Business

Cotton prices higher this week due to poor weather, crops destroyed

U.S. export demand for cotton has been poor in the last few weeks, while Vietnam is gearing to harvest its coffee but needs to free up storage for the crop.

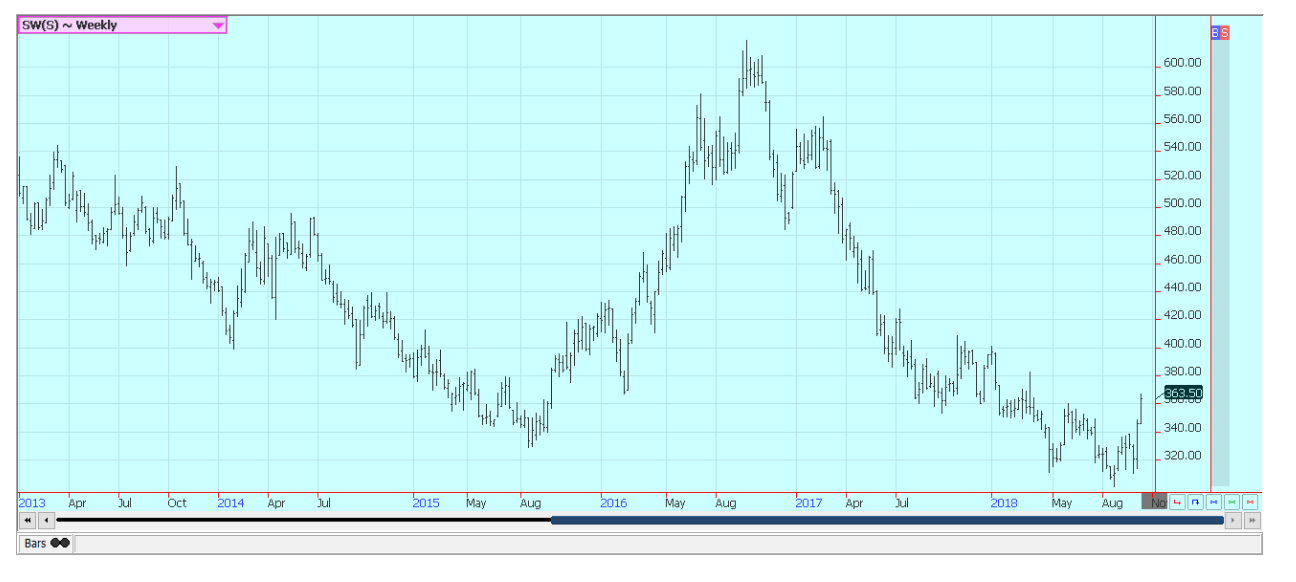

Wheat

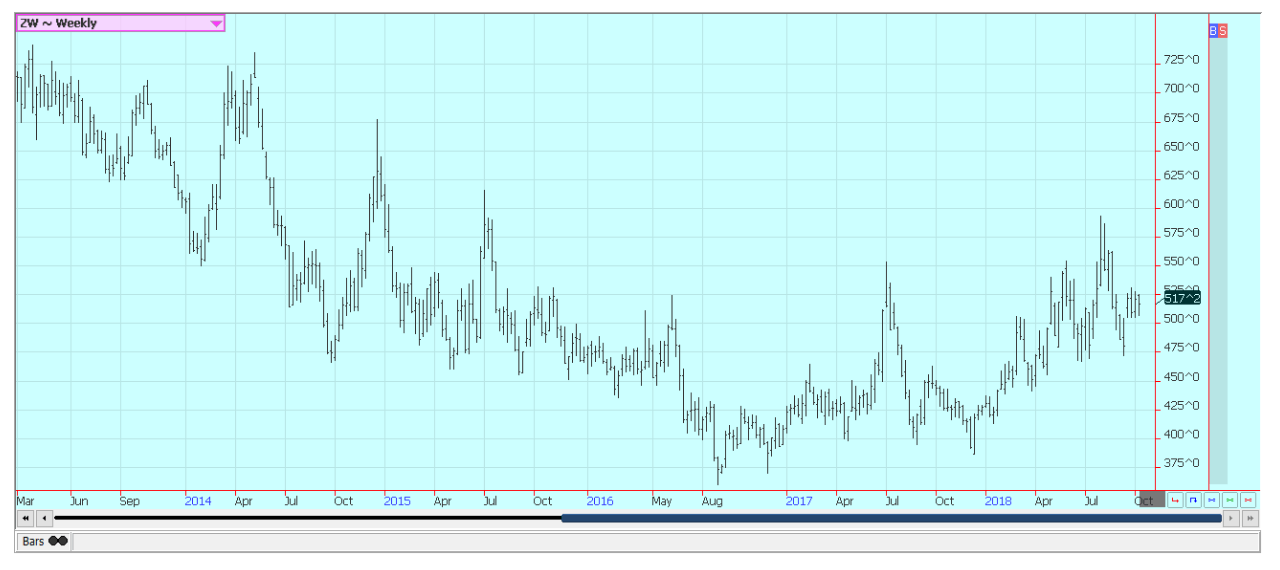

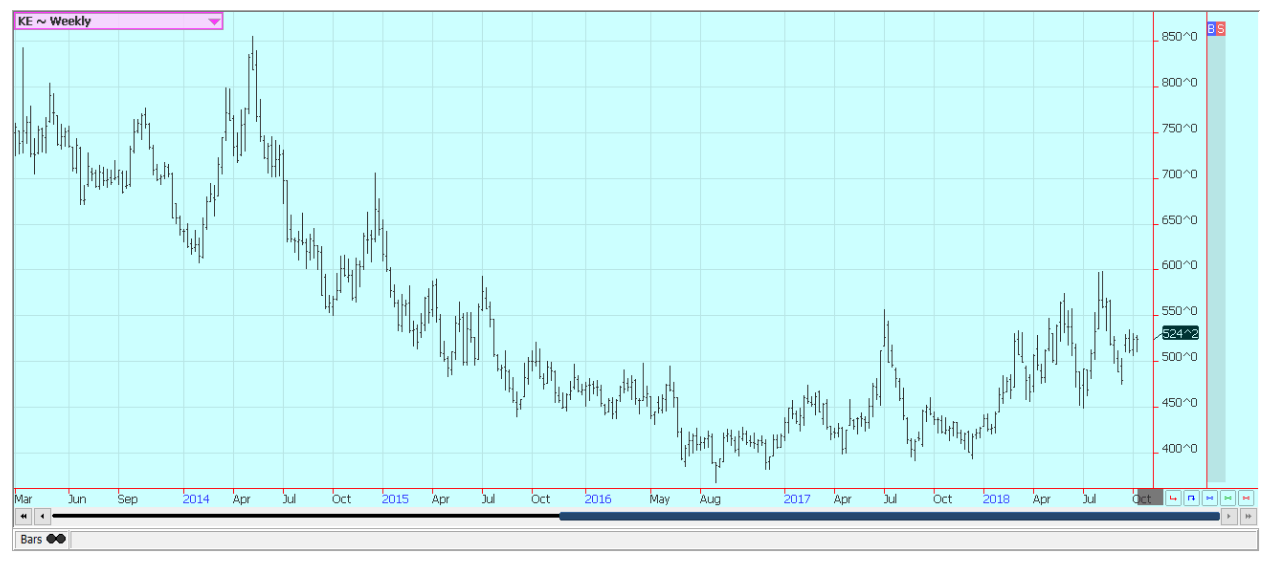

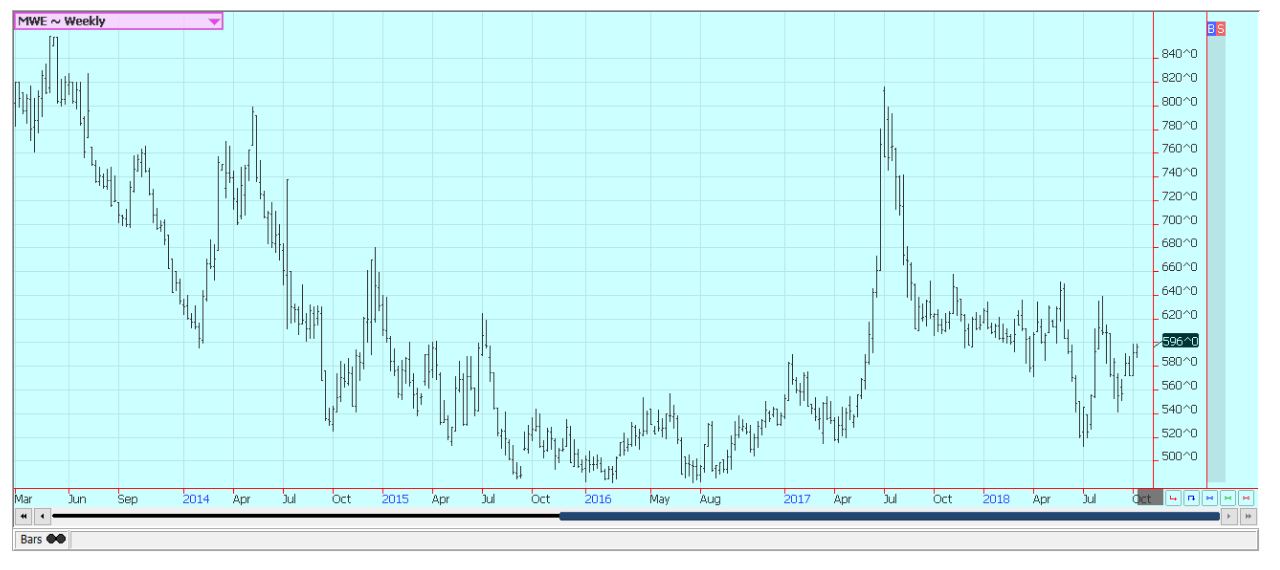

Wheat was mixed last week, and Winter wheat held to the trading range seen over the last few weeks. Chicago SRW was a little lower while HRW was unchanged and Spring wheat prices closed firmer. The USDA supply and demand estimates released on Thursday held no real surprises for the market.

U.S. production was increased slightly to reflect better Spring wheat yields. USDA finally cut production for Russia by a million tons, and also cut Australian production by 1.5 million tons. Overall, world production and ending stocks were lower due to these moves.

Futures did not react very well to the news and managed a lower close on Thursday, but rebounded to a higher close on Friday on news of problems with the Canadian Spring wheat harvest. About 35 percent of the crop there is still in the fields, and it might take some time for this part of the crop to be harvested as it is under some snow. There will be quality and yield losses in Canada to go with the reduced crops from other major exporters around the world.

