Business

Coffee market improves on behalf of cocoa and sugar

India is determined not to import sugar this year even though domestic production is short and internal prices are very high.

Weekly agriculture: China has imported significantly less sugar as it continues to liquidate supplies in government storage by selling them into the local cash market.

Wheat:

US markets were mixed last week, with Soft Red Winter a little higher and the other classes a little lower. Hard Red Winter Wheat was the weakest market as some very beneficial rains were reported in the Great Plains. More are expected this week. The planting intentions report released by USDA on Friday showed less potential planted area than had been expected by analysts. Durum planted area was estimated at 2.0 million acres and Other Spring Wheat area was estimated at 11.3 million acres. The trade had expected farmers to indicate 2.1 million acres of Durum and 11.3 million acres of Other Spring Wheat. The quarterly stocks estimate was above trade expectations at 1.655 billion bushels, but the difference between the actual estimate ant the average of the trade was minor as the trade had estimated stocks near 1.627 billion bushels. There was nothing really bearish about the trade estimates so the market will go back to watching the weather in the Great Plains and world prices. The weather has improved in the Great Plains and there are hopes for better crop prospects. USDA will issue its first crop conditions reports on Monday afternoon and the reports should reflect the generally worse than normal conditions for crops in the Great Plains as had been indicated in the individual state reports in the last couple of weeks. The improved rains last week might have reporters note the better conditions in the national reports on Monday. Wheat traders continue to monitor conditions in the Black Sea. Prices there have been relatively strong and could remain elevated if the Ruble does not start to work lower soon against the US Dollar. That might be hard as US Dollar Index futures chart patterns suggest weaker days are coming for the Dollar. US Wheat should remain in competitive positions in world markets.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

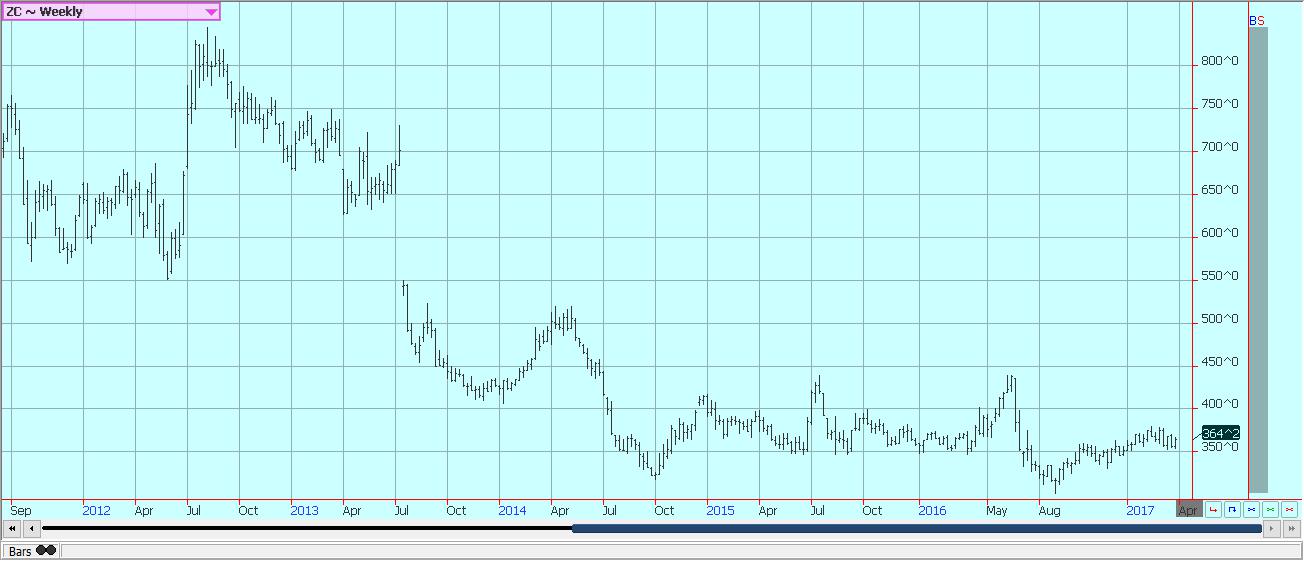

Corn:

