Business

Crop markets rally in anticipation of US-China trade deal in April

Negotiations between the US and China for a new trade agreement continue with good progress. Indications are that an agreement could be reached by the Easter holiday.

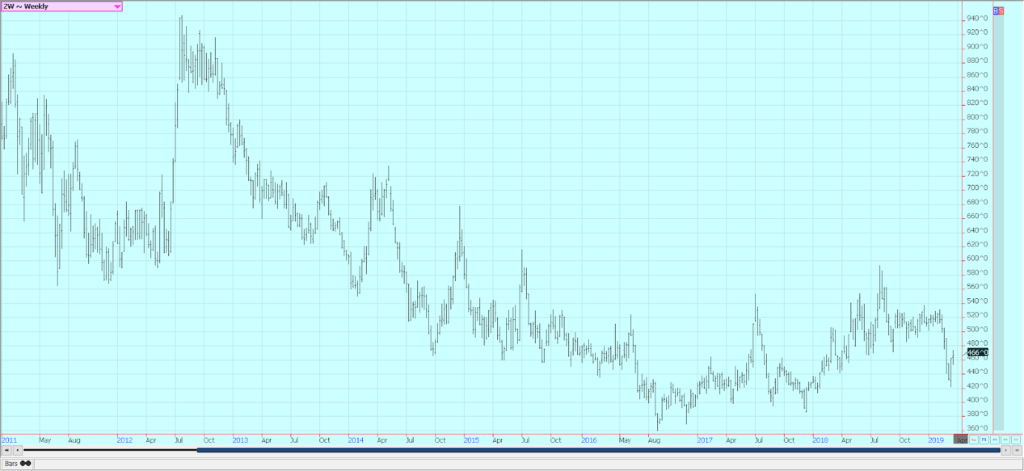

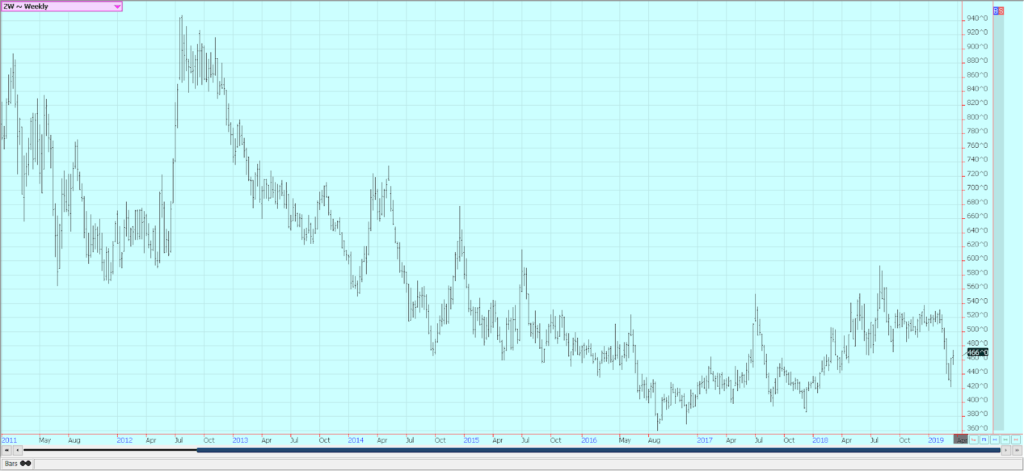

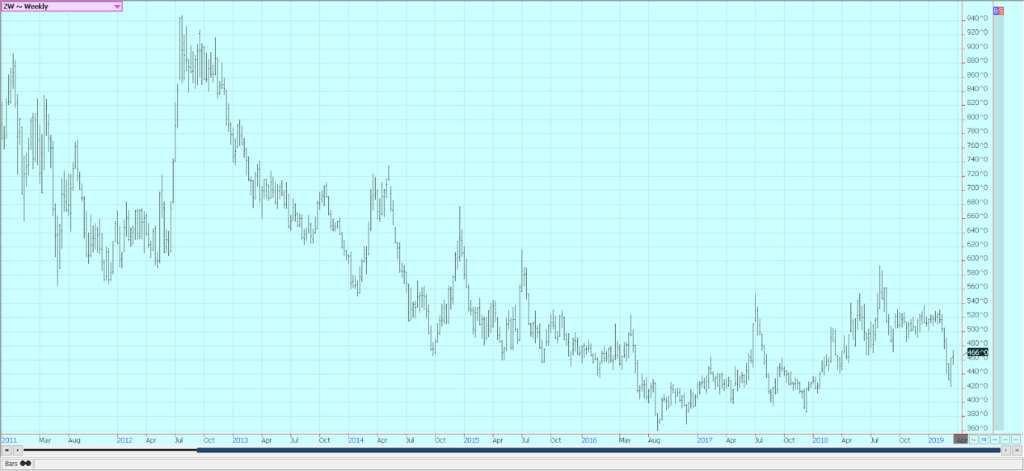

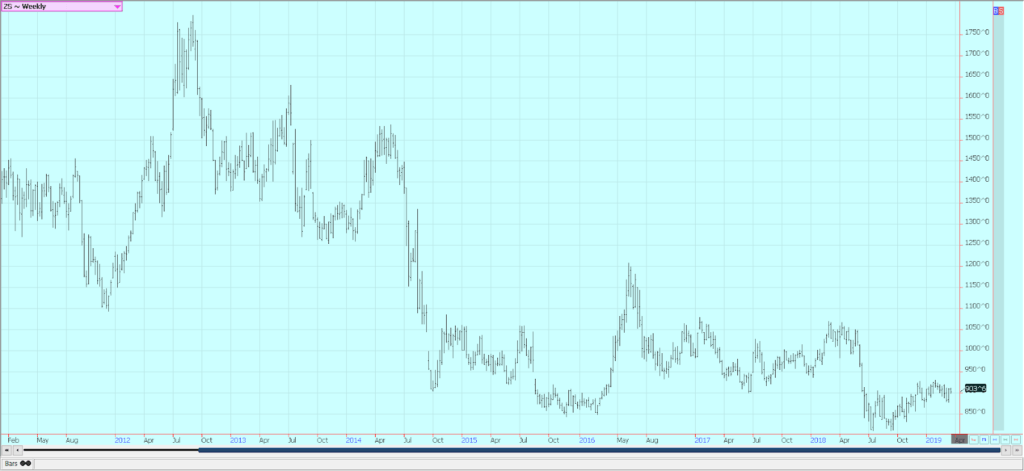

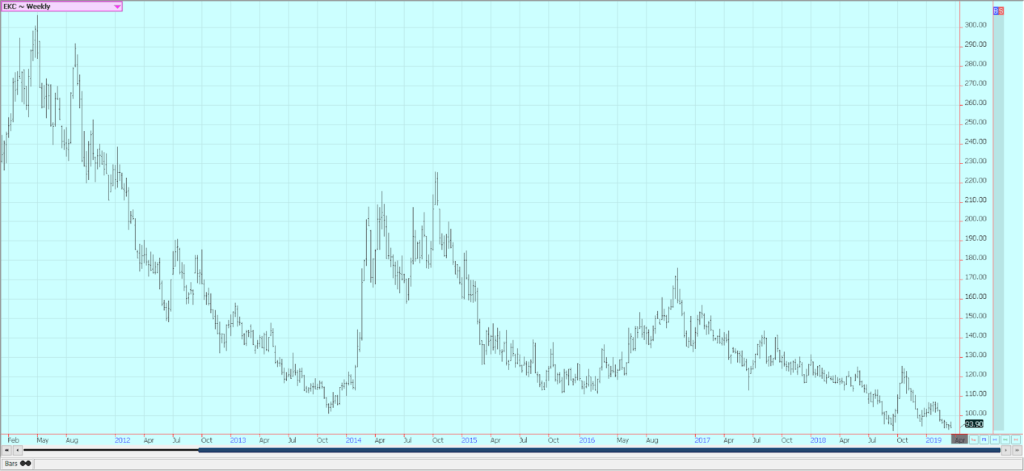

Wheat

Winter wheat markets were higher and Minneapolis spring wheat prices closed slightly higher for the week. Chicago SRW prices are now above important resistance on the weekly charts at 464.25 May, and breaking and holding above that level would encourage a lot of fund buying. The market remains worried about demand, but seems to have bottom out and started to go higher, anyway. Demand overall has been improving for US wheat in export markets, but took a hit last week as the weekly sales report was not strong. There are also concerns about production for the coming year. The crop was planted in difficult conditions last year as it was very wet in the Great Plains and the Midwest. It is very likely that not all intended area got planted. Both regions saw some extreme cold over the winter and some winterkill is expected.

Prices are cheap enough now that some cattle producers in the central and southern Great Plains might use the Wheat area for grazing instead of for cash crops. Prices are very high in the region right now for feed, so grazing the Wheat might make more economic sense. Minneapolis prices have been holding better as the market waits for spring to arrive. The big winter storm in the Dakotas and other areas last couple of weeks has given way to improving weather this week. The region will need a lot of good weather before planting can begin. Demand for spring wheat has been less lately due to the price spreads between Spring here and competing wheat around the world. A rally in world wheat prices would help improve demand potential for US and Canadian Spring wheat.