Firm prices extend from Russia to Australia on reduced world production. It remains very dry in Australia, and yield and production estimates continue to drop well below those estimated by USDA. It is reported to be wet and cold in Siberia, but planting conditions are reported to be improved near the Black Sea. The Spring wheat harvest in Siberia has been delayed. Harvest has been difficult in parts of the Canadian Prairies due to snow and cold weather.

Bullish traders think it is just a matter of time before world buyers turn to the U.S. as the other major exporters would be out of wheat for export, but the buyers are still looking everywhere they can for other origins and are trying to avoid U.S. wheat. The weather in the U.S. is improved for planting the next Winter wheat crop as much of the Great Plains has seen rains in the last couple of weeks and planting progress is slowing. More rain is possible this week.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

Corn

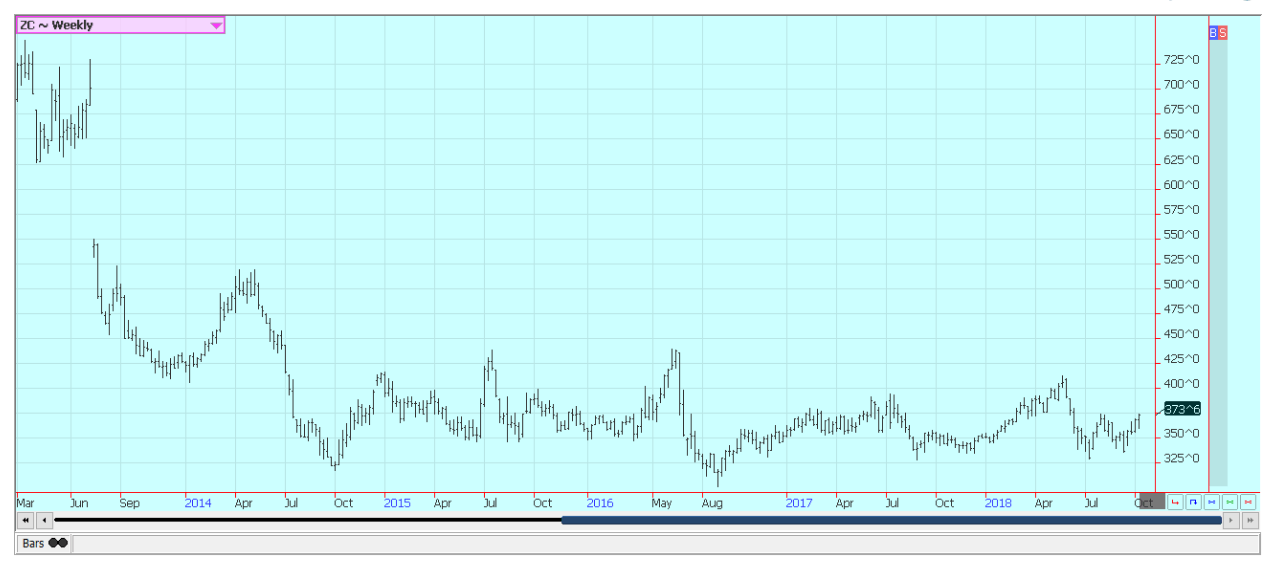

Corn was higher on Friday and higher for the week. Chart patterns remain bullish and point to moves to about 378 December and then just under 400 December over time. Support came from the USDA reports that were released on Thursday. Corn yields were estimated lower at 180.7 bushels per acre and production was estimated at 14.778 billion bushels, also lower than last month.

USDA estimated domestic ending stocks at 1.813 billion bushels, more than 1.2 million bushels less than trade expectations and below last month. World new crop ending stocks were in line with trade estimates at 149.4 million tons. The support came from short covering from funds and other speculators who had expected larger yield and production estimates. The harvest continues to roll along with at least some work going on in parts of the Midwest.

