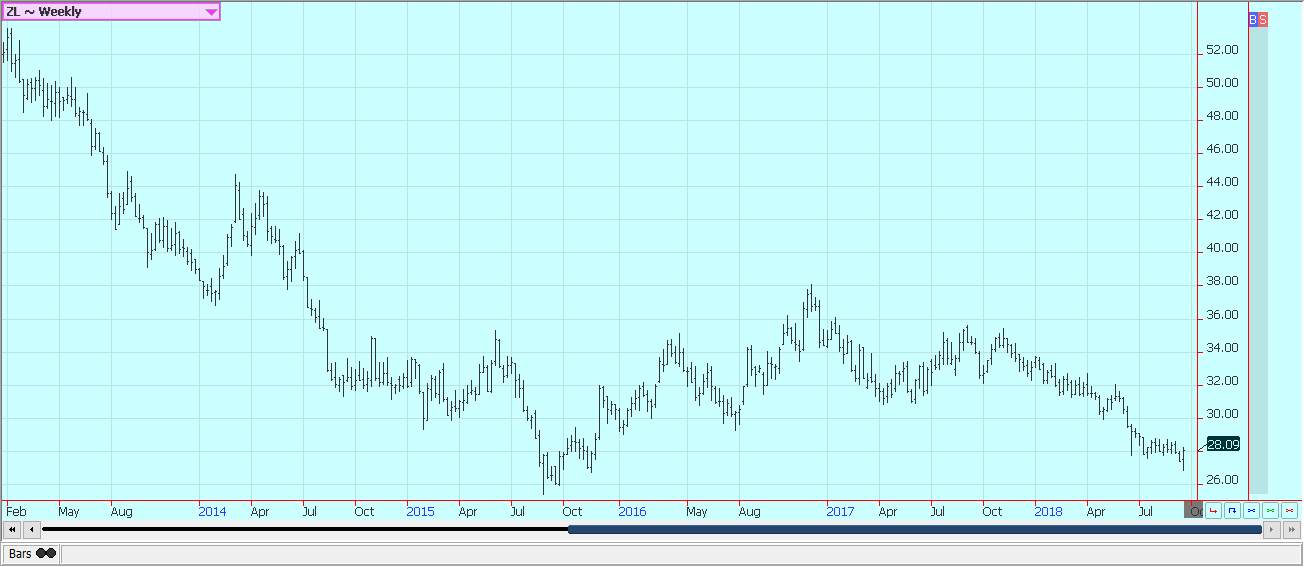

Weekly Chicago Soybean Oil Futures © Jack Scoville

Weekly Canola Futures © Jack Scoville

Cotton

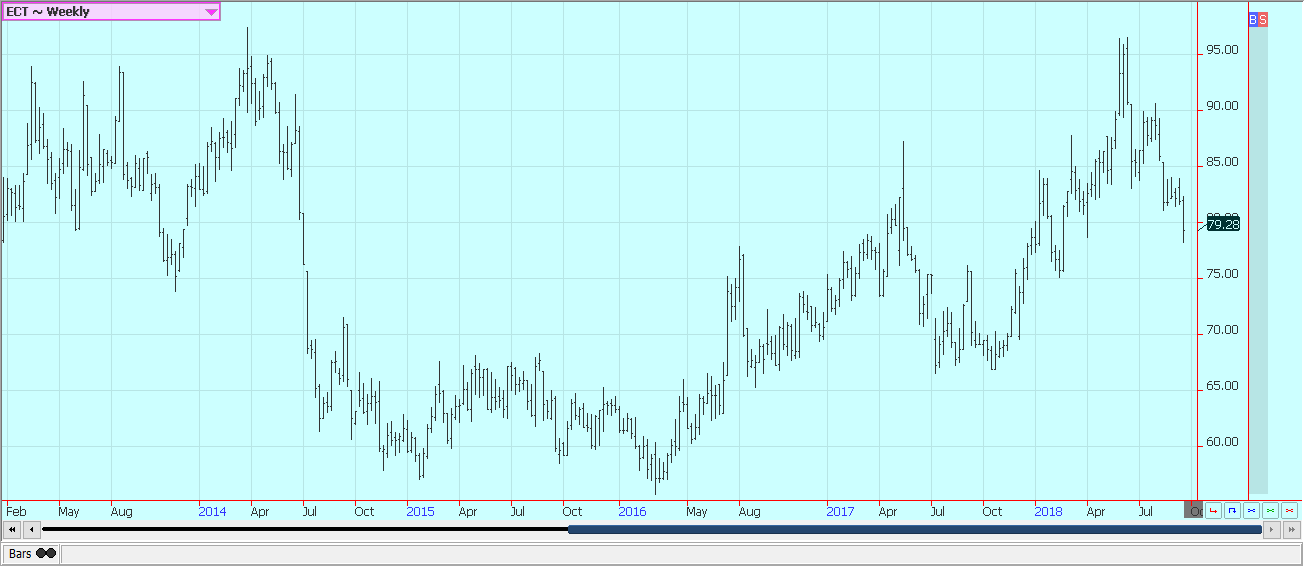

Cotton was lower after Hurricane Florence left the U.S. and no other storms are threatening the US. The storm has caused significant damage and losses to crops from Virginia to Georgia, but mostly in the Carolinas. U.S. weather remains good in the Delta and Southeast away from hurricane areas and has improved slightly in West Texas on north into Kansas with improved precipitation.

Even so, the crop is generally in poor condition in much of Texas and there are real questions on just how good the yield can be in the state this year. Eastern Texas crops are in good condition and about ready for harvest, but southern areas did not have good yields. Bolls are opening in the Delta and Southeast. Rains from the Indian monsoon have been below normal, but generally good enough to support crops.

The trade there remains optimistic that a good crop is coming and that they will not need to import very much Cotton this year. China has been active in India buying and will buy as much as possible there to make up for production losses inside of China. Conditions have also improved in Pakistan as rains have been reported.

Weekly U.S. Cotton Futures © Jack Scoville

Frozen concentrated orange juice and citrus

FCOJ was lower last week. The summer has been a quiet one in the Atlantic. Chart trends are mixed as the market has found some support from speculators due to the recent increase in storm activity, but it looks like some of them liquidated these positions last week.

Overall growing conditions in Florida are good to very good, and there is no storm development in the Atlantic at this time. The state is getting frequent periods of showers. Florida producers are seeing good sized fruit, and work in groves maintenance is active. Irrigation is being used when needed, and producers expect a good crop. A good crop now will likely mean increasing inventories of frozen concentrate.

Weaker demand has caused FCOJ inventories in Florida to increase on a year to year basis. USDA released production data for the previous crop. Florida Oranges production was left unchanged at 45 million boxes and total U.S. production was estimated at 92 million boxes, from 90 million estimated in June. Florida FCOJ inventories are now 253 million gallons, up 42 percent from last year.