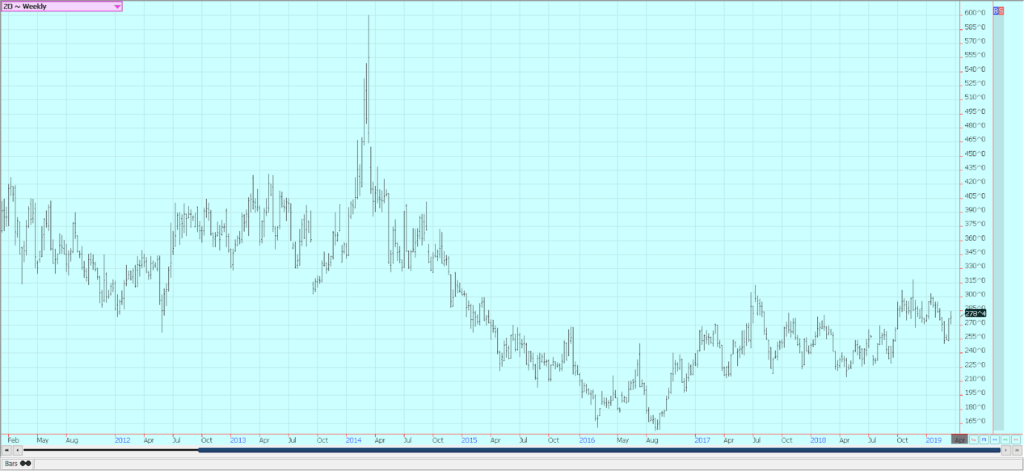

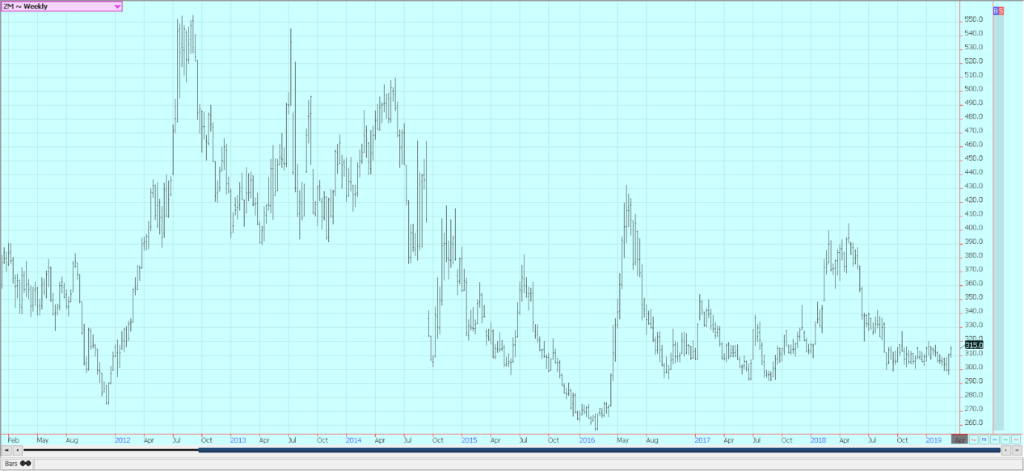

Corn

Corn closed higher last week despite demand concerns as domestic demand, particularly ethanol demand, has been down. The export sales report was positive and also positive for the market was news from USDA on Friday that China had bought 300,000 tons of US corn. Oats closed slightly higher. South American weather is generally good as more showers are reported in central and northern Brazil. The winter corn crop is being planted as soybeans get harvested, so the rains are very beneficial after an extended dry season.

US farmers are still trying to decide on their planting mix this year. Corn planting should be starting in areas near the Gulf Coast, but fieldwork in many cases has been delayed by excessive rains in the past few weeks. Much of the US will have rain this week. There has been way too much rain and snow this year for any fieldwork to be considered, but that might start to change this week. The market has a different feel right now and sentiment seems to be more even handed instead of only bearish. The funds and other speculators hold big short positions and might be forced to cover in the near future.