Rain started to delay harvest progress late last week. Some producers in Iowa said that corn was starting to lose quality due to the harvest delays and reports of diseases and perhaps mold. Some big snows were seen in the Dakotas, and it has turned very cold in the Midwest, with some areas freezing out. This could make it harder to harvest corn with weakened stalks. Harvest data as reported by producers still suggest that the crop can be another very big one. Demand prospects remain very good for ethanol and for export. U.S. corn export sales remain very strong and were over 1.0 million tons last week.

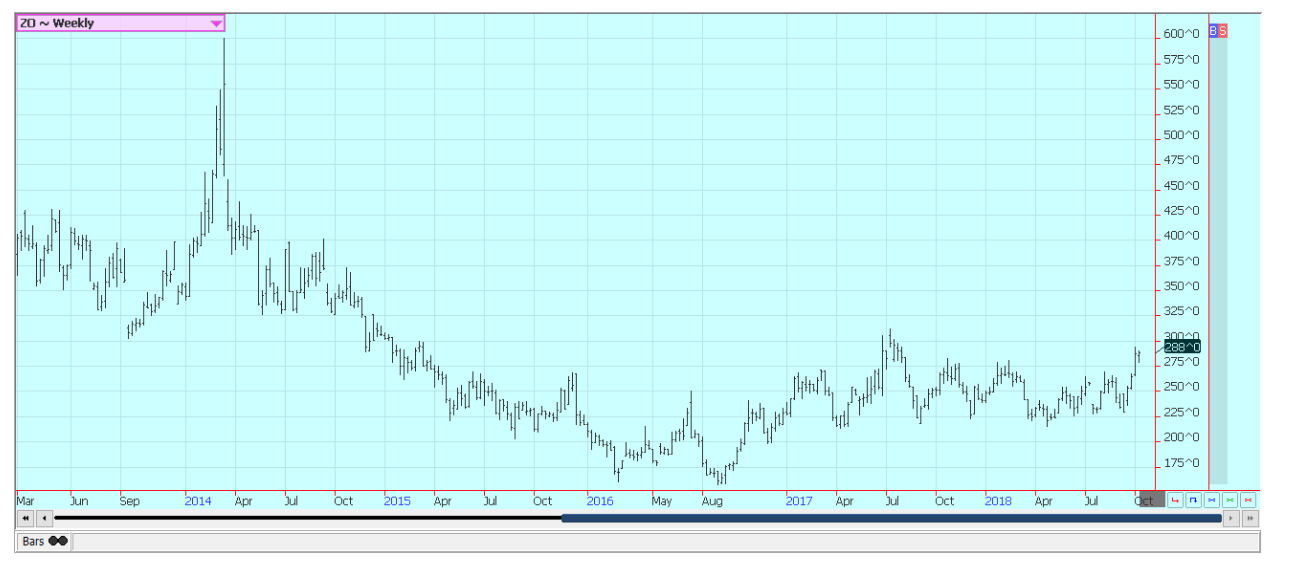

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

Soybeans and soybean meal

Soybeans were slightly lower last week, and soybean meal was also higher. USDA created some support for futures with its production and supply and demand estimates on Thursday. It showed a slight reduction in US production at 4.690 billion bushels as reduced harvested area proved a little more important than a slight increase in yields. Ending stocks were estimated at 885 million bushels, about 37 million bushels below trade expectations, but still a huge amount. World ending stocks were slightly above trade expectations at 110 million tons.

In Brazil, CONAB estimated the new Soybeans crop production between 117 and 119.4 million tons. The reports indicated less production than expected, but it is still expected to be a huge crop, and the US might have trouble getting it moved to the point where ending stocks are small enough to make a difference in prices.

Current ending stocks estimates are still more than ample, and the weekly export sales report was poor at 439,700 tons. However, Soybean Meal export sales were large at 348,000 tons. Brazil is still doing all the business with China despite the wide disparity in prices, and there is just no way the rest of the world can make up for the lost business with China for the U.S.

U.S. producers are still trying to harvest, but have been shut down by rains for several days. Some producers in Iowa and to the west are reporting yield losses and quality losses from the rains that have caused some sprouting and mold to form. Freezing temperatures were seen in northern and western areas and should prove beneficial for harvest progress and the cold could help preserve quality in some cases. Futures appear to have made seasonal lows, but ideas are that upside potential is no more than $9.00 per bushel right now.