Corn was higher for the week, with much of the rally coming in reaction to the USDA reports. USDA showed higher than expected quarterly stocks at 8.616 billion bushels, but the market reacted to the planting intentions report that showed less Corn area than expected. USDA said that planting intentions are for 89.996 million acres against an average trade guess of 90.969 million and 94 million planted last year. In fact, farmers plan to plant just about 500,000 acres more of Corn this year than Soybeans in the US. That is a big change that has been happening for years as Soybeans and its better demand profile challenge King Corn for area supremacy in the Midwest. The reduced area could help change the dynamic of the Corn market, especially if there are any weather problems this year as production ideas will start to drop. The biggest reductions in planted area came in the Midwest and the states that normally produce the highest yields. That fact and a normal growing season this year instead of the extra long year seen last year should produce sharply reduced national yield estimates for this year. The market will pivot to weather and demand now. The weather in the Midwest remains wet and cold. The demand remains solid.

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

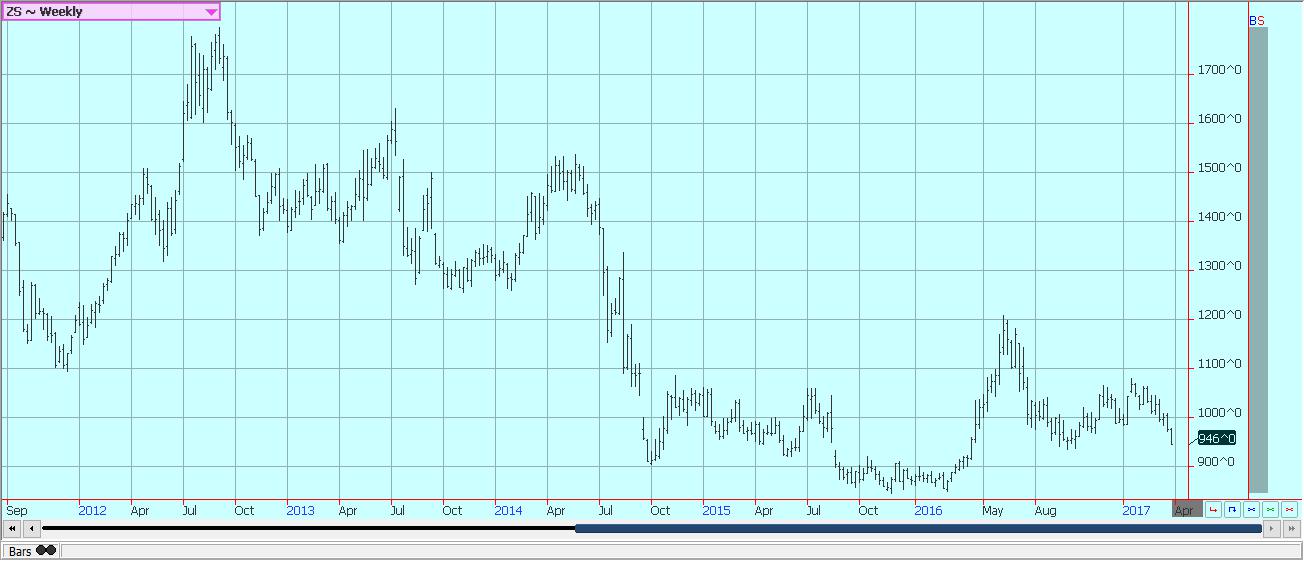

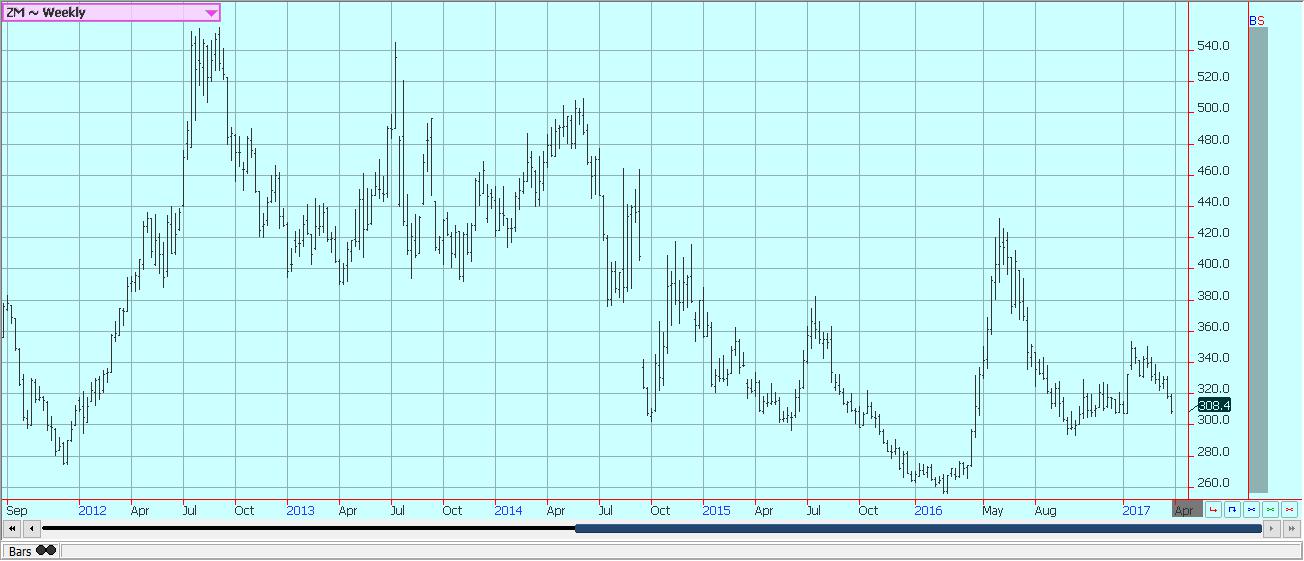

Soybeans and soybean meal:

Soybeans and Soybean Meal were lower last week in part in response to the USDA reports released on Friday. The quarterly stocks report showed higher than expected supplies at 1.735 billion bushels. The trade had expected stocks closer to 1.684 billion bushels based on Census Bureau and NOPA crush data and also on export data from USDA and the Census Bureau. This data is relatively specific and accurate, so the implication is that the crop last year was slightly underestimated by USDA. The Plantings Intentions report caught the attention. Farmers intend to plant Soybeans on 89.482 million acres, well above trade estimates of 88.214 million acres, but lower than the 83.433 million acres planted last year. It implies that production potential this year is very strong, especially