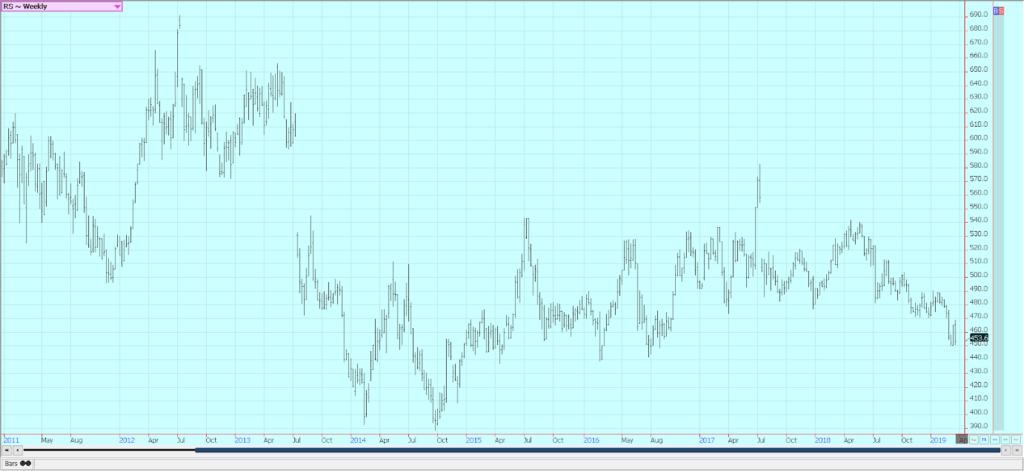

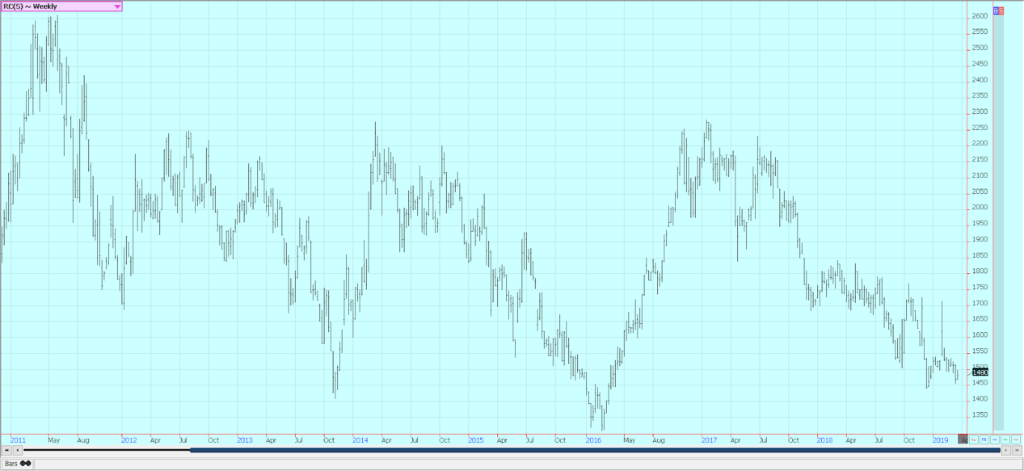

Soybeans and soybean meal

Soybeans were lower and soybean meal was higher last week, but soybean oil was lower. Demand for US soybeans was weak in the world export markets last week. Most of the rally came on the back of news from Washington that the negotiations for a new trade agreement between the US and China were moving along very well. The news has helped Chicago become a much more two sided market and to have a different feel to the trade. Brazil has started to show increased offers and very competitive prices soon. Argentina also looks to export this year as crops there are much better.

The weather in the US is very cold in the north and very wet in the south. Very little fieldwork is getting done, and planting delays are possible for corn and rice. This could force more acres to soybeans unless the weather changes in the next month. The weather will feature wet and cool conditions this week in almost all US growing areas. The weekly soybeans charts show that the market might be forming a bull flag, so any new buying and moves to new highs this week could find some significant speculator and fund buying.

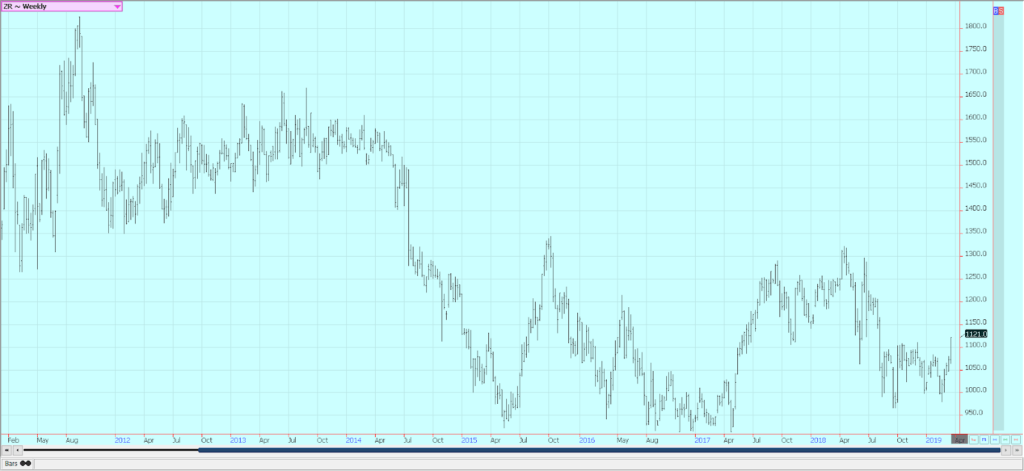

Rice

Rice was higher for the week and made new highs for the move. Planting conditions could stay improved this week near the Gulf Coast and in the Delta. All areas have seen some extreme precipitation and mostly cool to cold temperatures for the last month, and getting much fieldwork done has been all but impossible. However, some small areas in Texas and Louisiana have been planted, and areas near Houston are getting planted or got planted last week. Fieldwork should start to expand this week as the weather turns drier, but remains somewhat cool. The better weather is timely as producers were starting to get worried and some were wondering if they would be able to plant rice. The planting will be on time or only slightly delayed if favorable weather continues.