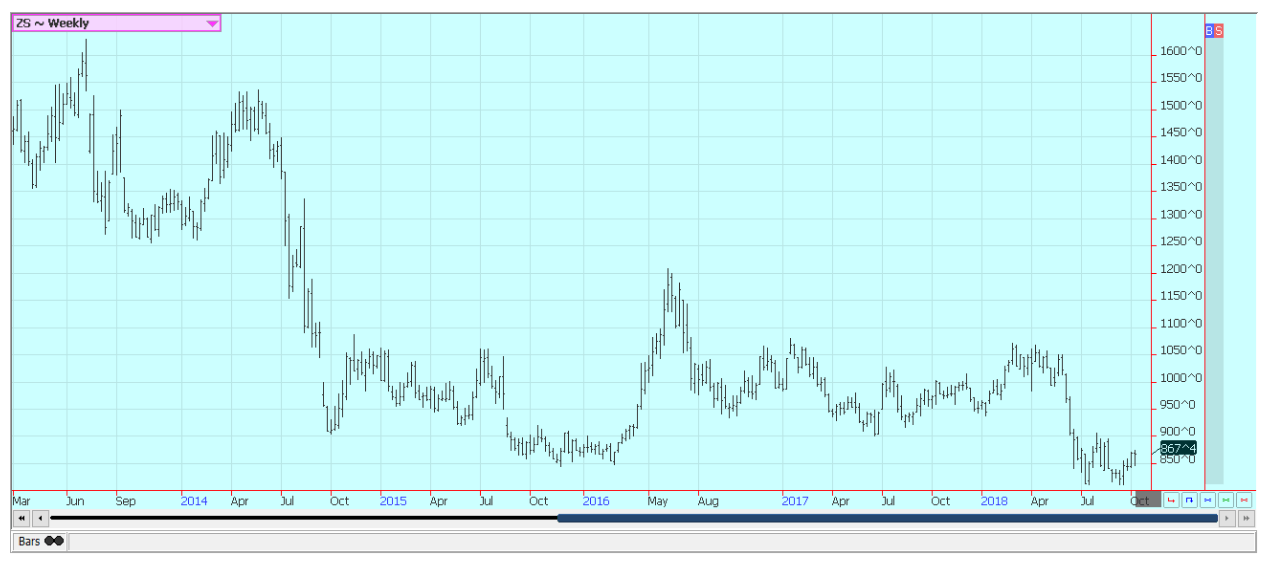

Weekly Chicago Soybeans Futures © Jack Scoville

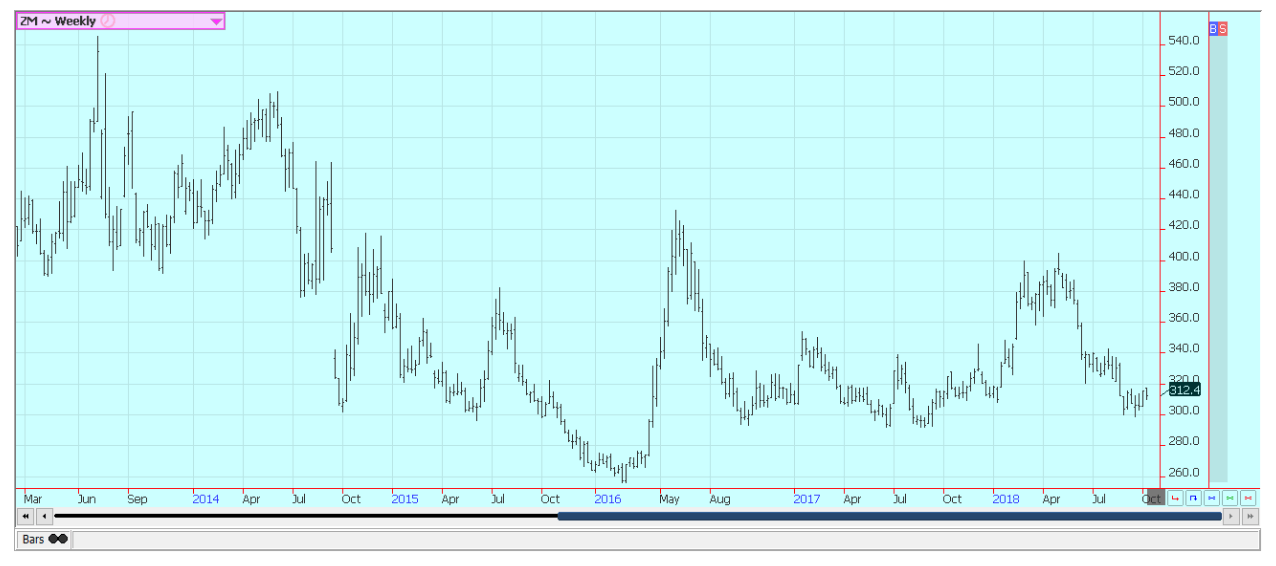

Weekly Chicago Soybean Meal Futures © Jack Scoville

Rice

Rice was lower last week, but the tone of the market is still positive. The harvest is coming to a close in many parts of the Mid South, although there was still a lot left to do in Mississippi and Texas and Louisiana still were waiting to harvest the second crop.

USDA trimmed its production estimate to 275.2 million hundredweight for all Rice and to 159.0 million for Long Grain. No changes were made to the demand side, so ending stocks were slightly lower. World ending stocks for the coming year were a little higher at 145.21 million tons. The funds have held a massive short position and have been trying to buy out of that position, but they have found little selling interest.

Farmers think prices are too cheap and are still concentrating on harvesting in most areas. Good to excellent yields have been reported in Texas and Louisiana so far, and good to very good yield reports are being heard in Mississippi and Arkansas. Cash prices are somewhat weaker as mills and elevators fill up. Milling yields have been acceptable to very good. Export demand has been good, and was especially strong last week as futures moved lower. Good export demand is expected to continue.

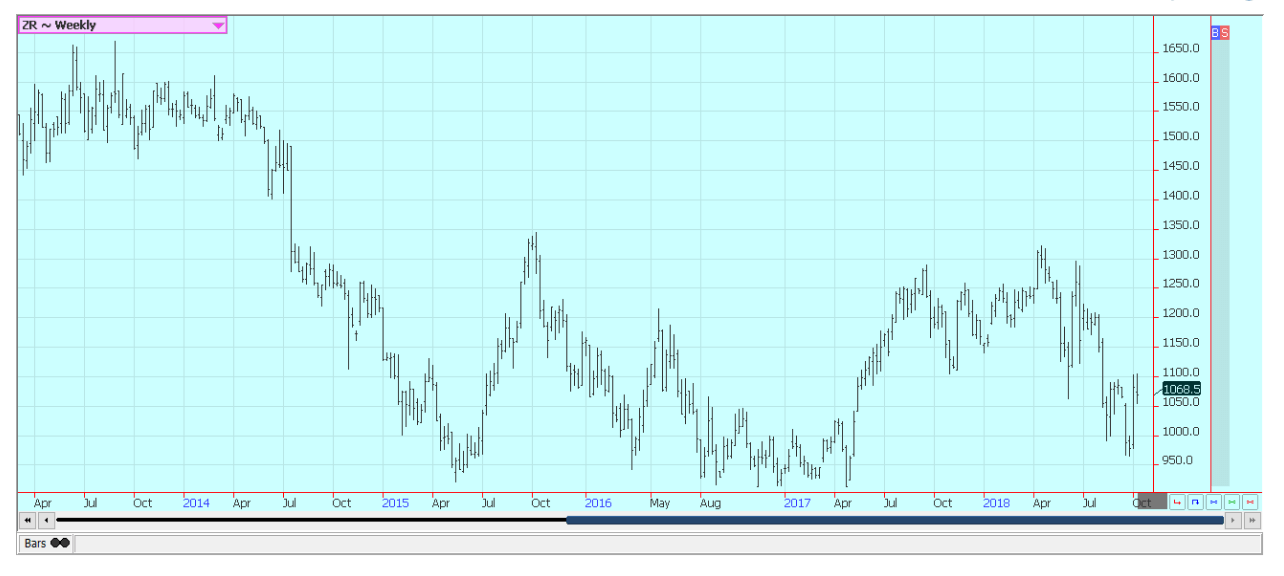

Weekly Chicago Rice Futures © Jack Scoville

Palm oil and vegetable oils

World vegetable oils prices were mostly higher again last week. Palm oil was lower in response to the MPOB monthly report. Production was as large as anticipated, but demand was weaker than anticipated and caused higher than expected ending stocks. The private export surveyors reported a slower pace to exports for the first third of the month.

The market is anticipating strong production for the short term as the weather is good for the trees. However, both Malaysia and Indonesia are watching long-term trends as El Nino is expected to develop. Indonesian supplies are already less as demand from China has been strong. The weather could hurt production potential down the road. Soybean Oil closed about unchanged.

The market is expecting better demand as world petroleum prices have moved higher. Support is also coming from less offer from South America and on higher Canola prices. Canola was lower on slow harvest progress amid wet and cold weather and reports of slow demand. Farmers have had a tough time getting into the fields due to rains, especially in the west. Yield reports are said to be below expectations and ideas are that StatsCan has overestimated production potential this year.

