Featured

How do corporate tax cuts affect wages?

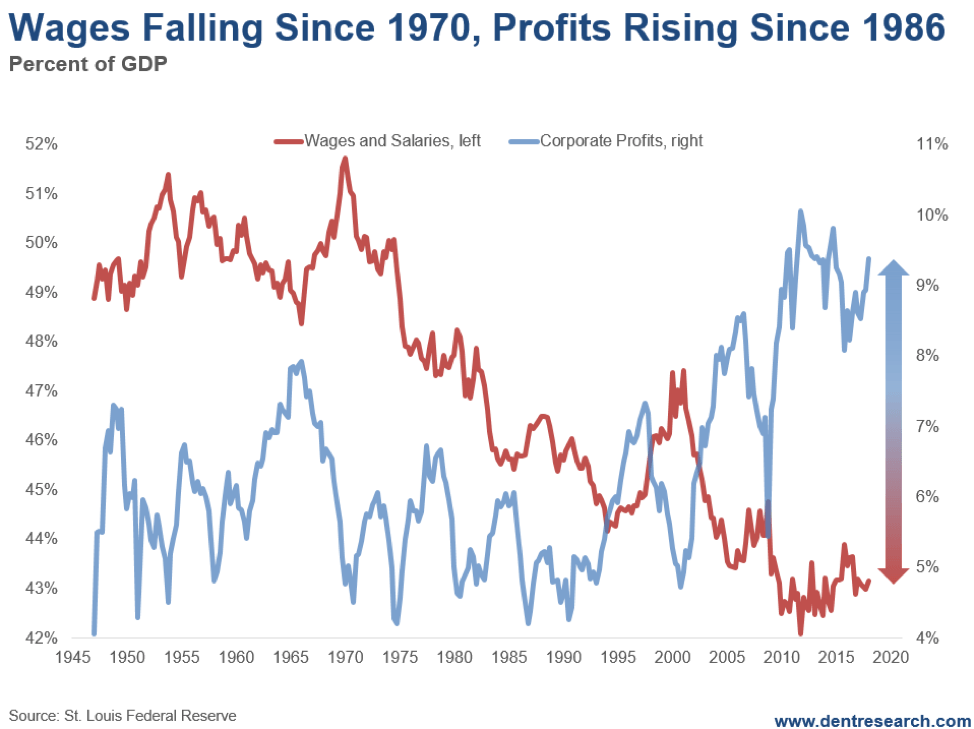

With corporate profits increased by 141 percent since 1986 and wages decreased by 29 percent since 1970, more issues on income inequality arise.

There’s no end to the insanity. Our central bankers and politicians are trying to keep this artificial bubble going at all costs.

How shortsighted. How arrogant. How selfish!

These politicians will be roasted in history, not just for creating the greatest bubble ever, but for extending it far beyond any logic.

I said in 2016 that no matter who gets elected, the musical chairs will stop between 2017 and 2020. This current administration will not be re-elected. The Republicans look likely to lose the House, possibly the Senate, and there hasn’t even been a crash or downturn yet.

So, you can see why Trump would want to have extra insurance going into the midterms this year, and the presidential election in 2020.

One tax cut that heavily favored business profits, and the top 1 percent to 10 percent that tend to own them, was not enough.

We need another one!

I know many of our readers own businesses, and we naturally want such tax cuts (including me). Corporations and businesses don’t need any tax cuts, let alone more.

© Harry Dent

There are a number of reasons we’ve had the greatest income inequality in the last century, and perhaps ever.

But this is the primary reason: wages and salaries, as a percent of GDP, peaked in 1970 at 51.7 percent and fell dramatically to 42.1 percent in late 2011.

They’re currently around 43 percent.

That’s a fall of 29 percent. Wages—from 1945 to 1974—in the last great boom and bust averaged around 50 percent of GDP. They were more stable and hence no extremes in income inequality or stock crashes greater than 20 percent happened during the Bob Hope boom from 1942 to 1968.

Corporate profits took a hit in the inflationary 1970s and into the early 1980s. But since 1986, they’ve gone straight up from 4.2 percent of GDP to 10.1 percent in late 2011.

They’re still at 9.4 percent currently. That’s an increase in their share of the economy by 141 percent.

So, wages go down 29 percent since 1970, and corporate profits go up 141 percent since 1986. How do you like them apples?

Trump shrewdly appeals to the most disgruntled workers (and for good reason) by telling them he’s going to “Make America Great Again”—by curbing immigration and bringing good jobs back.

Then his first major policy is to give one of the greatest tax cuts in history to businesses, which are overwhelmingly owned directly or through stock by the top 1 percent to 10 percent. They’re the ones who have gotten pretty much all of the wage and wealth gains in the past decades!

It would be one thing if companies were struggling and needed more capacity, yet they don’t.

Capacity utilization has been between 75 percent and 78 percent in recent years, but 80 percent to 85 percent is more normal. Companies will continue to buy back their stock (a practice that just spiked to new record levels in the first quarter), and create mergers and acquisitions that just rearrange the pie but don’t accrue to everyday workers. More typically, these result in layoffs. That’s what they have, and will again, get most rewarded for.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Biotech2 weeks ago

Biotech2 weeks agoEcnoglutide Shows Promise as Next-Generation Obesity Treatment

-

Business4 days ago

Business4 days agoThe TopRanked.io Weekly Digest: What’s Hot in Affiliate Marketing [uMobix Affiliate Program Review]

-

Business2 weeks ago

Business2 weeks agoThe TopRanked.io Weekly Digest: What’s Hot in Affiliate Marketing [PureVPN Affiliates Review]

-

Crowdfunding6 days ago

Crowdfunding6 days agoPMG Empowers Italian SMEs with Performance Marketing and Investor-Friendly Crowdfunding

You must be logged in to post a comment Login