The export sales report was good last week, and export demand overall has been positive for the market. The US has rice to sell, but the rice is getting sold and exported. Domestic demand has been moderate. Farmers have mostly sold the Rice in the south, but there is still a lot to sell in Arkansas and into Missouri and Mississippi. US internal prices are holding about steady. Prices in Asian export markets were steady to higher last week.

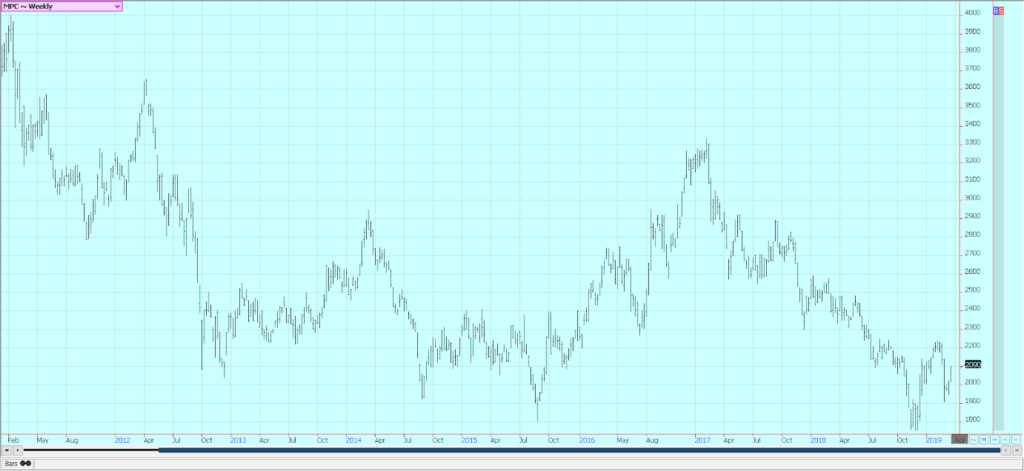

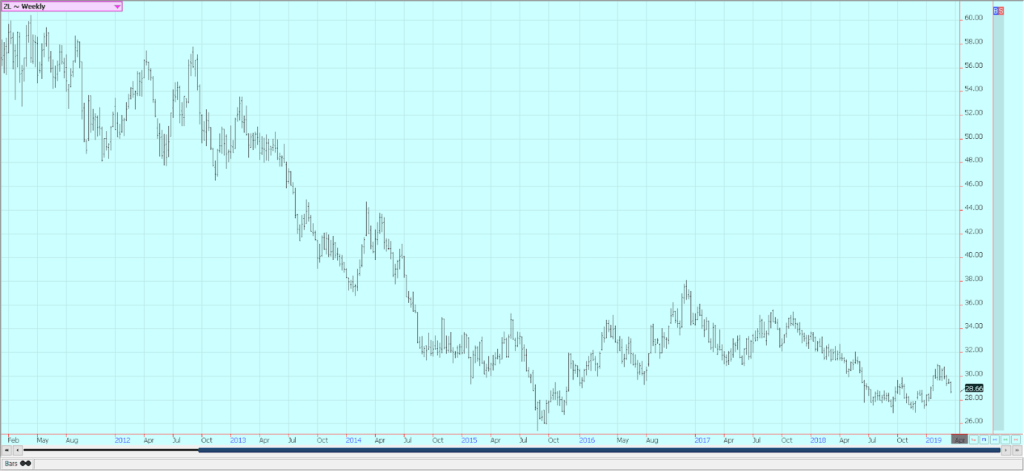

Palm oil and vegetable oils

Palm Oil was higher as demand reports from the private surveyors showed that palm oil demand remained weaker. There were some reports that production in Malaysia was holding better than expected. Production usually trends lower at this time of year due to seasonal factors, but reports from the country indicate that production has held closer to unchanged. Canola continues weak overall as supplies in the country remain high and demand has softened.

Compounding the problem for canola is a court case in which a Chinese national could be deported to the US on industrial espionage charges. The hearings on the case are underway in Canada now and the hearings and entire case has caused friction in the relationship between Canada and China. Soybean oil was lower on mostly speculative and chart based selling. It could eventually test support near 2800 basis the nearest trading month. US soybean oil faces increased competition in world markets from Argentina as its soybeans are harvested and processed. Argentina will look to reclaim its position as the largest exporter of soybean oil in the world.