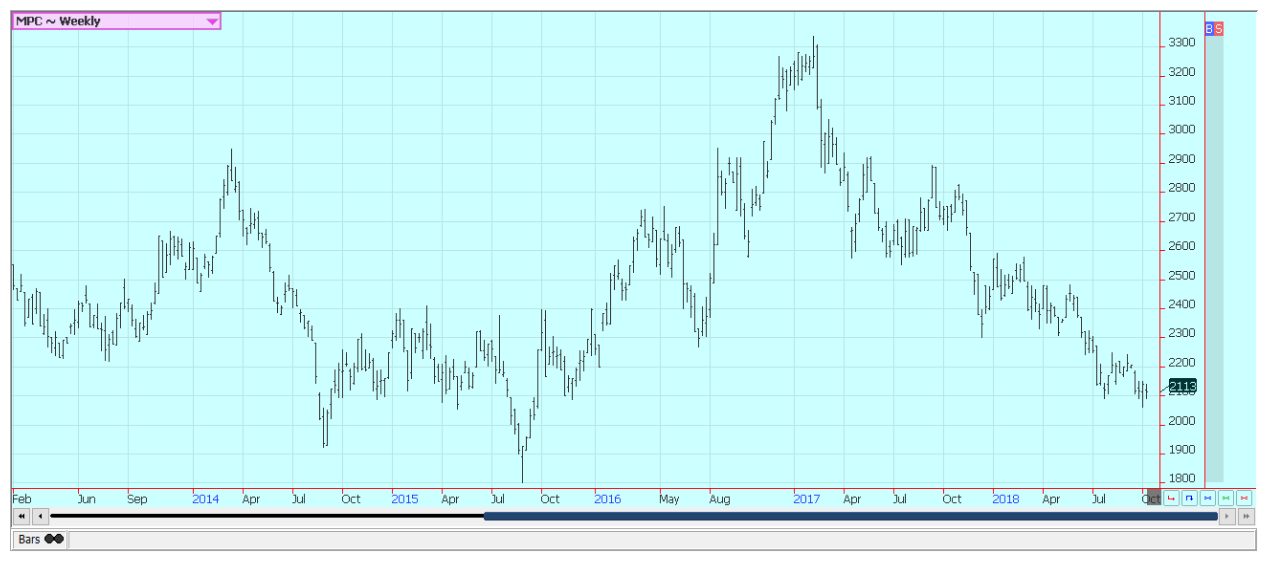

Weekly Malaysian Palm Oil Futures © Jack Scoville

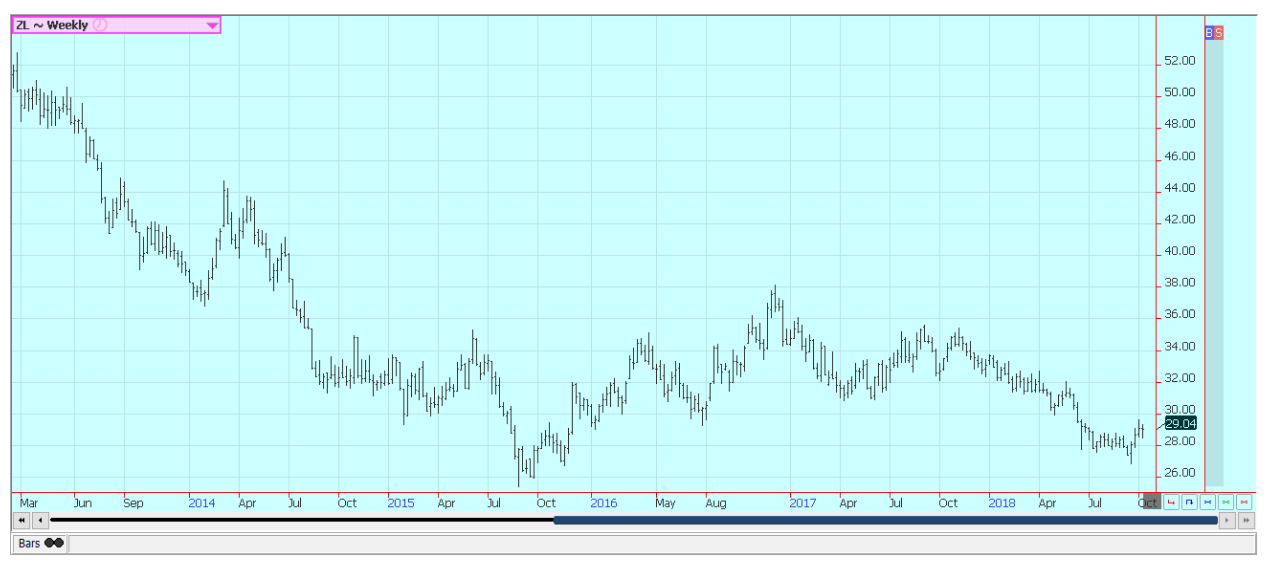

Weekly Chicago Soybean Oil Futures © Jack Scoville

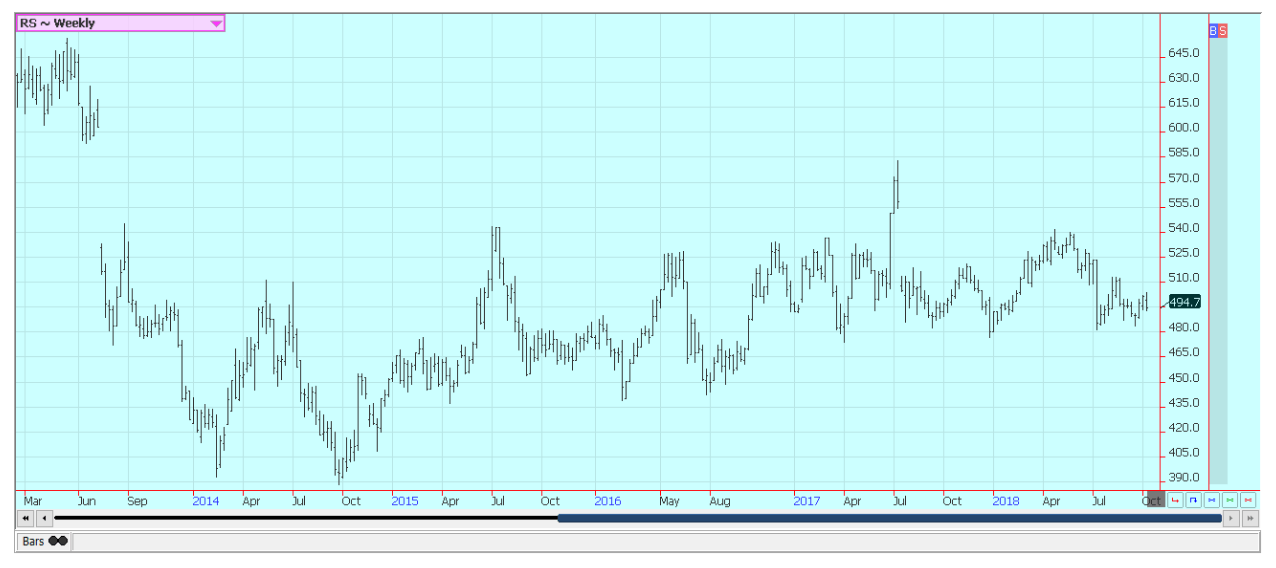

Weekly Canola Futures © Jack Scoville

Cotton

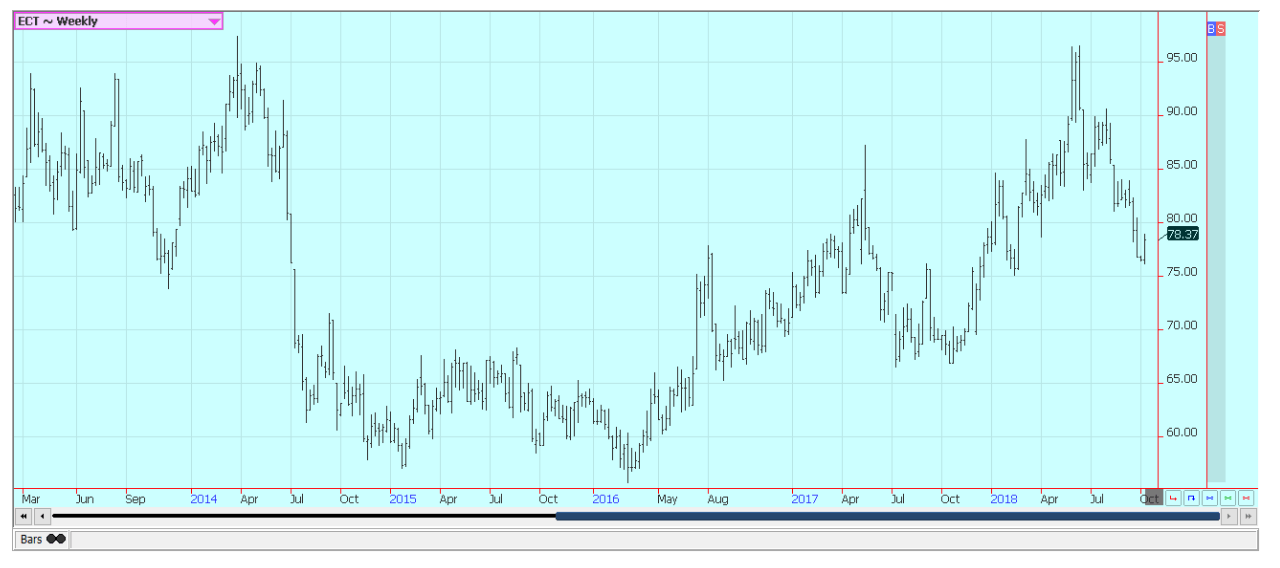

Cotton was higher for the week as the weather turned bad in the Southeast. Hurricane Michael ripped into Georgia and then into the Carolinas and brought devastating winds and rain to growing areas in Georgia. Social media showed pictures of widespread devastation in cottonfields, with many plants blown over and destroyed and cotton on the ground.

USDA showed a slight increase in production in its reports last week on a slight improvement in yields combined with a minimal loss in the harvested area. Ending stocks were higher as export demand was less. The report was bad for prices, but the storm was the more important factor in the price action. USDA reported improved export sales last week.

US export demand has been poor for the last few weeks, and the lack of demand has hurt prices. Export demand needs to improve soon for prices to rally significantly this year, but any increase in demand has to come with no purchases from China for a while. The trade in India remains optimistic that a good crop is coming and that they will not need to import very much Cotton this year.

China has been active in India buying and will buy as much as possible there to make up for production losses inside of China. USDA estimated production down in India and Pakistan due to bad weather during the growing season, so India might not be able to cover all of the Chinese demand. Chart trends remain down.

Weekly US Cotton Futures © Jack Scoville

Frozen concentrated orange juice and citrus

FCOJ was higher last week despite a big increase in Florida oranges production as estimated by USDA. USDA estimated all Oranges production at 79 million boxes, with improvements shown in both the early and mid categories and the Valencia categories. USDA showed production in line with estimates from Stegar and Gaines, and well above those estimates from the brokerage house analysts.