since the biggest increases were in the states with the highest yield potential. South America is in the market, and offers from both Argentina and Brazil fell below US levels last week. US sales are less than seen several months ago, but have held together well until now. The harvest is moving ahead with speed. The country is now closing in on the end of the harvest and should be done in the next couple of weeks. Production ideas are very high with many in the trade anticipating production up to and now above 109 million tons in Brazil. Argentina is also harvesting, and production ideas there are strong and are getting stronger. The weekly charts show that futures are moving close to some important support areas. Weaker markets overall are still anticipated for the Soy complex due to the potential large offer from South America and the potential for very strong production this Summer here in the US.

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

Rice:

Futures closed higher, but basically remained in the trading range established the previous week. The market closed on a firm note on Friday in response to the USDA reports. The stocks report showed ample supplies, but the plantings report showed less potential area for Rice than the market had expected. Planted area could reach just 2.636 million acres against the average trade estimate of 2.843 million acres. The report shows a chance for significantly less production this year even if Rice areas experience good conditions. The big reduction in area came in Long Grain and Medium and Short Grain showed little change from last year. It is a direct reflection of the market conditions until now. These intentions are not likely to change much as the market remains generally weak. There is a chance that Medium Grain area will be less than indicated this year due to all the precipitation that California has seen this year. It will all depend on the Spring floods in the Sacramento River Valley. It is a situation that is being closely watched by the market. World market conditions seem to be generally quiet and steady right now. Asian markets were quiet and showed steady to firm prices for the week.