Cotton

Cotton was higher again last week. The daily and weekly charts show that an up trend has started. The weekly export sales report showed weaker demand for US cotton again, but the market seemed more impressed with what was going on in Washington and in growing areas of the US. The US weather continues to feature a lot of rain in the south, and fieldwork and initial planting in far southern areas is mostly delayed. Drier weather is forecast for this week, and there are hopes that at least some initial fieldwork can get done.

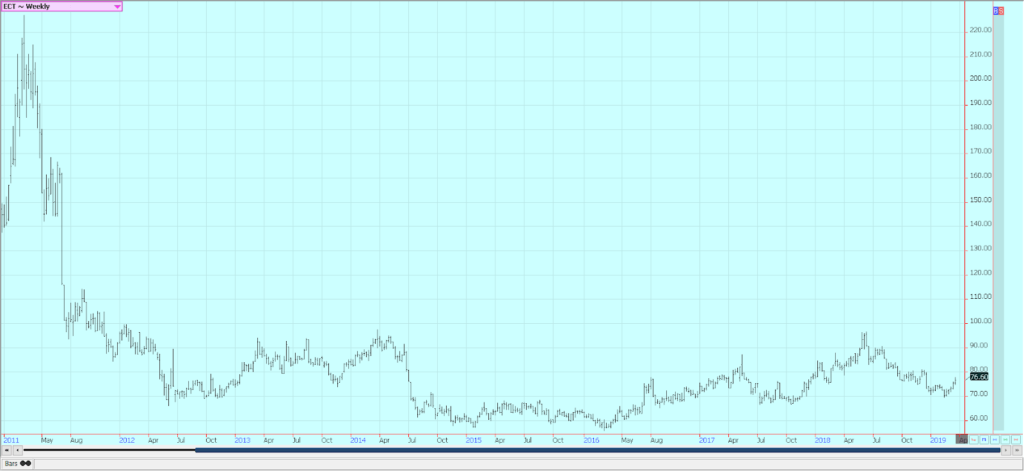

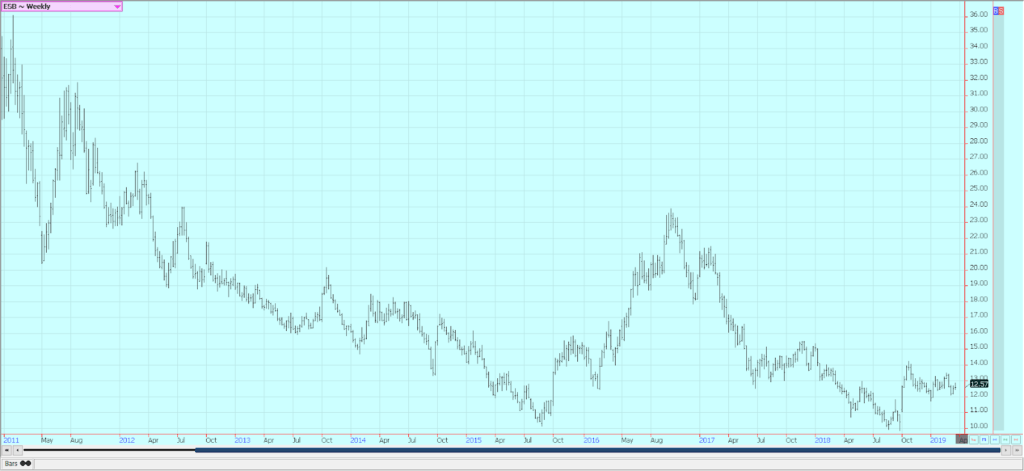

Frozen concentrated orange juice and citrus

FCOJ was higher again last week and trends are up on the daily and weekly charts. Speculators appeared to be the best buyers. Ideas continue that production remains strong and demand does not and are backed up by the weekly Florida Movement and Pack Report that shows that inventories inside the state are significantly higher than a year ago. The oranges harvest remains active in Florida as the weather is mostly dry. The early and mid harvest is about over and producers are concentrating on harvesting Valencias now.

The fruit is abundant. Florida producers are seeing small sized to good sized fruit, and work in groves maintenance is active. Irrigation is being used in all areas. Packing houses are open to process fruit for the fresh market, and all processors are open. Flowering for the next crop is seen everywhere and some small fruit is forming. Mostly good conditions are reported in Brazil, and some beneficial rains should be seen this week. USDA left Florida production estimates unchanged at 77 million boxes this month.