Good weather continues in Florida and as prospects for a much-improved crop from a year ago continue. Chart trends are down as futures stayed below some important resistance on the weekly charts. Overall growing conditions in Florida are good to very good, and there is no storm development in the Atlantic at this time, or at least nothing that would impact the state. Florida producers are seeing good sized fruit, and work in groves maintenance is active. Irrigation is being used when needed, and producers expect a good crop.

Weekly FCOJ Futures © Jack Scoville

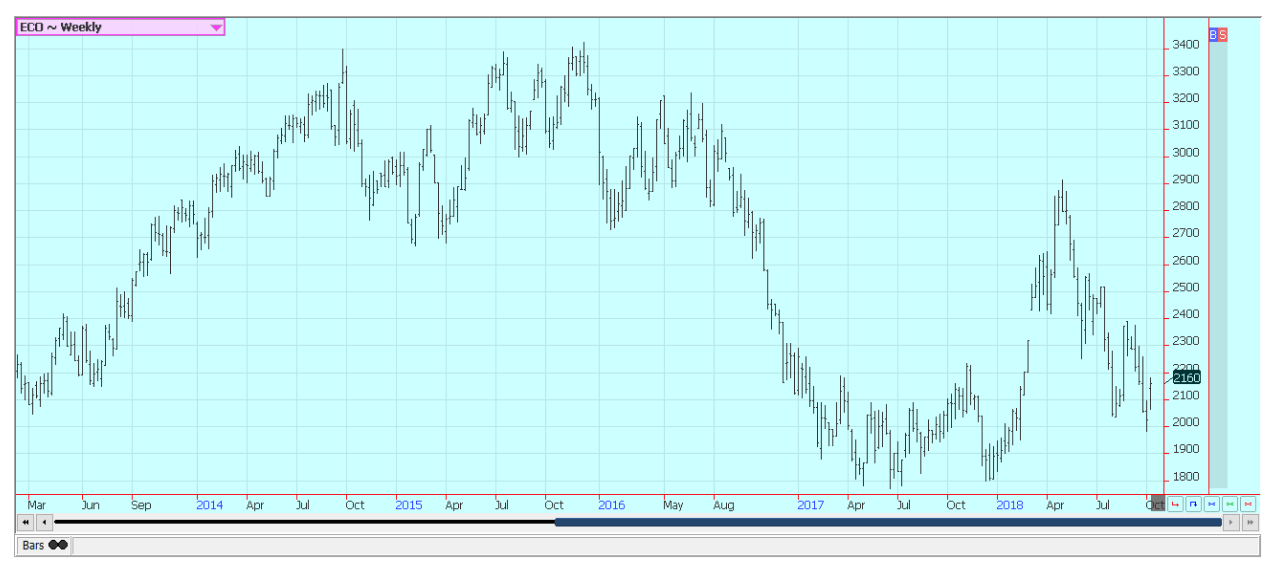

Coffee

Futures were higher again last week, and weekly charts show that futures had their best two weeks of upside action in years. It has been primarily a short covering rally as funds and other speculators have been buying out short positions due to trend changes in the Brazilian Real. The Real has found support as the right wing candidate for president in Brazil won the first round of elections and leads for the second round over the workers party candidate. Mr. Bolsanagro would move to institute market friendly reforms like selling state owned countries and removing Business regulations and perhaps environmental regulations. His rhetoric implies that he will pursue an aggressive far right agenda that could prove at least as divisive as the agenda of the Republicans in the US.

Futures are now at initial resistance near 110.00 December, but have the potential to move through that area and closer to the 120.00 December area. Ideas of strong production in Brazil and Vietnam have been keeping futures under selling pressure. Vietnam is getting close to its next harvest, and ideas are that producers there need to sell more of the previous crop to create new storage space. Producers in both countries are not selling.