Weekly Chicago Rice Futures © Jack Scoville

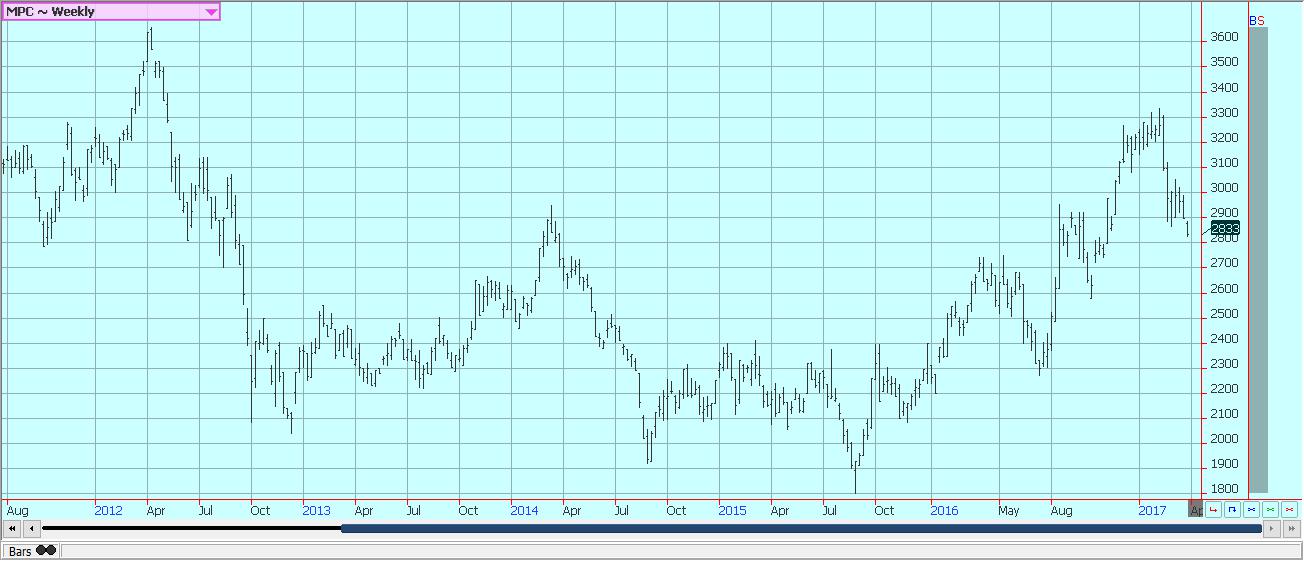

Palm oil and vegetable oils:

World vegetable oils markets were lower again last week. Ideas that world production was about to increase and that demand was suffering were the primary factors in the selling. Palm Oil export demand for March recovered to increase against February exports. However, March was also a longer month, so the average daily exports were actually slightly less on a month to month basis. Next up for the market will be the MPOB and USDA data in a week and a half. World vegetable oils markets got little cheer from the USDA reports on Friday as the reports indicated bigger than expected supplies of Soybeans now and the potential for a big crop again this year. Palm Oil production is likely to increase in the short term as trees start to produce more as they recover from the El Nino drought of last year. There are some anecdotal reports that the production in Malaysia is not recovering at as fast a rate as the market had anticipated. However, demand has not been real strong, either. Ideas are that inventories are increasing. The Indonesia Palm Oil authority showed bigger stocks in a report it issued a couple of weeks ago, and MPOB might do the same next week. South America is now in the selling mix. Argentina is the world’s largest seller of Soybean Oil and will be strong competition in the world market. Brazil is also a big seller.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures © Jack Scoville

Weekly Canola Futures © Jack Scoville

Cotton:

Futures closed slightly lower last week, but made a hook reversal on the daily charts on Friday in the face of higher than forecast planted area intentions. USDA said farmers intend to plant Cotton on 12.233 million acres against trade guesses of 11.409 million. Farmers planted 10.075 million acres last year. The market reaction suggests that ideas about plated area potential had crept higher in the last week. The action on Friday also suggests that additional buying is possible early this week. The week also featured another strong export sales report from USDA. Cotton remains mostly a demand story as US export demand has been stronger than any trade expectations so far this year. USDA has been forced in its monthly updates to increase export demand estimates at the expense of ending stocks and might be forced to do it again this month. US producers appear ready to meet the demand with increased production, but they might not be alone as growing conditions could also improve this year in countries like India, where weather was not optimal and the monsoon was erratic. Ideas that US buyers have a large amount of Cotton bought remain the other reason for futures to trend higher. These buyers will need to buy futures sooner or later to fix prices. The key time for them to get covered will be near the start of the delivery periods for the May and July Contracts. Prices can hold strong until then, with many now looking for a push to perhaps 8300 May.