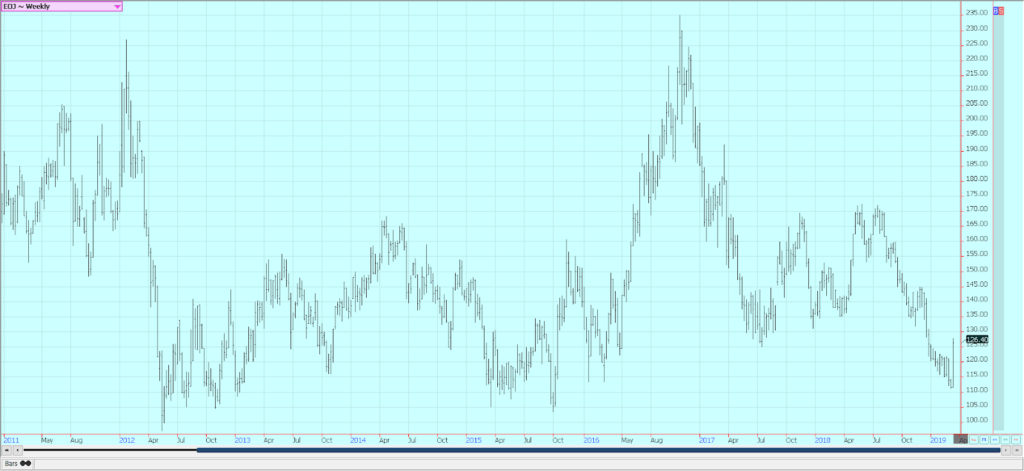

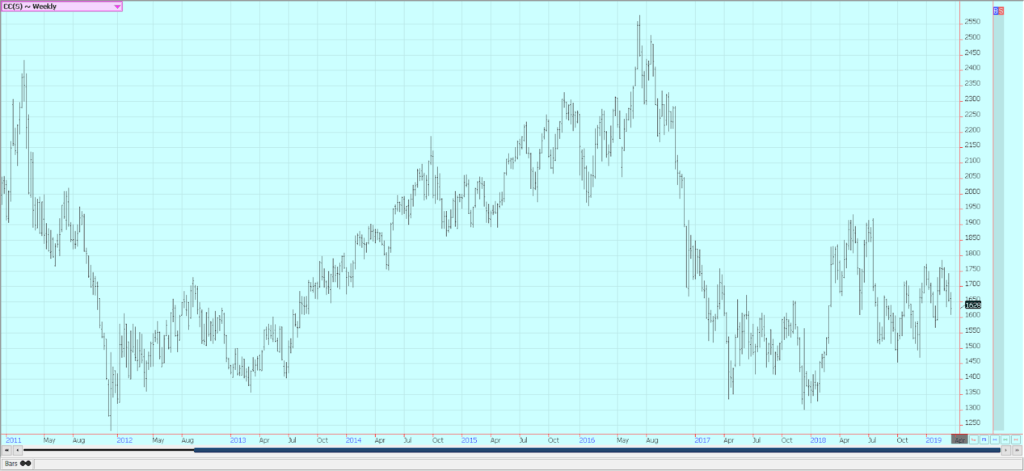

Coffee

Futures were a little lower for the week in New York. The weekly charts show that futures are testing lows made last Fall and are holding these levels. Prices closed lower for the week in London and continued to break down from an extended sideways trading pattern. Speculators are keeping the pressure on the New York market as they fear big supplies of Arabica with not enough demand. Brazil export data has shown a strong pace at over 3 million bags for the third month in a row. The strong pace comes at a time when Brazil exports are usually starting to wane and importers start to buy more from other origins. The ICO has forecast a surplus year again this year, and inventory data from ICO and others shows ample supplies.

Prices are moving below profitable levels for Colombia, and have been below profitable levels for producers in Central America. Further weakness will cause farmers in Brazil, Peru, and Vietnam to start losing money as well. Brazil had a big production year for the current crop, but the next crop should be less as it is the off year for production. Ideas are that the current production of 62 or 63 or more million bags can become about 52 million bags next year. El Nino is fading, but remains in the forecast, and coffee areas in Brazil could be affected by drought that could hurt production even more. Showers are in the forecast for this week. Vietnam is active in its harvest, but producers are not willing to sell at current prices. Production in Vietnam is estimated less than 30 million bags due to uneven weather during the growing season. It is still dry, and production potential for the next crop is getting hurt.