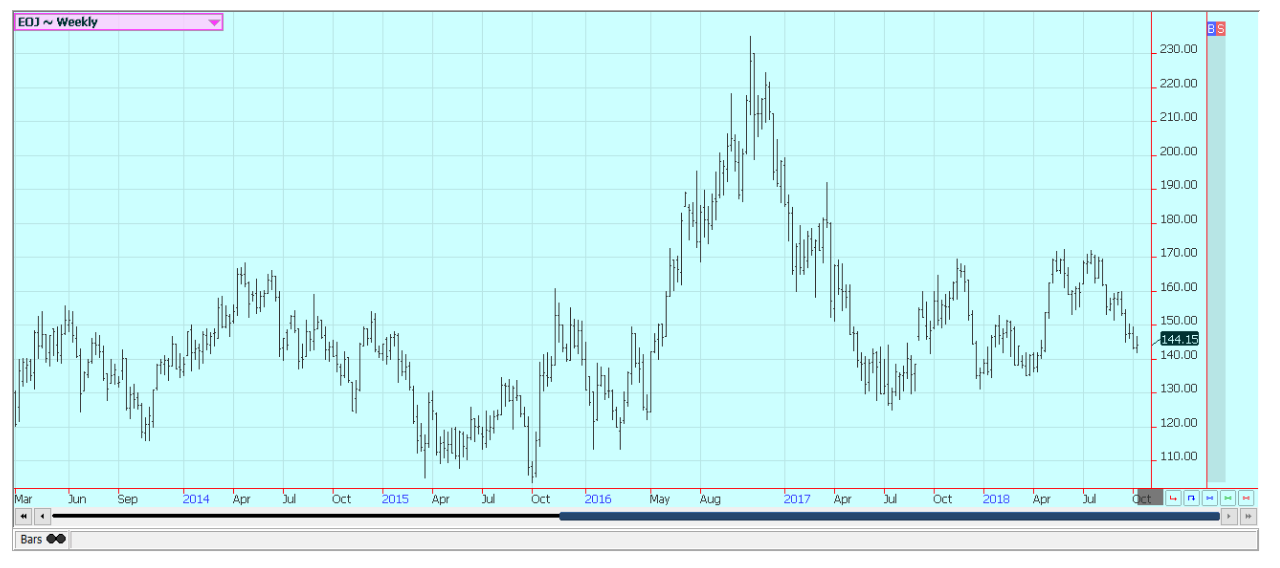

Weekly New York Arabica Coffee Futures © Jack Scoville

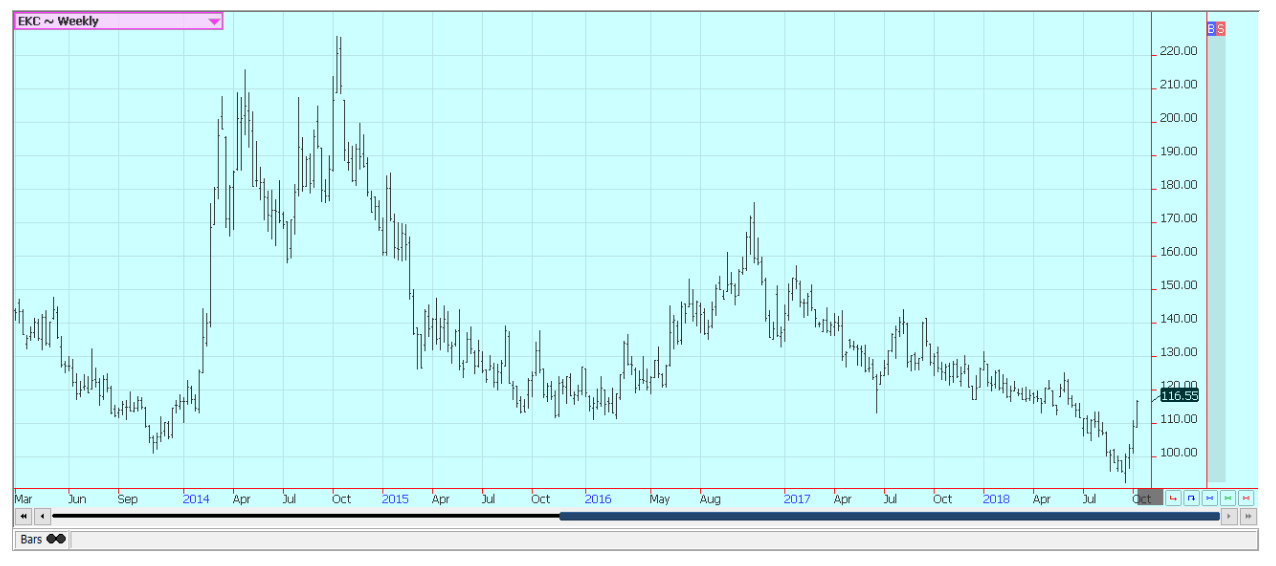

Weekly London Robusta Coffee Futures © Jack Scoville

Sugar

New York closed higher again last week and moved within a range of strong resistance near 1400 NY March. London was higher as well and has been the leader on the rally. Both markets are showing that medium-term lows have been made on the weekly charts.

Sugar was supported by reduced selling in Brazil due to the presidential elections that were held last week and ideas of increasing inflation in the US. The Real has been gaining on the US Dollar as a result and this has served to limit export interest in Brazil. Ideas of big world production are bearish and have been the reason for the selling. Just about everyone is looking for a significant production well above any demand potential.

Dry conditions continue in Brazil, the EU, and Russia, but conditions are mostly good in Ukraine. Very good conditions are reported in Thailand and India, although northwest India had been experiencing hot and dry weather that could cut yields. Brazil producers are worried about Cane production even with the rapid early harvest, and the market still talks about less production there this year.

The dry weather in much of Europe and in southern Russia near the Black Sea has hurt Sugarbeets production potential in these areas. Recent rains in parts of Ukraine have continued to improve production prospects there. Recent storms in northern Europe were detrimental to maturing crops and harvest, but the weather is now warmer and drier.