Weekly FCOJ Futures © Jack Scoville

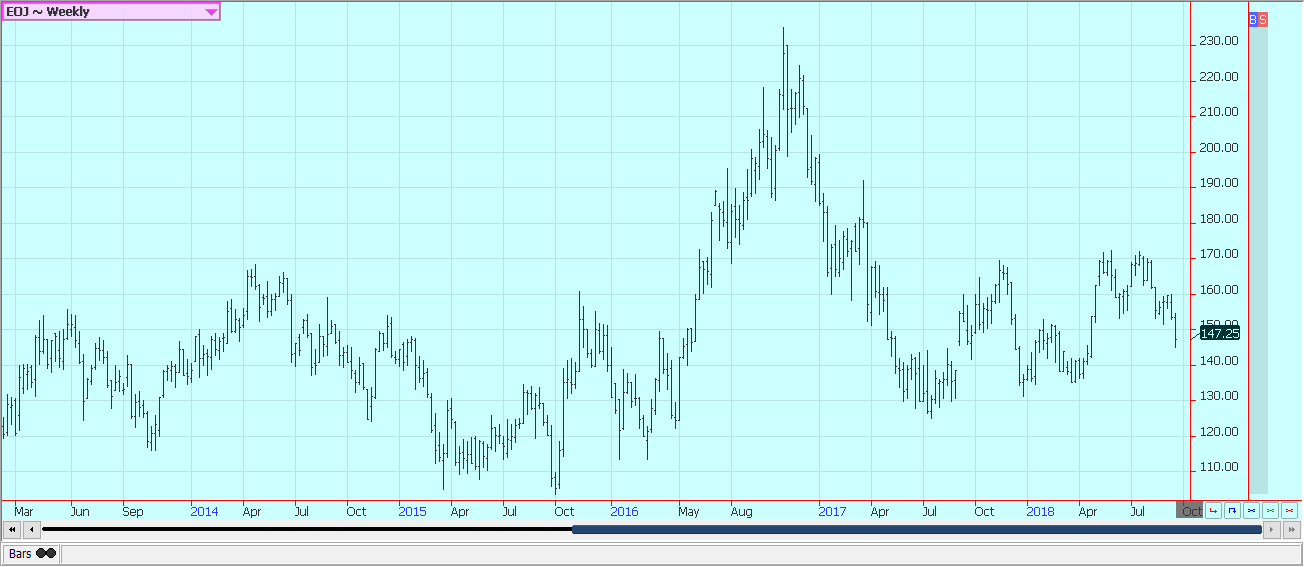

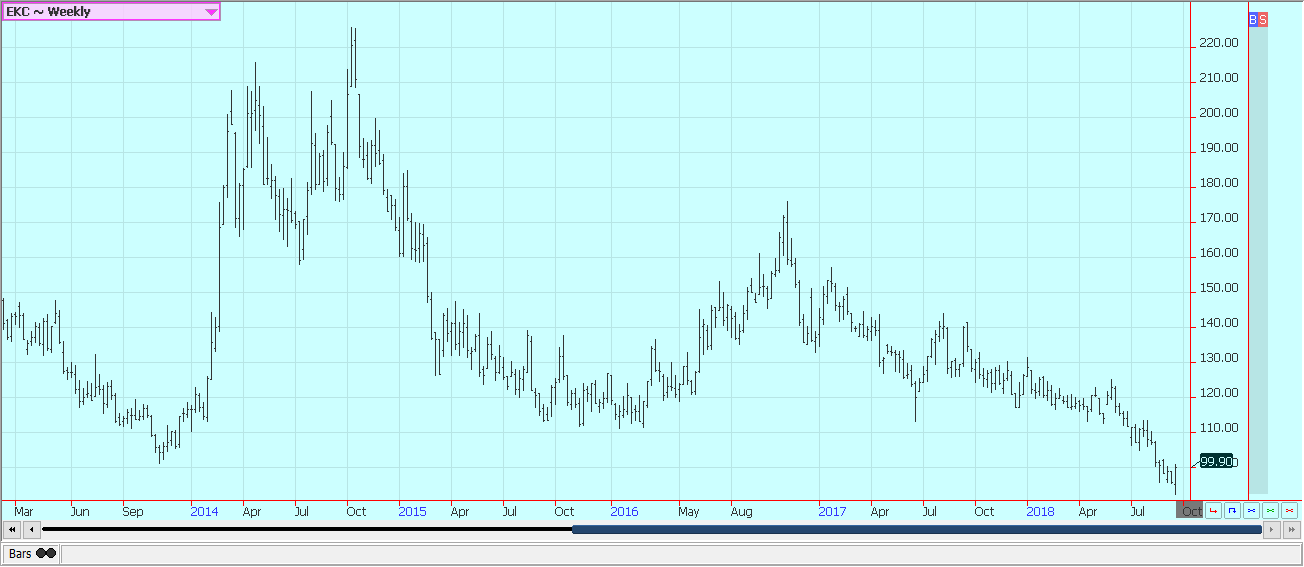

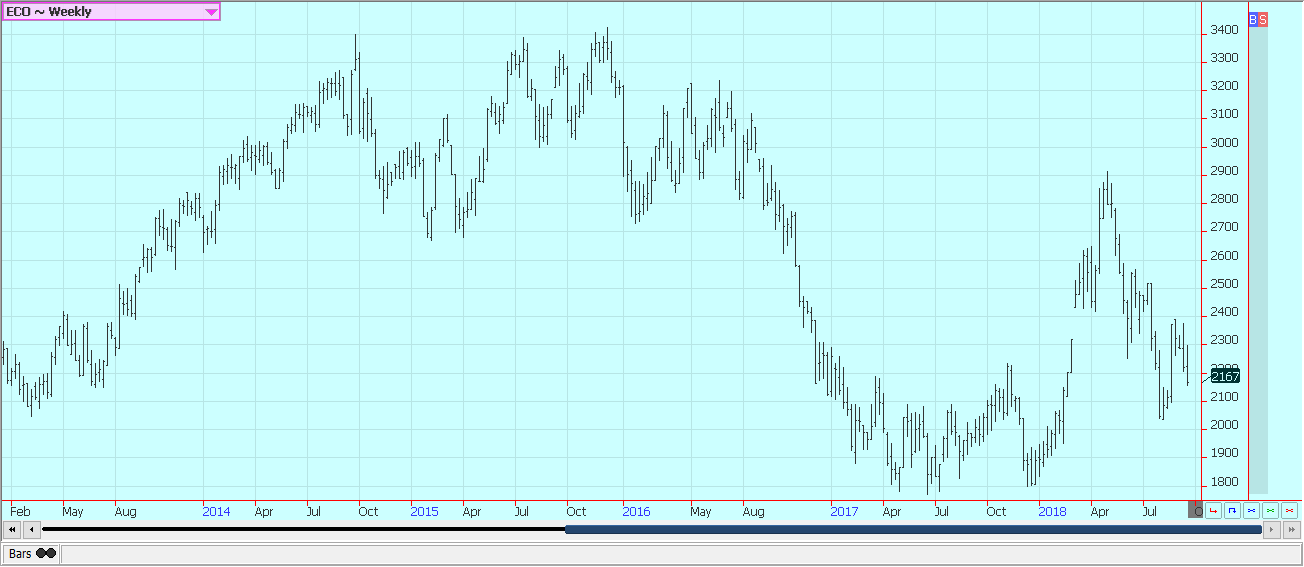

Coffee

Futures were lower last week in New York but near unchanged in London. Ideas of strong production in Brazil and Vietnam are keeping futures under selling pressure. Speculators have been looking at the weakness of the Brazilian Real against the U.S. Dollar and have been selling Coffee on ideas of increased offers in Brazil.

Vietnam is getting close to its next harvest, and ideas are that producers there need to sell more of the previous crop to create new storage space. Producers in both countries are not selling, although there is talk of some big sales in Brazil. But, the market is generally quiet there due to the after-effects of the truckers strike.

Arabica trees in Brazil were starting to show stress due to the lack of rain over the last few months. It will be dry again for the rest of the week. The months leading up to the winter were also dry, and that early dryness is affecting trees now. It is very possible that some production could be lost for the next crop due to the very dry overall conditions. Estimates for production this year range as high as 60 million bags.

Most of Central America is reporting good rains, so the overall losses could be minimal. Production in Vietnam is estimated at above 30 million bags and a new record. Growing conditions are called good.