Weekly US Cotton Futures © Jack Scoville

Frozen concentrated orange juice and citrus:

FCOJ collapsed and pushed to new lows for the move and new lows for the last several months. It was a complete reversal of trade from the last couple of weeks. It now appears that the market can continue to move lower now for the next few weeks until buying interest surfaces before the hurricane season that starts in June. The market remains in a bullish supply market mode, with less and less domestic demand hurting any upside potential. Domestic production remains very low due to the greening disease and drought. Florida remains very dry. Trees are in bloom in all areas of the state, and petals are starting to drop in some areas as fruit is forming. Good rains are needed for the bloom and initial fruit development. Irrigation is being heavily used to prevent loss. The harvest has been very active. Early and Mid Oranges are moving mostly to processors. The Valencia harvest is moving to processors and into the fresh market. Major freezes in southern Europe this Winter have damaged the citrus production. Ideas are that losses are extensive, but no one has quantified total losses yet. Brazil crops remain in mostly good condition. Brazil imports have arrived and have provided some space for juice producers that was needed due to the reduced Florida production this year.

Weekly FCOJ Futures © Jack Scoville

Coffee:

Futures were higher after making new lows for the move. Futures remain in a trading range at this time and appear to be trying to turn trends back up again. It needs a story to trigger the buying interest, and right now the cash market is not really providing one. Offers remain in the cash market, and differentials are stable to weak. Buyers have turned quiet and appear ready to use already contracted supplies. There is business in specific qualities at specific times. New York has featured buying support from commercials as they fix prices for differentials purchases. Speculators have been the best sellers. Overall traded volumes have been light to moderate, but underlying interest has been strong, especially from the sell side of the market. London is trading sideways as supplies available to the market remain tight. Offers are less and seen at high prices from Robusta countries such as Vietnam, and has been a short crop there as well due to dry weather at flowering time. Indonesia is also very low on supplies.