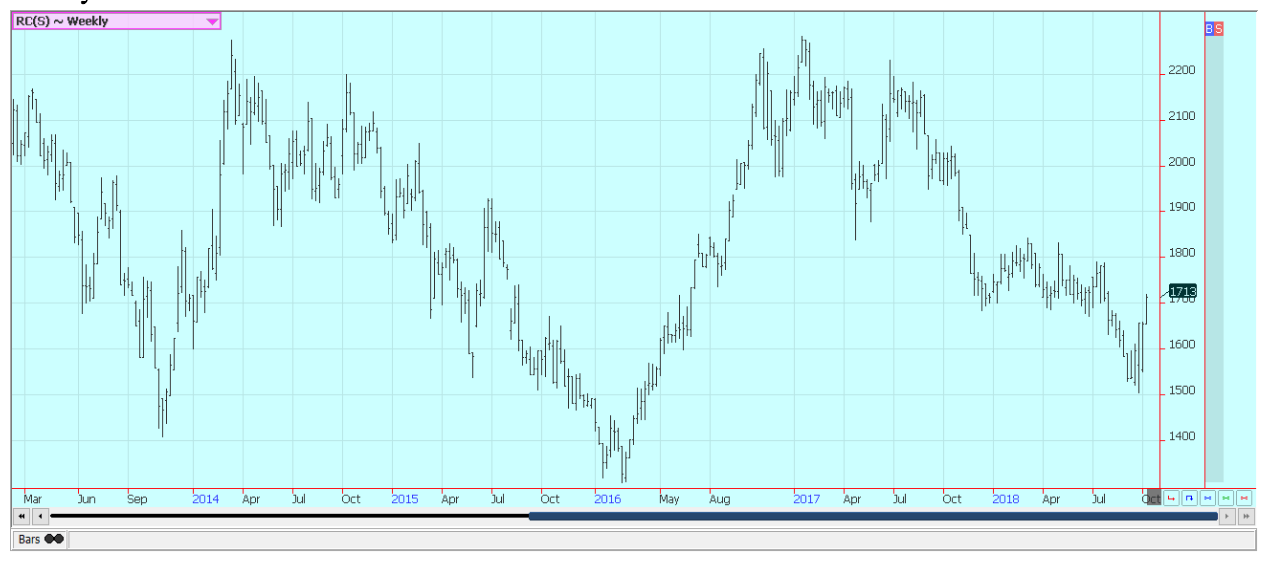

Weekly New York World Raw Sugar Futures © Jack Scoville

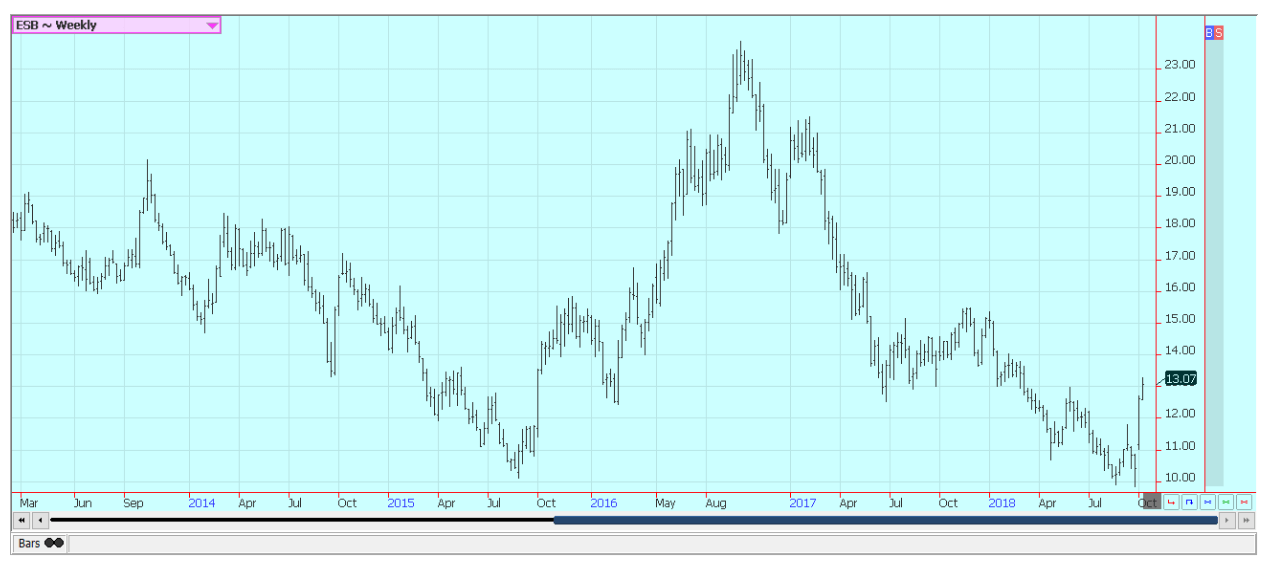

Weekly London White Sugar Futures © Jack Scoville

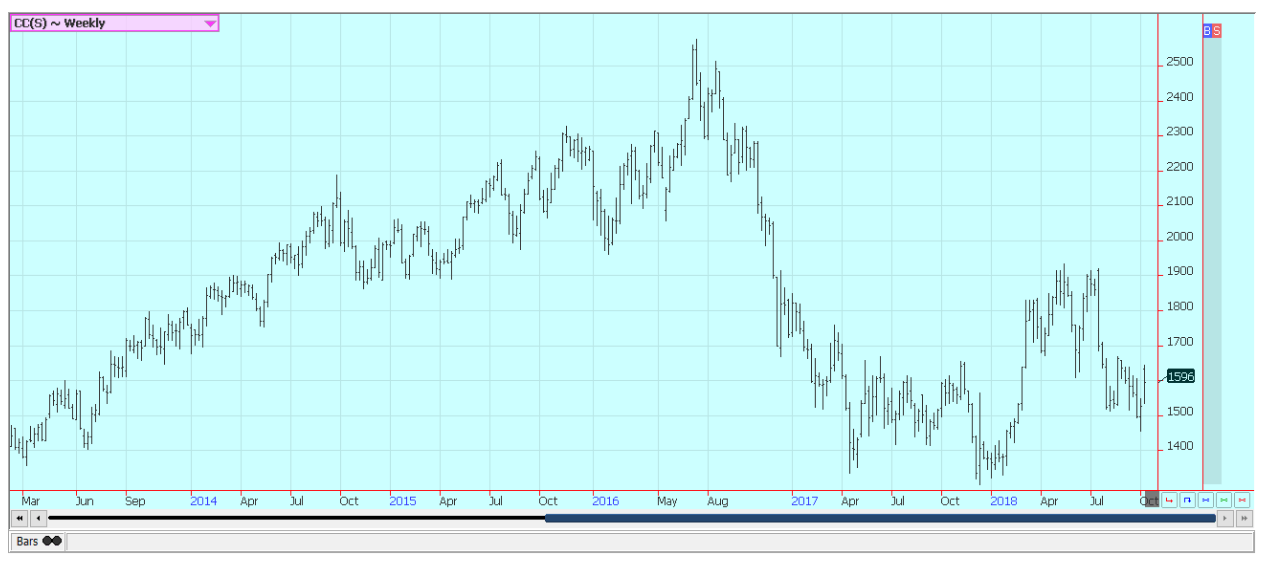

Cocoa

Futures closed higher for the week as the new main crop harvest comes to market in West Africa. Trends remain down on the weekly charts, but the recovery has been impressive as it is time for offers from the West Africa harvest to start increasing. The outlook for strong production in the coming year has been enough to keep the prices weak, but there are some disease concerns for West Africa as a lot of humid air has promoted some concerns that Black Pod Disease could spread. The main crop harvest is in its earliest stages in some parts of West Africa. Main crop production ideas for Ivory Coast are high. Ghana and Nigeria are expecting very good crops this year as well. Ghana and Ivory Coast are hoping to set a joint minimum price in an effort to ensure at least some return for their producers as prices now are viewed as cheap. Conditions also appear good in East Africa and Asia. Demand is said to be improving as offers from the new harvest start to increase.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Fintech2 weeks ago

Fintech2 weeks agoFintower Secures €1.5M Seed Funding to Transform Financial Planning

-

Impact Investing3 days ago

Impact Investing3 days agoItaly’s Listed Companies Reach Strong ESG Compliance, Led by Banks and Utilities

-

Impact Investing1 week ago

Impact Investing1 week agoBNP Paribas Delivers Record 2025 Results and Surpasses Sustainable Finance Targets

-

Impact Investing44 minutes ago

Impact Investing44 minutes agoCDP Approves €1.5 Billion Package to Boost Industry, Renewables, and International Development

You must be logged in to post a comment Login