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

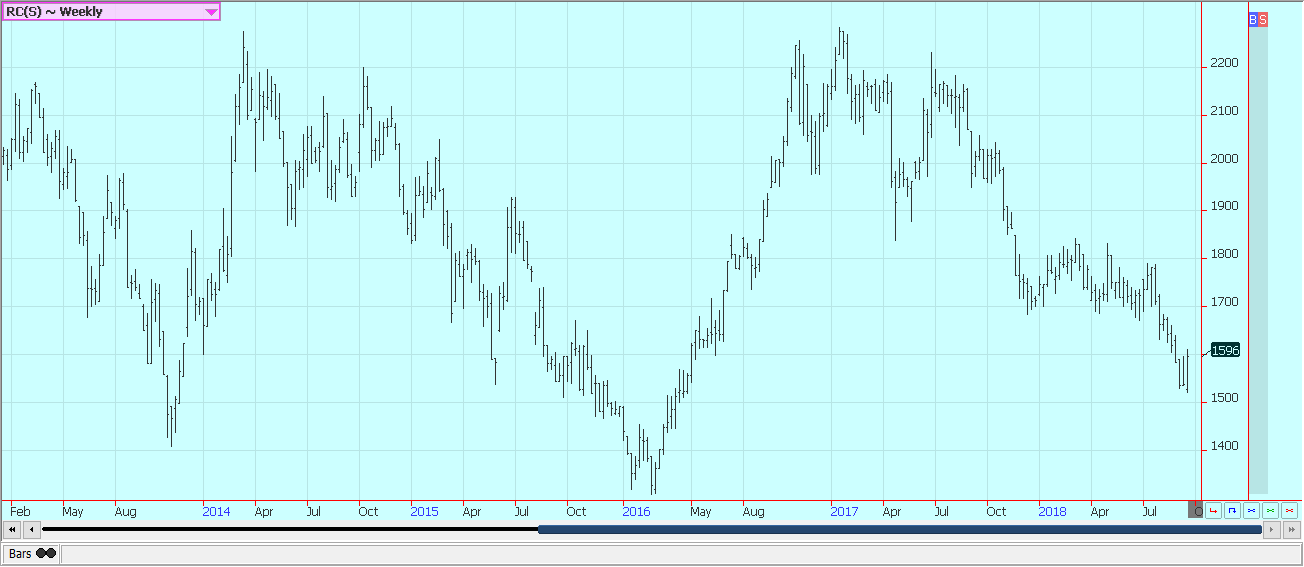

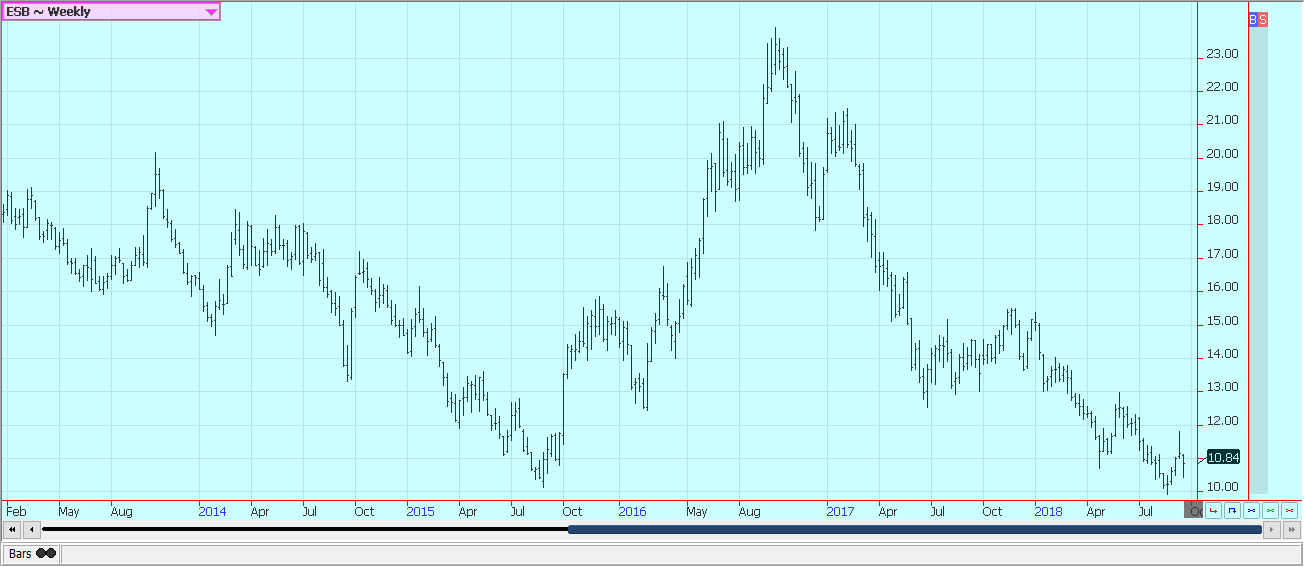

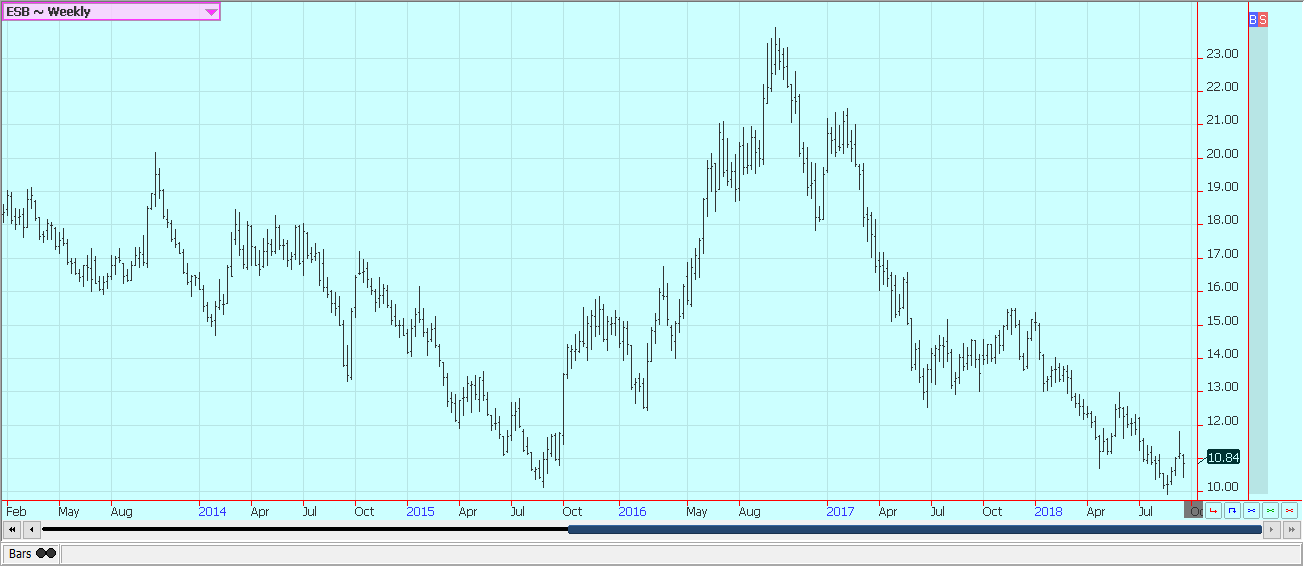

Sugar

New York was lower and London was near unchanged last week. New York price action overall is stronger, but both markets saw some big selling on Friday on reports of some very timely showers in Brazil growing areas. Ideas of big world production are bearish and have been the reason for the selling. Just about everyone is looking for a significant production well above any demand potential.