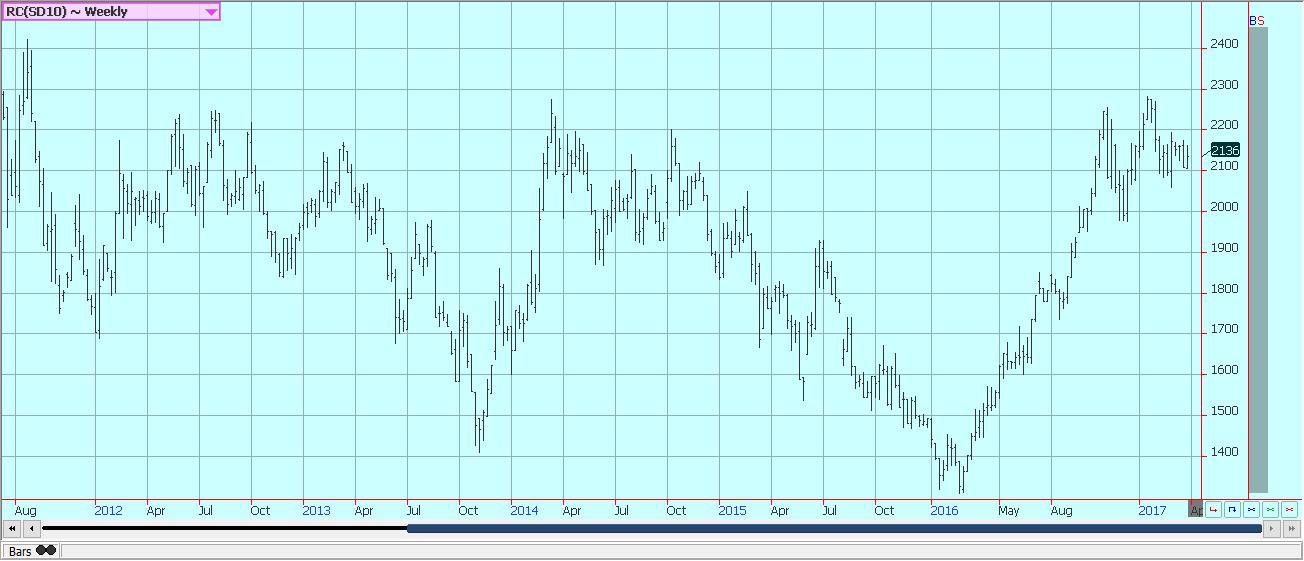

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

Sugar:

Futures closed lower for the week and made new lows for the move. The fundamentals appear to be changing from a tight situation to one with more available to the market. Production conditions have been better this year in Brazil, and a better harvest is anticipated in the next couple of months. However, the situation remains one of less production in Brazil at this time. Production is also less in India and Thailand. The year to date crush is now 599.2 million tons of Sugarcane, down 0.7% from last year, with Sugar production at 35.4 million tons, up 15%, and ethanol production at 25.3 million tons, down 8% from last year. India is determined not to import Sugar this year even though domestic production is short and internal prices are very high. India had lower production last year due to the uneven monsoon rains. China has imported significantly less Sugar as it continues to liquidate supplies in government storage by selling them into the local cash market. Demand from North Africa and the Middle East is consistent. The weather in Latin American countries away from Brazil appears to be mostly good, although northeast Brazil remain too dry. Center South areas have had plenty of rain. Most of Southeast Asia has had good rains.

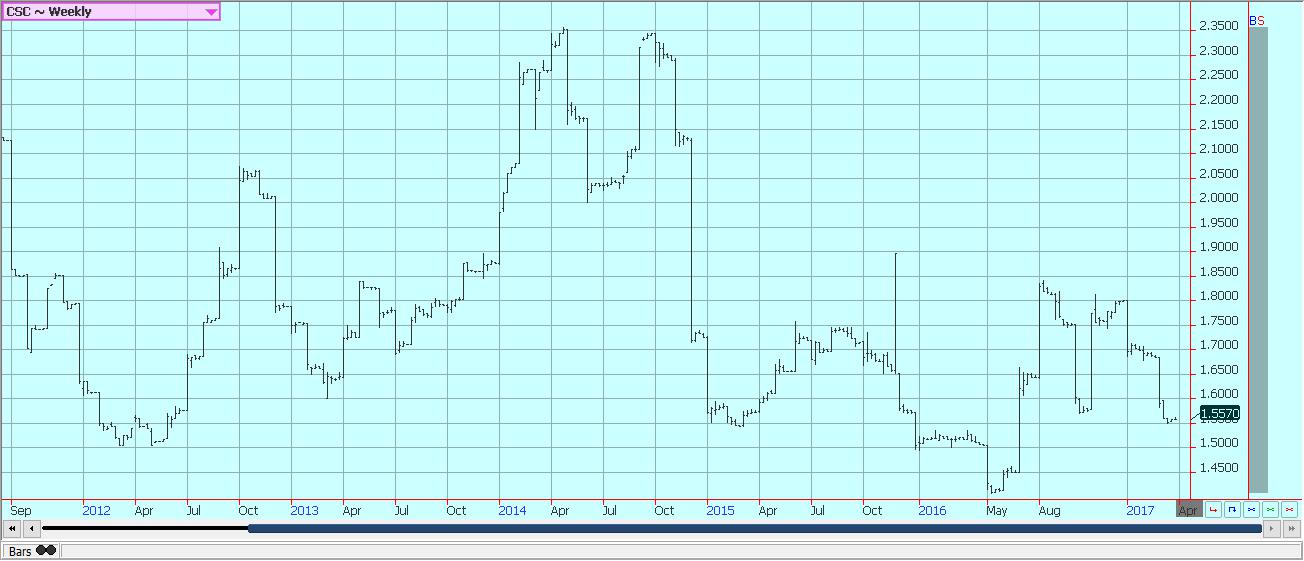

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

Cocoa:

Futures markets were lower last week as the market faded from resistance at about 3100 May New York futures. The weekly charts imply that a low has been found but prices need to move through this resistance area soon to confirm an uptrend is intact. The main crop harvest continues in West Africa under good weather conditions. However, there are reports that suggest that the quality of the remaining main crop is not good and that much of the Cocoa delivered recently is not of exportable quality. Overall world production is expected by the ICCO to be strong and above demand. The ICCO now anticipates that production could be above demand for several years and that prices could remain generally weak for an extended period. The demand from Europe is reported weak over all, and the North American demand has been weaker than anticipated. Supplies in storage in Europe are reported to be very high. The next production cycle still appears to be big as the growing conditions around the world are generally very good. West Africa has seen much better rains this year and now getting warm and dry weather. Growing conditions are good. East African conditions are now called good. Good conditions are still being reported in Southeast Asia.

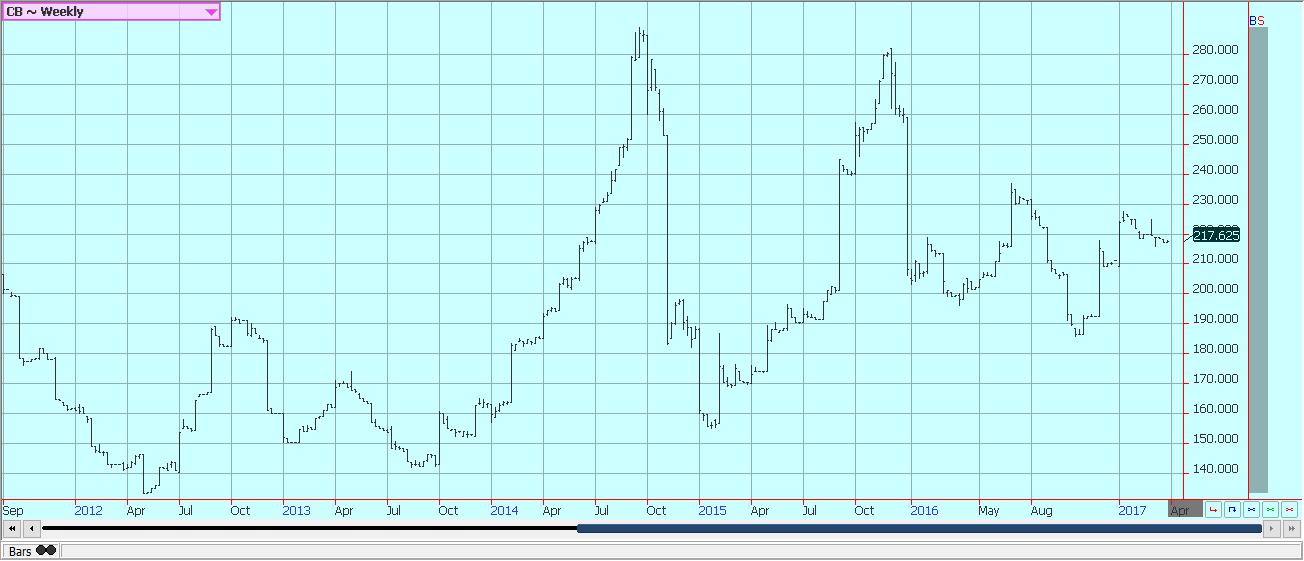

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

Dairy and Meat:

Dairy markets were mixed as big and stable supplies of milk are available to the market. Supplies are strong seasonally in all areas as the annual flush is active in the US. Demand is good for cream, and cheese makers are displaying increasing demand. Cream demand for Butter has been very good as orders for print butter have increased. However, butter inventories in cold storage are increasing in some areas. Demand for Ice Cream has been mixed depending on the region. Cheese demand appears to be getting stronger due to promotions on the retail level. Exports are reported to be stronger. Dried products prices are generally weaker. Bottled milk demand has been steady to lower due to school holidays.