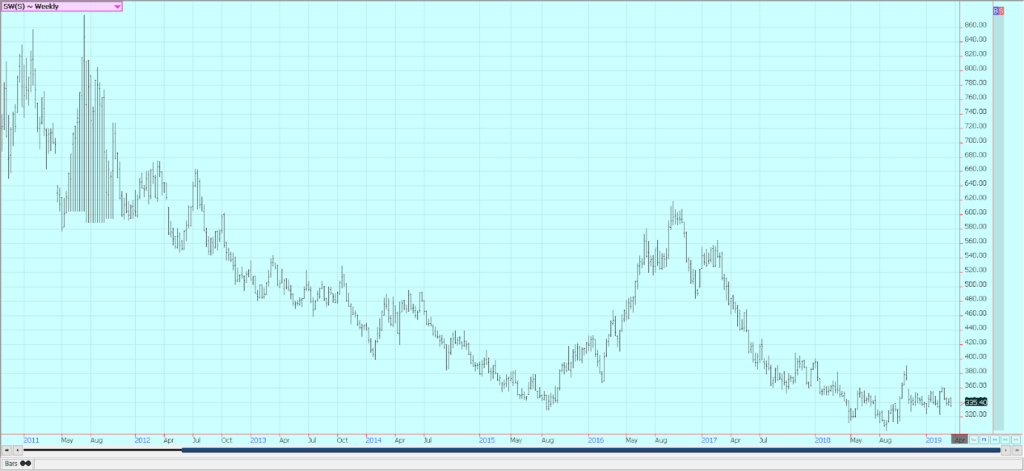

Sugar

Futures closed mixed last week, with New York prices slightly higher and London a little lower. Chart patterns on the weekly charts are down in New York and sideways in London. The fundamentals still suggest big supplies, and the weather in Brazil has improved to support big production ideas. Reports that Brazilian mills might pause and give sugarcane production a chance to improve helped support the market. Brazil weather is improving in all areas as there is less rain in southern areas and more to the north. Brazil has been using a larger part of its sugarcane harvest to produce ethanol this year instead of sugar, but Thailand has shown increased production this year.

Ideas that production in India and Pakistan is being hurt by news that Indian mills are asking the government not to force them to sell sugar into a depressed world market in order to try to maintain some control over operating losses. Very good conditions are reported in Thailand.

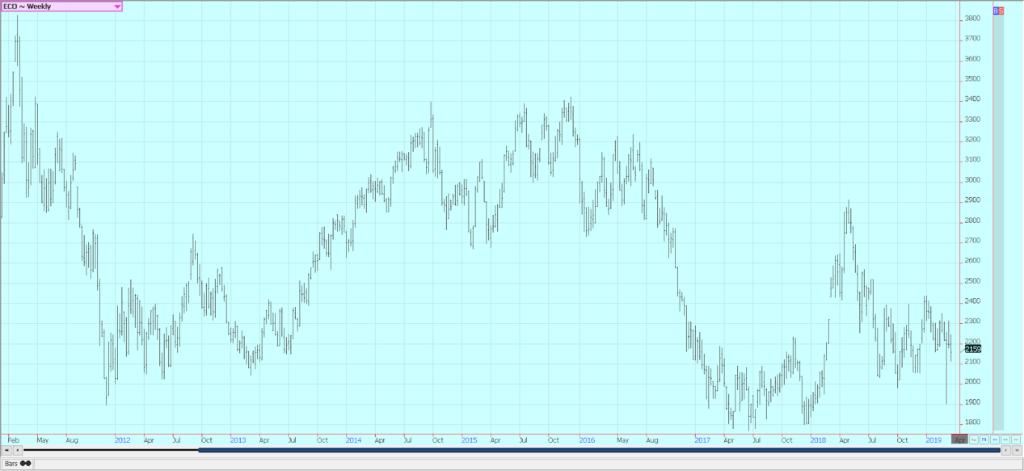

Cocoa

Futures closed lower in both markets. Chart patterns remain weak, and weekly chart trends are down in both markets. The main crop harvest should be about over and mid crop harvest is still a month or more away. The main crop harvest is active in West Africa, and Ivory Coast arrivals are strong. However, arrivals have started to fade. The weekly pace just a month or two ago was about 15 percent ahead of a year ago and now is under 10 percent of a year ago.

Growing conditions are generally good in West Africa. Some early week showers and cooler temperatures were beneficial, it is warmer now and mostly dry. Harmattan winds were reported early in the week in Nigeria, and there is talk of production losses there. Cameroon is also reporting less production and prices there are reported strong. Conditions appear good in East Africa and Asia.

(Featured image by Valentin Valkov via Shutterstock)

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Markets1 week ago

Markets1 week agoRising U.S. Debt and Growing Financial Risks

-

Africa5 days ago

Africa5 days agoCameroon’s Government Payment Delays Exceed 200 Days, Straining Businesses and Public Finances

-

Crowdfunding2 weeks ago

Crowdfunding2 weeks agoThe Youth Program at Enzian Shooting Club Is Expanding Thanks to Crowdfunding

-

Africa12 hours ago

Africa12 hours agoMorocco’s Industrial Activity Stalls in January 2026