Dry conditions continue in Brazil, the EU, and Russia, but conditions are mostly good in Ukraine. Very good conditions are reported in Thailand and India. Brazil producers are worried about Cane production even with the rapid early harvest, and the market is now starting to talk about less production there this year. The dry weather in much of Europe and in southern Russia near the Black Sea has hurt Sugarbeets production potential in these areas. Recent rains in parts of Ukraine have continued to improve production prospects there.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

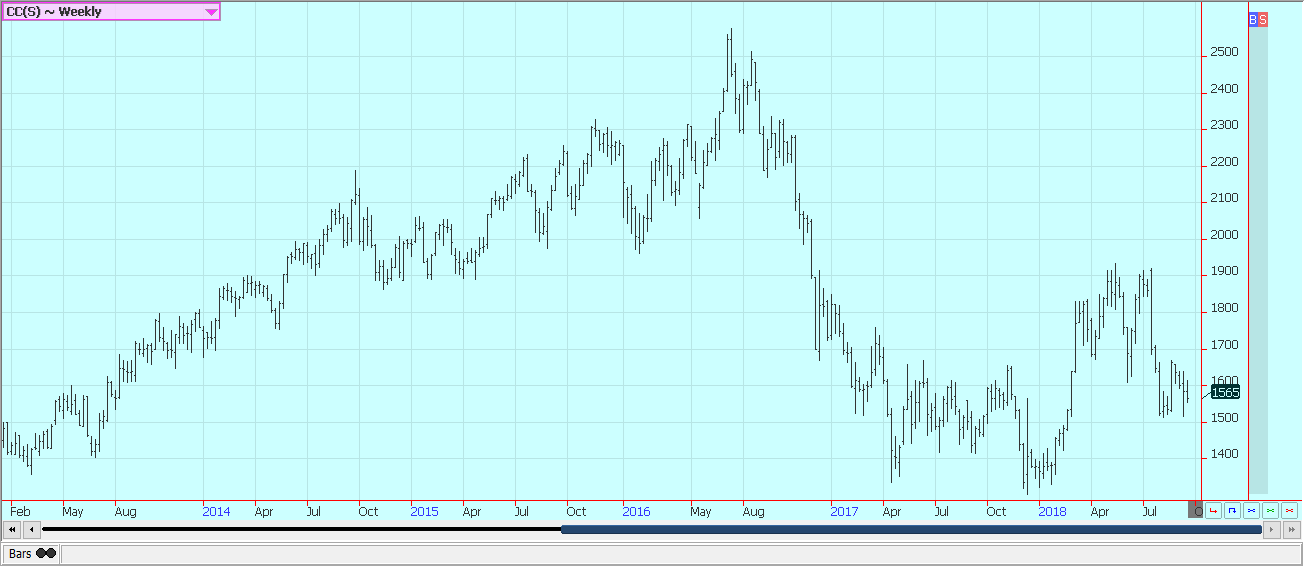

Cocoa

Futures closed lower for the week. The outlook for strong production in the coming year has been enough to keep the prices weak. The main crop harvest is in its earliest stages in some parts of West Africa, but will not really get going for at least another few weeks.

Main crop production ideas for Ivory Coast are high. Ghana and Nigeria are expecting very good crops this year as well, although Nigerian estimates have started to drop a little bit on the volume of rains that have hit the country in recent weeks. Conditions also appear good in East Africa and Asia.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Crowdfunding1 week ago

Crowdfunding1 week agoBSG Stahl Riesa Launches Crowdfunding for New Floodlights

-

Cannabis6 days ago

Cannabis6 days agoSnoop Dogg Searches for the Lost “Orange” Cannabis Strain After Launching Treats to Eat

-

Crypto2 weeks ago

Crypto2 weeks agoIntesa Sanpaolo Signals Institutional Shift With Major Bitcoin ETF Investments

-

Cannabis19 hours ago

Cannabis19 hours agoBrewDog Sale Leaves Thousands of Crowdfunding Investors Empty-Handed

You must be logged in to post a comment Login