US cattle and beef prices were lower. Beef prices have been weaker in the last week and have led Cattle futures lower. Ideas are that weaker prices will be seen once feedlot offers start to increase, but prices might be starting to weaken now. Overall beef exports have been very strong this marketing year.

Pork markets and Lean Hogs futures were weaker last week on reports of increasing supplies. Pork demand remains stronger than expected, but packers have been pulling back from the market as they sense increasing supplies are coming. The big supply of hogs expected to be in the market remains the big problem for higher prices. Packer demand has been very good until now. There are big supplies out there for any demand. The charts show that the market could remain in a trading range at good levels for both processors and producers.

Weekly Chicago Class 3 Milk Futures © Jack Scoville

Weekly Chicago Cheese Futures © Jack Scoville

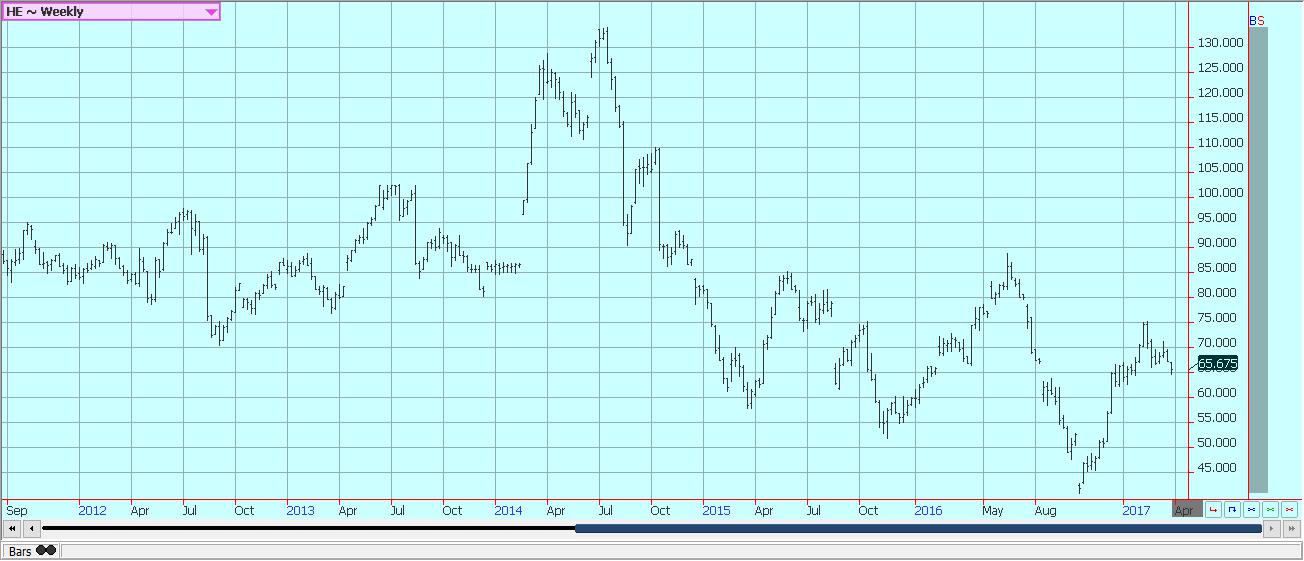

Weekly Chicago Butter Futures © Jack Scoville

Weekly Chicago Live Cattle Futures © Jack Scoville

Weekly Feeder Cattle Futures © Jack Scoville

Weekly Chicago Lean Hog Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Biotech5 days ago

Biotech5 days agoUniversal Nanoparticle Platform Enables Multi-Isotope Cancer Diagnosis and Therapy

-

Fintech2 weeks ago

Fintech2 weeks agoRuvo Raises $4.6M to Power Crypto-Pix Remittances Between Brazil and the U.S.

-

Impact Investing2 days ago

Impact Investing2 days agoMainStreet Partners Barometer Reveals ESG Quality Gaps in European Funds

-

Biotech1 week ago

Biotech1 week agoEurope’s Biopharma at a Crossroads: Urgent Reforms Needed to Restore Global Competitiveness

You must be logged in to post a comment Login